Water Treatment Equipment Market Report

Published Date: 02 February 2026 | Report Code: water-treatment-equipment

Water Treatment Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Water Treatment Equipment market covering key insights such as market size, growth forecasts, and industry trends from 2023 to 2033.

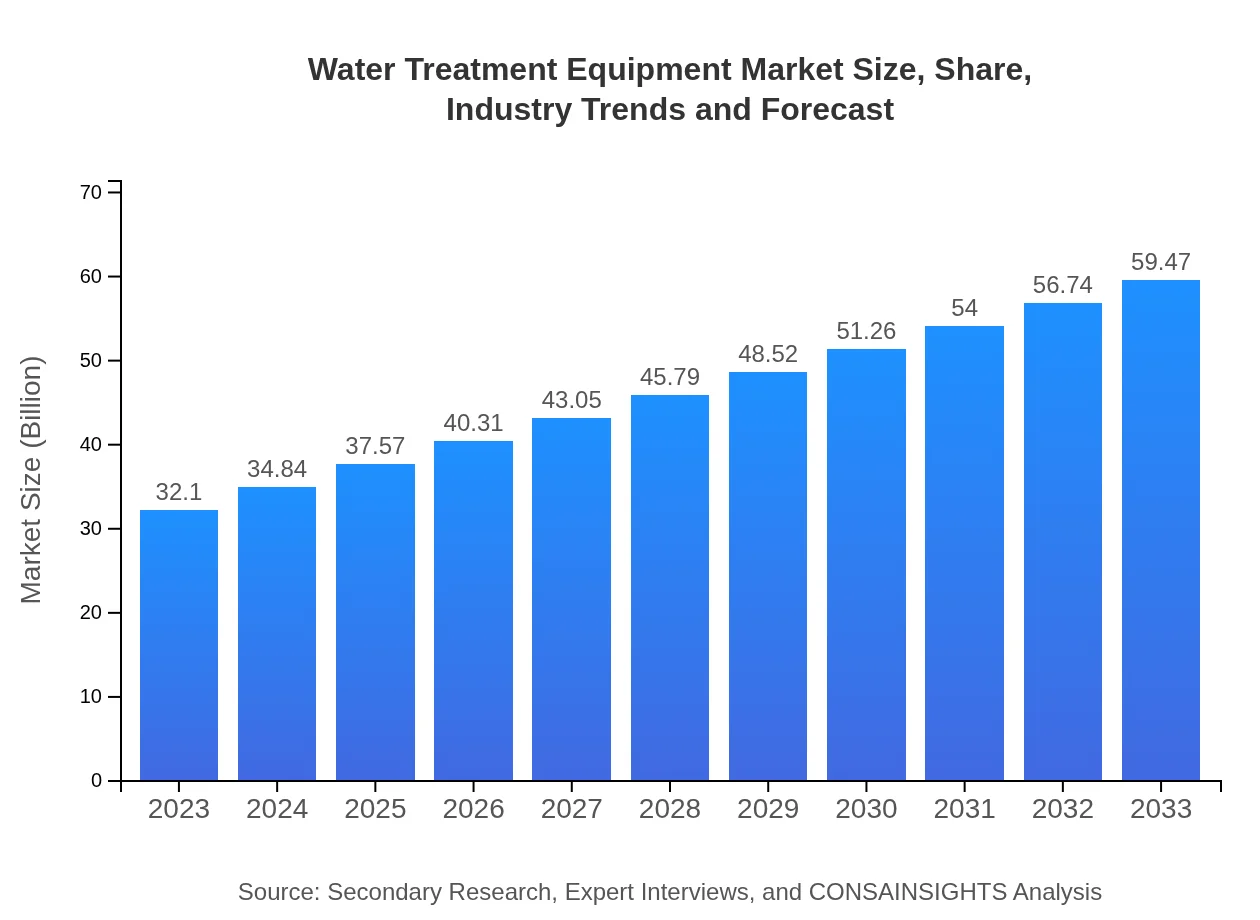

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $32.10 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $59.47 Billion |

| Top Companies | VEOLIA, Xylem Inc., SUEZ, Evoqua Water Technologies |

| Last Modified Date | 02 February 2026 |

Water Treatment Equipment Market Overview

Customize Water Treatment Equipment Market Report market research report

- ✔ Get in-depth analysis of Water Treatment Equipment market size, growth, and forecasts.

- ✔ Understand Water Treatment Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Water Treatment Equipment

What is the Market Size & CAGR of Water Treatment Equipment market in 2023 and 2033?

Water Treatment Equipment Industry Analysis

Water Treatment Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Water Treatment Equipment Market Analysis Report by Region

Europe Water Treatment Equipment Market Report:

Europe's market size in 2023 is estimated at $8.89 billion, with a projection of $16.47 billion by 2033. The region is characterized by high adoption of innovative technologies and strong regulatory support for environmental protection.Asia Pacific Water Treatment Equipment Market Report:

In Asia Pacific, the market size in 2023 is expected at $6.11 billion, and it is projected to grow to $11.32 billion by 2033. This growth is fueled by urbanization, industrial expansion, and increasing investments in smart water management technologies.North America Water Treatment Equipment Market Report:

North America is projected to dominate the market, valued at $12.28 billion in 2023 and expected to climb to $22.75 billion by 2033. Factors contributing to this growth include advanced infrastructure and stringent regulations regarding wastewater management.South America Water Treatment Equipment Market Report:

South America's market is anticipated to reach $2.65 billion in 2023, rising to $4.91 billion by 2033. Growth drivers include increased regulatory frameworks for clean water and investments in environmental sustainability initiatives.Middle East & Africa Water Treatment Equipment Market Report:

The Middle East and Africa market is expected to see growth from $2.17 billion in 2023 to $4.01 billion by 2033, driven by increasing water scarcity issues and investments in desalination and water recycling technologies.Tell us your focus area and get a customized research report.

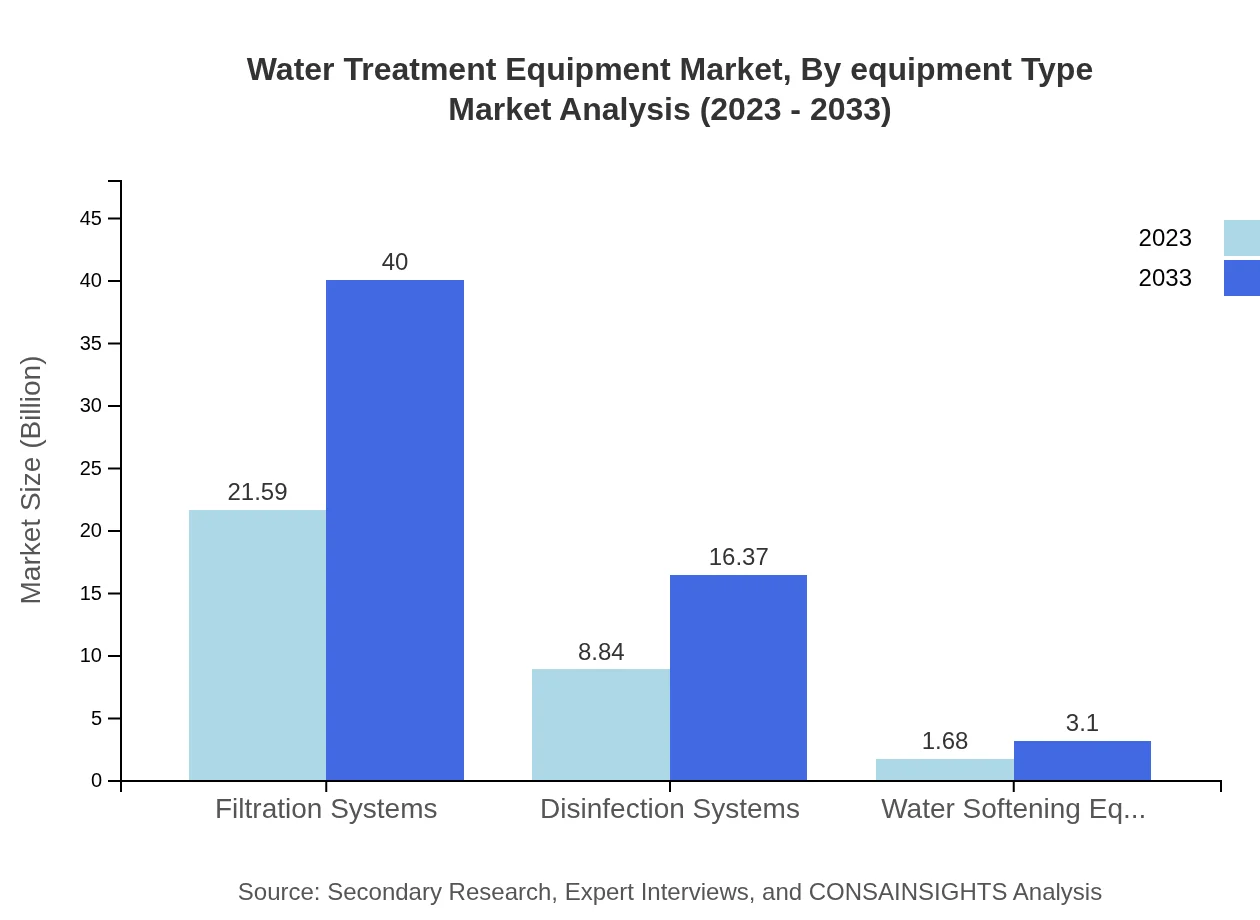

Water Treatment Equipment Market Analysis By Equipment Type

The filtration systems segment is expected to lead the market, accounting for a significant share due to heightened demand for safe drinking water. The filtration systems market is projected to grow from $21.59 billion in 2023 to $40.00 billion by 2033. The disinfection systems and water softening equipment segments are also crucial, with expected growth from $8.84 billion to $16.37 billion and from $1.68 billion to $3.10 billion respectively by 2033.

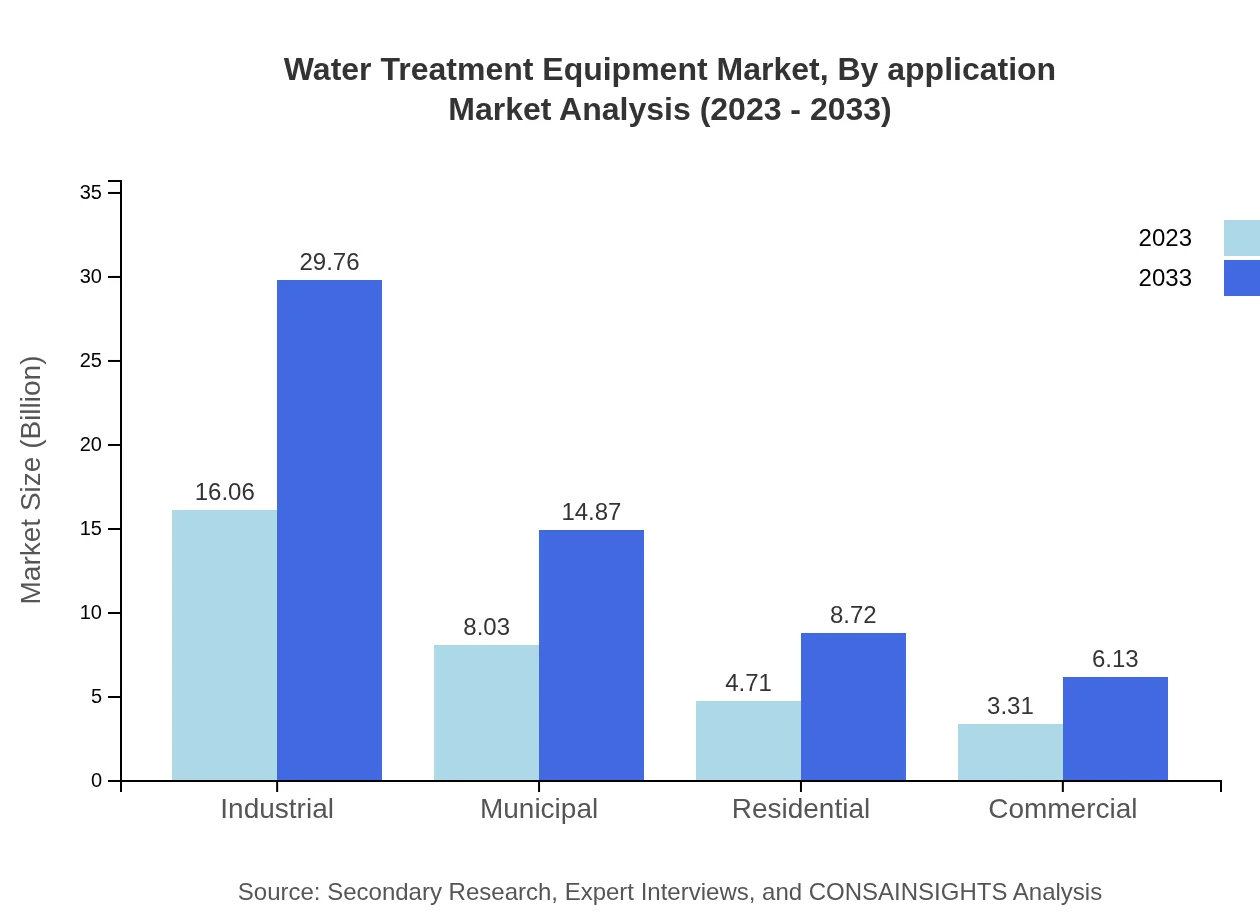

Water Treatment Equipment Market Analysis By Application

Applications for water treatment equipment span across municipal, residential, industrial, and commercial uses. The industrial segment is forecasted to hold the largest share, expected to rise from $16.06 billion in 2023 to $29.76 billion by 2033, driven by industrial sectors needing water for processing, cooling, and cleaning.

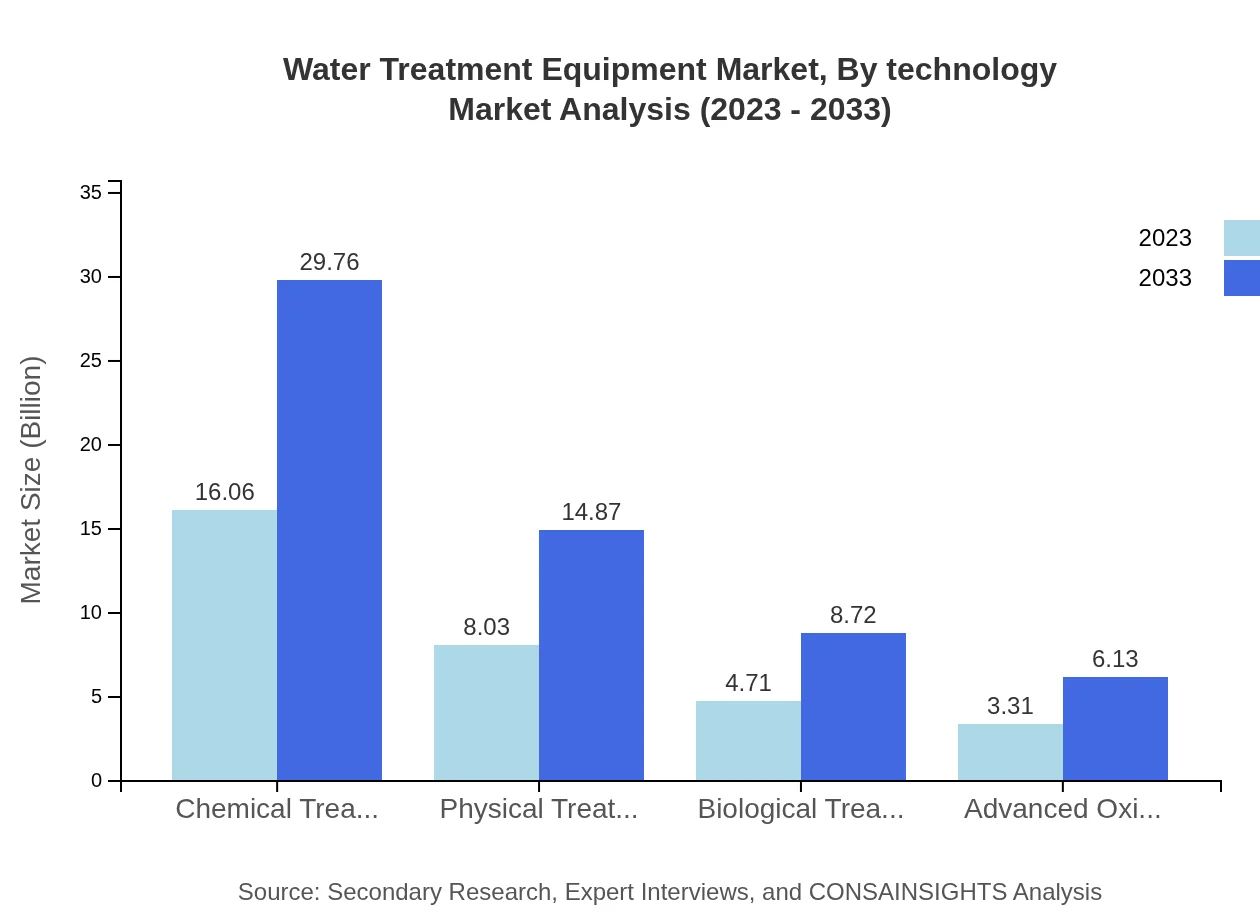

Water Treatment Equipment Market Analysis By Technology

Technologies applied in water treatment include physical, chemical, and biological methods of treatment. The chemical treatment segment is projected to account for the largest market share, with growth from $16.06 billion in 2023 to $29.76 billion by 2033, driven by its effectiveness across various applications.

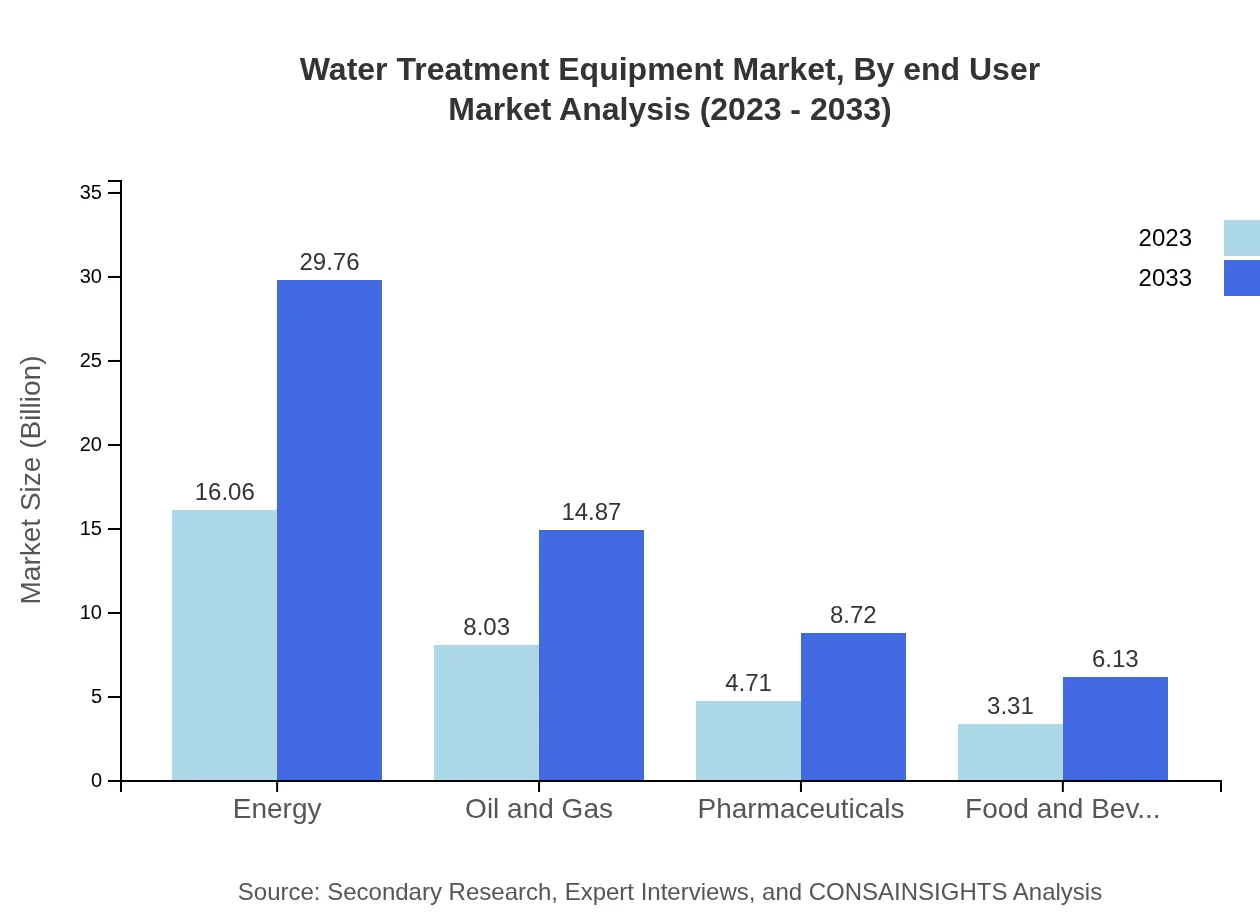

Water Treatment Equipment Market Analysis By End User

End-users of water treatment equipment are categorized into municipal, industrial, residential, and commercial sectors. The municipal segment is set for substantial growth, expected to rise from $8.03 billion in 2023 to $14.87 billion by 2033, propelled by urban expansion and rising water quality standards.

Water Treatment Equipment Market Analysis By Market Channel

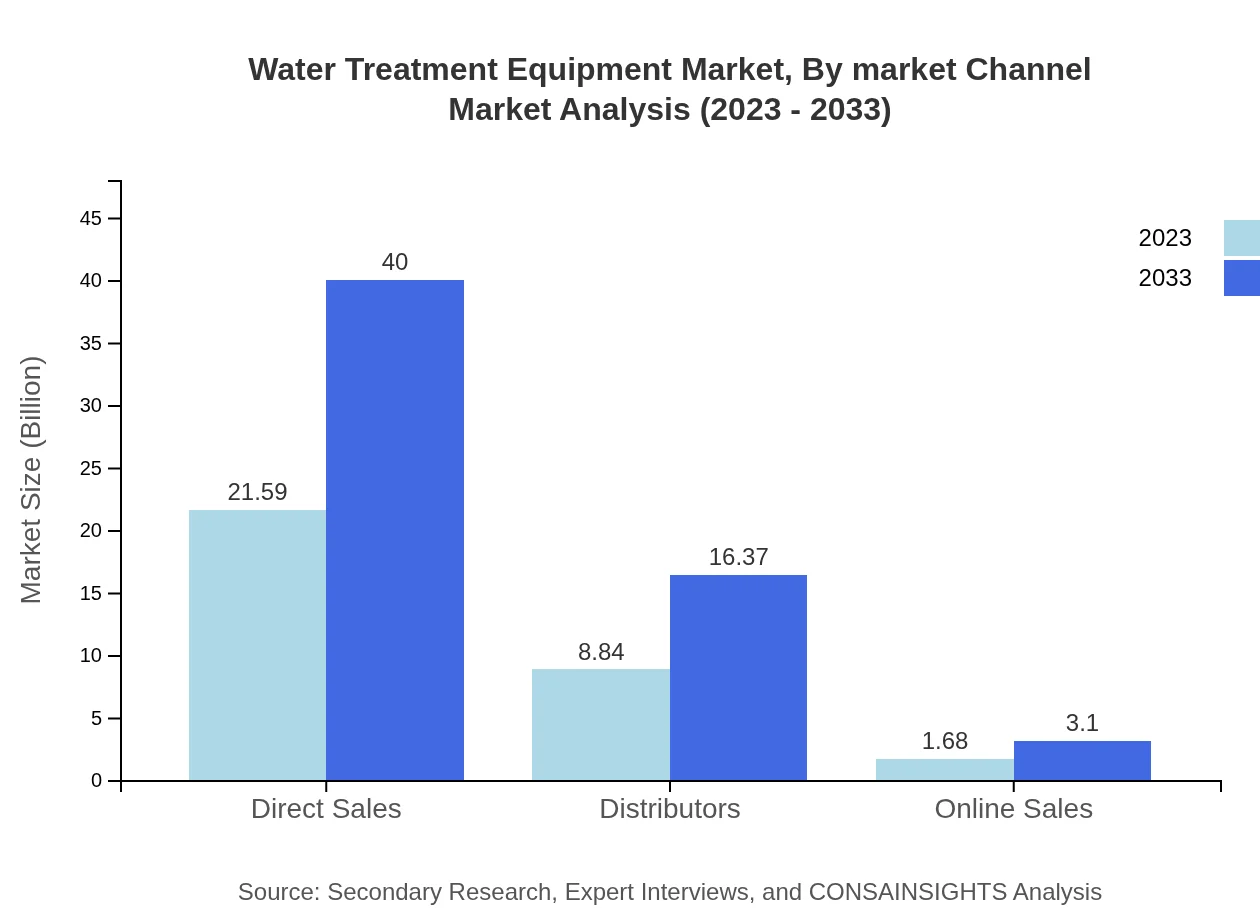

Market channels for water treatment equipment include direct sales, distributors, and online sales. Direct sales are leading with an anticipated market size of $21.59 billion in 2023, increasing to $40.00 billion by 2033, attributed to significant relationships between manufacturers and large-scale users.

Water Treatment Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Water Treatment Equipment Industry

VEOLIA:

A leading global company in optimized resource management, VEOLIA provides a range of innovative water treatment solutions to multiple sectors, focusing on sustainable practices.Xylem Inc.:

Xylem is a global leader in water technology, offering advanced analytical equipment, treatment products, and comprehensive services for efficient water management.SUEZ:

SUEZ specializes in water and wastewater management, providing cutting-edge technologies designed to improve water quality and enhance operational efficiency.Evoqua Water Technologies:

Evoqua is recognized for its focus on effective water treatment solutions and services across various sectors, including industrial and municipal applications.We're grateful to work with incredible clients.

FAQs

What is the market size of water Treatment Equipment?

The water treatment equipment market is valued at approximately $32.1 billion in 2023, with an expected CAGR of 6.2% over the next decade. This growth is attributed to increasing demand for clean water and advanced treatment technologies.

What are the key market players or companies in this water Treatment Equipment industry?

Key players in the water treatment equipment market include major companies like Veolia, SUEZ, Xylem Inc., and Danaher Corporation. These firms are pivotal in driving innovation and expanding the market through advanced technologies and solutions.

What are the primary factors driving the growth in the water Treatment Equipment industry?

The growth in the water treatment equipment industry is fueled by rising environmental concerns, regulatory standards, and the need for efficient water management. Technological advancements and urbanization also propel the demand for advanced treatment solutions.

Which region is the fastest Growing in the water Treatment Equipment?

The Asia-Pacific region is the fastest-growing market for water treatment equipment, projected to grow from $6.11 billion in 2023 to $11.32 billion by 2033, reflecting a significant increase in water treatment needs and infrastructure investments.

Does ConsaInsights provide customized market report data for the water Treatment Equipment industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the water treatment equipment industry, providing insights into market trends, forecasts, and competitive analysis.

What deliverables can I expect from this water Treatment Equipment market research project?

The water treatment equipment market research project will deliver comprehensive reports including market size data, trend analyses, segmentation insights, and competitive landscape evaluations ensuring informed decision-making.

What are the market trends of water Treatment Equipment?

Current trends in the water treatment equipment market involve increased automation, rising adoption of smart technologies, and eco-friendly solutions. There is a marked shift towards efficient treatment processes and sustainable water usage practices.