Whiskey Market Report

Published Date: 31 January 2026 | Report Code: whiskey

Whiskey Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the global Whiskey market, including market trends, size estimates, and forecasts from 2023 to 2033. Key insights into different segments, regional performance, and major players are highlighted to guide stakeholders in making informed decisions.

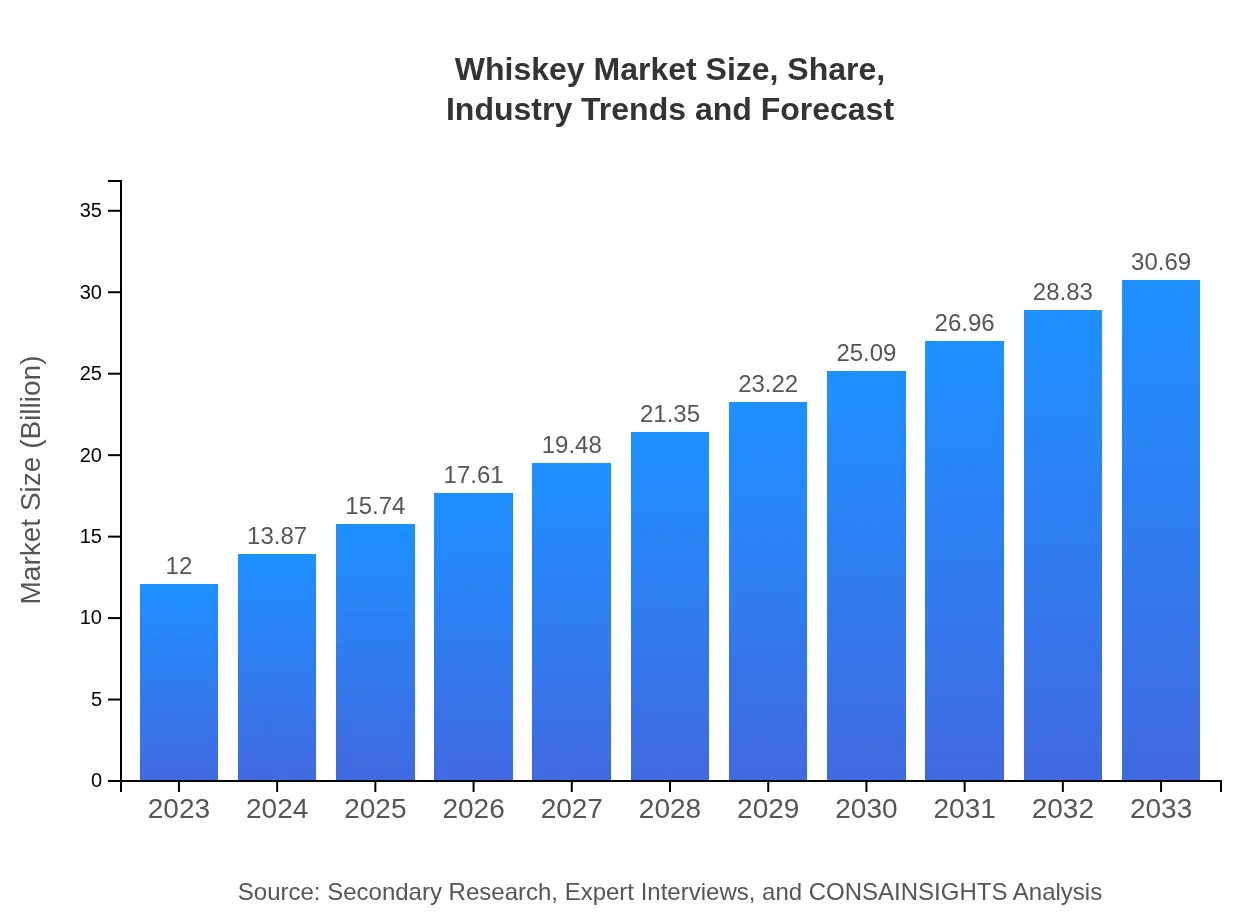

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.00 Billion |

| CAGR (2023-2033) | 9.5% |

| 2033 Market Size | $30.69 Billion |

| Top Companies | Diageo, Brown-Forman, Pernod Ricard, William Grant & Sons, Suntory Holdings |

| Last Modified Date | 31 January 2026 |

Whiskey Market Overview

Customize Whiskey Market Report market research report

- ✔ Get in-depth analysis of Whiskey market size, growth, and forecasts.

- ✔ Understand Whiskey's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Whiskey

What is the Market Size & CAGR of the Whiskey market in 2023?

Whiskey Industry Analysis

Whiskey Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Whiskey Market Analysis Report by Region

Europe Whiskey Market Report:

Europe, a historical hub for Whiskey production, reported a market size of $3.52 billion in 2023, expected to reach $9.01 billion by 2033. The diverse range of local brands, along with a growing interest in whiskey tourism, significantly contributes to the region's market expansion.Asia Pacific Whiskey Market Report:

In the Asia Pacific region, the Whiskey market was valued at $2.15 billion in 2023, with projections of reaching $5.49 billion by 2033. The rise of middle-class consumers and their increasing disposable income are fueling the demand for premium whiskey products. Additionally, countries like Japan and India are notable for their whiskey production and consumption, contributing significantly to market growth.North America Whiskey Market Report:

North America remains a dominant market for Whiskey, valued at $4.68 billion in 2023, projected to rise to $11.96 billion by 2033. The U.S., being the largest consumer of bourbon, and an increasing trend toward craft whiskey distillation, are key drivers of growth within this region.South America Whiskey Market Report:

The South American Whiskey market, valued at $0.58 billion in 2023, is anticipated to grow to $1.48 billion by 2033. The growing trend of whiskey consumption among millennials, facilitated by international marketing and local adaptations of popular whiskey styles, is set to boost the market in this region.Middle East & Africa Whiskey Market Report:

In the Middle East and Africa, the market is currently valued at $1.08 billion in 2023, projected to grow to $2.75 billion by 2033. Increased urbanization, coupled with evolving consumer preferences towards Western spirits, is anticipated to drive the demand for whiskey in this region.Tell us your focus area and get a customized research report.

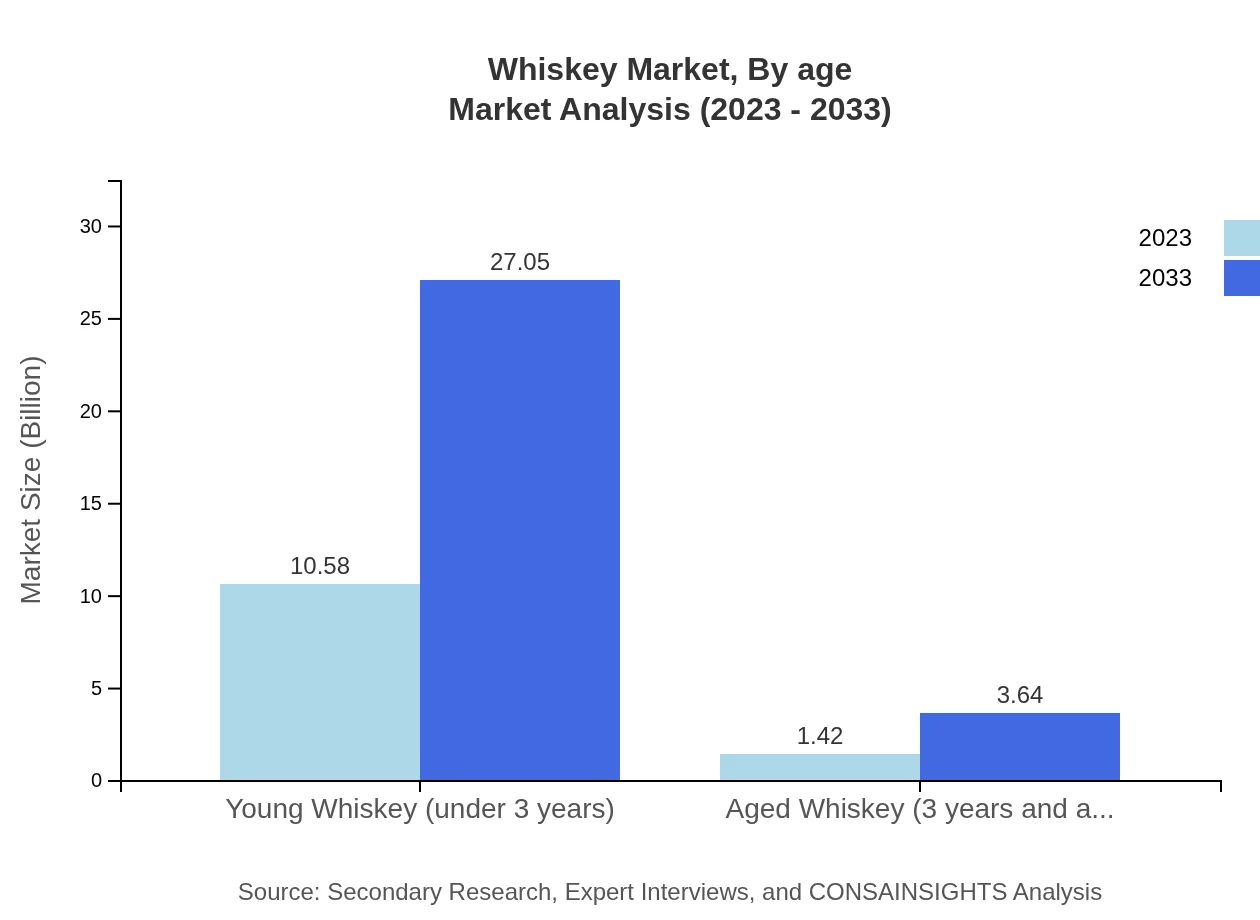

Whiskey Market Analysis By Age

The Whiskey market is significantly influenced by age segmentation. Young Whiskey (under 3 years) is expected to dominate with a market value of $10.58 billion in 2023, increasing to $27.05 billion by 2033, holding 88.13% market share. Aged Whiskey (3 years and above) presents a smaller segment with a market size of $1.42 billion in 2023, likely to grow to $3.64 billion by 2033, capturing 11.87% of the market share.

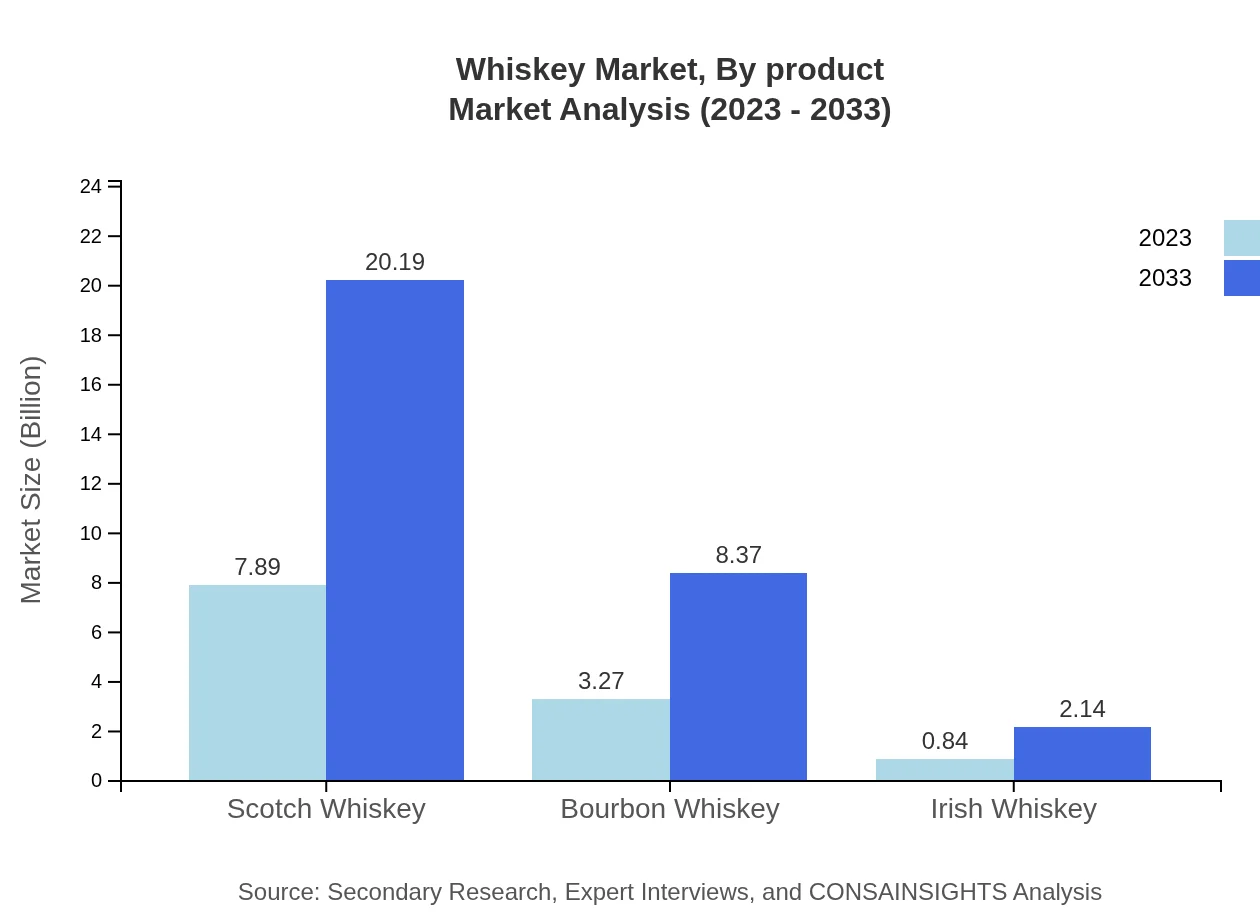

Whiskey Market Analysis By Product

In terms of product types, Scotch Whiskey is projected to lead with a market value of $7.89 billion in 2023 and expected to increase to $20.19 billion by 2033, comprising 65.77% market share. Bourbon Whiskey follows, with a market of $3.27 billion in 2023 anticipated to grow to $8.37 billion by 2033, capturing 27.27% share. Irish Whiskey, while smaller, is expected to grow from $0.84 billion to $2.14 billion, representing a share of 6.96% over the decade.

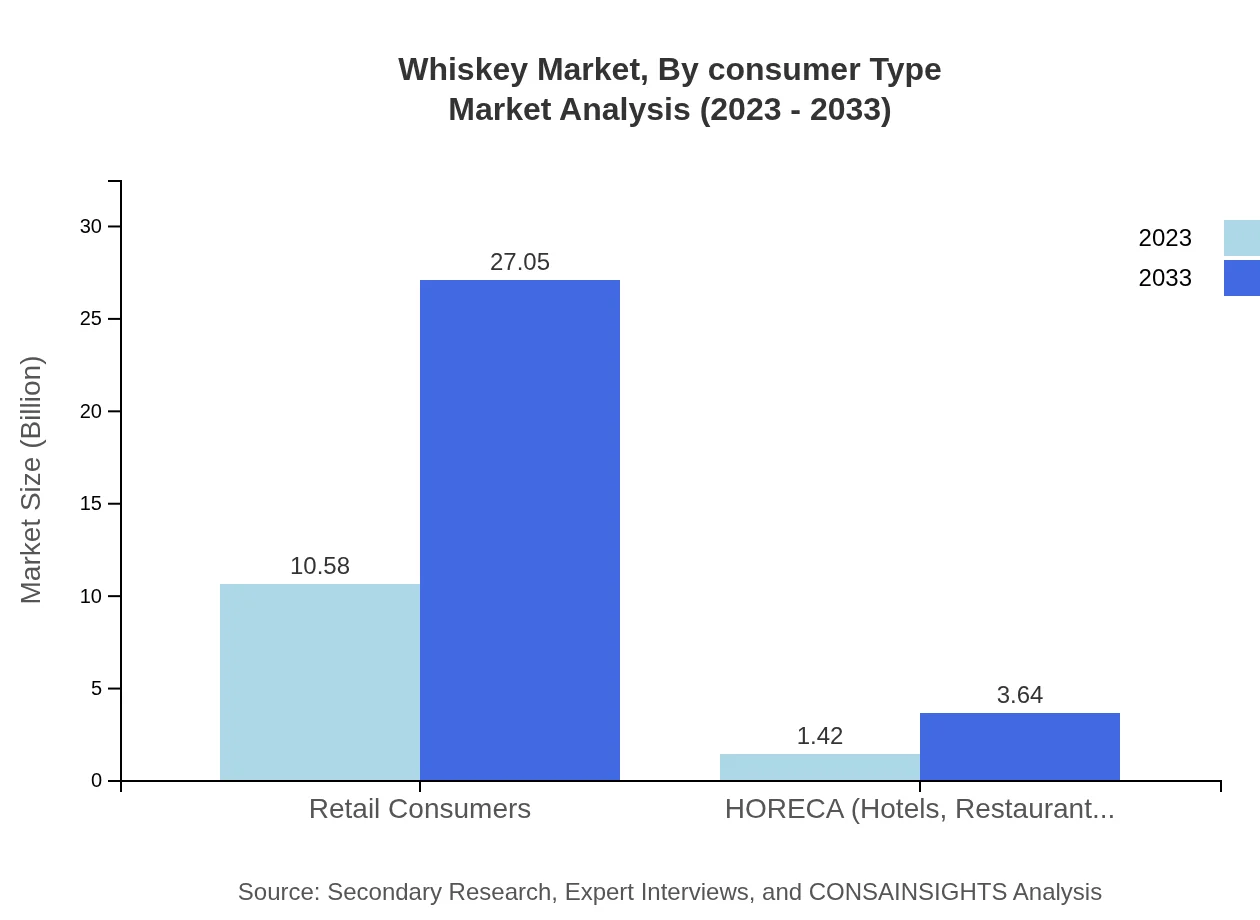

Whiskey Market Analysis By Consumer Type

The Whiskey market is heavily influenced by consumer type segments. Retail consumers currently constitute a considerable share, valued at $10.58 billion in 2023 and growing to $27.05 billion by 2033, holding an 88.13% market share. Conversely, the HORECA sector is valued at $1.42 billion in 2023, expected to reach $3.64 billion by 2033, covering 11.87% of the market.

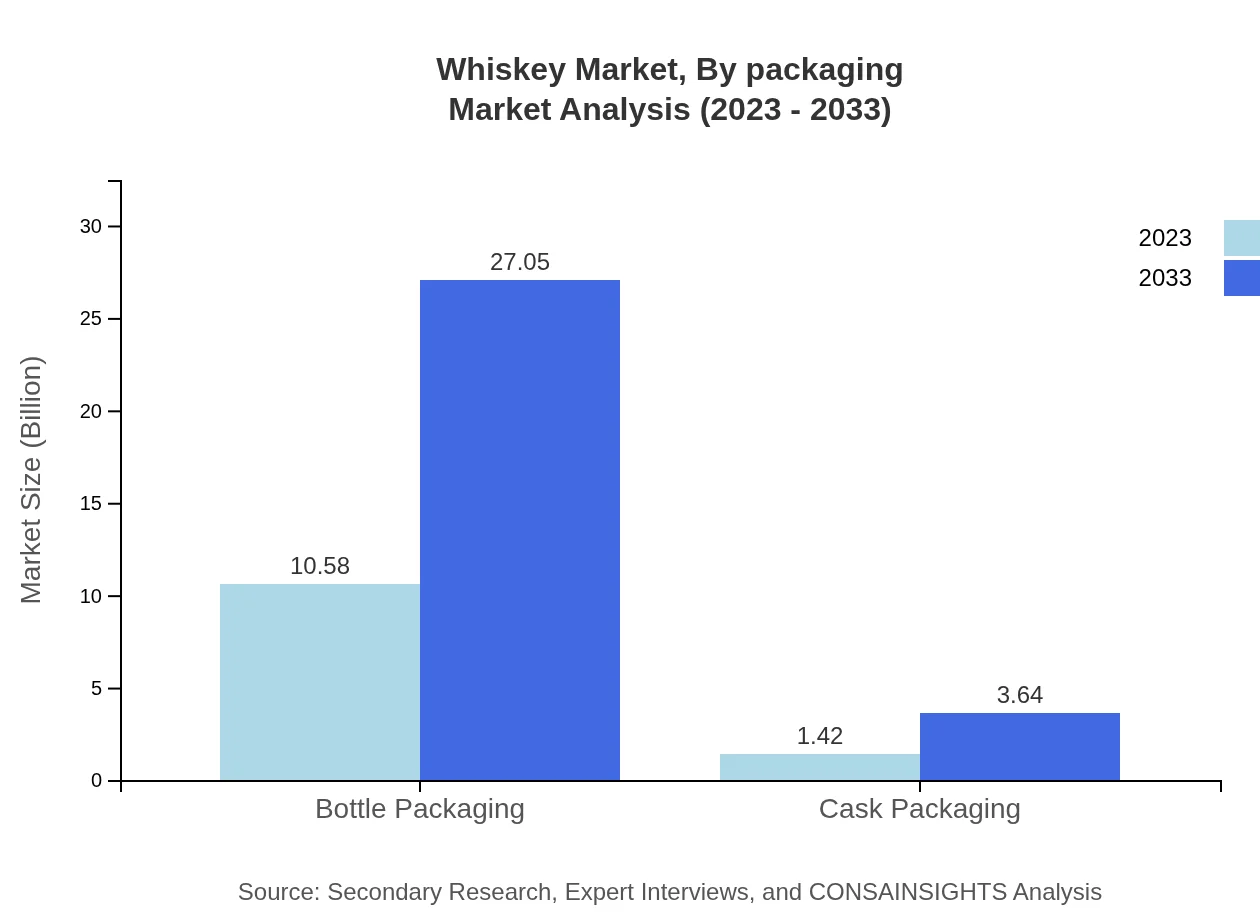

Whiskey Market Analysis By Packaging

Packaging also plays a crucial role in the Whiskey market. Bottle packaging dominates with a market size of $10.58 billion in 2023, projected to reach $27.05 billion by 2033, accounting for 88.13% market share. Cask packaging remains relevant, with an expected growth from $1.42 billion to $3.64 billion during the forecast period, making up 11.87% of the market.

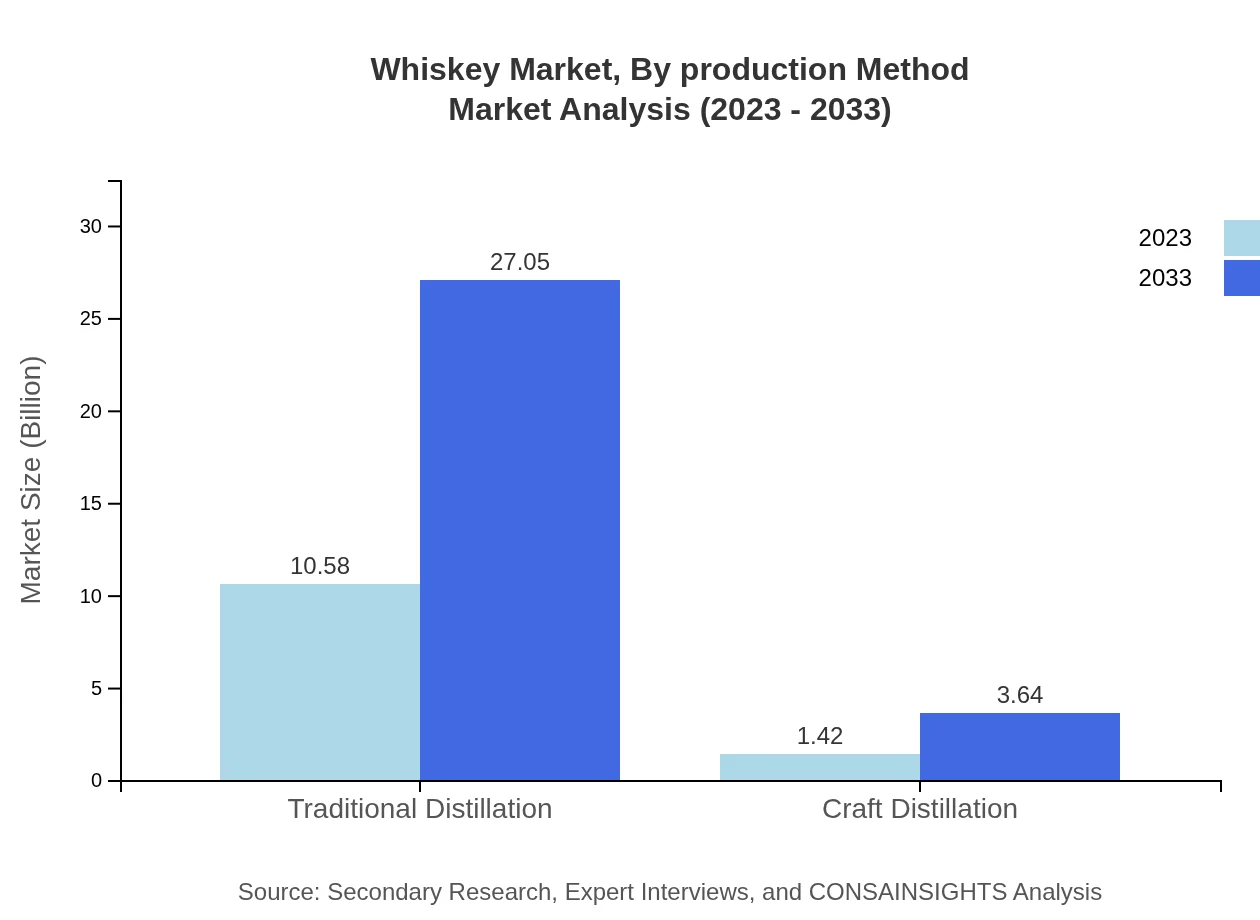

Whiskey Market Analysis By Production Method

The production method segment highlights a significant distinction between traditional and craft distillation. Traditional distillation holds a substantial market value of $10.58 billion in 2023, projected to grow to $27.05 billion by 2033, capturing 88.13% of the market share. Craft distillation, while smaller, is expected to gain ground from $1.42 billion to $3.64 billion, evident of a growing trend towards small-batch production.

Whiskey Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Whiskey Industry

Diageo:

A leading global alcohol beverage company headquartered in London, Diageo owns several prominent whiskey brands including Johnnie Walker, Buchanan's, and Crown Royal, significantly impacting the global whiskey landscape.Brown-Forman:

Based in the USA, Brown-Forman is known for its high-quality brands like Jack Daniel's and Woodford Reserve. The company innovates throughout the whiskey production process, enhancing its market share and consumer loyalty.Pernod Ricard:

As one of the largest spirits and wine companies, Pernod Ricard owns brands such as Jameson and Chivas Regal. Its extensive distribution networks play a vital role in expanding the global reach of its whiskey products.William Grant & Sons:

An independent distiller based in Scotland, recognized for brands like Glenfiddich and The Balvenie, William Grant & Sons has built a reputation for quality and innovation in the whiskey market.Suntory Holdings:

Famous for its Japanese whiskeys, including Yamazaki and Hibiki, Suntory Holdings emphasizes artisanal craftsmanship and experiential marketing to resonate with whiskey connoisseurs globally.We're grateful to work with incredible clients.

FAQs

What is the market size of whiskey?

The global whiskey market is valued at approximately $12 billion as of 2023, with a projected compound annual growth rate (CAGR) of 9.5% through 2033, indicating strong growth opportunities ahead.

What are the key market players or companies in the whiskey industry?

Key players include well-established brands like Diageo, Pernod Ricard, Beam Suntory, and Brown-Forman, which dominate various segments of the whiskey market across the globe.

What are the primary factors driving the growth in the whiskey industry?

The primary growth drivers include increasing consumer interest in premium liquor, rising global demand for craft and artisanal brands, and a growing trend of whiskey cocktails enhancing market appeal.

Which region is the fastest Growing in the whiskey market?

North America is the fastest-growing region, with market value projected to increase from $4.68 billion in 2023 to $11.96 billion by 2033, reflecting a robust growth trajectory.

Does ConsaInsights provide customized market report data for the whiskey industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the whiskey industry, allowing for in-depth analysis and strategic insights.

What deliverables can I expect from this whiskey market research project?

Deliverables include comprehensive market analysis, segment performance data, competitive landscape insights, and strategic recommendations to support informed decision-making.

What are the market trends of whiskey?

Current trends include the rise of flavored whiskeys, sustainability in production, and increasing interest in premium and aged varieties, which collectively drive market evolution.