Water Treatment Chemicals Market Report

Published Date: 02 February 2026 | Report Code: water-treatment-chemicals

Water Treatment Chemicals Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Water Treatment Chemicals market, analyzing trends, forecasts, and regional performances from 2023 to 2033. It aims to equip stakeholders with data-driven analysis for informed decision-making and strategy formulation.

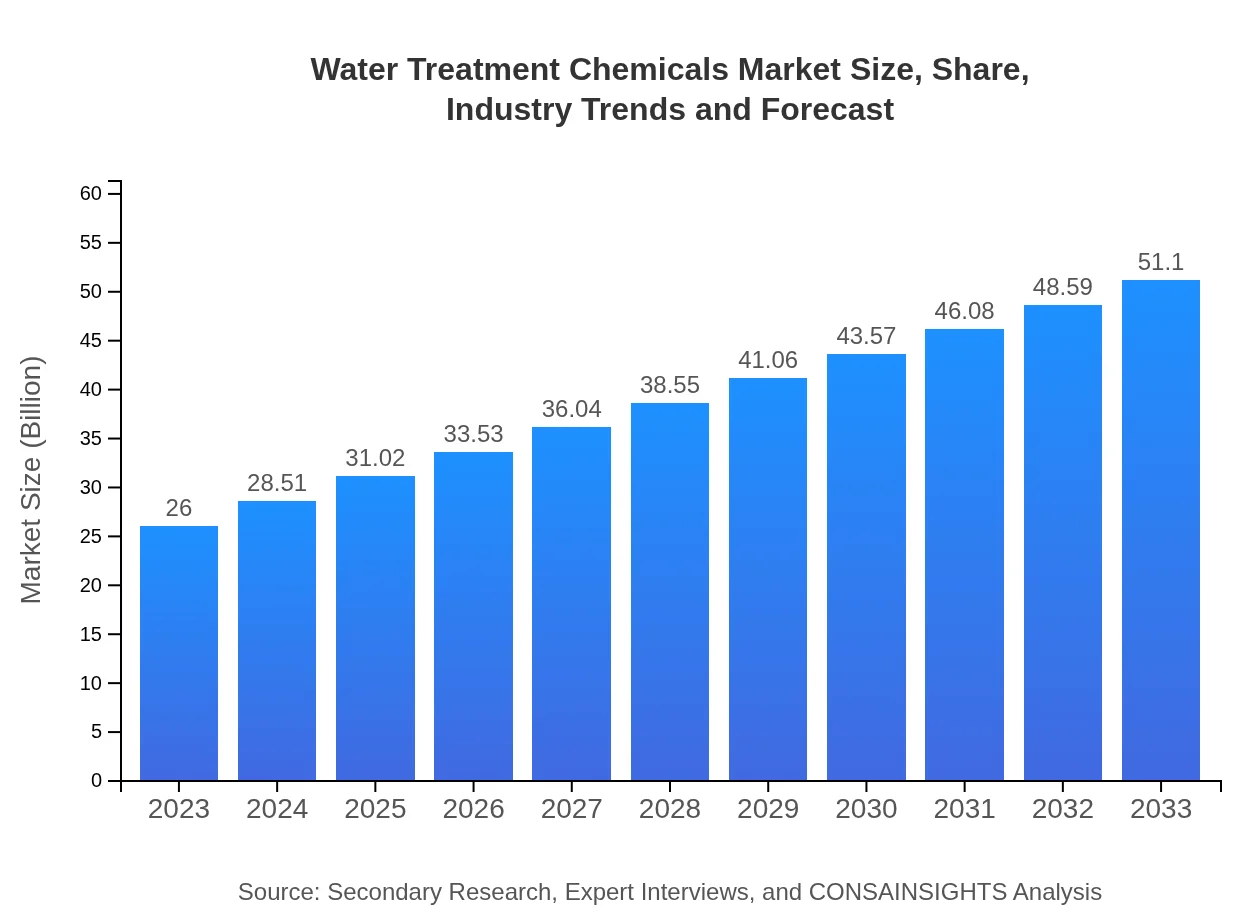

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $26.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $51.10 Billion |

| Top Companies | BASF SE, Ecolab, Kemira Oyj, Suez Water Technologies |

| Last Modified Date | 02 February 2026 |

Water Treatment Chemicals Market Overview

Customize Water Treatment Chemicals Market Report market research report

- ✔ Get in-depth analysis of Water Treatment Chemicals market size, growth, and forecasts.

- ✔ Understand Water Treatment Chemicals's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Water Treatment Chemicals

What is the Market Size & CAGR of Water Treatment Chemicals market in 2023?

Water Treatment Chemicals Industry Analysis

Water Treatment Chemicals Market Segmentation and Scope

Tell us your focus area and get a customized research report.

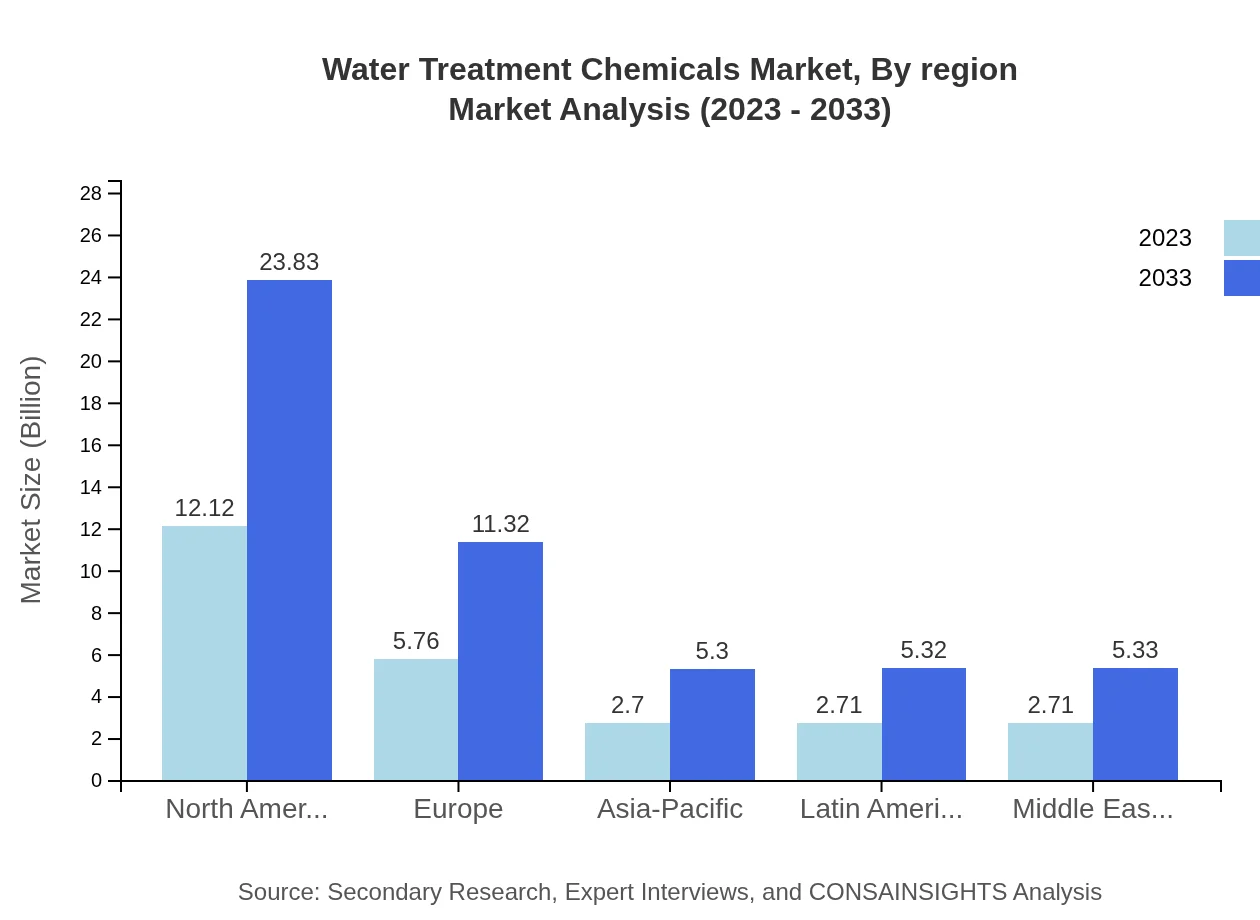

Water Treatment Chemicals Market Analysis Report by Region

Europe Water Treatment Chemicals Market Report:

The European market for Water Treatment Chemicals is forecasted to grow from $6.82 billion in 2023 to $13.40 billion by 2033, primarily due to regulatory frameworks focused on improving water quality standards and increasing wastewater treatment projects.Asia Pacific Water Treatment Chemicals Market Report:

In Asia Pacific, the Water Treatment Chemicals market was valued at $5.03 billion in 2023 and is expected to reach $9.89 billion by 2033, driven by rapid industrialization and urban growth. The region is facing increasing water quality issues, leading governments to invest in infrastructure and treatment facilities.North America Water Treatment Chemicals Market Report:

North America's market is one of the largest, starting at $8.53 billion in 2023 and expanding to $16.77 billion by 2033. The growth in this region is spurred by stringent environmental regulations and investments in upgrading water treatment facilities.South America Water Treatment Chemicals Market Report:

South America’s market for Water Treatment Chemicals is projected to grow from $2.14 billion in 2023 to $4.20 billion in 2033. The increase is propelled by rising industrial activities and the need for efficient water management systems amidst growing populations.Middle East & Africa Water Treatment Chemicals Market Report:

In the Middle East and Africa, the market is anticipated to grow from $3.48 billion in 2023 to $6.84 billion by 2033, with growing water scarcity and the need for sustainable solutions driving investment in water treatment technologies.Tell us your focus area and get a customized research report.

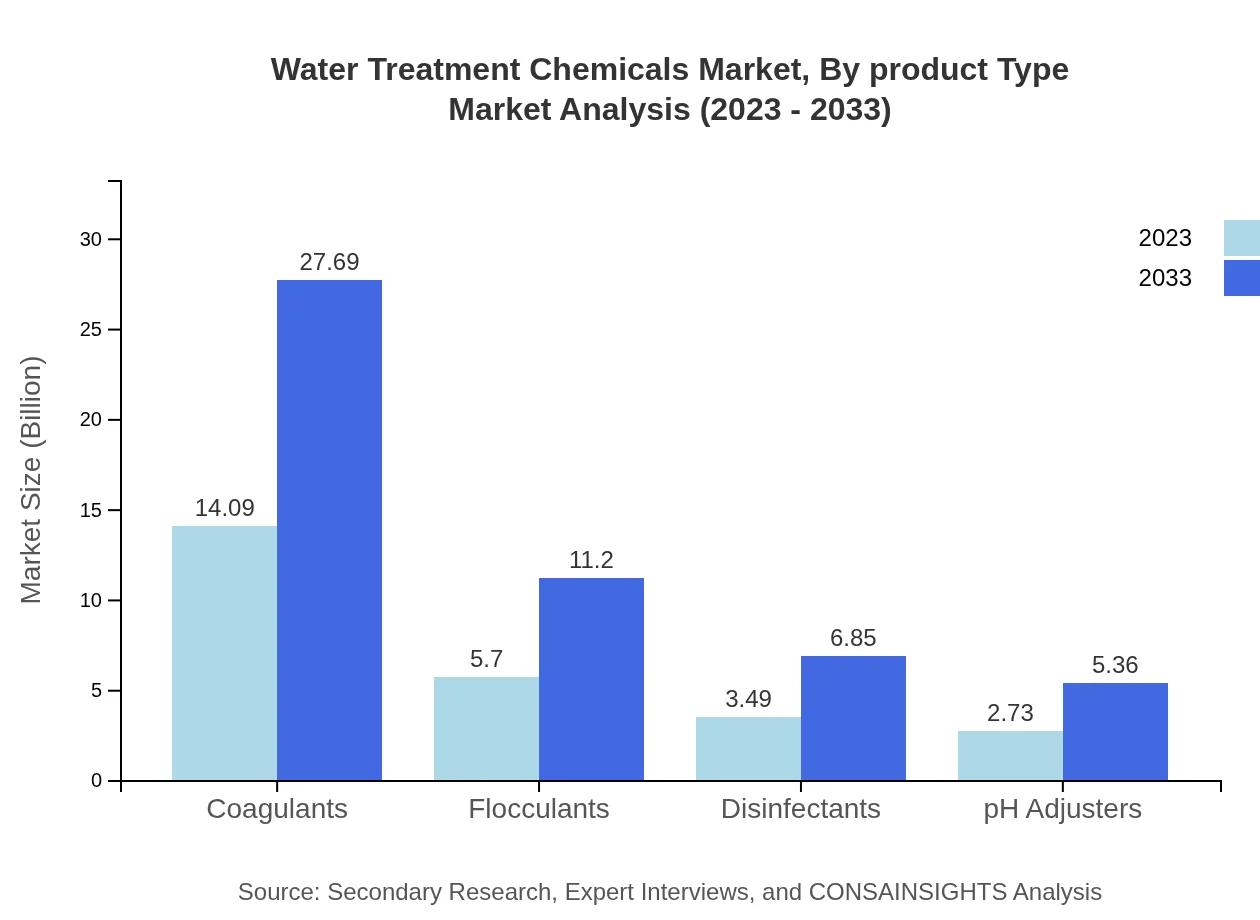

Water Treatment Chemicals Market Analysis By Product Type

The Water Treatment Chemicals market can be segmented by product types, which includes coagulants, flocculants, disinfectants, and pH adjusters. Coagulants dominate the market, contributing significantly to the municipal and industrial water treatment sectors, while flocculants are critical for suspended solids removal. Disinfectants hold a vital role in ensuring safe drinking water and are essential in wastewater treatment processes.

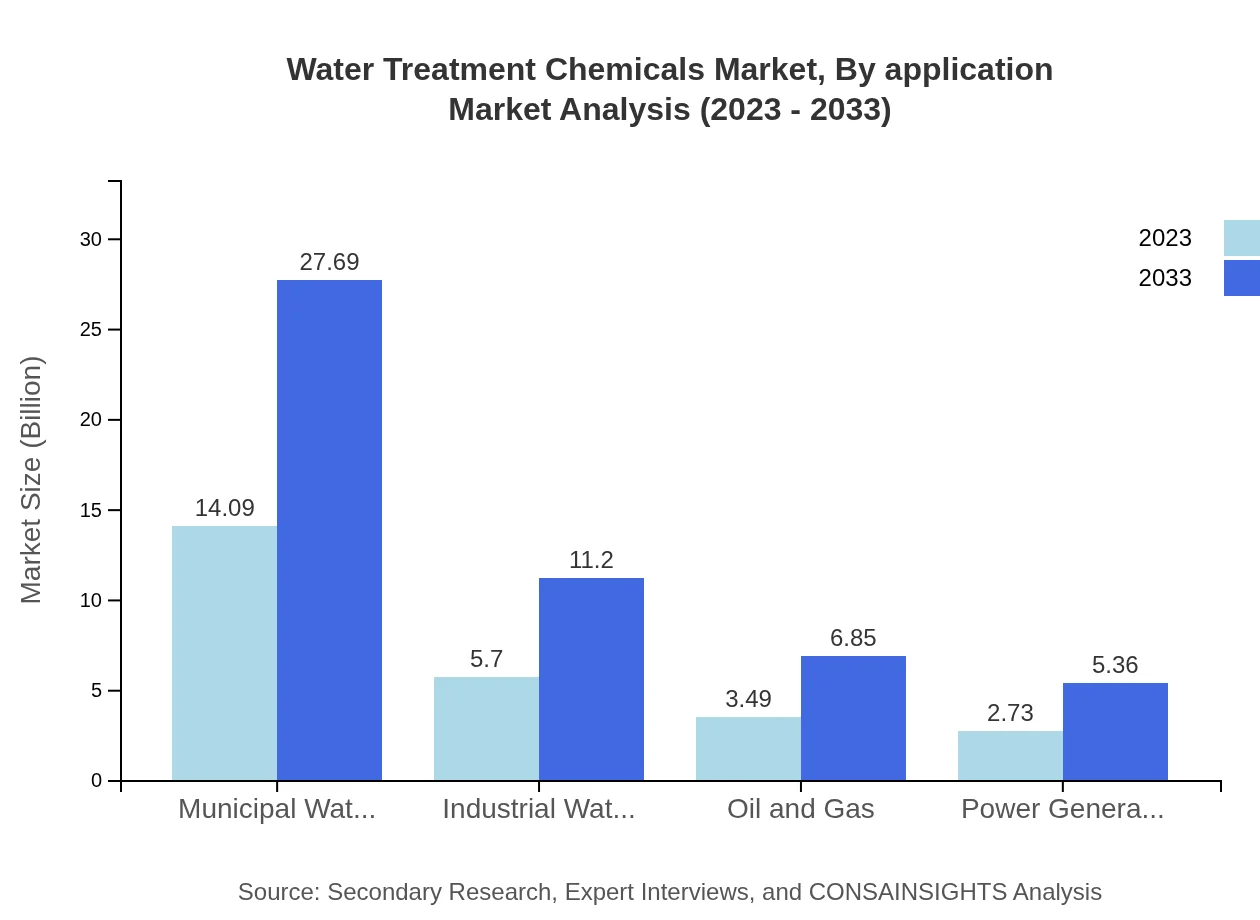

Water Treatment Chemicals Market Analysis By Application

In terms of applications, the Water Treatment Chemicals market encompasses municipal water treatment, industrial water treatment, and other applications. Municipal water treatment remains the most significant segment, accounting for over 54% market share in 2023, while industrial water treatment is also a large sector due to the high water demand across various industries.

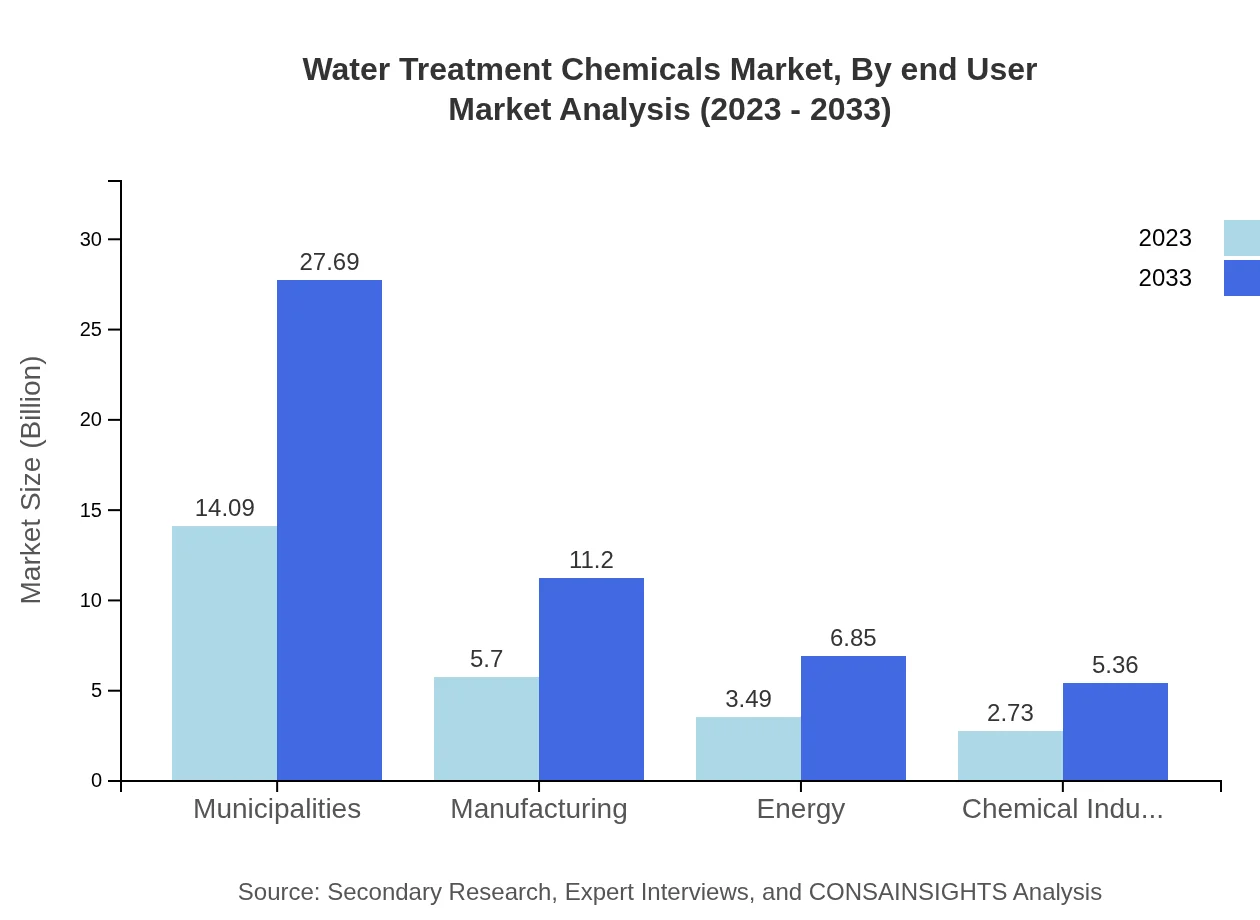

Water Treatment Chemicals Market Analysis By End User

Evaluating by end-users, the Water Treatment Chemicals market serves different sectors, including municipalities, manufacturing, energy, oil and gas, and chemical industries. Municipalities represent the largest end-user group due to increasing populations and stringent regulations on drinking water quality.

Water Treatment Chemicals Market Analysis By Region

The market exhibits distinct performance across regions with North America, Europe, and Asia Pacific taking lead positions. Innovations and investments in technology heavily influence regional performance, with Asia Pacific showing robust growth due to increased industrialization and infrastructure development.

Water Treatment Chemicals Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Water Treatment Chemicals Industry

BASF SE:

BASF is a leading global chemical company known for its extensive portfolio of water treatment chemicals, providing innovative solutions for municipal and industrial water needs.Ecolab:

Ecolab offers services and products in water, hygiene, and energy sectors, significant for delivering water treatment solutions that combat pollution and support sustainability.Kemira Oyj:

Kemira specializes in water treatment chemicals, focusing on products for the pulp and paper and oil and gas industries, offering tailored solutions for various applications.Suez Water Technologies:

A major player in the field, Suez delivers comprehensive water treatment and management solutions to a broad array of industries, emphasizing sustainability.We're grateful to work with incredible clients.

FAQs

What is the market size of water Treatment Chemicals?

The global water-treatment-chemicals market is currently valued at approximately $26 billion, with a projected compound annual growth rate (CAGR) of 6.8% over the next decade, indicating strong growth potential in this industry.

What are the key market players or companies in the water Treatment Chemicals industry?

Key players in the water-treatment chemicals market include major companies such as Ecolab, BASF, and Veolia, which dominate through their substantial product offerings and global reach, enhancing customer solutions in various sectors.

What are the primary factors driving the growth in the water Treatment Chemicals industry?

The growth of the water-treatment chemicals market is driven by increasing water scarcity, stringent environmental regulations, and growing industrialization, alongside heightened awareness of water quality and sustainability measures.

Which region is the fastest Growing in the water Treatment Chemicals market?

Asia Pacific will be the fastest-growing region in the water-treatment-chemicals market, with expected growth from $5.03 billion in 2023 to $9.89 billion by 2033, driven by rapid industrialization and urbanization.

Does ConsaInsights provide customized market report data for the water Treatment Chemicals industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the water-treatment chemicals industry, ensuring that stakeholders receive the most relevant insights for their strategic planning.

What deliverables can I expect from this water Treatment Chemicals market research project?

Deliverables include comprehensive market analysis reports, segmentation data, regional insights, competitive analysis, and actionable recommendations tailored to the unique aspects of the water-treatment chemicals market.

What are the market trends of water Treatment Chemicals?

Current trends in the water-treatment chemicals market include the rise of eco-friendly products, advancements in chemical technology, and increased investments in water treatment infrastructure across emerging economies.