Wine Market Report

Published Date: 31 January 2026 | Report Code: wine

Wine Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the wine market from 2023 to 2033. It provides insights on market trends, size, CAGR, regional dynamics, industry analysis, product performance, and forecasts to inform stakeholders in making informed decisions.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $423.59 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $754.48 Billion |

| Top Companies | Constellation Brands, Diageo, Pernod Ricard, Treasury Wine Estates, Ruffino |

| Last Modified Date | 31 January 2026 |

Wine Market Overview

Customize Wine Market Report market research report

- ✔ Get in-depth analysis of Wine market size, growth, and forecasts.

- ✔ Understand Wine's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Wine

What is the Market Size & CAGR of Wine market in 2023?

Wine Industry Analysis

Wine Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Wine Market Analysis Report by Region

Europe Wine Market Report:

Europe boasts the largest wine market, anticipated to grow from $119.79 billion in 2023 to $213.37 billion by 2033. Countries like France, Italy, and Spain have long-standing traditions in winemaking, with unique regional specialties that attract both local and international consumers. The growth is fueled by the premiumization trend and evolving tastes among consumers.Asia Pacific Wine Market Report:

The Asia Pacific wine market is expected to grow from $90.14 billion in 2023 to $160.55 billion by 2033. The rise in wine consumption is driven by a burgeoning middle class, a growing interest in wine culture, and an increase in wine education. Countries like China and Japan are leading this consumption trend, particularly for premium and imported wines, which are perceived as status symbols.North America Wine Market Report:

North America remains a substantial market for wine, expected to increase from $143.85 billion in 2023 to $256.22 billion by 2033. The United States is a major contributor, characterized by a robust domestic wine industry, innovative marketing strategies, and an increasing acceptance of diverse wine styles among consumers.South America Wine Market Report:

In South America, the market size is projected to expand from $30.03 billion in 2023 to $53.49 billion by 2033. Countries like Chile and Argentina serve as primary producers and exporters, with their wines gaining international acclaim. Wine tourism plays a significant role in promoting local wines while attracting tourists.Middle East & Africa Wine Market Report:

The Middle East and Africa wine market is forecasted to rise from $39.78 billion in 2023 to $70.85 billion by 2033. This region shows a growing acceptance of wine, particularly among affluent populations looking for luxury experiences, with emerging markets in South Africa leading the growth.Tell us your focus area and get a customized research report.

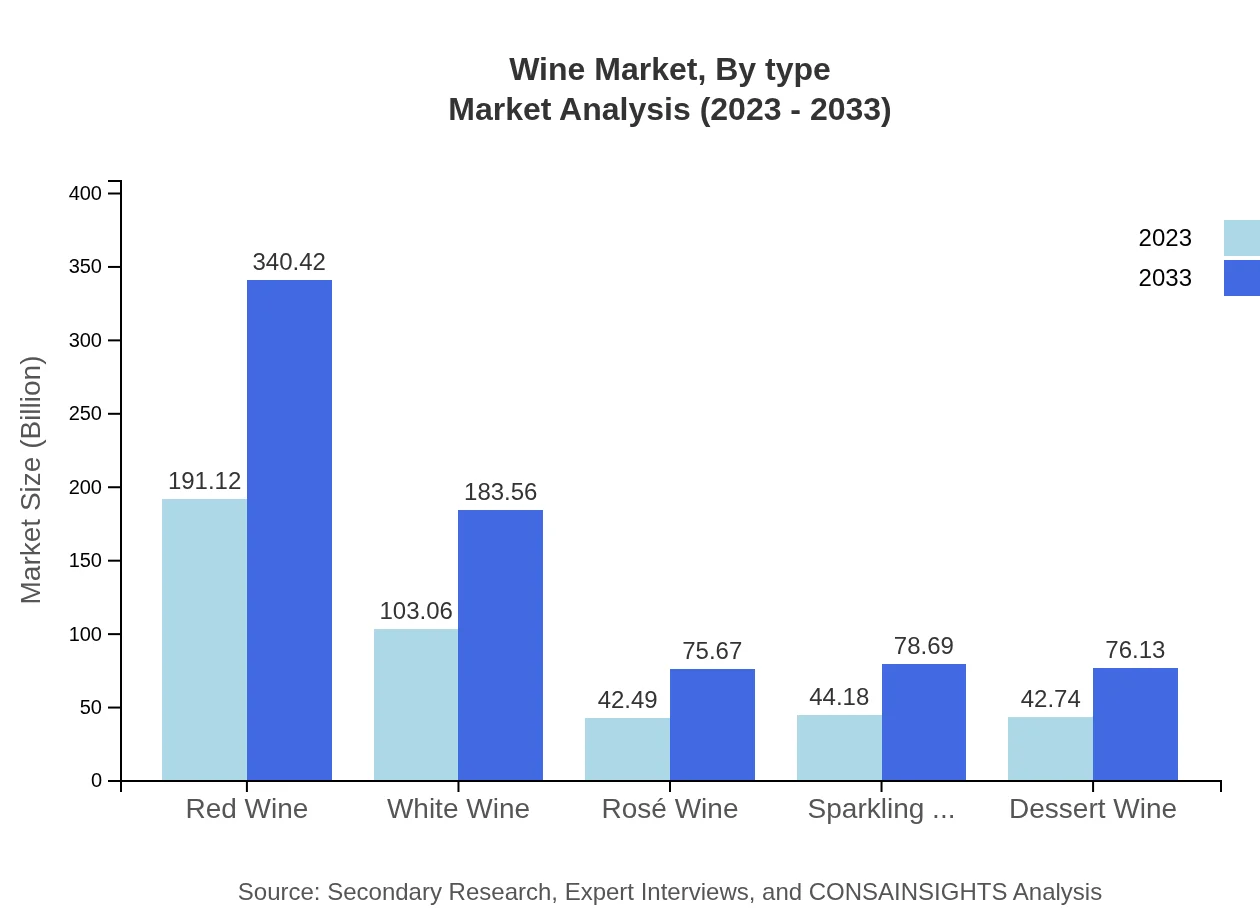

Wine Market Analysis By Type

Red wine represents the largest segment, with a market size of $191.12 billion in 2023 and growth to $340.42 billion by 2033. In contrast, white wine is projected to grow from $103.06 billion to $183.56 billion during the same period. Rosé wines, sparkling wines, and dessert wines also show promising growth rates, with rosé reaching $75.67 billion and sparkling wines $78.69 billion by 2033. This segmentation highlights consumer preferences and the impact of lifestyle choices on purchasing behaviors.

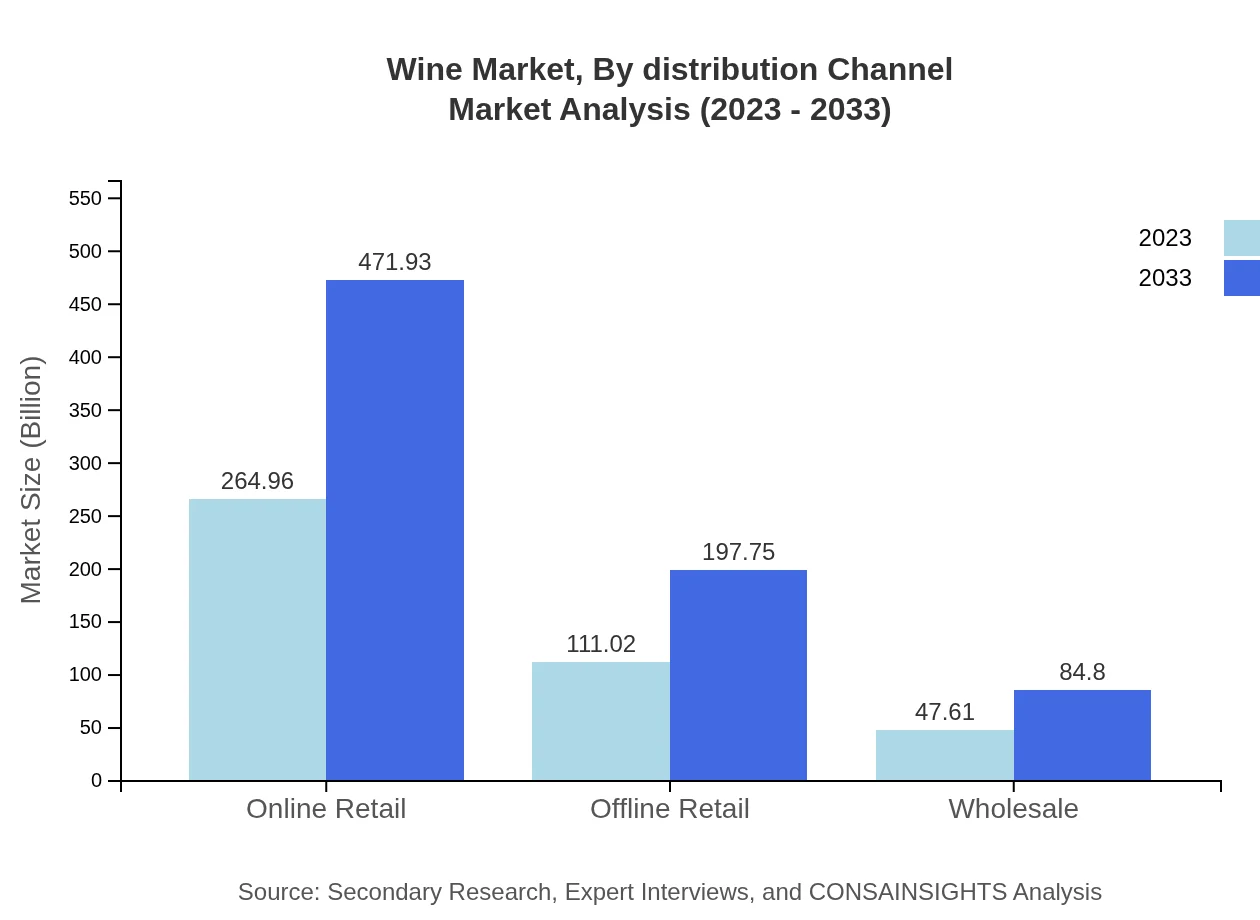

Wine Market Analysis By Distribution Channel

The distribution of wine occurs through various channels, prominently featuring online retail, which is projected to grow from $264.96 billion in 2023 to $471.93 billion by 2033. Offline retail remains significant, with an expected growth from $111.02 billion to $197.75 billion. The wholesale channel has a smaller market size but is essential for distribution to restaurants and bars, expanding from $47.61 billion to $84.80 billion.

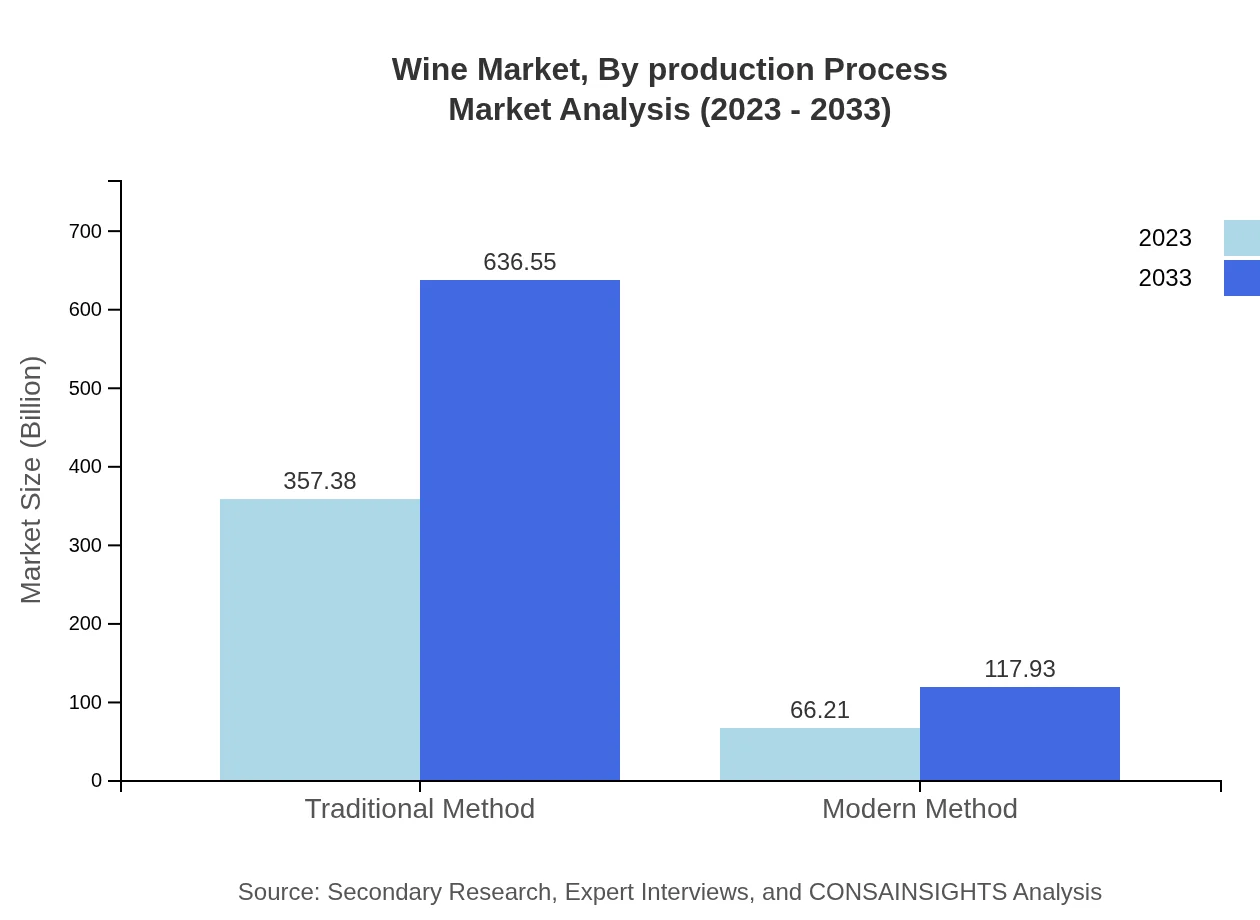

Wine Market Analysis By Production Process

The wine production process is primarily categorized into traditional and modern methods. Traditional methods are predominant, holding a market size of $357.38 billion in 2023 and projected to double to $636.55 billion by 2033. Conversely, modern methods also show growth potential, increasing from $66.21 billion to $117.93 billion. This indicates a balance between heritage techniques and innovative practices in winemaking.

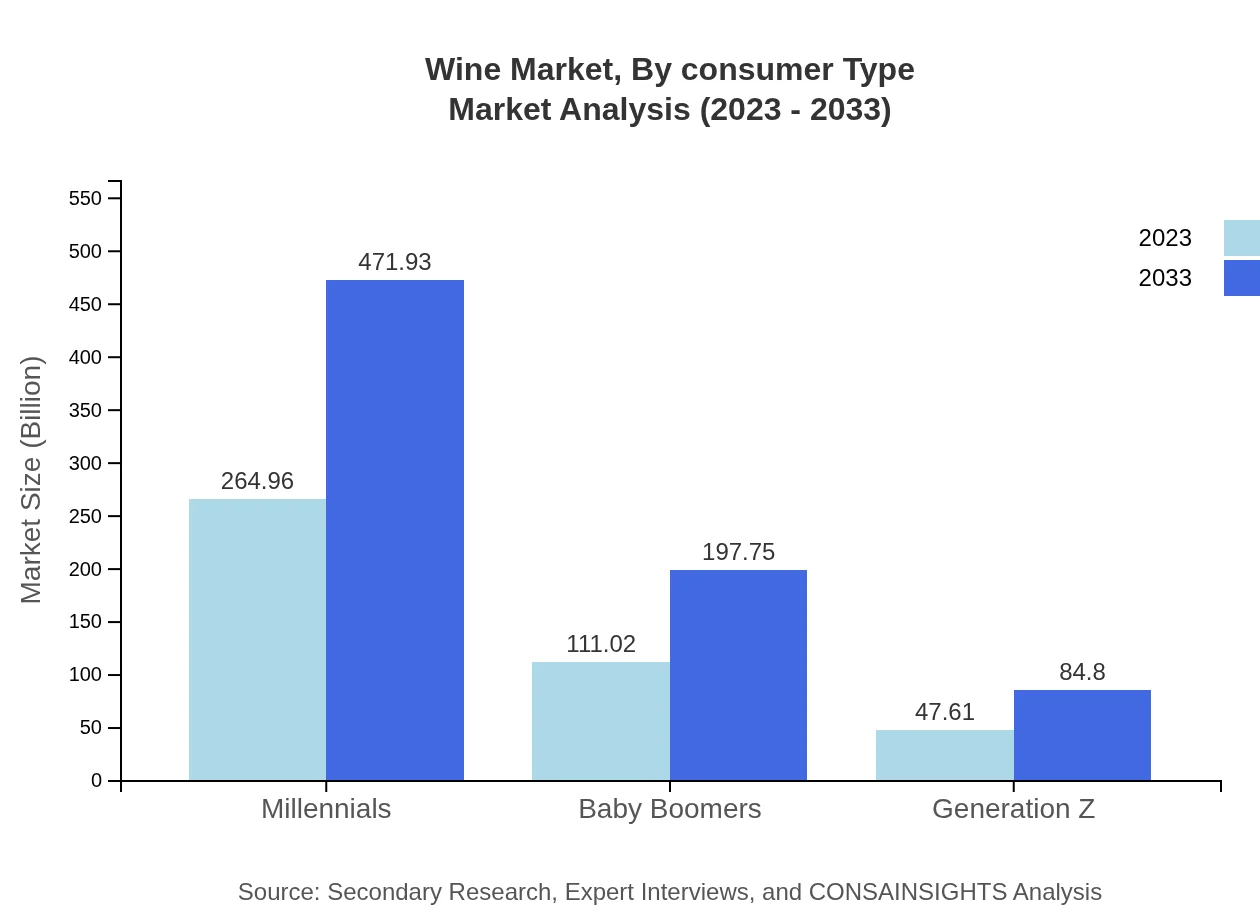

Wine Market Analysis By Consumer Type

The wine market is segmented by consumer demographics, with millennials accounting for $264.96 billion in 2023 and expected to reach $471.93 billion by 2033. By contrast, baby boomers represent a significant segment, with market values of $111.02 billion to $197.75 billion in the same time frame. Generation Z is emerging as a newer audience, projected to grow from $47.61 billion to $84.80 billion, indicating shifts in preferences and marketing strategies.

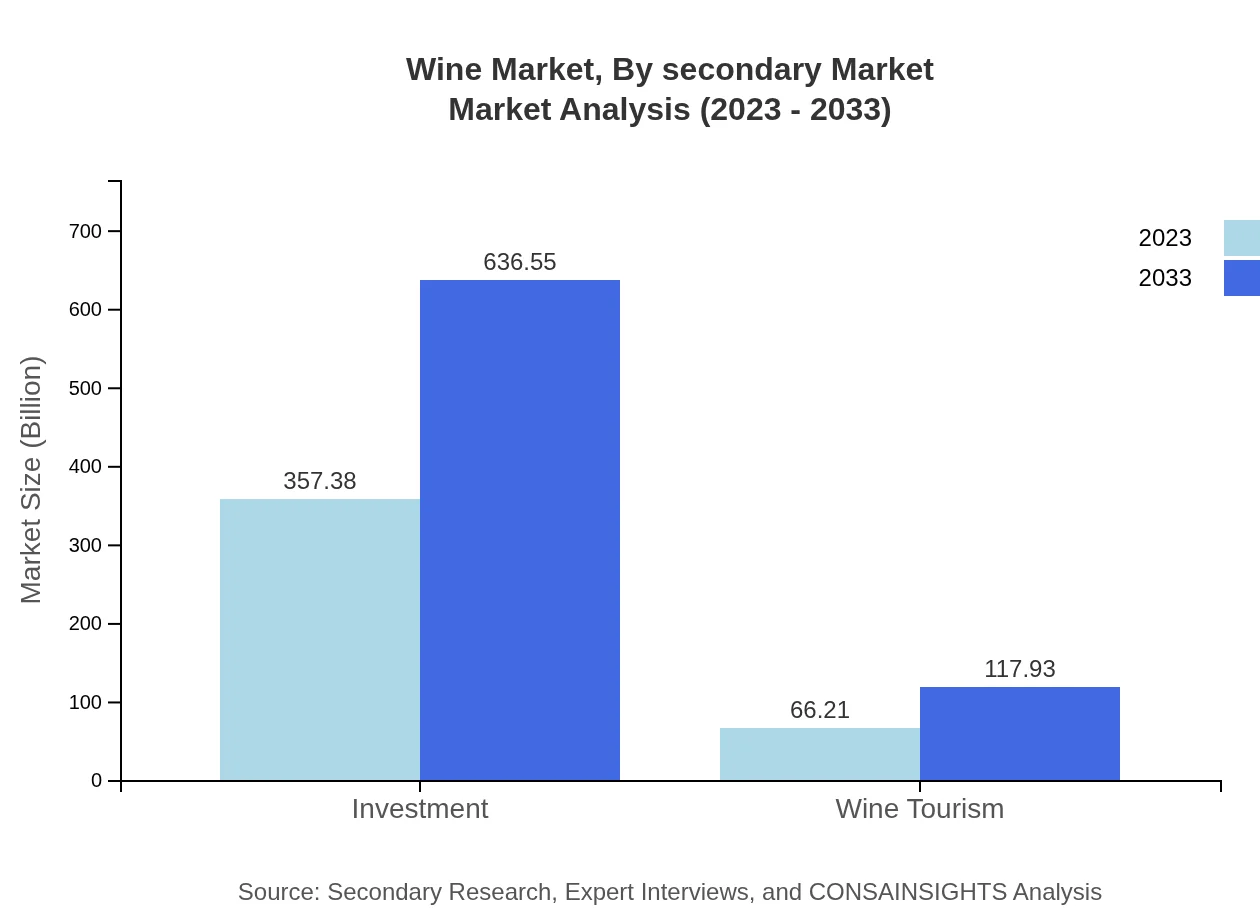

Wine Market Analysis By Secondary Market

Investment in wine, including wine tourism and collectors, constitutes a secondary market valued at $357.38 billion in 2023, expected to grow to $636.55 billion. Wine tourism plays a significant role, growing from $66.21 billion to $117.93 billion, reflecting a rising interest in experiences related to wine production and tasting, influencing overall market dynamics.

Wine Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Wine Industry

Constellation Brands:

A leading international producer and marketer of beer, wine, and spirits, known for its innovative marketing and distribution strategies.Diageo:

A global leader in beverage alcohol, own numerous renowned wine brands and invests heavily in sustainability practices.Pernod Ricard:

A major player with a wide range of wines and spirits; known for strategic acquisitions and innovative product launches.Treasury Wine Estates:

An Australian-based wine company recognized for its high-quality product lines and strong presence in both domestic and international markets.Ruffino:

An established Italian wine producer offering premium wines with a focus on quality and heritage, appealing to both traditional and modern consumers.We're grateful to work with incredible clients.

FAQs

What is the market size of wine?

The global wine market is valued at approximately $423.59 billion in 2023, with an expected CAGR of 5.8%. Projections suggest the market could reach significant figures by 2033, indicating a robust growth trajectory ahead.

What are the key market players or companies in the wine industry?

Key players in the wine industry include renowned companies such as Constellation Brands, E. & J. Gallo Winery, and Treasury Wine Estates. These leaders significantly impact market trends and overall industry dynamics, shaping consumer preferences and innovations.

What are the primary factors driving the growth in the wine industry?

Driving factors for the wine industry's growth include increasing millennial consumption, rising disposable incomes, and a growing interest in wine tourism. These elements combine to enhance market demand and widen consumer bases across regions.

Which region is the fastest Growing in the wine market?

The Asia Pacific region is currently the fastest-growing market for wine. With an estimated market size of $90.14 billion in 2023 and projected growth to $160.55 billion by 2033, it shows promising demand and consumption trends.

Does ConsaInsights provide customized market report data for the wine industry?

Yes, ConsaInsights offers tailored market report data to meet specific needs in the wine industry. These customized reports allow for insights into niche markets, consumer behaviors, and variations in regional dynamics.

What deliverables can I expect from this wine market research project?

Deliverables from this wine market research project typically include comprehensive reports covering market size, growth forecasts, competitive analysis, and segmented data. Custom visuals and data interpretations are also included for better decision-making.

What are the market trends of wine?

Current trends in the wine market include an increase in online retailing, sustainable production methods, and growing consumer interest in premium wines. These trends reflect changing consumer lifestyles and preferences towards personalized and environmentally friendly options.