Wireless Occupancy Sensors Market Report

Published Date: 22 January 2026 | Report Code: wireless-occupancy-sensors

Wireless Occupancy Sensors Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Wireless Occupancy Sensors market from 2023 to 2033, including market size, growth trends, segment analyses, and regional insights, supporting stakeholders in making informed business decisions.

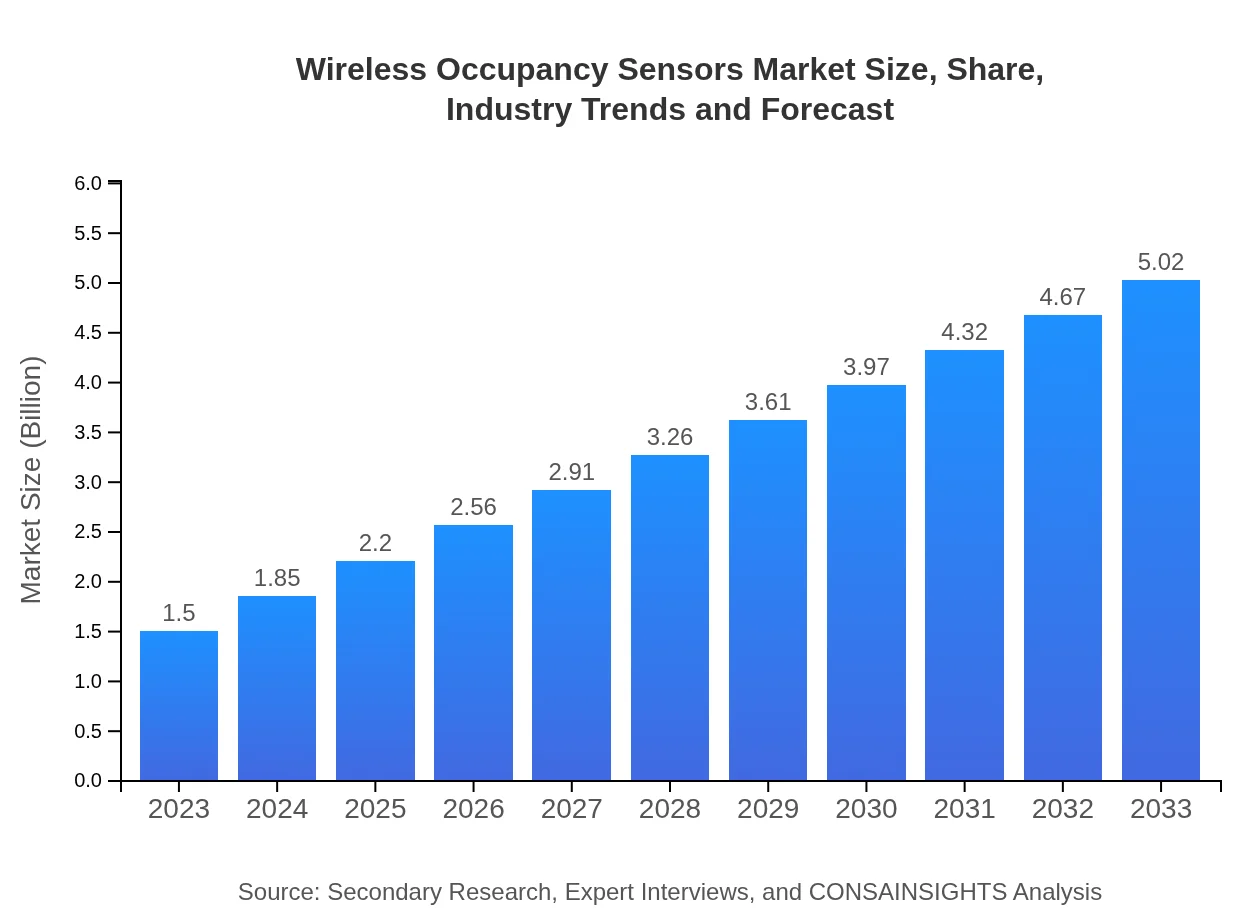

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 12.3% |

| 2033 Market Size | $5.02 Billion |

| Top Companies | Philips Lighting, Honeywell , Lutron Electronics, Schneider Electric |

| Last Modified Date | 22 January 2026 |

Wireless Occupancy Sensors Market Overview

Customize Wireless Occupancy Sensors Market Report market research report

- ✔ Get in-depth analysis of Wireless Occupancy Sensors market size, growth, and forecasts.

- ✔ Understand Wireless Occupancy Sensors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Wireless Occupancy Sensors

What is the Market Size & CAGR of Wireless Occupancy Sensors market in 2023?

Wireless Occupancy Sensors Industry Analysis

Wireless Occupancy Sensors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Wireless Occupancy Sensors Market Analysis Report by Region

Europe Wireless Occupancy Sensors Market Report:

Europe's market is anticipated to grow from $0.49 billion in 2023 to $1.63 billion by 2033, attributed to the robust adoption of IoT devices and the EU's commitment to reducing carbon emissions and enhancing energy efficiency across all sectors.Asia Pacific Wireless Occupancy Sensors Market Report:

The Asia Pacific region is projected to witness significant growth, expanding from $0.27 billion in 2023 to $0.90 billion by 2033. The market growth in this region is fueled by rapid urbanization, the development of smart cities, and increased investments in automation and smart technologies.North America Wireless Occupancy Sensors Market Report:

North America holds a significant market share, expected to rise from $0.52 billion in 2023 to $1.75 billion by 2033. The growing demand for smart home technologies, alongside stringent regulations on energy efficiency in commercial properties, is driving this growth.South America Wireless Occupancy Sensors Market Report:

In South America, the market is expected to grow from $0.06 billion in 2023 to $0.20 billion by 2033. Growth is supported by increasing government initiatives for energy conservation and the rise of smart building projects across major cities.Middle East & Africa Wireless Occupancy Sensors Market Report:

The Middle East and Africa market is projected to increase from $0.16 billion in 2023 to $0.54 billion by 2033. The growth is largely driven by rising investments in infrastructure development and smart city initiatives in emerging economies.Tell us your focus area and get a customized research report.

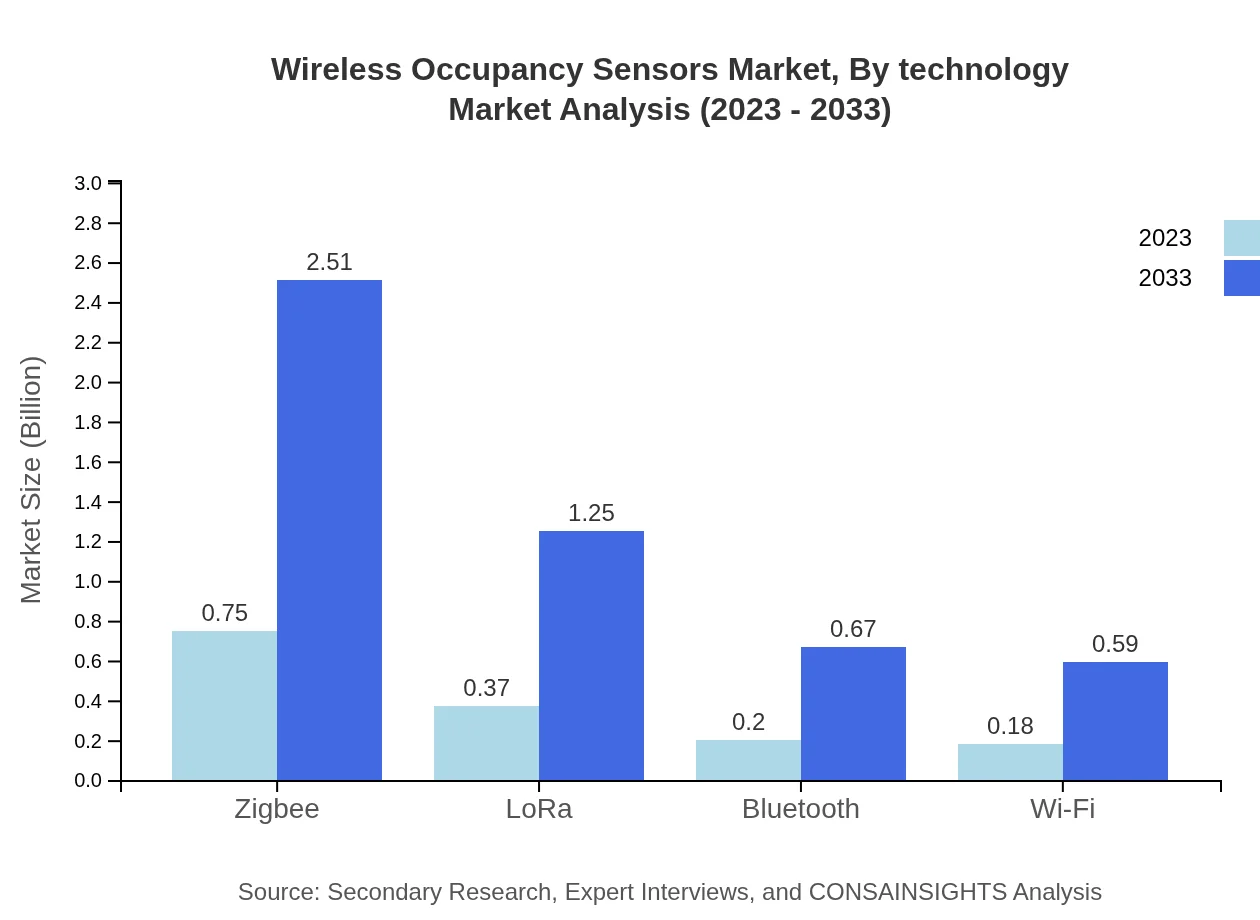

Wireless Occupancy Sensors Market Analysis By Technology

The segmentation by technology reveals Zigbee as a leader with a market size of $0.75 billion in 2023 and projected growth to $2.51 billion by 2033, commanding a 50.05% share due to its energy efficiency. LoRa follows with $0.37 billion, expected to grow to $1.25 billion, holding a 24.97% market share. Bluetooth and Wi-Fi technologies also maintain significant positions, accounting for 13.27% and 11.71% shares respectively in their respective segments.

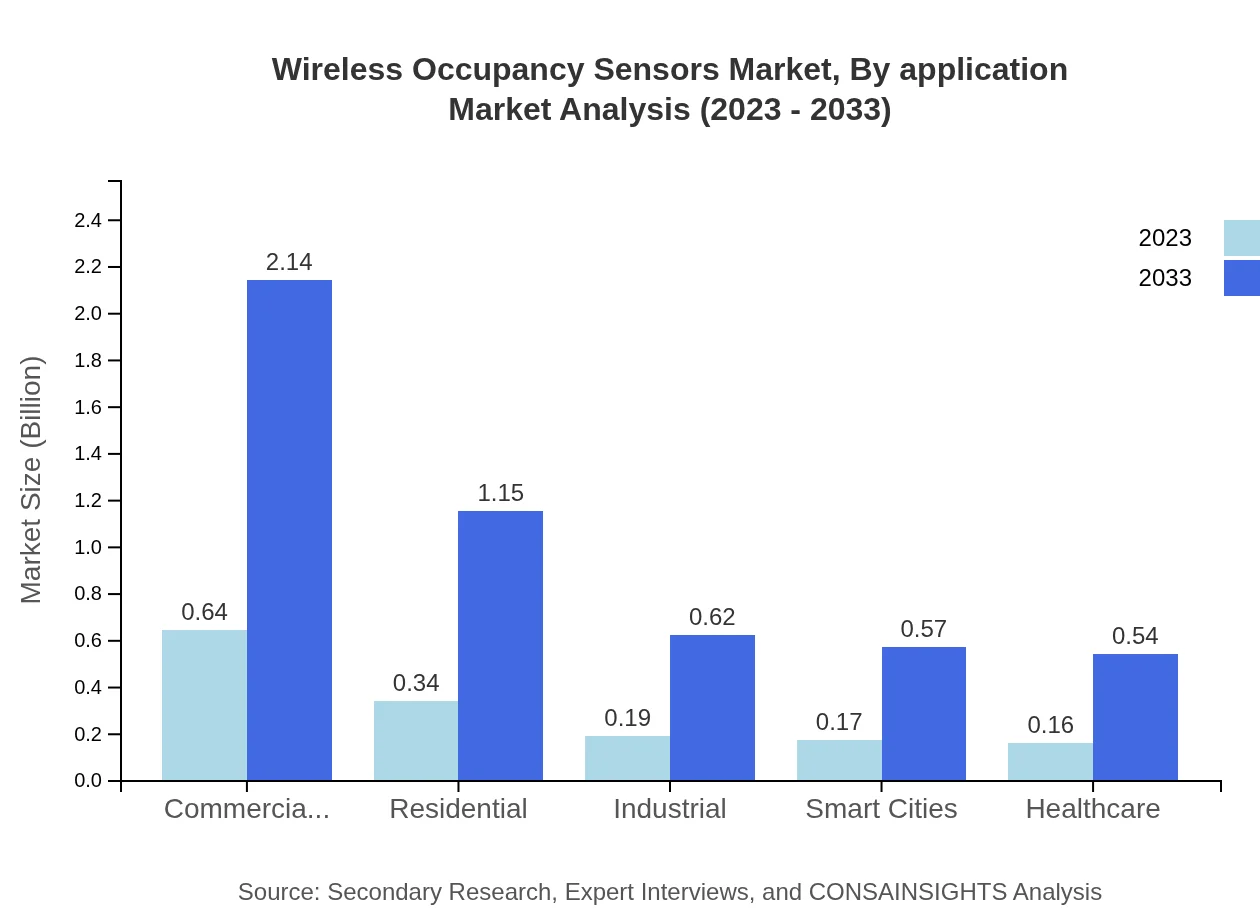

Wireless Occupancy Sensors Market Analysis By Application

In terms of application, the commercial sector shows strong performance with a size of $0.75 billion in 2023, projected to grow to $2.51 billion, representing 50.05% of the market. The residential sector holds $0.37 billion, with forecasts indicating an increase to $1.25 billion by 2033. Additionally, segments like education and healthcare are expanding, driven by a growing emphasis on smart technology integration.

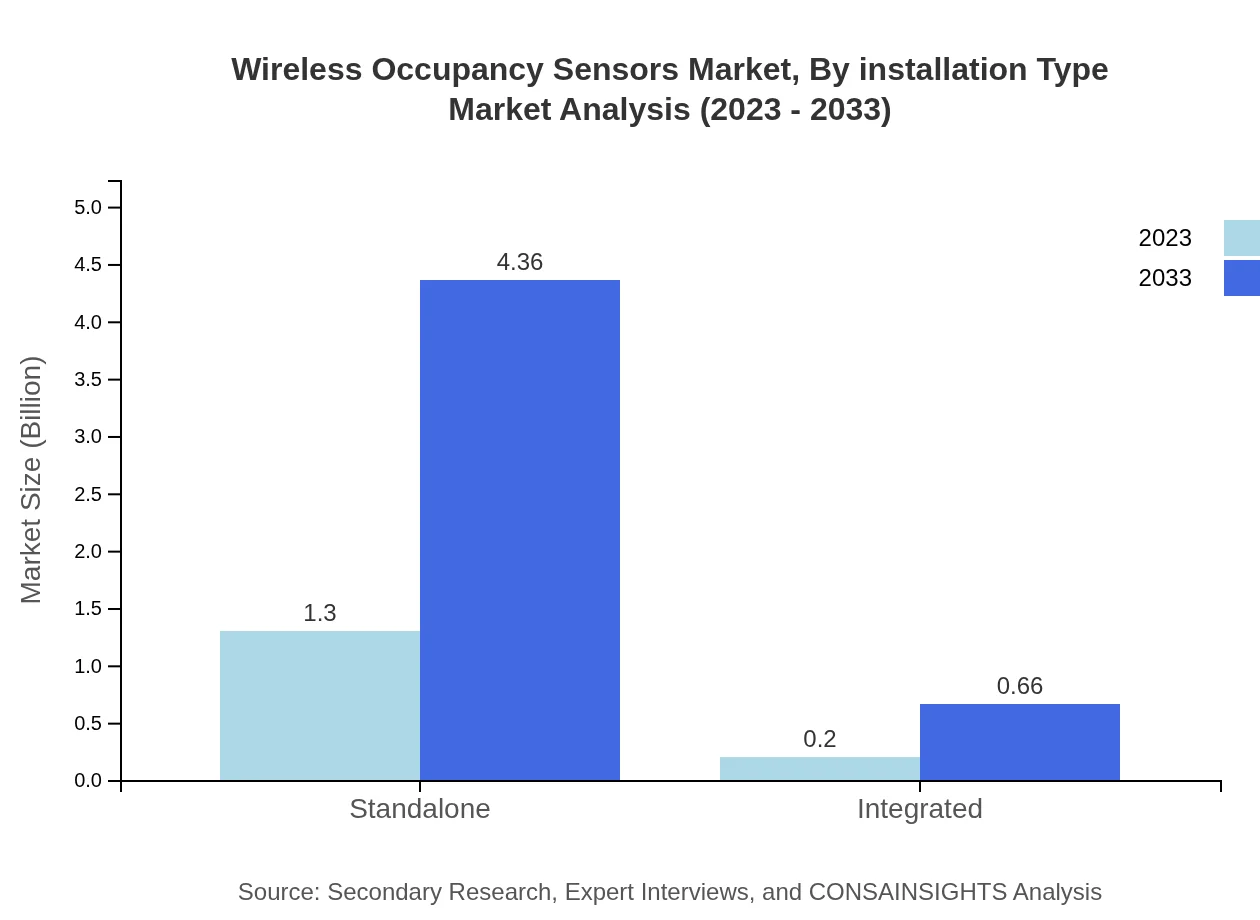

Wireless Occupancy Sensors Market Analysis By Installation Type

The Standalone installation type dominates the market, with a value of $1.30 billion in 2023 and anticipated growth to $4.36 billion by 2033, maintaining an 86.81% market share. Integrated systems are also growing, forecasted from $0.20 billion to $0.66 billion, garnering a 13.19% share due to rising demand for more complex building management systems.

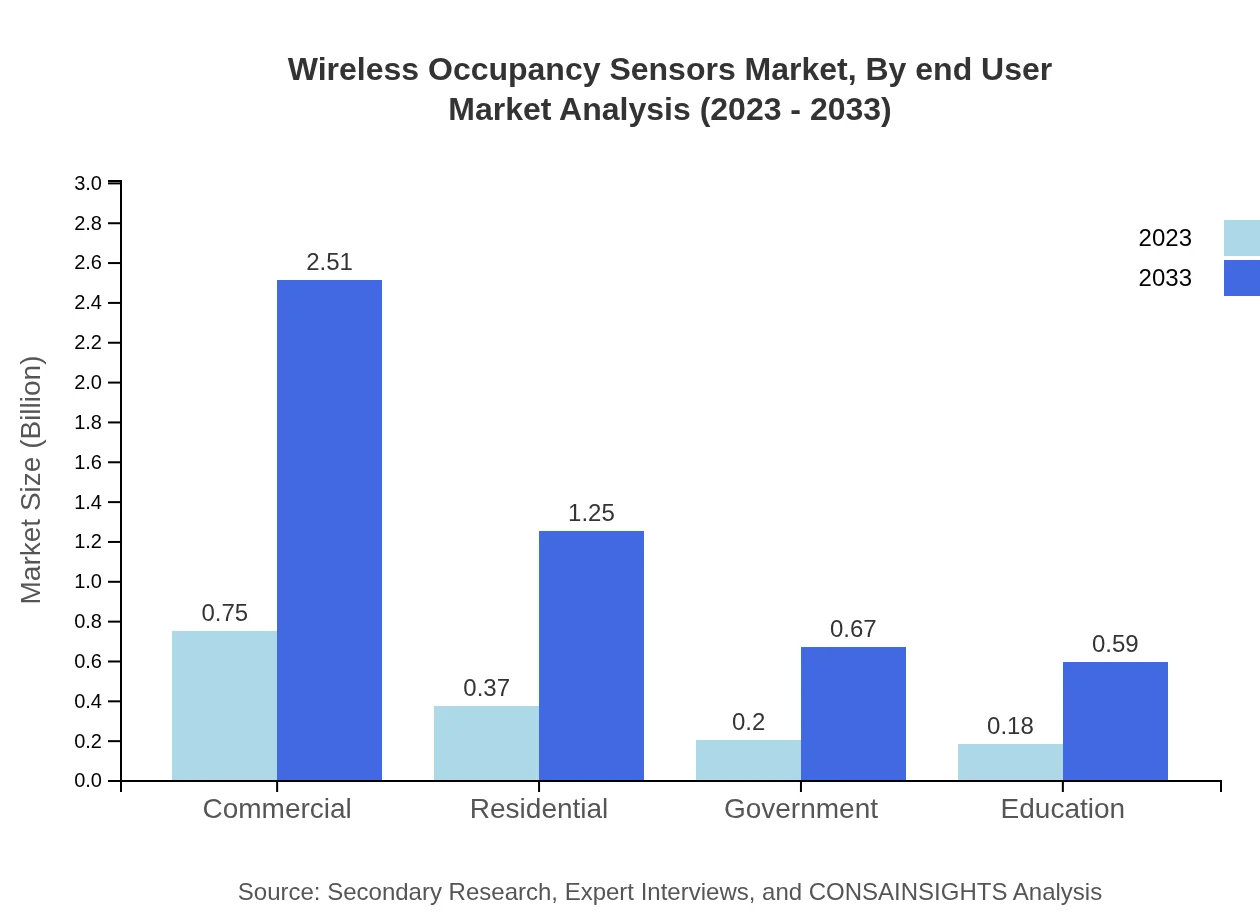

Wireless Occupancy Sensors Market Analysis By End User

Each end-user segment showcases distinct characteristics, with commercial buildings asserting dominance by contributing significantly to the market size. As organizations increasingly adopt energy-efficient solutions in sectors such as healthcare and education, the statistics reflect a promising trajectory for future growth in these areas.

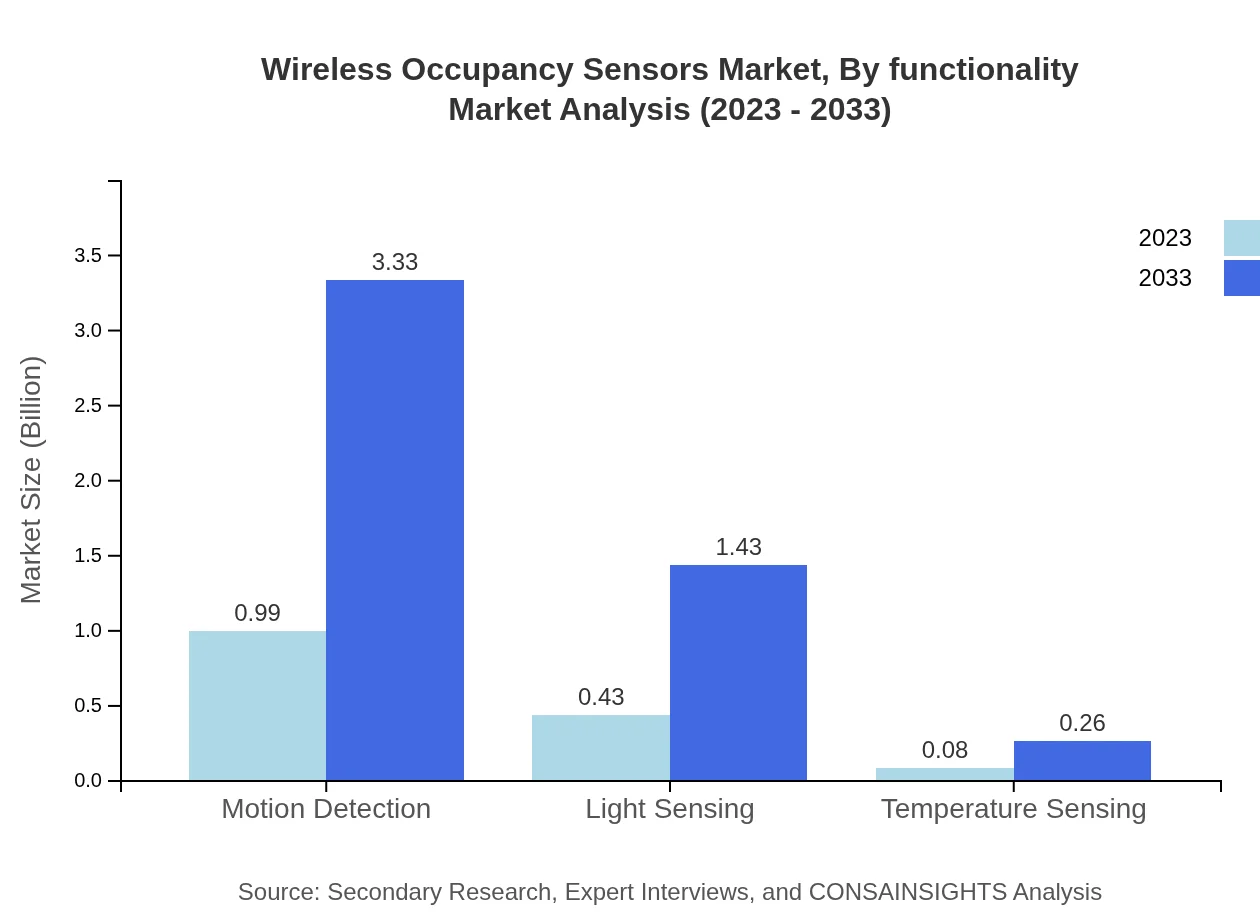

Wireless Occupancy Sensors Market Analysis By Functionality

Functionality plays a vital role in the market, particularly in areas like Motion Detection, which is currently valued at $0.99 billion, expected to rise to $3.33 billion by 2033. Light and temperature sensing functionalities are also essential, as they contribute significantly to energy efficiency and comfort in smart environments.

Wireless Occupancy Sensors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Wireless Occupancy Sensors Industry

Philips Lighting:

A global leader in lighting and connected lighting solutions, Philips Lighting focuses on smart systems that enhance building efficiency through advanced occupancy sensors.Honeywell :

Honeywell is a major player in the building management sector, providing innovative occupancy sensor solutions integrated into their comprehensive smart building technologies.Lutron Electronics:

Lutron is renowned for its advanced controls systems, including occupancy sensors designed to work seamlessly with their lighting solutions.Schneider Electric:

A leader in energy management and automation, Schneider offers a range of essential occupancy sensor solutions that support sustainability and operational efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of wireless Occupancy Sensors?

The wireless occupancy sensors market is projected to achieve a size of approximately $1.5 billion by 2033, growing with a CAGR of 12.3% from 2023. This significant growth reflects increasing demand for energy-efficient solutions.

What are the key market players or companies in this wireless Occupancy Sensors industry?

Key companies in the wireless occupancy sensors industry include major players like Philips, Johnson Controls, Honeywell, and Siemens. These companies are known for their innovative solutions and strong market presence, driving advancements in smart sensor technologies.

What are the primary factors driving the growth in the wireless Occupancy Sensors industry?

The growth in the wireless occupancy sensors industry is primarily driven by the increasing focus on energy conservation and smart building technologies, along with rising demand for automated solutions. Additionally, enhanced technological advancements and urbanization fuel market expansion.

Which region is the fastest Growing in the wireless Occupancy Sensors?

The fastest-growing region in the wireless occupancy sensors market is North America, expected to increase from $0.52 billion in 2023 to $1.75 billion by 2033. This growth is driven by technological adoption and substantial investments in smart building infrastructure.

Does ConsaInsights provide customized market report data for the wireless Occupancy Sensors industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the wireless occupancy sensors industry. Clients can request detailed insights and analytics based on unique requirements, ensuring they receive targeted market information.

What deliverables can I expect from this wireless Occupancy Sensors market research project?

From the wireless occupancy sensors market research project, clients can expect comprehensive reports, including market size analysis, regional data, competitive landscape, and trend analyses, along with graphical representations for better comprehension of the data.

What are the market trends of wireless Occupancy Sensors?

Current trends in the wireless occupancy sensors market include the increasing integration of IoT technologies, a shift towards fully automated systems, and rising consumer preference for smart home solutions. This progression ensures enhanced user experiences and operational efficiencies.