Water Truck Market Report

Published Date: 22 January 2026 | Report Code: water-truck

Water Truck Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Water Truck market, focusing on insights, forecasts, and data from 2023 to 2033. It covers market size, growth trends, industry analysis, segmentation, and regional dynamics to equip stakeholders with valuable information for strategic decision-making.

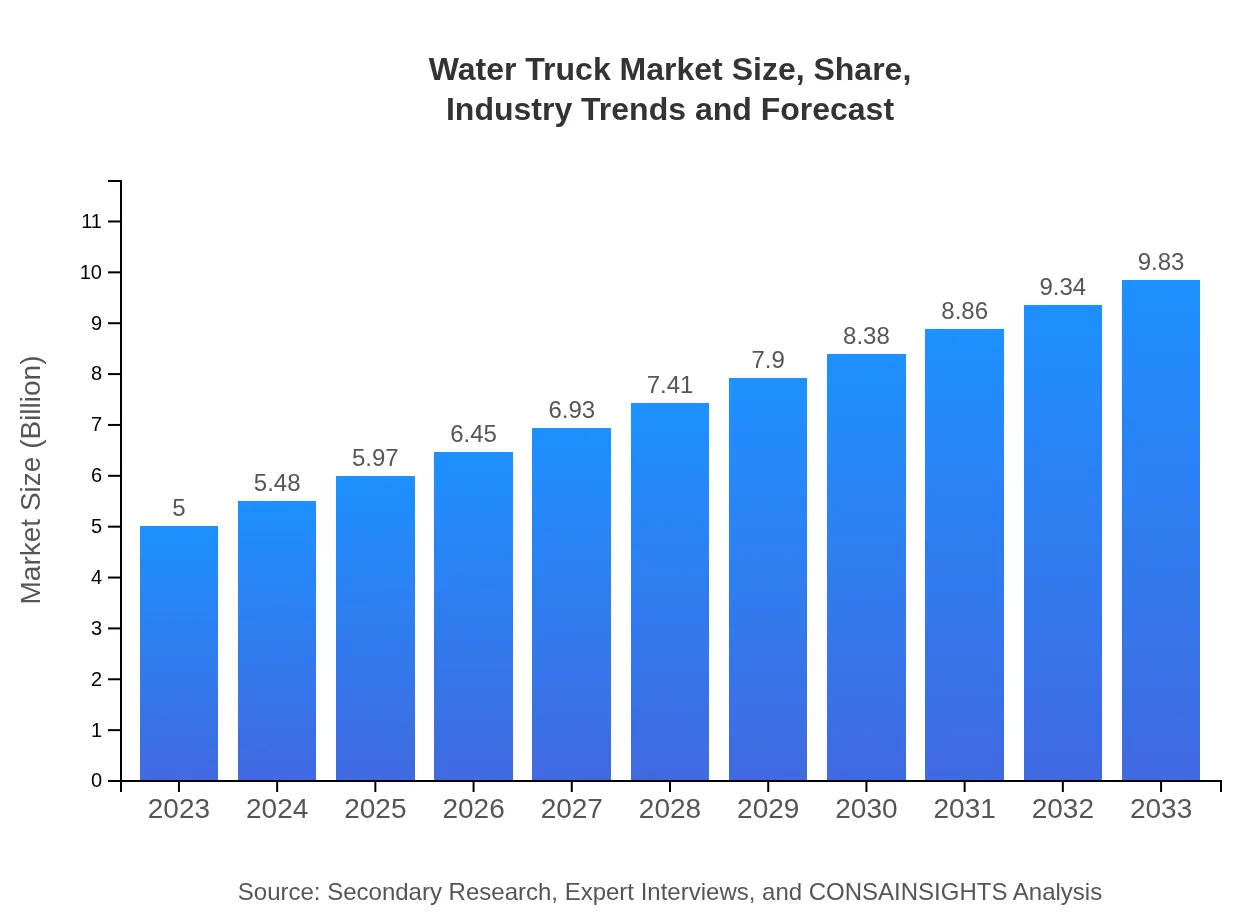

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $9.83 Billion |

| Top Companies | Daimler AG, Volvo Group, Ashok Leyland, Hino Motors, Scania Group |

| Last Modified Date | 22 January 2026 |

Water Truck Market Overview

Customize Water Truck Market Report market research report

- ✔ Get in-depth analysis of Water Truck market size, growth, and forecasts.

- ✔ Understand Water Truck's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Water Truck

What is the Market Size & CAGR of Water Truck market in 2023?

Water Truck Industry Analysis

Water Truck Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Water Truck Market Analysis Report by Region

Europe Water Truck Market Report:

The European market is projected to rise from $1.40 billion in 2023 to $2.75 billion in 2033. The region is focusing on innovative technologies and sustainable practices to enhance water transportation efficiency. Additionally, the emphasis on environmental conservation aligns with the increased adoption of water trucks in various sectors.Asia Pacific Water Truck Market Report:

The Asia-Pacific region is projected to grow from $0.92 billion in 2023 to $1.81 billion by 2033, driven by rapid urbanization and infrastructural developments. Countries like India and China are investing heavily in water management solutions, thus bolstering market growth. Increased agricultural activities further capitalize on water trucks for irrigation and crop management.North America Water Truck Market Report:

North America holds a significant share of the market, expanding from $1.93 billion in 2023 to $3.79 billion by 2033. The region's growth is primarily driven by advanced construction projects and stringent regulations surrounding water usage. The presence of leading manufacturers further catalyzes market dynamics.South America Water Truck Market Report:

Expected to expand from $0.14 billion in 2023 to $0.27 billion in 2033, South America's water truck market is influenced by improving agricultural practices and water infrastructure initiatives. Governments are increasingly focusing on resource sustainability, thereby driving demand for these vehicles.Middle East & Africa Water Truck Market Report:

The Middle East and Africa market is focused on overcoming water scarcity, expected to grow from $0.61 billion in 2023 to $1.21 billion by 2033. The ongoing construction boom and rising agricultural investments are key drivers, with governments implementing policies to improve water infrastructure.Tell us your focus area and get a customized research report.

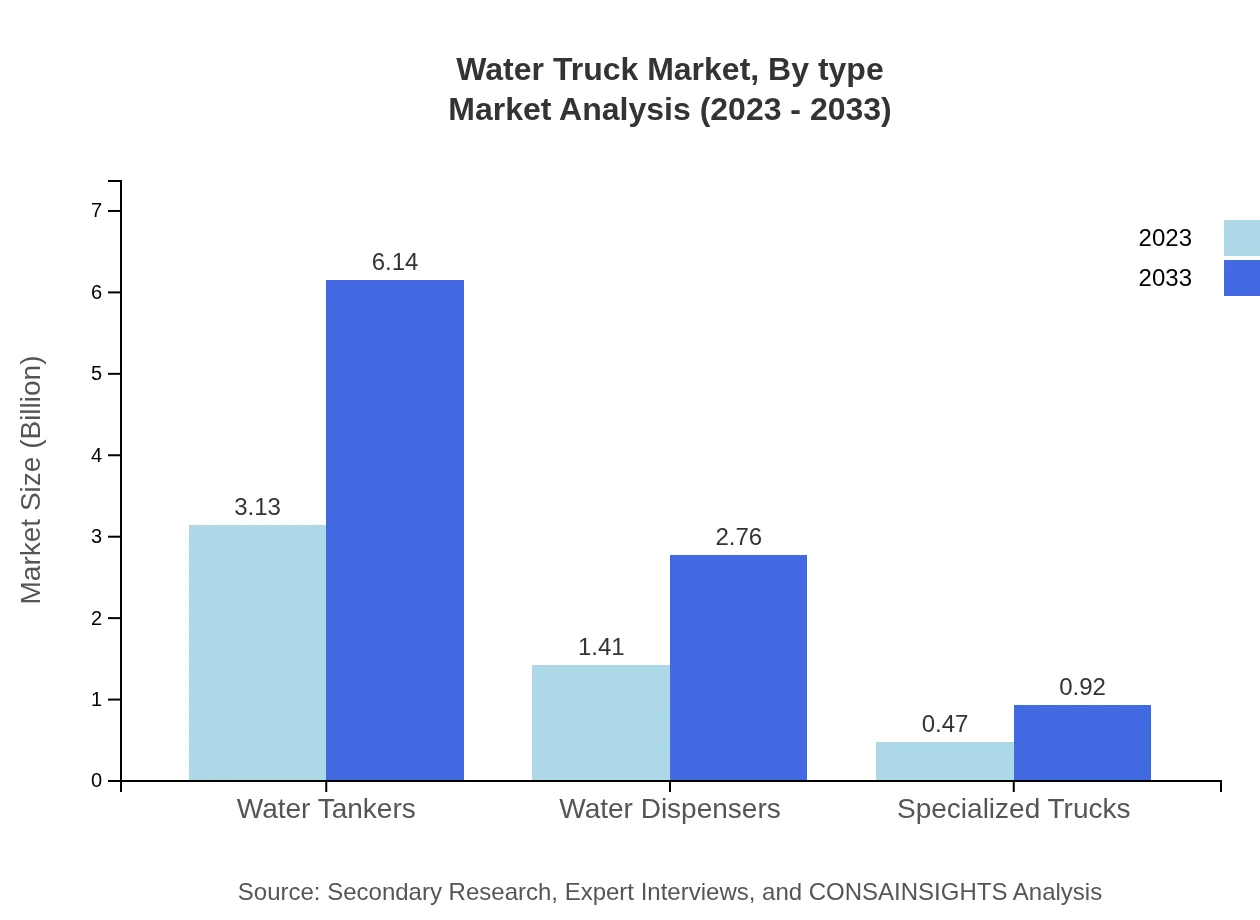

Water Truck Market Analysis By Type

The Water Truck market by type is dominated by water tankers, which are projected to grow from $3.13 billion in 2023 to $6.14 billion by 2033. Water dispensers and specialized trucks also play significant roles, with respective projections indicating growth from $1.41 billion to $2.76 billion, and $0.47 billion to $0.92 billion over the same period. Diesel remains the primary fuel for operation, holding a continuous market share of 62.5%, while alternative fuels are gaining traction for their environmental benefits.

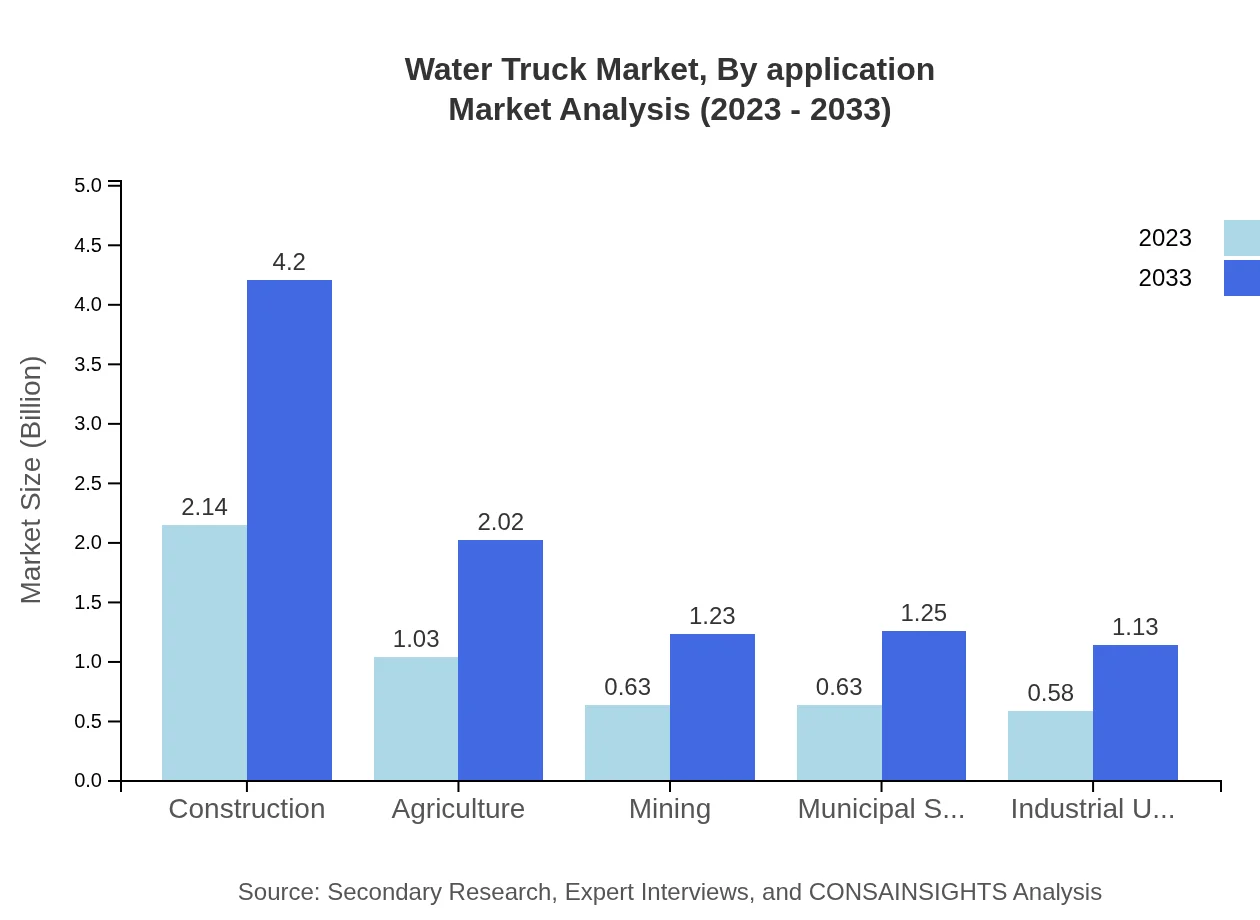

Water Truck Market Analysis By Application

In terms of applications, construction leads with a projected market size of $2.14 billion in 2023, increasing to $4.20 billion by 2033. Agricultural usage follows closely, growing from $1.03 billion to $2.02 billion. Mining and municipal services are also critical applications, reflecting the versatile nature of water trucks across various industries.

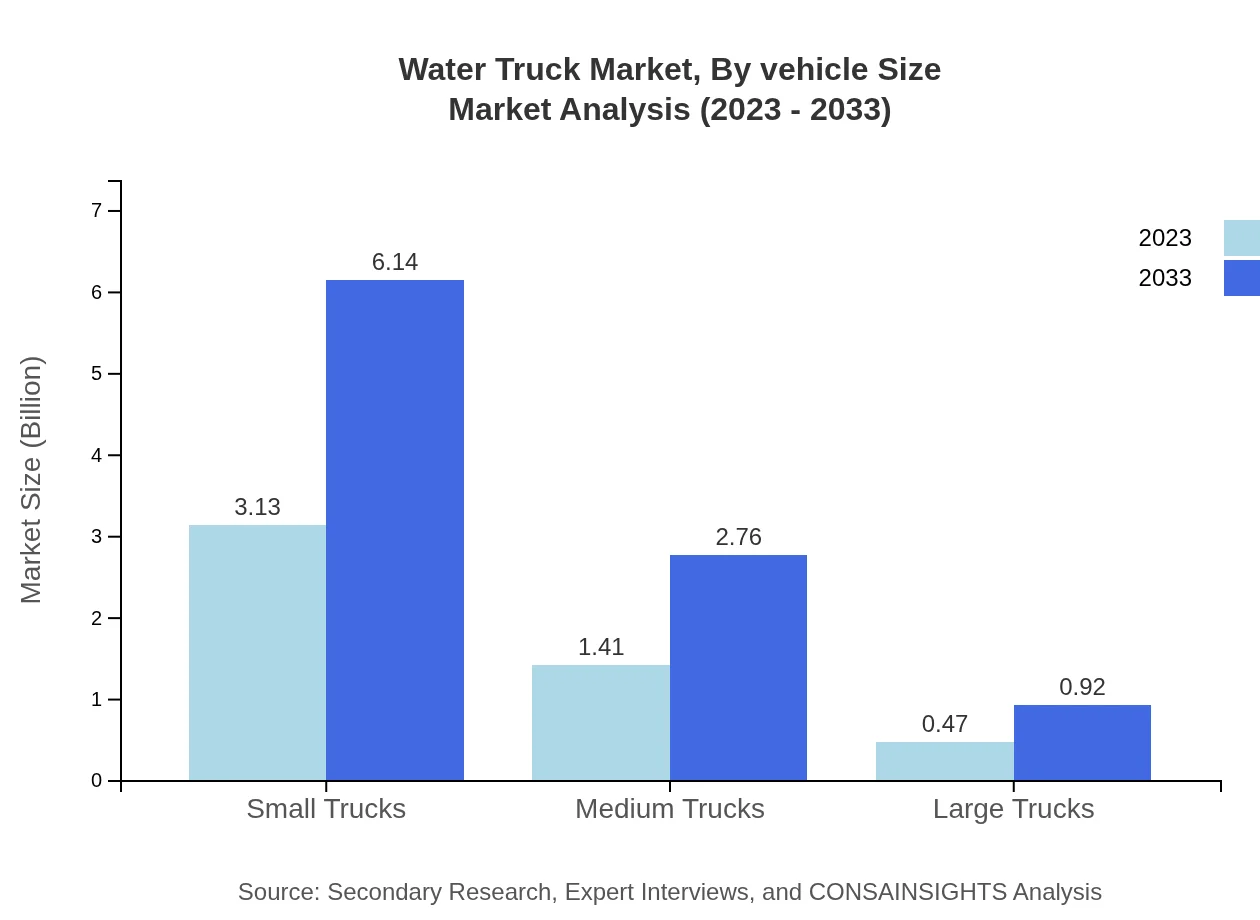

Water Truck Market Analysis By Vehicle Size

Vehicle size segmentation reveals a significant inclination towards small trucks, maintaining a market size of $3.13 billion in 2023 and escalating to $6.14 billion by 2033. Medium and large trucks show promising growth, with medium trucks projected to rise from $1.41 billion to $2.76 billion, while large trucks progress from $0.47 billion to $0.92 billion.

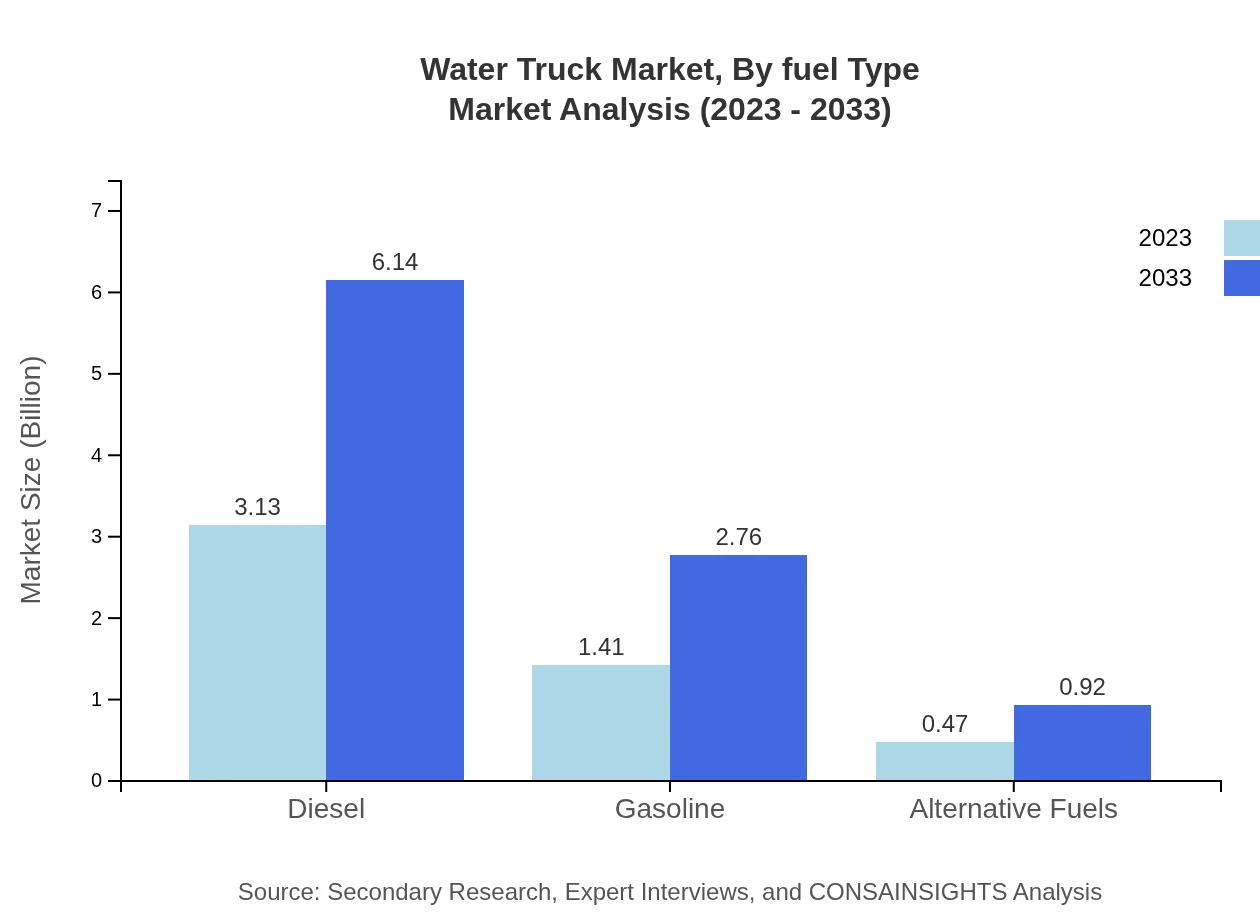

Water Truck Market Analysis By Fuel Type

In terms of fuel types, diesel holds the majority market share, remaining at 62.5% throughout the forecast period. Gasoline and alternative fuels also reflect growth, with gasoline growing from $1.41 billion to $2.76 billion and alternative fuels escalating from $0.47 billion to $0.92 billion, depicting a shift towards more sustainable options.

Water Truck Market Analysis By End User

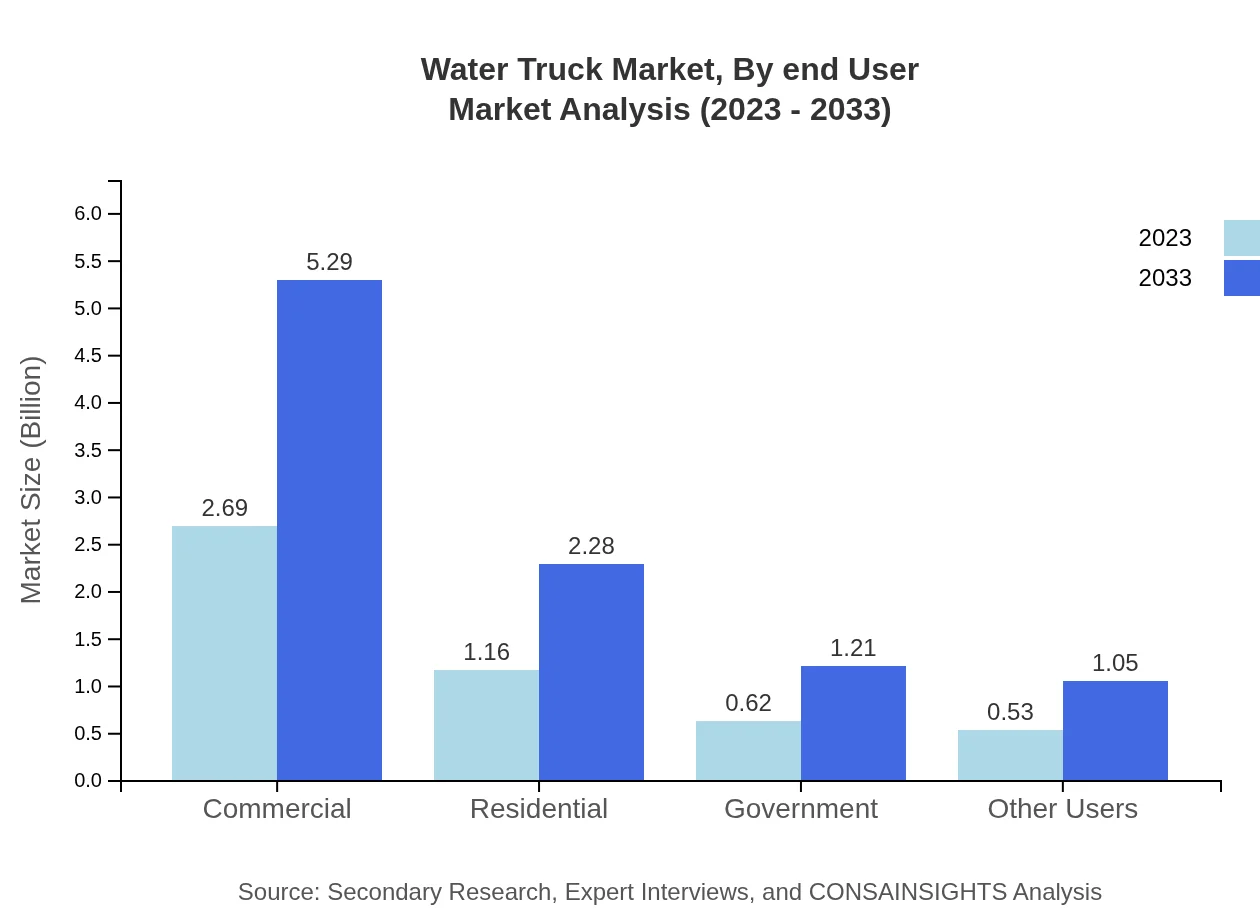

The end-user segment shows commercial applications dominating with a size of $2.69 billion in 2023 and a forecast of $5.29 billion by 2033. Residential and government sectors also contribute significantly, while industrial use remains essential for maintaining operational logistics across various industries.

Water Truck Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Water Truck Industry

Daimler AG:

A leading manufacturer providing innovative and sustainable water solutions for various industries, enhancing operational efficiency.Volvo Group:

Known for its advanced technologies in vehicle manufacturing, Volvo is committed to producing environmentally friendly water trucks.Ashok Leyland:

A prominent player in the water truck market, focusing on versatile applications and robust designs tailored for different environments.Hino Motors:

Specializing in commercial vehicles, Hino offers a range of water trucks designed for durability and efficiency in water transport.Scania Group:

A leading company in the water truck segment, known for its high-performance models that meet stringent environmental regulations.We're grateful to work with incredible clients.

FAQs

What is the market size of water truck?

The global water truck market is anticipated to reach approximately $5 billion by 2033, growing at a CAGR of 6.8%. This growth indicates a robust demand for water transportation solutions across various sectors.

What are the key market players or companies in this water truck industry?

Key players in the water truck market typically include manufacturers and suppliers specializing in commercial trucks, tankers, and specialized vehicles. Notable companies often dominate particular segments like water dispensers or tankers.

What are the primary factors driving the growth in the water truck industry?

The growth in the water truck industry is driven by factors including increasing demand for potable water delivery, expanding construction projects, and agricultural needs. Urbanization also plays a significant role in boosting market requirements.

Which region is the fastest Growing in the water truck market?

North America is the fastest-growing region in the water truck market, with projected growth from $1.93 billion in 2023 to around $3.79 billion by 2033. Europe and Asia Pacific also show substantial growth potential.

Does ConsaInsights provide customized market report data for the water truck industry?

Yes, ConsaInsights offers customized market report data for the water truck industry, allowing organizations to receive tailored insights based on specific needs, regional analysis, and segment focus.

What deliverables can I expect from this water truck market research project?

Deliverables from our water truck market research project typically include comprehensive reports, trend analysis, segment performance data, and actionable insights that inform strategic decision-making.

What are the market trends of water truck?

Current trends in the water truck market include a shift towards environmentally friendly vehicles, integration of smart technologies in fleet management, and increasing adoption in construction and agriculture sectors.