Windows And Doors Market Report

Published Date: 22 January 2026 | Report Code: windows-and-doors

Windows And Doors Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Windows and Doors market from 2023 to 2033, highlighting key insights, market size, trends, competitive landscape, and forecasts. It covers growth drivers, technological advancements, and market segmentation.

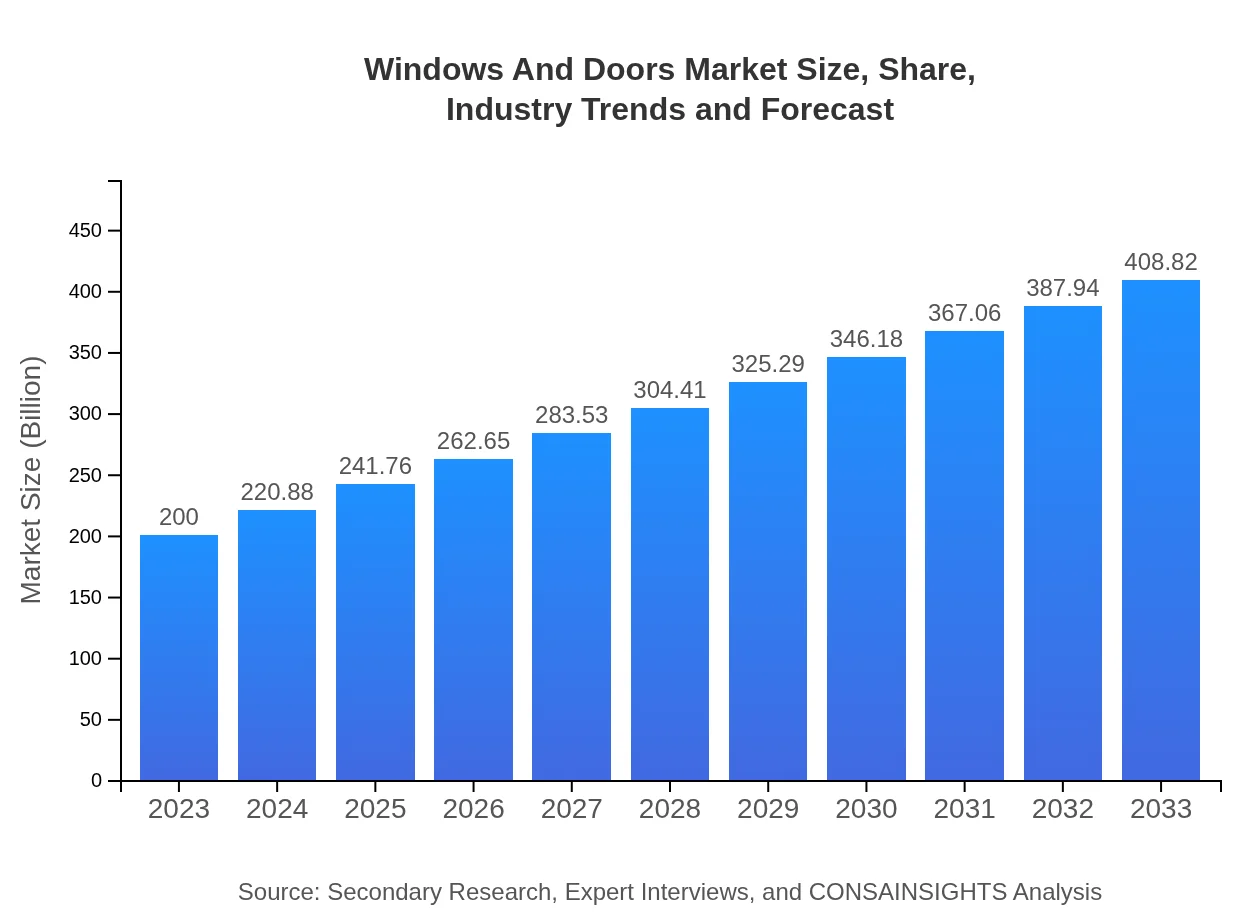

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $200.00 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $408.82 Billion |

| Top Companies | Andersen Corporation, Royal Building Products, Pella Corporation, Milgard Windows & Doors, Jeld-Wen Holding, Inc. |

| Last Modified Date | 22 January 2026 |

Windows And Doors Market Overview

Customize Windows And Doors Market Report market research report

- ✔ Get in-depth analysis of Windows And Doors market size, growth, and forecasts.

- ✔ Understand Windows And Doors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Windows And Doors

What is the Market Size & CAGR of Windows And Doors market in 2023?

Windows And Doors Industry Analysis

Windows And Doors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Windows And Doors Market Analysis Report by Region

Europe Windows And Doors Market Report:

Europe's market is forecasted to grow from USD 49.88 billion in 2023 to USD 101.96 billion by 2033. The European Union's stringent building regulations regarding energy efficiency and sustainability propel the adoption of advanced window and door technologies. Renovation projects and smart city initiatives are also crucial contributors to market growth across key European countries.Asia Pacific Windows And Doors Market Report:

In the Asia Pacific region, the Windows and Doors market is projected to grow from USD 39.22 billion in 2023 to USD 80.17 billion by 2033. Rapid urbanization, growth in residential construction, and rising disposable incomes in countries such as China and India contribute significantly to this expansion. Strong demand for energy-efficient solutions is also encouraging the adoption of advanced materials and technologies.North America Windows And Doors Market Report:

In North America, the Windows and Doors market is set to expand from USD 77.96 billion in 2023 to USD 159.36 billion by 2033. Key growth drivers include robust home improvement activity, an emphasis on energy efficiency, and advancements in smart home technology. The U.S. market, being one of the largest, continues to dominate with significant demand for energy-efficient and high-quality products.South America Windows And Doors Market Report:

The market in South America is anticipated to grow from USD 11.32 billion in 2023 to USD 23.14 billion in 2033. An increase in investments in infrastructure development and residential housing, along with a growing real estate sector, is driving market growth. These regions are witnessing a surge in demand for modern and stylish design approaches, specifically in urban areas.Middle East & Africa Windows And Doors Market Report:

The Middle East and Africa market will experience growth from USD 21.62 billion in 2023 to USD 44.19 billion by 2033. Urbanization and infrastructure development, particularly in the Gulf Cooperation Council (GCC) countries, are significant growth drivers. There is a growing preference for modern designs in residential and commercial buildings, propelling demand for innovative window and door solutions.Tell us your focus area and get a customized research report.

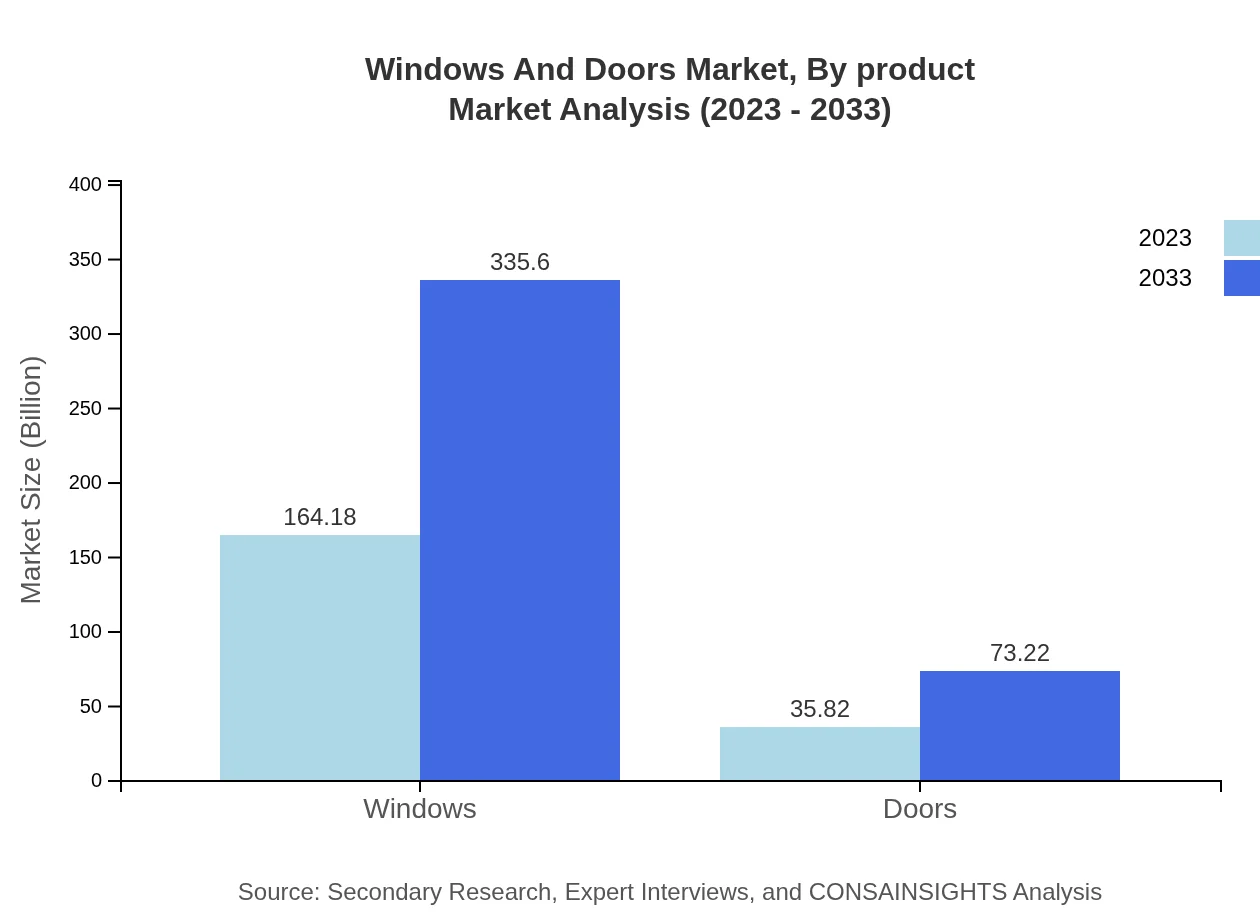

Windows And Doors Market Analysis By Product

The market for windows is projected to grow from USD 164.18 billion in 2023 to USD 335.60 billion by 2033, capturing a market share of 82.09%. Meanwhile, the doors segment is expected to grow from USD 35.82 billion in 2023 to USD 73.22 billion by 2033, maintaining a market share of 17.91%. Windows dominate the market due to their essential role in building aesthetics and energy conservation.

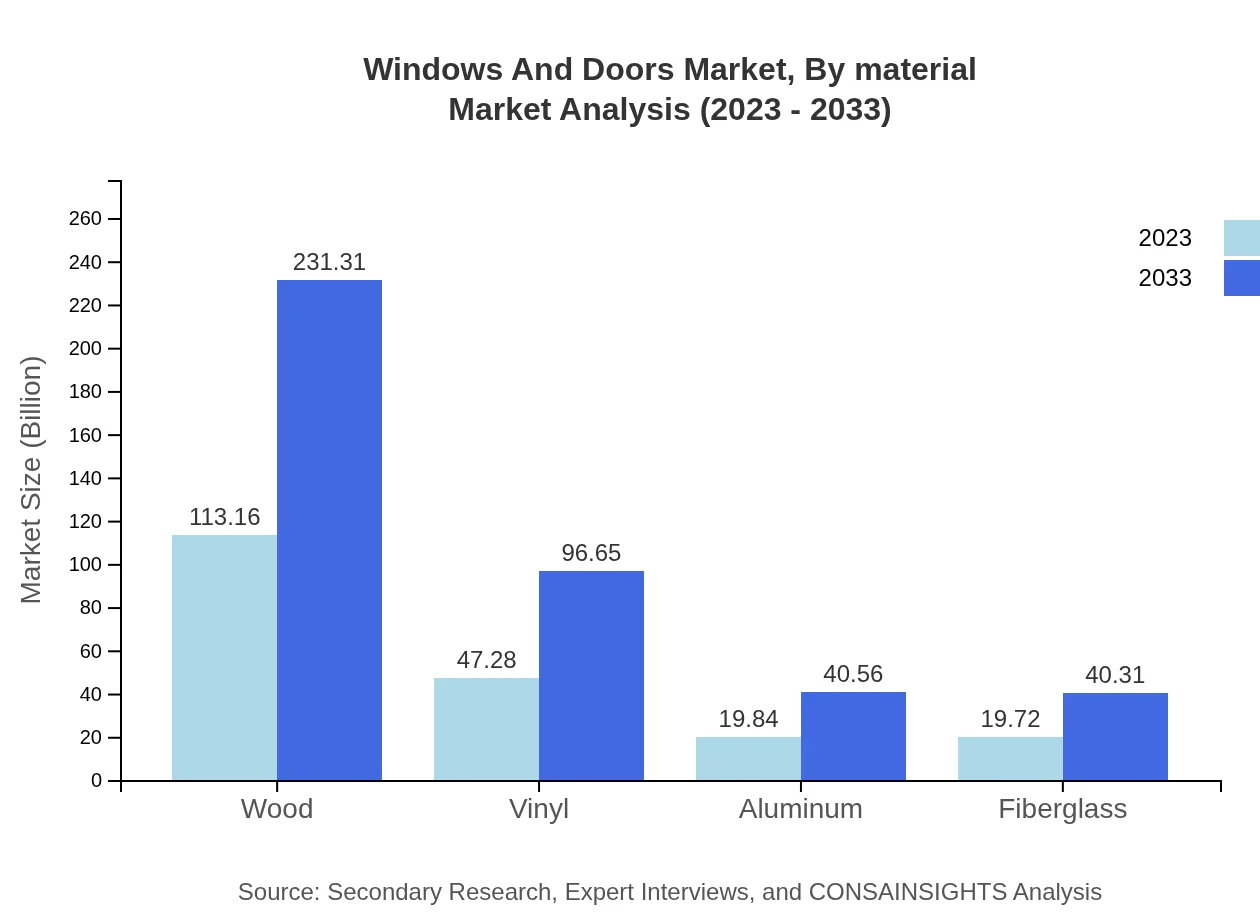

Windows And Doors Market Analysis By Material

Wood remains the most significant material in the Windows and Doors market, expected to grow from USD 113.16 billion in 2023 to USD 231.31 billion by 2033, holding a market share of 56.58%. Vinyl follows with growth from USD 47.28 billion to USD 96.65 billion, while aluminum and fiberglass also show promising growth. The choice of material is heavily influenced by factors such as climate, design preferences, and maintenance considerations.

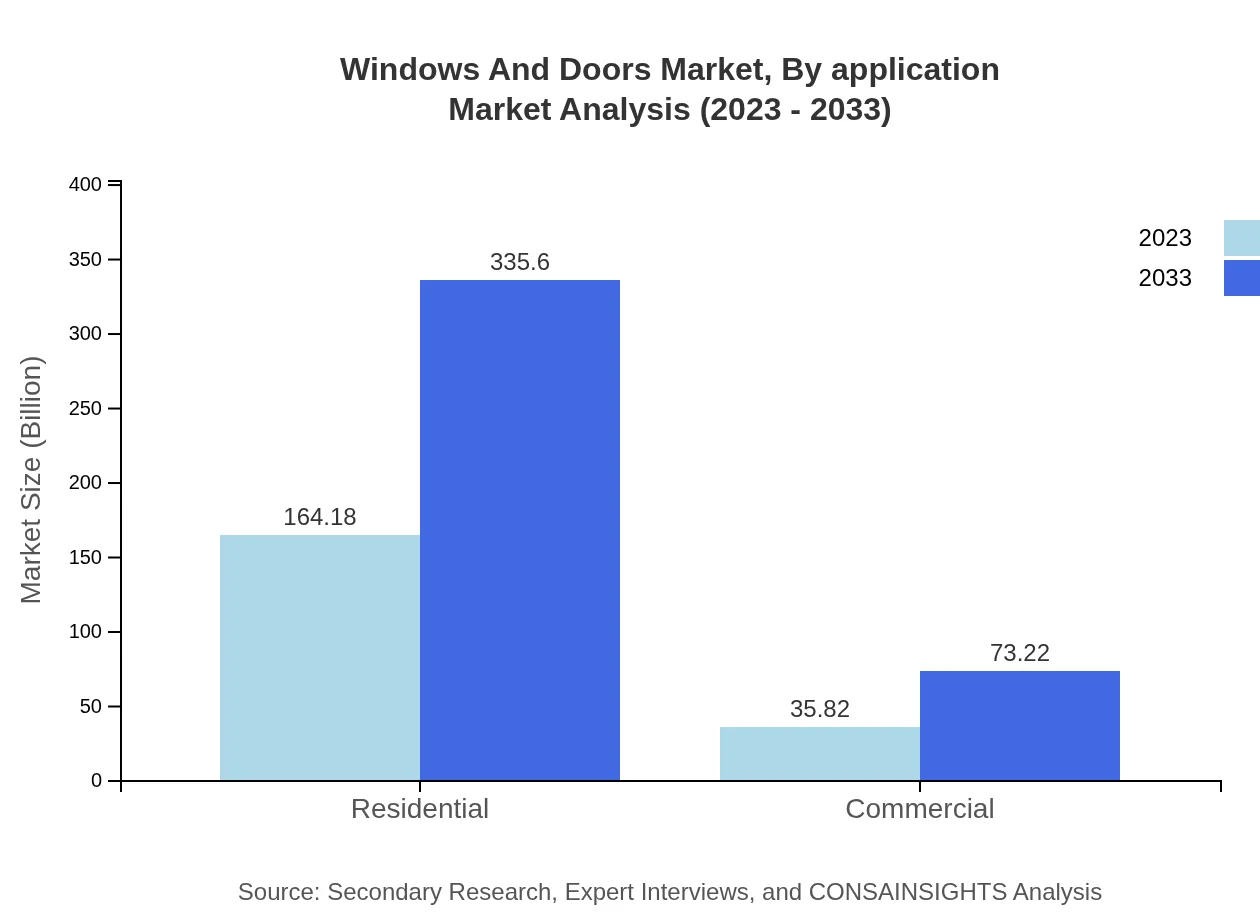

Windows And Doors Market Analysis By Application

The residential segment dominates the Windows and Doors market, projected to grow significantly from USD 164.18 billion in 2023 to USD 335.60 billion by 2033 with an 82.09% market share. The commercial segment, while smaller, is also growing, expected to increase from USD 35.82 billion to USD 73.22 billion. This growth is driven by rapid urbanization and construction activities within cities.

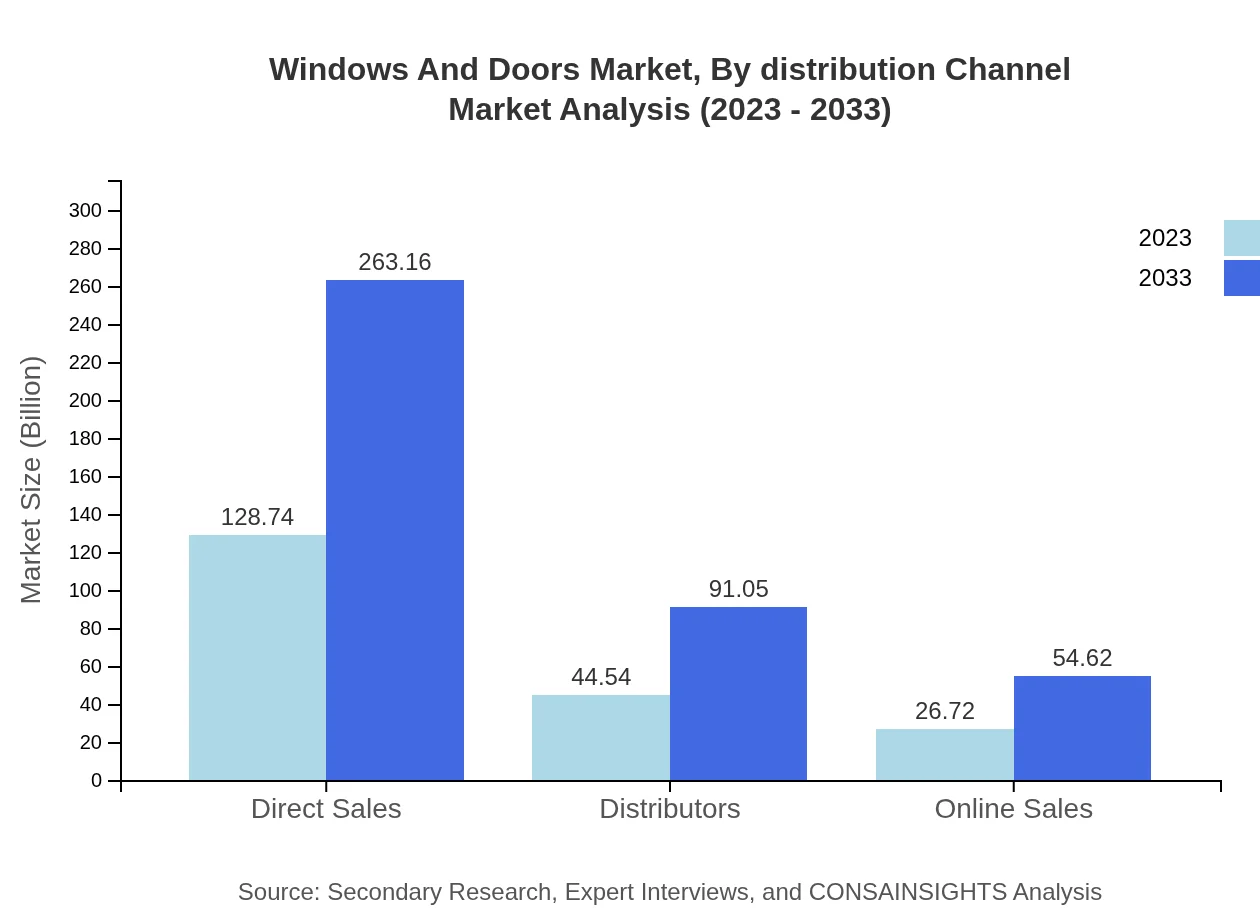

Windows And Doors Market Analysis By Distribution Channel

Direct sales hold the largest share of the market, expected to grow from USD 128.74 billion in 2023 to USD 263.16 billion by 2033, which accounts for 64.37% of the sales channels. Distributors also play a crucial role, anticipated to grow from USD 44.54 billion to USD 91.05 billion, while online sales are gaining traction with growth from USD 26.72 billion to USD 54.62 billion, reflecting changing consumer purchasing behaviors.

Windows And Doors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Windows And Doors Industry

Andersen Corporation:

A leading manufacturer of windows and doors, known for its high-quality products and innovative designs. Andersen focuses on sustainability and energy-efficient solutions.Royal Building Products:

Part of the Axiall Corporation, Royal Building Products offers a wide range of building materials, including windows and doors, emphasizing durability and aesthetic appeal.Pella Corporation:

Pella is renowned for its creative window and door solutions, providing a variety of materials and styles. The company is strongly committed to energy efficiency and consumer satisfaction.Milgard Windows & Doors:

Milgard specializes in high-quality vinyl and fiberglass windows and doors, with a focus on customization and service excellence, providing solutions for residential and commercial needs.Jeld-Wen Holding, Inc.:

Jeld-Wen produces a broad array of windows and doors, recognized for their innovation and energy-efficient products, catering to both homeowners and builders.We're grateful to work with incredible clients.

FAQs

What is the market size of the windows And Doors?

The global windows-and-doors market is currently valued at approximately $200 billion, with an expected compound annual growth rate (CAGR) of 7.2% projected through 2033, indicating sustainable growth in this sector.

What are the key market players or companies in the windows And Doors industry?

Key players in the windows-and-doors industry include major manufacturers and distributors that provide innovative solutions. Notable companies often lead in product diversity, technological advancements, and customer service, ensuring a competitive edge in the evolving market.

What are the primary factors driving the growth in the windows And Doors industry?

The growth is driven by a booming construction sector, increasing demand for energy-efficient products, and smart home innovations. Additionally, rising urbanization and renovation activities significantly contribute to the industry's expansion and modernization.

Which region is the fastest Growing in the windows And Doors?

The fastest-growing region in the windows-and-doors market is North America, which is projected to grow from $77.96 billion in 2023 to $159.36 billion by 2033. This growth is fueled by advancements in technology and increased construction activities.

Does ConsaInsights provide customized market report data for the windows And Doors industry?

Yes, ConsaInsights offers tailored market report data for the windows-and-doors industry, allowing clients to obtain insights that are specifically aligned with their unique business needs and strategic objectives.

What deliverables can I expect from this windows And Doors market research project?

Deliverables typically include comprehensive reports, segmented analyses, market forecasts, and trend evaluations. Clients can also expect visualizations and actionable insights that assist in informed decision-making strategies.

What are the market trends of the windows And Doors?

Trends include a shift toward sustainable materials, integration of smart technology, and customization options for consumers. Additionally, there is significant growth in online sales channels, transforming how products reach consumers.