Wireless Pos Terminal Market Report

Published Date: 31 January 2026 | Report Code: wireless-pos-terminal

Wireless Pos Terminal Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Wireless POS Terminal market from 2023 to 2033, exploring market size, trends, and regional insights. It includes detailed forecasts, segmentation analysis, and profiles of leading companies in the industry.

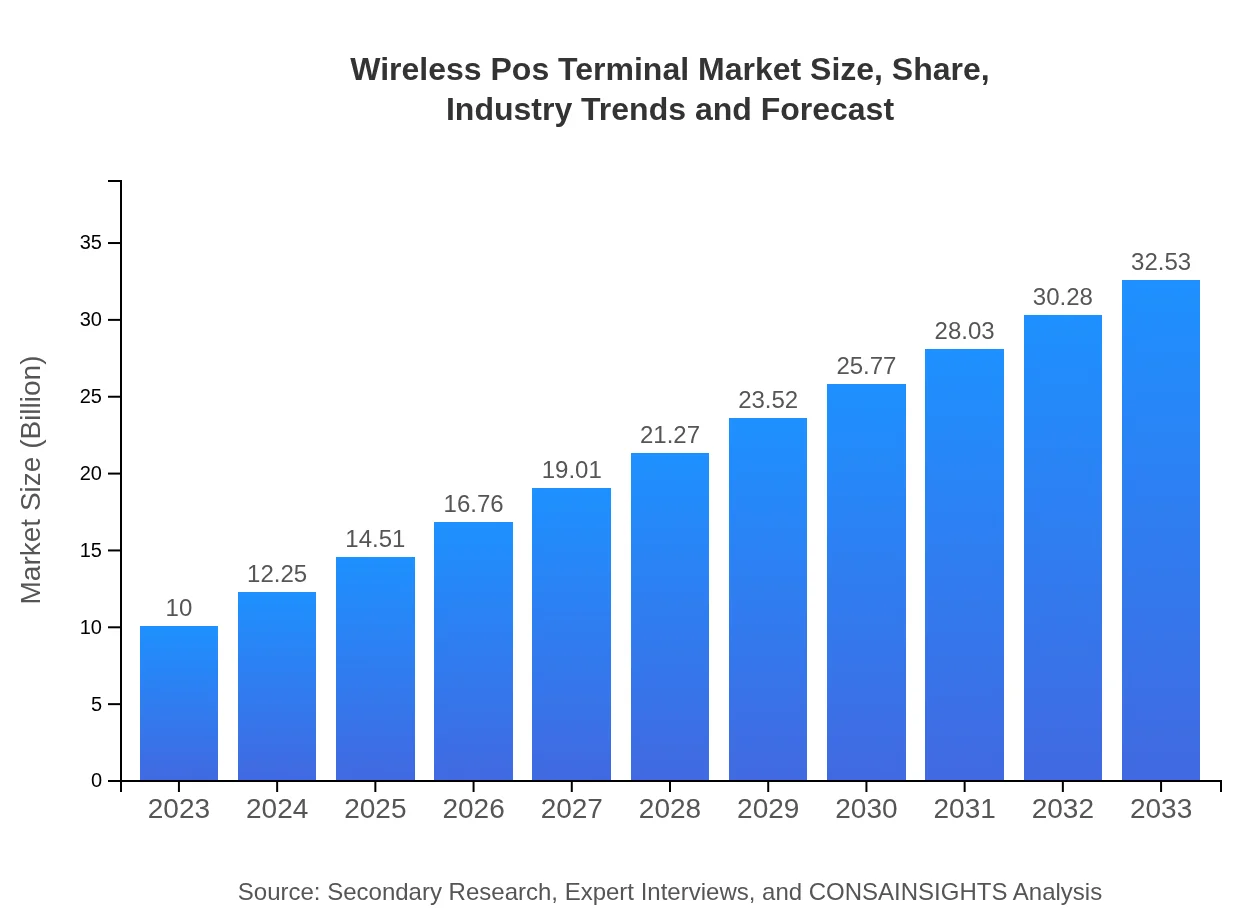

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $32.53 Billion |

| Top Companies | Square, Inc., Verifone Systems, Inc., Ingenico Group, PayPal Holdings, Inc. |

| Last Modified Date | 31 January 2026 |

Wireless Pos Terminal Market Overview

Customize Wireless Pos Terminal Market Report market research report

- ✔ Get in-depth analysis of Wireless Pos Terminal market size, growth, and forecasts.

- ✔ Understand Wireless Pos Terminal's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Wireless Pos Terminal

What is the Market Size & CAGR of Wireless Pos Terminal market in 2023?

Wireless Pos Terminal Industry Analysis

Wireless Pos Terminal Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Wireless Pos Terminal Market Analysis Report by Region

Europe Wireless Pos Terminal Market Report:

In Europe, the market size is anticipated to grow from $2.45 billion in 2023 to $7.96 billion by 2033, primarily due to increasing regulatory support for cashless transactions and a focus on improving customer experiences.Asia Pacific Wireless Pos Terminal Market Report:

The Asia Pacific region is poised for significant growth, with the market size projected to increase from $2.05 billion in 2023 to $6.67 billion by 2033. This growth is driven by the expanding retail sector and increasing smartphone adoption across countries like China, India, and Japan.North America Wireless Pos Terminal Market Report:

North America's market is projected to increase from $3.37 billion in 2023 to $10.95 billion by 2033, fueled by technological innovations and a high acceptance of contactless payment solutions among consumers.South America Wireless Pos Terminal Market Report:

In South America, the Wireless POS Terminal market is expected to grow from $0.99 billion in 2023 to $3.21 billion by 2033. The rise in e-commerce and expanding payment infrastructure are vital growth enablers in this region.Middle East & Africa Wireless Pos Terminal Market Report:

The Middle East and Africa market is estimated to rise from $1.15 billion in 2023 to $3.73 billion by 2033, driven by an increasing push towards digitalization in retail and other sectors.Tell us your focus area and get a customized research report.

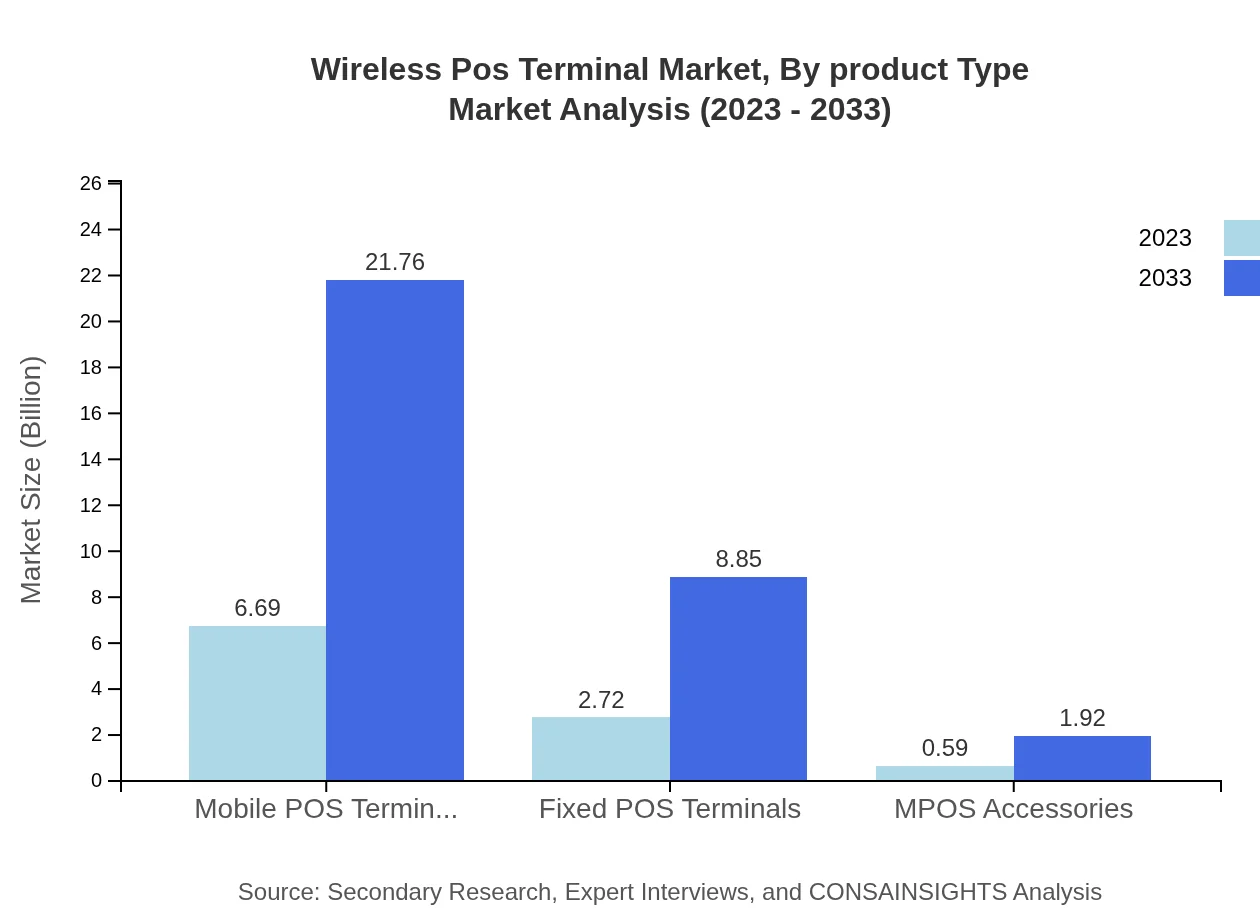

Wireless Pos Terminal Market Analysis By Product Type

The wireless POS terminal market is dominated by mobile POS terminals, expected to grow from $6.69 billion in 2023 to $21.76 billion by 2033, holding a market share of 66.9%. Fixed terminals follow, with a growth forecast from $2.72 billion to $8.85 billion, representing 27.2% share, while accessories grow from $0.59 billion to $1.92 billion, staying at 5.9% share.

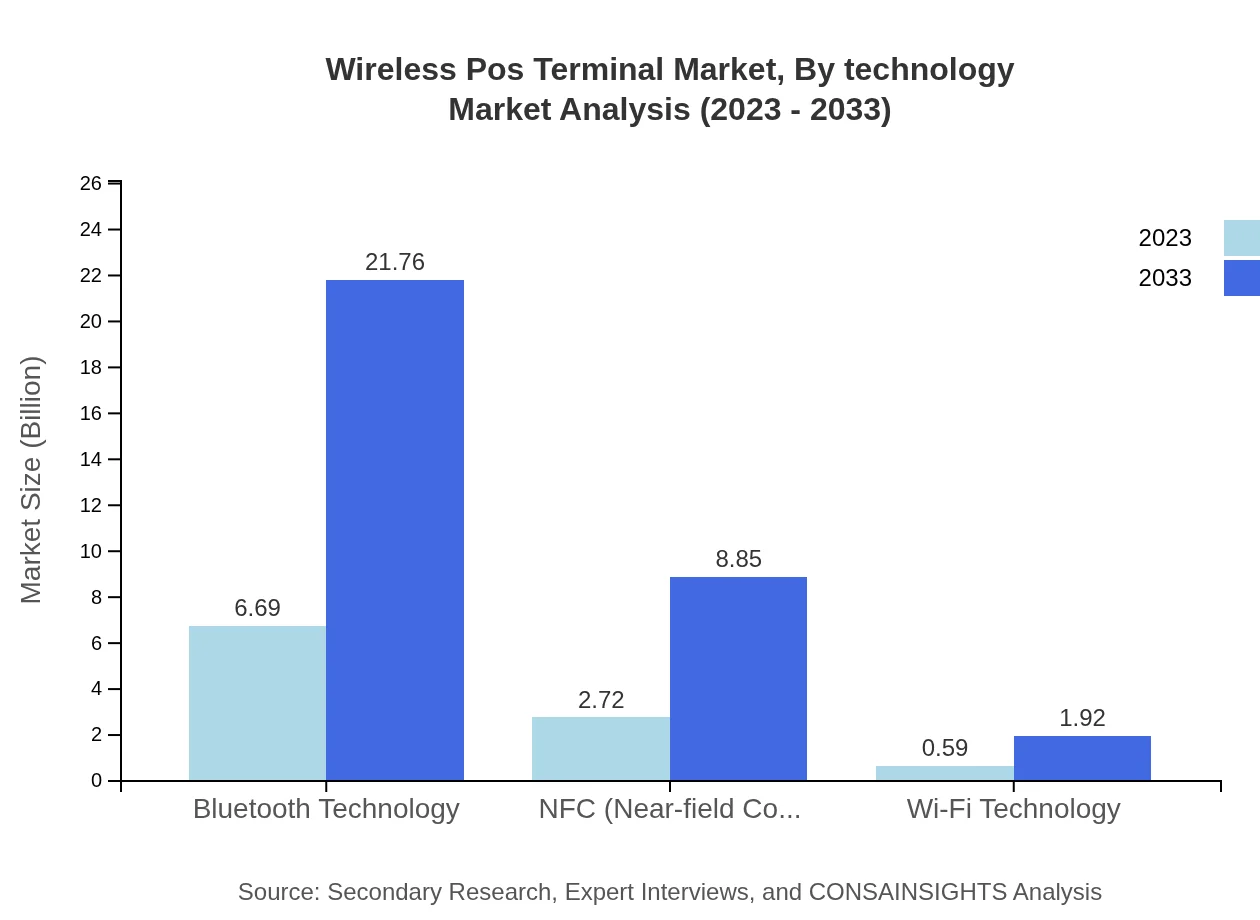

Wireless Pos Terminal Market Analysis By Technology

Bluetooth technology leads the market with a size from $6.69 billion in 2023 to $21.76 billion by 2033, capturing a 66.9% share. NFC technology follows, projected to grow from $2.72 billion to $8.85 billion, maintaining a 27.2% share, while Wi-Fi technology remains a minor segment, forecasted to grow from $0.59 billion to $1.92 billion, representing 5.9% share.

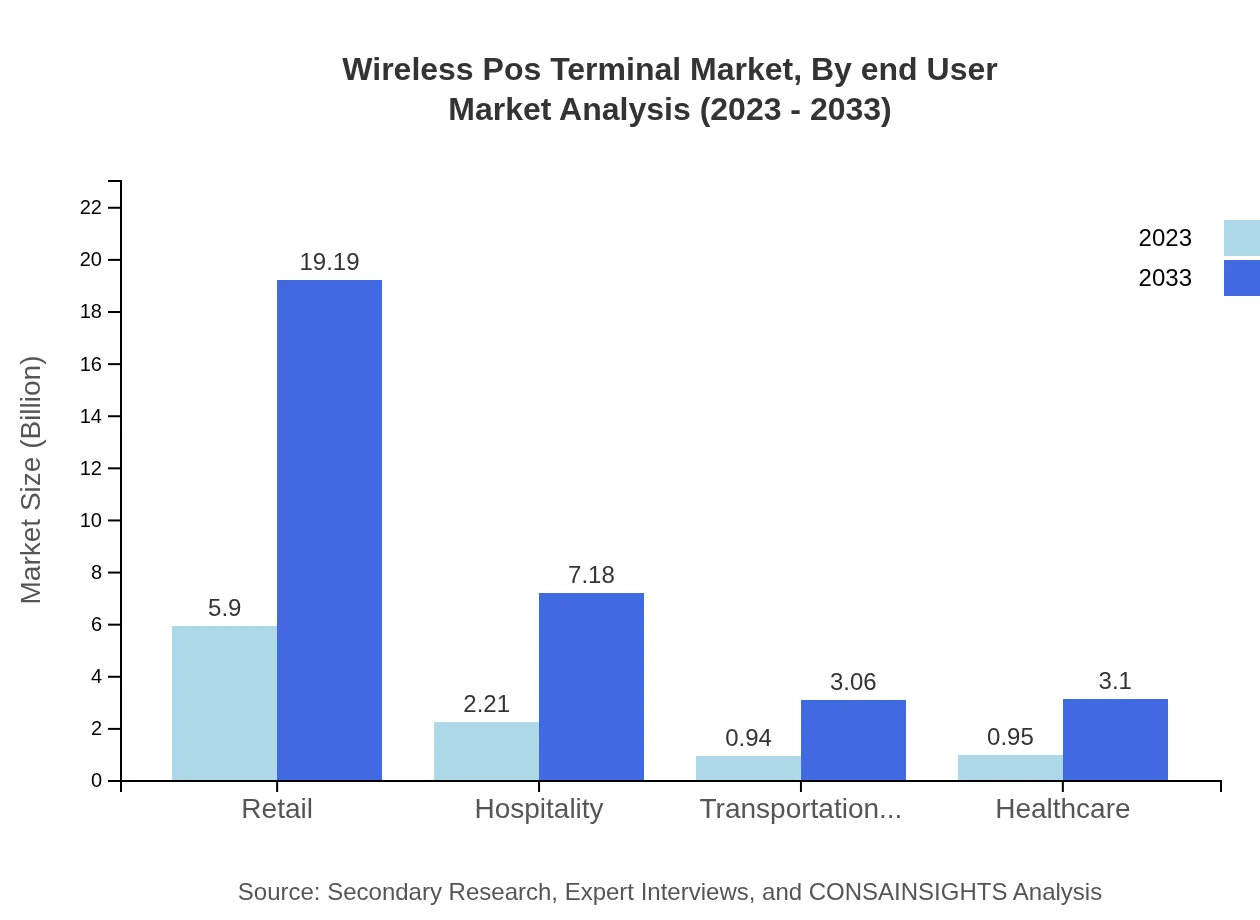

Wireless Pos Terminal Market Analysis By End User

The retail sector dominates the end-user market, projected to expand from $5.90 billion in 2023 to $19.19 billion by 2033, reflecting a 58.98% market share. The hospitality sector follows with $2.21 billion to $7.18 billion, holding a 22.08% share, while the transportation sector grows from $0.94 billion to $3.06 billion, representing a 9.41% share. The healthcare sector is also growing steadily from $0.95 billion to $3.10 billion, holding a 9.53% share.

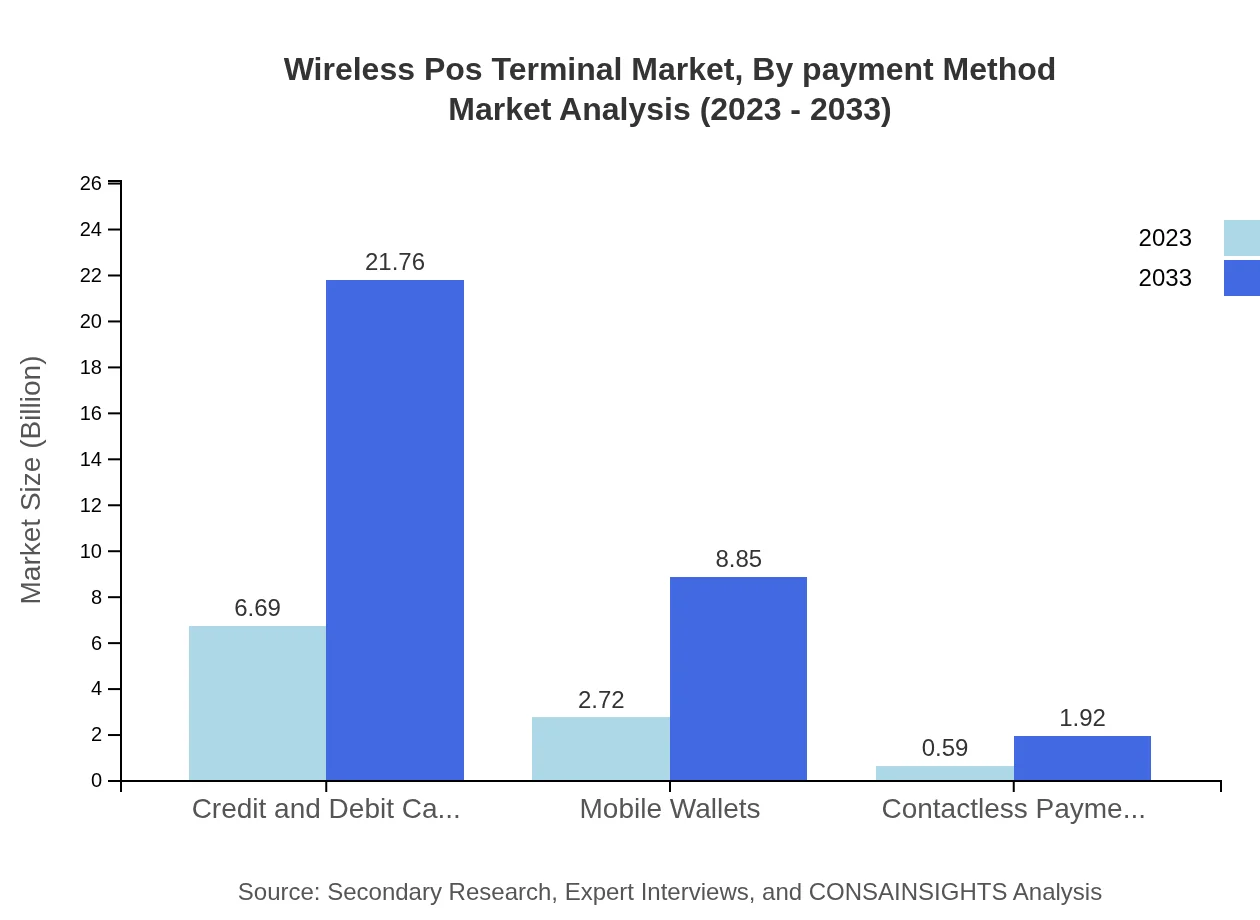

Wireless Pos Terminal Market Analysis By Payment Method

Payment methods in the wireless POS terminal market are also evolving; credit/debit card transactions led with a market size from $6.69 billion to $21.76 billion, capturing 66.9%. Mobile wallets follow, with growth from $2.72 billion to $8.85 billion, holding a 27.2% share, while contactless payments, though smaller, show growth from $0.59 billion to $1.92 billion, maintaining a 5.9% share.

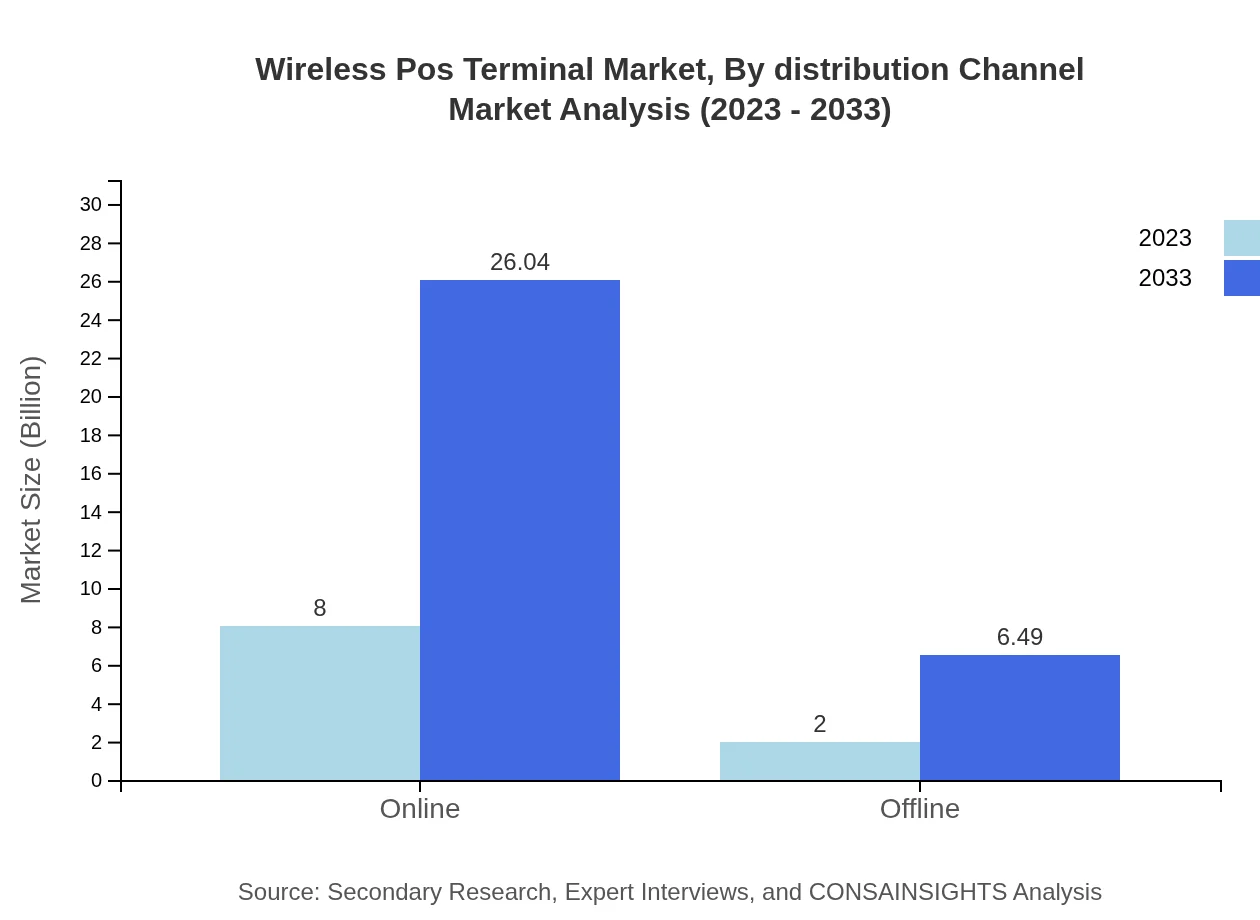

Wireless Pos Terminal Market Analysis By Distribution Channel

Distribution channels include online and offline sales. Online sales dominate with a size growing from $8 billion to $26.04 billion, holding 80.04% market share, while offline sales are anticipated to increase from $2 billion to $6.49 billion, maintaining a 19.96% share. The rising trend of e-commerce and digital transactions is transforming traditional distribution methods.

Wireless Pos Terminal Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Wireless Pos Terminal Industry

Square, Inc.:

A leader in mobile payments, Square offers innovative solutions for businesses to accept wireless payments efficiently and securely.Verifone Systems, Inc.:

Known for its secure payment solutions, Verifone provides a wide range of wireless POS terminals that cater to various business sizes and sectors.Ingenico Group:

A global leader in integrated payment solutions, Ingenico offers a variety of wireless POS terminals equipped with advanced security features.PayPal Holdings, Inc.:

PayPal extends its services into the wireless POS space, facilitating secure transactions across multiple payment methods, notably in e-commerce.We're grateful to work with incredible clients.

FAQs

What is the market size of Wireless POS Terminal?

The Wireless POS Terminal market is valued at $10 billion in 2023, with a projected CAGR of 12% through 2033, indicating strong growth potential over the next decade.

What are the key market players or companies in the Wireless POS Terminal industry?

Key players in the Wireless POS Terminal industry include Verifone, Ingenico, Square, and PayPal, which are instrumental in shaping market dynamics and introducing innovative solutions.

What are the primary factors driving the growth in the Wireless POS Terminal industry?

Growth in the Wireless POS Terminal industry is driven by increasing adoption of contactless payments, a surge in mobile transactions, and the need for more flexible payment processing solutions across various sectors.

Which region is the fastest Growing in the Wireless POS Terminal market?

The fastest-growing region in the Wireless POS Terminal market is projected to be North America, with a market increase from $3.37 billion in 2023 to $10.95 billion by 2033.

Does ConsaInsights provide customized market report data for the Wireless POS Terminal industry?

Yes, ConsaInsights offers tailored market report data for the Wireless POS Terminal industry, enabling clients to gain insights specific to their business needs and strategic objectives.

What deliverables can I expect from this Wireless POS Terminal market research project?

Deliverables from the Wireless POS Terminal market research project include comprehensive market analysis reports, regional insights, competitive landscape assessments, and data on market trends and segments.

What are the market trends of Wireless POS Terminal?

Current market trends in the Wireless POS Terminal industry include the rise of mobile wallets, increasing acceptance of contactless payments, and a notable shift towards digital and remote payment solutions.