Wood Based Panel Market Report

Published Date: 02 February 2026 | Report Code: wood-based-panel

Wood Based Panel Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Wood Based Panel market covering insights from 2023 to 2033. It explores market size, trends, segmentation, and regional performance, summarizing data critical for stakeholders and decision-makers.

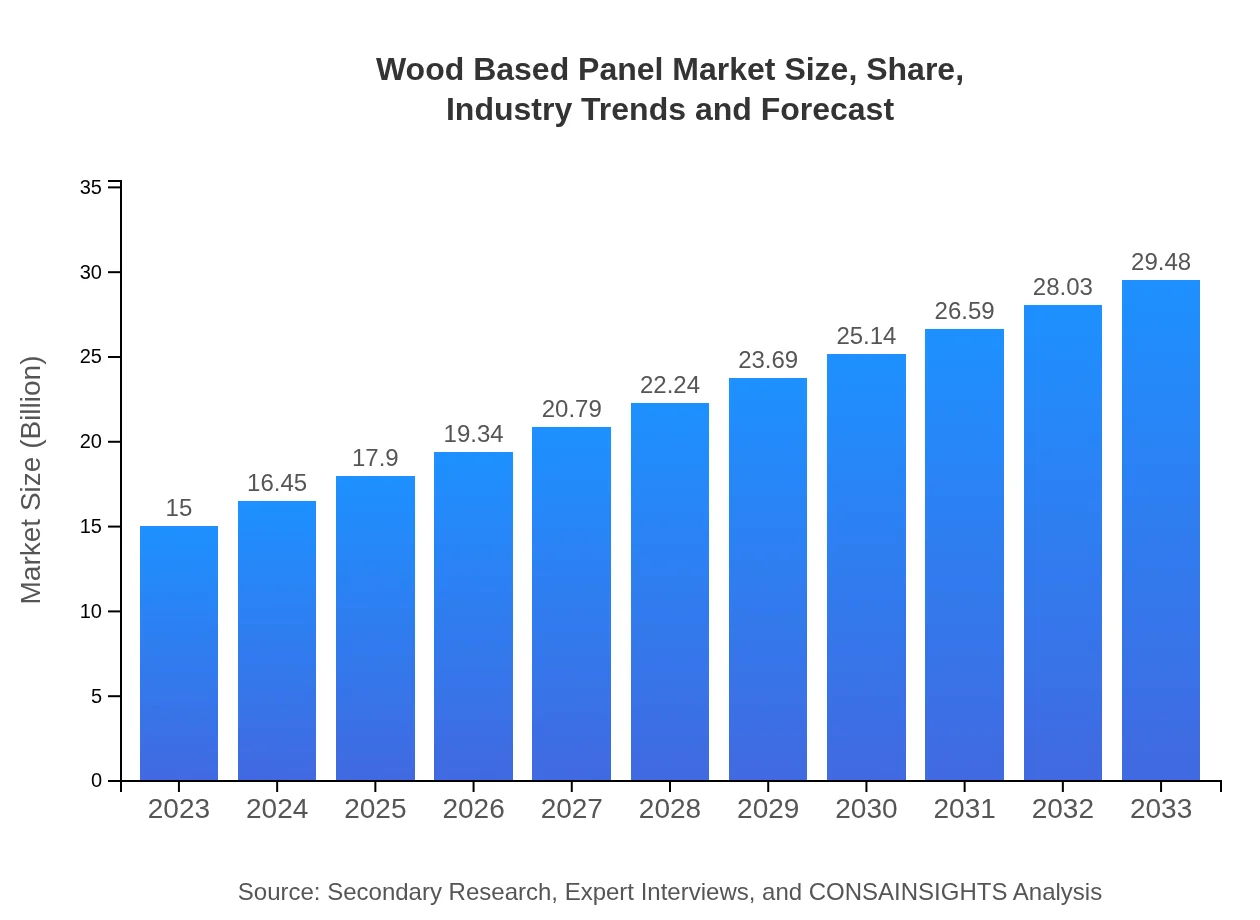

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $29.48 Billion |

| Top Companies | Kronospan, Matrix Timber, Louisiana-Pacific Corporation (LP), Egger Group |

| Last Modified Date | 02 February 2026 |

Wood Based Panel Market Overview

Customize Wood Based Panel Market Report market research report

- ✔ Get in-depth analysis of Wood Based Panel market size, growth, and forecasts.

- ✔ Understand Wood Based Panel's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Wood Based Panel

What is the Market Size & CAGR of Wood Based Panel market in 2023?

Wood Based Panel Industry Analysis

Wood Based Panel Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Wood Based Panel Market Analysis Report by Region

Europe Wood Based Panel Market Report:

The European Wood Based Panel market was valued at USD 4.18 billion in 2023 and is expected to reach USD 8.21 billion by 2033. Technological advancements and eco-friendly practices supported by government initiatives ensure a healthy growth trajectory in this region.Asia Pacific Wood Based Panel Market Report:

The Asia Pacific region, valued at USD 2.96 billion in 2023, is expected to grow to USD 5.82 billion by 2033. This rapid growth is attributed to booming construction activities, urbanization, and a surge in furniture exports, making it the fastest-growing market for Wood Based Panels.North America Wood Based Panel Market Report:

In North America, the market size was USD 5.58 billion in 2023, forecasted to increase to USD 10.97 billion by 2033. The demand for engineered wood products in construction and renovation projects, coupled with strict environmental regulations, are major contributors to this growth.South America Wood Based Panel Market Report:

South America’s market stood at USD 0.72 billion in 2023 and is projected to reach USD 1.41 billion by 2033. Increased investment in residential projects and a growing preference for sustainable materials are key factors driving this growth.Middle East & Africa Wood Based Panel Market Report:

The Middle East and Africa market started at USD 1.57 billion in 2023, anticipated to expand to USD 3.08 billion by 2033. The rise in construction and infrastructure projects is the primary reason for this predicted growth.Tell us your focus area and get a customized research report.

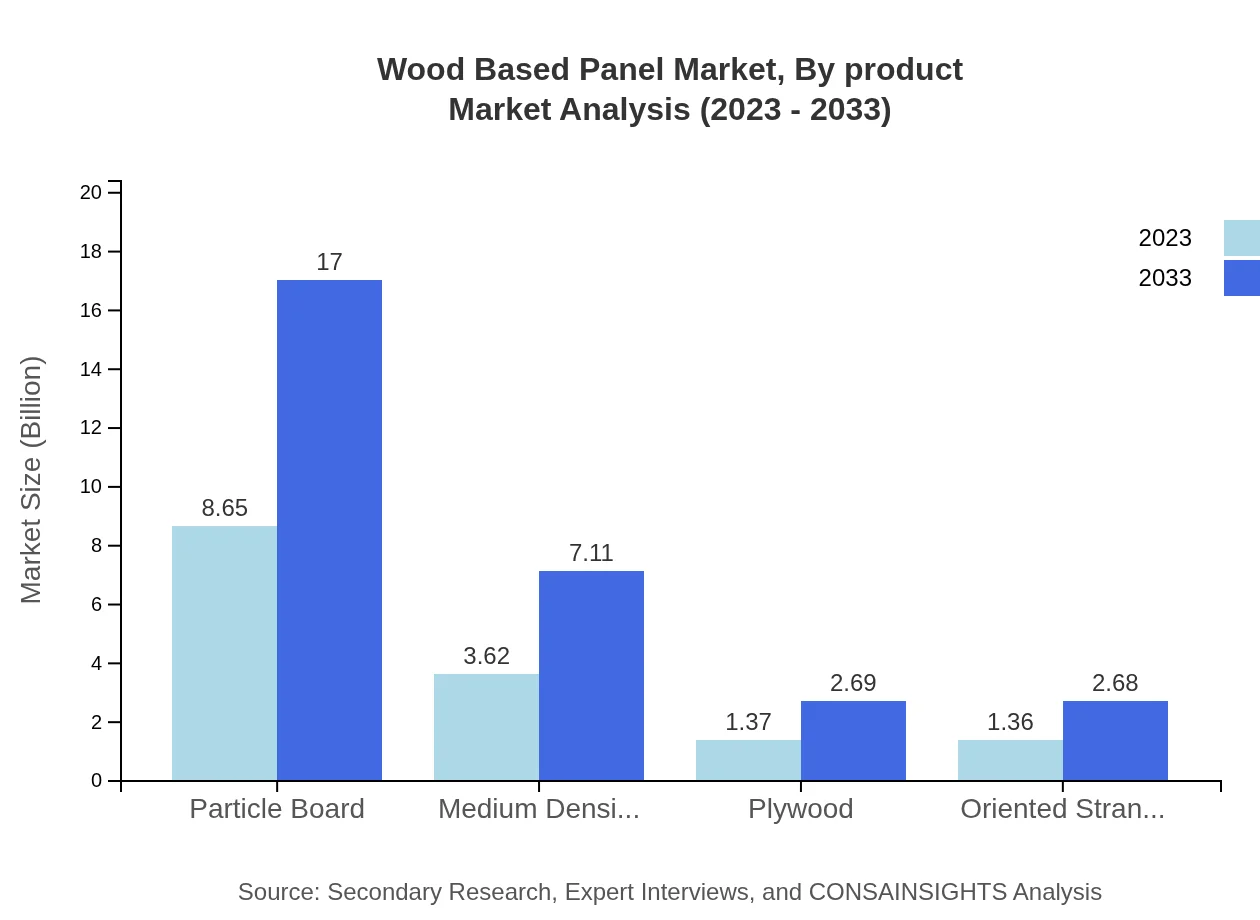

Wood Based Panel Market Analysis By Product

The Wood-Based Panel Market is significantly driven by product type segmentation. Particle boards dominate the market share, accounting for USD 8.65 billion in 2023, with a projected rise to USD 17.00 billion by 2033. MDF follows with a share of USD 3.62 billion, expected to double in size by 2033. Plywood and OSB, while smaller in their respective shares, are still seeing growth due to niche applications in furniture and construction.

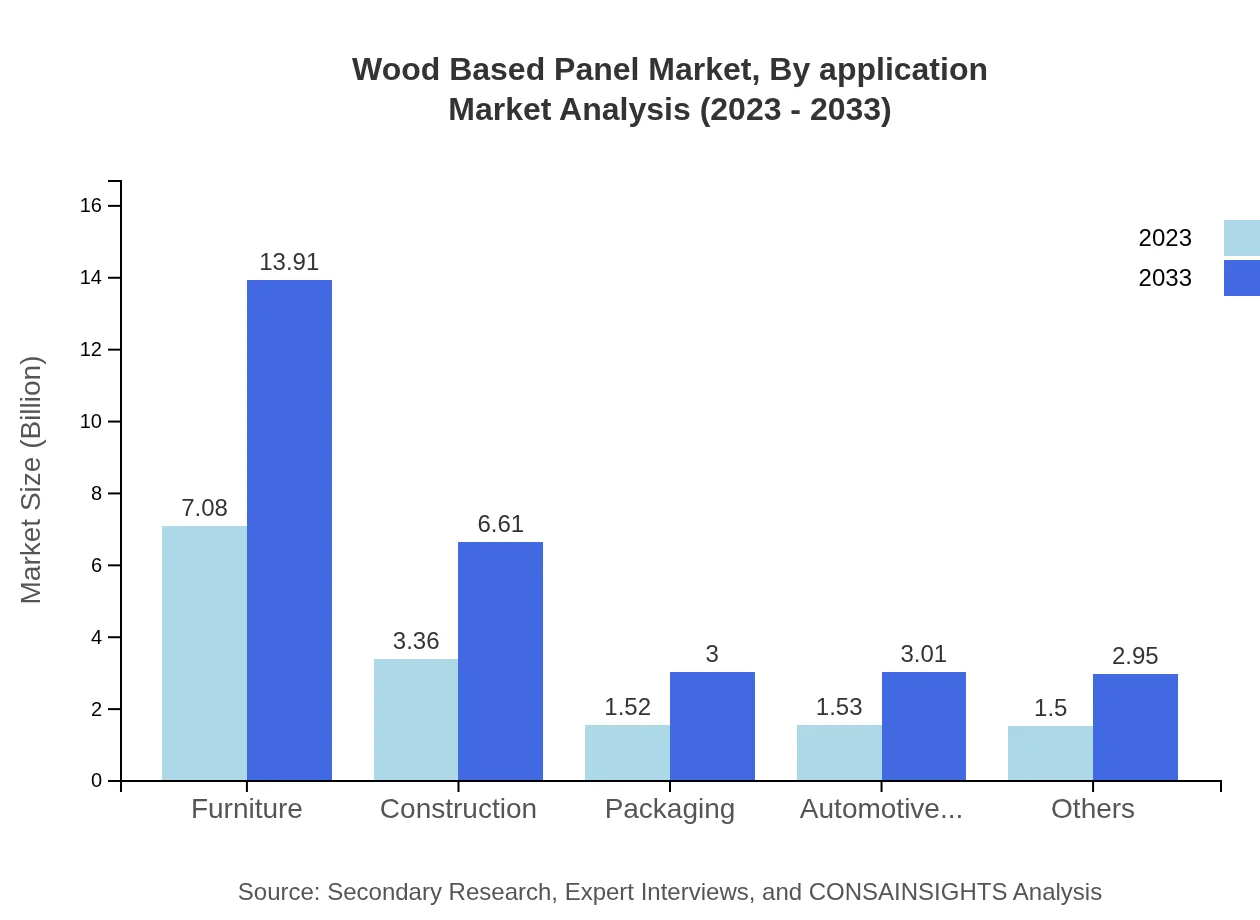

Wood Based Panel Market Analysis By Application

The application of Wood-Based Panels spans numerous sectors, with furniture manufacturing commanding the largest market segment at USD 8.65 billion in 2023 and expected to grow to USD 17.00 billion by 2033. The construction and packaging industries also represent significant shares, driven largely by demand for lightweight and versatile materials in furniture and other applications.

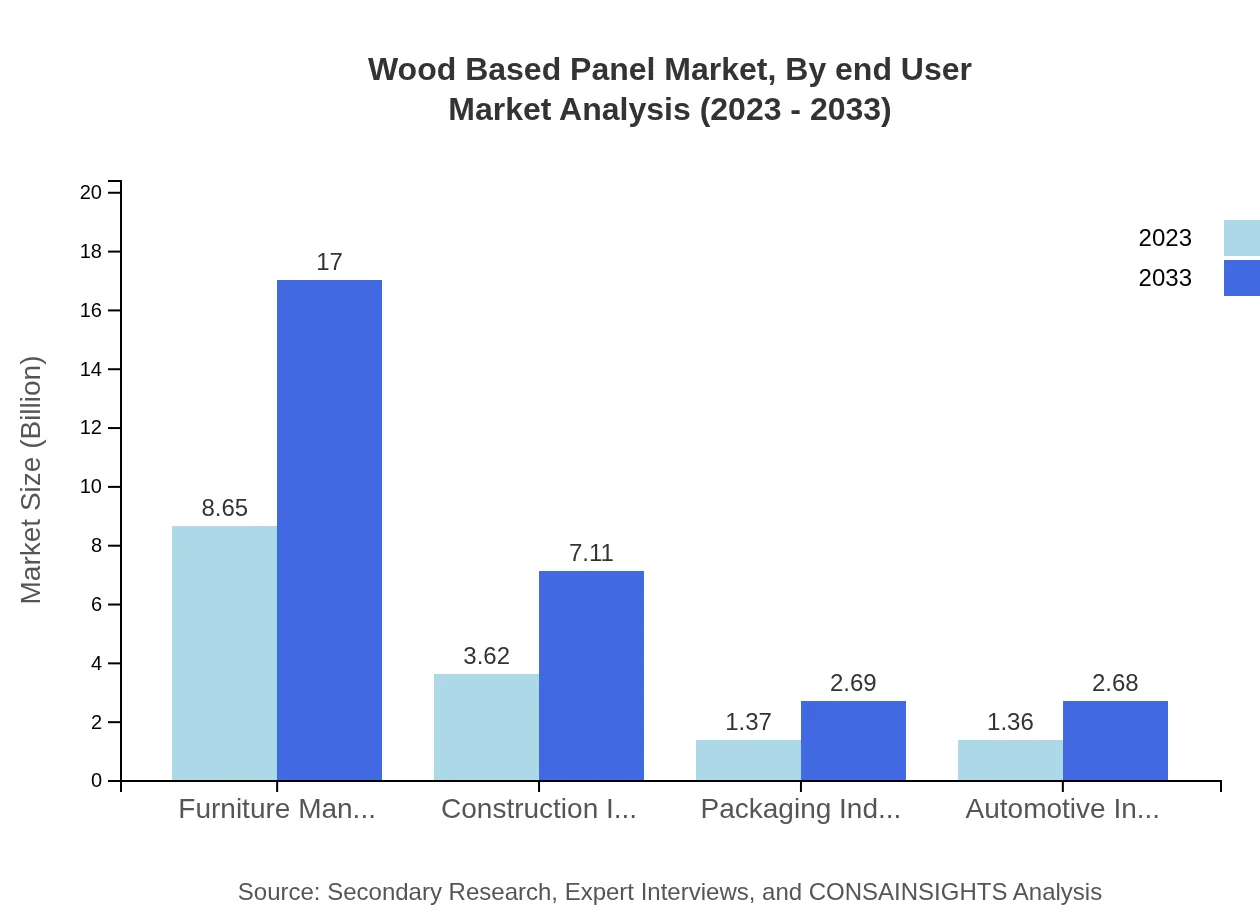

Wood Based Panel Market Analysis By End User

The primary end-users of Wood-Based Panels include construction, automotive, and furniture sectors. The construction industry alone is projected to grow from USD 3.36 billion in 2023 to USD 6.61 billion by 2033. Emerging markets in Asia Pacific lead the way in increased usage for residential and commercial construction, while furniture remains a consistent demand driver.

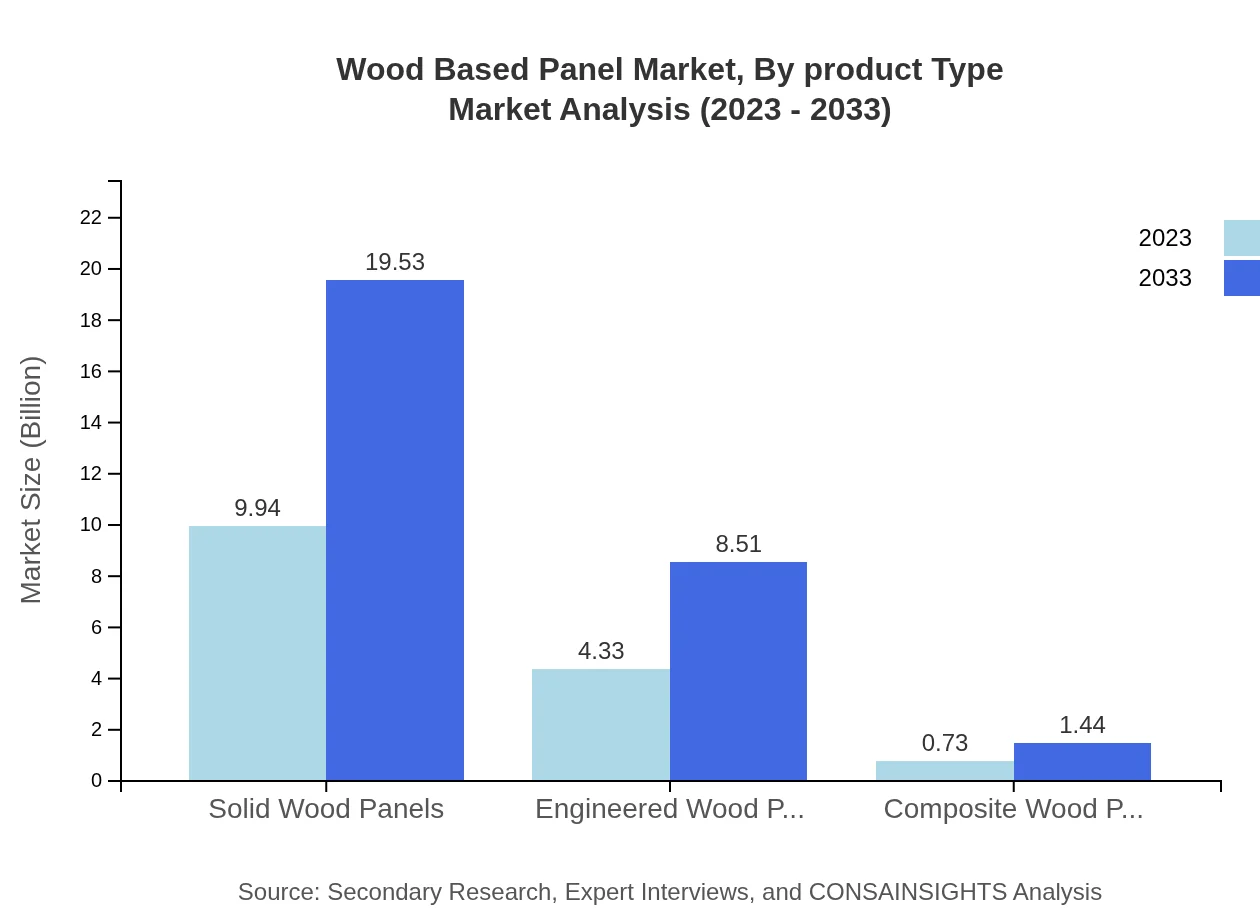

Wood Based Panel Market Analysis By Product Type

Product types such as Solid Wood Panels and Engineered Wood Panels see different growth trends, with Solid Wood Panels valued at USD 9.94 billion in 2023, growing to USD 19.53 billion by 2033, while Engineered Wood Panels are predicted to climb from USD 4.33 billion to USD 8.51 billion. Their performance highlights the trend towards engineered solutions in demanding applications.

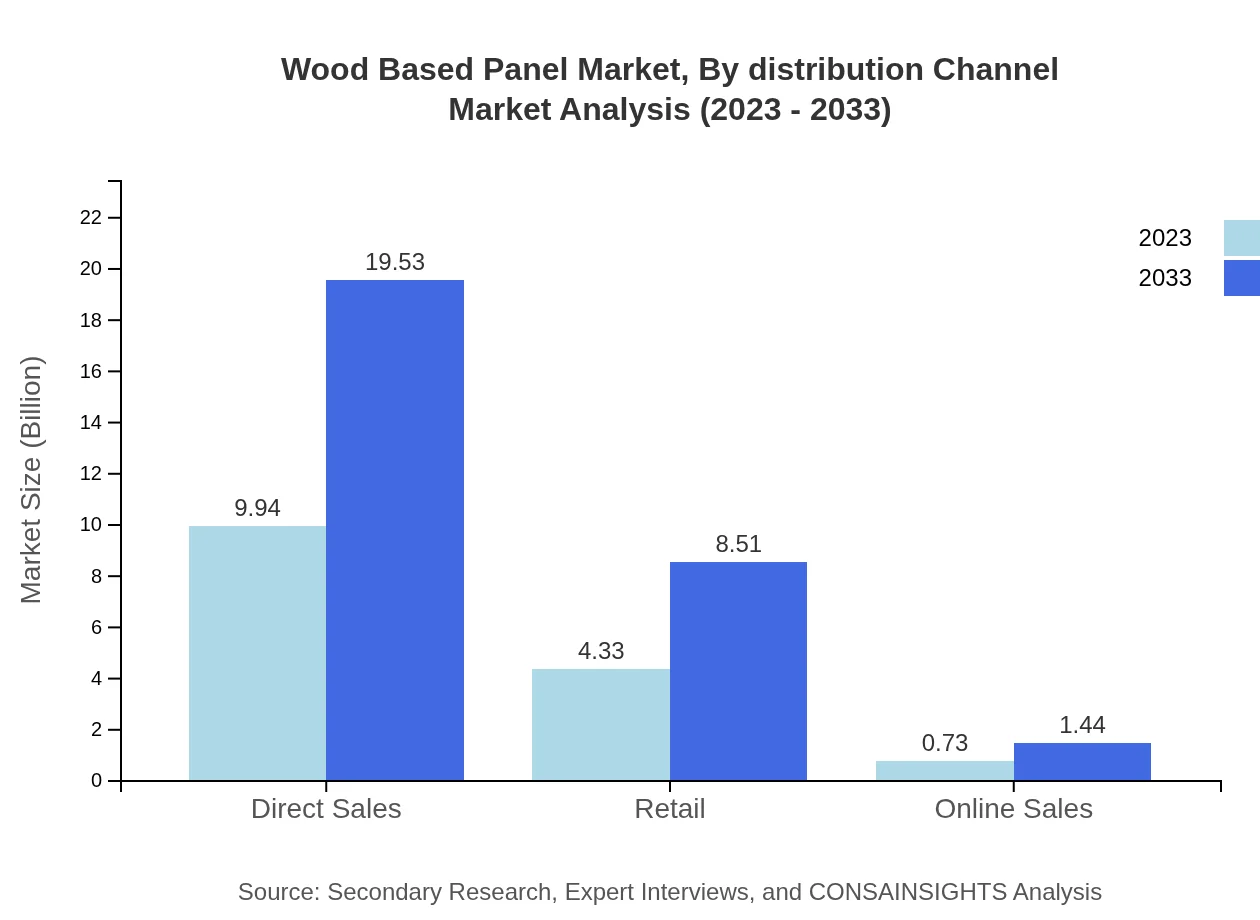

Wood Based Panel Market Analysis By Distribution Channel

Distribution channels in this market include direct sales, retail, and online sales. Direct sales accounted for the largest market share in 2023 at USD 9.94 billion, projected to grow to USD 19.53 billion. Retail and online sales are also significant, reflecting changes in consumer purchasing behavior towards e-commerce solutions.

Wood Based Panel Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Wood Based Panel Industry

Kronospan:

Kronospan is one of the largest manufacturers of engineered wood products, renowned for its wide range of particle board, MDF, and laminate flooring solutions, catering to both the furniture and construction sectors.Matrix Timber:

Matrix Timber specializes in manufacturing high-quality plywood and OSB, leading the market with innovative products aimed at reducing environmental impact through sustainable sourcing.Louisiana-Pacific Corporation (LP):

LP focuses on engineered wood products including OSB and specialty wood products, with a strong emphasis on sustainability and waste reduction.Egger Group:

Egger offers a comprehensive portfolio of wood-based materials including laminated boards, furniture products, and flooring solutions designed with innovation and ecological considerations.We're grateful to work with incredible clients.

FAQs

What is the market size of wood Based panels?

The wood-based panel market size is estimated at $15 billion in 2023, with a projected CAGR of 6.8% from 2023 to 2033. This growth reflects the increasing demand for sustainable building materials worldwide.

What are the key market players or companies in the wood Based panel industry?

Key players in the wood-based panel industry include major manufacturers such as Georgia-Pacific LLC, Kronospan, and Weyerhaeuser, which are well-established and dominate the market due to their extensive product offerings and distribution networks.

What are the primary factors driving the growth in the wood Based panel industry?

The primary factors driving growth in the wood-based panel industry include increasing construction activities, rising demand for eco-friendly materials, and the expansion of the furniture and automotive industries, all of which enhance market potential.

Which region is the fastest Growing in the wood Based panel market?

The fastest-growing region in the wood-based panel market is North America, projected to grow from $5.58 billion in 2023 to $10.97 billion by 2033, reflecting a strong construction market and increasing demand for wood-based products.

Does ConsaInsights provide customized market report data for the wood Based panel industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the wood-based panel industry, providing detailed insights into market dynamics, trends, and forecasts based on client specifications.

What deliverables can I expect from this wood Based panel market research project?

Deliverables from the wood-based panel market research project may include comprehensive market analysis reports, trend assessments, segmentation data, competitive landscape evaluations, and tailored insights relevant to your strategic needs.

What are the market trends of wood Based panels?

Current market trends in wood-based panels include the increasing adoption of engineered wood products, the shift towards sustainable materials, and innovations in manufacturing processes aimed at reducing waste and improving efficiency.