Water Treatment Technology Market Report

Published Date: 02 February 2026 | Report Code: water-treatment-technology

Water Treatment Technology Market Size, Share, Industry Trends and Forecast to 2033

This market report delves into the Water Treatment Technology industry from 2023 to 2033, providing insights on market size, trends, segments, and leading companies, along with a comprehensive regional analysis and forecasts for the upcoming decade.

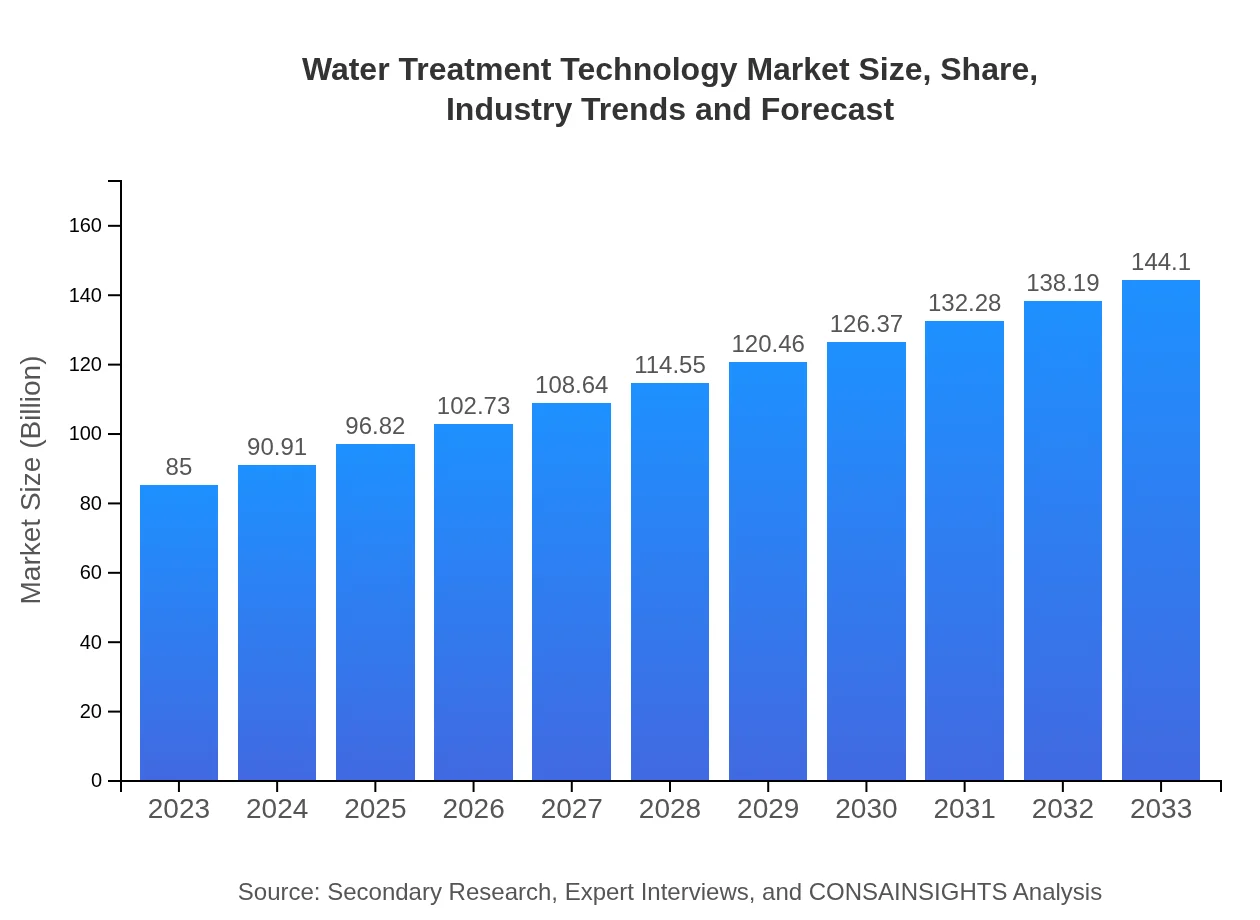

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $85.00 Billion |

| CAGR (2023-2033) | 5.3% |

| 2033 Market Size | $144.10 Billion |

| Top Companies | Veolia Environnement, SUEZ Water Technologies & Solutions, Xylem Inc., Evoqua Water Technologies, Pentair plc |

| Last Modified Date | 02 February 2026 |

Water Treatment Technology Market Overview

Customize Water Treatment Technology Market Report market research report

- ✔ Get in-depth analysis of Water Treatment Technology market size, growth, and forecasts.

- ✔ Understand Water Treatment Technology's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Water Treatment Technology

What is the Market Size & CAGR of Water Treatment Technology market in 2033?

Water Treatment Technology Industry Analysis

Water Treatment Technology Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Water Treatment Technology Market Analysis Report by Region

Europe Water Treatment Technology Market Report:

Europe is witnessing substantial growth within the Water Treatment Technology sector, valued at $21.98 billion in 2023 and anticipated to reach $37.27 billion by 2033. The region is characterized by strict regulations surrounding water quality and sustainability, prompting investments in innovative solutions. Moreover, initiatives for improving water reuse and recycling are further supporting market expansion in European nations.Asia Pacific Water Treatment Technology Market Report:

The Asia Pacific region holds a significant market share in the Water Treatment Technology sector, valued at $17.13 billion in 2023 and projected to reach $29.04 billion by 2033. The growth in this region is propelled by urbanization, population growth, and substantial industrial activities, driving the demand for advanced water treatment solutions. Countries like China and India are investing heavily in infrastructure development, further boosting market dynamics.North America Water Treatment Technology Market Report:

North America stands as a leading market for Water Treatment Technology, with an estimated worth of $30.77 billion in 2023, projected to grow to $52.17 billion by 2033. Factors contributing to this robust growth include stringent regulations on water quality, ongoing investments in wastewater treatment systems, and advancements in technology that enhance treatment efficacy. The United States, in particular, is a major contributor, driven by both municipal and industrial demand.South America Water Treatment Technology Market Report:

In South America, the market for Water Treatment Technology is on a steady rise, with a valuation of $7.10 billion in 2023, expected to grow to $12.03 billion by 2033. The region's investment in sustainable water management practices to tackle pollution and improve public health is driving this growth. Initiatives to enhance agricultural water efficiency are also gaining traction across various countries.Middle East & Africa Water Treatment Technology Market Report:

The Middle East and Africa exhibit a growing demand for Water Treatment Technology, with a market valuation of $8.02 billion in 2023, projected to rise to $13.60 billion by 2033. Water scarcity issues, driven by climate change and population growth, are substantial factors influencing the market. Investments in desalination technologies and sustainable water management practices are key drivers in this region.Tell us your focus area and get a customized research report.

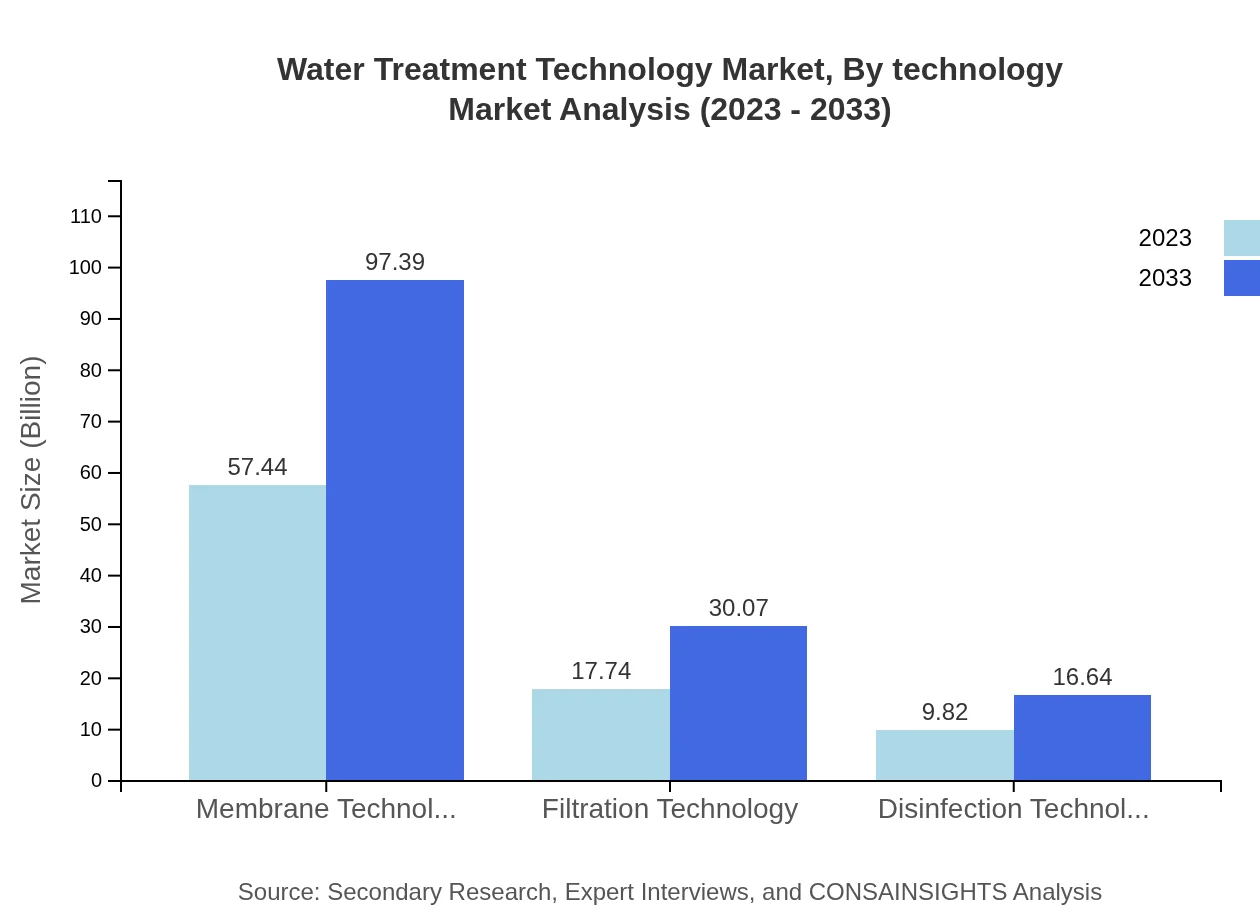

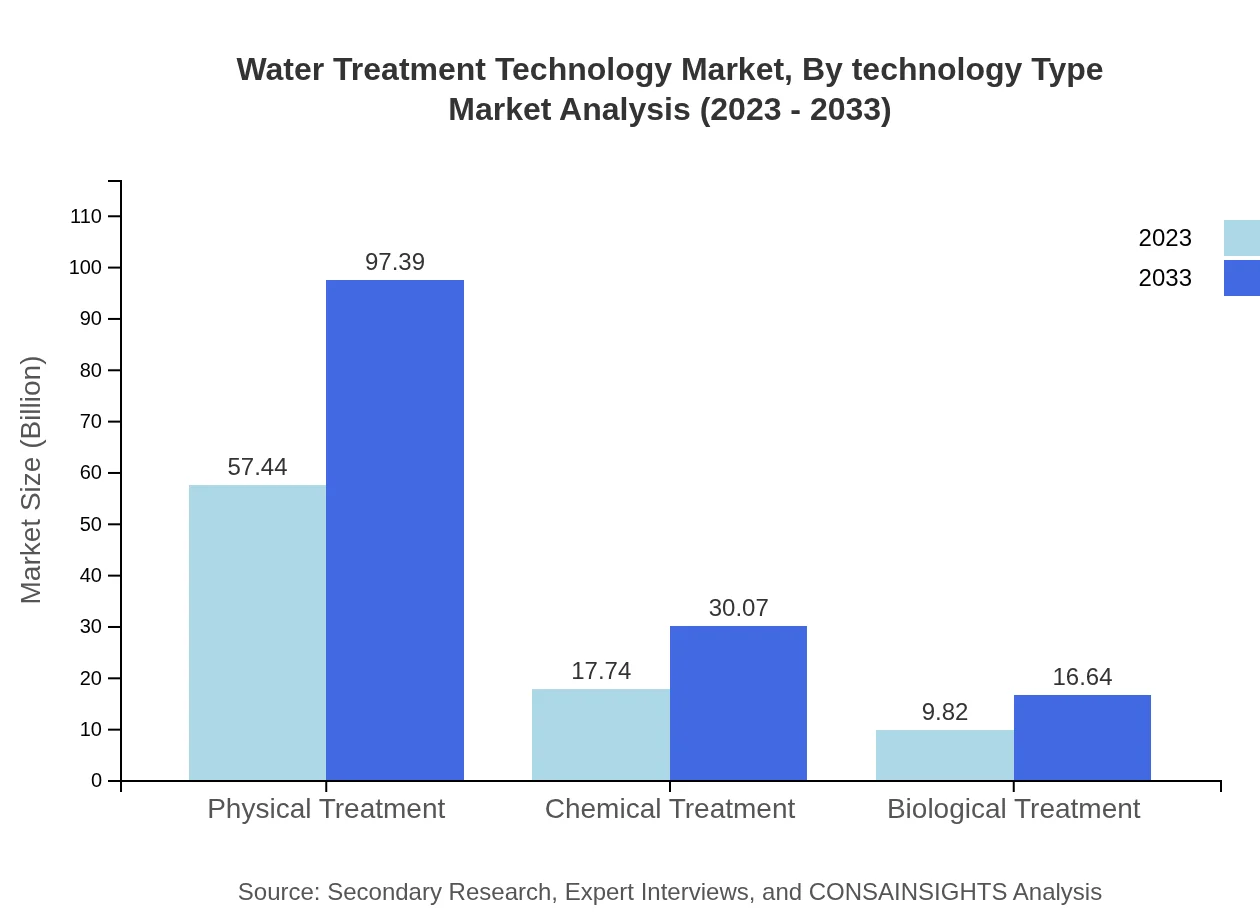

Water Treatment Technology Market Analysis By Technology

The Water Treatment Technology market is primarily segmented into several key technology categories, notably membrane technology, filtration technology, and disinfection technology. Membrane technology alone is significant, with a market size of $57.44 billion in 2023, expected to grow to $97.39 billion by 2033. This technology is favored for its efficiency in removing contaminants. Filtration technology accounts for $17.74 billion, with expectations to expand to $30.07 billion, while disinfection technology, valued at $9.82 billion in 2023, is projected to increase to $16.64 billion.

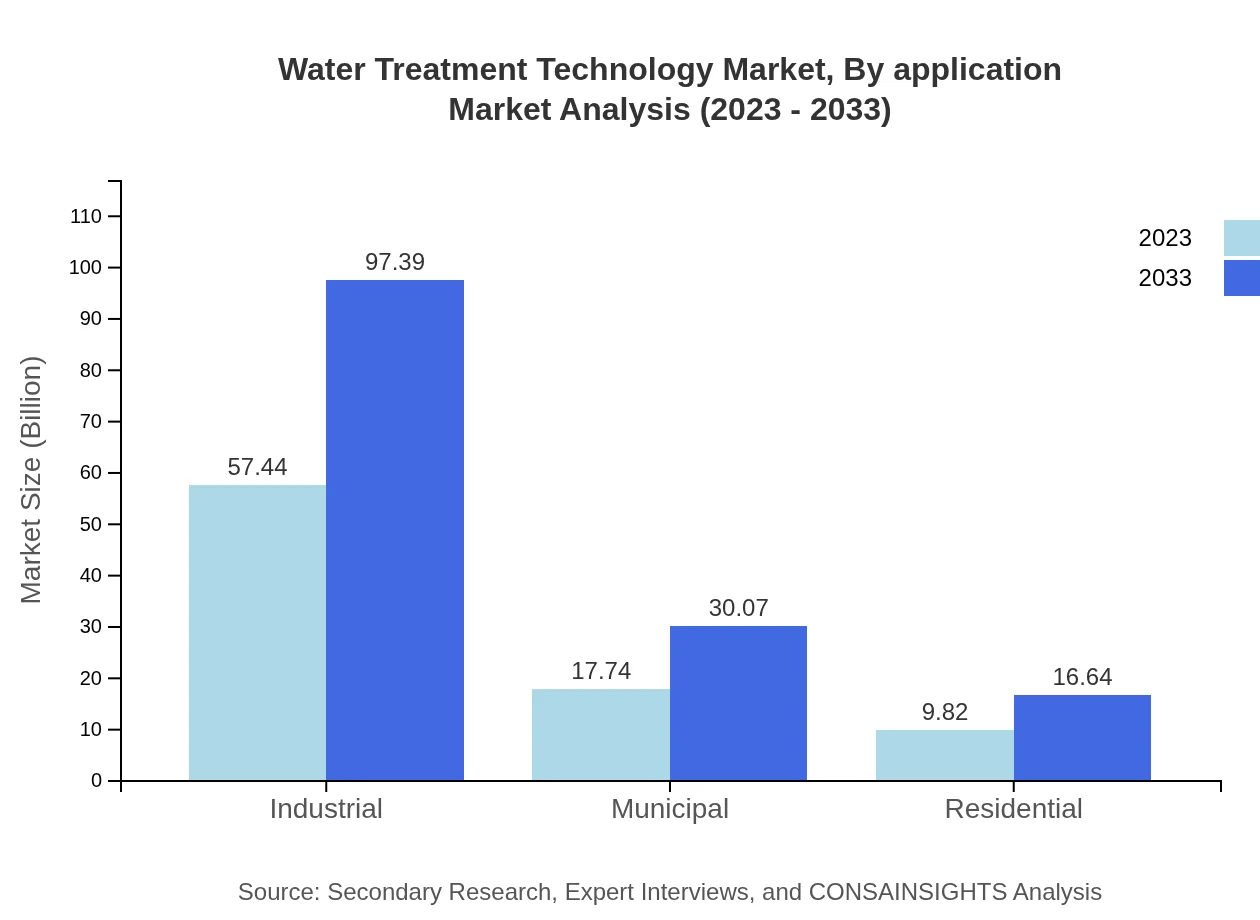

Water Treatment Technology Market Analysis By Application

Applications in the Water Treatment Technology market are diverse, including municipal, industrial, agricultural, and residential uses. Municipal applications dominate, with a market size of $17.74 billion in 2023, forecasted to reach $30.07 billion by 2033. Industrial applications also hold a significant share, indicative of the sector's demand for water recycling and treatment solutions in manufacturing processes. Similarly, agricultural applications are on rise, underscoring the importance of water efficiency in farming.

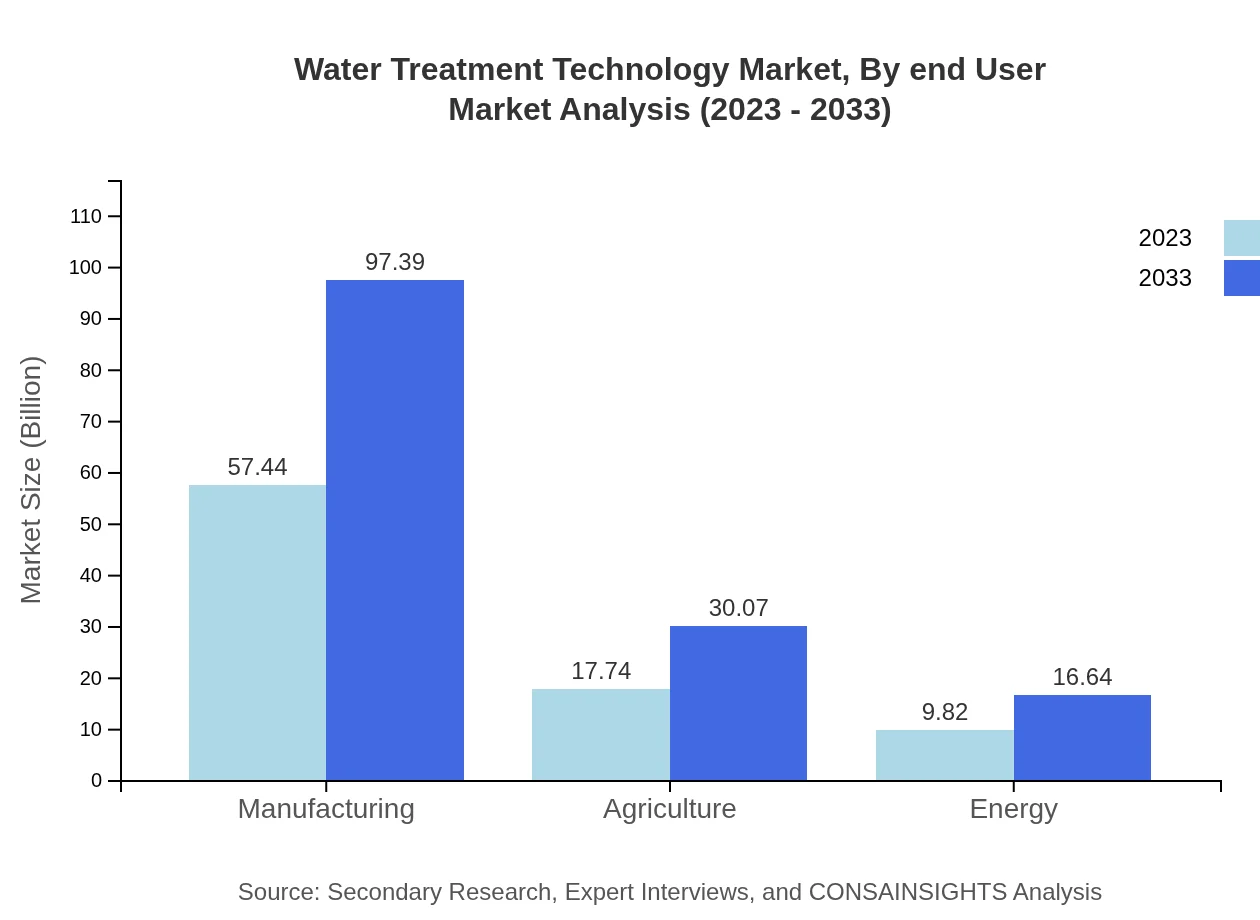

Water Treatment Technology Market Analysis By End User

The end-user segment of the Water Treatment Technology market includes industrial, municipal, residential, and agricultural end-users. Industrial applications, with a market footprint of $57.44 billion in 2023, are expected to grow significantly by 2033, driven by increased focus on sustainable practices. The municipal sector, with a size of $17.74 billion in 2023, is pivotal for community water management, underlining the essential nature of public water services.

Water Treatment Technology Market Analysis By Technology Type

Product types in the Water Treatment Technology market include physical, chemical, and biological treatments, each catering to different treatment needs. Physical treatment methods dominate the market, currently valued at $57.44 billion, while chemical treatment holds a growing share corresponding to an anticipated increase from $17.74 billion to $30.07 billion by 2033. These segments reveal the adaptability of technologies to different water treatment challenges.

Water Treatment Technology Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Water Treatment Technology Industry

Veolia Environnement:

Veolia is a French multinational company known for its extensive work in water, waste, and energy management. The company leads in providing advanced water treatment solutions and technologies, focusing on sustainability and ecological progress.SUEZ Water Technologies & Solutions:

SUEZ is recognized for its innovation in water treatment technologies, servicing both municipal and industrial clients. SUEZ offers a range of sustainable solutions addressing data-driven operations and efficiency.Xylem Inc.:

Xylem is a leading global water technology company dedicated to solving water challenges through technology and innovation. The firm provides products and services ranging from transport and treatment to testing and analytics.Evoqua Water Technologies:

Evoqua specializes in water and wastewater treatment solutions, providing services and products focused on improving water quality and minimizing environmental impact.Pentair plc:

Pentair offers a comprehensive range of water treatment technologies and solutions. The company's focus ranges from residential systems to large-scale industrial water treatment operations.We're grateful to work with incredible clients.

FAQs

What is the market size of water Treatment Technology?

The global water treatment technology market is expected to reach approximately $85 billion by 2033, growing at a CAGR of 5.3%. In 2023, the market size was estimated at around $85 billion, reflecting robust growth driven by increasing water demand.

What are the key market players or companies in the water Treatment Technology industry?

Key players in the water treatment technology industry include major companies like Xylem Inc., Veolia, SUEZ, and Ecolab. These organizations are pivotal in technological advancements and market share, driving competitive dynamics within the sector.

What are the primary factors driving the growth in the water Treatment Technology industry?

Growth in the water treatment technology industry is propelled by increasing regulatory demands for safe water, rising population necessitating efficient water resources management, and technological advancements that enhance water purification processes.

Which region is the fastest Growing in the water Treatment Technology?

The fastest-growing region in the water treatment technology market is North America, projected to grow from $30.77 billion in 2023 to $52.17 billion by 2033. This growth is driven by stringent regulations and increased investments in water infrastructure.

Does ConsaInsights provide customized market report data for the water Treatment Technology industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the water treatment technology industry. Clients can access detailed insights that address unique challenges or opportunities in their markets.

What deliverables can I expect from this water Treatment Technology market research project?

Deliverables from the water treatment technology market research project typically include comprehensive reports, industry analysis, market forecasts, and segmentation data for various regions, providing essential insights for strategic decision-making.

What are the market trends of water Treatment Technology?

Current trends in the water treatment technology market include increasing adoption of membrane technologies for filtration, growth in digital water solutions, and rising investments in sustainable water management practices across various sectors.