Whipping Cream Market Report

Published Date: 31 January 2026 | Report Code: whipping-cream

Whipping Cream Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Whipping Cream market from 2023 to 2033, encompassing market size, trends, regional insights, and key players in the industry. It delivers essential insights and data crucial for stakeholders seeking to understand market dynamics and forecast developments.

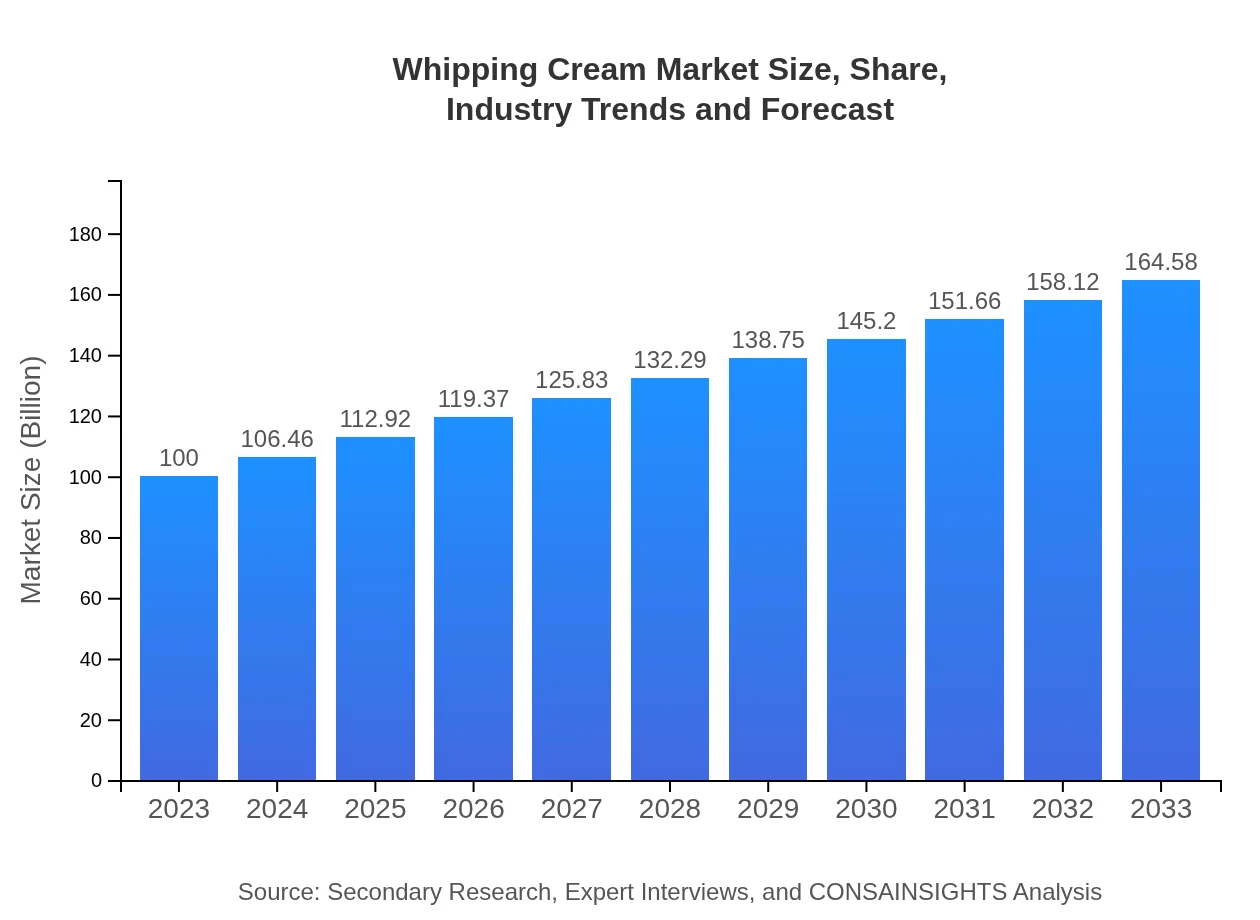

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Whipping Cream Co., Dairy Delights Inc., Creamy Whips Ltd., DairyPure, AlpenDairy |

| Last Modified Date | 31 January 2026 |

Whipping Cream Market Overview

Customize Whipping Cream Market Report market research report

- ✔ Get in-depth analysis of Whipping Cream market size, growth, and forecasts.

- ✔ Understand Whipping Cream's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Whipping Cream

What is the Market Size & CAGR of Whipping Cream market in 2023?

Whipping Cream Industry Analysis

Whipping Cream Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Whipping Cream Market Analysis Report by Region

Europe Whipping Cream Market Report:

Europe's market is projected to grow from $32.24 billion in 2023 to $53.06 billion by 2033, bolstered by a mature dairy industry, strong consumer preference for premium and organic products, and a growing trend focused on healthy living and gourmet cooking.Asia Pacific Whipping Cream Market Report:

The Asia Pacific region is expected to see substantial growth, with the market projected to rise from $19.74 billion in 2023 to $32.49 billion by 2033, driven by rising urbanization and changing dietary habits, particularly in countries like China and India, where Western foods are increasingly popular.North America Whipping Cream Market Report:

North America remains a dominant player in the market, with size estimates increasing from $32.85 billion in 2023 to $54.06 billion in 2033. This surge is attributed to the established presence of key manufacturers, high consumption rates of dairy products, and a strong culture of culinary experimentation.South America Whipping Cream Market Report:

In South America, the Whipping Cream market is anticipated to grow from $4.39 billion in 2023 to $7.22 billion by 2033. The growth is supported by the increasing consumption of dairy products and a burgeoning food service sector. Cultural adoption of cakes and desserts enhances market prospects.Middle East & Africa Whipping Cream Market Report:

The Middle East and Africa region is expected to see market growth from $10.78 billion in 2023 to $17.74 billion by 2033. This region benefits from an expanding urban population and a rising demand for Western-style cuisine, enhancing the utilization of whipping cream in various culinary applications.Tell us your focus area and get a customized research report.

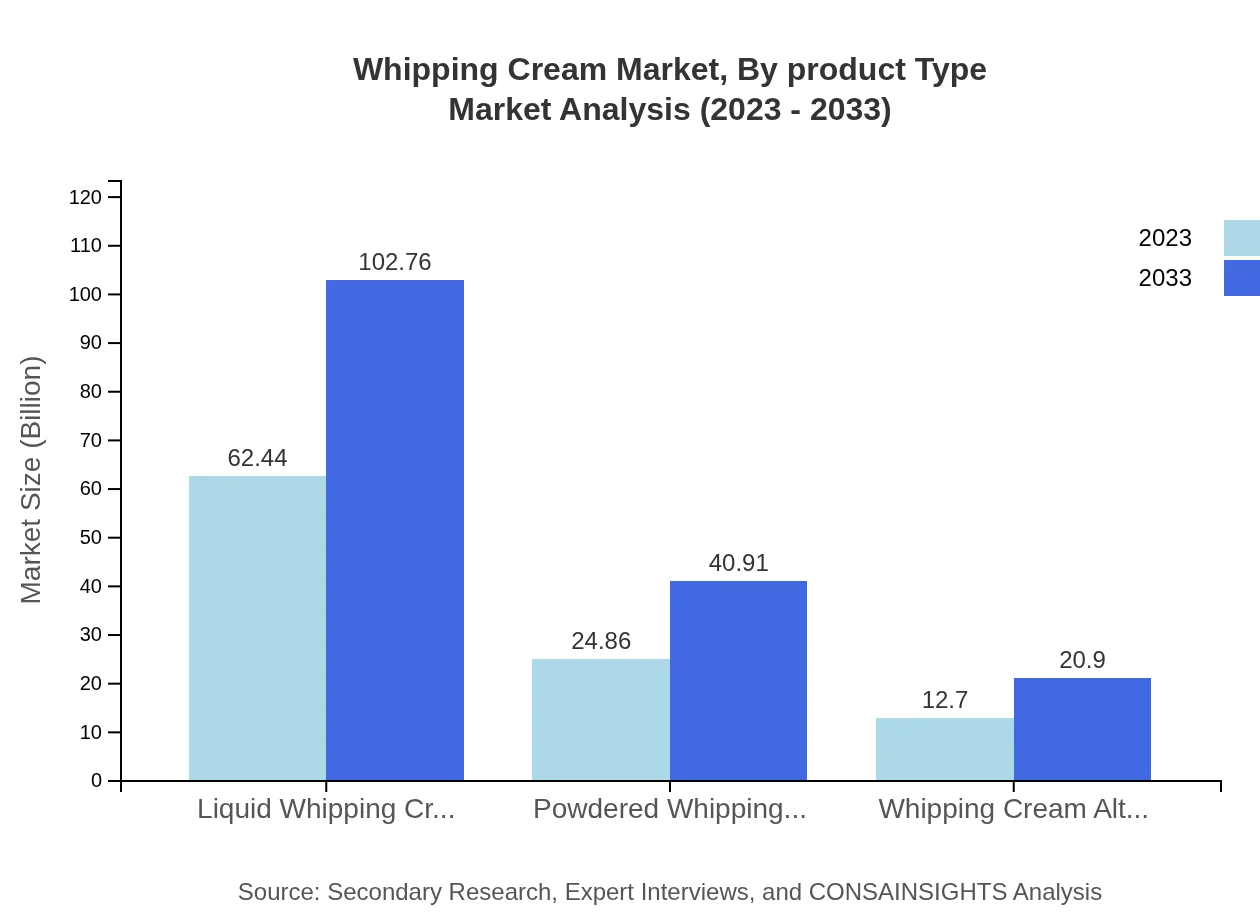

Whipping Cream Market Analysis By Product Type

The Whipping Cream market, segmented by product type, showcases liquid whipping cream dominating the landscape, valued at $62.44 billion in 2023 with projections hitting $102.76 billion by 2033. Powdered options and alternatives, while smaller, are witnessing increased demand due to trends in health consciousness and convenience.

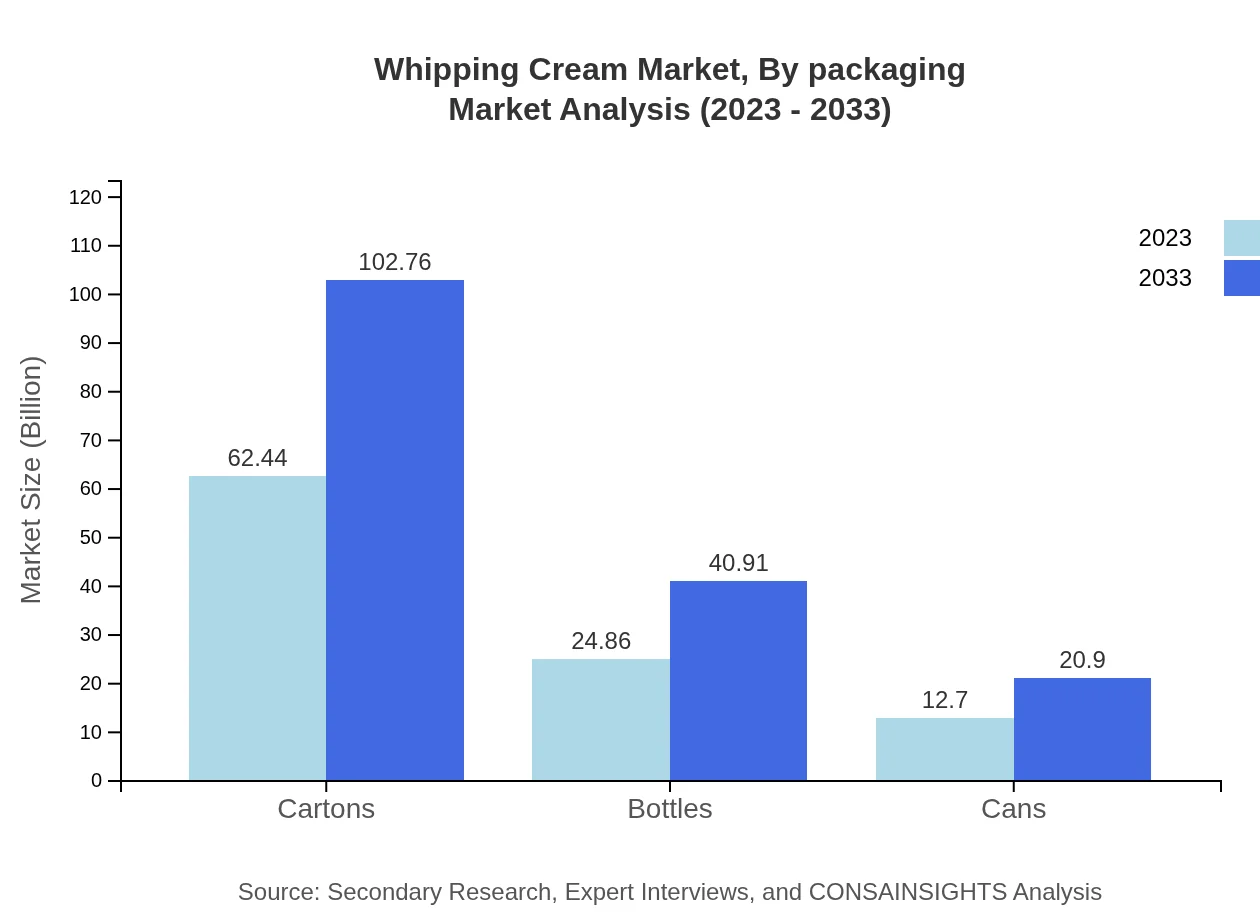

Whipping Cream Market Analysis By Packaging

Packaging plays a crucial role, with cartons leading at $62.44 billion in size for 2023, expected to grow along with consumer preference for sustainability. Bottles and cans also contribute significantly, as convenience and shelf life become paramount considerations.

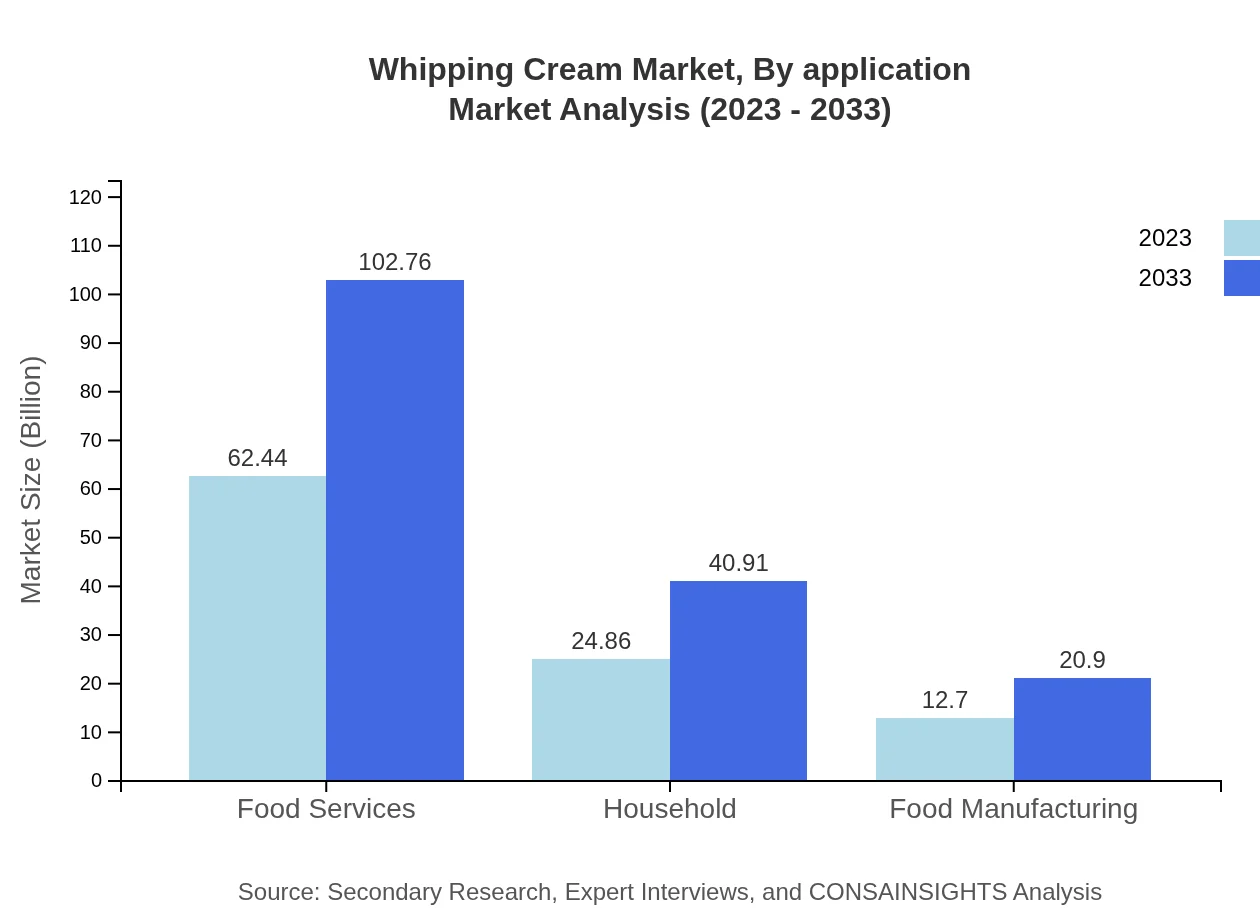

Whipping Cream Market Analysis By Application

Applications in food services, retail, and households reflect changing consumer behaviors. Food services hold the largest share due to the booming restaurant industry and café culture, while retail shows continuous growth, backed by consumer purchasing shifts toward quality and convenience products.

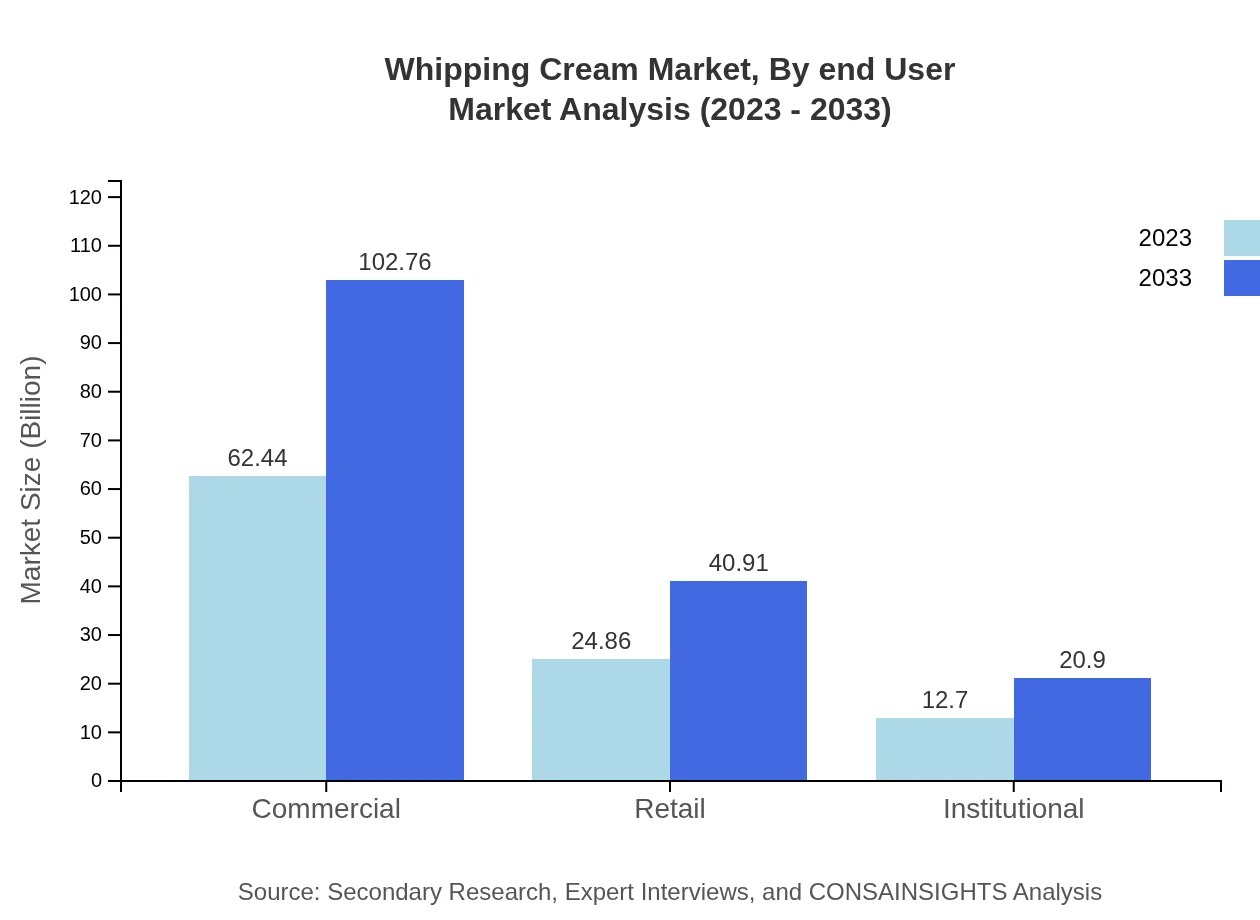

Whipping Cream Market Analysis By End User

End-users of whipping cream predominantly include commercial establishments, households, and food manufacturers. The market size for commercial use was $62.44 billion in 2023, expected to grow significantly due to increased cake and dessert consumption in restaurants and catering services.

Whipping Cream Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Whipping Cream Industry

Whipping Cream Co.:

A leading producer specializing in high-quality whipping cream, catering to both retail and food service sectors.Dairy Delights Inc.:

Known for innovative dairy products, they have expanded their line to include organic and flavored whipping creams.Creamy Whips Ltd.:

Focused on sustainability, this company is a supplier of both traditional and non-dairy whipping cream alternatives.DairyPure:

A prominent player in the North American market, offering a wide range of dairy products including premium whipping cream.AlpenDairy:

An European firm recognized for its quality dairy products, AlpenDairy has established itself in the whipping cream segment.We're grateful to work with incredible clients.

FAQs

What is the market size of whipping cream?

The global whipping cream market is valued at approximately $100 million in 2023, with a projected CAGR of 5% from 2023 to 2033. This growth is indicative of a strong consumer demand and expansion in culinary applications.

What are the key market players or companies in the whipping cream industry?

Key players in the whipping cream industry include renowned dairy manufacturers and food service suppliers. These companies typically focus on quality, innovation, and distribution, ensuring product availability for both commercial and retail segments.

What are the primary factors driving the growth in the whipping cream industry?

Growth in the whipping cream market is primarily driven by increased consumer interest in baking and cooking, the expansion of the food service industry, and innovations in product formulations that cater to health-conscious consumers.

Which region is the fastest Growing in the whipping cream market?

The fastest-growing region in the whipping cream market is projected to be Europe, rising from $32.24 million in 2023 to $53.06 million by 2033. Asia Pacific follows closely, demonstrating significant growth potential in the coming years.

Does ConsInsights provide customized market report data for the whipping cream industry?

Yes, ConsInsights offers customized market report data tailored to specific needs in the whipping cream industry. This includes in-depth analysis on market trends, consumer preferences, and regional insights.

What deliverables can I expect from this whipping cream market research project?

Deliverables typically include a comprehensive report with market size details, growth forecasts, competitive landscape analysis, and segmented data covering various aspects such as distribution channels and consumer demographics.

What are the market trends of whipping cream?

Notable trends in the whipping cream market include increasing demand for plant-based and alternative whipping creams, rising health awareness leading to low-fat options, and innovation in packaging that enhances convenience for consumers.