Wet Chemicals Market Report

Published Date: 02 February 2026 | Report Code: wet-chemicals

Wet Chemicals Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report delves into the Wet Chemicals market, providing insights into market trends, growth prospects, and regional analyses from 2023 to 2033. It aims to equip stakeholders with valuable data for informed decision-making.

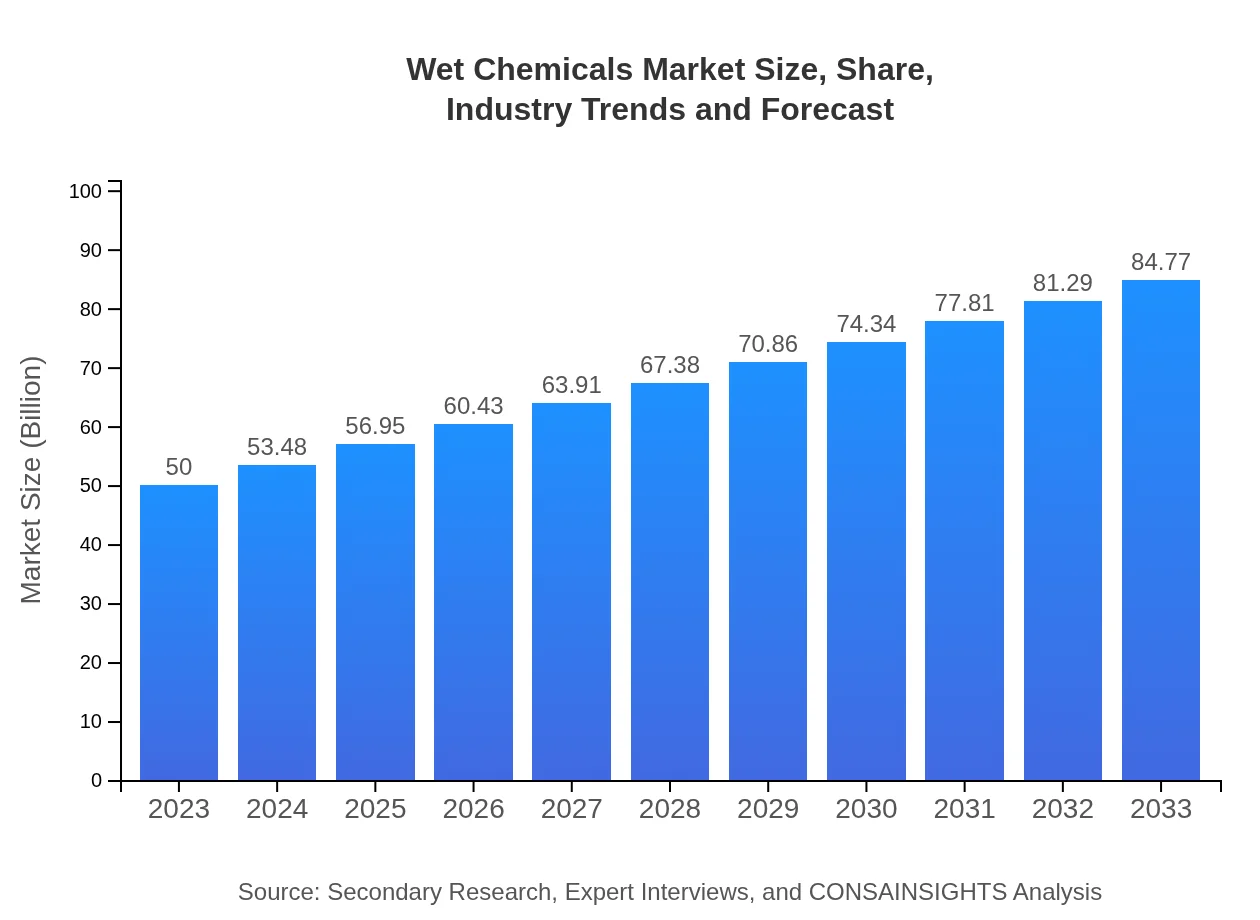

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 5.3% |

| 2033 Market Size | $84.77 Billion |

| Top Companies | BASF SE, Dow Inc., Hanwha Solutions, Solvay SA |

| Last Modified Date | 02 February 2026 |

Wet Chemicals Market Overview

Customize Wet Chemicals Market Report market research report

- ✔ Get in-depth analysis of Wet Chemicals market size, growth, and forecasts.

- ✔ Understand Wet Chemicals's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Wet Chemicals

What is the Market Size & CAGR of Wet Chemicals market in 2023?

Wet Chemicals Industry Analysis

Wet Chemicals Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Wet Chemicals Market Analysis Report by Region

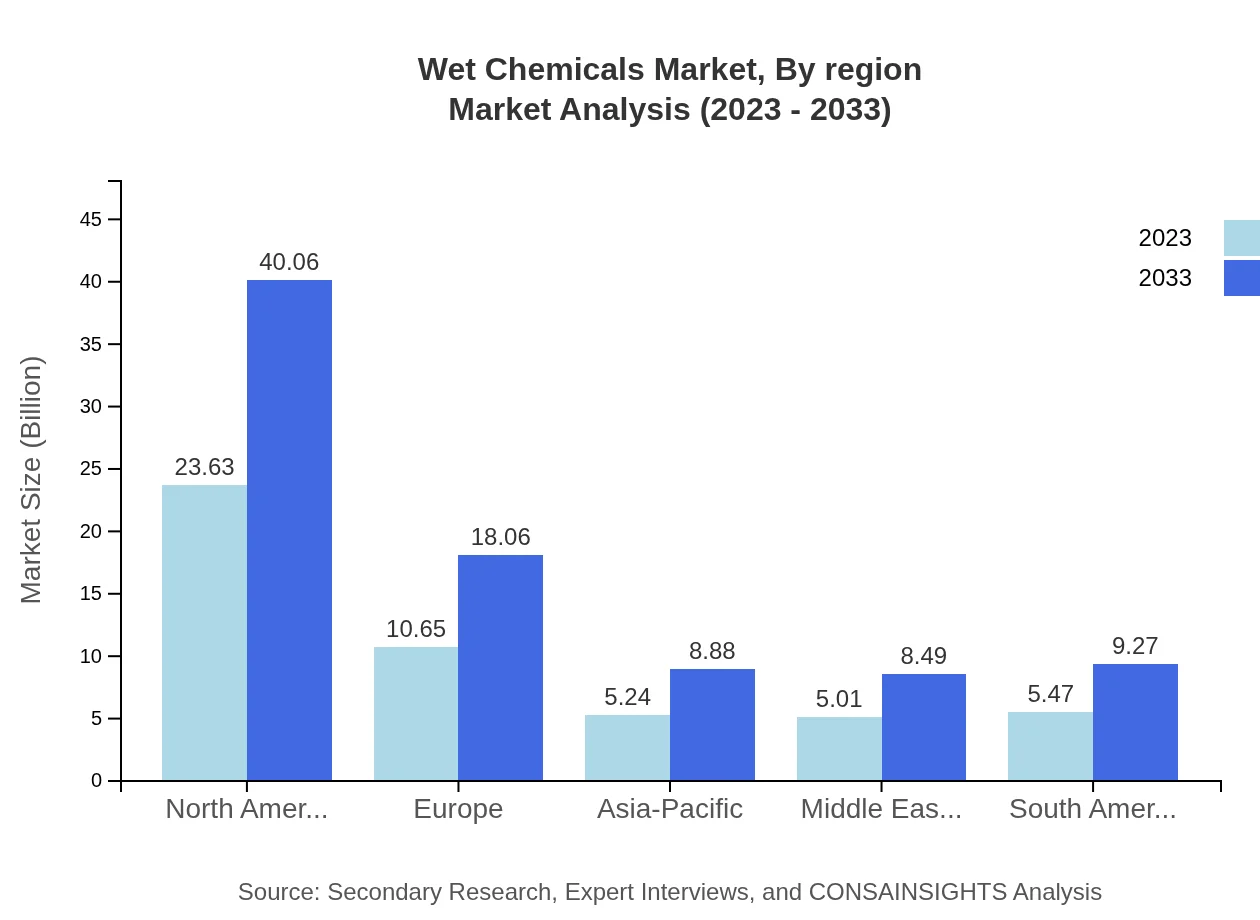

Europe Wet Chemicals Market Report:

Europe's market size is predicted to grow from $15.30 billion in 2023 to $25.95 billion by 2033, driven by increased demand for cleaning and specialty chemicals and strong regulatory frameworks promoting sustainable practices.Asia Pacific Wet Chemicals Market Report:

In the Asia Pacific region, the Wet Chemicals market is expected to grow from $9.50 billion in 2023 to $16.11 billion by 2033, driven by rapid industrialization and demand for electronics manufacturing.North America Wet Chemicals Market Report:

North America leads the global market with a size of $17.70 billion in 2023 anticipated to elevate to $30.00 billion by 2033 due to investments in sustainable practices and extensive pharmaceutical industries.South America Wet Chemicals Market Report:

The South American market will see an increase from $1.68 billion in 2023 to $2.84 billion by 2033, aided by growth in agricultural applications and food processing.Middle East & Africa Wet Chemicals Market Report:

The Middle East and Africa region’s market is expected to rise from $5.83 billion in 2023 to $9.88 billion by 2033, with growth fueled by expanding oil and gas sectors and technological advances in chemical production.Tell us your focus area and get a customized research report.

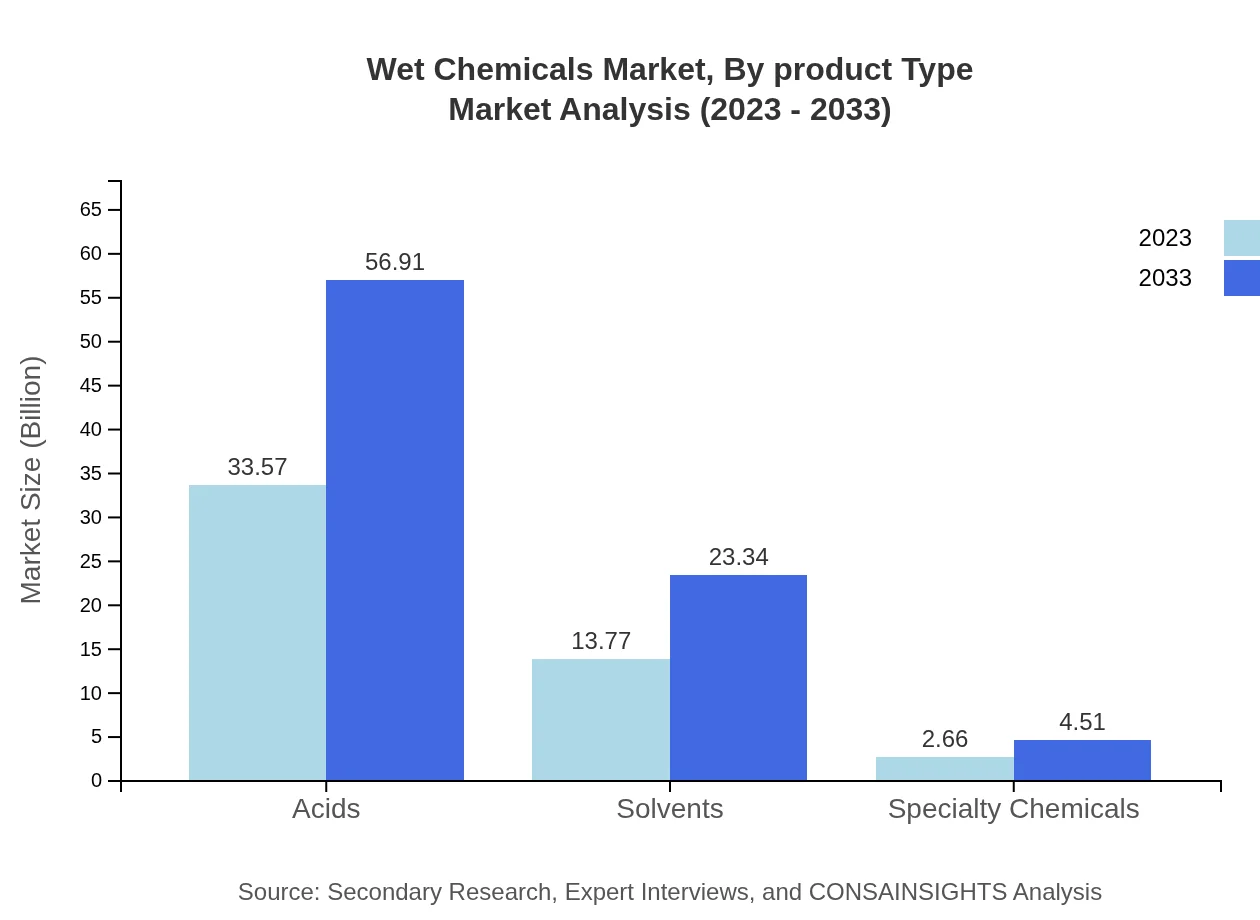

Wet Chemicals Market Analysis By Product Type

The key product types in the Wet Chemicals market include Acids, Solvents, and Specialty Chemicals. In 2023, Acids lead with a market size of $33.57 billion, expected to reach $56.91 billion by 2033, while Solvents and Specialty Chemicals show growing tendencies as well.

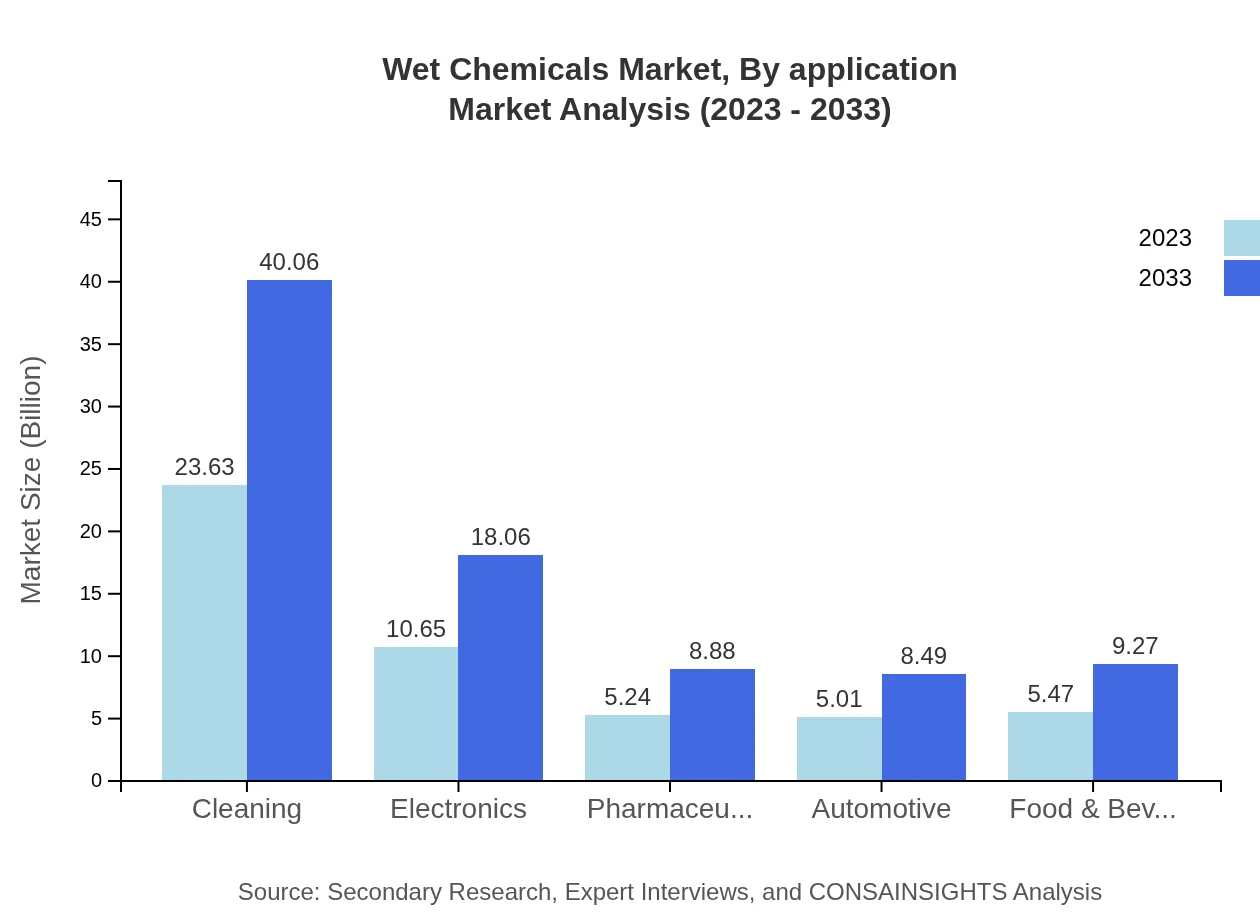

Wet Chemicals Market Analysis By Application

Wet Chemicals are utilized extensively in Cleaning, Electronics Manufacturing, Pharmaceuticals, Automotive, Food & Beverages, and more. The Cleaning segment represents the largest share, amounting to 47.26% of the market, reflecting demand for effective and sustainable cleaning solutions.

Wet Chemicals Market Analysis By Region

Regionally, North America holds the largest share, followed by Europe and Asia Pacific. Demand trends indicate a shift towards sustainable products across various regions, influenced by regulatory frameworks and consumer preferences.

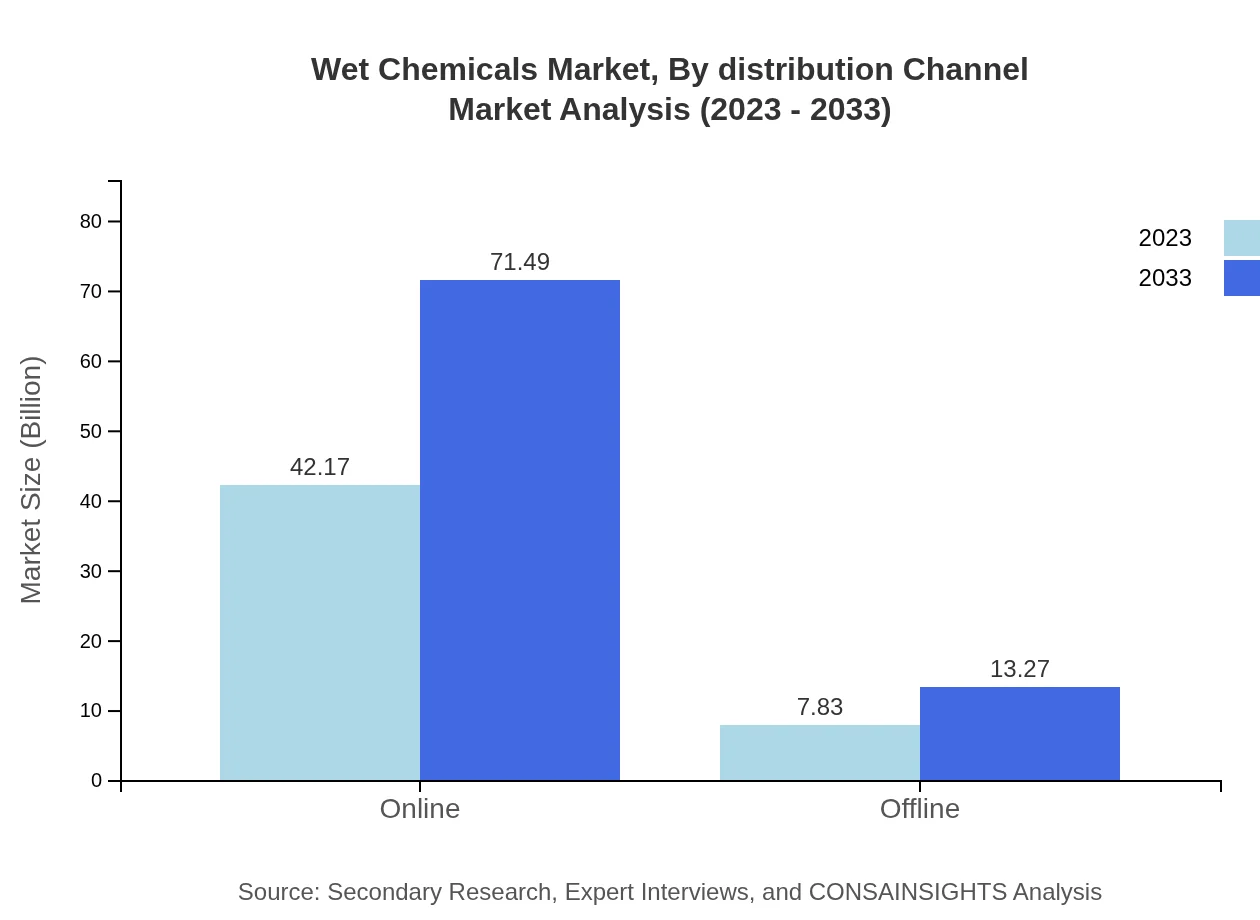

Wet Chemicals Market Analysis By Distribution Channel

Online distribution channels currently dominate, accounting for 84.34% of the market. This trend reflects the growing reliance on digital commerce, particularly in consumer-centric segments like cleaning and electronics.

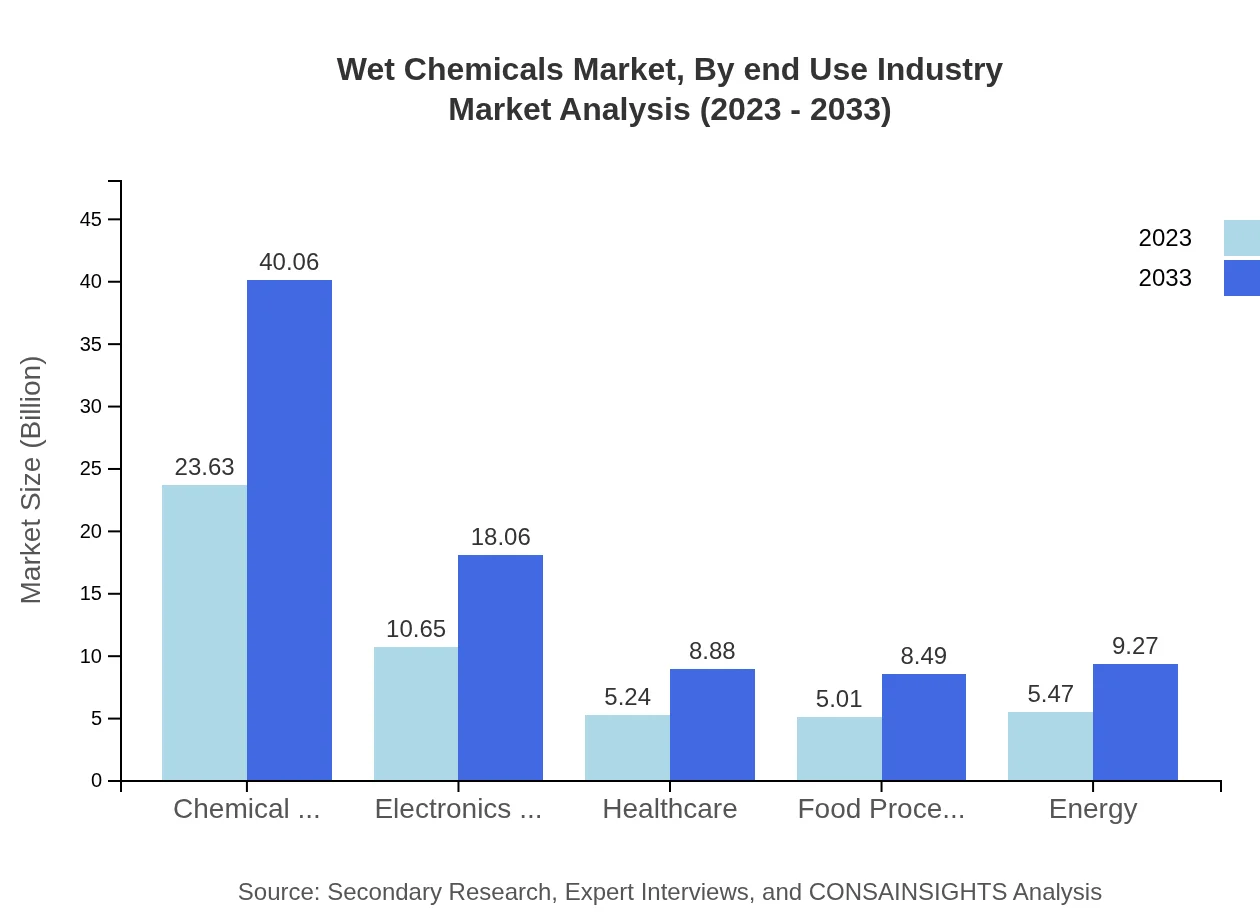

Wet Chemicals Market Analysis By End Use Industry

Major end-use industries include Chemical Manufacturing, Electronics Manufacturing, Healthcare, and Energy. The Chemical Manufacturing sector is anticipated to maintain a strong market presence, exhibiting growth in sustainably sourced chemical products.

Wet Chemicals Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Wet Chemicals Industry

BASF SE:

A leading global chemical company known for its innovation and market leadership in specialty chemicals and performance products.Dow Inc.:

Specializes in technology-based products and solutions, driving advancements in agricultural and electronic applications.Hanwha Solutions:

Focuses on sustainable chemical solutions, enhancing their portfolio through strategic investments and R&D initiatives.Solvay SA:

Provides sustainable and innovative solutions across diverse industrial sectors with a strong emphasis on high-performance materials.We're grateful to work with incredible clients.

FAQs

What is the market size of Wet Chemicals?

The global wet chemicals market is projected to grow from USD 50 billion in 2023 to a substantial size by 2033, achieving a CAGR of 5.3%. This growth reflects increasing demand across various industries.

What are the key market players or companies in the Wet Chemicals industry?

Key players in the wet chemicals market include major corporations that specialize in chemical manufacturing, electronics, and pharmaceuticals. Companies focus on innovative solutions and sustainability to maintain a competitive edge.

What are the primary factors driving the growth in the Wet Chemicals industry?

Growth factors include rising demand in electronics and semiconductor manufacturing, advancements in chemical processing technologies, and the increasing use of wet chemicals in various applications such as cleaning and pharmaceuticals.

Which region is the fastest Growing in the Wet Chemicals market?

North America is the fastest-growing region in the wet chemicals market, expanding from a market size of USD 17.70 billion in 2023 to USD 30.00 billion by 2033, fueled by technological advancements and increases in manufacturing activities.

Does ConsaInsights provide customized market report data for the Wet Chemicals industry?

Yes, ConsaInsights offers customized market report data tailored specifically for the wet chemicals industry, allowing businesses to gain insights into market trends, competitive landscape, and regional dynamics.

What deliverables can I expect from this Wet Chemicals market research project?

Expect comprehensive reports including market size analysis, segmentation data, CAGR forecasts, competitive landscape assessments, and insights on regional trends and market dynamics in the wet chemicals industry.

What are the market trends of Wet Chemicals?

Current trends in the wet chemicals market include increasing use in electronics manufacturing, a shift towards sustainable practices, and growing applications in diverse sectors such as healthcare, automotive, and food processing.