Waterproofing Systems Market Report

Published Date: 02 February 2026 | Report Code: waterproofing-systems

Waterproofing Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Waterproofing Systems market, highlighting market size, growth trends, segmentation, and regional insights. It covers forecasts from 2023 to 2033, exploring key drivers and challenges shaping the industry.

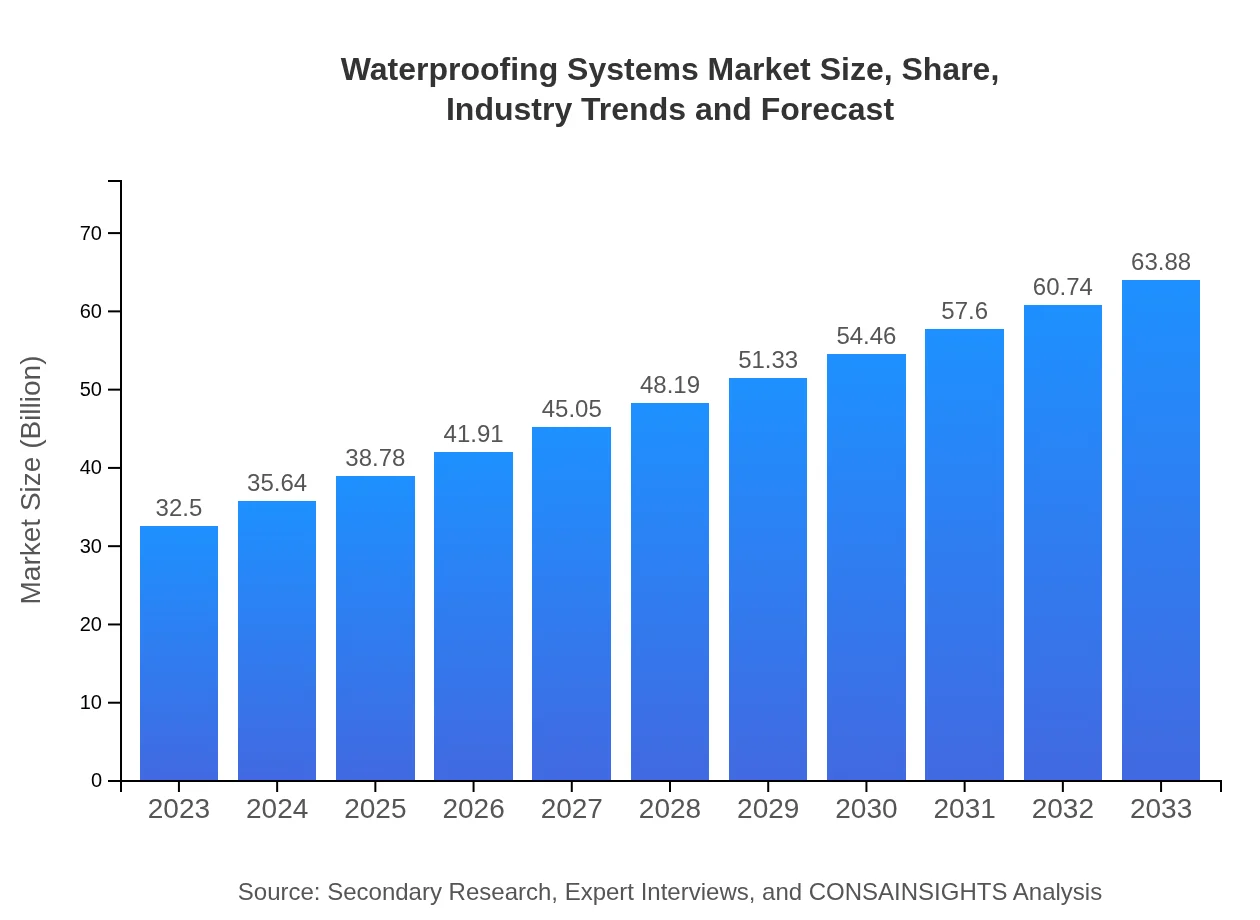

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $32.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $63.88 Billion |

| Top Companies | BASF SE, Sika AG, Koster Bauchemie AG, GAF Materials Corporation |

| Last Modified Date | 02 February 2026 |

Waterproofing Systems Market Overview

Customize Waterproofing Systems Market Report market research report

- ✔ Get in-depth analysis of Waterproofing Systems market size, growth, and forecasts.

- ✔ Understand Waterproofing Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Waterproofing Systems

What is the Market Size & CAGR of Waterproofing Systems market in 2023?

Waterproofing Systems Industry Analysis

Waterproofing Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Waterproofing Systems Market Analysis Report by Region

Europe Waterproofing Systems Market Report:

Europe's waterproofing systems market is projected to increase from $11.05 billion in 2023 to $21.72 billion by 2033, driven by technological advancements and a strong emphasis on sustainability within the construction sector.Asia Pacific Waterproofing Systems Market Report:

The Asia Pacific region is poised for significant growth, projected to expand from $6.15 billion in 2023 to $12.08 billion by 2033, fueled by rapid urbanization and infrastructure development. Countries such as China and India are leading this growth trajectory due to increased investments in construction activities.North America Waterproofing Systems Market Report:

North America represents a mature market, expected to see growth from $11.20 billion in 2023 to approximately $22.02 billion by 2033. The demand is propelled by renovation activities in existing structures and stringent regulatory standards for water management in construction.South America Waterproofing Systems Market Report:

In South America, the waterproofing systems market is expected to grow from $0.15 billion in 2023 to $0.30 billion by 2033. The demand is primarily driven by infrastructure projects and rising housing construction, particularly in Brazil and Argentina.Middle East & Africa Waterproofing Systems Market Report:

The Middle East and Africa region is anticipated to expand from $3.95 billion in 2023 to $7.76 billion by 2033. This growth is underpinned by infrastructural upgrades and increasing awareness of waterproofing benefits, particularly in arid regions.Tell us your focus area and get a customized research report.

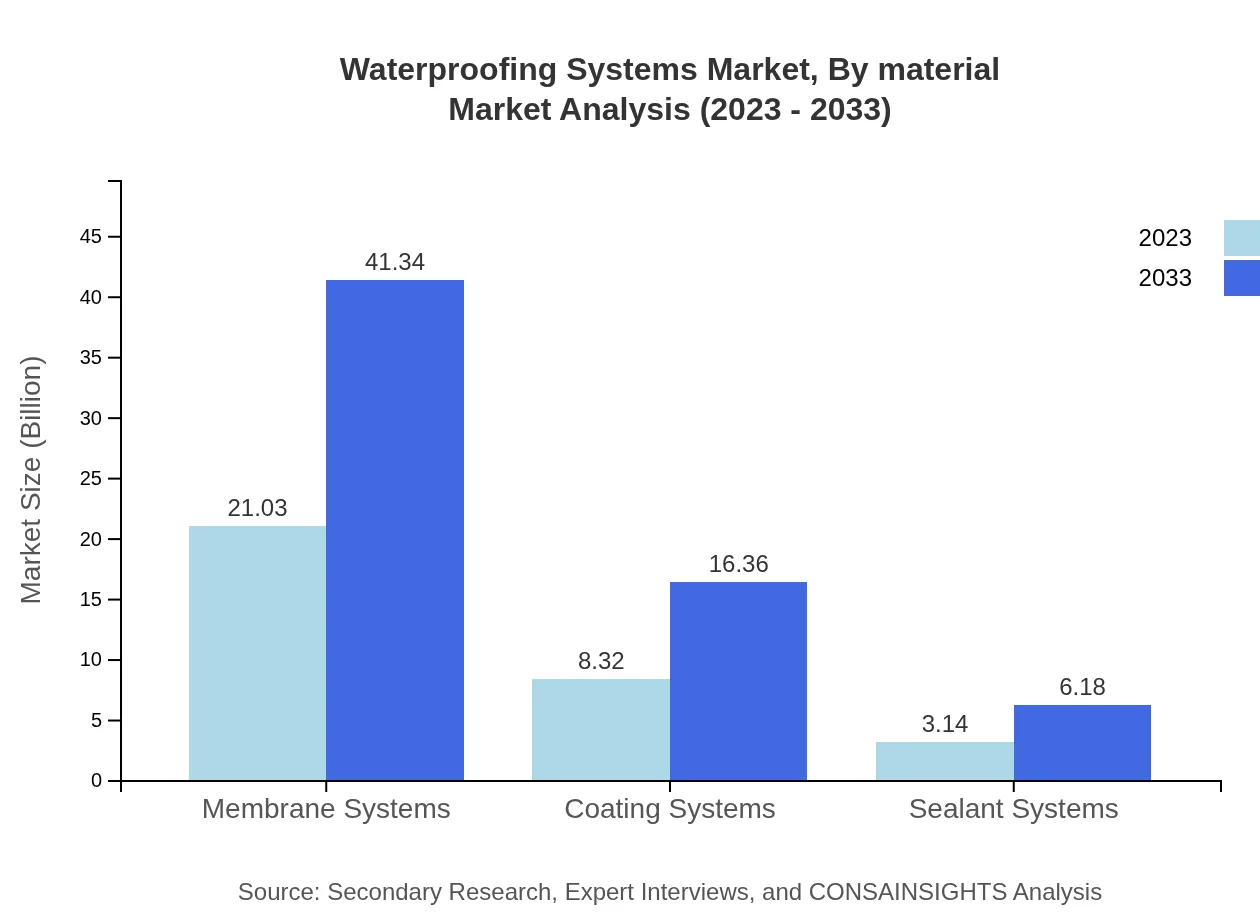

Waterproofing Systems Market Analysis By Material

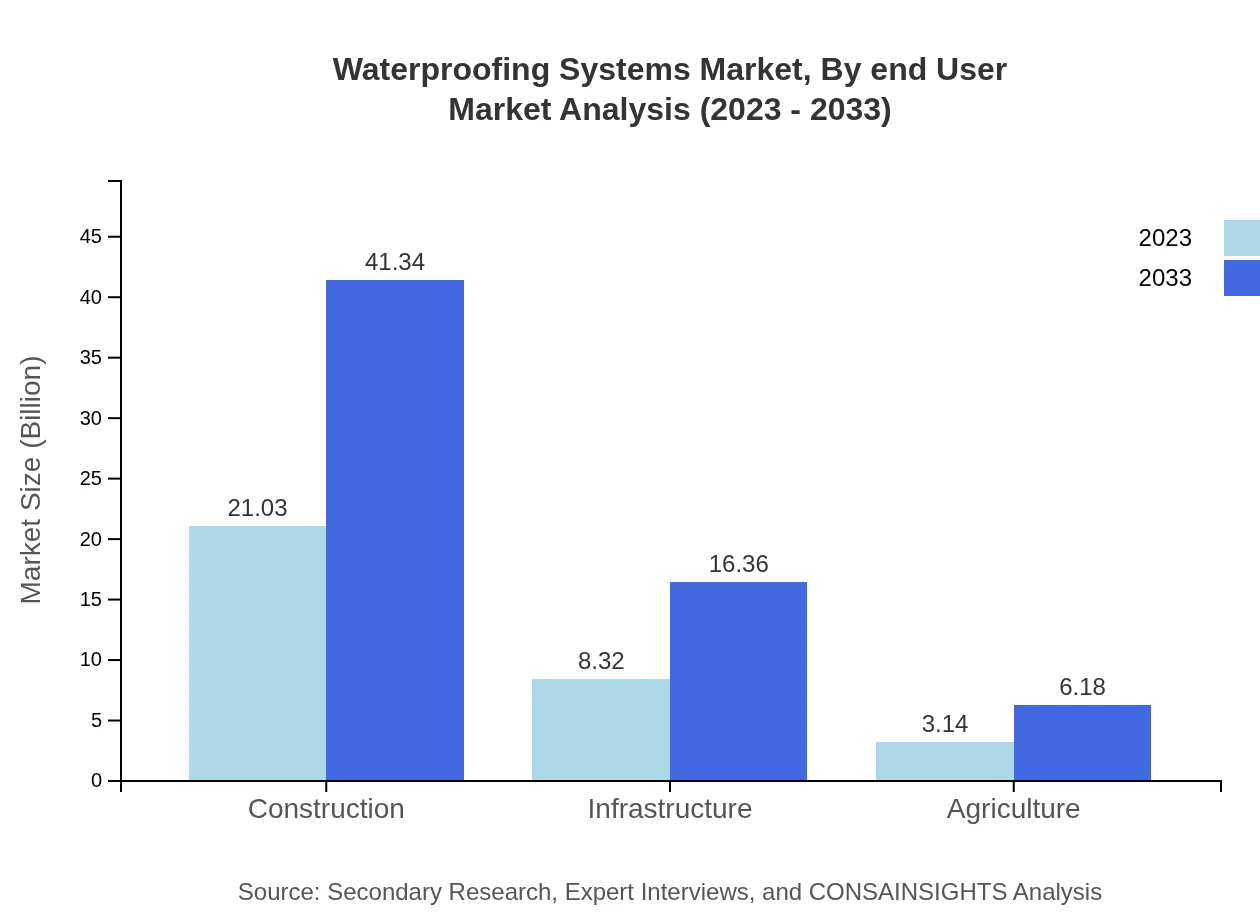

The Waterproofing Systems market, segmented by material type, includes membrane systems, coating systems, sealant systems, and traditional methods. Membrane systems dominate the market, contributing to approximately $21.03 billion in revenue in 2023, expected to double to $41.34 billion by 2033.

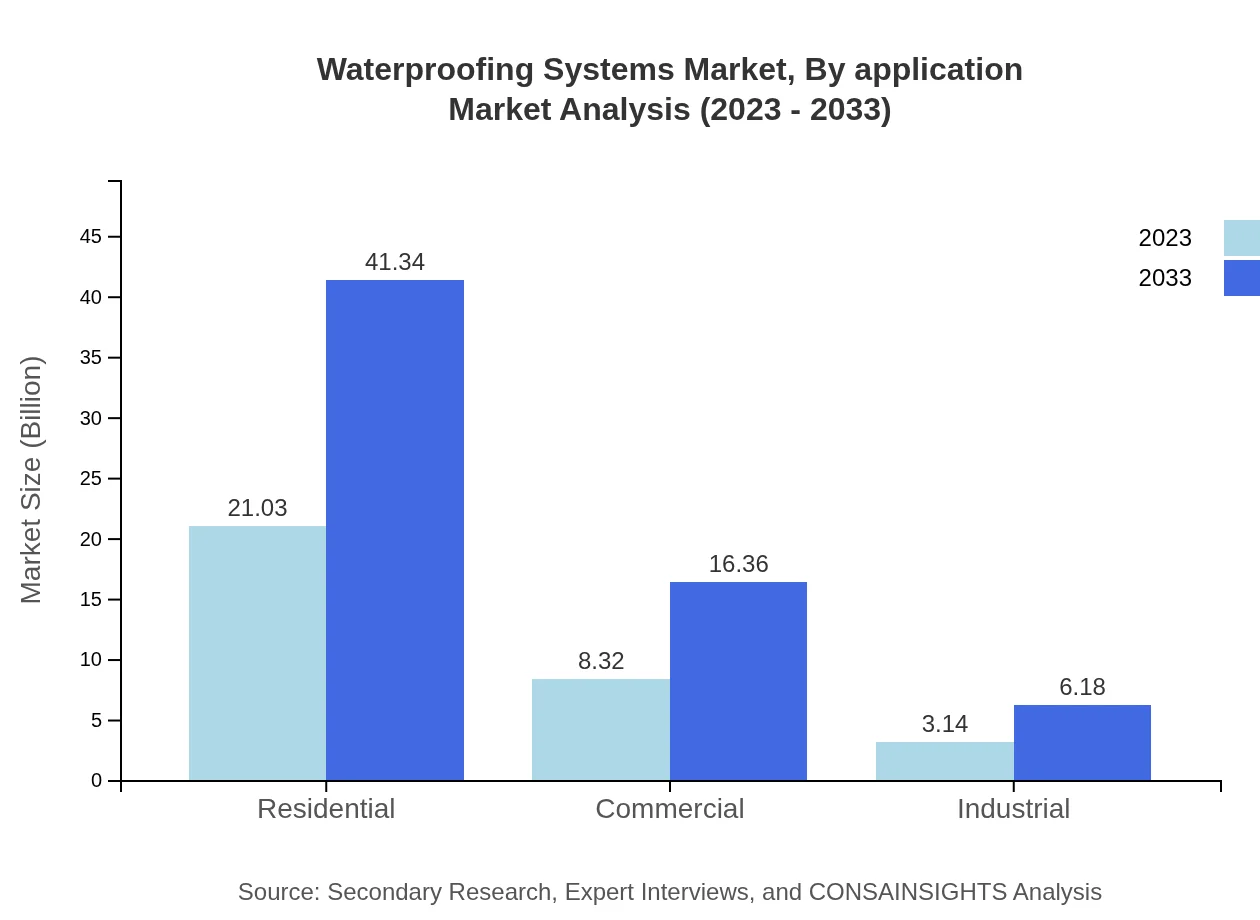

Waterproofing Systems Market Analysis By Application

The market can also be classified by application into construction, agricultural, and industrial uses. The construction segment alone is projected to maintain a significant market share of 64.72%, influenced by the rising need for housing and commercial structures.

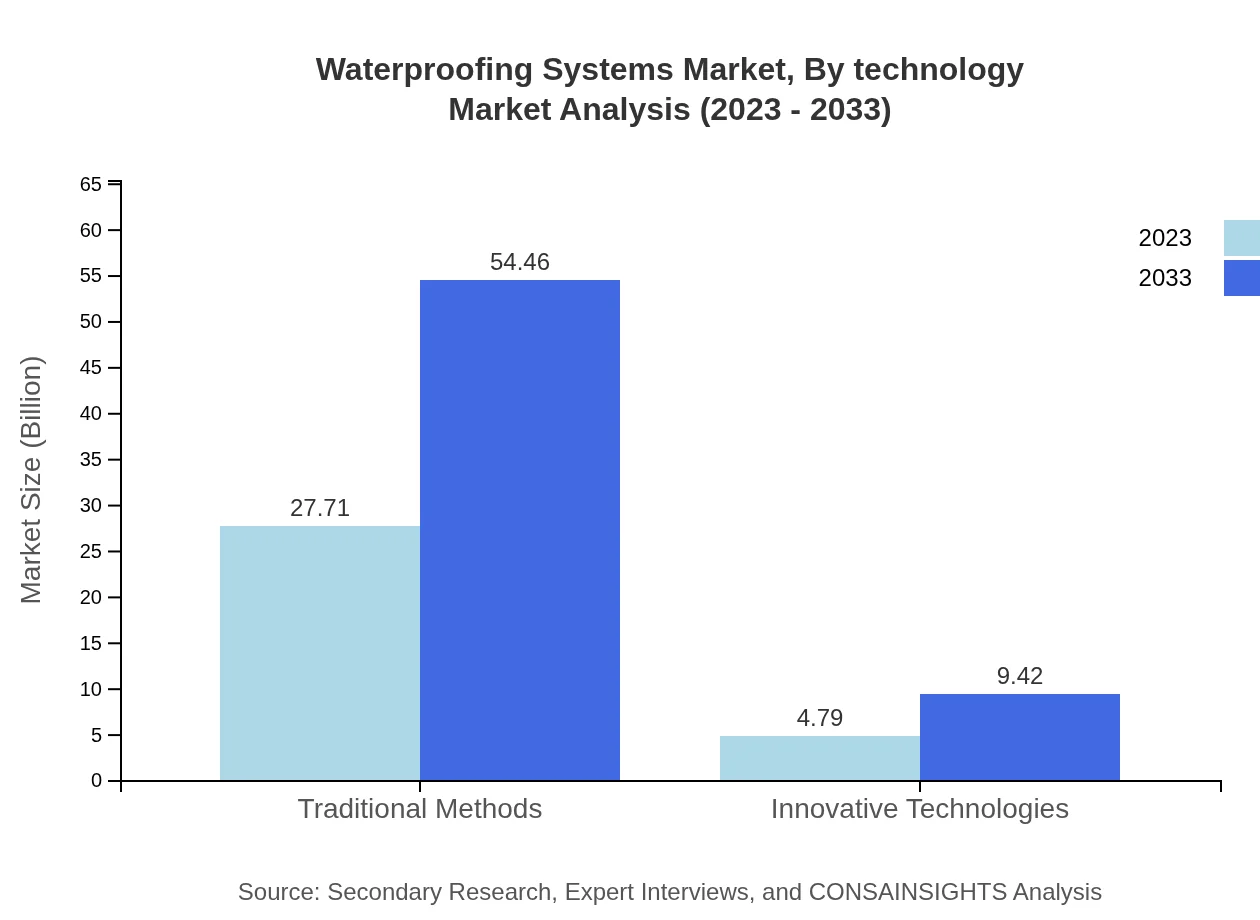

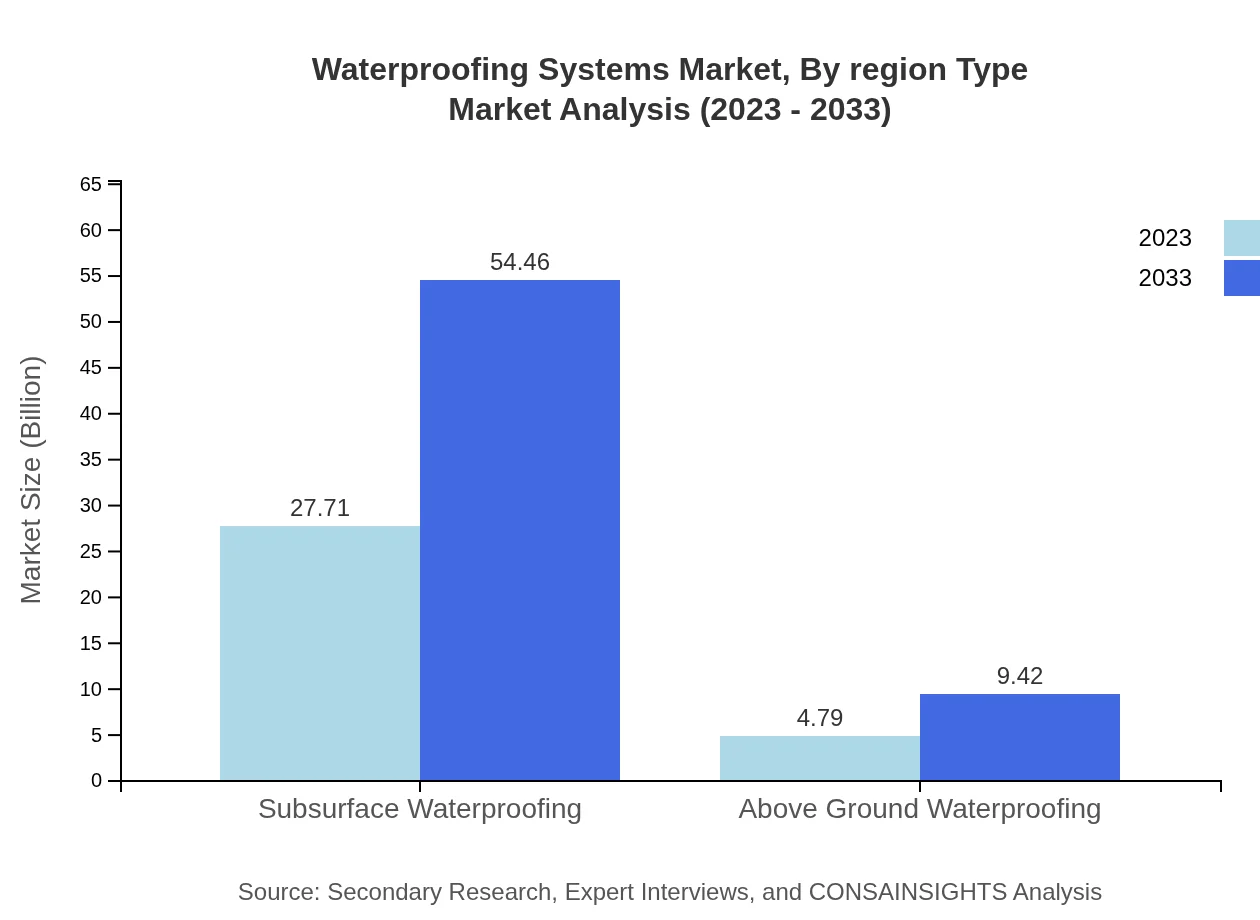

Waterproofing Systems Market Analysis By Technology

Innovative technologies, including eco-friendly waterproofing solutions and advanced application methods, hold a growing share. This segment is expected to grow from $4.79 billion in 2023 to $9.42 billion by 2033, reflecting the market's shift towards sustainable practices.

Waterproofing Systems Market Analysis By End User

The end-user industries are crucial as residential, commercial, and industrial sectors exhibit varied demands. The residential sector, with a share of 64.72%, is expected to grow alongside the increasing focus on home improvement and new constructions.

Waterproofing Systems Market Analysis By Region Type

Regional analysis indicates that emerging economies in the Asia Pacific and Africa are becoming significant contributors to the market growth, while mature markets in North America and Europe continue to innovate and sustain their growth trajectories.

Waterproofing Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Waterproofing Systems Industry

BASF SE:

A global leader in chemical solutions, BASF provides innovative waterproofing solutions for both construction and infrastructure applications, leveraging advanced technologies and sustainability initiatives.Sika AG:

Sika AG specializes in construction materials and is known for its efficient waterproofing systems that address diverse applications, gaining a strong foothold in the European market.Koster Bauchemie AG:

Known for its comprehensive range of waterproofing products, Koster has established itself as a reliable name in the industry with a focus on technologically advanced solutions.GAF Materials Corporation:

GAF is a leading manufacturer of roofing and waterproofing systems, expanding its footprint in North America and focusing on sustainable roofing solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of waterproofing systems?

The global waterproofing systems market is valued at approximately $32.5 billion in 2023, predicted to grow at a CAGR of 6.8% to reach significantly higher market sizes by 2033.

What are the key market players or companies in this waterproofing systems industry?

Key players in the waterproofing systems market include BASF SE, Sika AG, Soprema Group, and Carlisle Companies Incorporated, which play crucial roles in innovation and market expansion.

What are the primary factors driving the growth in the waterproofing systems industry?

The waterproofing systems industry growth is driven by increased urbanization, rising construction activities, and the need for moisture protection across buildings and infrastructure sectors.

Which region is the fastest Growing in the waterproofing systems?

The Asia Pacific region is forecasted to be the fastest-growing market for waterproofing systems from 2023 to 2033, expanding from a $6.15 billion market in 2023 to $12.08 billion by 2033.

Does ConsaInsights provide customized market report data for the waterproofing systems industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the waterproofing systems industry, ensuring clients receive relevant insights.

What deliverables can I expect from this waterproofing systems market research project?

Deliverables from the waterproofing systems market research project include detailed reports, market forecasts, competitive analysis, and segment insights provided in comprehensive formats.

What are the market trends of waterproofing systems?

Current trends in the waterproofing systems market include the adoption of innovative technologies, a shift towards eco-friendly solutions, and increasing demand in residential and commercial sectors.