Wealth Management Platform Market Report

Published Date: 24 January 2026 | Report Code: wealth-management-platform

Wealth Management Platform Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Wealth Management Platform market, presenting insights and data from 2023 to 2033. It covers market size, growth forecasts, technological trends, and regional analyses to provide a holistic view of the industry's trajectory.

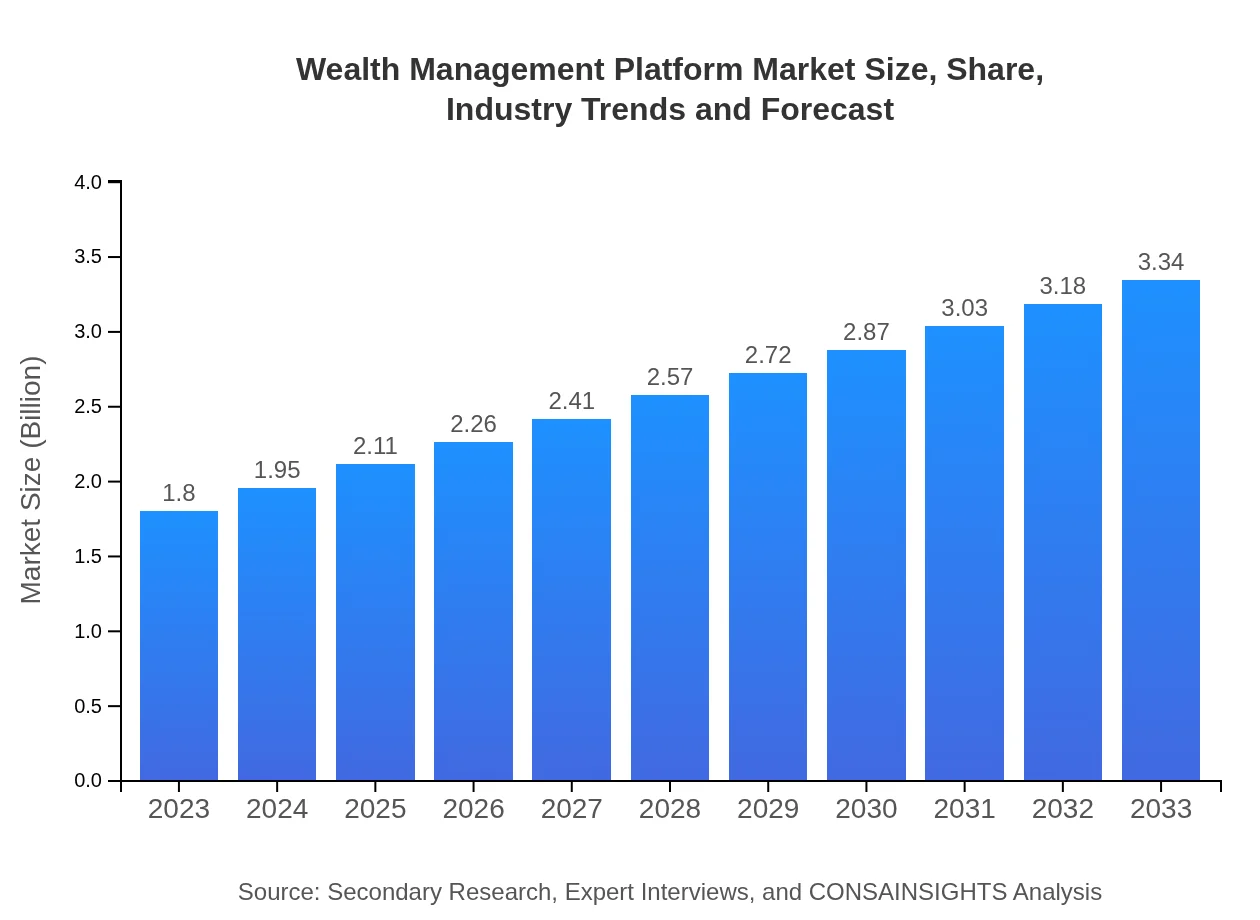

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $3.34 Billion |

| Top Companies | BlackRock , Charles Schwab, Fidelity Investments, Morgan Stanley |

| Last Modified Date | 24 January 2026 |

Wealth Management Platform Market Overview

Customize Wealth Management Platform Market Report market research report

- ✔ Get in-depth analysis of Wealth Management Platform market size, growth, and forecasts.

- ✔ Understand Wealth Management Platform's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Wealth Management Platform

What is the Market Size & CAGR of Wealth Management Platform market in 2023?

Wealth Management Platform Industry Analysis

Wealth Management Platform Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Wealth Management Platform Market Analysis Report by Region

Europe Wealth Management Platform Market Report:

Europe's market is estimated at $0.50 trillion for 2023, with a growth trajectory leading to $0.93 trillion by 2033. The increasing regulatory focus on fiduciary responsibilities is pushing firms to adopt better compliance and reporting solutions.Asia Pacific Wealth Management Platform Market Report:

In 2023, the Asia Pacific wealth management platform market is valued at $0.36 trillion, projected to grow to $0.68 trillion by 2033. Factors such as increasing wealth levels, urbanization, and a growing appetite for investment products drive this expansion.North America Wealth Management Platform Market Report:

North America remains a dominant player, with the market standing at $0.65 trillion in 2023 and projected to reach $1.20 trillion by 2033. The region benefits from a mature financial services industry and high penetration of digital solutions.South America Wealth Management Platform Market Report:

The South American market is valued at $0.11 trillion in 2023, with expectations to reach $0.20 trillion by 2033. The focus on improving financial literacy and access to wealth management solutions bolsters market growth in this region.Middle East & Africa Wealth Management Platform Market Report:

Valued at $0.18 trillion in 2023, the Middle East and Africa market is expected to grow to $0.34 trillion by 2033. Wealth consolidation and identification of investment opportunities in the region drive substantial growth.Tell us your focus area and get a customized research report.

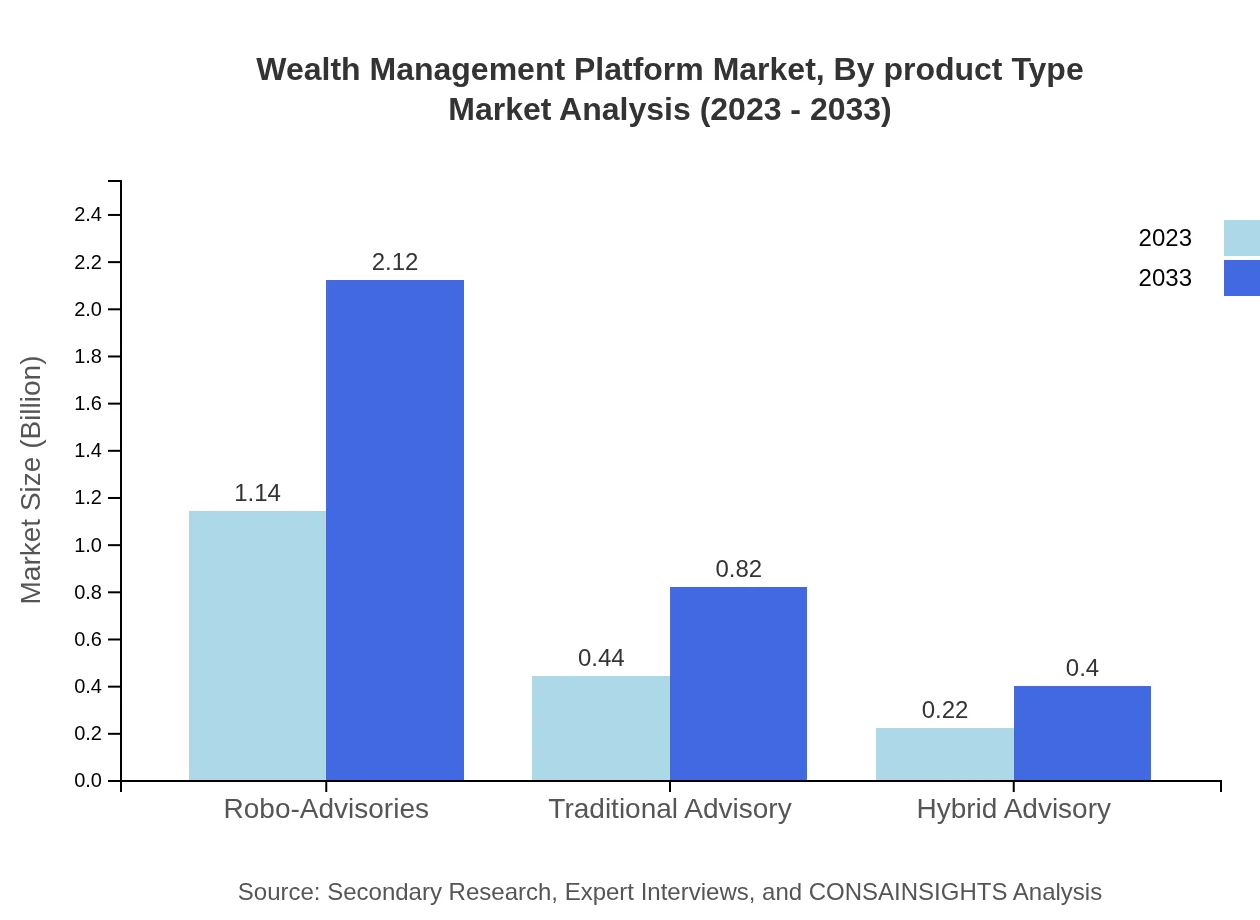

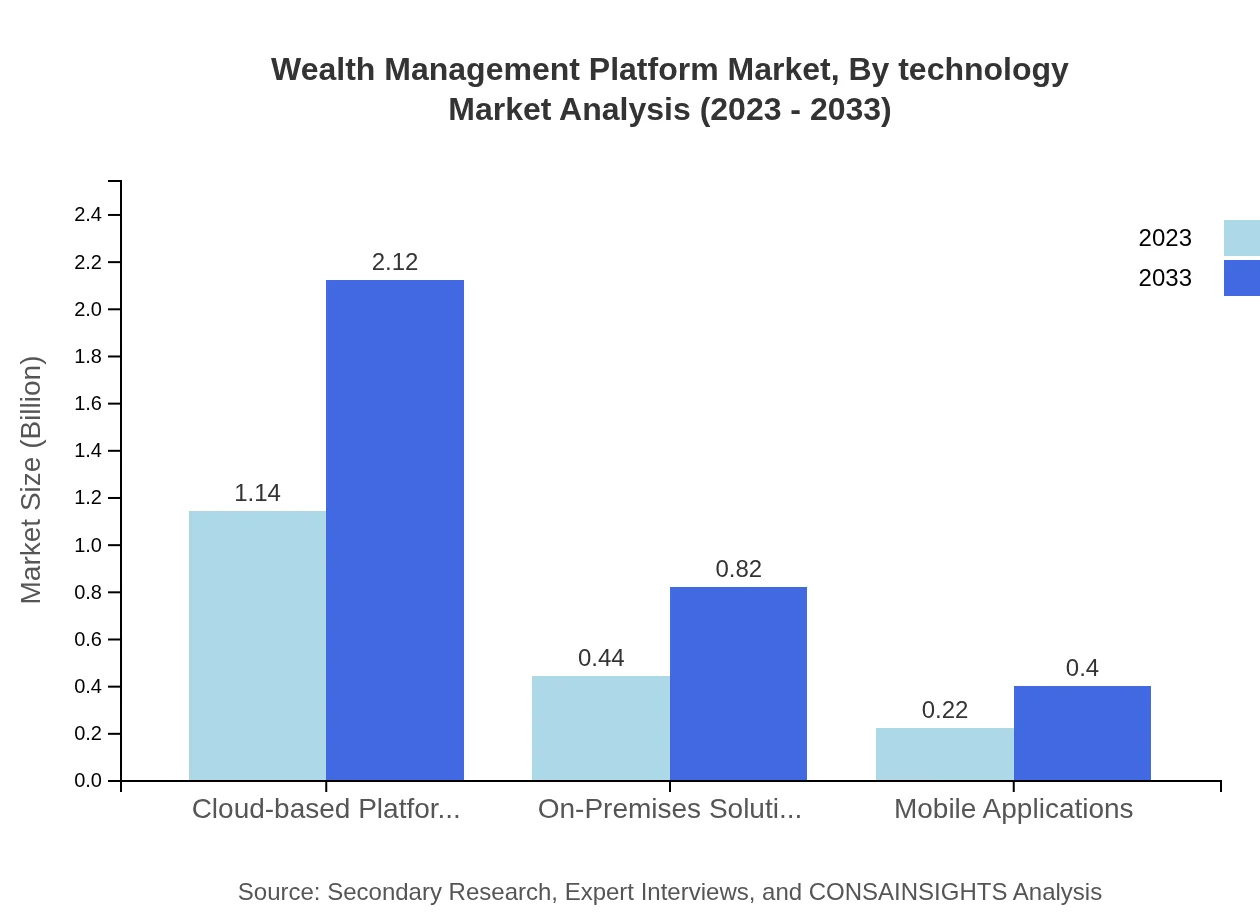

Wealth Management Platform Market Analysis By Product Type

The Wealth Management Platform market segments into various product types, leading to distinct performance indicators. Cloud-based platforms dominate the market with a size of $1.14 trillion in 2023, expected to grow to $2.12 trillion by 2033, accounting for approximately 63.51% market share. On-premises solutions follow with $0.44 trillion and expected growth to $0.82 trillion. Mobile applications, encompassing $0.22 trillion, reflect an increase driven by consumer preferences for portability and accessibility.

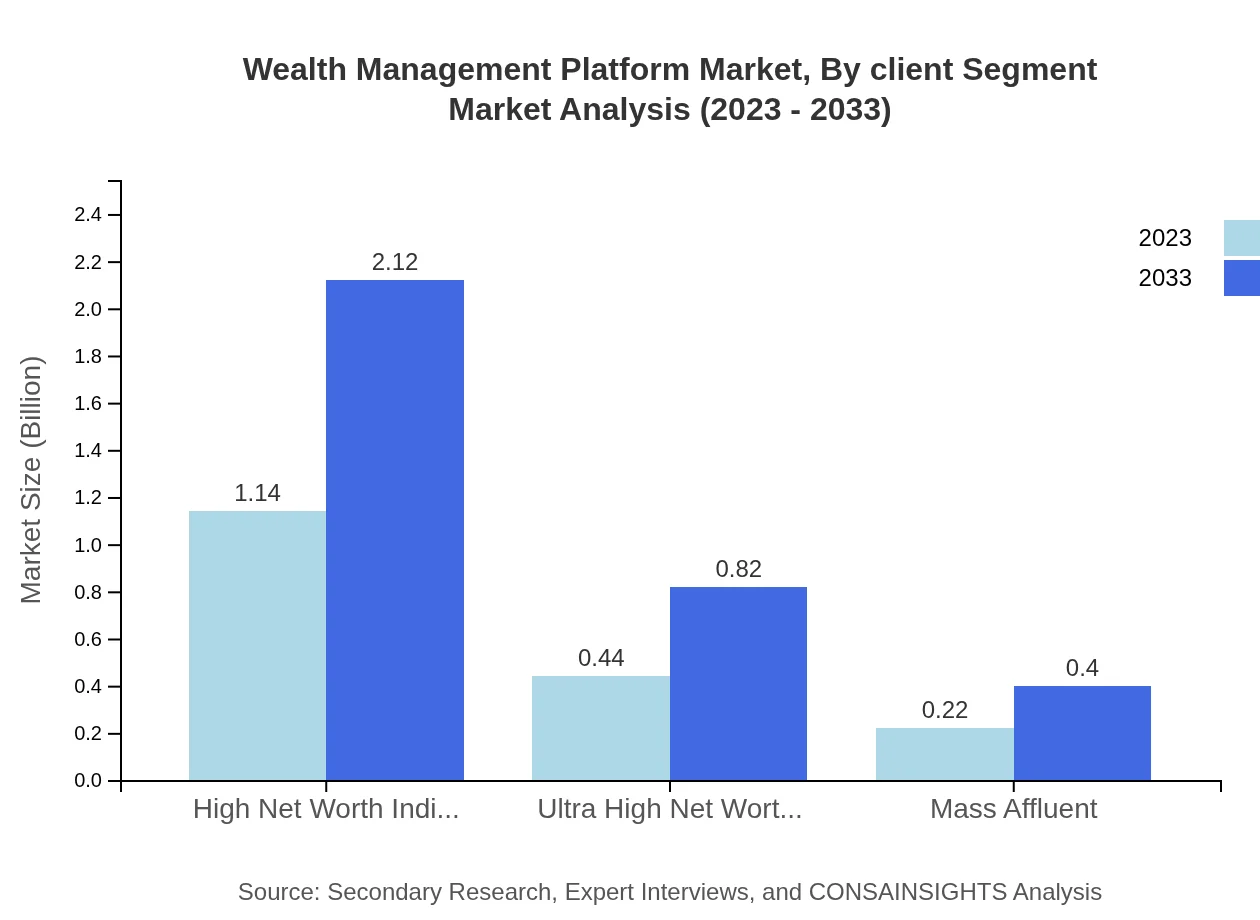

Wealth Management Platform Market Analysis By Client Segment

Within the client segment, high net worth individuals represent a considerable market share, valued at $1.14 trillion in 2023, projected to reach $2.12 trillion by 2033. Ultra high net worth individuals and mass affluent clients are also notable, with respective forecasts of $0.44 trillion to $0.82 trillion and $0.22 trillion to $0.40 trillion. These segments increasingly seek personalized wealth management solutions tailored to their unique financial situations.

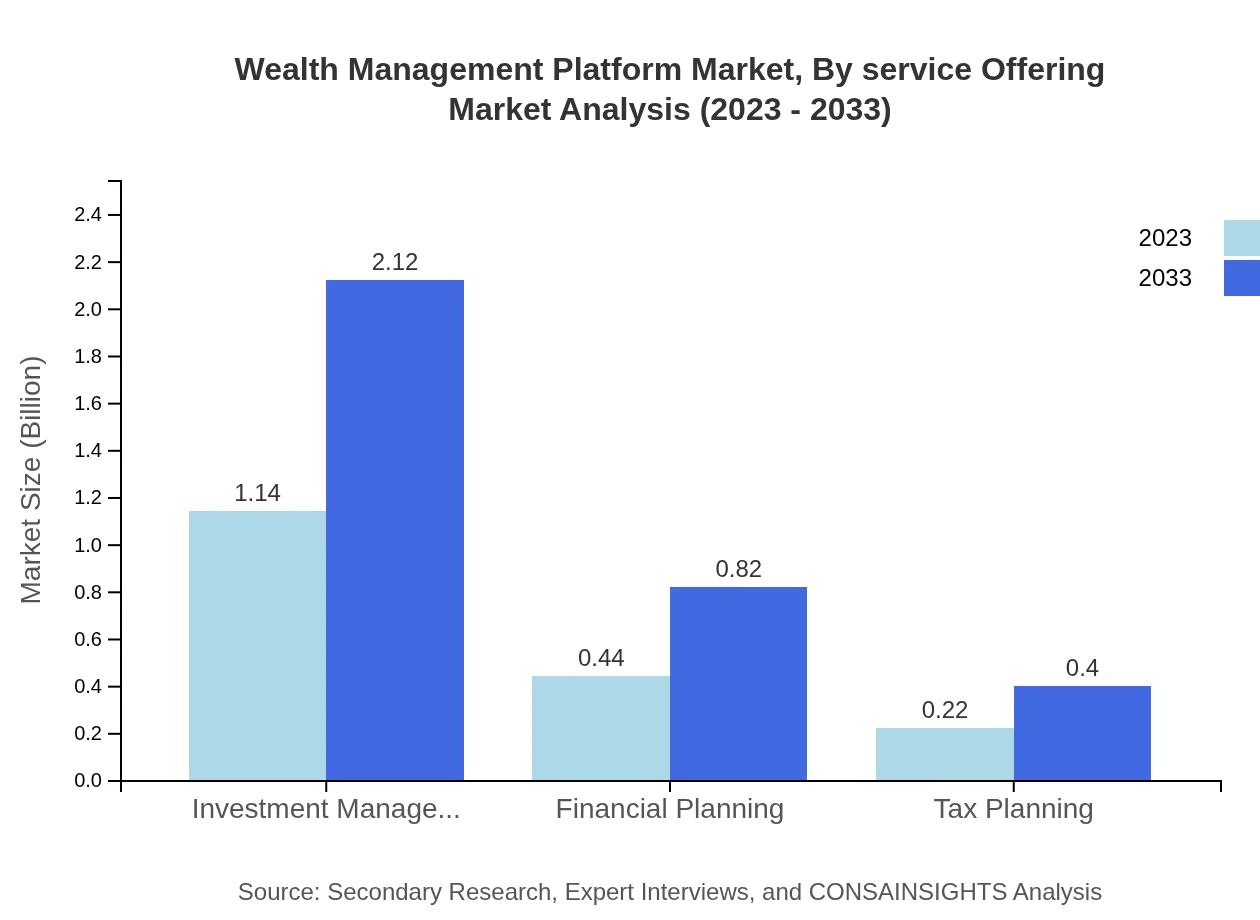

Wealth Management Platform Market Analysis By Service Offering

Service offerings diversify the Wealth Management Platform market, with investment management services holding leading value at $1.14 trillion in 2023 and growing to $2.12 trillion. Financial planning and tax planning services also contribute with respective market sizes of $0.44 trillion to $0.82 trillion and $0.22 trillion to $0.40 trillion, reflecting the comprehensive service expectations of clients.

Wealth Management Platform Market Analysis By Technology

Technology underpins the operational functionality of wealth management platforms, with cloud technologies taking center stage. As firms adopt AI and machine learning, the performance of digital platforms improves. The emphasis on cybersecurity also grows, protecting sensitive client data while using innovative solutions to streamline client interactions.

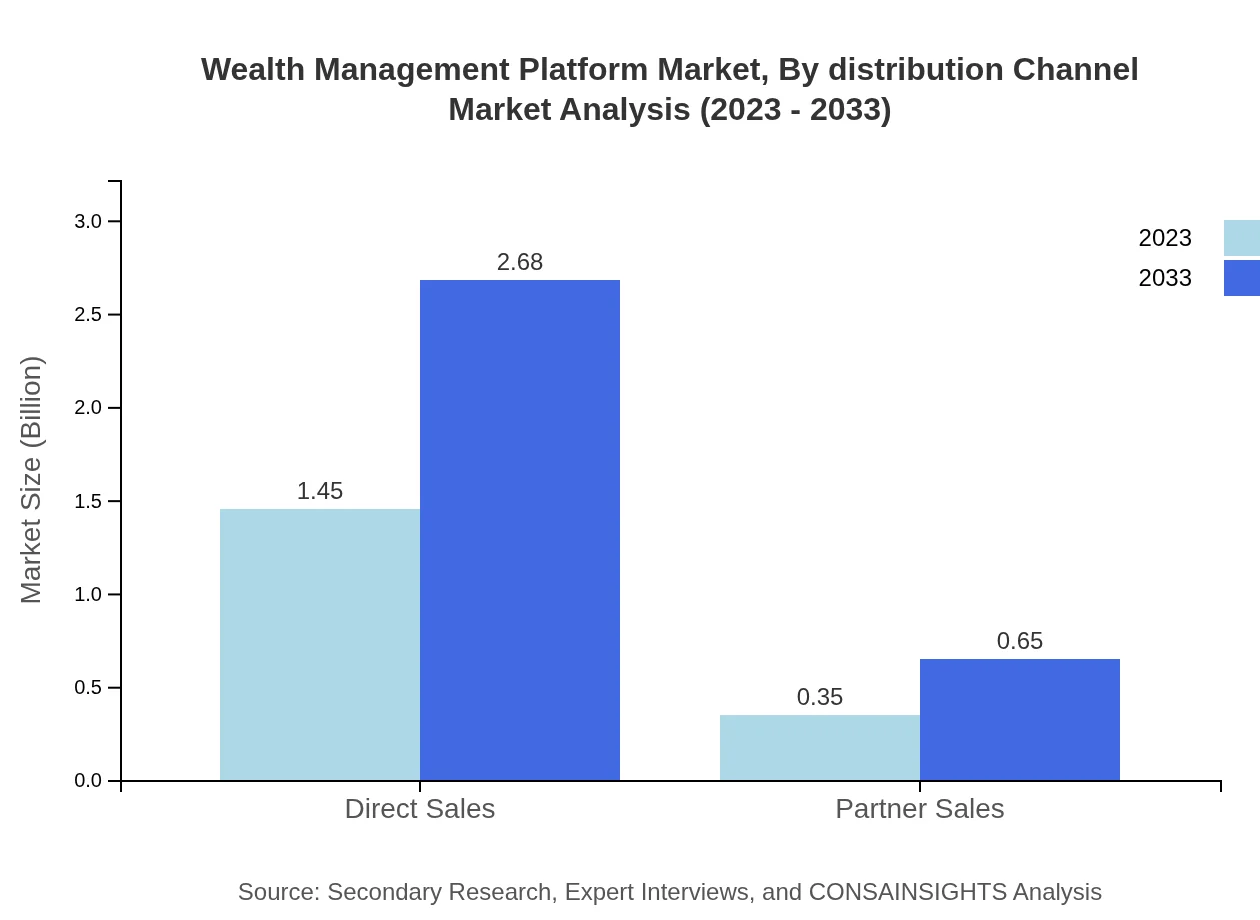

Wealth Management Platform Market Analysis By Distribution Channel

Direct sales are predominant in the Wealth Management Platform distribution channel, valued at $1.45 trillion in 2023, expected to rise to $2.68 trillion. Partner sales, while smaller in scale at $0.35 trillion in 2023, are also expected to grow as companies build alliances to enhance their service offerings.

Wealth Management Platform Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Wealth Management Platform Industry

BlackRock :

BlackRock is a leading global investment management firm, known for its advanced technology-driven investment solutions that enhance wealth management for institutions and individuals alike.Charles Schwab:

Charles Schwab offers comprehensive financial planning and wealth management services with a strong emphasis on technology, aiming to simplify the investment process for clients.Fidelity Investments:

Fidelity is renowned for its diverse investment products and wealth management solutions tailored to meet the needs of varying investor segments.Morgan Stanley:

Morgan Stanley combines technology and dedicated advisory services, focusing on high net worth clients to offer customized investment strategies.We're grateful to work with incredible clients.

FAQs

What is the market size of wealth management platform?

The wealth management platform market is currently valued at approximately $1.8 billion and is expected to grow at a CAGR of 6.2% over the next decade, indicating robust growth potential.

What are the key market players or companies in the wealth management platform industry?

Key players in this space include major financial institutions and technology providers that offer integrated solutions, enhancing client experiences through innovative platforms, though specific companies weren't listed in this report.

What are the primary factors driving the growth in the wealth management platform industry?

Growth is primarily driven by increasing digitalization, rising demand for efficient investment solutions, and the preference for personalized financial advisory services that cater to diverse client needs.

Which region is the fastest Growing in the wealth management platform?

North America leads as the fastest-growing region, projected to expand from $0.65 billion in 2023 to $1.20 billion by 2033. Europe and Asia Pacific also show significant growth trends.

Does ConsaInsights provide customized market report data for the wealth management platform industry?

Yes, ConsaInsights offers tailored market reports that can be customized according to specific client needs and queries within the wealth management platform sector.

What deliverables can I expect from this wealth management platform market research project?

Clients can expect detailed market analysis reports, segmented data insights, competitive landscape evaluations, and future growth predictions tailored to the wealth management platform industry.

What are the market trends of wealth management platform?

Current trends include the rise of cloud-based platforms, increasing use of mobile applications for better client engagement, and a shift towards hybrid advisory models that blend traditional and digital services.