Water Treatment Systems Market Report

Published Date: 02 February 2026 | Report Code: water-treatment-systems

Water Treatment Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Water Treatment Systems market from 2023 to 2033, focusing on market size, growth rates, regional insights, industry trends, and key players to guide stakeholders in making informed decisions.

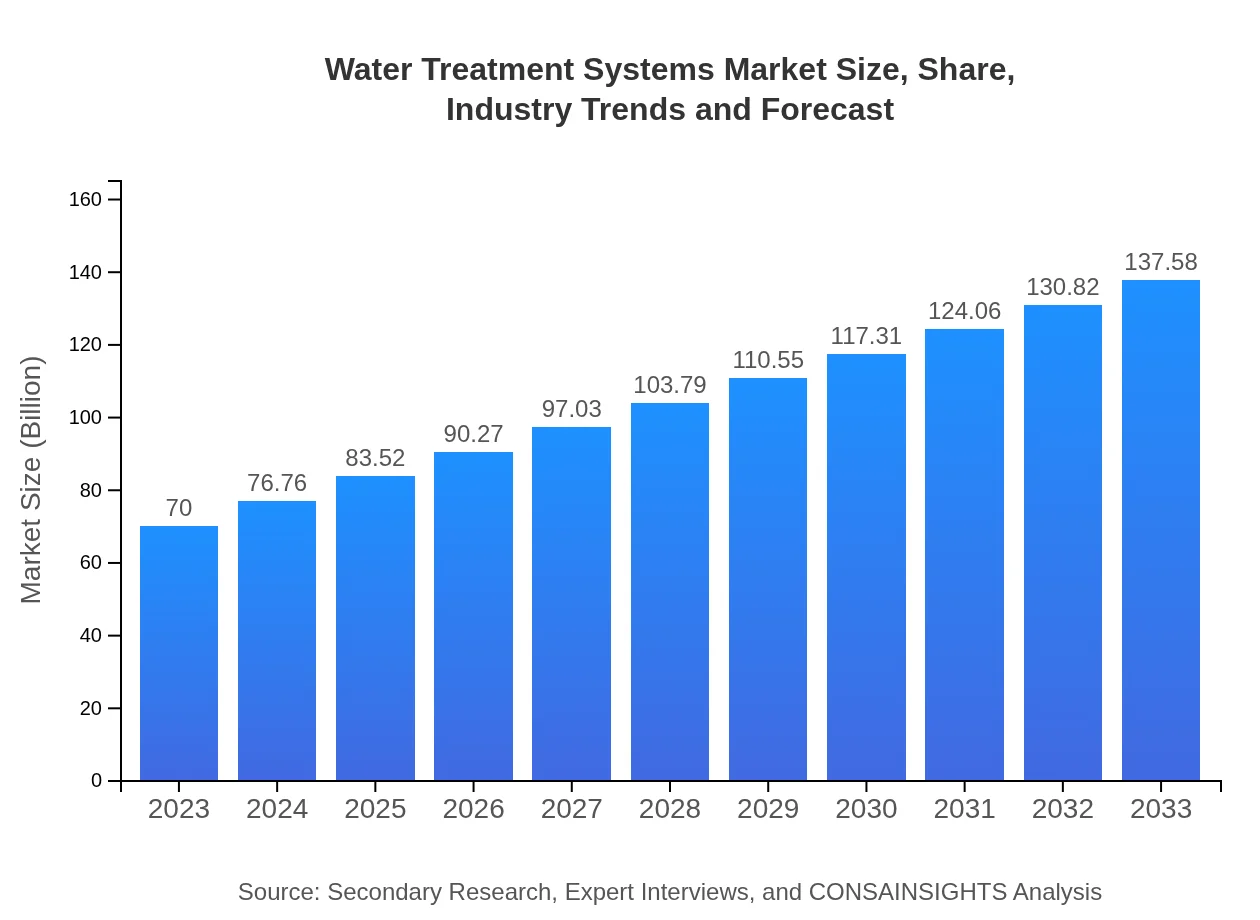

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $70.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $137.58 Billion |

| Top Companies | Veolia Environment S.A., SUEZ Water Technologies & Solutions, Xylem Inc., Evoqua Water Technologies |

| Last Modified Date | 02 February 2026 |

Water Treatment Systems Market Overview

Customize Water Treatment Systems Market Report market research report

- ✔ Get in-depth analysis of Water Treatment Systems market size, growth, and forecasts.

- ✔ Understand Water Treatment Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Water Treatment Systems

What is the Market Size & CAGR of Water Treatment Systems market in 2023?

Water Treatment Systems Industry Analysis

Water Treatment Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Water Treatment Systems Market Analysis Report by Region

Europe Water Treatment Systems Market Report:

Europe holds a substantial market share, valued at $19.08 billion in 2023 and projected to reach $37.50 billion in 2033. The region is characterized by advanced water management practices and heavy investment in sustainable technologies as part of EU regulations to ensure water quality.Asia Pacific Water Treatment Systems Market Report:

In the Asia Pacific region, the market was valued at $14.20 billion in 2023, projected to reach $27.92 billion by 2033. Rapid industrialization and urbanization, coupled with stringent environmental regulations, are major growth factors. China and India are key players, focusing on infrastructural upgrades to improve water quality and availability.North America Water Treatment Systems Market Report:

North America exhibits significant growth, with the market estimated at $24.81 billion in 2023 and expected to reach $48.76 billion by 2033. The U.S. leads in technological advancement and has stringent regulations that propel the adoption of innovative water treatment solutions.South America Water Treatment Systems Market Report:

The South American market is set to grow from $5.50 billion in 2023 to $10.80 billion by 2033. Brazil and Argentina are the leading markets, driven by increasing investment in water infrastructure and treatment facilities to tackle pollution and ensure clean water access.Middle East & Africa Water Treatment Systems Market Report:

The Middle East and Africa market was valued at $6.41 billion in 2023, anticipated to reach $12.60 billion by 2033. Water scarcity and demand pressures are driving investments in desalination and sustainable water management practices, making this a growing segment of the global market.Tell us your focus area and get a customized research report.

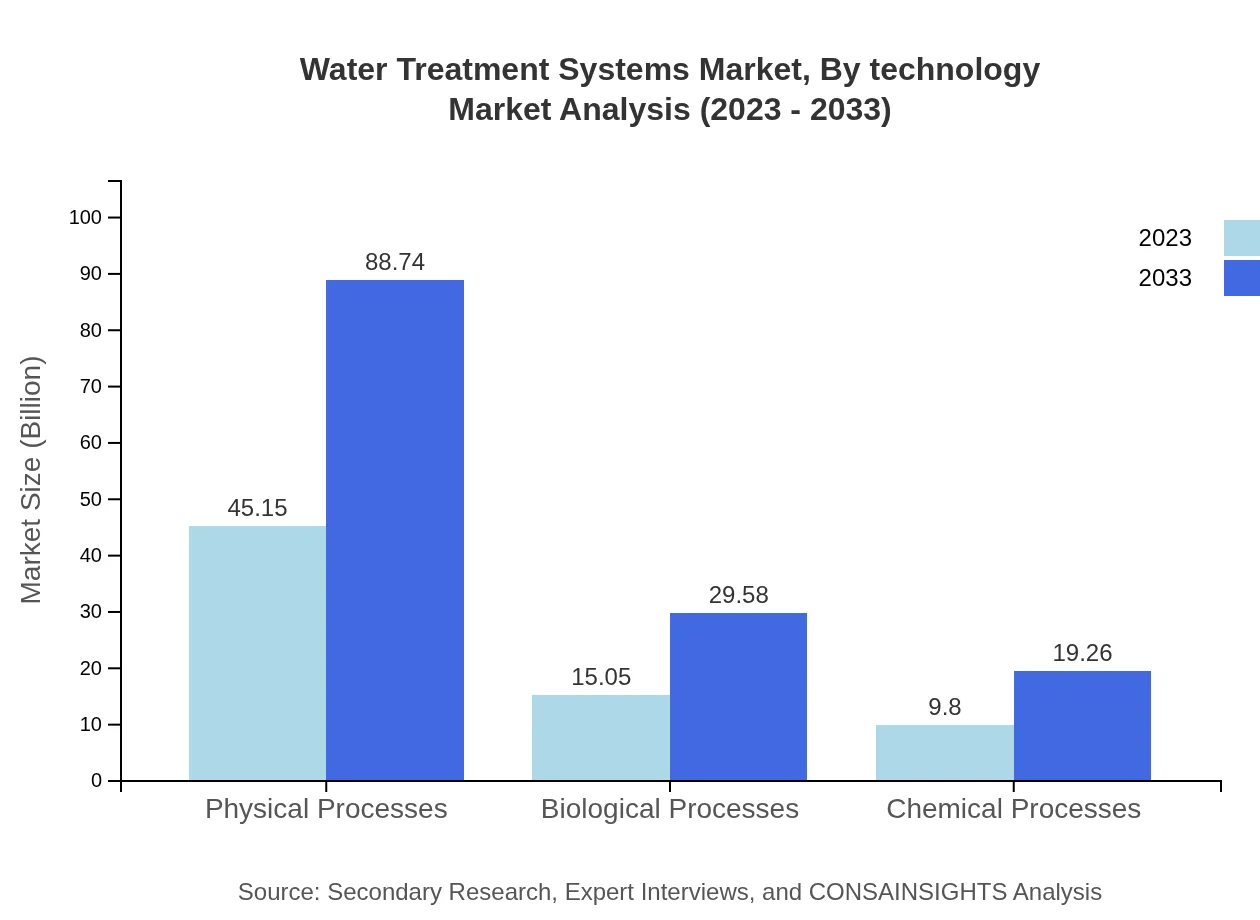

Water Treatment Systems Market Analysis By Technology

In terms of technology, Physical Processes dominate the market with a size of $45.15 billion in 2023, expected to elevate to $88.74 billion by 2033, capturing 64.5% of the market share. Biological Processes follow with $15.05 billion in 2023, projected to move to $29.58 billion by 2033, holding a 21.5% market share. Chemical Processes are also critical, valued at $9.80 billion in 2023 and reaching $19.26 billion by 2033, maintaining a market share of 14%.

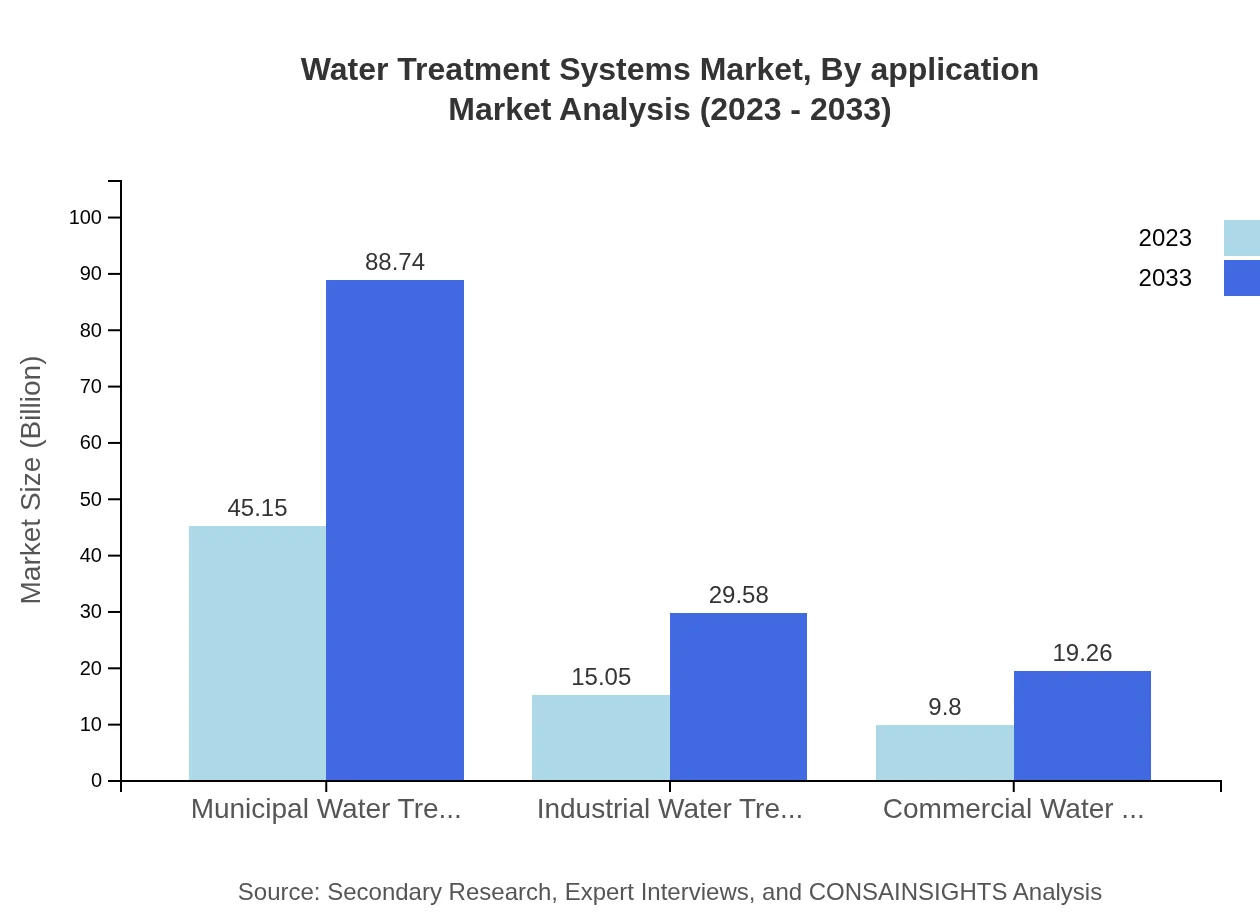

Water Treatment Systems Market Analysis By Application

Municipal Water Treatment is the leading application segment, valued at $45.15 billion in 2023 and projected to reach $88.74 billion by 2033, holding a 64.5% market share. Industrial Water Treatment and Commercial Water Treatment contribute $15.05 billion and $9.80 billion respectively in 2023, expected to grow to $29.58 billion and $19.26 billion by 2033, each with market shares of 21.5% and 14%.

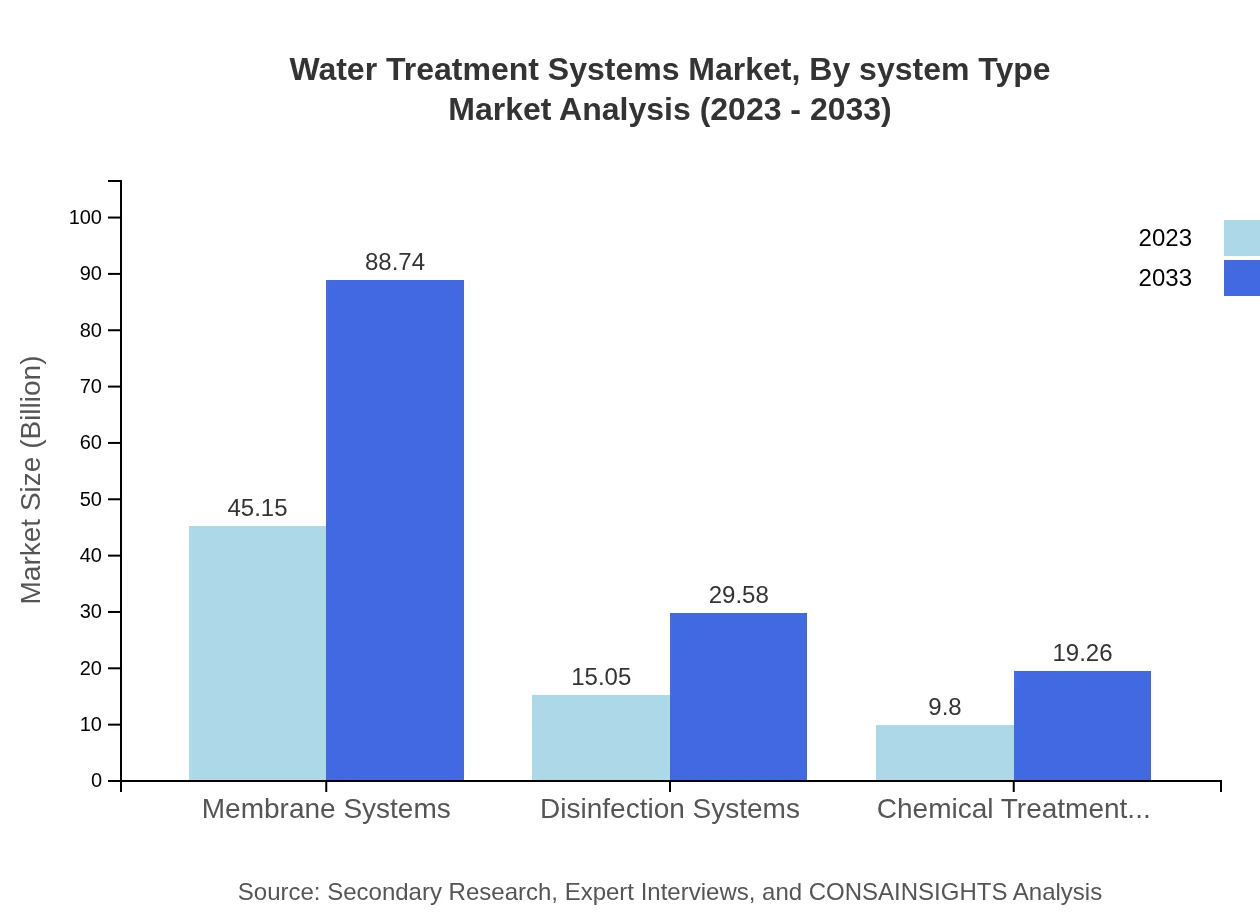

Water Treatment Systems Market Analysis By System Type

The market for Membrane Systems is expected to grow from $45.15 billion in 2023 to $88.74 billion by 2033, maintaining a 64.5% share. Followed by Disinfection Systems valued at $15.05 billion in 2023 and projected to reach $29.58 billion by 2033 with a market share of 21.5%. Chemical Treatment Systems will grow from $9.80 billion in 2023 to $19.26 billion by 2033, contributing 14% to the market share.

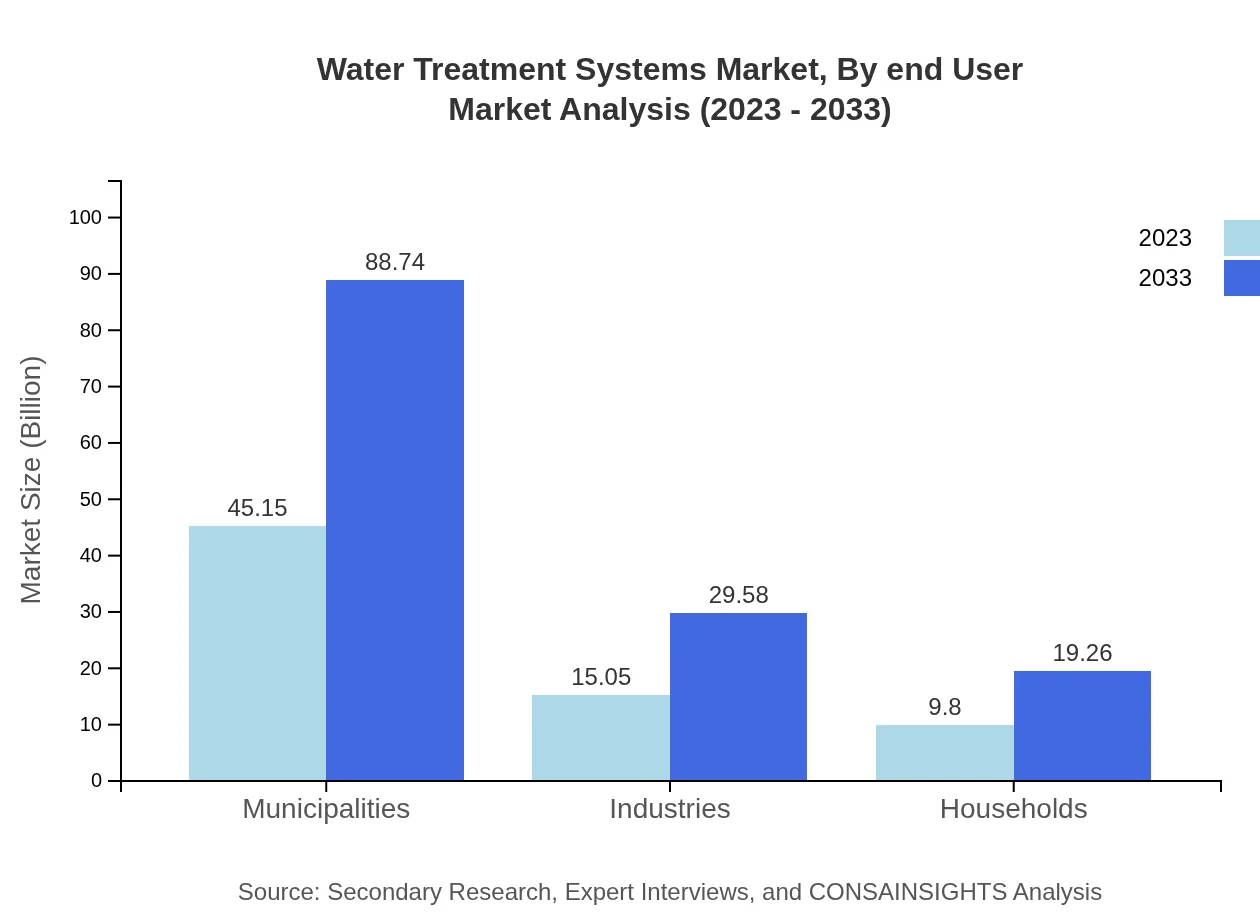

Water Treatment Systems Market Analysis By End User

Municipalities represent the largest end-user segment, estimated at $45.15 billion in 2023, likely to increase to $88.74 billion by 2033, reflecting a stable market share of 64.5%. Industries follow with a market size of $15.05 billion in 2023, projected to grow to $29.58 billion by 2033, while households contribute $9.80 billion in 2023, increasing to $19.26 billion by 2033.

Water Treatment Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Water Treatment Systems Industry

Veolia Environment S.A.:

A global leader in optimized resource management, Veolia provides innovative water treatment solutions to ensure sustainable water supply and management across various sectors.SUEZ Water Technologies & Solutions:

SUEZ is renowned for its comprehensive water treatment and recycling solutions, offering advanced technologies that improve water quality while conserving resources.Xylem Inc.:

Xylem specializes in numerous water technologies including treatment, testing, and analytics, fostering sustainable water usage across various applications globally.Evoqua Water Technologies:

Evoqua provides extensive water and wastewater treatment solutions, dedicated to redefining the water treatment industry through technological advancements.We're grateful to work with incredible clients.

FAQs

What is the market size of water Treatment Systems?

The water treatment systems market is valued at approximately $70 billion in 2023, with a projected CAGR of 6.8% through 2033. This growth reflects the increasing necessity for effective water management solutions globally.

What are the key market players or companies in this water Treatment Systems industry?

Key players in the water treatment systems industry include major companies such as Veolia Environnement, SUEZ, Xylem Inc., and GE Water & Process Technologies. These companies lead through innovation and comprehensive service offerings.

What are the primary factors driving the growth in the water Treatment Systems industry?

Growth in the water treatment systems industry is driven by urbanization, stringent regulations on water quality, environmental concerns, and rising demand for clean water among municipalities and industries. Enhanced technology and sustainable practices also contribute.

Which region is the fastest Growing in the water Treatment Systems?

The fastest-growing region in the water treatment systems market is North America, with a market size increase from $24.81 billion in 2023 to $48.76 billion by 2033, driven by advanced infrastructure and significant investment in clean technologies.

Does ConsaInsights provide customized market report data for the water Treatment Systems industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the water treatment systems industry, helping businesses gain insights and develop strategic initiatives based on their unique requirements.

What deliverables can I expect from this water Treatment Systems market research project?

Deliverables from the water treatment systems market research project include comprehensive market analysis reports, regional market assessments, segment data, competitive landscape updates, and tailored recommendations for strategic decision-making.

What are the market trends of water Treatment Systems?

Market trends in water treatment systems indicate a shift towards smart technology integration, increased adoption of membrane systems, advancing chemical treatment processes, and a growing emphasis on sustainability and circular water practices in various sectors.