Wireless In Flight Entertainment W Ife Market Report

Published Date: 31 January 2026 | Report Code: wireless-in-flight-entertainment-w-ife

Wireless In Flight Entertainment W Ife Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Wireless In Flight Entertainment (W IFE) market, focusing on market trends, growth prospects, and competitive landscape from 2023 to 2033.

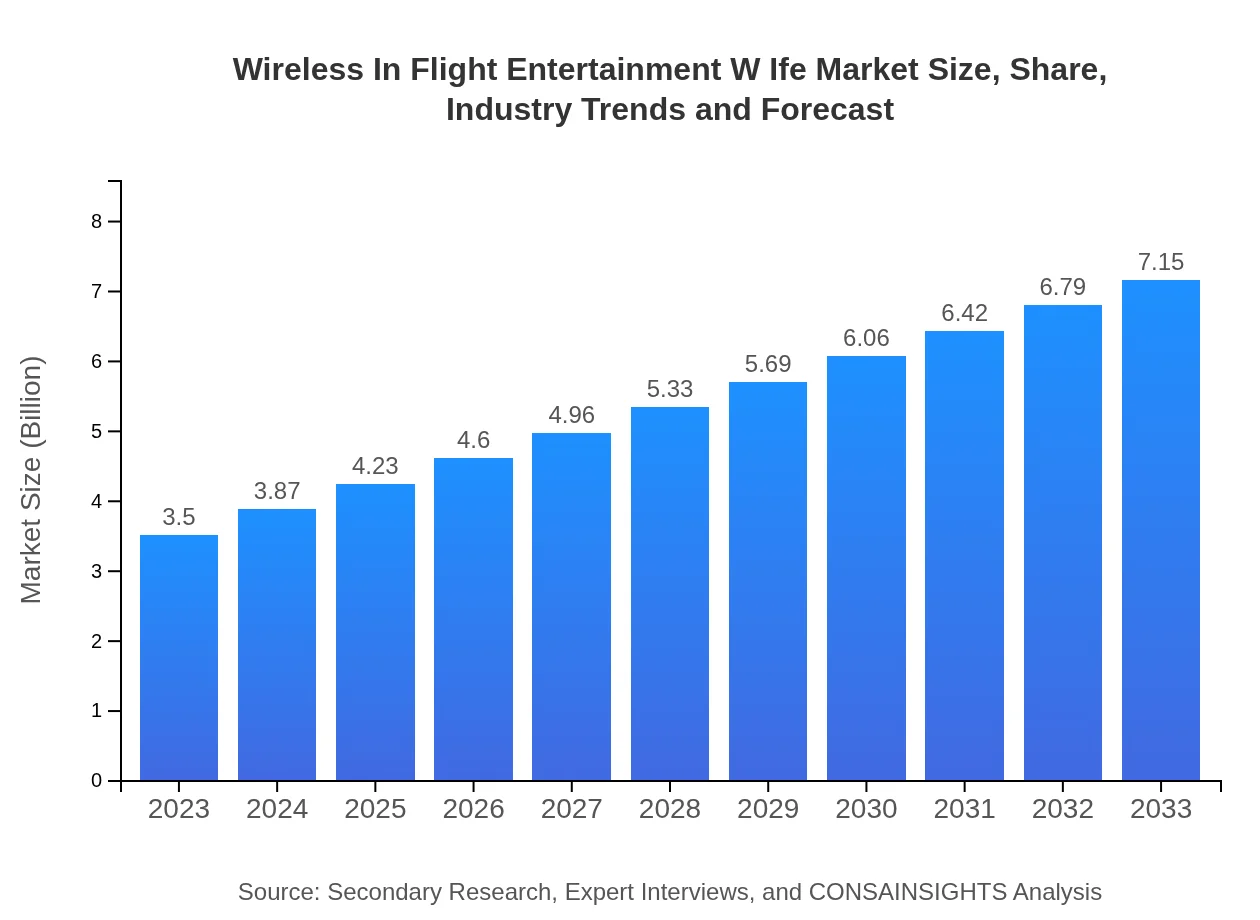

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $7.15 Billion |

| Top Companies | Viasat Inc., Gogo Inc., Inmarsat, Thales Group, Panasonic Avionics Corporation |

| Last Modified Date | 31 January 2026 |

Wireless In Flight Entertainment W Ife Market Overview

Customize Wireless In Flight Entertainment W Ife Market Report market research report

- ✔ Get in-depth analysis of Wireless In Flight Entertainment W Ife market size, growth, and forecasts.

- ✔ Understand Wireless In Flight Entertainment W Ife's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Wireless In Flight Entertainment W Ife

What is the Market Size & CAGR of Wireless In Flight Entertainment W Ife market in 2023?

Wireless In Flight Entertainment W Ife Industry Analysis

Wireless In Flight Entertainment W Ife Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Wireless In Flight Entertainment W Ife Market Analysis Report by Region

Europe Wireless In Flight Entertainment W Ife Market Report:

The European W IFE market is expected to grow from $0.90 billion in 2023 to $1.85 billion in 2033, driven by the industry's focus on digital transformation and innovative passenger services.Asia Pacific Wireless In Flight Entertainment W Ife Market Report:

In the Asia-Pacific region, the W IFE market is projected to grow from $0.72 billion in 2023 to $1.48 billion in 2033. The rapid expansion of the airline industry and increasing demand for enhanced passenger services are key growth drivers.North America Wireless In Flight Entertainment W Ife Market Report:

North America is the largest market, with revenue anticipated to rise from $1.19 billion in 2023 to $2.44 billion by 2033. The region's significant investments in W IFE systems and high consumer demand for connectivity are pivotal.South America Wireless In Flight Entertainment W Ife Market Report:

The South American W IFE market is expected to increase from $0.27 billion in 2023 to $0.54 billion in 2033. Growth in this region is propelled by improvements in airline infrastructure and rising air travel.Middle East & Africa Wireless In Flight Entertainment W Ife Market Report:

For the Middle East and Africa, the W IFE market is projected to reach $0.41 billion in 2023 and grow to $0.84 billion by 2033. Investment in tourism and expanding airline services play a crucial role in this region.Tell us your focus area and get a customized research report.

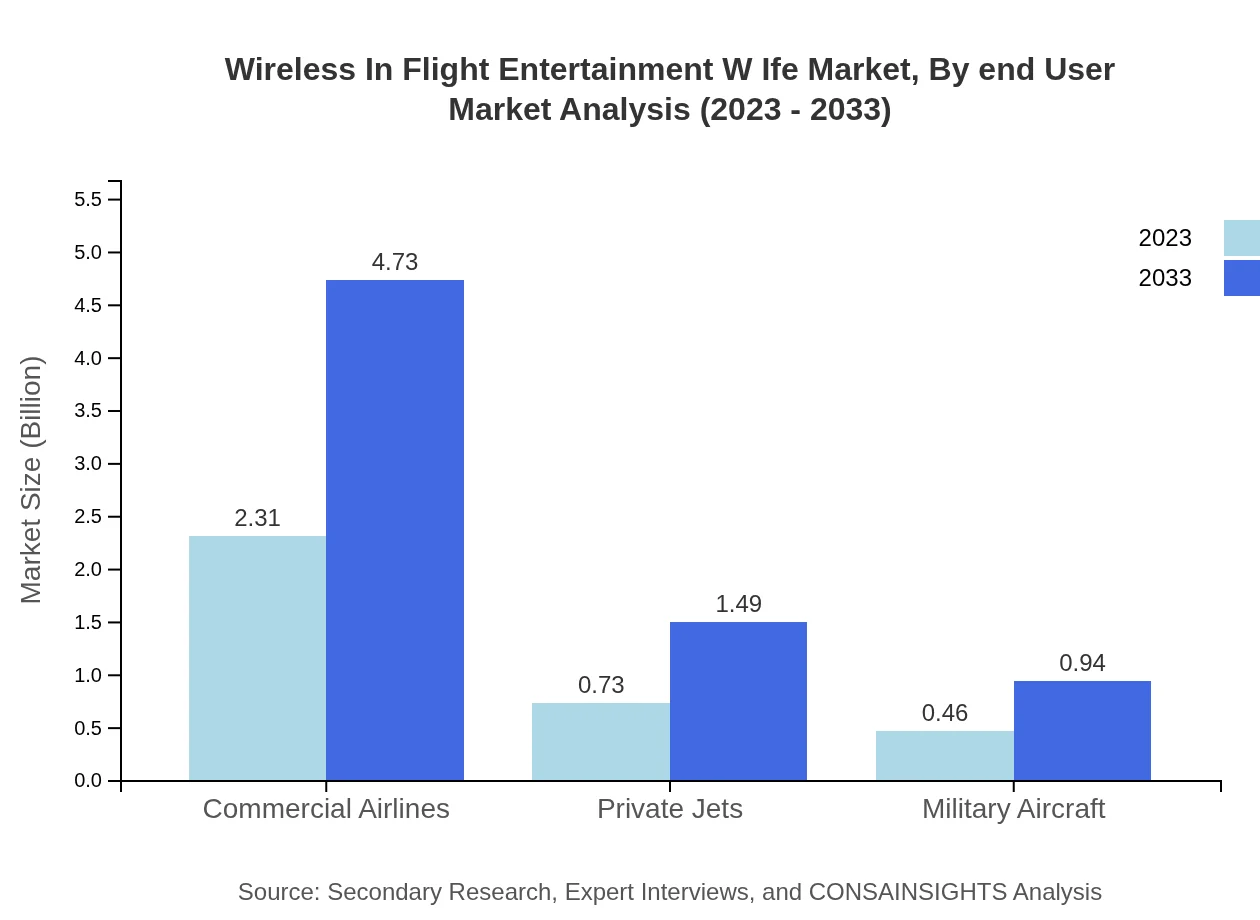

Wireless In Flight Entertainment W Ife Market Analysis By End User

The market is segmented by end-user into commercial airlines, private jets, and military aircraft. Commercial airlines lead with a market size of $2.31 billion in 2023 and expected growth to $4.73 billion in 2033, maintaining a market share of 66.14%. Private jets and military aircraft are also significant, with sizes of $0.73 billion and $0.46 billion in 2023, respectively.

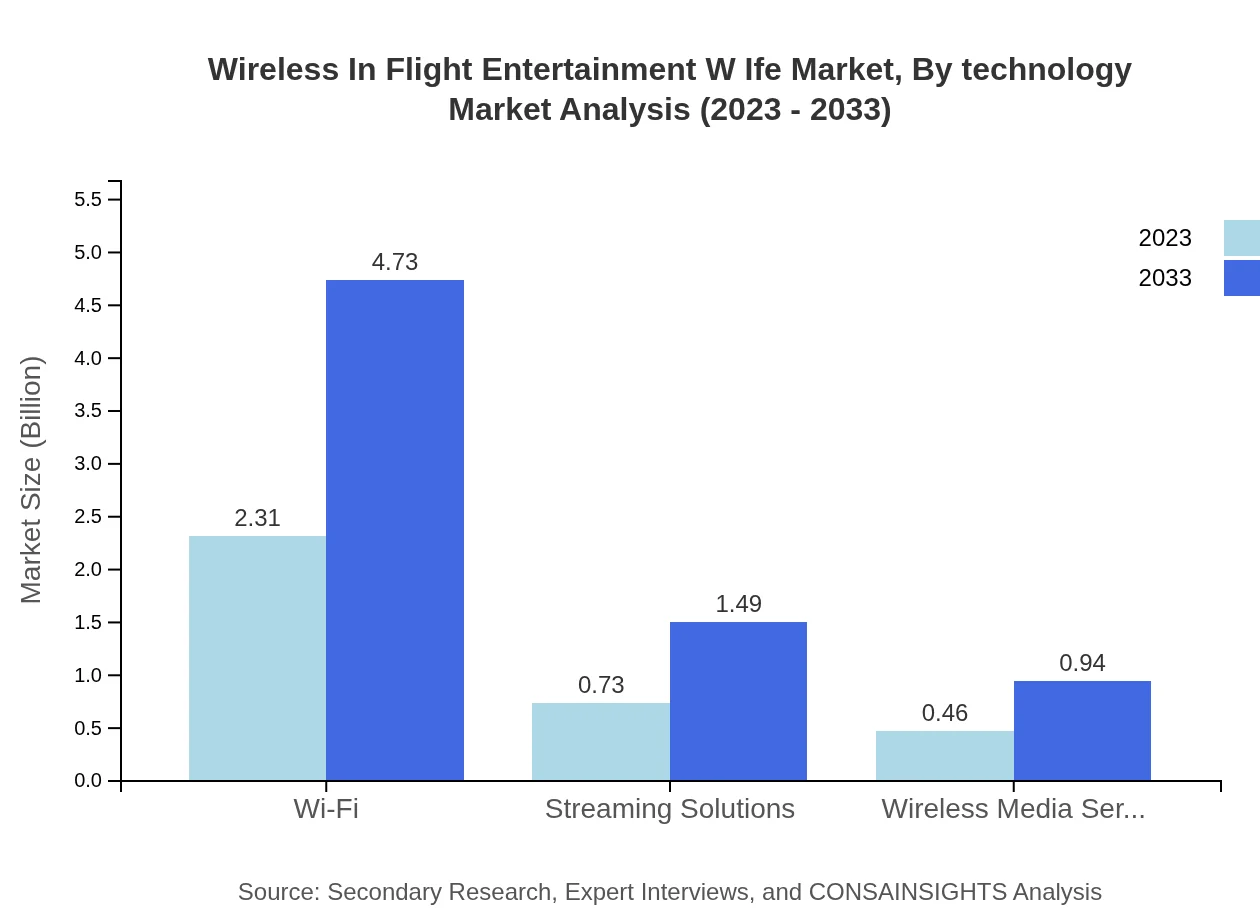

Wireless In Flight Entertainment W Ife Market Analysis By Technology

The W IFE market is largely defined by technology segmentation, featuring solutions like Wi-Fi, streaming platforms, and wireless media servers which ensure seamless entertainment experiences. Wi-Fi remains dominant, reflecting an industry size of $2.31 billion in 2023 and growing to $4.73 billion in 2033.

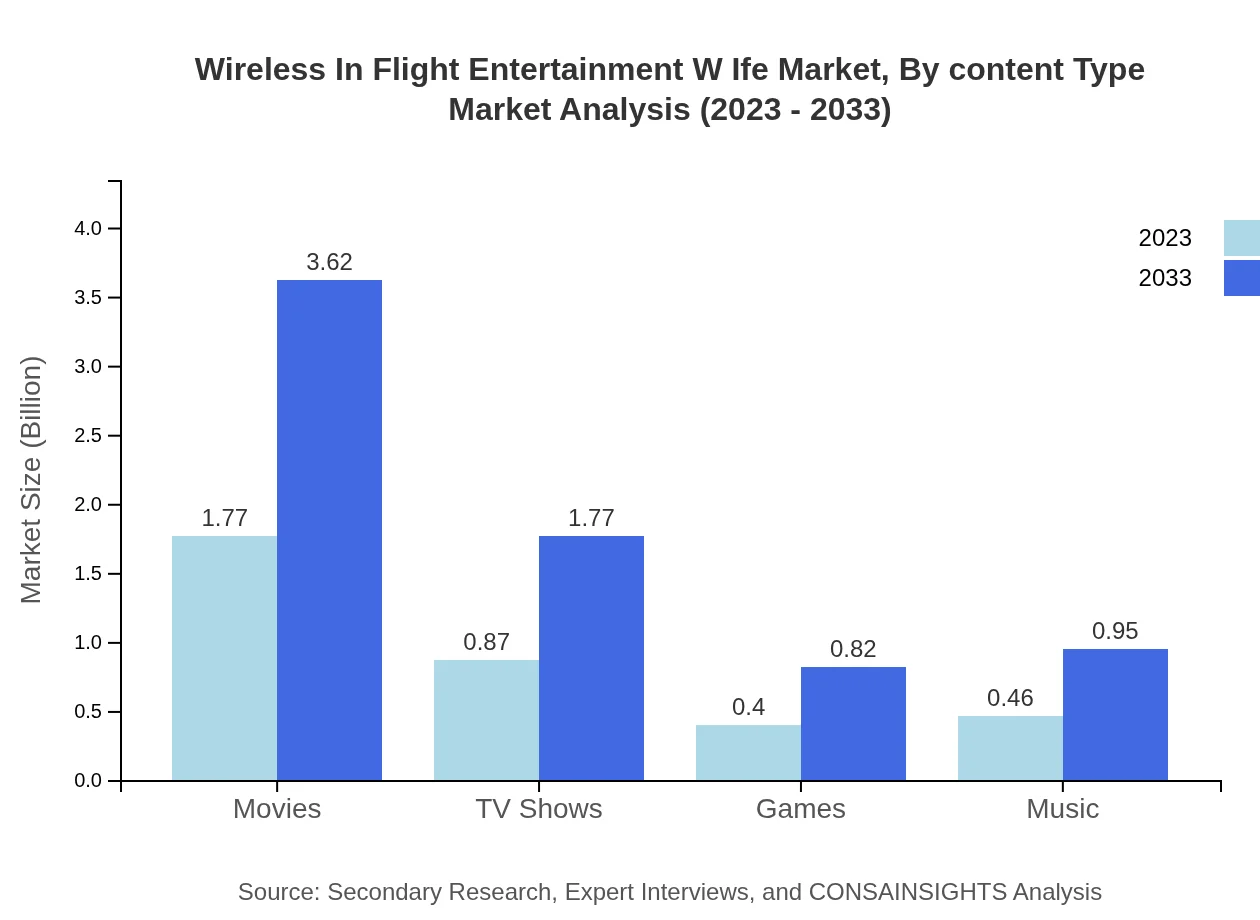

Wireless In Flight Entertainment W Ife Market Analysis By Content Type

Content types in the W IFE market include movies, TV shows, games, and music. Movies lead the category with a market size of $1.77 billion in 2023, which is expected to reach $3.62 billion by 2033, capturing a significant share of 50.59%.

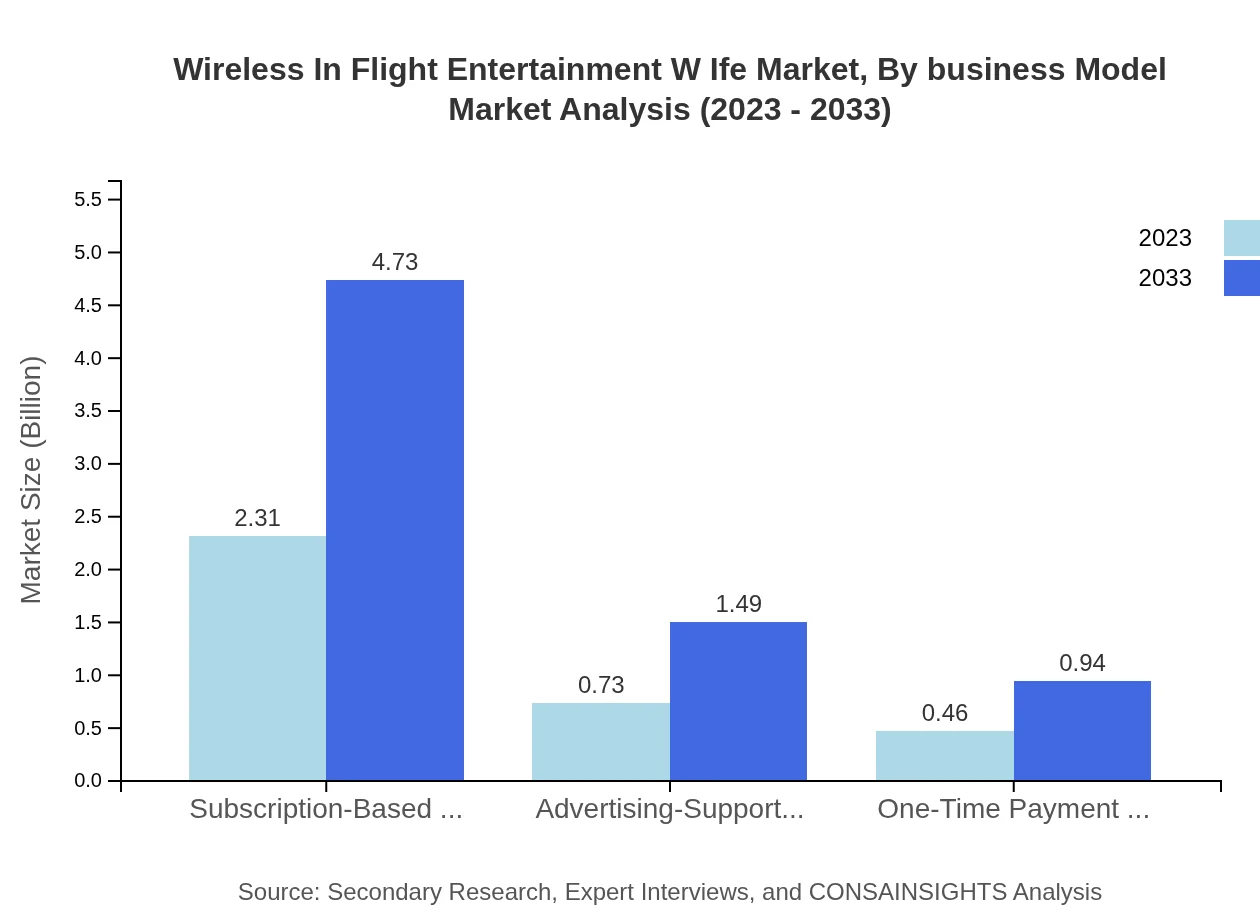

Wireless In Flight Entertainment W Ife Market Analysis By Business Model

Business model segmentation reveals major frameworks like subscription-based, advertising-supported, and one-time payment models. Subscription-based models dominate with a 66.14% market share and a size expectation of $2.31 billion in 2023, expanding to $4.73 billion in 2033.

Wireless In Flight Entertainment W Ife Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Wireless In Flight Entertainment W Ife Industry

Viasat Inc.:

A leader in satellite communications, Viasat offers high-speed internet services for airlines, enhancing passenger connectivity.Gogo Inc.:

Gogo is a significant provider of wireless inflight internet and entertainment services, delivering advanced technology solutions to airlines.Inmarsat:

Inmarsat specializes in global satellite communications, providing inflight connectivity solutions to improve the passenger experience.Thales Group:

Thales contributes to the market with innovative inflight entertainment systems that cater to passenger demands for upscale content.Panasonic Avionics Corporation:

Panasonic is a major player in the IFE market, offering comprehensive solutions including connectivity, software, and content development.We're grateful to work with incredible clients.

FAQs

What is the market size of wireless in Flight entertainment (IFE)?

The global wireless in-flight entertainment (IFE) market is valued at approximately $3.5 billion in 2023 and is projected to grow at a CAGR of 7.2%, reaching significant heights by 2033.

What are the key market players or companies in the wireless in Flight entertainment (IFE) industry?

Key players in the wireless IFE industry include major companies such as Panasonic Avionics Corporation, Gogo Inc., Viasat Inc., and Thales Group, driving innovation and competition in the market.

What are the primary factors driving the growth in the wireless in Flight entertainment (IFE) industry?

The growth in the wireless IFE industry is primarily driven by increased passenger demand for connectivity, advancements in technology, and airlines seeking to enhance passenger experience through diverse entertainment options.

Which region is the fastest Growing in the wireless in Flight entertainment (IFE) industry?

The Asia Pacific region is the fastest-growing in the wireless IFE industry, with a market growth from $0.72 billion in 2023 to approximately $1.48 billion by 2033, indicating robust expansion.

Does ConsaInsights provide customized market report data for the wireless in Flight entertainment (IFE) industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the wireless IFE industry, allowing clients to focus on their unique research requirements and insights.

What deliverables can I expect from this wireless in Flight entertainment (IFE) market research project?

Deliverables from the wireless IFE market research project typically include comprehensive market analysis, regional insights, segment dynamics, trends, forecasts, and strategic recommendations to inform business decisions.

What are the market trends of wireless in Flight entertainment (IFE)?

Current trends in the wireless IFE market emphasize personalization of content, integration of streaming services, and the move towards subscription-based models, reflecting changing consumer preferences and technology advancements.