Wheat Protein Market Report

Published Date: 31 January 2026 | Report Code: wheat-protein

Wheat Protein Market Size, Share, Industry Trends and Forecast to 2033

This report examines the Wheat Protein market dynamics from 2023 to 2033, providing insights on market size, growth trends, segmentation, regional analysis, and key industry players.

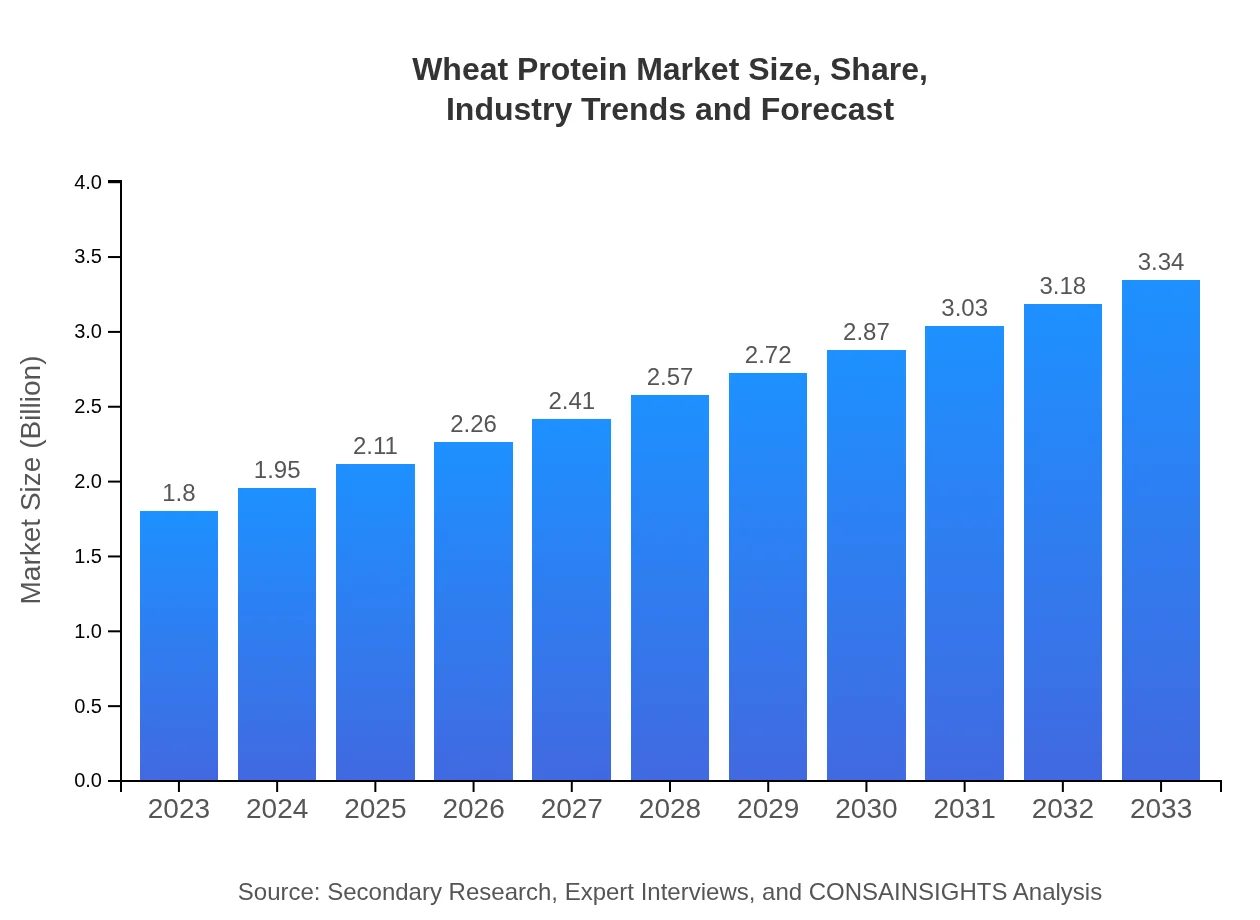

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $3.34 Billion |

| Top Companies | Cargill, Inc., Tereos, ADM, Roquette Frères |

| Last Modified Date | 31 January 2026 |

Wheat Protein Market Overview

Customize Wheat Protein Market Report market research report

- ✔ Get in-depth analysis of Wheat Protein market size, growth, and forecasts.

- ✔ Understand Wheat Protein's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Wheat Protein

What is the Market Size & CAGR of the Wheat Protein market in 2023?

Wheat Protein Industry Analysis

Wheat Protein Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Wheat Protein Market Analysis Report by Region

Europe Wheat Protein Market Report:

Europe’s market for Wheat Protein was valued at 0.53 in 2023 and is expected to grow to 0.99 by 2033. The shift towards healthier eating habits, alongside robust regulations supporting plant-based food sources, bolsters market growth.Asia Pacific Wheat Protein Market Report:

In the Asia Pacific region, the market was valued at 0.34 in 2023, expected to reach 0.63 by 2033. Growing health awareness and increased demand for plant-based proteins drive expansion, with countries like China and India at the forefront of this developmental trend.North America Wheat Protein Market Report:

North America represents a significant market, with a value of 0.69 in 2023 projected to double to 1.28 by 2033. The U.S. dominates this region due to increased consumption of health supplements and a prevalent vegan lifestyle. The research and development efforts aimed at product innovation are also key growth drivers here.South America Wheat Protein Market Report:

In South America, the market for Wheat Protein stood at 0.09 in 2023 and is forecasted to grow to 0.17 by 2033. The rising trends of healthy eating and plant-based diets are encouraging the industry's growth pace.Middle East & Africa Wheat Protein Market Report:

The Middle East and Africa market is relatively modest, standing at 0.15 in 2023 with a growth projection to 0.27 by 2033. An increasing preference for meat alternatives in urban areas drives the demand for wheat protein products.Tell us your focus area and get a customized research report.

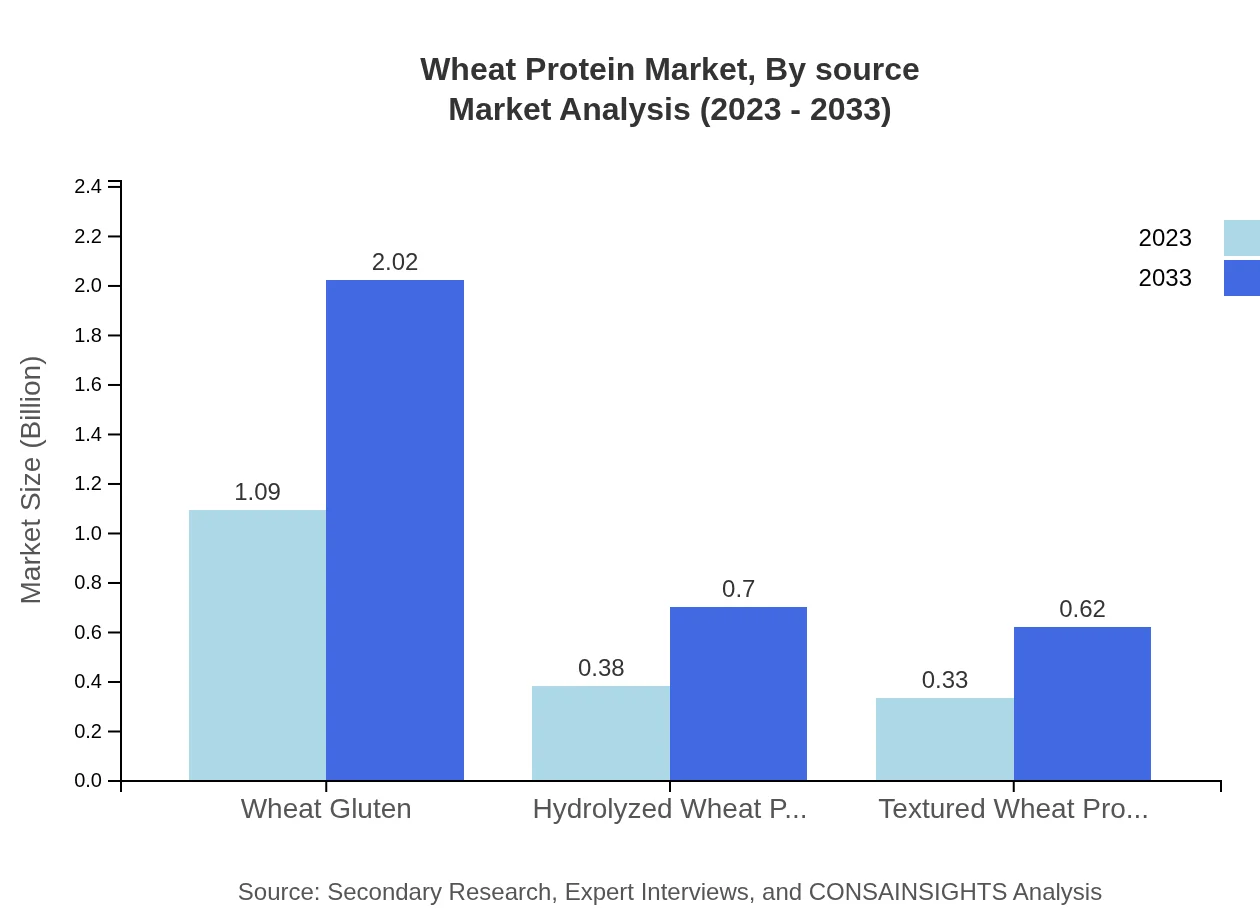

Wheat Protein Market Analysis By Source

The Wheat Protein market is dominated by powdered forms, holding a significant size of 1.09 in 2023 and expected to reach 2.02 by 2033. This segment's popularity stems from its versatility in baking and cooking. Liquid wheat protein follows, with a size of 0.38 in 2023 projected to grow to 0.70 by 2033. Solid forms represent a smaller segment with significant potential, expected to grow from 0.33 in 2023 to 0.62 by 2033.

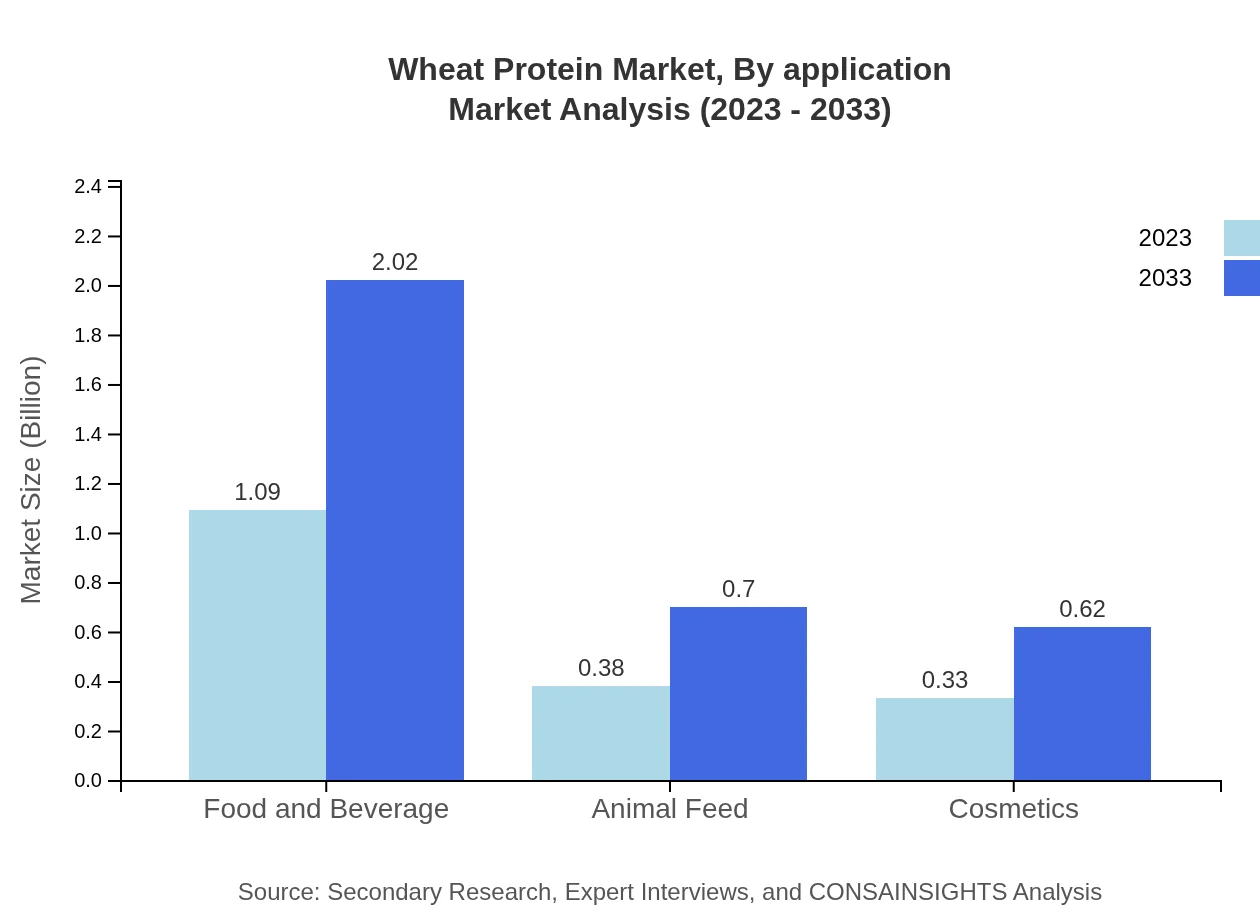

Wheat Protein Market Analysis By Application

In terms of application, the food and beverage industry leads with a size of 1.09 in 2023, projected to expand to 2.02 by 2033, driven by rising demand for protein-rich diets. Animal feed follows, sitting at 0.38 in 2023 with projections to reach 0.70 by 2033. The cosmetics industry, although smaller, will also see growth, from 0.33 to 0.62 in the same period.

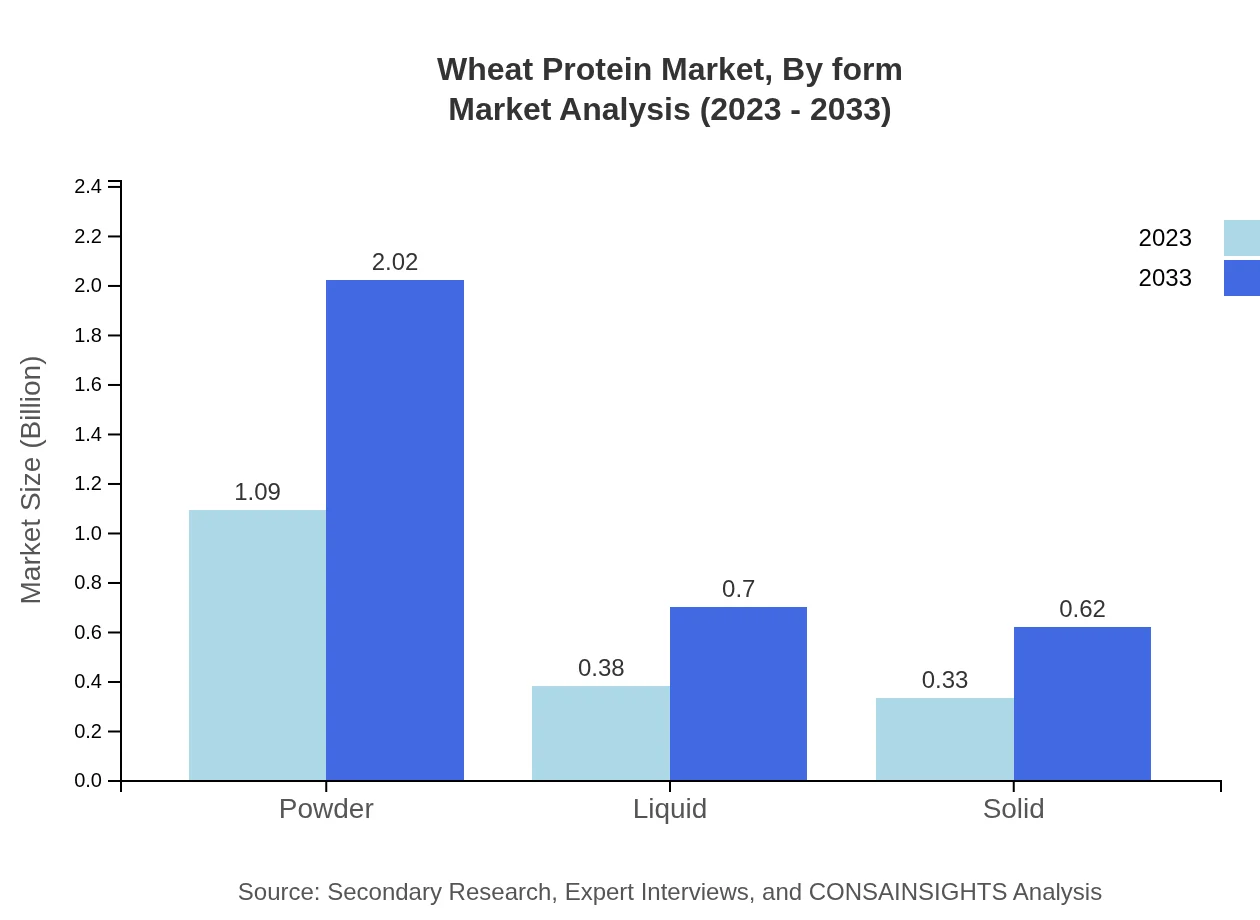

Wheat Protein Market Analysis By Form

Powdered wheat protein dominates the market with a substantial share, featuring a size of 1.09 in 2023 and estimated to reach 2.02 by 2033. Liquid and solid forms also show market viability, particularly in specialized products and unique applications within food formulations.

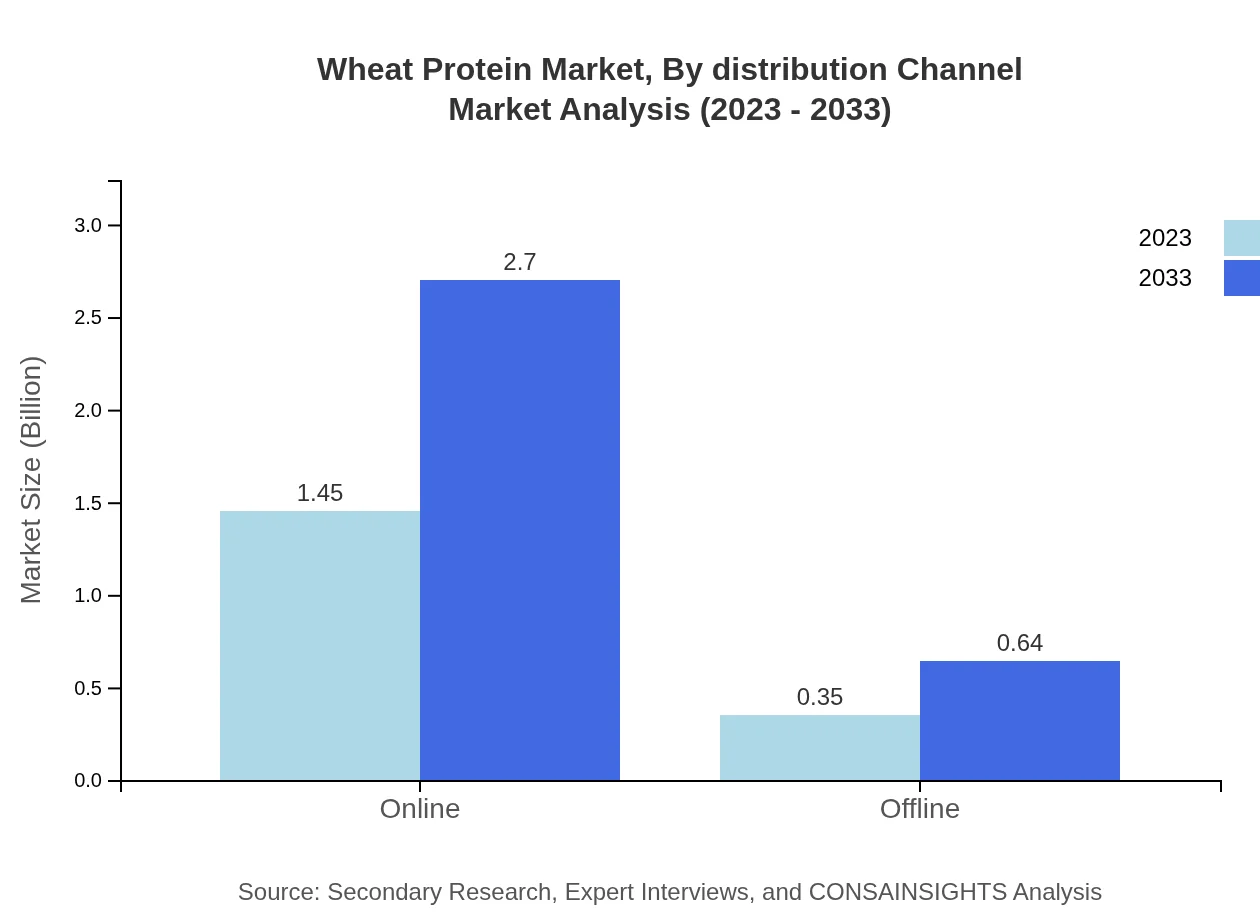

Wheat Protein Market Analysis By Distribution Channel

The online distribution channel is currently leading, with a size of 1.45 in 2023 expected to grow to 2.70 in 2033, highlighting the significant shift to e-commerce for purchasing wheat protein products. Offline sales remain vital, with projections of growth from 0.35 in 2023 to 0.64 by 2033, reflecting continued consumer engagement in physical retail outlets.

Wheat Protein Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Wheat Protein Industry

Cargill, Inc.:

Cargill is a global leader in agricultural products, providing a comprehensive range of wheat-based proteins suitable for various applications, particularly in food and beverages.Tereos:

Tereos is a dominant player in the wheat protein market, recognized for its innovative products and solutions aimed at enhancing nutritional profiles in meat alternatives.ADM:

Archer Daniels Midland Company (ADM) is known for its expansive portfolio in plant-based ingredients, including vital contributions to the wheat protein segment.Roquette Frères:

Roquette is renowned for its focus on innovative plant-based ingredients, including wheat proteins, serving food industries with a strong emphasis on nutrition and health.We're grateful to work with incredible clients.

FAQs

What is the market size of wheat Protein?

The wheat protein market is valued at approximately $1.8 billion in 2023, with a compound annual growth rate (CAGR) of 6.2% expected through 2033. This growth indicates increasing demand across several sectors including food, beverages, and animal feed.

What are the key market players or companies in the wheat protein industry?

Key players in the wheat protein industry include prominent manufacturers and distributors focusing on product innovation and supply chain efficiency, ensuring quality wheat protein products meet diverse customer demands in food, nutrition, and personal care segments.

What are the primary factors driving the growth in the wheat protein industry?

Factors driving growth include rising health consciousness among consumers, increased demand for plant-based proteins, and the expanding application of wheat protein in food and beverage products, animal feed, and cosmetics, enhancing overall industry dynamics.

Which region is the fastest Growing in the wheat protein market?

North America is the fastest-growing region in the wheat protein market, anticipated to grow from $0.69 billion in 2023 to $1.28 billion by 2033. Europe and Asia Pacific also show significant growth, driven by rising health trends.

Does ConsaInsights provide customized market report data for the wheat protein industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the wheat protein industry. This includes in-depth analysis based on regional insights, segment breakdowns, and trend forecasts for stakeholders.

What deliverables can I expect from this wheat protein market research project?

Deliverables include comprehensive market analysis reports, segment-wise breakdown, regional insights, competitive landscape assessment, and future forecasts, equipping businesses with essential data to make informed decisions in the wheat protein market.

What are the market trends of wheat protein?

Current market trends in wheat protein include the rising preference for plant-based diets, advancements in extraction technologies, and increasing product launches focusing on organic and clean-label products, indicating a shift towards health and sustainability.