Water Treatment Biocides Market Report

Published Date: 02 February 2026 | Report Code: water-treatment-biocides

Water Treatment Biocides Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Water Treatment Biocides market, including trends, industry insights, forecasts from 2023 to 2033, and detailed segments on product types and applications.

| Metric | Value |

|---|---|

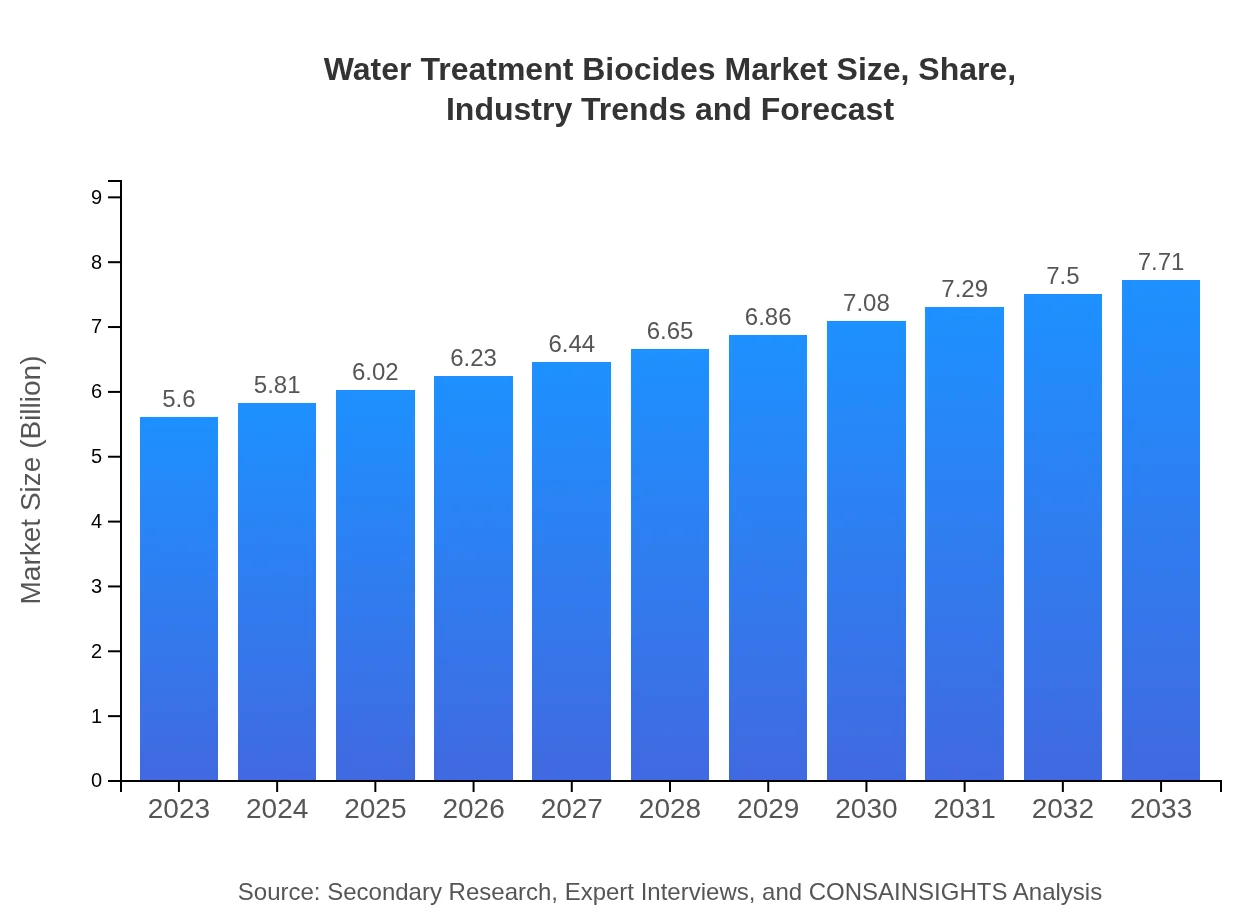

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 3.2% |

| 2033 Market Size | $7.71 Billion |

| Top Companies | BASF SE, Ecolab Inc., Dow Chemical Company, Lonza Group AG |

| Last Modified Date | 02 February 2026 |

Water Treatment Biocides Market Overview

Customize Water Treatment Biocides Market Report market research report

- ✔ Get in-depth analysis of Water Treatment Biocides market size, growth, and forecasts.

- ✔ Understand Water Treatment Biocides's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Water Treatment Biocides

What is the Market Size & CAGR of Water Treatment Biocides market in 2023 and 2033?

Water Treatment Biocides Industry Analysis

Water Treatment Biocides Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Water Treatment Biocides Market Analysis Report by Region

Europe Water Treatment Biocides Market Report:

Europe's market is expected to rise from $1.55 billion in 2023 to $2.14 billion in 2033, driven by the adoption of innovative biocides and increasing concerns over waterborne diseases.Asia Pacific Water Treatment Biocides Market Report:

In the Asia Pacific region, the Water Treatment Biocides market is expected to grow from $1.07 billion in 2023 to $1.47 billion in 2033. Rapid industrialization, increasing urbanization, and awareness regarding water quality drive this growth.North America Water Treatment Biocides Market Report:

The North American market is projected to grow from $2.14 billion in 2023 to $2.94 billion in 2033, supported by stringent regulations and technological advancements in water treatment processes.South America Water Treatment Biocides Market Report:

South America’s market is anticipated to increase from $0.44 billion in 2023 to $0.60 billion in 2033, fueled by a growing emphasis on environmental sustainability and efficient water management practices.Middle East & Africa Water Treatment Biocides Market Report:

In the Middle East and Africa, the market is forecast to grow from $0.40 billion in 2023 to $0.55 billion by 2033, influenced by the necessity of water treatment in arid regions and industrial growth.Tell us your focus area and get a customized research report.

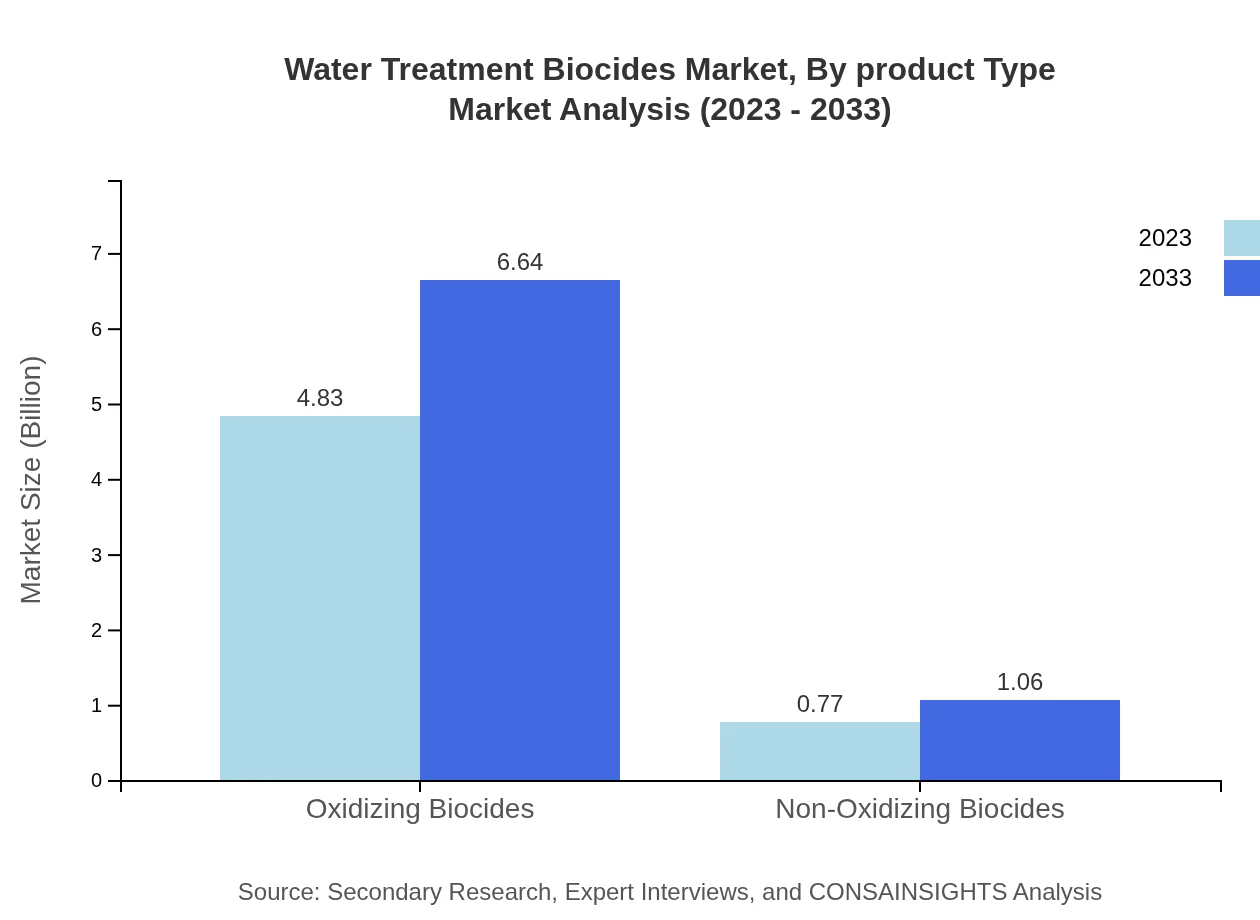

Water Treatment Biocides Market Analysis By Product Type

The market segment is dominated by oxidizing biocides, representing approximately 86.2% share in 2023, with projected growth continuing through to 2033. Non-oxidizing biocides are also vital, holding a 13.8% market share, increasingly favored for specific applications in controlled environments.

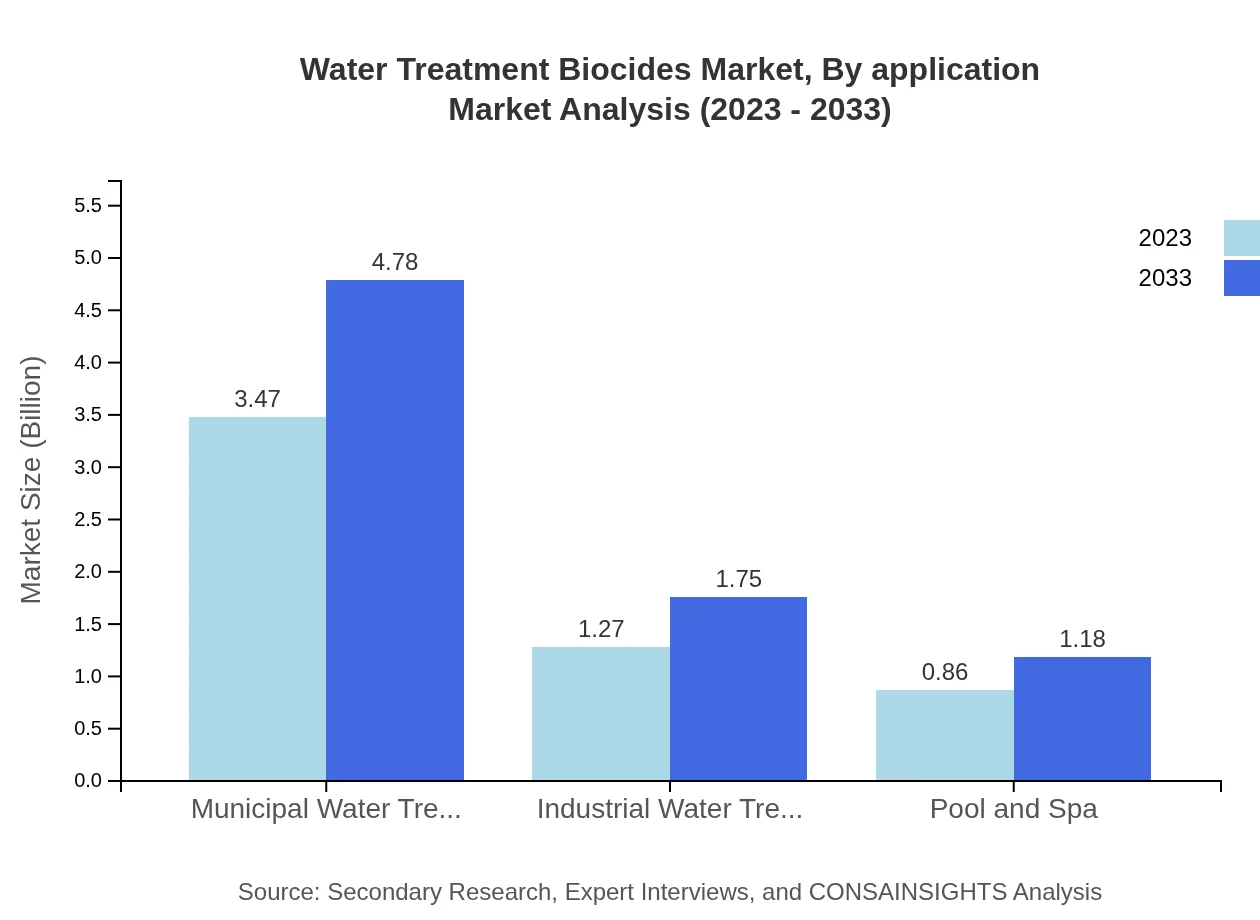

Water Treatment Biocides Market Analysis By Application

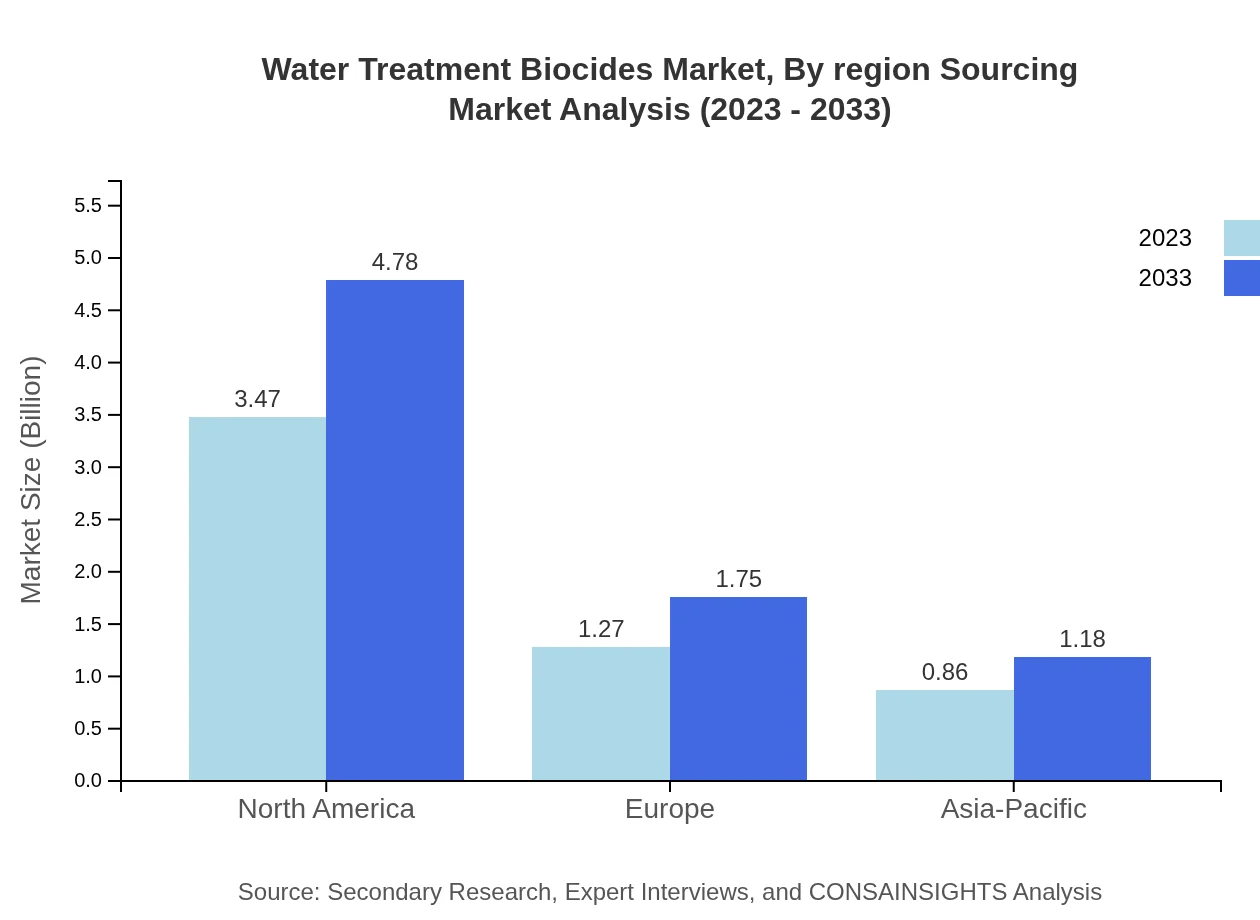

The application segment for municipal water treatment constitutes a significant market with a size of $3.47 billion in 2023, expected to grow to $4.78 billion by 2033. Industrial water treatment follows closely, with a market size of $1.27 billion in 2023, demonstrating the essential need for effective biocidal solutions across various industries.

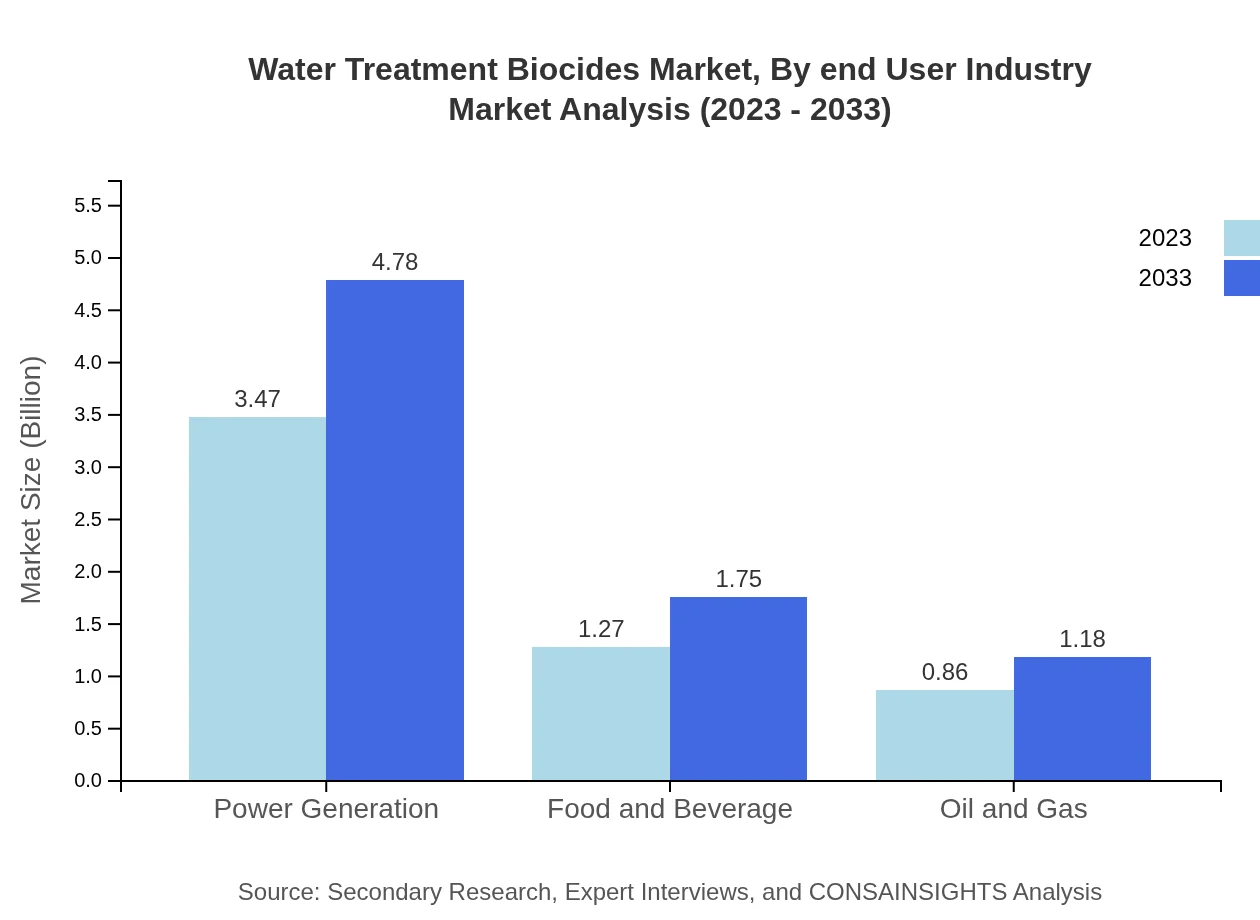

Water Treatment Biocides Market Analysis By End User Industry

The market serves multiple end-user industries including power generation, food and beverage, and oil and gas. Power generation and food & beverage industries each hold lucrative market shares of around 61.95% and 22.7% respectively in 2023, demonstrating the critical applications of biocides in maintaining safety and quality standards.

Water Treatment Biocides Market Analysis By Region Sourcing

Key sourcing regions include North America, Europe, Asia Pacific, South America, and Middle East & Africa. Each region presents unique challenges and growth opportunities influenced by local regulations, market demands, and technological advancements, underpinning the competitive landscape.

Water Treatment Biocides Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Water Treatment Biocides Industry

BASF SE:

A global leader in chemical manufacturing, BASF offers an extensive range of water treatment biocides focused on sustainability and safety across industries.Ecolab Inc.:

Ecolab specializes in water, hygiene, and energy technologies, providing comprehensive solutions for water treatment applications globally.Dow Chemical Company:

With a wide portfolio including innovative biocides, Dow focuses on advancing technologies for effective water treatment processes.Lonza Group AG:

Lonza is a leader in specialty chemicals and biocides, emphasizing on R&D for enhanced efficacy and ecologically sound products.We're grateful to work with incredible clients.

FAQs

What is the market size of water Treatment Biocides?

The global water treatment biocides market is projected to reach approximately $5.6 billion by 2033, growing at a CAGR of 3.2%. In 2023, it stands at $5.0 billion, showing steady expansion in its applications across various industries.

What are the key market players or companies in the water Treatment Biocides industry?

Prominent players include BASF SE, AkzoNobel N.V., and Ecolab Inc., which are leading innovators in the biocide formulations. These companies focus on developing sustainable and effective solutions in the water treatment sector to enhance performance and compliance with regulations.

What are the primary factors driving the growth in the water Treatment Biocides industry?

Key growth drivers include increasing water scarcity, stringent environmental regulations, and the rising need for efficient water treatment across industries. Urbanization and industrialization also propel the demand for biocides to maintain water quality and safety.

Which region is the fastest Growing in the water Treatment Biocides market?

The Asia-Pacific region is anticipated to be the fastest-growing market, with its size projected to expand from $1.07 billion in 2023 to $1.47 billion by 2033. Rapid industrialization and rising population drive substantial demand for water treatment solutions in this region.

Does ConsaInsights provide customized market report data for the water Treatment Biocides industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs within the water treatment biocides industry. These reports include in-depth analyses, focused on individual segments and regional trends to support strategic decision-making.

What deliverables can I expect from this water Treatment Biocides market research project?

Expect comprehensive reports featuring market size data, growth analyses, segmentation insights, and regional trends. Additionally, you will receive visual data presentations, market forecasts, and strategic recommendations tailored to enhance your understanding and strategy in this industry.

What are the market trends of water Treatment Biocides?

Current trends include a shift toward eco-friendly biocides and innovative formulations. The focus is on enhancing efficacy in various applications such as municipal, industrial, and recreational water treatment, driven by both regulatory pressure and consumer demand for sustainability.