Weapons And Ammunition Market Report

Published Date: 03 February 2026 | Report Code: weapons-and-ammunition

Weapons And Ammunition Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Weapons and Ammunition market from 2023 to 2033, covering size, industry dynamics, technological advancements, and regional insights to guide stakeholders in strategic planning.

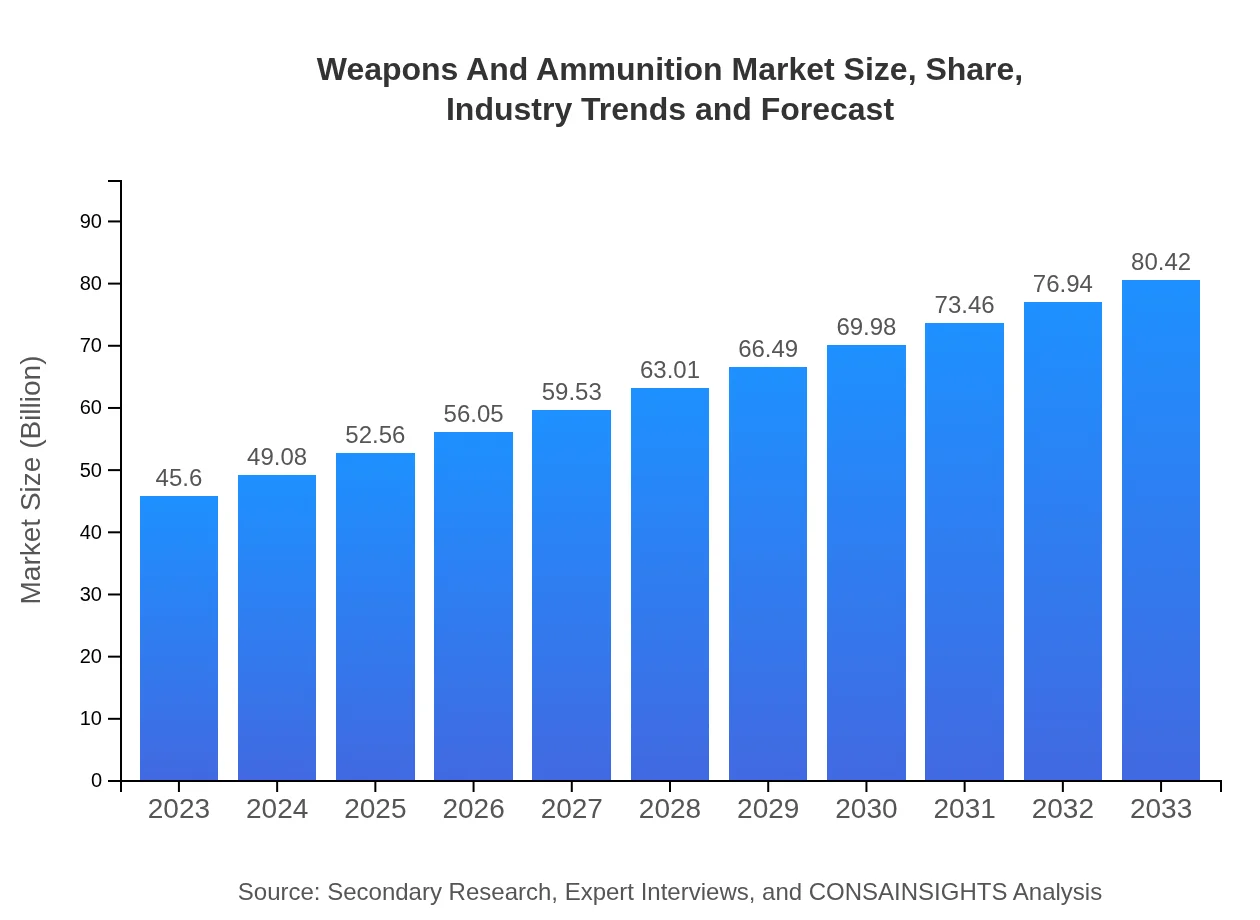

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $45.60 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $80.42 Billion |

| Top Companies | Lockheed Martin, Raytheon Technologies, Northrop Grumman, BAE Systems, General Dynamics |

| Last Modified Date | 03 February 2026 |

Weapons And Ammunition Market Overview

Customize Weapons And Ammunition Market Report market research report

- ✔ Get in-depth analysis of Weapons And Ammunition market size, growth, and forecasts.

- ✔ Understand Weapons And Ammunition's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Weapons And Ammunition

What is the Market Size & CAGR of Weapons And Ammunition market in 2023?

Weapons And Ammunition Industry Analysis

Weapons And Ammunition Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Weapons And Ammunition Market Analysis Report by Region

Europe Weapons And Ammunition Market Report:

Europe's Weapons and Ammunition market is projected to increase from $11.90 billion in 2023 to $20.99 billion by 2033. The region faces various security concerns, prompting NATO member states to enhance their military capabilities. The focus on collaborative defense initiatives also drives growth in advanced weapon systems and equipment.Asia Pacific Weapons And Ammunition Market Report:

The Asia Pacific region is poised for remarkable growth in the Weapons and Ammunition market, with a projected market size of $16.94 billion by 2033, up from $9.60 billion in 2023. Key drivers include escalating territorial conflicts and rising defense budgets of countries such as India and China. The burgeoning demand for advanced weaponry to secure national interests is prompting governments to increase investments in military technologies.North America Weapons And Ammunition Market Report:

North America remains the largest market for Weapons and Ammunition, forecasted to expand from $17.26 billion in 2023 to $30.43 billion by 2033. The United States is a leading contributor, with significant investments in military modernization and defense technology. The ongoing geopolitical threats and counter-terrorism efforts are key factors contributing to the growth.South America Weapons And Ammunition Market Report:

In South America, the market is expected to grow from $4.04 billion in 2023 to $7.12 billion by 2033. Political instability and increasing crime rates have necessitated enhanced law enforcement capabilities, thereby driving demand for weapons. Countries are investing in modernizing their military capabilities, which is crucial for maintaining stability in the region.Middle East & Africa Weapons And Ammunition Market Report:

The Middle East and Africa market is anticipated to grow steadily, from $2.80 billion in 2023 to $4.95 billion by 2033. The demand is largely influenced by regional conflicts, necessitating increased military preparedness. Additionally, investments in security infrastructure and defense cooperation among nations further support market development.Tell us your focus area and get a customized research report.

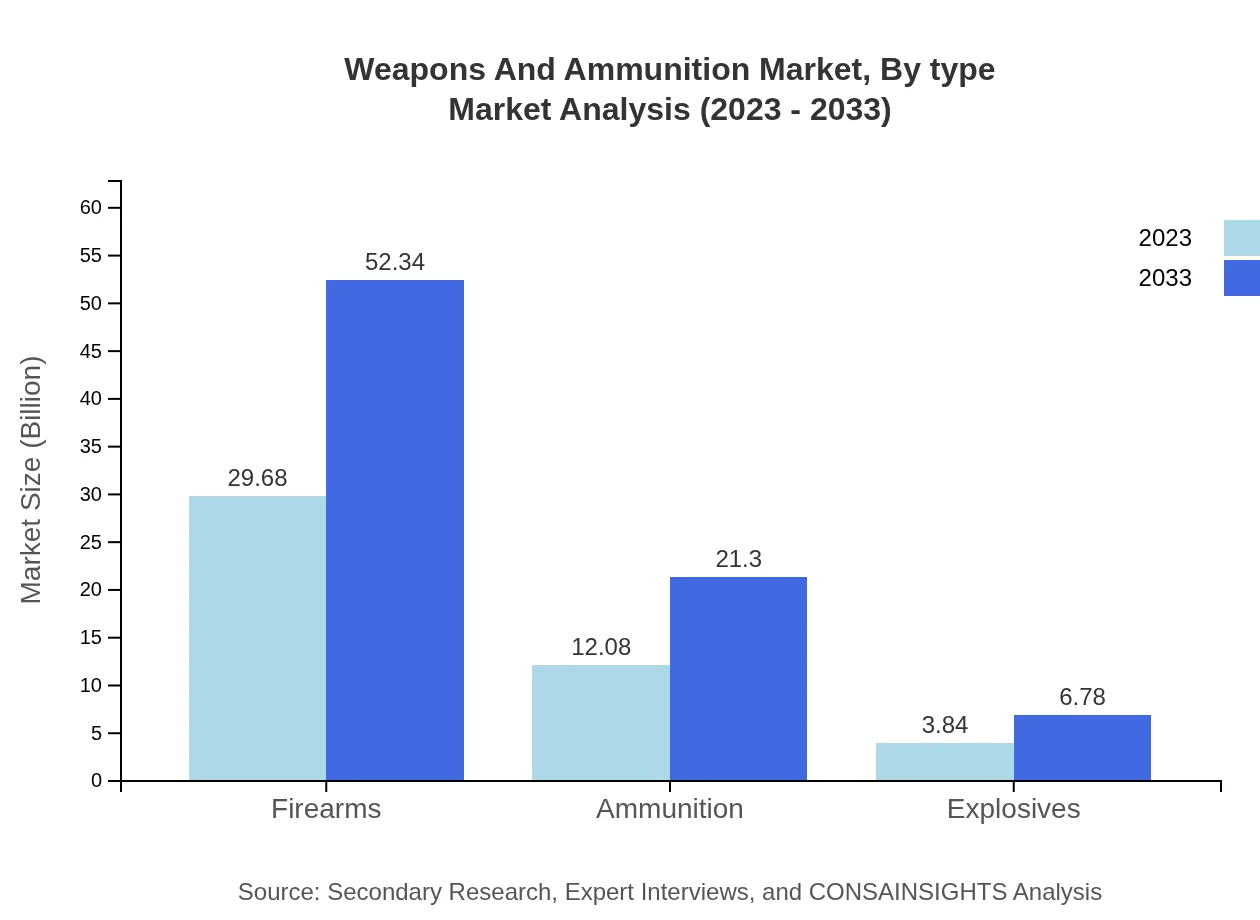

Weapons And Ammunition Market Analysis By Type

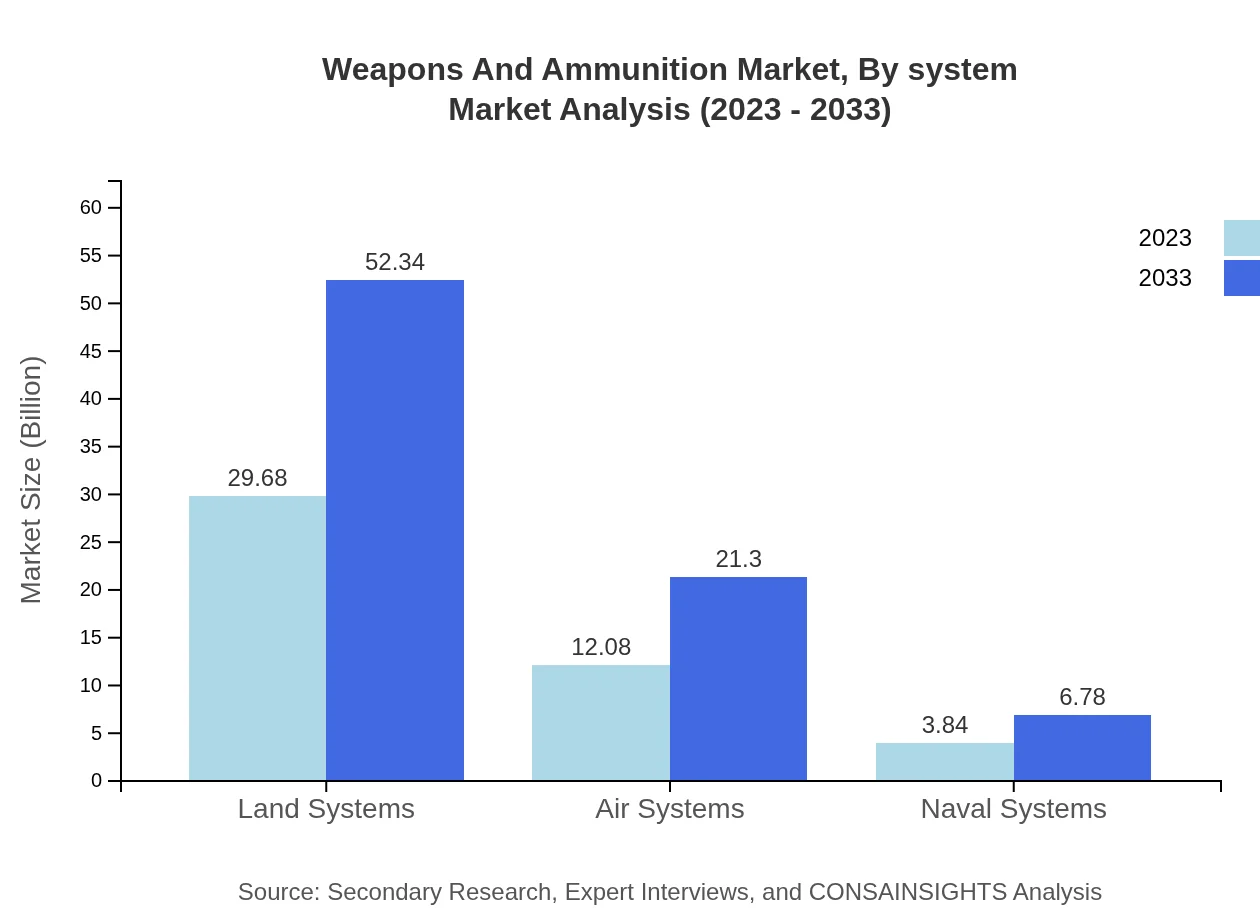

The Weapons and Ammunition market is primarily divided into Firearms, Ammunition, and Explosives. Firearms, anticipated to grow from $29.68 billion in 2023 to $52.34 billion by 2033, dominate the market, accounting for a 65.08% market share. Ammunition also shows a significant increase, projected to rise from $12.08 billion in 2023 to $21.30 billion by 2033, holding a 26.49% share. Explosives represent a smaller yet impactful segment, expanding from $3.84 billion to $6.78 billion, contributing to 8.43% share.

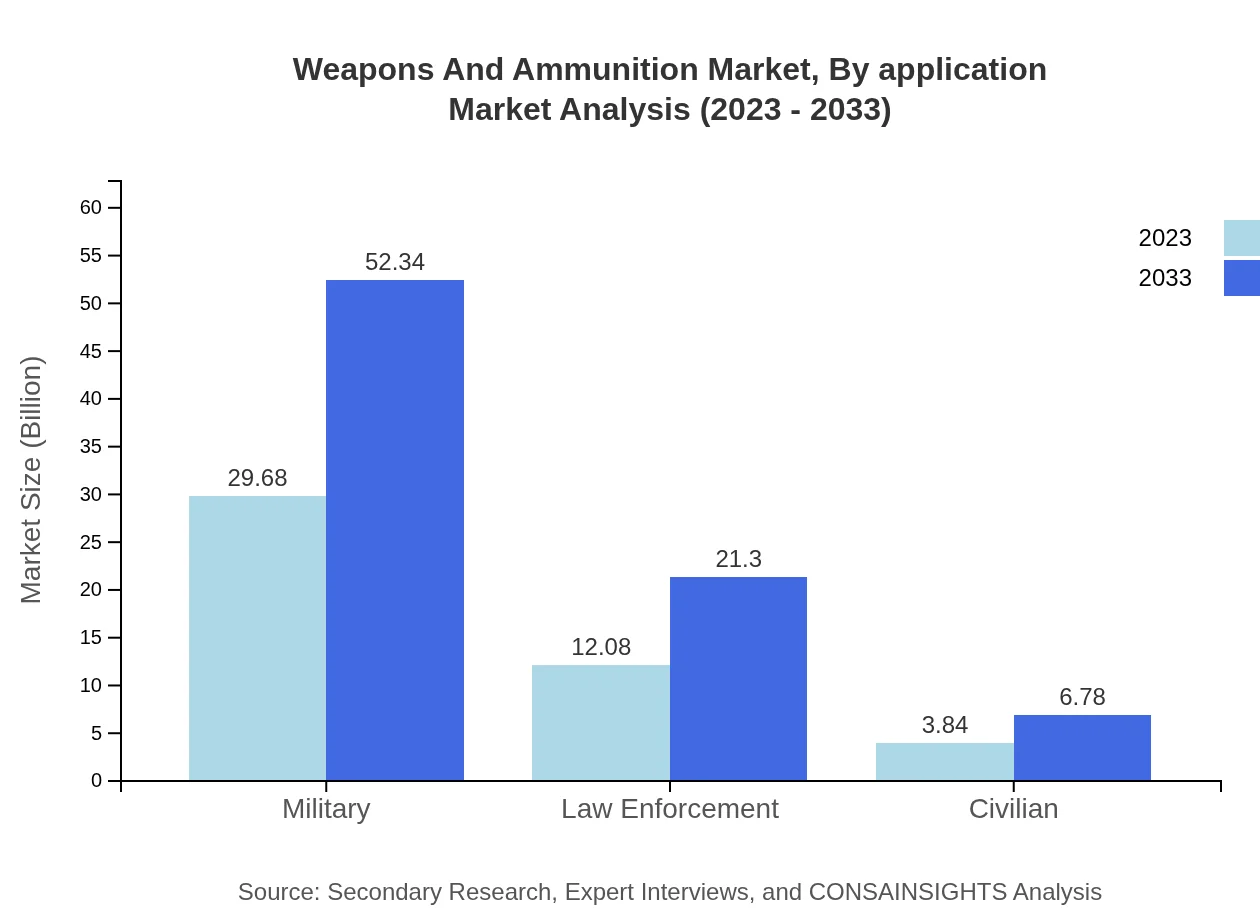

Weapons And Ammunition Market Analysis By Application

The application segments of the Weapons and Ammunition market include Military, Law Enforcement, and Civilian uses. The Military segment remains the largest, expected to grow from $29.68 billion in 2023 to $52.34 billion by 2033 (65.08% share). Law Enforcement is anticipated to rise from $12.08 billion to $21.30 billion (26.49% share), while Civilian applications show growth from $3.84 billion to $6.78 billion (8.43% share).

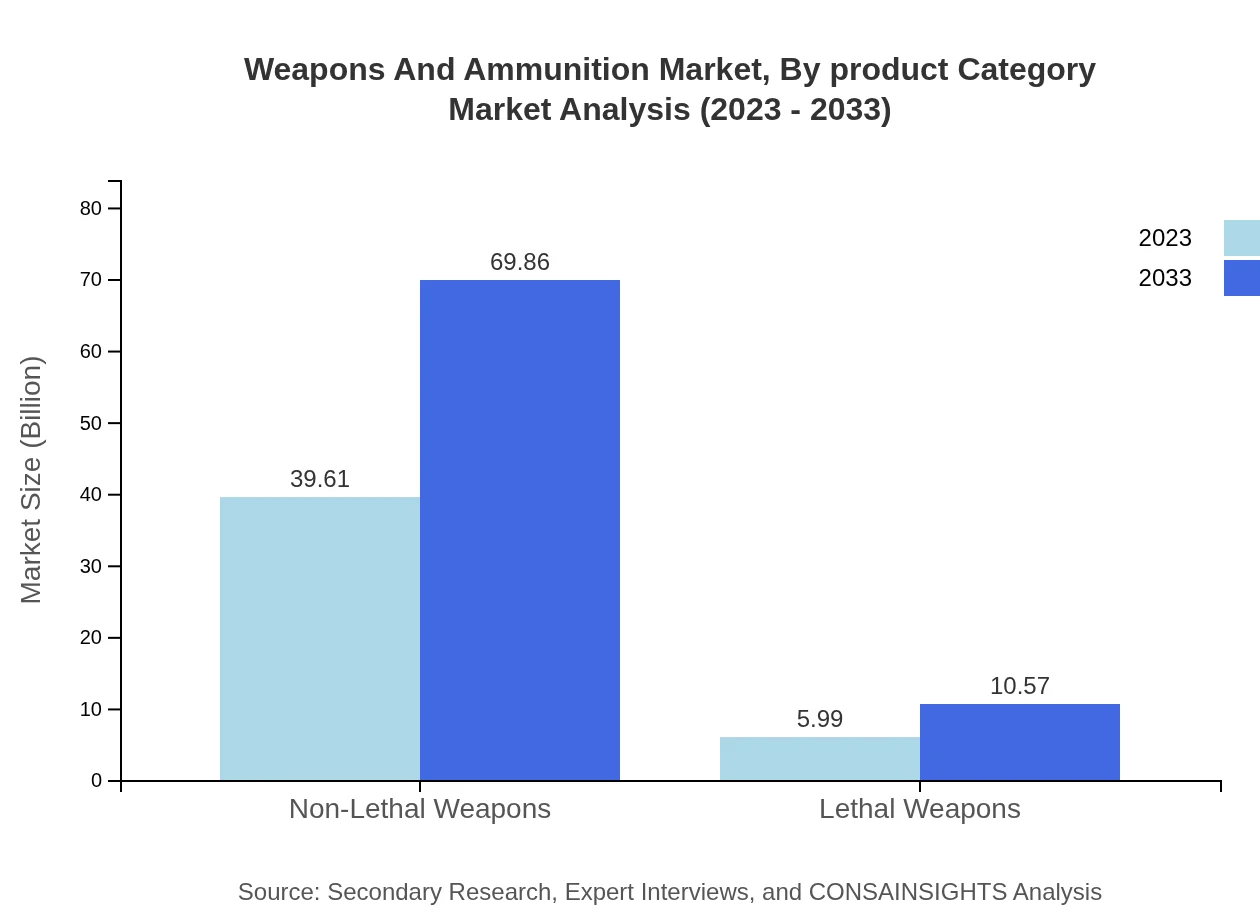

Weapons And Ammunition Market Analysis By Product Category

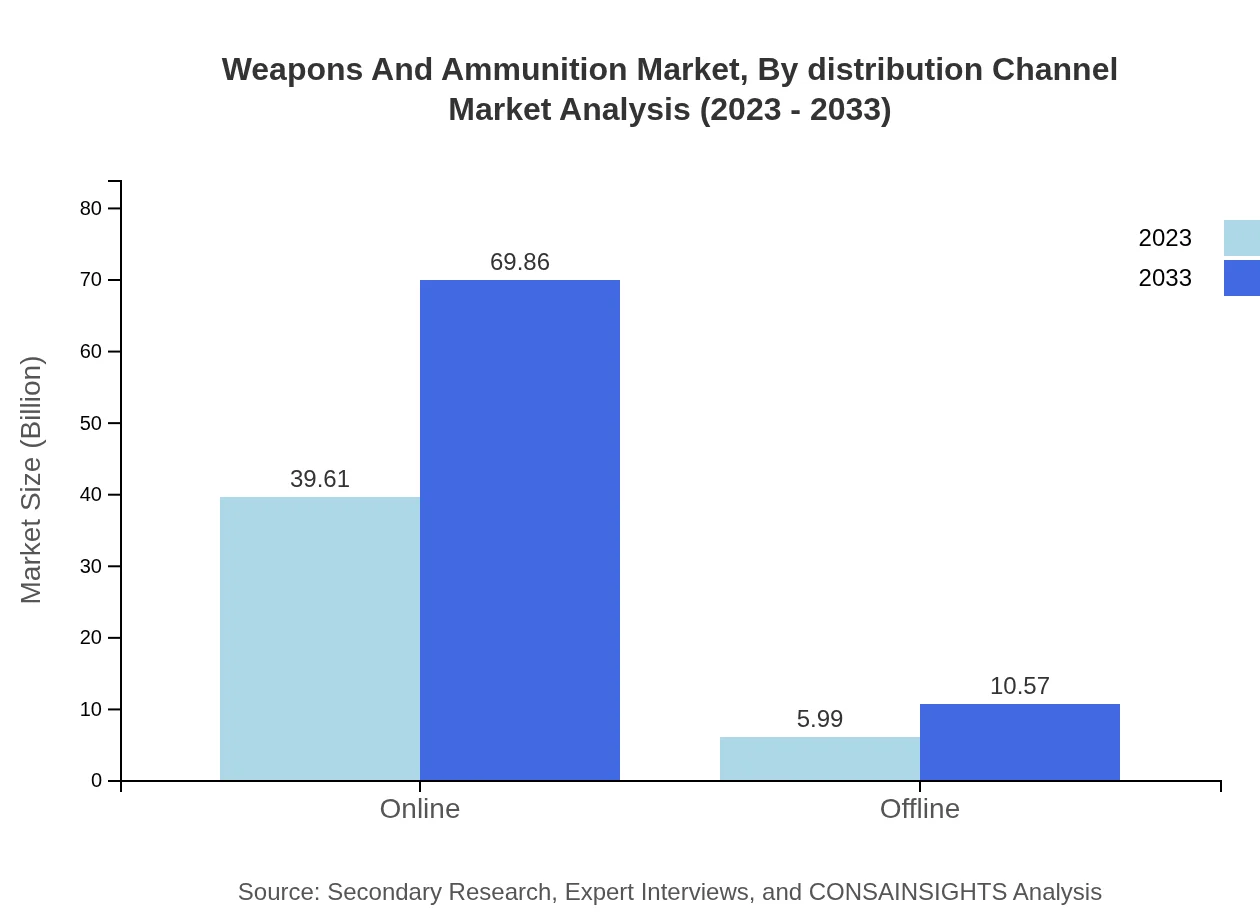

This segment encompasses Non-Lethal and Lethal Weapons. Non-Lethal Weapons are poised for substantial growth from $39.61 billion in 2023 to $69.86 billion by 2033 (86.86% share). Lethal Weapons are projected to increase from $5.99 billion to $10.57 billion, maintaining a 13.14% share. The preference for non-lethal options in law enforcement and civilian use enhances this segment's growth.

Weapons And Ammunition Market Analysis By Distribution Channel

The distribution channels for Weapons and Ammunition comprise Online and Offline channels. The online segment is expected to grow impressively from $39.61 billion in 2023 to $69.86 billion by 2033 (86.86% share). The offline channel, while smaller, is also set to rise from $5.99 billion to $10.57 billion (13.14% share), reflecting changing purchasing trends among consumers.

Weapons And Ammunition Market Analysis By System

The Weapons and Ammunition market is segmented into Land, Air, and Naval Systems. Both Land and Air Systems are estimated to grow from $29.68 billion to $52.34 billion by 2033 (65.08% share each). Naval Systems, while smaller, are projected to increase from $3.84 billion to $6.78 billion (8.43% share). This segmentation articulates the varied applications and demands from different military branches.

Weapons And Ammunition Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Weapons And Ammunition Industry

Lockheed Martin:

A leading defense contractor providing advanced aerospace and maritime systems, Lockheed Martin plays a pivotal role in developing innovative weapons technology.Raytheon Technologies:

Specializing in defense and aerospace systems, Raytheon develops advanced missile systems and defense electronics, contributing significantly to the global market.Northrop Grumman:

Focused on aerospace and defense technologies, Northrop Grumman is instrumental in providing cutting-edge weaponry and systems integration solutions.BAE Systems:

Offering a range of military and civilian products, BAE Systems focuses on delivering advanced weapons systems, cyber solutions, and naval technologies.General Dynamics:

General Dynamics is prominent in land systems and combat vehicles, supporting armed forces with innovative technologies and next-generation weaponry.We're grateful to work with incredible clients.

FAQs

What is the market size of weapons And Ammunition?

The global weapons and ammunition market is valued at $45.6 billion in 2023, with a projected CAGR of 5.7%, indicating steady growth leading up to 2033. This expansion reflects increasing defense expenditures and geopolitical tensions, driving demand for various weapon types.

What are the key market players or companies in this weapons And Ammunition industry?

Key players in the weapons and ammunition market include global defense firms such as Lockheed Martin, BAE Systems, and Northrop Grumman. These companies play crucial roles in manufacturing, supplying, and innovating weapon systems, highlighting the competitive landscape of this industry.

What are the primary factors driving the growth in the weapons And Ammunition industry?

Growth in the weapons and ammunition industry is primarily driven by rising geopolitical conflicts, increased military spending, and a focus on modernization of armed forces. Additionally, advancements in technology and the proliferation of defense contracts boost market demand significantly.

Which region is the fastest Growing in the weapons And Ammunition?

The fastest-growing region in the weapons and ammunition market is North America, projected to expand from $17.26 billion in 2023 to $30.43 billion by 2033. This growth is attributed to high defense budgets and technological innovations in military capabilities.

Does ConsaInsights provide customized market report data for the weapons And Ammunition industry?

Yes, ConsaInsights offers customized market report data for the weapons and ammunition industry. Clients can request tailored insights that adapt to specific market segments, regional analysis, and strategic forecasts to meet their research needs effectively.

What deliverables can I expect from this weapons And Ammunition market research project?

Deliverables from this weapons and ammunition market research project typically include comprehensive market analysis reports, trend evaluations, forecasts, and actionable insights on competitive landscapes, segmented data, regional analysis, and potential growth opportunities.

What are the market trends of weapons And Ammunition?

Key market trends in weapons and ammunition include the shift towards non-lethal weapons, increased procurement by civilian sectors, and the integration of smart technology in defense systems. Moreover, the growing importance of cybersecurity in defense strategies is contributing to evolving market dynamics.