Wheat Gluten Market Report

Published Date: 31 January 2026 | Report Code: wheat-gluten

Wheat Gluten Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Wheat Gluten market, covering market size, growth forecasts, regional insights, industry trends, and leading players from 2023 to 2033.

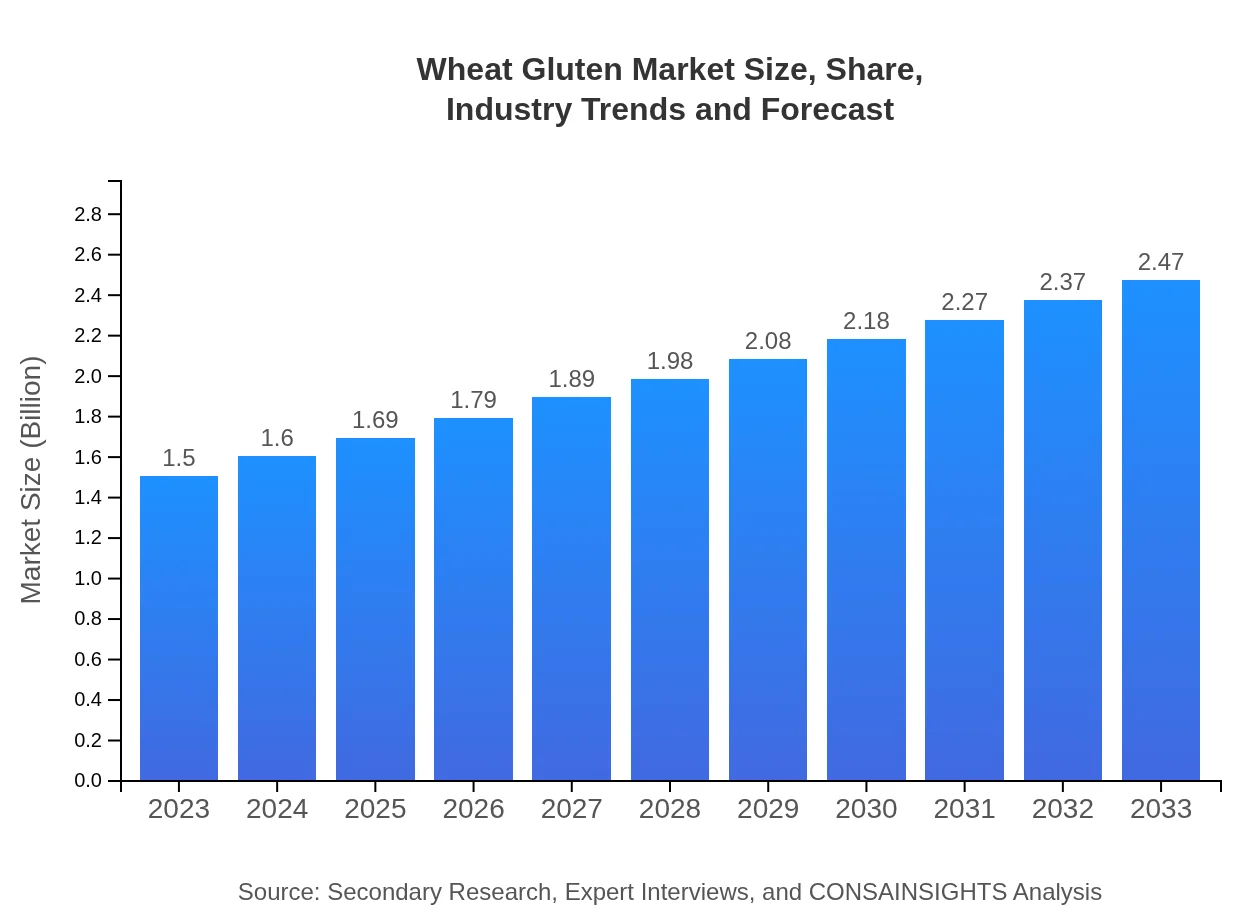

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $2.47 Billion |

| Top Companies | Triton Ingredients, Cargill, Inc., MGP Ingredients, Inc., Archer Daniels Midland Company (ADM) |

| Last Modified Date | 31 January 2026 |

Wheat Gluten Market Overview

Customize Wheat Gluten Market Report market research report

- ✔ Get in-depth analysis of Wheat Gluten market size, growth, and forecasts.

- ✔ Understand Wheat Gluten's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Wheat Gluten

What is the Market Size & CAGR of Wheat Gluten market in 2023?

Wheat Gluten Industry Analysis

Wheat Gluten Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Wheat Gluten Market Analysis Report by Region

Europe Wheat Gluten Market Report:

The European Wheat Gluten market is estimated at USD 0.45 billion in 2023 and is forecasted to reach USD 0.74 billion by 2033, driven by high demand for gluten-rich flour from the bakery sector and expanding applications in functional foods.Asia Pacific Wheat Gluten Market Report:

In 2023, the Wheat Gluten market in Asia Pacific is valued at approximately USD 0.33 billion and is projected to reach USD 0.54 billion by 2033. The region's growth is attributed to increasing adoption of processed foods and a burgeoning health-conscious population, which demand high-quality gluten products in various applications.North America Wheat Gluten Market Report:

North America represents a significant market for Wheat Gluten, starting at USD 0.48 billion in 2023 and projected to grow to USD 0.79 billion by 2033. The increasing trend towards healthy eating and plant-based diet adoption in the U.S. and Canada supports growth in this region.South America Wheat Gluten Market Report:

The Wheat Gluten market in South America starts at USD 0.10 billion in 2023 and is expected to rise to USD 0.17 billion by 2033. The growth is driven by expanding food sectors in Brazil and Argentina, where wheat gluten is gaining traction in various processed food items, including bakery products.Middle East & Africa Wheat Gluten Market Report:

In the Middle East and Africa, the Wheat Gluten market is valued at USD 0.14 billion in 2023 and is projected to reach USD 0.23 billion by 2033. Increasing health awareness and the growth of the snack food market are influencing the demand for wheat gluten in this region.Tell us your focus area and get a customized research report.

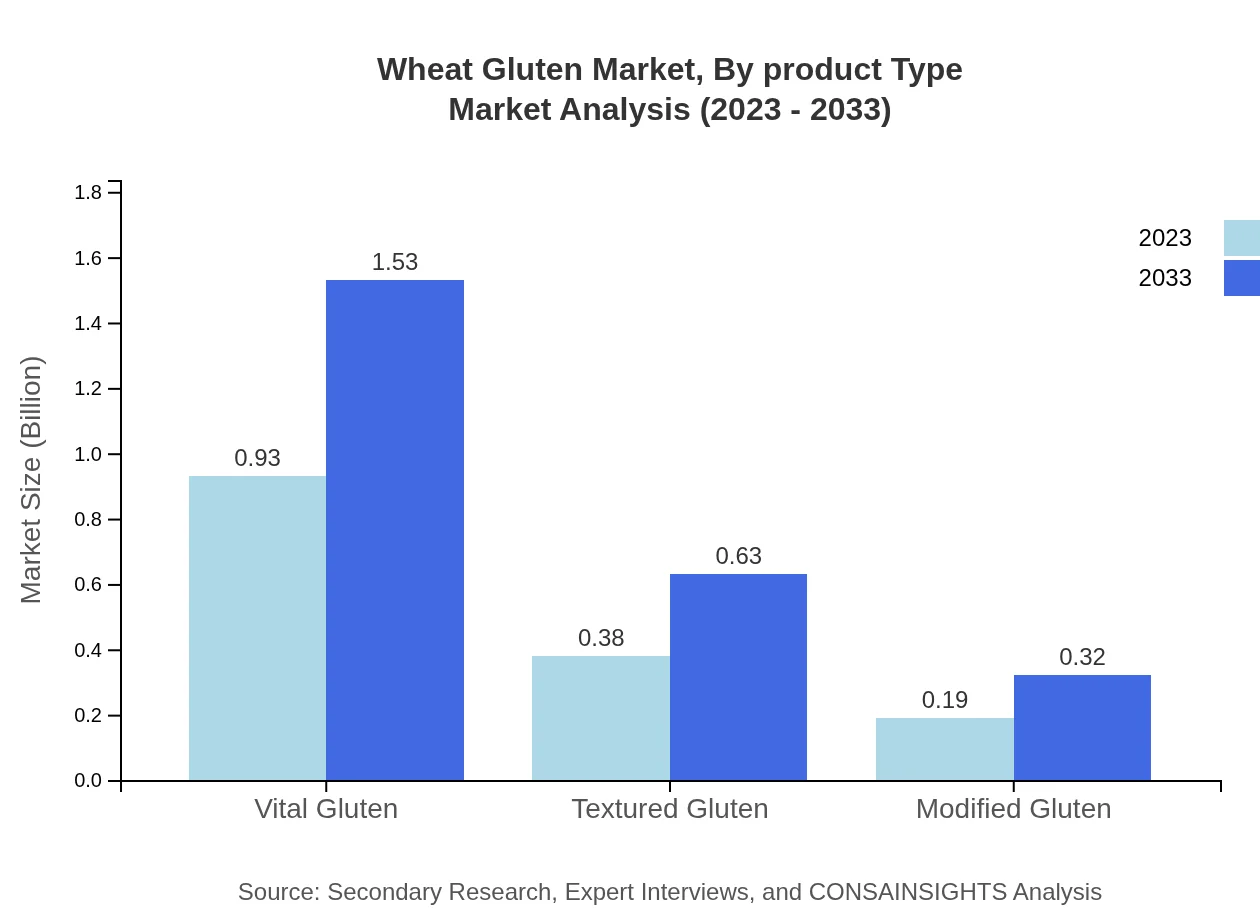

Wheat Gluten Market Analysis By Product Type

The Wheat Gluten market is divided into various product types, such as vital gluten, modified gluten, and textured gluten. Vital gluten holds a dominant share due to its high protein content, making it popular among food manufacturers. Estimated market size for vital gluten is USD 0.93 billion in 2023, expected to grow to USD 1.53 billion by 2033. Modified gluten and textured gluten, while smaller segments, are seeing increased demand owing to their specific functional properties in food formulations.

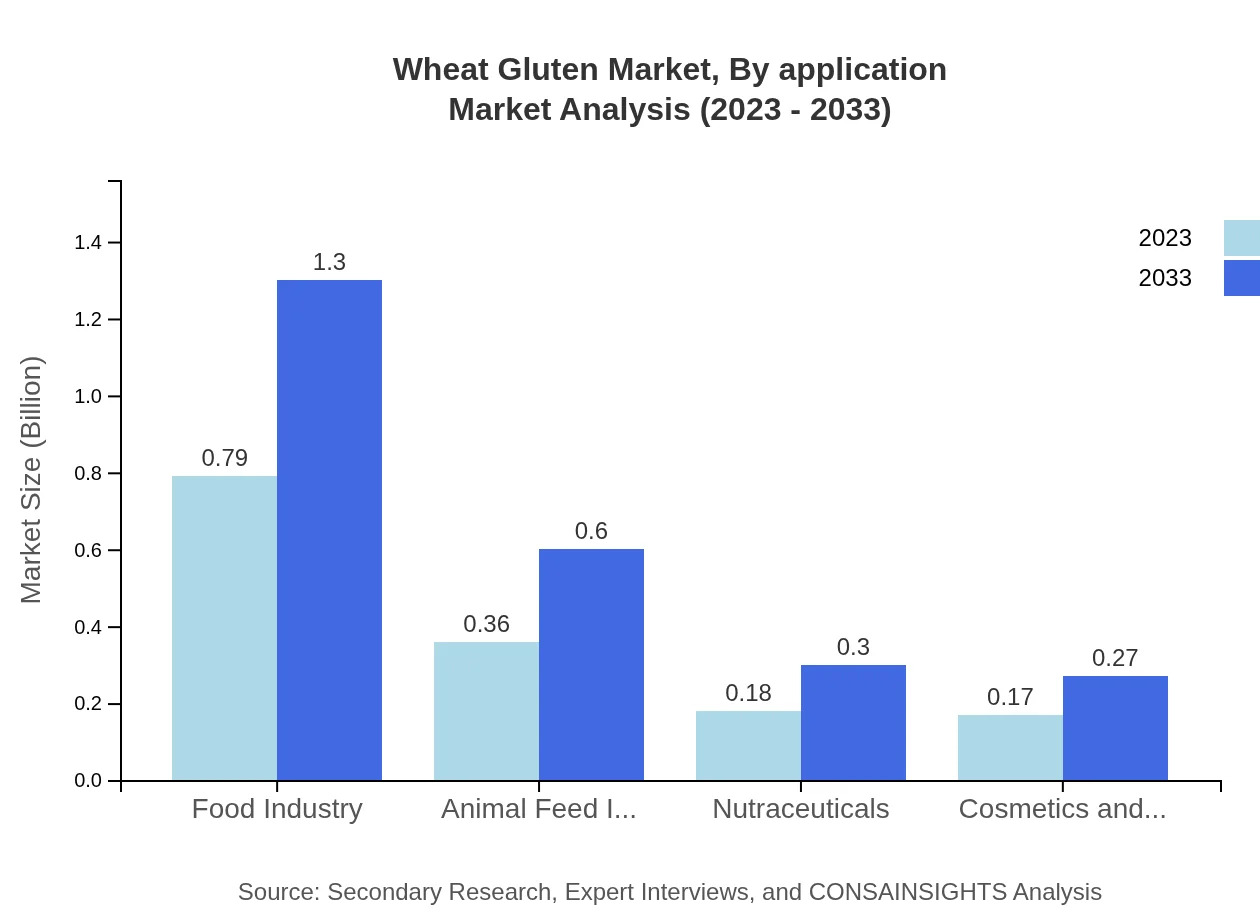

Wheat Gluten Market Analysis By Application

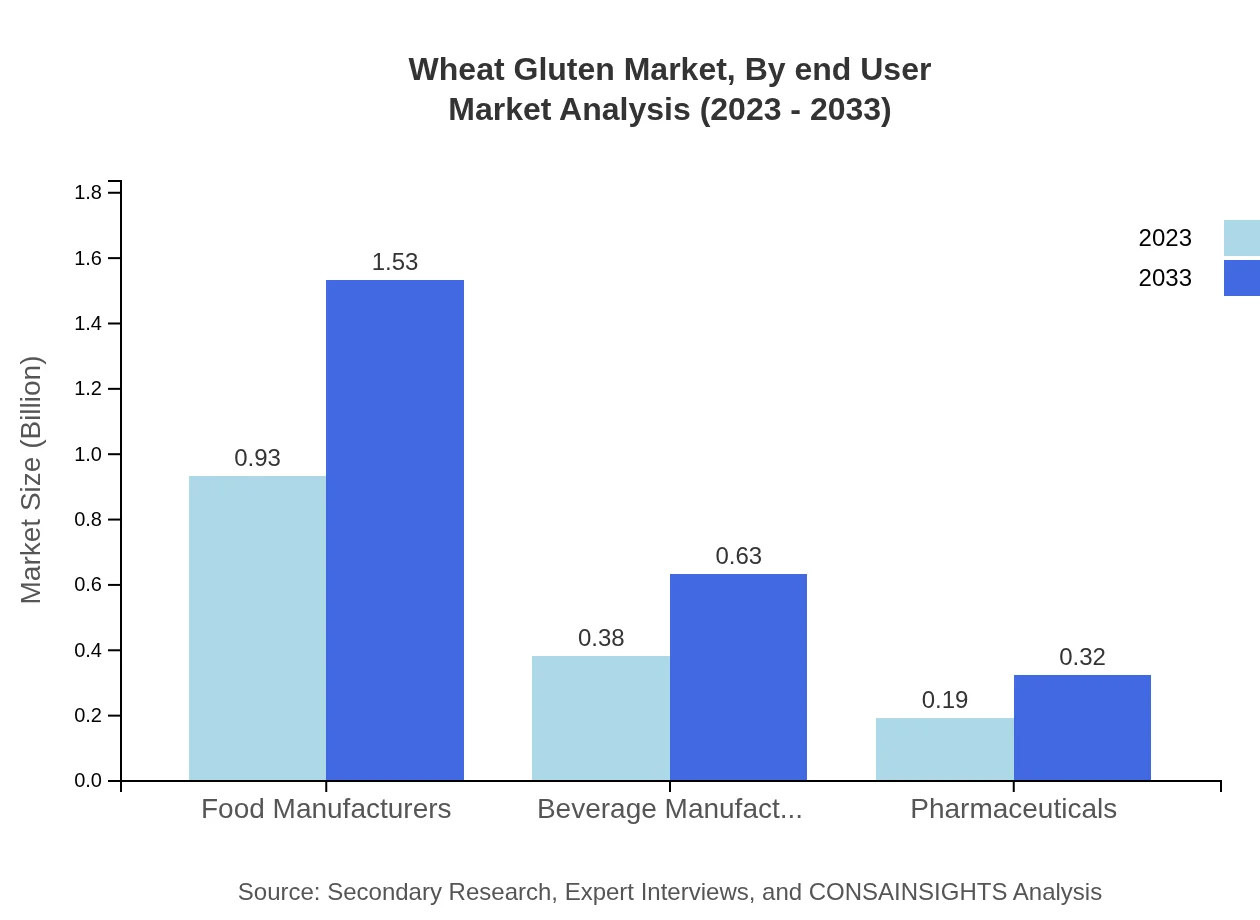

In terms of application, food manufacturers lead the market with a size of USD 0.93 billion in 2023, projected to enhance to USD 1.53 billion by 2033. Beverage manufacturers also contribute significantly, with an expected increase from USD 0.38 billion to USD 0.63 billion over the same period. Other applications include pharmaceuticals, which are seeing gradual growth as gluten components find their way into formulations.

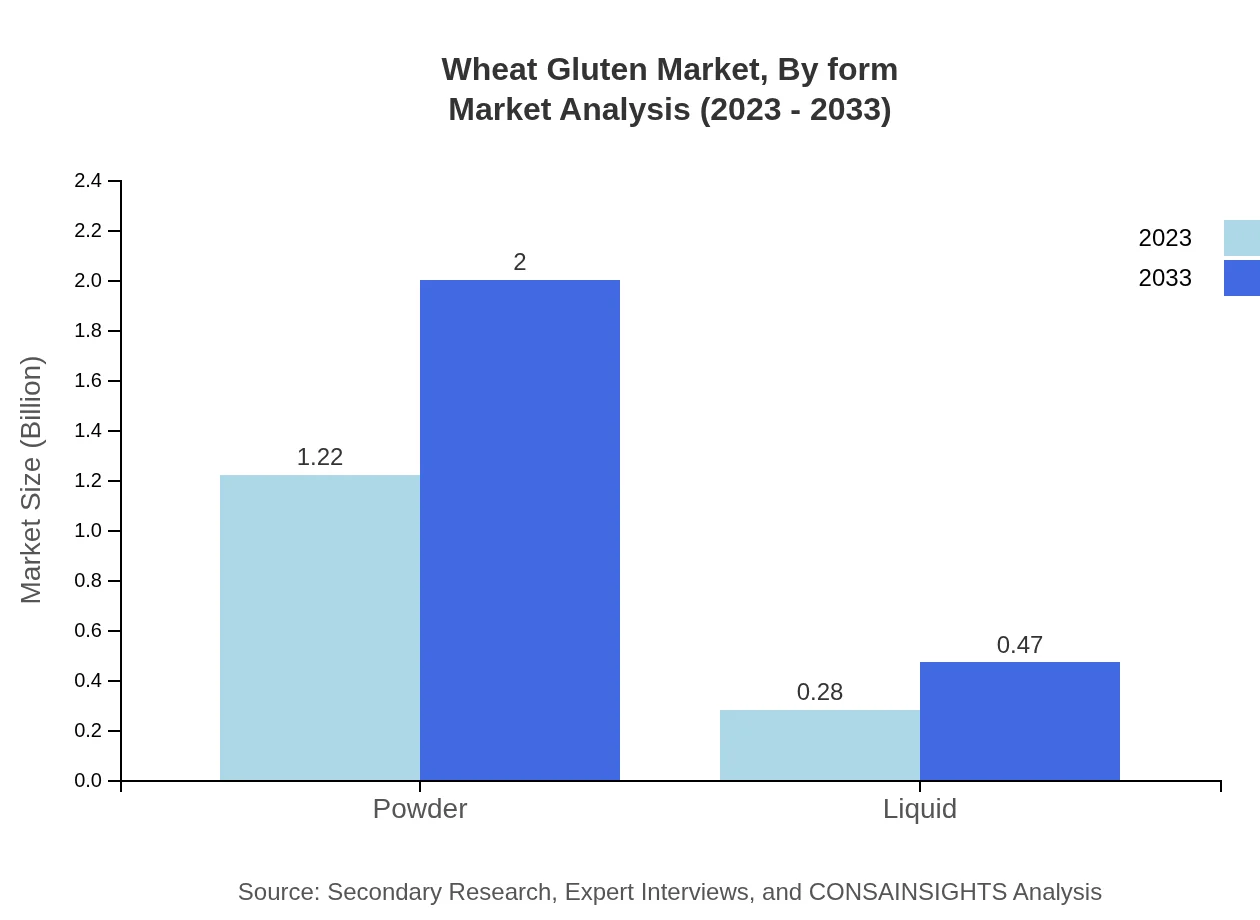

Wheat Gluten Market Analysis By Form

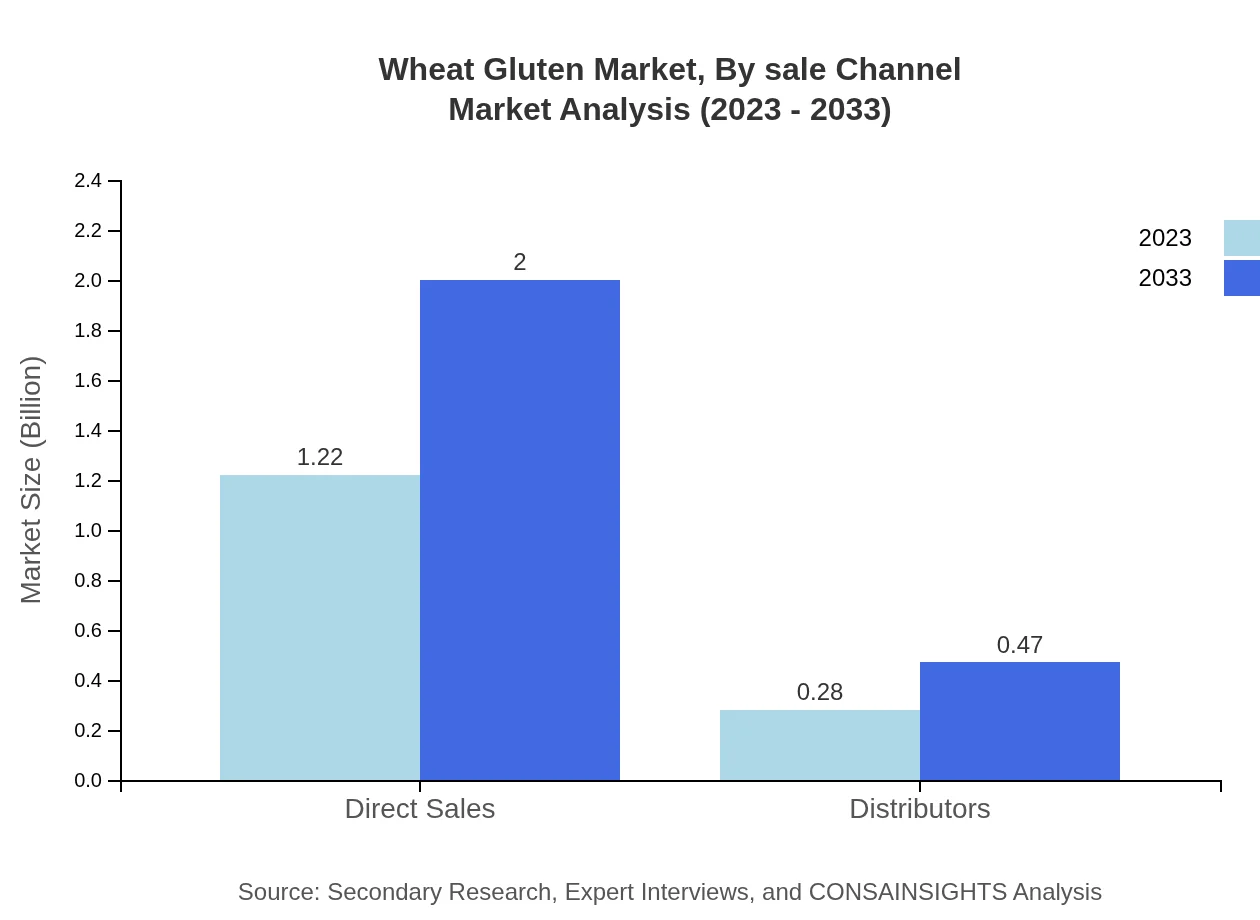

The Wheat Gluten market is segmented into powder and liquid forms. Powdered wheat gluten dominates the market, starting at USD 1.22 billion in 2023 and projected to reach USD 2.00 billion by 2033, accounting for 81.15% of the market share. Liquid wheat gluten has a smaller size, with expectations to grow from USD 0.28 billion to USD 0.47 billion, capturing an 18.85% share in 2023.

Wheat Gluten Market Analysis By End User

The primary end-users of wheat gluten include the food and beverage sector, pharmaceuticals, and nutraceuticals. The food industry alone represents a substantial segment, with an initial market size of USD 0.79 billion in 2023 expected to reach USD 1.30 billion by 2033, driven by the growing health-oriented trends among consumers. The nutraceuticals sector is also emerging, highlighting the increasing intersection of health and diet.

Wheat Gluten Market Analysis By Sale Channel

The sales channel for wheat gluten includes direct sales and distributors. Direct sales dominate the landscape with a significant share of 81.15% in 2023, starting at USD 1.22 billion and anticipated to reach USD 2.00 billion by 2033. Distributors account for a smaller portion, estimated to grow from USD 0.28 billion to USD 0.47 billion during the same timeframe.

Wheat Gluten Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Wheat Gluten Industry

Triton Ingredients:

Triton is a leading supplier of high-quality wheat gluten, recognized for its commitment to sustainable sourcing and innovative product development in the food and beverage industries.Cargill, Inc.:

Cargill is a major player in the global agricultural sector, providing a variety of food products including wheat gluten, which it manufactures for diverse applications from baking to animal nutrition.MGP Ingredients, Inc.:

MGP Ingredients is a specialized company producing high-quality wheat gluten for the food industry, emphasizing flavor, texture, and enhanced nutritional profiles in its product lineup.Archer Daniels Midland Company (ADM):

ADM is a global leader in the agriculture sector, known for its vast range of products including wheat gluten, which is pivotal for health-conscious consumers across multiple food applications.We're grateful to work with incredible clients.

FAQs

What is the market size of wheat Gluten?

The global wheat gluten market is valued at approximately $1.5 billion in 2023, with a compound annual growth rate (CAGR) of 5% projected through 2033, indicating sustained growth in demand.

What are the key market players or companies in the wheat Gluten industry?

Key market players include leading food ingredient companies and gluten producers such as Archer Daniels Midland Company, or ADM, and DuPont. These companies significantly impact wheat gluten supply and distribution, shaping market trends.

What are the primary factors driving the growth in the wheat Gluten industry?

Key drivers of growth in the wheat gluten industry include increasing demand for gluten-based food products, rising health consciousness among consumers, and a surge in applications across the food and beverage sectors.

Which region is the fastest Growing in the wheat Gluten market?

The Asia-Pacific region is poised to be the fastest-growing market for wheat gluten, expected to increase from $0.33 billion in 2023 to $0.54 billion by 2033, driven by rising population and urbanization.

Does ConsaInsights provide customized market report data for the wheat Gluten industry?

Yes, ConsaInsights offers customized market reports for the wheat gluten industry, tailored to specific business needs, helping clients stay informed about market insights and trends.

What deliverables can I expect from this wheat Gluten market research project?

From the wheat gluten market research project, deliverables include detailed market analysis, segment insights, regional forecasts, and competitive landscape assessments, alongside actionable recommendations.

What are the market trends of wheat Gluten?

Current trends in the wheat gluten market reflect a focus on health benefits, increased production of gluten-free products, and the growing utilization of wheat gluten in non-food industries like cosmetics and nutraceuticals.