Waterproof Adhesives And Sealants Market Report

Published Date: 02 February 2026 | Report Code: waterproof-adhesives-and-sealants

Waterproof Adhesives And Sealants Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Waterproof Adhesives and Sealants market from 2023 to 2033, covering market size, growth rates, industry analysis, segmentation, and regional dynamics, alongside trends and forecasts.

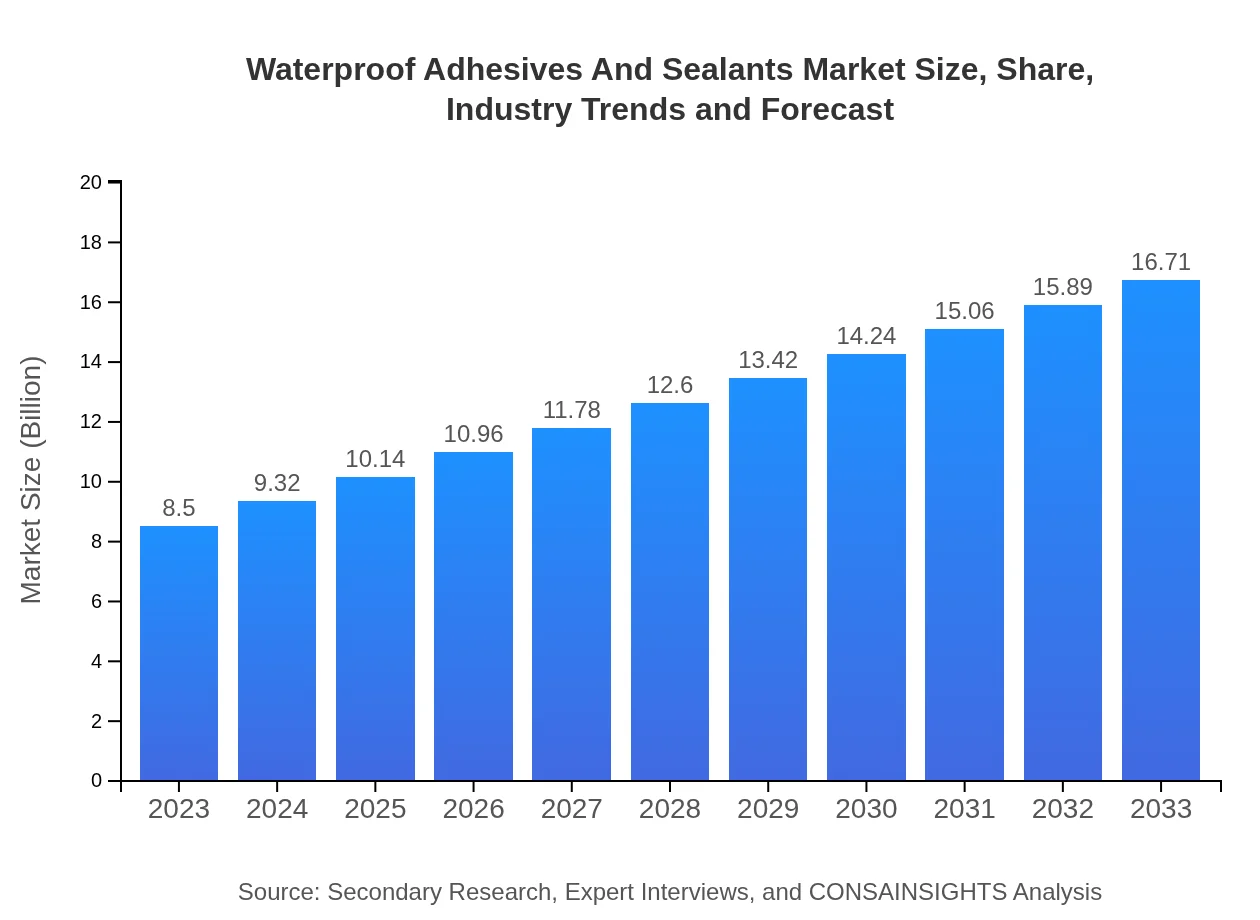

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $16.71 Billion |

| Top Companies | Henkel AG & Co. KGaA, 3M Company, Sika AG, Bostik (Arkema Group) |

| Last Modified Date | 02 February 2026 |

Waterproof Adhesives And Sealants Market Overview

Customize Waterproof Adhesives And Sealants Market Report market research report

- ✔ Get in-depth analysis of Waterproof Adhesives And Sealants market size, growth, and forecasts.

- ✔ Understand Waterproof Adhesives And Sealants's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Waterproof Adhesives And Sealants

What is the Market Size & CAGR of Waterproof Adhesives And Sealants market in 2023?

Waterproof Adhesives And Sealants Industry Analysis

Waterproof Adhesives And Sealants Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Waterproof Adhesives And Sealants Market Analysis Report by Region

Europe Waterproof Adhesives And Sealants Market Report:

By 2033, the European market is expected to increase from USD 2.20 billion in 2023 to USD 4.33 billion, driven by stringent regulations promoting high-quality construction standards and the growing preference for eco-friendly products.Asia Pacific Waterproof Adhesives And Sealants Market Report:

The Asia Pacific region, valued at approximately USD 1.74 billion in 2023, is expected to grow to USD 3.42 billion by 2033. This growth is driven by rapid urbanization, infrastructural development, and an increased emphasis on sustainable building materials.North America Waterproof Adhesives And Sealants Market Report:

North America continues to be a significant market for waterproof adhesives and sealants. The market size is anticipated to rise from USD 3.17 billion in 2023 to USD 6.24 billion by 2033, fueled by increasing demand in the construction and automotive industries coupled with advanced technology integration.South America Waterproof Adhesives And Sealants Market Report:

In South America, the market is projected to grow from USD 0.33 billion in 2023 to USD 0.65 billion by 2033, driven by a surge in construction activities and home renovations, although growth may be slower compared to other regions.Middle East & Africa Waterproof Adhesives And Sealants Market Report:

In the Middle East and Africa, the market is projected to expand from USD 1.06 billion in 2023 to USD 2.08 billion by 2033 as economic recovery and construction boom in regional countries stimulate demand.Tell us your focus area and get a customized research report.

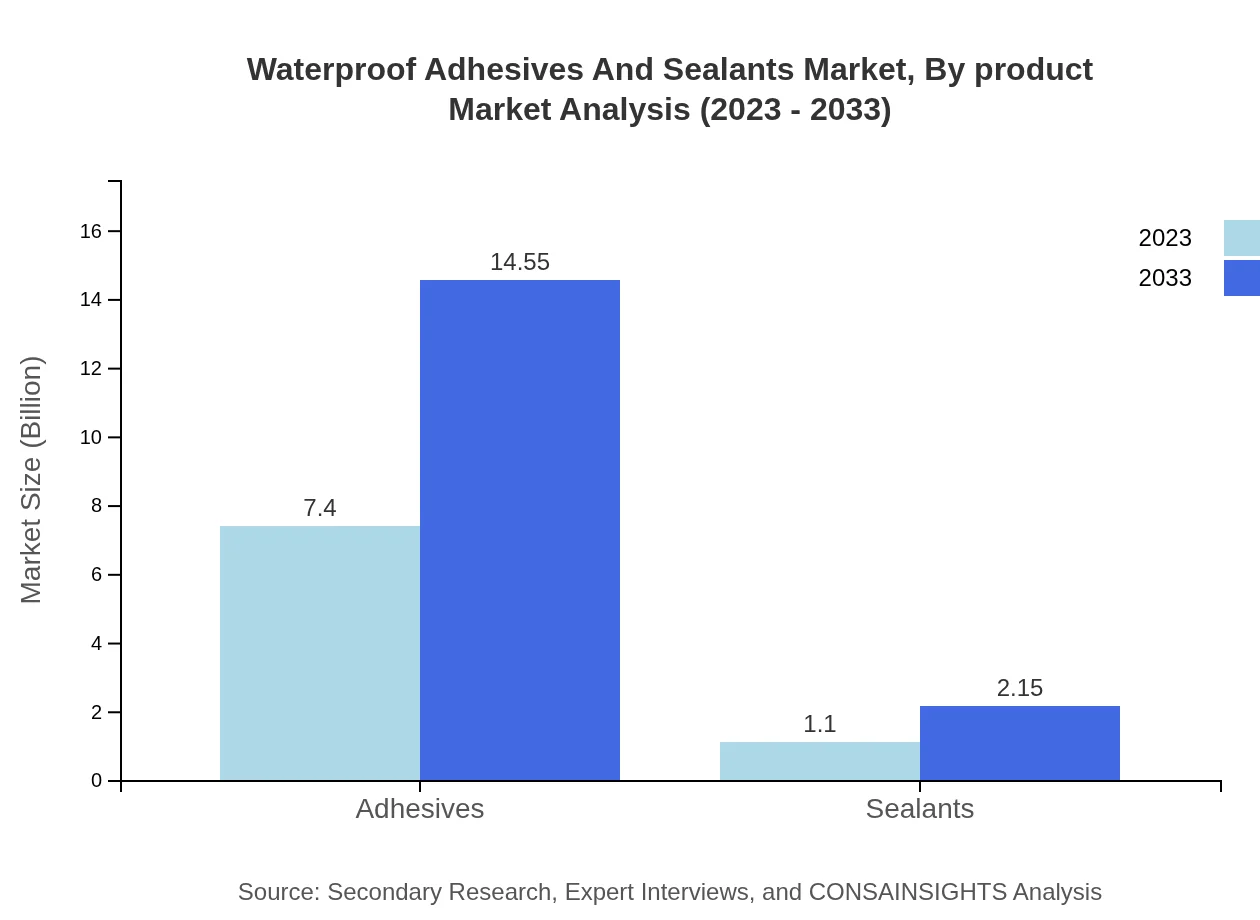

Waterproof Adhesives And Sealants Market Analysis By Product

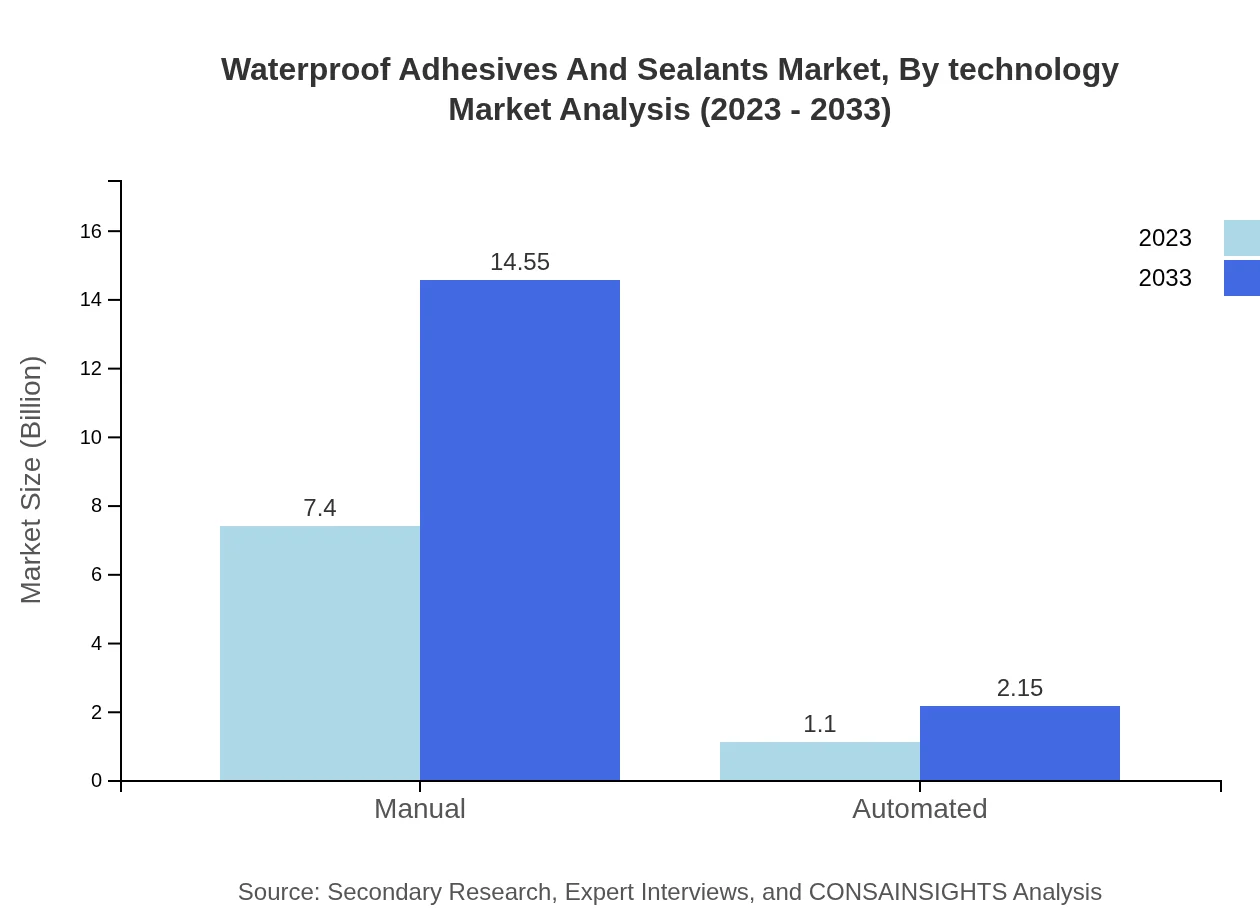

The product segment is divided into adhesives and sealants, with adhesives accounting for the majority market share. In 2023, adhesives held a market size of USD 7.40 billion and are expected to grow to USD 14.55 billion by 2033. Sealants contribute with a market size of USD 1.10 billion in 2023, projected to increase to USD 2.15 billion by 2033.

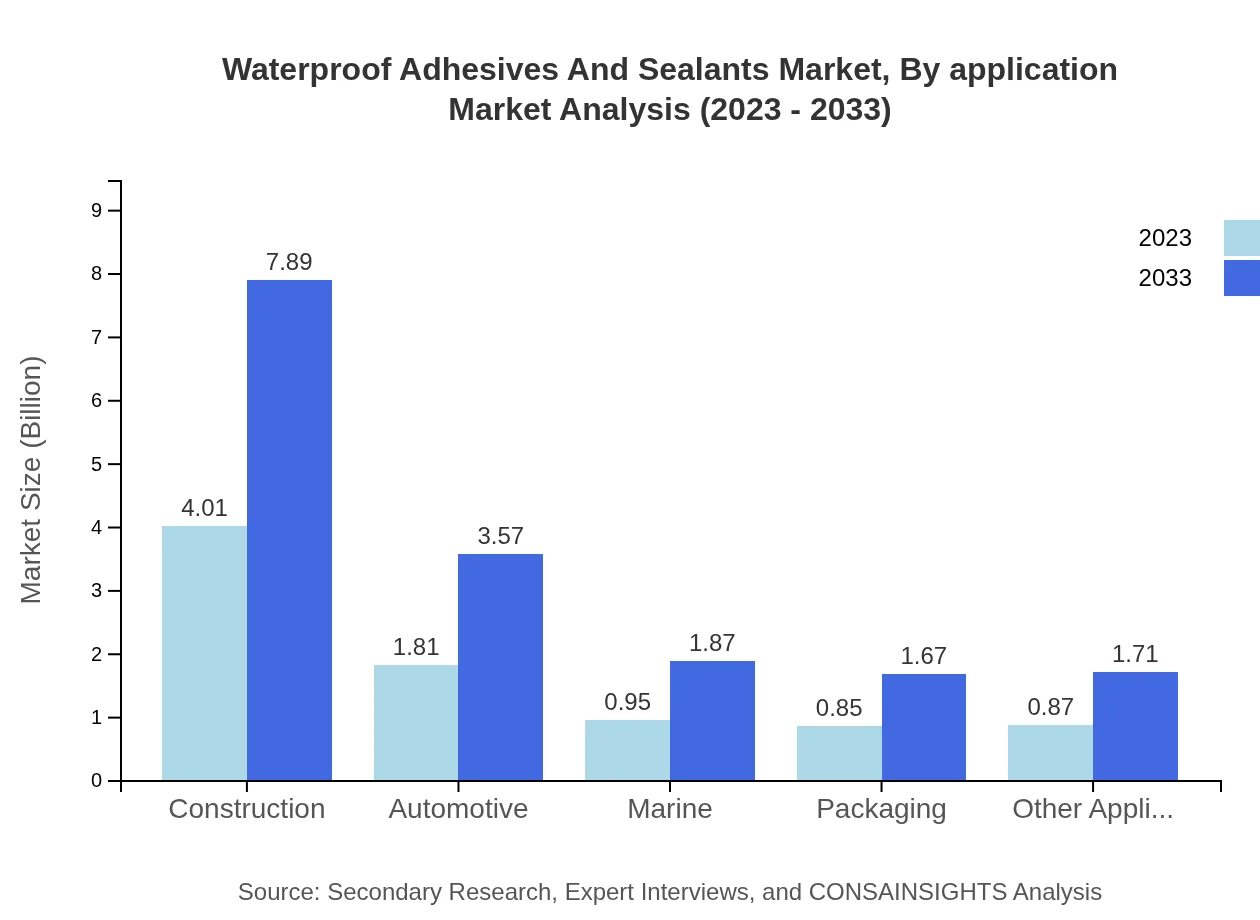

Waterproof Adhesives And Sealants Market Analysis By Application

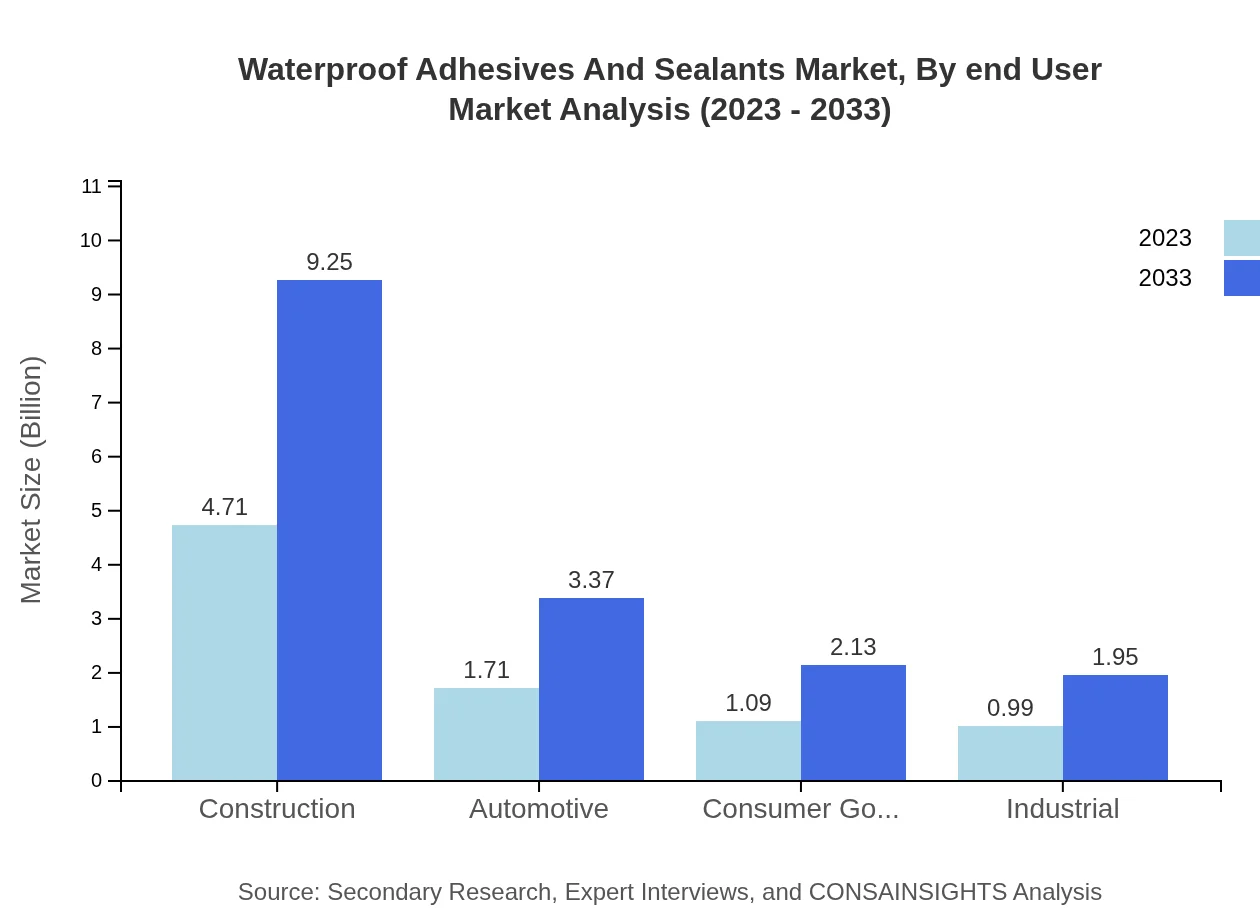

Applications include construction, automotive, consumer goods, marine, and packaging. Construction is the largest application segment, expected to grow from USD 4.71 billion in 2023 to USD 9.25 billion by 2033, while automotive applications show a promising growth from USD 1.71 billion to USD 3.37 billion in the same period.

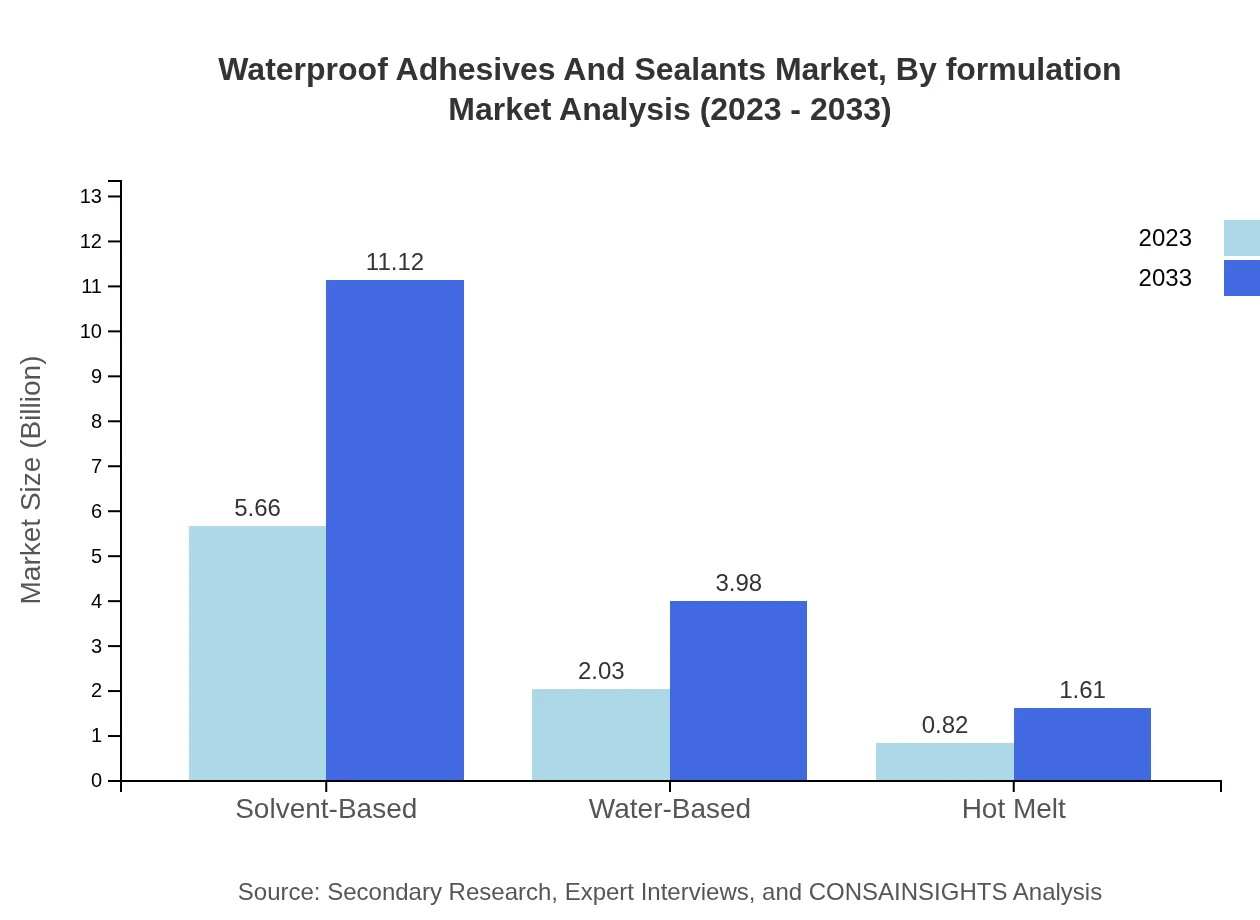

Waterproof Adhesives And Sealants Market Analysis By Formulation

Formulations are categorized into solvent-based, water-based, and hot melt. Solvent-based formulations dominate the market, valued at USD 5.66 billion in 2023 and projected to reach USD 11.12 billion by 2033. Water-based adhesives and sealants are becoming increasingly popular due to their lower volatile organic compounds.

Waterproof Adhesives And Sealants Market Analysis By End User

End-user industries such as construction, automotive, marine, consumer goods, and industrial applications dictate market trends. The construction industry remains a key consumer, accounting for 55.39% of the market share in 2023.

Waterproof Adhesives And Sealants Market Analysis By Technology

Technologies employed in manufacturing and application include manual and automated methods. The manual deployment holds a larger share, whereas innovations in automated systems are reducing labor costs and enhancing product consistency.

Waterproof Adhesives And Sealants Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Waterproof Adhesives And Sealants Industry

Henkel AG & Co. KGaA:

A global leader in adhesives and sealants, Henkel offers a wide range of waterproof products for various applications including construction and automotive sectors.3M Company:

3M specializes in innovation and technology, producing a diverse range of waterproof adhesives and sealants known for their durability and efficacy.Sika AG:

Sika is renowned for its advanced bonding and sealing solutions, featuring waterproof products that cater to the construction and automotive industries.Bostik (Arkema Group):

Bostik manufactures an extensive portfolio of adhesive solutions, focusing on sustainability and high-performance waterproof adhesives.We're grateful to work with incredible clients.

FAQs

What is the market size of waterproof adhesives and sealants?

As of 2023, the global market for waterproof adhesives and sealants is valued at approximately $8.5 billion, with a projected Compound Annual Growth Rate (CAGR) of 6.8% through 2033, indicating substantial growth potential.

What are the key market players or companies in this industry?

Key players in the waterproof adhesives and sealants market include major companies like 3M, Henkel AG, Sika AG, Dow Inc., and BASF SE. These companies drive innovation and competition in this growing sector.

What are the primary factors driving the growth in the waterproof adhesives and sealants industry?

Growth is driven by increasing construction activities, demand for durable and efficient sealing materials, rise in automotive production, and advancements in adhesive technology that enhance performance and applications.

Which region is the fastest Growing in the waterproof adhesives and sealants market?

The Asia Pacific region is the fastest-growing market for waterproof adhesives and sealants, expected to expand from $1.74 billion in 2023 to $3.42 billion by 2033, driven by rapid industrialization and urban growth.

Does ConsInsights provide customized market report data for the waterproof adhesives and sealants industry?

Yes, ConsInsights offers customized market report data tailored to client specifications for the waterproof adhesives and sealants industry, ensuring relevant insights for strategic decisions.

What deliverables can I expect from this market research project?

Expected deliverables include comprehensive market analysis reports, segmented data insights, competitive landscape assessments, market forecasts, and tailored recommendations to support business strategy.

What are the market trends of waterproof adhesives and sealants?

Current market trends include increased adoption of eco-friendly adhesives, advancements in technology leading to higher performance materials, and a shift towards automation in application processes.