Water Soluble Packaging Market Report

Published Date: 02 February 2026 | Report Code: water-soluble-packaging

Water Soluble Packaging Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report provides insights into the Water Soluble Packaging market, covering market dynamics, size forecasts from 2023 to 2033, industry analysis, segmentations, regional breakdowns, global leaders, trends, and future outlook. It aims to equip stakeholders with critical data for better decision-making.

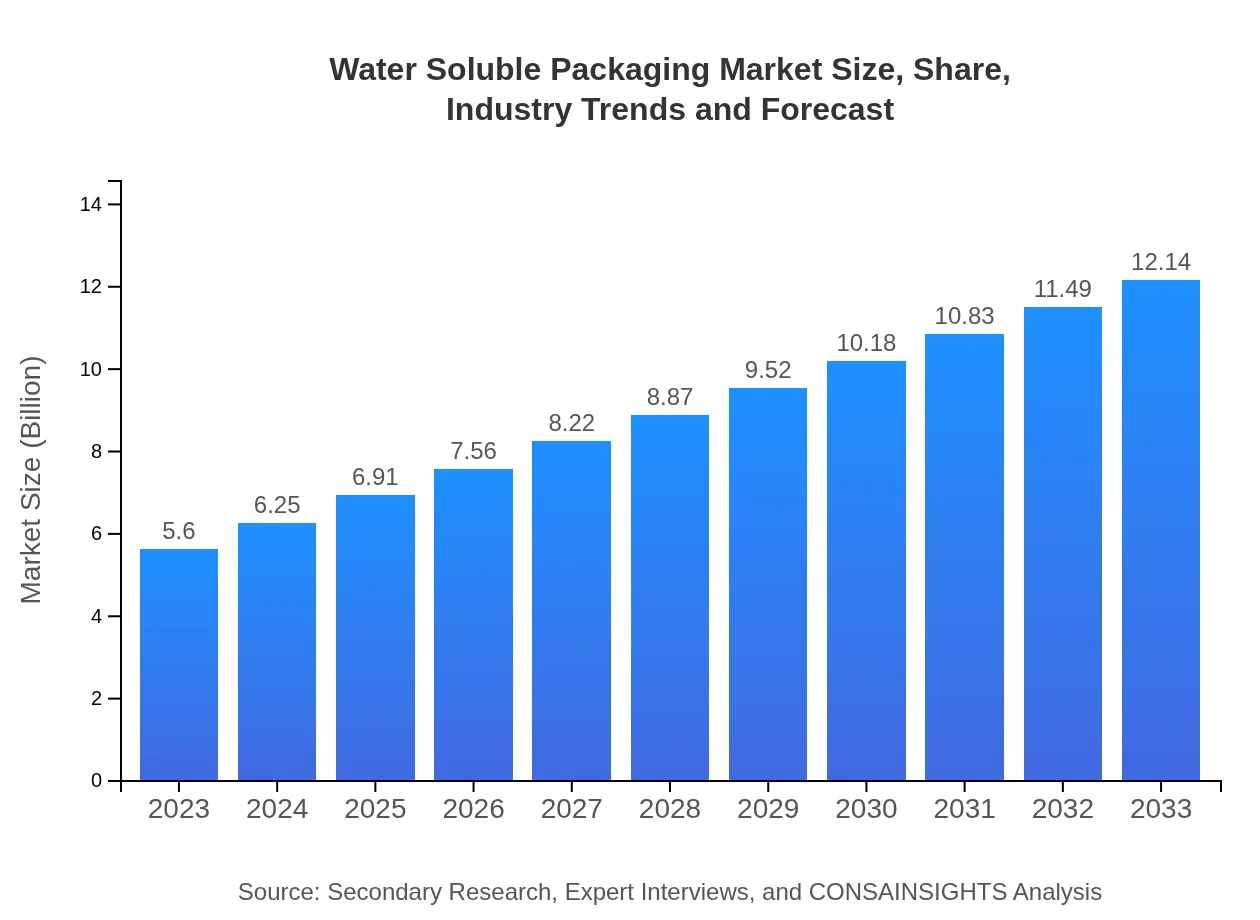

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $12.14 Billion |

| Top Companies | Kuraray Co., Ltd., Mondi Group, Aphena Pharma Solutions, ReValve |

| Last Modified Date | 02 February 2026 |

Water Soluble Packaging Market Overview

Customize Water Soluble Packaging Market Report market research report

- ✔ Get in-depth analysis of Water Soluble Packaging market size, growth, and forecasts.

- ✔ Understand Water Soluble Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Water Soluble Packaging

What is the Market Size & CAGR of Water Soluble Packaging market in 2023?

Water Soluble Packaging Industry Analysis

Water Soluble Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

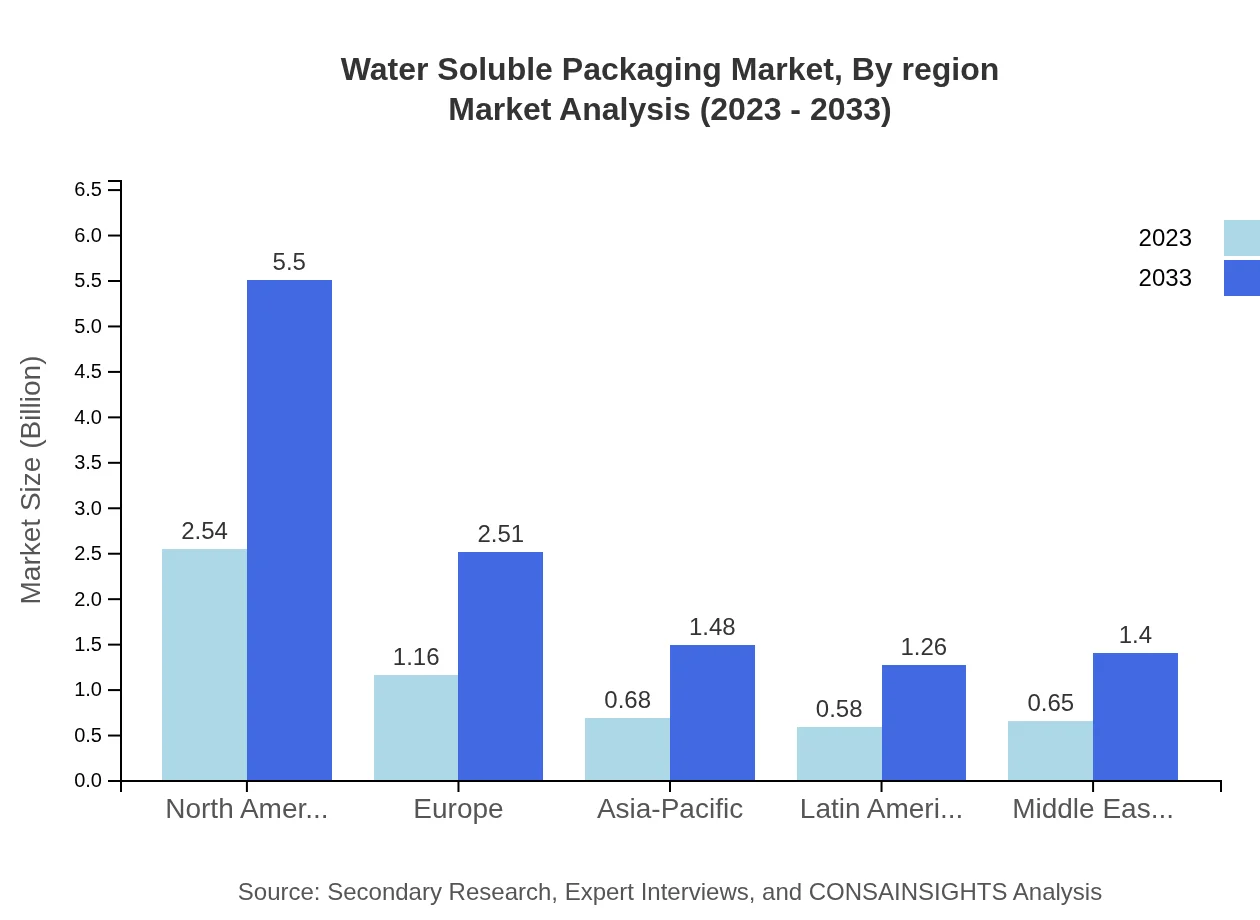

Water Soluble Packaging Market Analysis Report by Region

Europe Water Soluble Packaging Market Report:

Europe stands as a leading market for Water Soluble Packaging, valued at USD 1.93 billion in 2023 and expected to surge to USD 4.19 billion by 2033. The region is at the forefront of global sustainability initiatives, prompting advances in biodegradable packaging solutions.Asia Pacific Water Soluble Packaging Market Report:

The Asia Pacific region is witnessing significant growth in the Water Soluble Packaging market, recorded at USD 0.87 billion in 2023, projected to reach USD 1.89 billion by 2033, driven by urbanization and increasing environmental awareness among consumers.North America Water Soluble Packaging Market Report:

North America remains a critical market, with growth from USD 1.97 billion in 2023 to an anticipated USD 4.28 billion by 2033. This is due to stringent regulations against plastic waste and heightened consumer preference for eco-friendly packaging.South America Water Soluble Packaging Market Report:

South America's market is relatively nascent, with a market size of USD 0.06 billion in 2023, expected to expand to USD 0.13 billion by 2033. This growth is primarily influenced by enhancing regulatory frameworks promoting sustainable practices.Middle East & Africa Water Soluble Packaging Market Report:

The Middle East and Africa region's Water Soluble Packaging market is growing steadily, projected to climb from USD 0.76 billion in 2023 to USD 1.65 billion by 2033. This growth reflects rising initiatives for sustainable practices amid increasing packaging waste concerns.Tell us your focus area and get a customized research report.

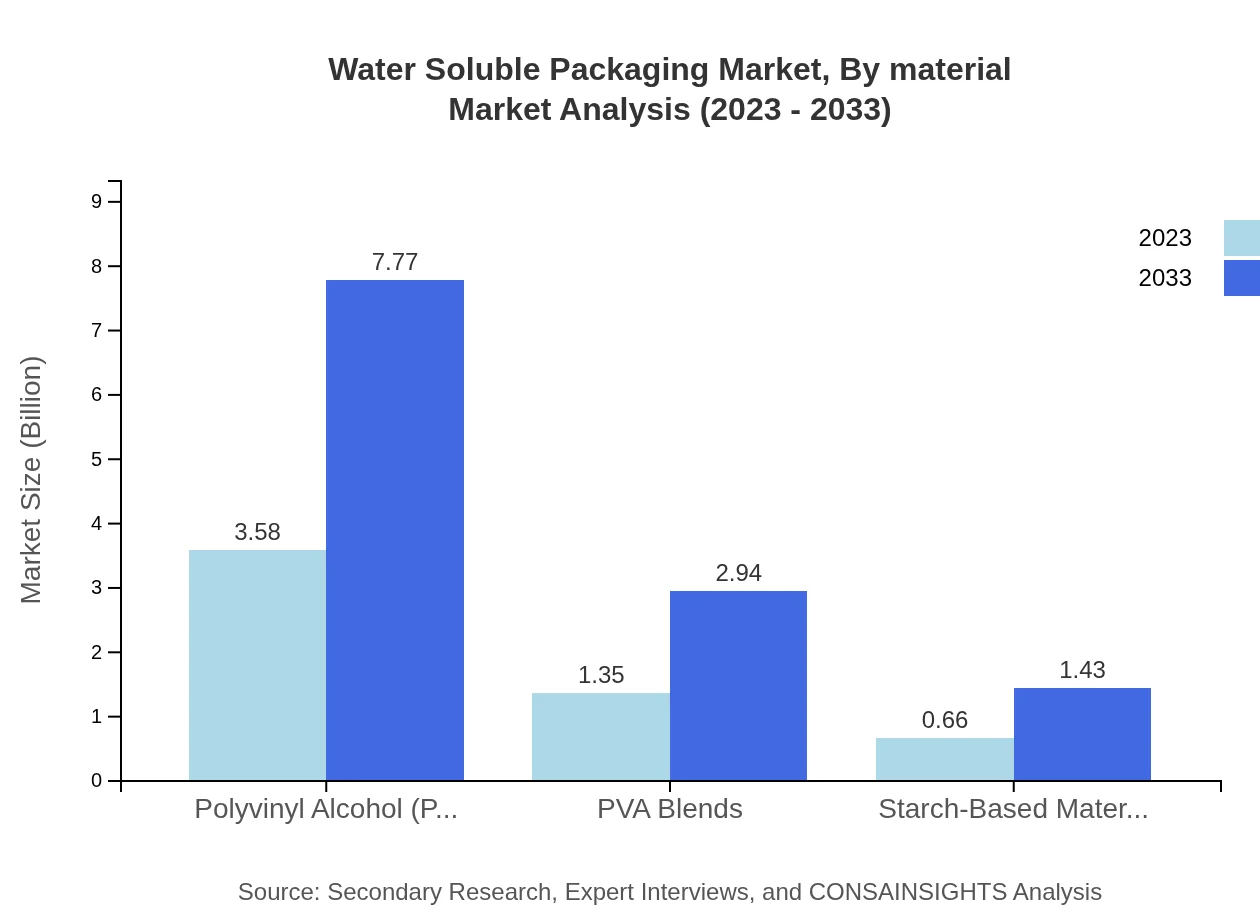

Water Soluble Packaging Market Analysis By Material

In 2023, the polyvinyl alcohol (PVA) segment dominates the market, accounting for 63.99% share with a market size of USD 3.58 billion, expected to grow to USD 7.77 billion by 2033. PVA blends and starch-based materials follow, holding 24.19% and 11.82% shares, respectively, showcasing significant growth potential.

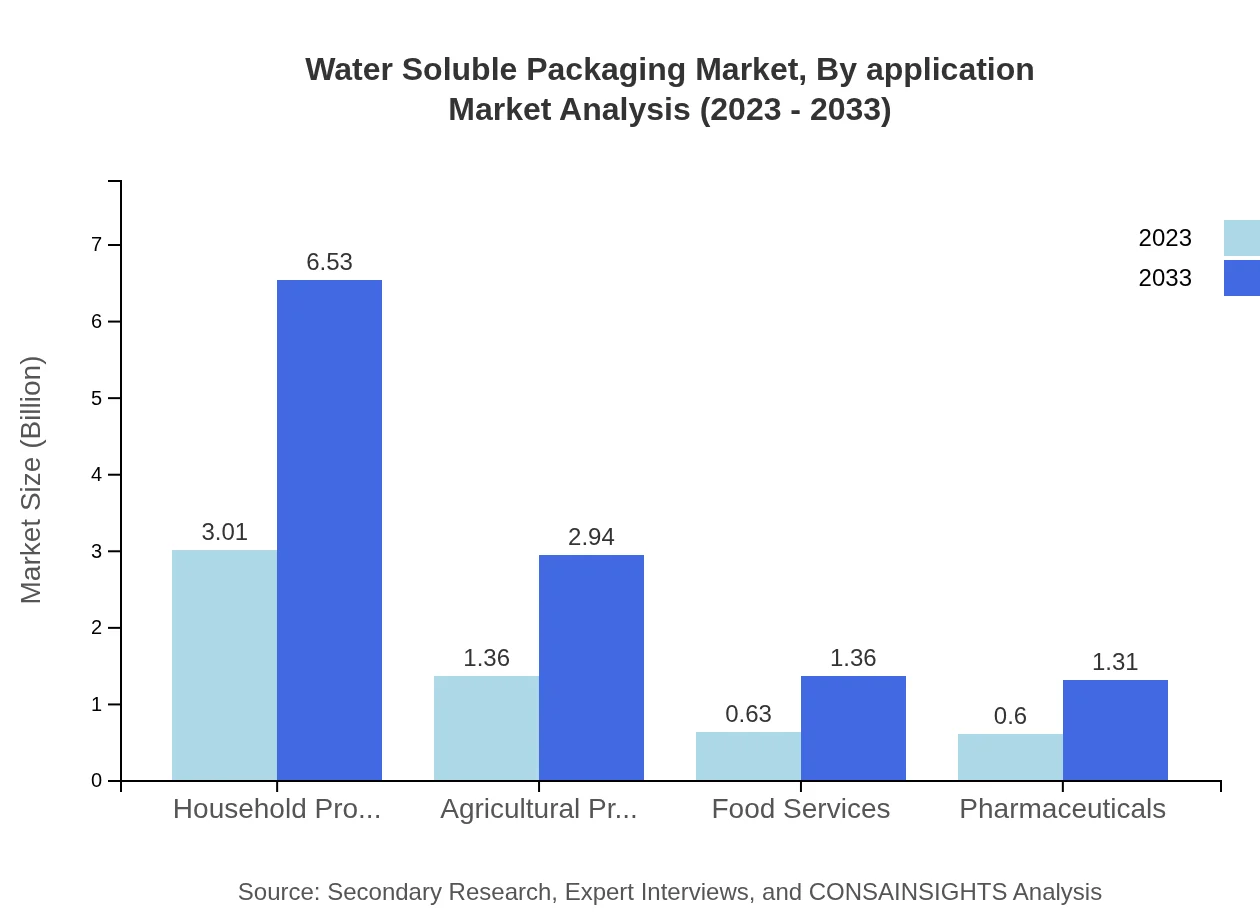

Water Soluble Packaging Market Analysis By Application

Household products lead the application segment with USD 3.01 billion in 2023 (53.78% share), with expectations to reach USD 6.53 billion by 2033. The pharmaceuticals and life sciences segment follows, reflecting a growing emphasis on sustainable packaging solutions.

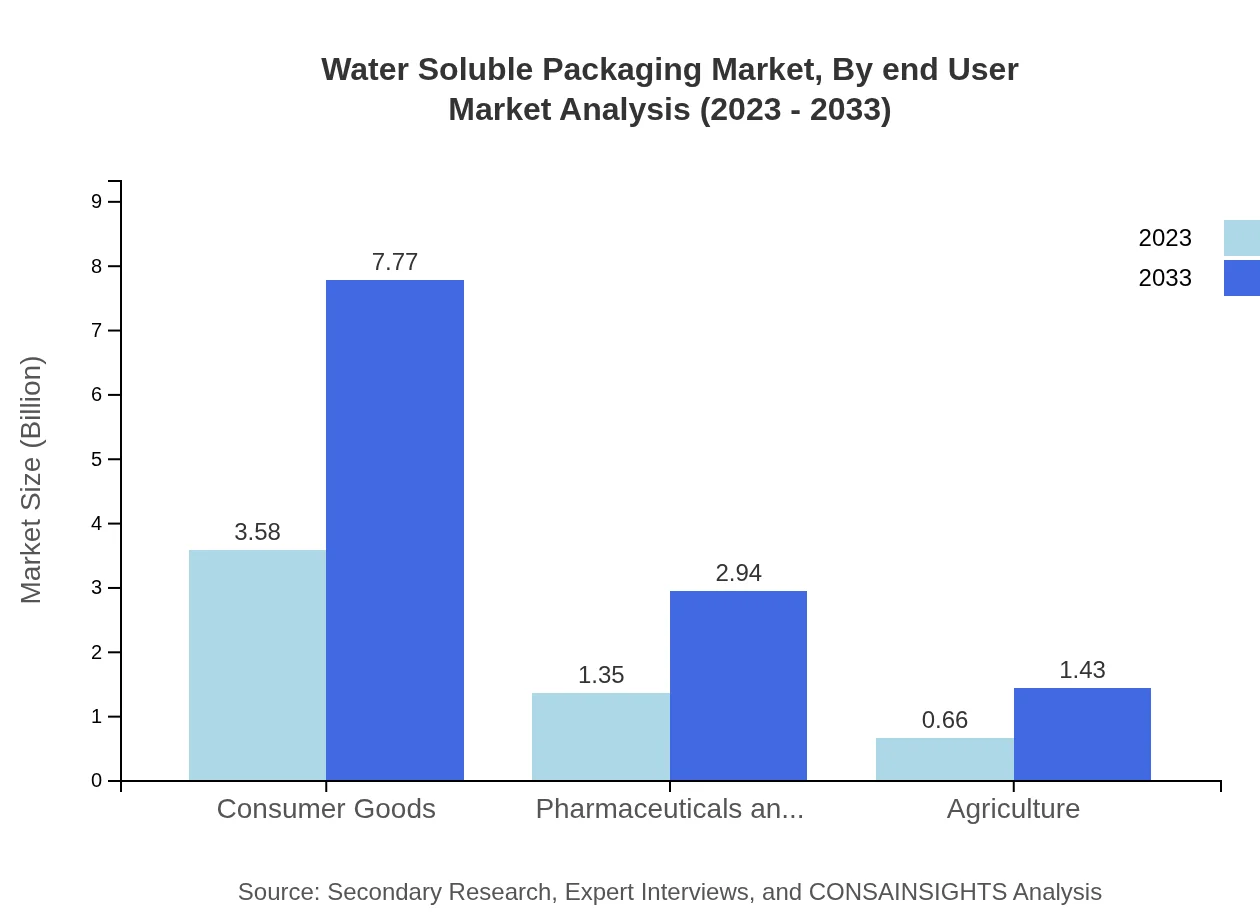

Water Soluble Packaging Market Analysis By End User

The consumer goods sector commands the market's largest share at 63.99%, with projections to maintain growth alongside pharmaceutical applications driven by increasing demand for eco-friendly alternatives in packaging solutions.

Water Soluble Packaging Market Analysis By Region

Geographically, North America and Europe collectively account for over 65% of the market share, driven by regulatory compliance and high environmental awareness. Meanwhile, the Asia Pacific region shows substantial growth potential due to rapid economic growth and urbanization.

Water Soluble Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Water Soluble Packaging Industry

Kuraray Co., Ltd.:

A leader in PVA production, Kuraray continuously innovates in water-soluble applications, contributing significantly to sustainable packaging trends in various industries.Mondi Group:

Recognized for their commitment to sustainable packaging solutions, Mondi utilizes advanced technologies in producing water-soluble packaging to meet diverse customer needs.Aphena Pharma Solutions:

Aphena focuses on pharmaceutical packaging, employing water-soluble materials to enhance environmental responsibility in their product offerings.ReValve:

An innovative company specializing in water-soluble packaging solutions for the food services and agriculture sectors, ReValve emphasizes sustainability in their product designs.We're grateful to work with incredible clients.

FAQs

What is the market size of water Soluble packaging?

The water-soluble packaging market is projected to reach approximately $5.6 billion by 2033, growing at a CAGR of 7.8% from its current estimated size, reflecting increased demand for sustainable solutions in packaging.

What are the key market players or companies in this water Soluble packaging industry?

Key players in the water-soluble packaging industry include major firms like BASF, Mondi Group, Aicello Corporation, and BPS (Bio Plastics Solutions), which innovate to enhance product offerings and market share.

What are the primary factors driving the growth in the water Soluble packaging industry?

Significant drivers of growth in the water-soluble packaging industry include environmental awareness, stringent regulations on plastic waste, technological advancements, and increasing adoption in consumer goods and pharmaceuticals sectors.

Which region is the fastest Growing in the water Soluble packaging?

The fastest-growing region for water-soluble packaging is Europe, whose market is projected to expand from $1.93 billion in 2023 to $4.19 billion by 2033, showcasing strong regulatory support for sustainable packaging.

Does ConsaInsights provide customized market report data for the water Soluble packaging industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the water-soluble packaging industry, providing valuable insights into market trends, competitors, and regional dynamics.

What deliverables can I expect from this water Soluble packaging market research project?

Expect comprehensive deliverables including detailed market analysis, segmentation insights, competitor profiles, forecasts, and strategic recommendations, aligning with your business needs in the water-soluble packaging sector.

What are the market trends of water Soluble packaging?

Current market trends in water-soluble packaging indicate a shift towards biodegradable materials, innovations in formulation technology, rising demand in the agriculture sector, and increased applications in consumer goods and healthcare products.