White Oil Market Report

Published Date: 02 February 2026 | Report Code: white-oil

White Oil Market Size, Share, Industry Trends and Forecast to 2033

This market report covers the comprehensive analysis of the White Oil market, offering insights into the market size, growth trends, and regional forecasts from 2023 to 2033. It includes detailed segments, industry analysis, and key market leaders.

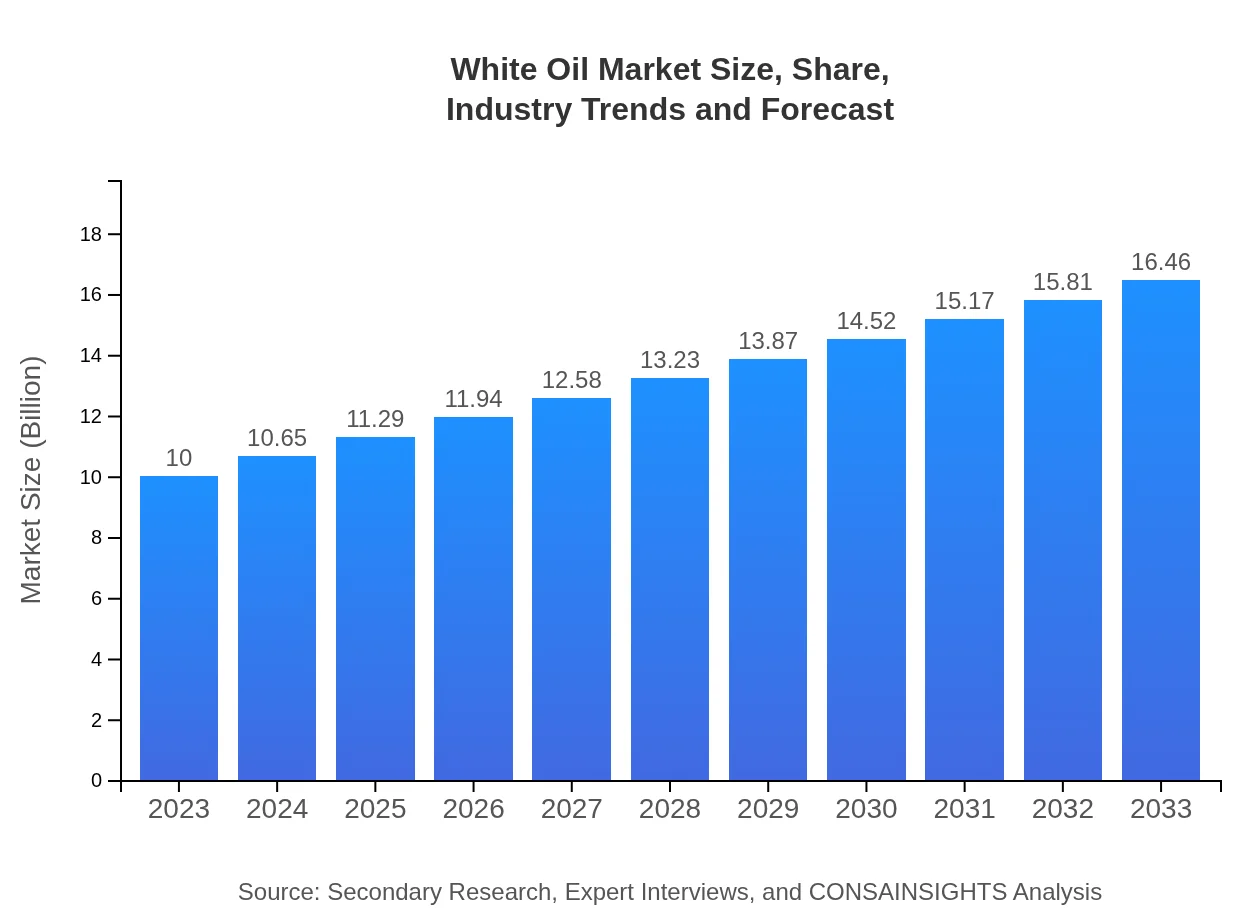

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $16.46 Billion |

| Top Companies | ExxonMobil, Royal Dutch Shell, SABIC, Chevron |

| Last Modified Date | 02 February 2026 |

White Oil Market Overview

Customize White Oil Market Report market research report

- ✔ Get in-depth analysis of White Oil market size, growth, and forecasts.

- ✔ Understand White Oil's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in White Oil

What is the Market Size & CAGR of White Oil market in 2023?

White Oil Industry Analysis

White Oil Market Segmentation and Scope

Tell us your focus area and get a customized research report.

White Oil Market Analysis Report by Region

Europe White Oil Market Report:

The European market for White Oil is estimated at $3.52 billion in 2023, growing to $5.80 billion by 2033. The stringent regulations regarding product safety and efficacy in personal care and cosmetics ensure a stable market demand.Asia Pacific White Oil Market Report:

The Asia Pacific region, valued at $1.72 billion in 2023, is projected to grow to $2.83 billion by 2033. The increasing demand for personal care products and food-grade applications in countries such as China and India drives this growth. Additionally, the expanding pharmaceutical sector supports the use of White Oil in formulations.North America White Oil Market Report:

North America, with a market size of $3.42 billion in 2023, is projected to grow to $5.62 billion by 2033. The region benefits from advanced technological infrastructure and a robust pharmaceuticals industry, which drives high-quality White Oil usage.South America White Oil Market Report:

In South America, the White Oil market is valued at $0.72 billion in 2023, expecting to reach $1.19 billion by 2033. Key growth factors include rising consumer demand for personal care and cosmetic products, as well as growing awareness of product safety.Middle East & Africa White Oil Market Report:

In the Middle East and Africa, the White Oil market, valued at $0.62 billion in 2023, is expected to reach $1.02 billion by 2033. Increasing investments in industrial applications and rising consumer awareness in personal care sectors are the primary growth drivers.Tell us your focus area and get a customized research report.

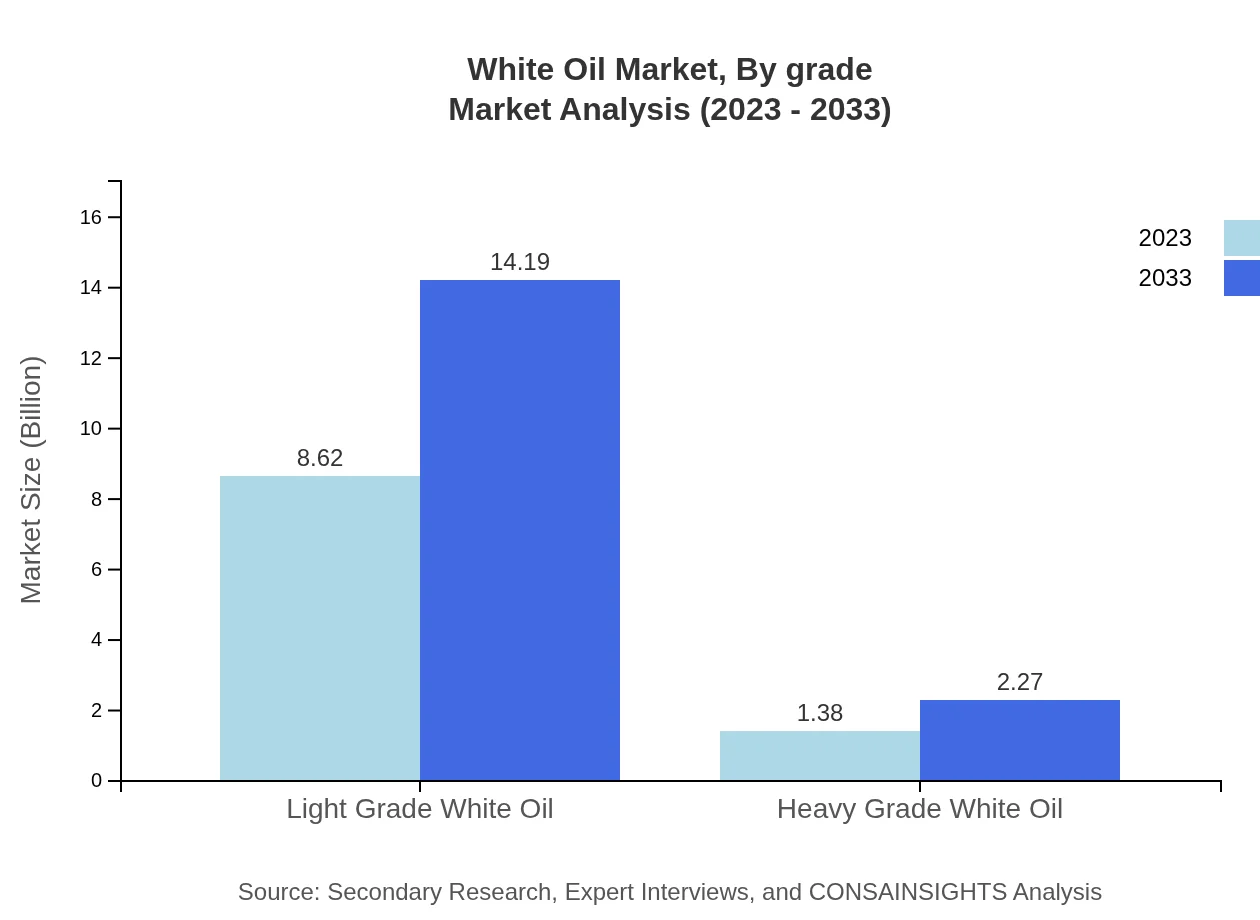

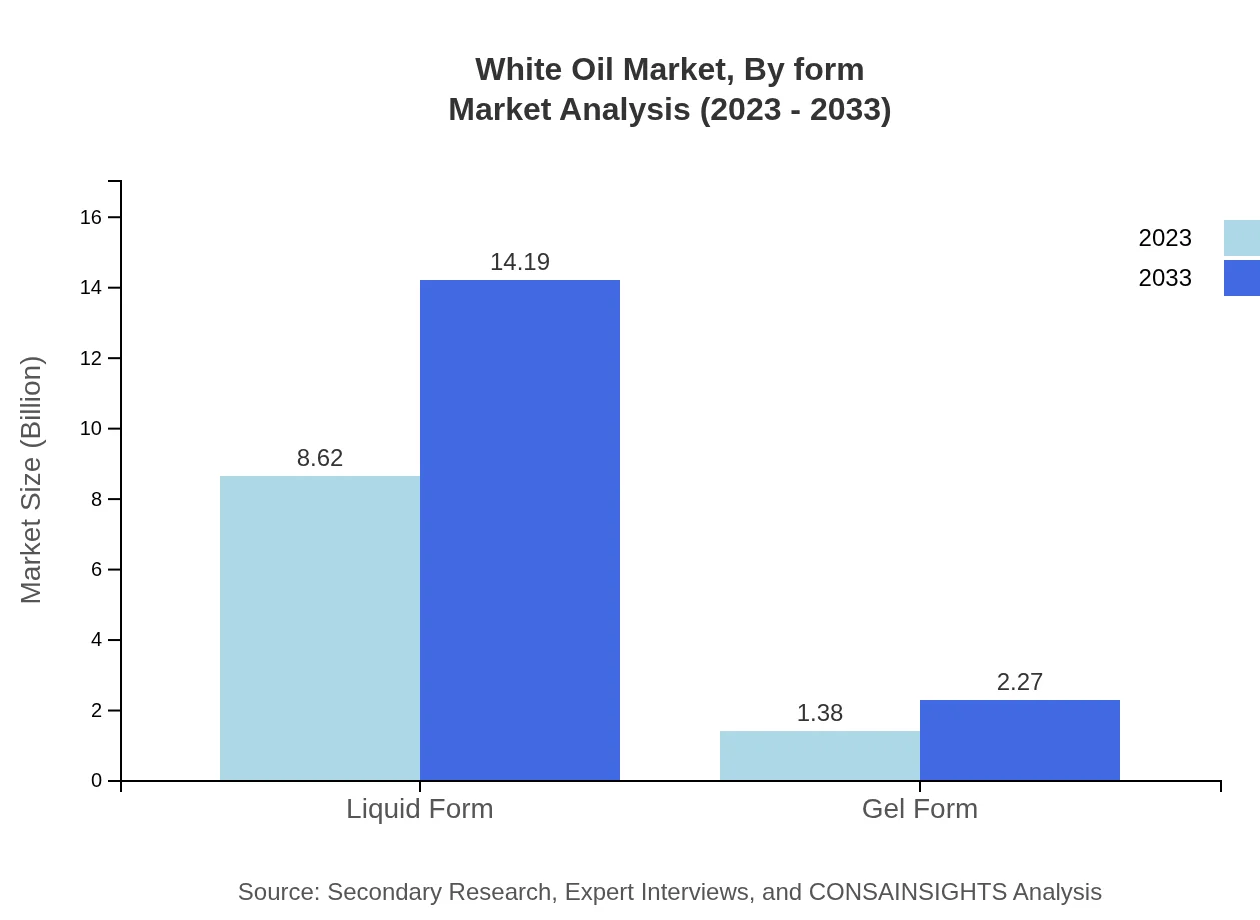

White Oil Market Analysis By Grade

The White Oil market segmentation by grade includes Light Grade, which dominates the market with a total size of $8.62 billion in 2023 expected to grow to $14.19 billion by 2033. Heavy Grade White Oil, while smaller, also shows growth trends, moving from $1.38 billion in 2023 to $2.27 billion in 2033.

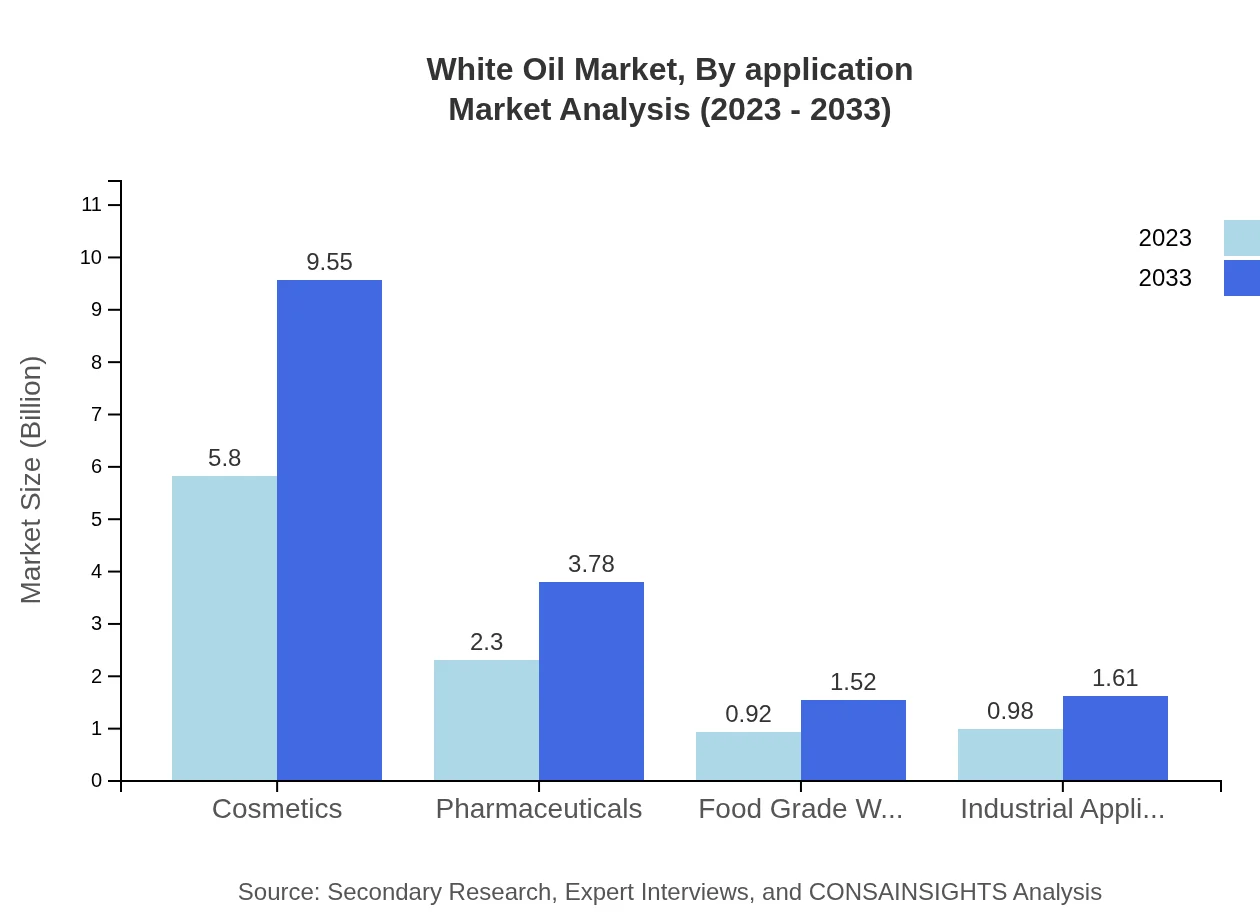

White Oil Market Analysis By Application

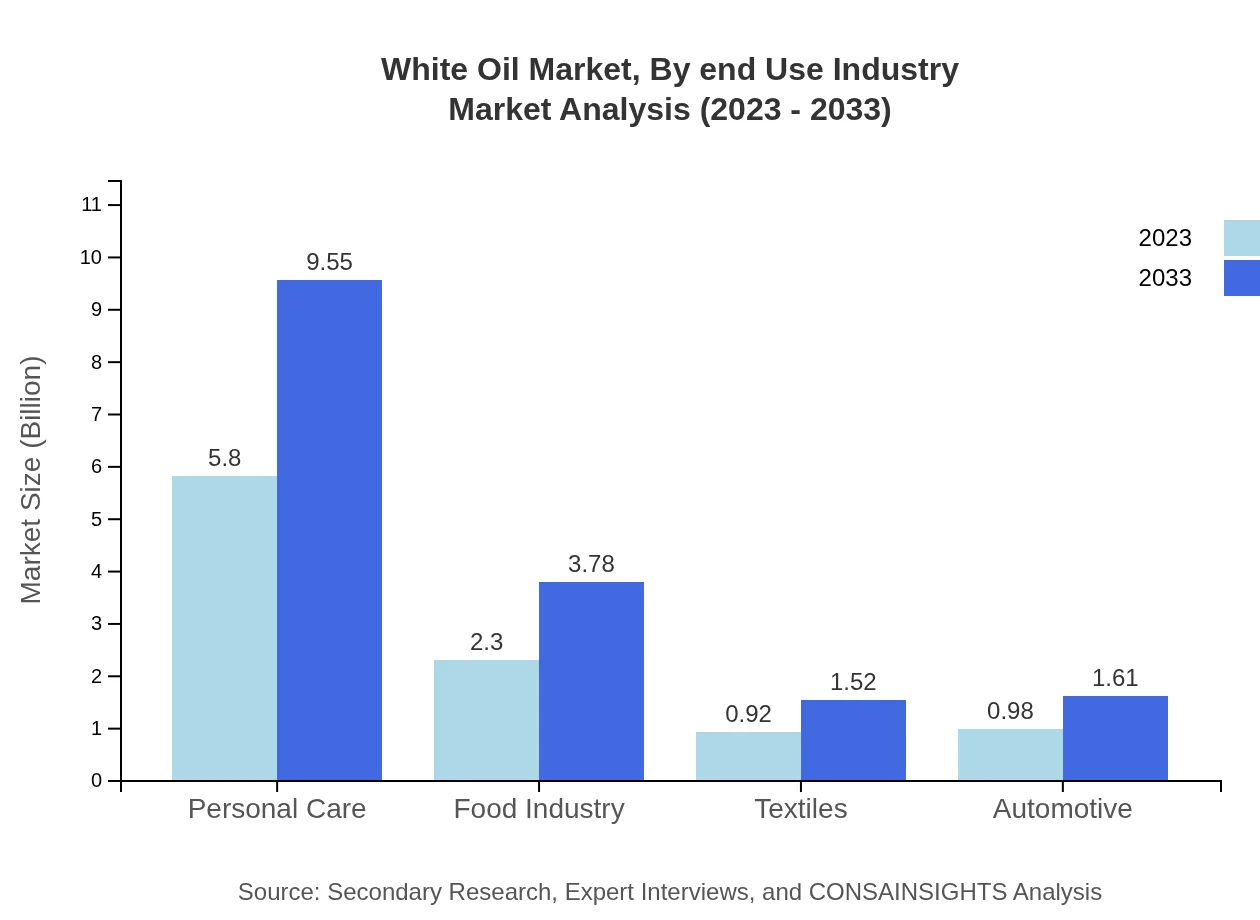

In terms of applications, cosmetics lead with a size of $5.80 billion in 2023, forecasted to rise to $9.55 billion by 2033. The pharmaceuticals segment is valued at $2.30 billion in 2023, anticipated to expand to $3.78 billion by 2033. Other important applications include industrial applications and food-grade oils.

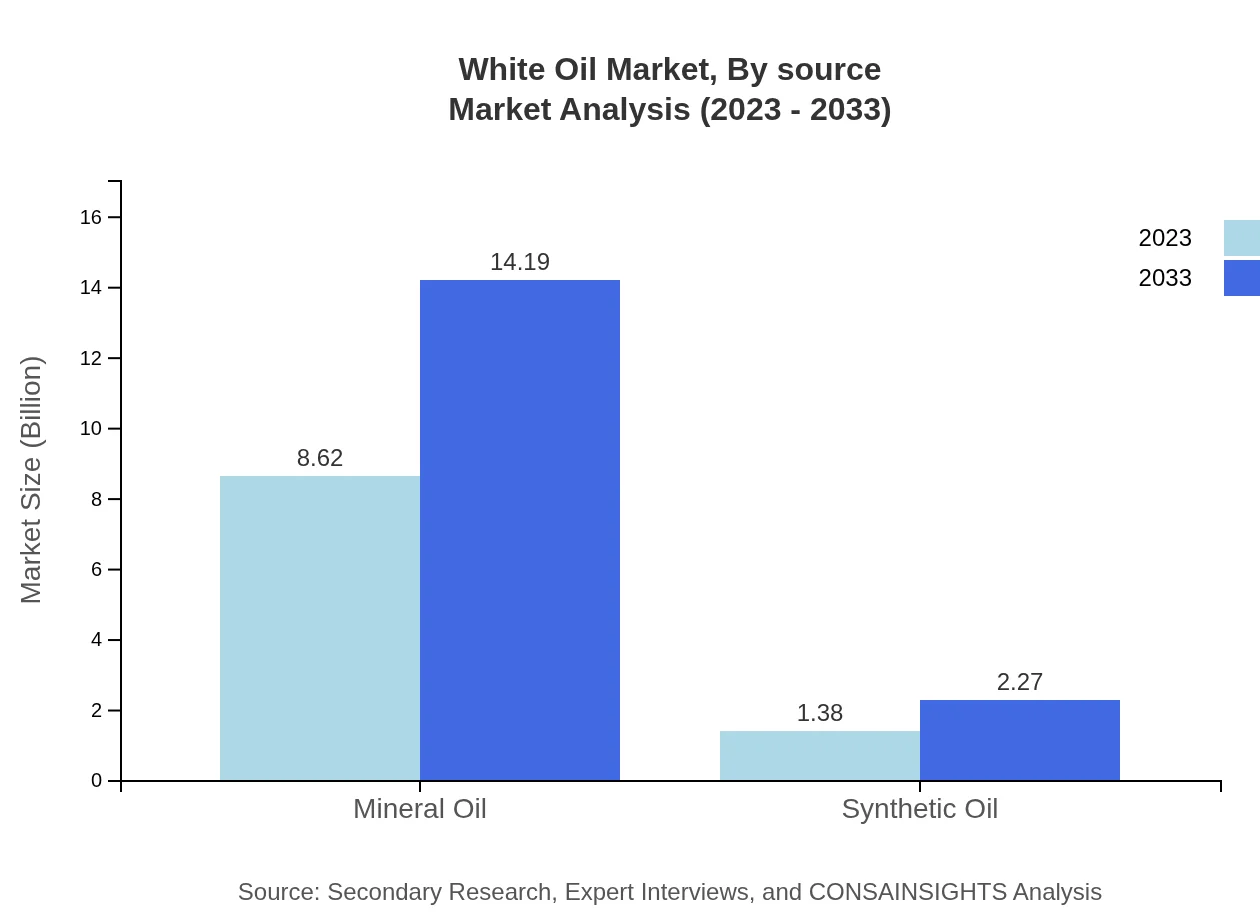

White Oil Market Analysis By Source

The source of White Oil is primarily mineral oil, accounting for a substantial market share due to its widespread use in various applications. Synthetic oils, while a smaller segment, are showing growth as they cater to niche markets requiring specific properties such as biodegradability.

White Oil Market Analysis By Form

The liquid form of White Oil is predominant, valued at $8.62 billion in 2023 and expected to maintain its share through 2033. Gel forms, while smaller, are also gaining traction in specialized cosmetics and pharmaceuticals.

White Oil Market Analysis By End Use Industry

The White Oil market's end-use industry spans various sectors, including personal care, pharmaceuticals, and food industry applications. The personal care sector alone amounts to $5.80 billion in 2023, reflecting the high consumer preference for safe and effective products.

White Oil Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in White Oil Industry

ExxonMobil:

A leader in the petrochemical industry known for high-quality White Oil products used across various applications.Royal Dutch Shell:

A global player in oil exploration and refining, providing premium White Oil solutions to meet consumer and industry needs.SABIC:

One of the largest petrochemical manufacturers, focusing on sustainable and innovative White Oil products.Chevron:

A multinational company providing advanced refining technologies and high-quality White Oil tailored for diverse industries.We're grateful to work with incredible clients.

FAQs

What is the market size of white Oil?

The global white oil market is anticipated to reach a market size of $10 billion by 2033, with a steady CAGR of 5%. In 2023, the market size was at $8 billion, illustrating strong growth potential in the sector.

What are the key market players or companies in the white Oil industry?

Key players in the white oil market include multinational giants such as ExxonMobil, Royal Dutch Shell, and Chevron. These companies play a crucial role in driving innovation and setting industry standards across various applications.

What are the primary factors driving the growth in the white Oil industry?

The growth of the white oil industry is driven by rising demand in cosmetics, pharmaceuticals, and food industries. Increased awareness of product safety and rising disposable incomes in developing regions further fuel this market's expansion.

Which region is the fastest Growing in the white Oil market?

The Asia Pacific region is the fastest-growing market for white oil, expected to attain a size of $2.83 billion by 2033, up from $1.72 billion in 2023, showcasing a robust growth trajectory fueled by expanding manufacturing bases.

Does ConsaInsights provide customized market report data for the white Oil industry?

Yes, ConsaInsights offers tailored market report data for the white oil industry. Customization can include specific regional insights, segment analyses, and competitor profiling, catering to unique client research needs.

What deliverables can I expect from this white Oil market research project?

From the white oil market research project, clients can expect detailed reports, market trend analyses, competitive landscape evaluations, and growth forecasts. These deliverables provide valuable insights for strategic decision-making.

What are the market trends of white Oil?

Current market trends in the white oil sector include a shift towards sustainable and environmentally friendly products. There's also a growing focus on innovations in product formulations, particularly in cosmetics and personal care products.