Whole Grain Foods Market Report

Published Date: 31 January 2026 | Report Code: whole-grain-foods

Whole Grain Foods Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Whole Grain Foods market by providing insights and data on market trends, size, segmentation, and leading companies. The focus is on market projections from 2023 to 2033, offering a comprehensive overview of the industry's future.

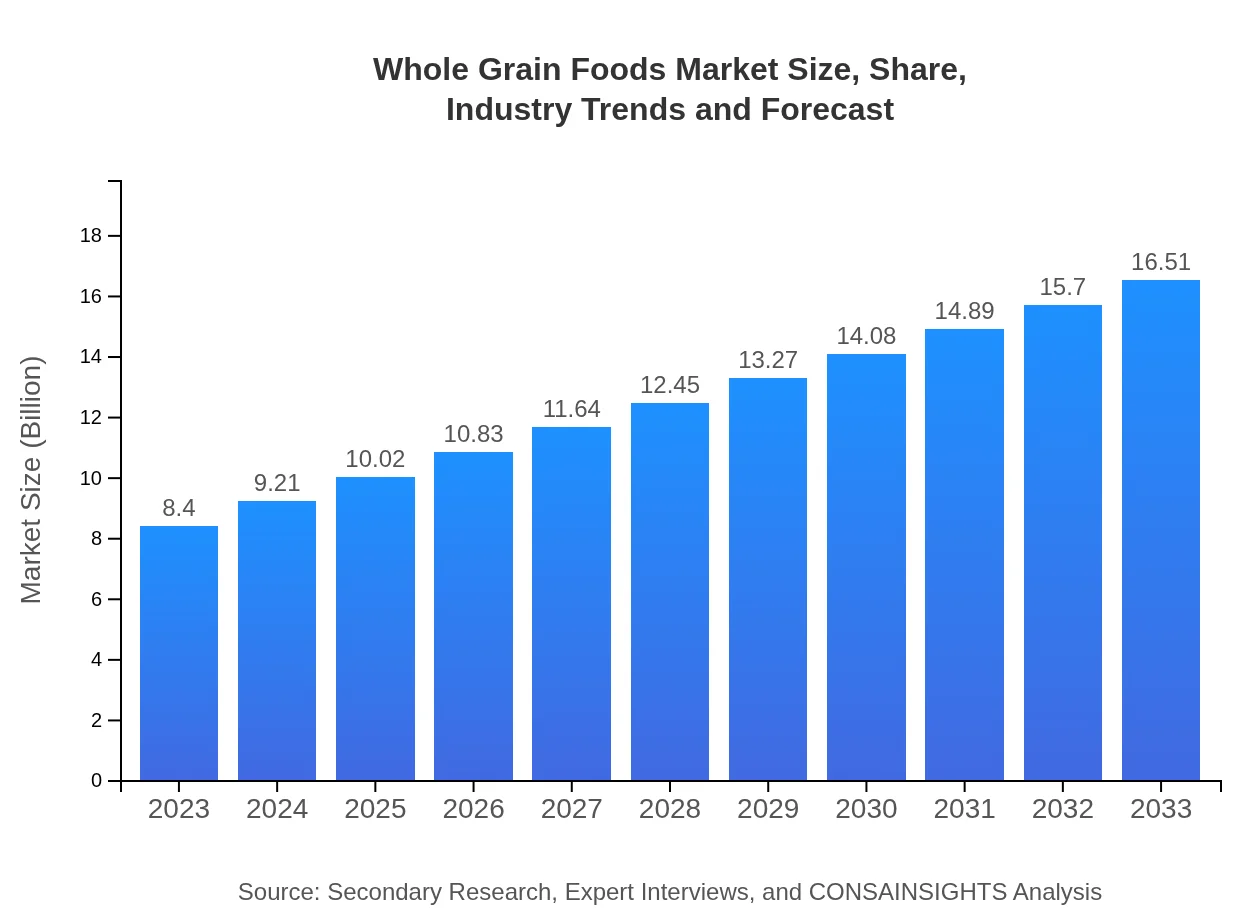

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.40 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $16.51 Billion |

| Top Companies | Nature Valley, Quaker Oats Company, Dave’s Killer Bread, Ezekiel Bread, Arnold Bread |

| Last Modified Date | 31 January 2026 |

Whole Grain Foods Market Overview

Customize Whole Grain Foods Market Report market research report

- ✔ Get in-depth analysis of Whole Grain Foods market size, growth, and forecasts.

- ✔ Understand Whole Grain Foods's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Whole Grain Foods

What is the Market Size & CAGR of Whole Grain Foods market in 2023?

Whole Grain Foods Industry Analysis

Whole Grain Foods Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Whole Grain Foods Market Analysis Report by Region

Europe Whole Grain Foods Market Report:

The European market for Whole Grain Foods is anticipated to rise from USD 2.68 billion in 2023 to USD 5.26 billion by 2033. Strong regulatory support for healthy eating and a well-established consumer base contribute to this growth. Whole grains are increasingly integrated into diets across various European nations, driven by both culinary traditions and health recommendations.Asia Pacific Whole Grain Foods Market Report:

In the Asia Pacific region, the Whole Grain Foods market is expected to grow from USD 1.54 billion in 2023 to USD 3.02 billion by 2033, reflecting a CAGR of 7.2%. Consumer interest in healthy eating and increasing disposable incomes are driving this growth. Nations like Japan and China exhibit rising demand for whole grain products, particularly in the snacks and breakfast categories.North America Whole Grain Foods Market Report:

North America holds one of the largest shares of the Whole Grain Foods market, expected to grow from USD 3.01 billion in 2023 to USD 5.92 billion by 2033. The increasing prevalence of gluten-free and organic whole grain products is propelling market demand alongside a health-conscious consumer base prioritizing nutritious food choices.South America Whole Grain Foods Market Report:

The South American market remains modest, projected to increase from USD 0.04 billion in 2023 to USD 0.08 billion by 2033. Factors contributing to this slow growth include lower health awareness compared to other regions and limited distribution channels for whole grain products.Middle East & Africa Whole Grain Foods Market Report:

In the Middle East and Africa, the Whole Grain Foods market is projected to grow from USD 1.13 billion in 2023 to USD 2.22 billion by 2033. The rise in disposable income and an urbanizing population are steering consumer choices towards healthier options, paving the way for whole grain products to gain traction.Tell us your focus area and get a customized research report.

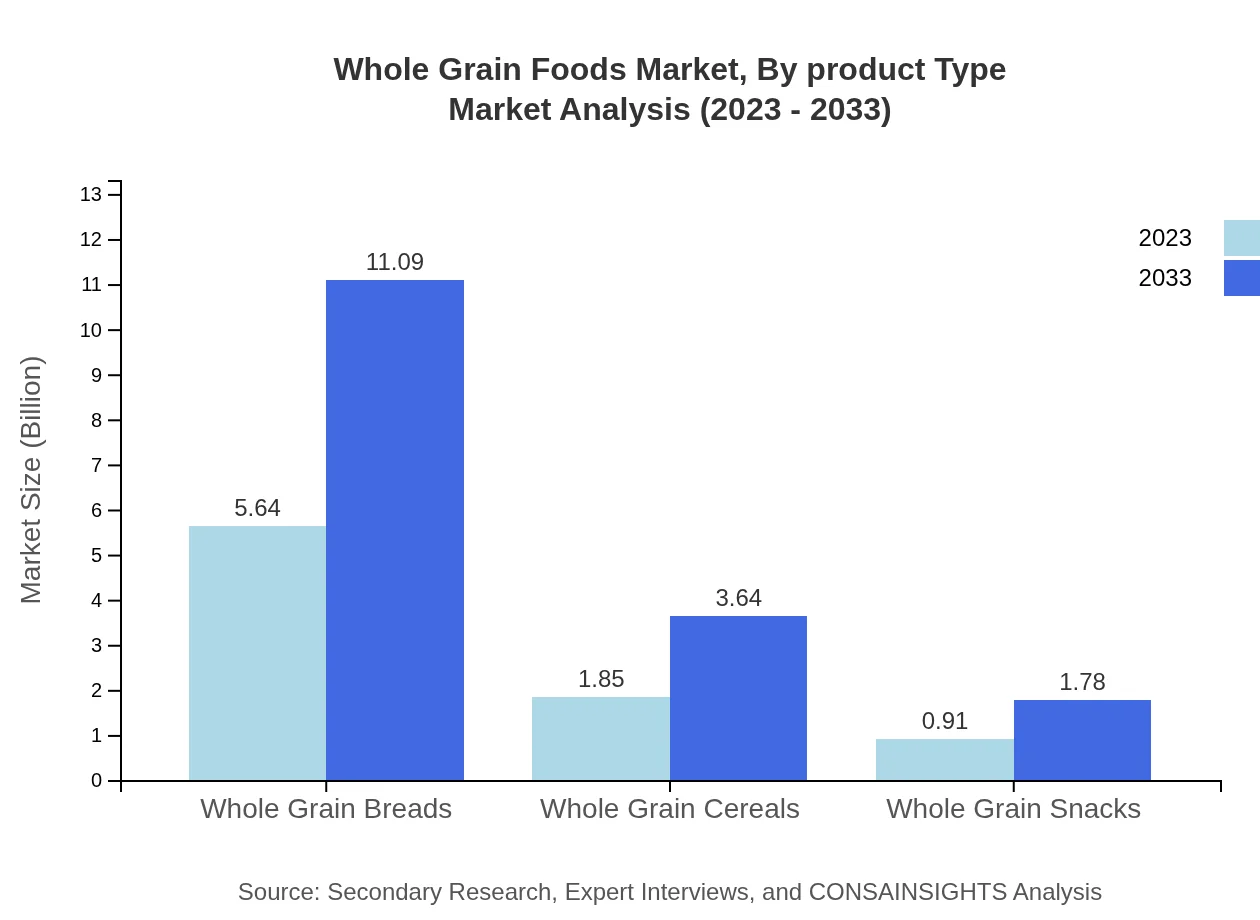

Whole Grain Foods Market Analysis By Product Type

In terms of product types, whole grain breads lead the market, growing from USD 5.64 billion in 2023 to USD 11.09 billion in 2033, capturing 67.19% market share throughout the forecast period. Whole grain cereals are also significant, with a market size projected to increase from USD 1.85 billion to USD 3.64 billion, maintaining a 22.03% share. Whole grain snacks, while smaller in market size, are expected to grow from USD 0.91 billion to USD 1.78 billion, following consumer trends towards healthy snacking options.

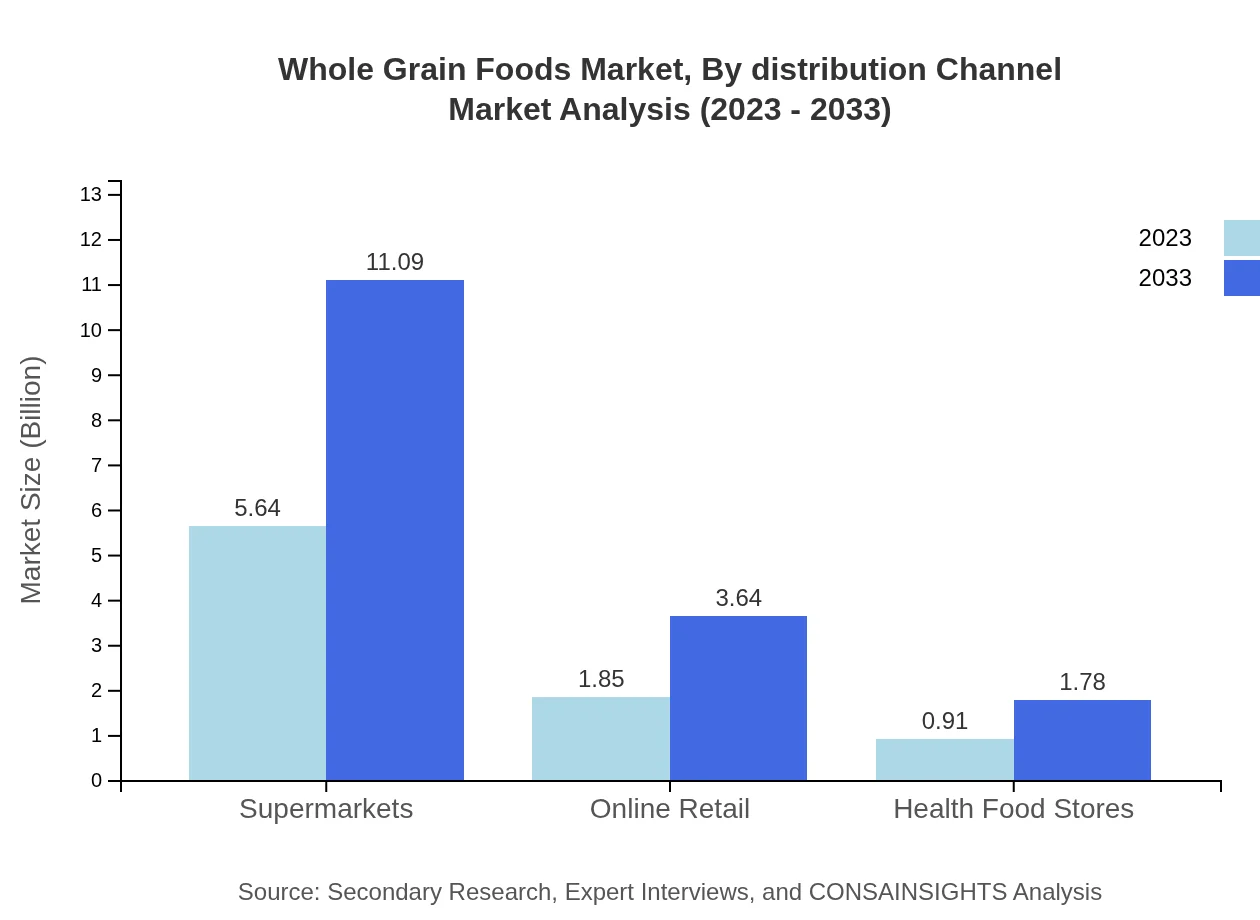

Whole Grain Foods Market Analysis By Distribution Channel

Distribution channels play a crucial role in the Whole Grain Foods market. Supermarkets dominate this space, expected to grow from USD 5.64 billion in 2023 to USD 11.09 billion by 2033, representing a 67.19% market share. Online retail is emerging rapidly, expected to double from USD 1.85 billion to USD 3.64 billion, while health food stores maintain a consistent presence, projected to grow from USD 0.91 billion to USD 1.78 billion.

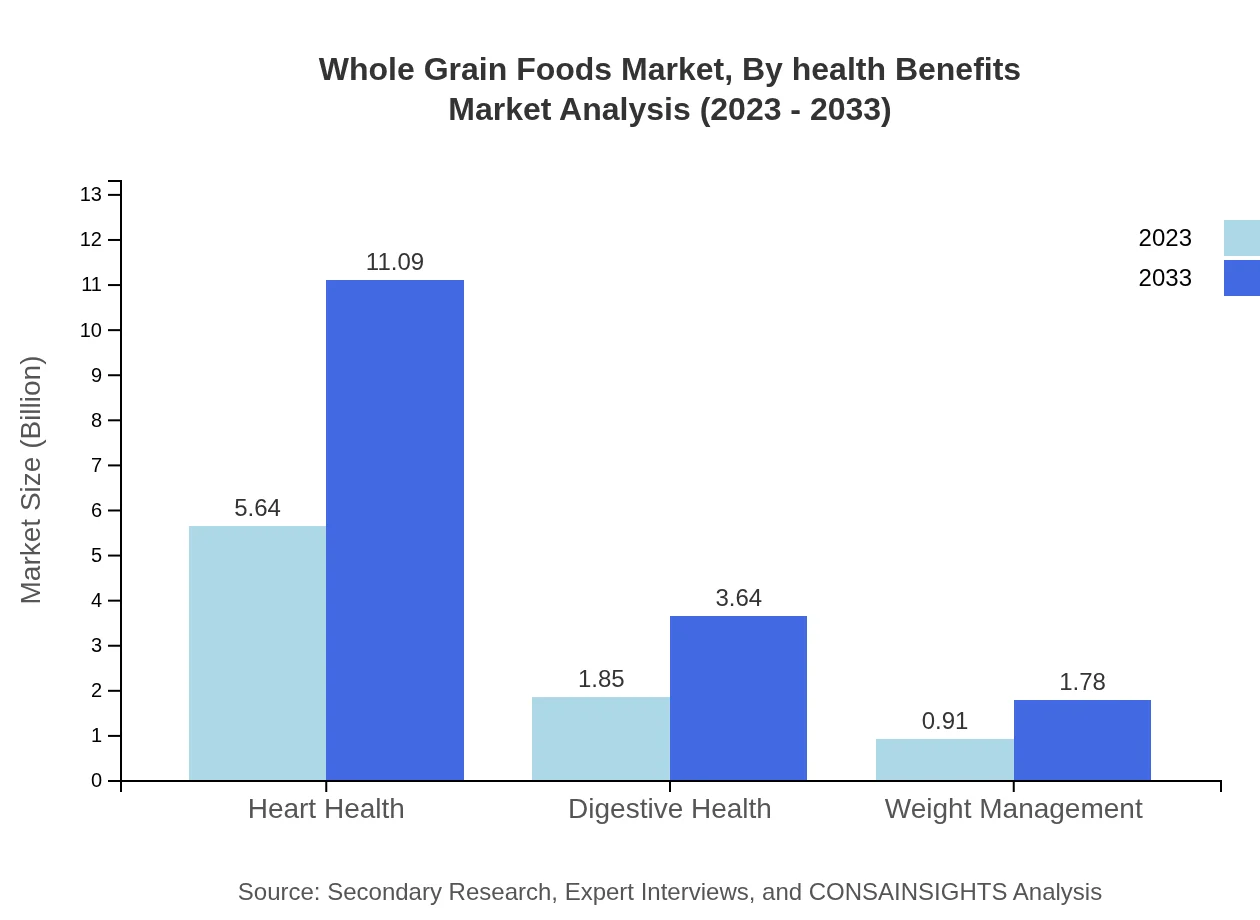

Whole Grain Foods Market Analysis By Health Benefits

Health benefits shape consumer choices significantly. Products catering to heart health dominate, expected to grow from USD 5.64 billion to USD 11.09 billion, maintaining a 67.19% share. Similarly, digestive health-oriented products will grow from USD 1.85 billion to USD 3.64 billion, highlighting rising consumer awareness of gut health. Weight management products are also gaining traction, from USD 0.91 billion to USD 1.78 billion.

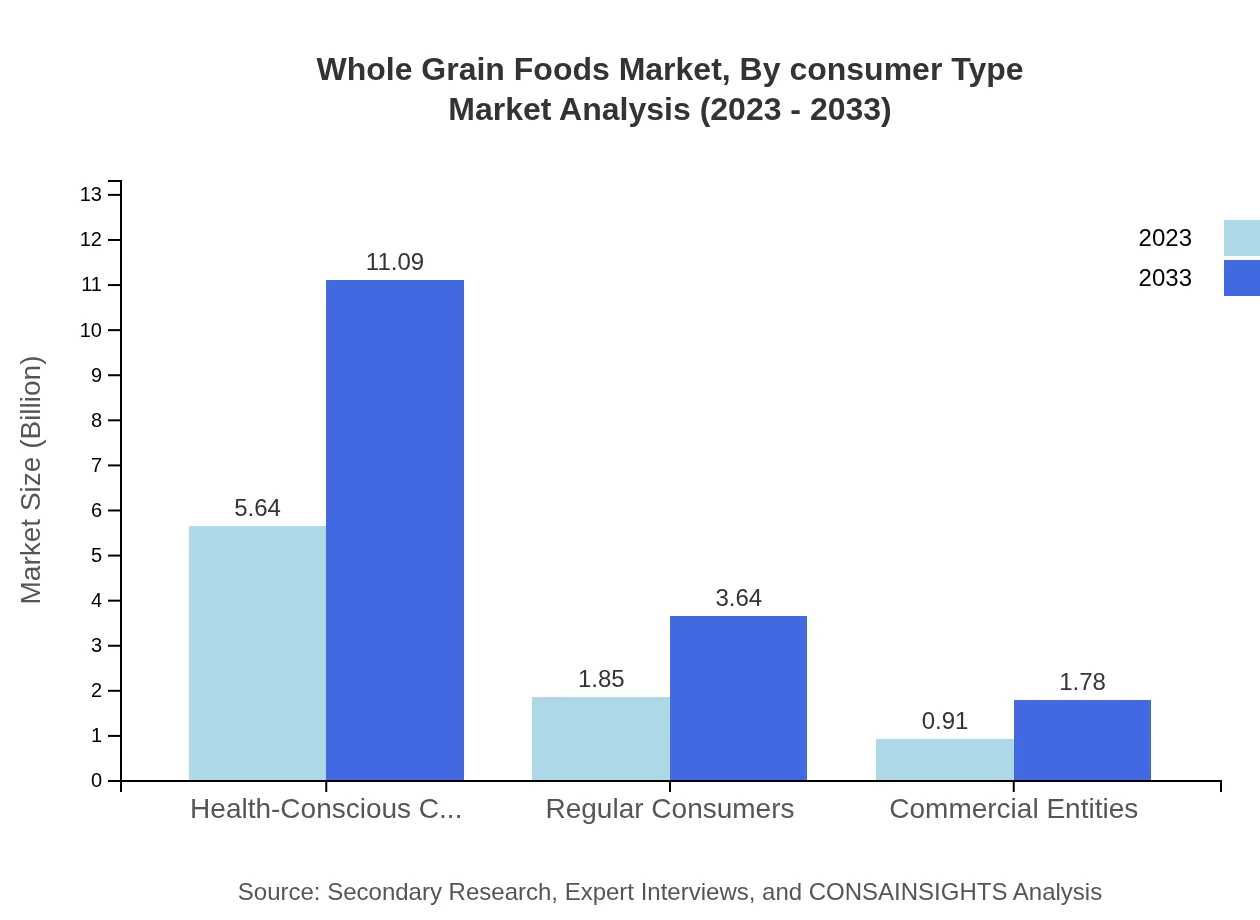

Whole Grain Foods Market Analysis By Consumer Type

The market segmentation by consumer type showcases health-conscious consumers leading the market, projected to grow from USD 5.64 billion to USD 11.09 billion, reflecting a 67.19% share. Regular consumers follow, anticipated to expand from USD 1.85 billion to USD 3.64 billion, while commercial entities will see notable growth from USD 0.91 billion to USD 1.78 billion.

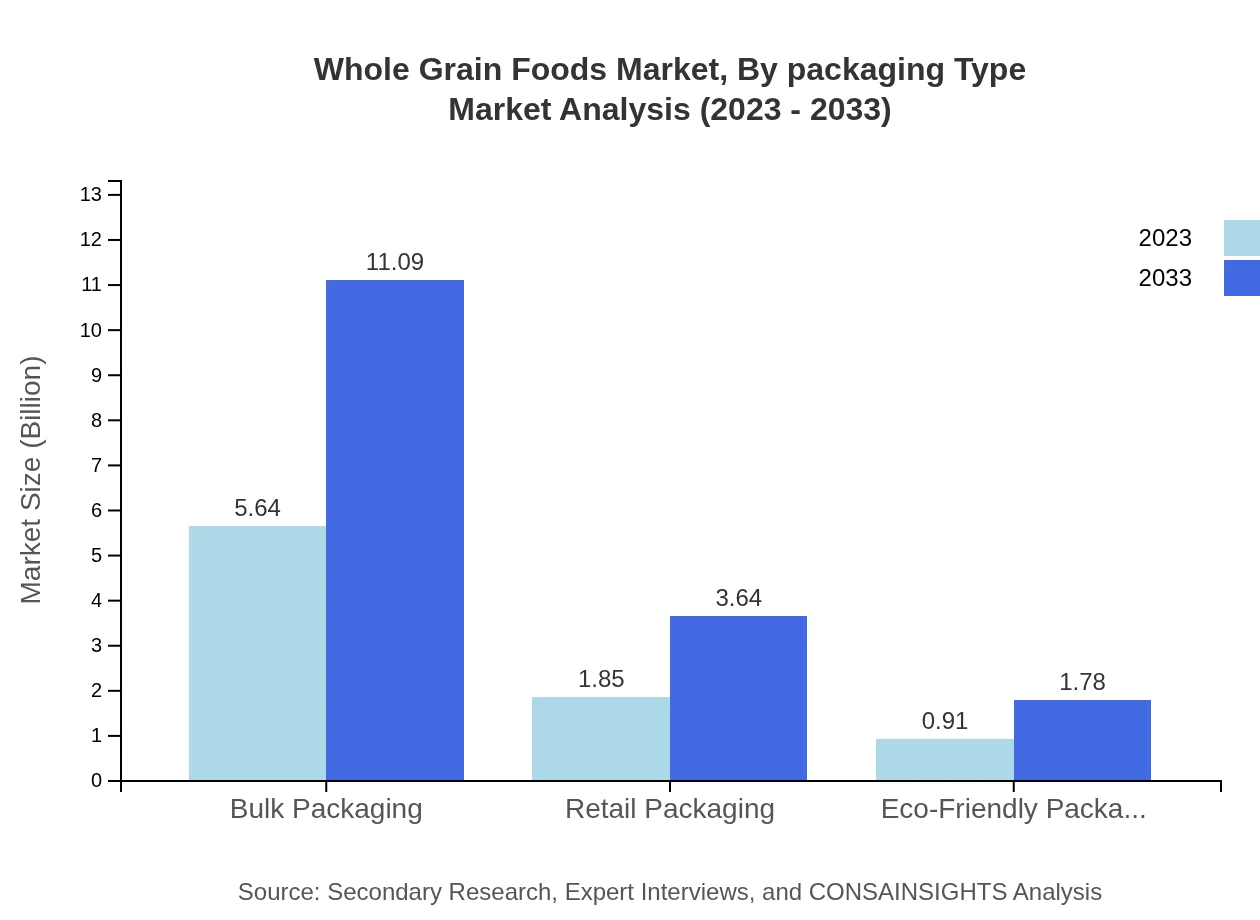

Whole Grain Foods Market Analysis By Packaging Type

Packaging types influence product delivery and consumer choice. Bulk packaging remains the most significant segment, projected to grow from USD 5.64 billion to USD 11.09 billion, capturing a 67.19% market share. Retail packaging, catering to consumer convenience, is expected to grow from USD 1.85 billion to USD 3.64 billion, while eco-friendly packaging is steadily gaining importance, projected from USD 0.91 billion to USD 1.78 billion.

Whole Grain Foods Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Whole Grain Foods Industry

Nature Valley:

A brand under General Mills, Nature Valley specializes in granola bars and whole grain snacks, leading innovations in taste and sustainability.Quaker Oats Company:

Part of PepsiCo, the Quaker Oats Company is known for its whole grain oatmeal products and cereals, focusing on health and wellness.Dave’s Killer Bread:

This brand is renowned for its organic whole grain breads, emphasizing clean ingredients and social responsibility.Ezekiel Bread:

Known for its unique sprouted whole grain bread, this brand appeals to health-conscious consumers looking for nutritious options.Arnold Bread:

A leading brand in the bread market that offers a range of whole grain products aimed at combining taste with health benefits.We're grateful to work with incredible clients.

FAQs

What is the market size of Whole Grain Foods?

The whole grain foods market is projected to reach $8.4 billion in 2023, with a compound annual growth rate (CAGR) of 6.8% expected through 2033.

What are the key market players or companies in the Whole Grain Foods industry?

Key market players in the whole grain foods sector include large food manufacturers known for healthy snack products, prominent bread producers, and companies specializing in whole grain cereals. These entities contribute significantly to market growth.

What are the primary factors driving the growth in the Whole Grain Foods industry?

Growth in the whole grain foods industry is driven by increasing health awareness, a rise in health-conscious consumers, and a shift towards nutritious diets. The focus on dietary fiber and the benefits of whole grains contributes to expanding consumer interest.

Which region is the fastest Growing in the Whole Grain Foods market?

The Asia Pacific region is the fastest-growing market for whole grain foods, with market size increasing from $1.54 billion in 2023 to $3.02 billion by 2033, reflecting a strong demand for health-oriented food options.

Does ConsaInsights provide customized market report data for the Whole Grain Foods industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements within the whole grain foods industry, allowing clients to access detailed insights that meet their specific needs.

What deliverables can I expect from this Whole Grain Foods market research project?

Deliverables from this market research project typically include an in-depth report with market size analysis, segmented data, trends, forecasts, and insights on key players, ensuring comprehensive coverage of the whole grain foods market.

What are the market trends of Whole Grain Foods?

Market trends in whole grain foods indicate a notable shift towards health-focused products, with segments like whole grain breads and cereals gaining significant market share, driven by rising consumer preferences for nutritious and convenient food options.