Wax Emulsion Market Report

Published Date: 02 February 2026 | Report Code: wax-emulsion

Wax Emulsion Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report analyzes the Wax Emulsion market, providing insights into market size, growth trends, competitive landscape, and forecasts from 2023 to 2033, enabling stakeholders to make well-informed decisions.

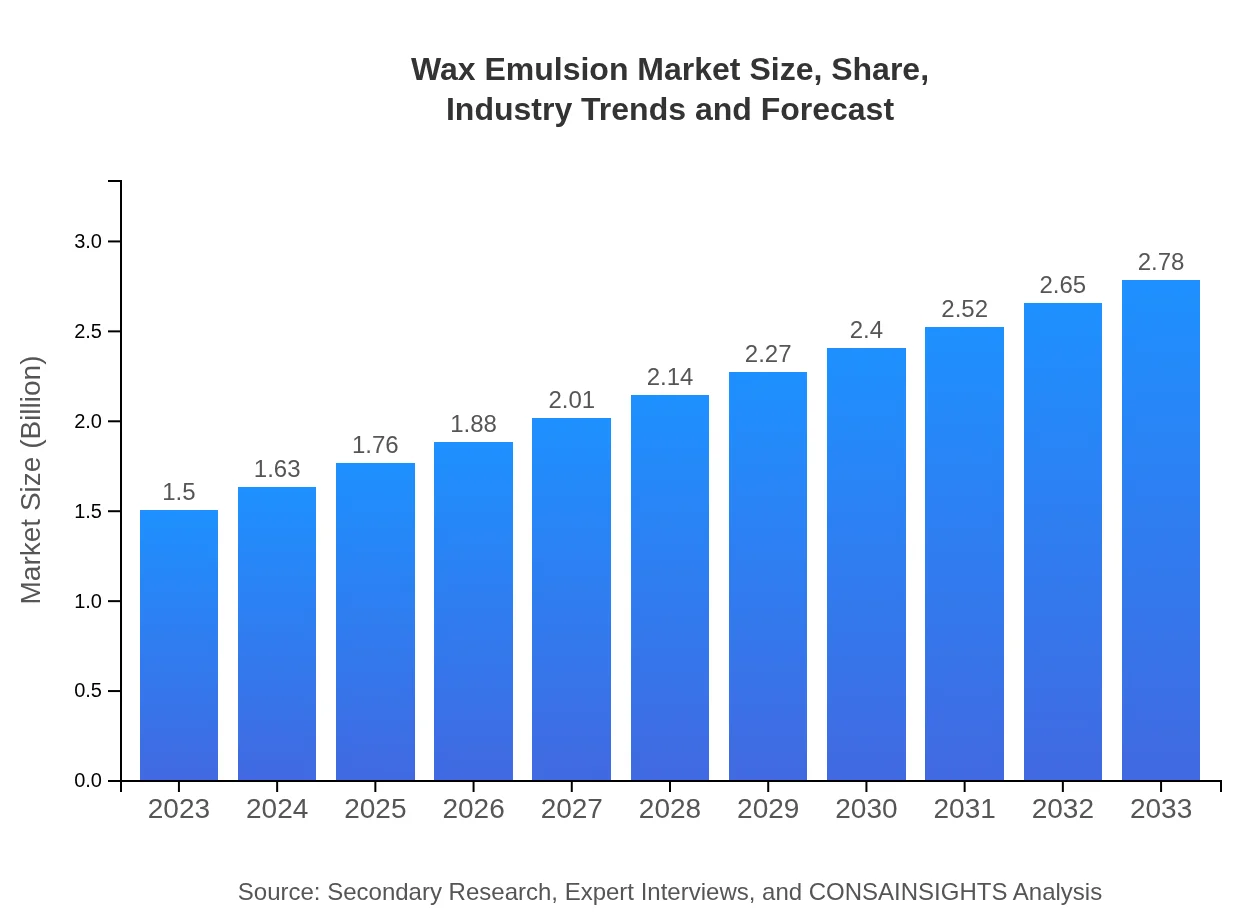

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | BASF SE, Kraton Corporation, Clariant AG, Michelman Inc. |

| Last Modified Date | 02 February 2026 |

Wax Emulsion Market Overview

Customize Wax Emulsion Market Report market research report

- ✔ Get in-depth analysis of Wax Emulsion market size, growth, and forecasts.

- ✔ Understand Wax Emulsion's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Wax Emulsion

What is the Market Size & CAGR of Wax Emulsion market in 2023?

Wax Emulsion Industry Analysis

Wax Emulsion Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Wax Emulsion Market Analysis Report by Region

Europe Wax Emulsion Market Report:

Europe holds a significant portion of the wax emulsion market, estimated to grow from $0.48 billion in 2023 to $0.89 billion by 2033, supported by stringent environmental regulations and increasing adoption of green coatings.Asia Pacific Wax Emulsion Market Report:

The Asia Pacific region is emerging as a significant market for wax emulsions, anticipated to grow from $0.26 billion in 2023 to $0.49 billion by 2033, driven largely by expansion in construction and automotive industries.North America Wax Emulsion Market Report:

North America is expected to see growth from $0.53 billion in 2023 to $0.99 billion by 2033, as manufacturers push for innovations in eco-friendly products aligned with regulatory trends in sustainability.South America Wax Emulsion Market Report:

In South America, the wax emulsion market is projected to grow from $0.04 billion in 2023 to $0.08 billion by 2033, spurred on by increasing investment in infrastructure and awareness about sustainable products.Middle East & Africa Wax Emulsion Market Report:

The Middle East and Africa market is projected to grow from $0.18 billion in 2023 to $0.33 billion by 2033, driven by the rising demand for construction materials and coatings.Tell us your focus area and get a customized research report.

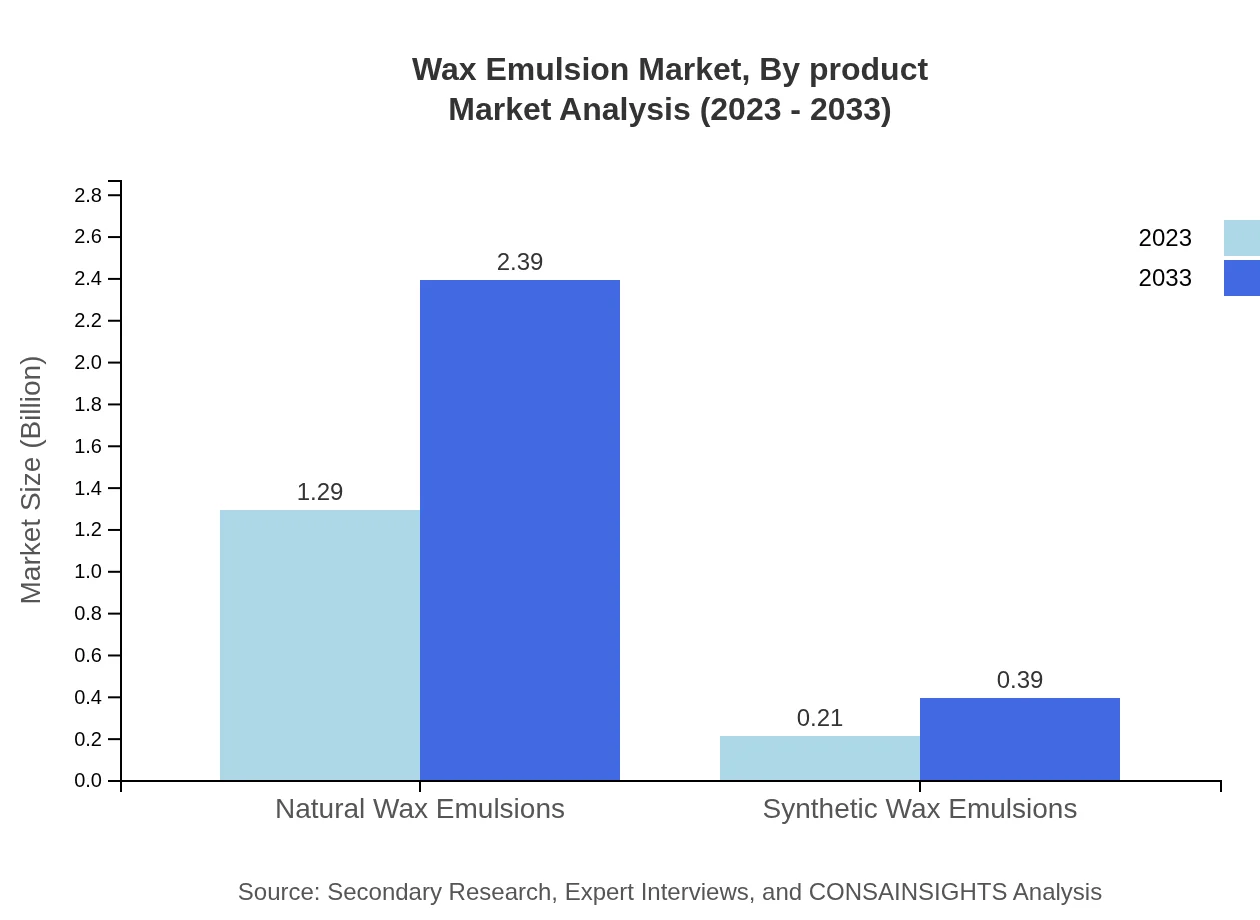

Wax Emulsion Market Analysis By Product

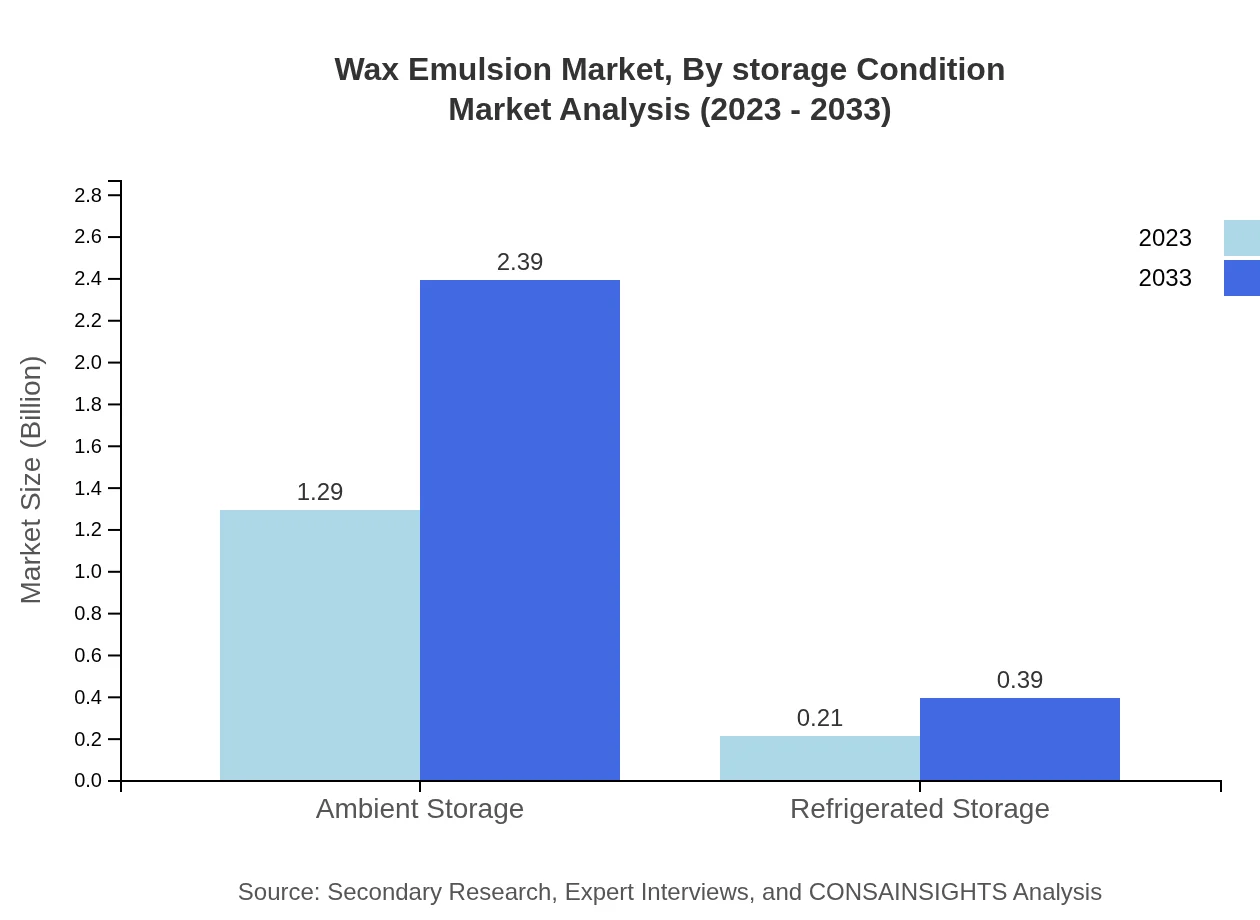

The Wax Emulsion market segmented by product types includes natural and synthetic wax emulsions. Natural wax emulsions dominate the segment with market size projected to reach $2.39 billion by 2033, maintaining an 86% market share, whereas synthetic wax emulsions are expected to grow to $0.39 billion, holding a 14% market share by 2033.

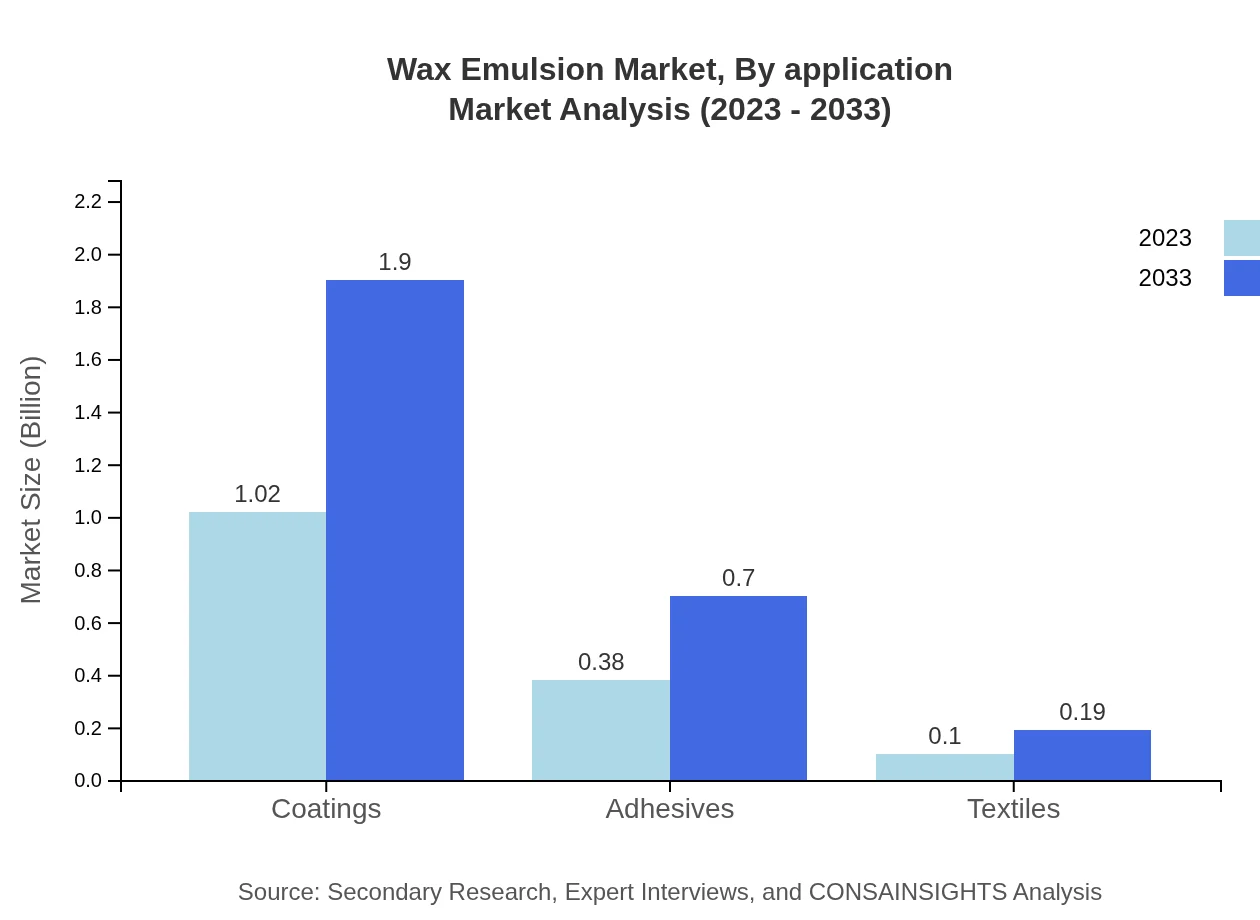

Wax Emulsion Market Analysis By Application

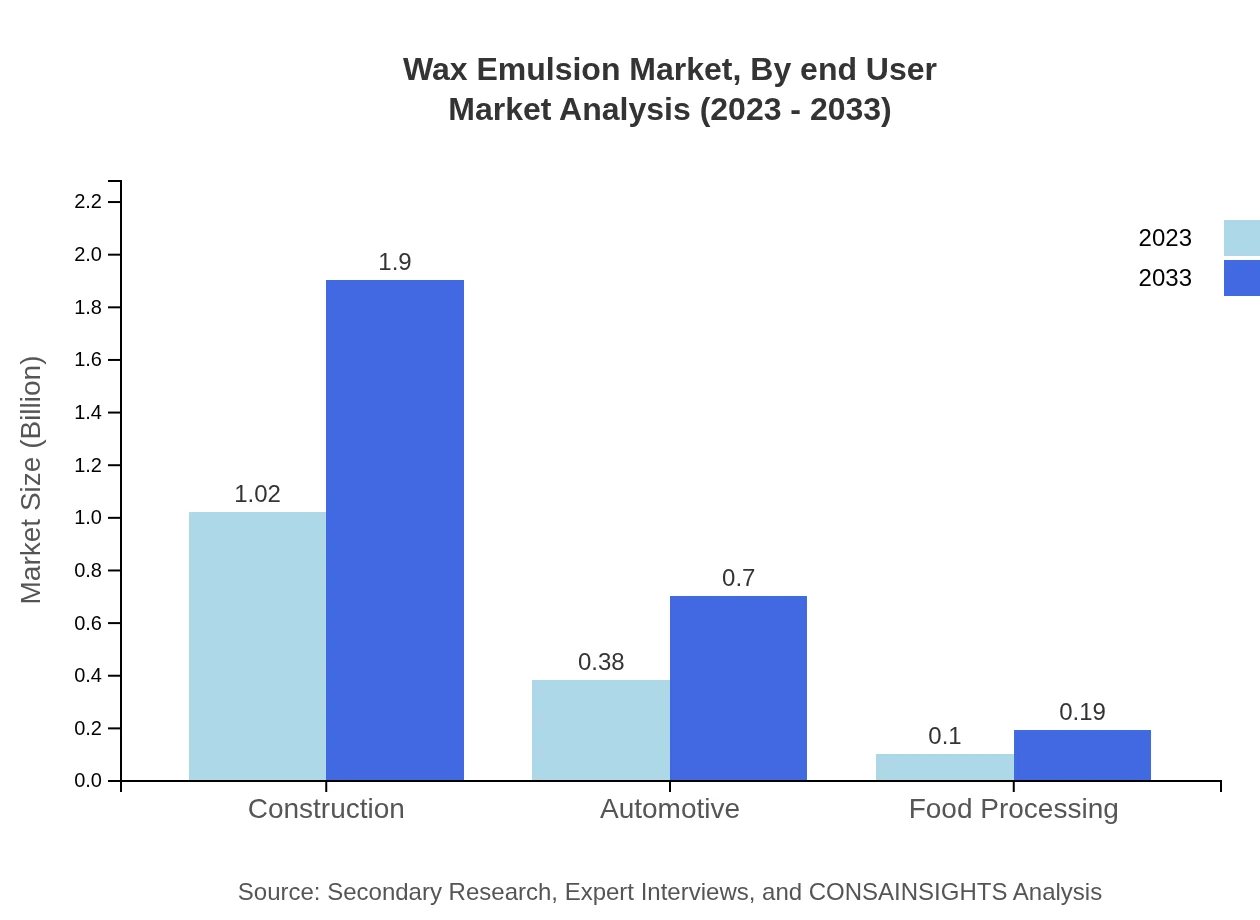

Application segments include construction, automotive, food processing, and textiles. The construction segment leads the market with a projected growth from $1.02 billion in 2023 to $1.90 billion in 2033, representing a significant market share of 68.2%. Automotive applications follow closely, expected to grow from $0.38 billion to $0.70 billion, sharing 25.11% of the market.

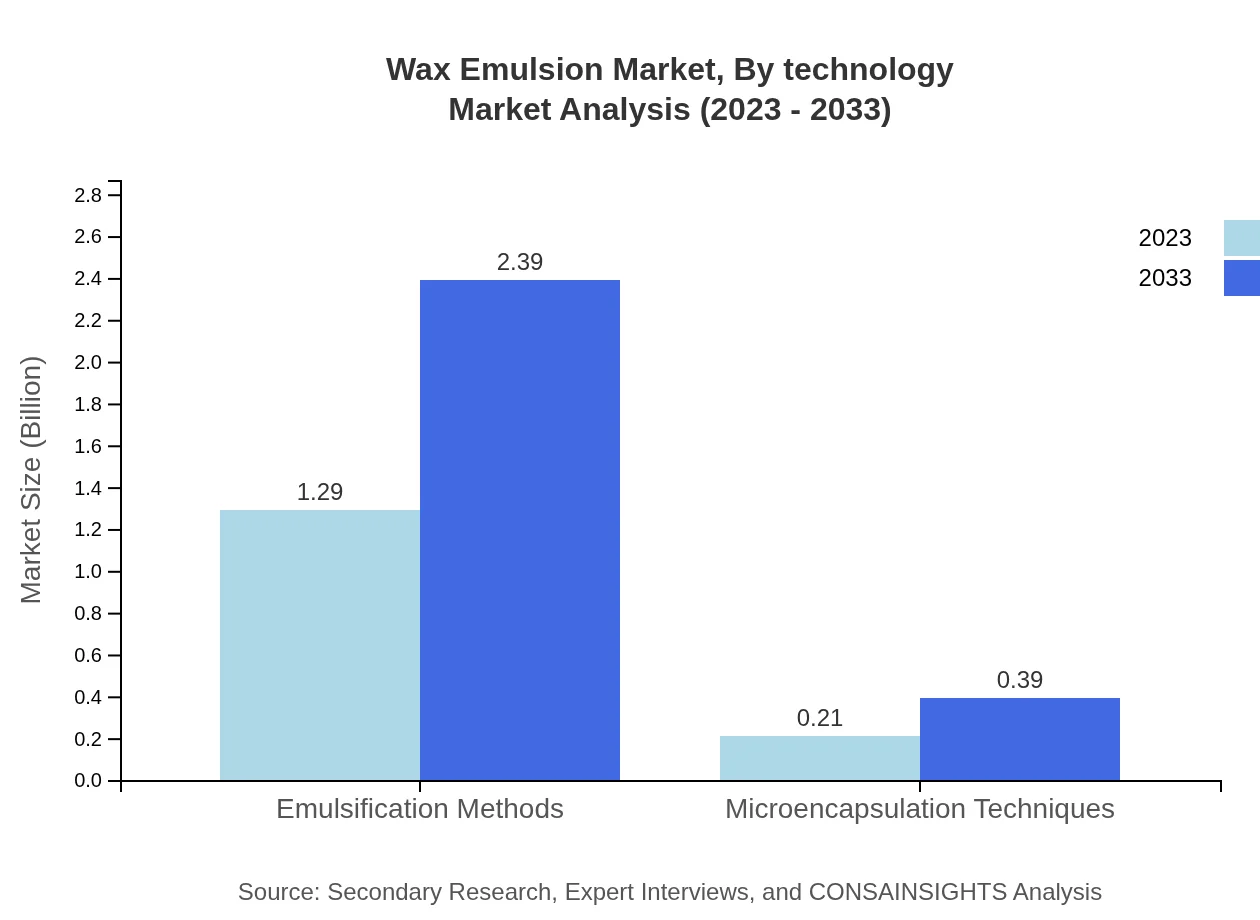

Wax Emulsion Market Analysis By Technology

The adoption of emulsification methods and microencapsulation techniques is enhancing the functionality of wax emulsions. Emulsification methods lead the market with a size forecast to reach $2.39 billion by 2033, while microencapsulation techniques are anticipated to grow from $0.21 billion to $0.39 billion, gaining a 14% market share.

Wax Emulsion Market Analysis By End User

End-user segments include the construction industry, automotive sector, food processing, and textiles. The construction industry is the leading end-user, projected to reach $1.90 billion by 2033 while food processing remains a smaller segment, with growth from $0.10 billion to $0.19 billion.

Wax Emulsion Market Analysis By Storage Condition

Storage conditions significantly impact wax emulsion longevity and stability. Ambient storage conditions dominate the market with a size expected to reach $2.39 billion by 2033, while refrigerated storage conditions also contribute, anticipated to grow from $0.21 billion to $0.39 billion.

Wax Emulsion Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Wax Emulsion Industry

BASF SE:

A leading chemical manufacturer, BASF SE offers a wide range of wax emulsion products known for their high quality and environmental compatibility.Kraton Corporation:

Kraton Corporation specializes in polymer and wax emulsions, focusing on innovative applications in various industries, including coatings and adhesives.Clariant AG:

Clariant AG is recognized for its sustainable wax emulsion formulations, contributing significantly to the industry with its environmental commitment.Michelman Inc.:

Michelman Inc. provides advanced coatings and emulsions, promoting eco-friendly solutions and enhancing performance across multiple sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of wax emulsion?

The global wax emulsion market is valued at approximately $1.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.2% expected to enhance its size by 2033.

What are the key market players or companies in this wax emulsion industry?

Key players in the wax emulsion market include prominent companies such as BASF SE, AkzoNobel, Wacker Chemie AG, and Clariant AG, which lead through innovation and quality.

What are the primary factors driving the growth in the wax emulsion industry?

The growth of the wax emulsion industry is driven by increasing demand in sectors such as construction, automotive, and coatings, along with a rise in eco-friendly product trends boosting natural wax emulsions.

Which region is the fastest Growing in the wax emulsion market?

The Asia Pacific region is the fastest-growing market for wax emulsions, anticipated to grow from $0.26 billion in 2023 to $0.49 billion by 2033, reflecting significant industrial development.

Does ConsaInsights provide customized market report data for the wax emulsion industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the wax emulsion industry to accommodate diverse client requirements and ensure targeted insights.

What deliverables can I expect from this wax emulsion market research project?

Expect comprehensive deliverables including market analysis reports, trends assessments, competitive landscapes, and forecasts, alongside custom data insights tailored to specific segments of the wax emulsion market.

What are the market trends of wax emulsion?

Current market trends include a shift towards increased use of natural wax emulsions, rising demand for coatings and adhesives, and advancements in emulsification methods, contributing to the consistent growth of the industry.