Wood Adhesives Market Report

Published Date: 02 February 2026 | Report Code: wood-adhesives

Wood Adhesives Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the wood adhesives market from 2023 to 2033, including market dynamics, size, segmentation, and future trends. It aims to equip stakeholders with key data and analysis to facilitate informed decision-making in this expanding industry.

| Metric | Value |

|---|---|

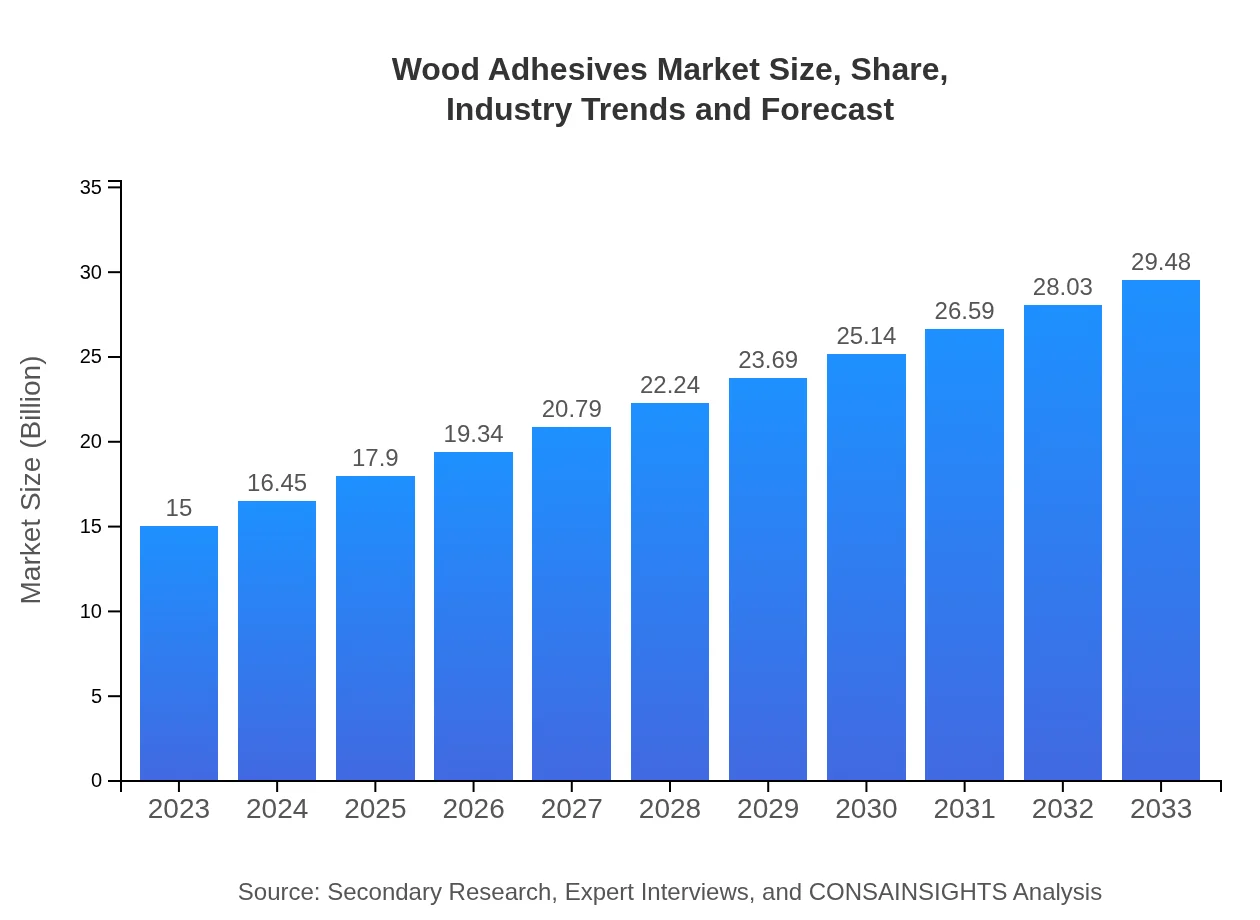

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $29.48 Billion |

| Top Companies | Henkel AG & Co. KGaA, 3M Company, BASF SE, Scotch Weld |

| Last Modified Date | 02 February 2026 |

Wood Adhesives Market Overview

Customize Wood Adhesives Market Report market research report

- ✔ Get in-depth analysis of Wood Adhesives market size, growth, and forecasts.

- ✔ Understand Wood Adhesives's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Wood Adhesives

What is the Market Size & CAGR of Wood Adhesives market in 2023?

Wood Adhesives Industry Analysis

Wood Adhesives Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Wood Adhesives Market Analysis Report by Region

Europe Wood Adhesives Market Report:

In Europe, the wood adhesives market is expected to grow from $4.77 billion in 2023 to $9.38 billion by 2033. The region is seeing significant growth in the furniture and construction sectors due to increased housing and renovation activities, alongside a growing demand for eco-friendly adhesive solutions driven by strict environmental regulations.Asia Pacific Wood Adhesives Market Report:

The Asia-Pacific region's wood adhesives market is projected to grow from $2.97 billion in 2023 to $5.84 billion by 2033, driven by rapid urbanization, increasing construction activities, and rising furniture demand in countries like China and India. The region's growing middle-class population is also spurring demand for high-quality furniture products, further propelling market growth.North America Wood Adhesives Market Report:

The North American wood adhesives market is projected to grow from $4.92 billion in 2023 to $9.66 billion by 2033. This growth is influenced by the resurgence of the construction industry, particularly in the U.S. and Canada. The region's focus on technological advancements and sustainable production processes is also fostering innovative adhesive solutions, creating a favorable market environment.South America Wood Adhesives Market Report:

In South America, the market is expected to expand from $0.63 billion in 2023 to $1.24 billion by 2033. This growth is primarily attributed to the increasing emphasis on sustainable building practices and the rising furniture sector. Brazil and Argentina are leading contributors to this growth, supported by an improvement in purchasing power and investment in infrastructure.Middle East & Africa Wood Adhesives Market Report:

The Middle East and Africa region is projected to see growth from $1.71 billion in 2023 to $3.36 billion by 2033, supported by increasing construction activities and the adoption of advanced wood processing technologies. Countries like the UAE and South Africa are leading this growth trend, where ongoing infrastructure projects and urbanization drive demand.Tell us your focus area and get a customized research report.

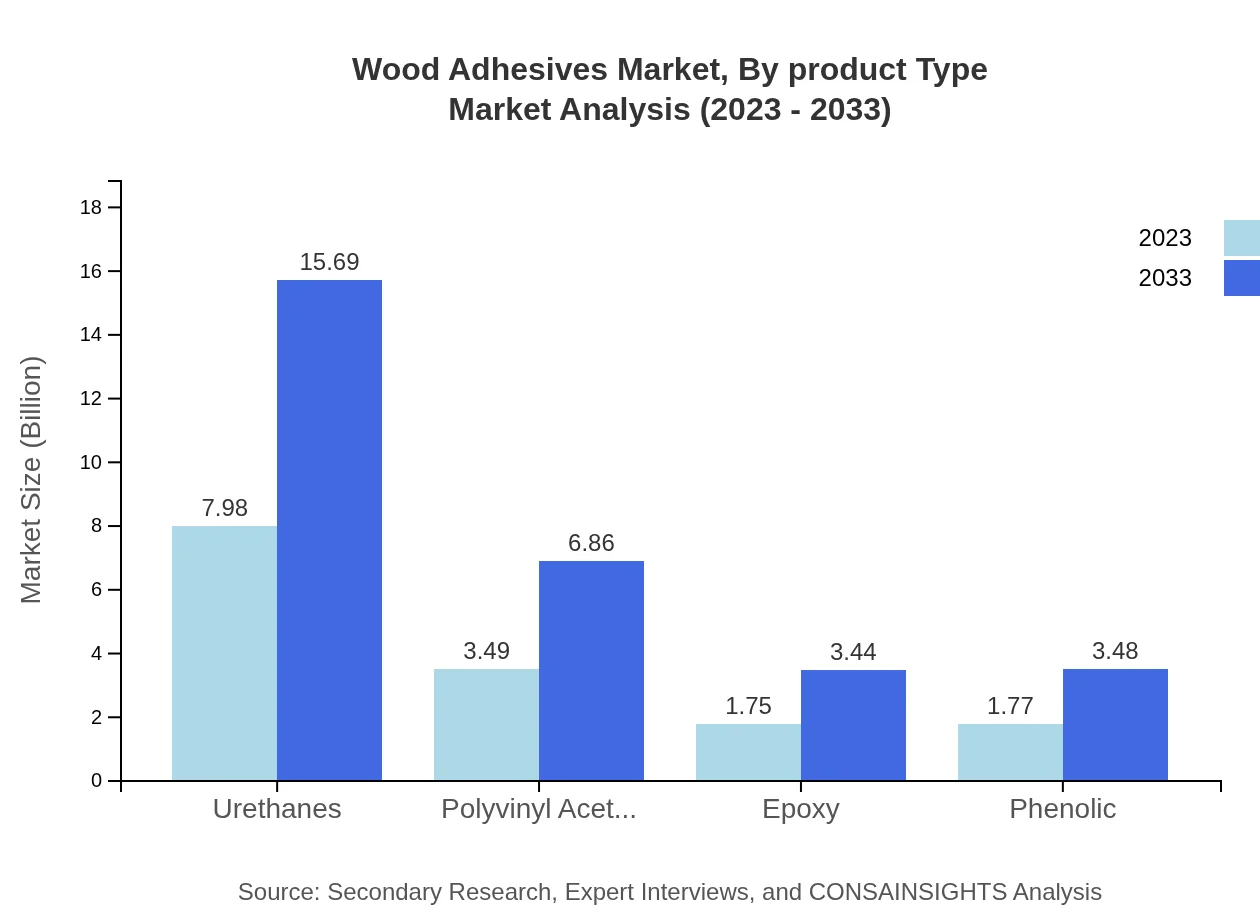

Wood Adhesives Market Analysis By Product Type

The wood adhesives market is classified into various product types, including water-based, solvent-based, hot melt, and reactive adhesives. Water-based adhesives lead the market, showing a size of $7.98 billion in 2023, and are expected to reach $15.69 billion by 2033, maintaining a consistent market share of 53.22%. Solvent-based adhesives hold a size of $3.49 billion in 2023, growing to $6.86 billion by 2033, while hot melt and reactive adhesives showcase sizes of $1.75 billion and $1.77 billion in 2023, expected to rise to $3.44 billion and $3.48 billion respectively by 2033.

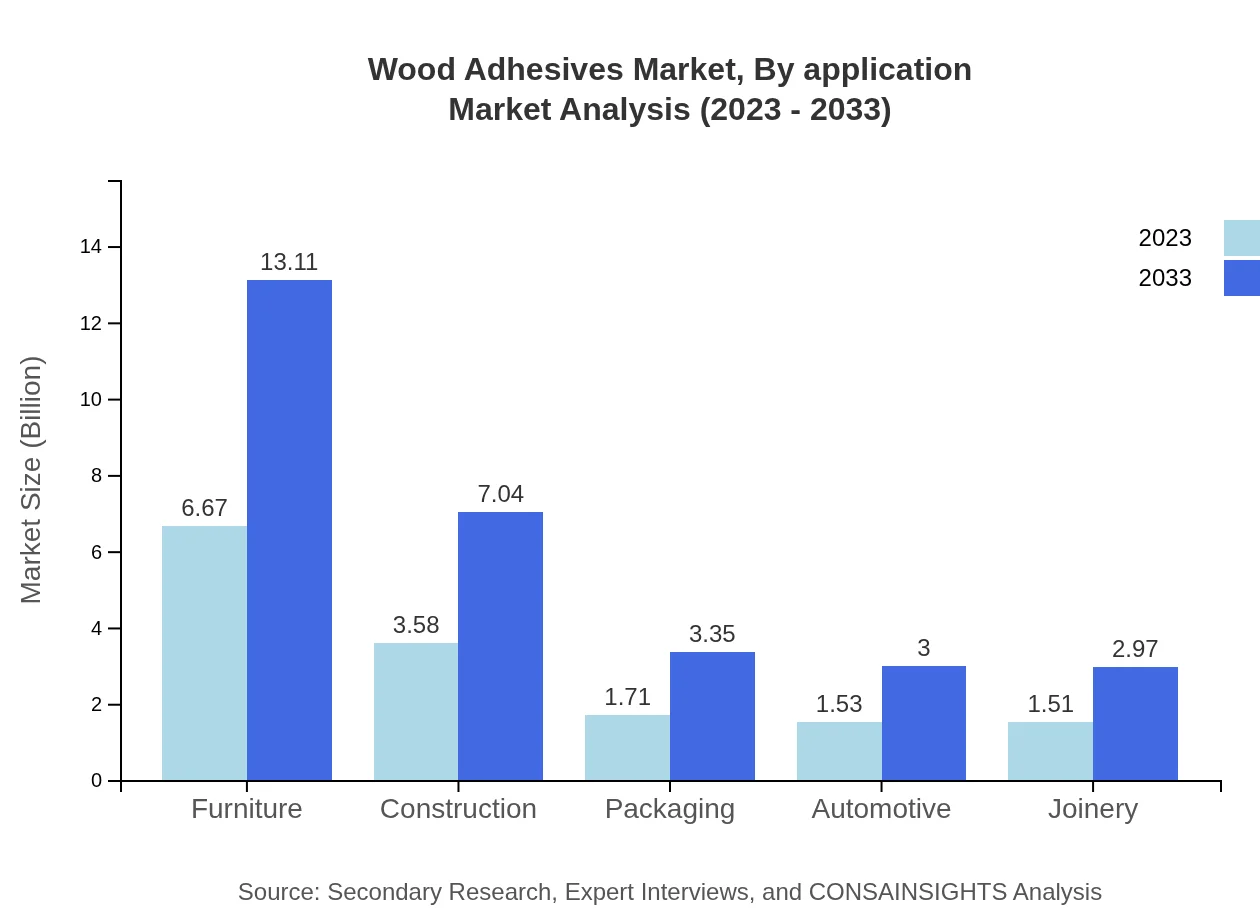

Wood Adhesives Market Analysis By Application

Applications of wood adhesives span several industries, notably furniture manufacturing, construction, automotive, and packaging. The furniture sector is the leading application area, with a market size of $6.67 billion in 2023, projected to grow to $13.11 billion by 2033. The construction industry follows closely, expected to expand from $3.58 billion in 2023 to $7.04 billion by 2033, showcasing the versatility and demand for adhesives in various sectors.

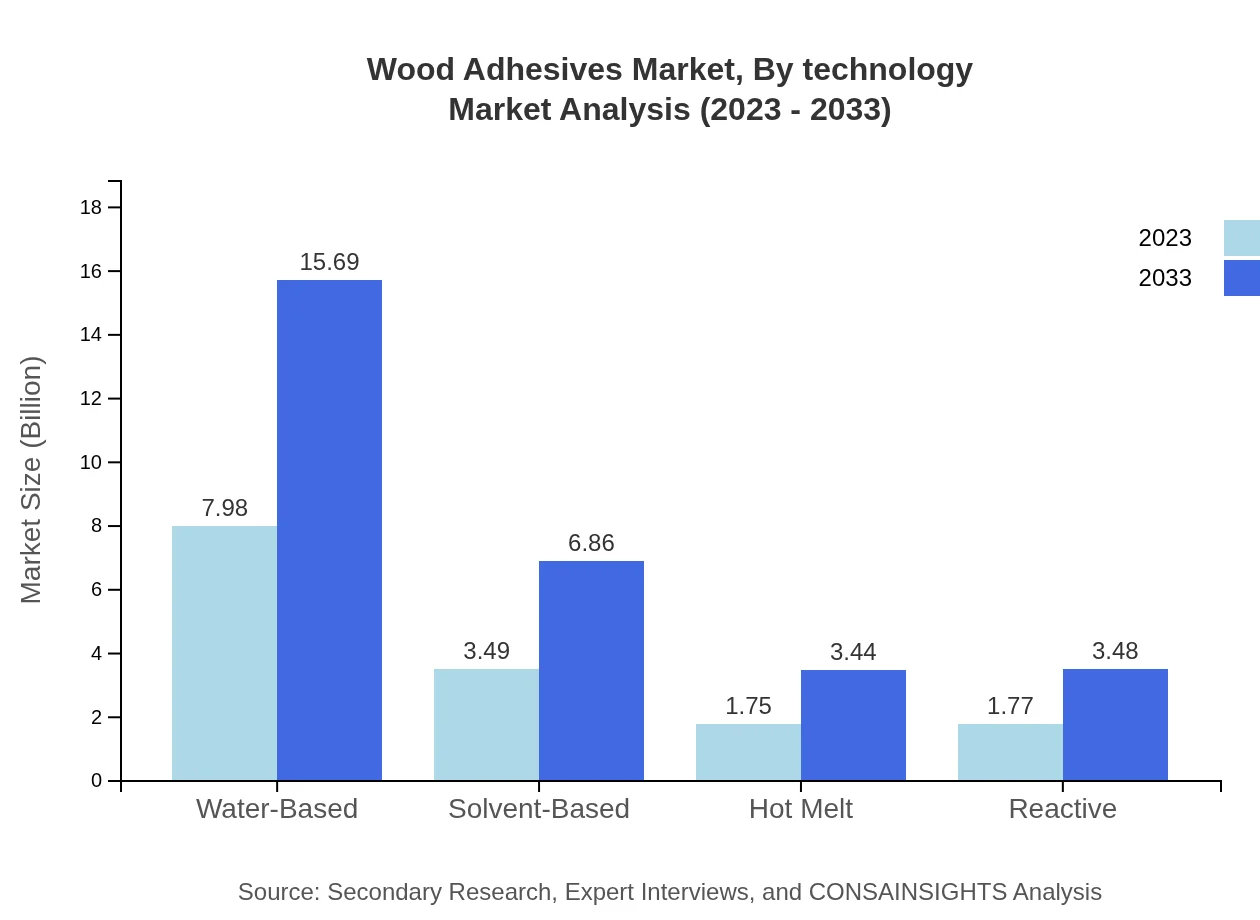

Wood Adhesives Market Analysis By Technology

Technological advancements in wood adhesives include the development of low-emission formulations and enhanced bonding capabilities. Water-based technologies dominate, providing safer application environments and improving operator safety. The shift towards eco-friendly adhesives with minimal VOC emissions is driving innovation, thus expanding the market scope for bio-based adhesives. Manufacturers are increasingly adopting advanced formulations that cater to sustainability while meeting performance standards required by industries.

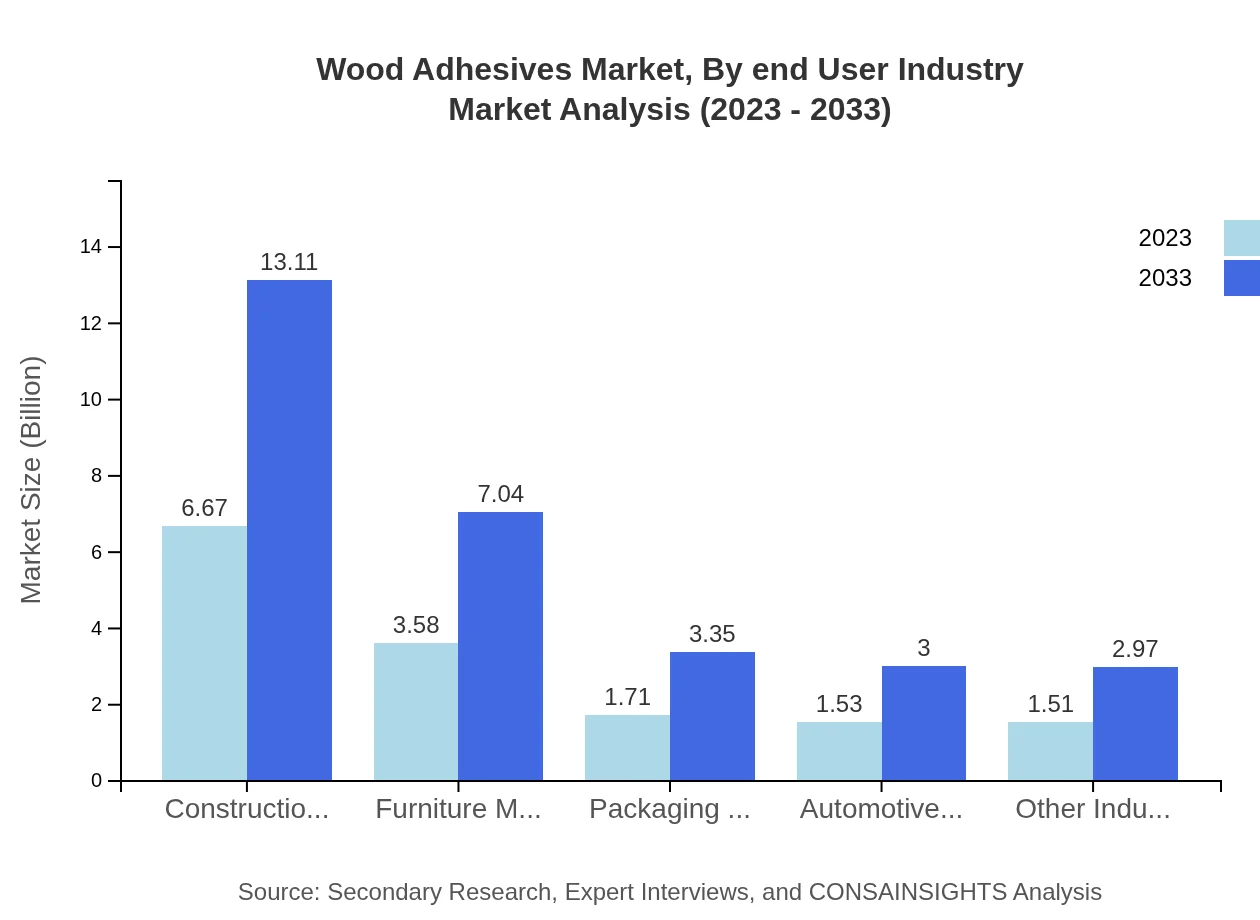

Wood Adhesives Market Analysis By End User Industry

End-user industries utilizing wood adhesives include furniture manufacturing, construction, packaging, automotive, and other sectors. Each industry demands specific adhesive-related performance characteristics. The furniture manufacturing sector remains the most significant, dominating with a share of 44.47% in 2023, while construction and automotive sectors follow with substantial shares of 23.89% and 10.19%, respectively, reflecting the extensive use of adhesives in bonding processes across various applications.

Wood Adhesives Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Wood Adhesives Industry

Henkel AG & Co. KGaA:

Henkel is a global leader in adhesives and sealants, known for its innovative wood adhesive products that enhance durability and environmental compliance.3M Company:

3M offers a wide range of adhesive solutions tailored to wood applications, leveraging advanced technology to deliver high-performance products for various industries.BASF SE:

BASF is a leading chemical company that provides eco-friendly wood adhesives designed to meet customer specifications and industry regulations.Scotch Weld:

Scotch Weld specializes in bonding solutions, providing reliable adhesive options for wood applications in construction and woodworking industries.We're grateful to work with incredible clients.

FAQs

What is the market size of wood Adhesives?

The global wood adhesives market is valued at approximately $15 billion as of 2023, with a projected CAGR of 6.8%. This growth indicates a robust demand for adhesive solutions in various applications, including furniture, construction, and automotive.

What are the key market players or companies in the wood Adhesives industry?

Key players in the wood adhesives market include industry giants such as Henkel AG, Bostik, 3M, and Jowat AG, recognized for their innovation in adhesive formulations and strong distribution networks.

What are the primary factors driving the growth in the wood Adhesives industry?

Growth drivers include the expanding construction industry, increased demand for furniture, technological advancements in adhesive formulations, and a shift towards eco-friendly and sustainable products.

Which region is the fastest Growing in the wood Adhesives?

Asia Pacific is the fastest-growing region for wood adhesives, expected to grow from $2.97 billion in 2023 to $5.84 billion by 2033, fueled by rising construction and manufacturing activities.

Does Consainsights provide customized market report data for the wood Adhesives industry?

Yes, Consainsights offers customized market report data tailored to client-specific needs within the wood-adhesives industry, providing insights on market trends, forecasts, and competitive analysis.

What deliverables can I expect from this wood Adhesives market research project?

Deliverables include comprehensive market analysis, detailed segmentation data, competitive landscape assessment, and strategic recommendations for market entry or expansion.

What are the market trends of wood Adhesives?

Market trends include a rising preference for water-based adhesives, increasing use in green buildings, and innovations like bio-based adhesives driven by environmental consciousness.