Wood Pulp Market Report

Published Date: 02 February 2026 | Report Code: wood-pulp

Wood Pulp Market Size, Share, Industry Trends and Forecast to 2033

This report explores the Wood Pulp market from 2023 to 2033, providing insights into market size, growth rates, key trends, segment analyses, and regional performance. It aims to offer a comprehensive understanding for stakeholders in the industry.

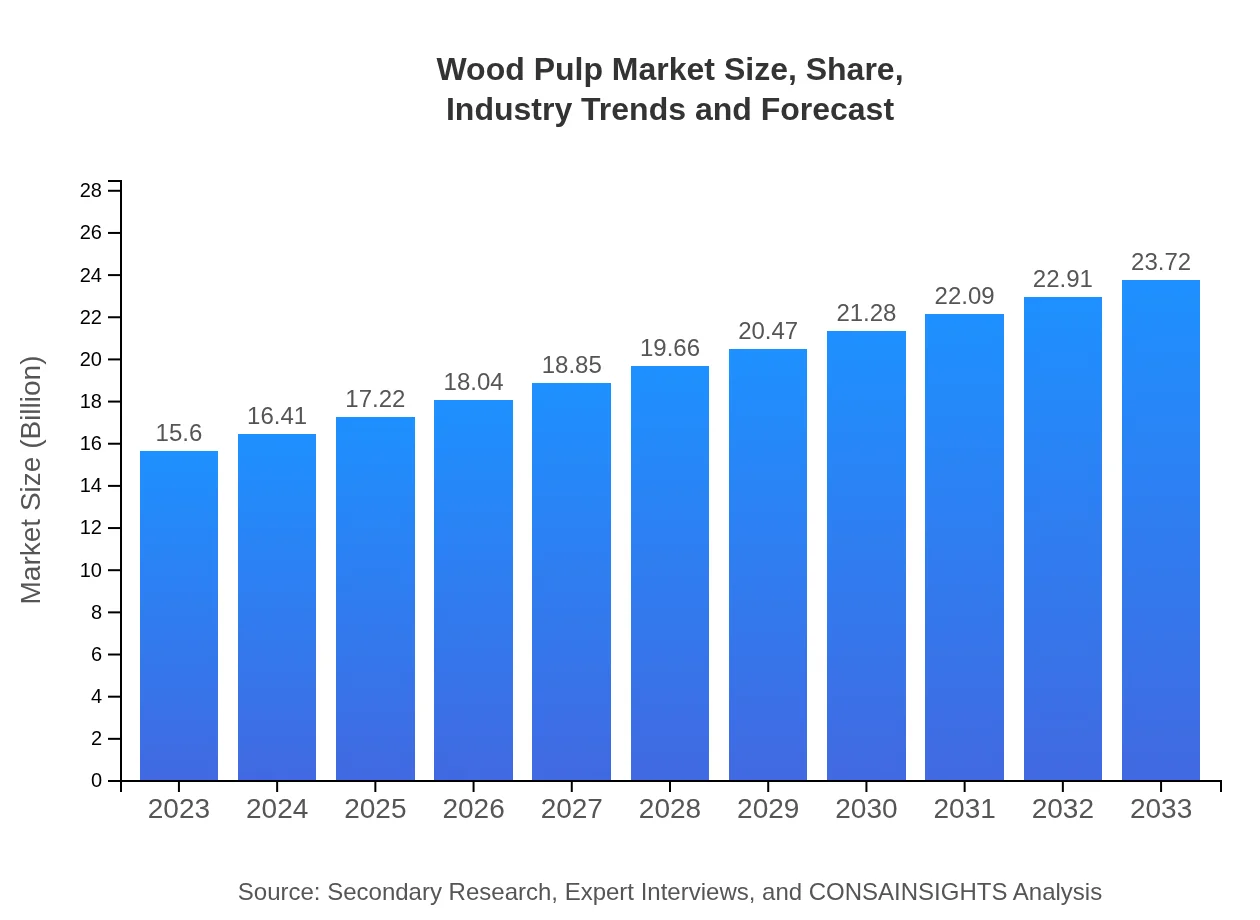

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $23.72 Billion |

| Top Companies | International Paper, Weyerhaeuser, Stora Enso, Georgia-Pacific |

| Last Modified Date | 02 February 2026 |

Wood Pulp Market Overview

Customize Wood Pulp Market Report market research report

- ✔ Get in-depth analysis of Wood Pulp market size, growth, and forecasts.

- ✔ Understand Wood Pulp's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Wood Pulp

What is the Market Size & CAGR of the Wood Pulp market in 2023?

Wood Pulp Industry Analysis

Wood Pulp Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Wood Pulp Market Analysis Report by Region

Europe Wood Pulp Market Report:

The European wood pulp market, valued at $4.96 billion in 2023, is projected to expand to $7.54 billion by 2033. The European Union's stringent regulations concerning sustainability and eco-friendliness are driving shifts in production practices. Countries such as Sweden and Finland are key players in this market, focusing on quality and sustainable sourcing.Asia Pacific Wood Pulp Market Report:

In 2023, the Asia Pacific region holds a market size of $3.12 billion for wood pulp, projected to grow to $4.75 billion by 2033. The rapid industrialization in countries like China and India drives demand, particularly in packaging and paper production. Market players in this region are increasingly adopting sustainable practices to comply with environmental regulations, enhancing market growth.North America Wood Pulp Market Report:

North America features a significant market size of $5.15 billion in 2023, anticipated to grow to $7.82 billion by 2033. This growth is attributed to the strong presence of established paper industries and a shift towards sustainable wood sourcing. Innovation in production technologies further propels market advancements in this region.South America Wood Pulp Market Report:

South America, holding a market size of $0.43 billion in 2023, is expected to reach $0.66 billion by 2033. The region is rich in forest resources and has seen a steady increase in pulp production, primarily for export. However, challenges such as local regulations and competition from other regions can impact growth.Middle East & Africa Wood Pulp Market Report:

In the Middle East and Africa, the market size is $1.93 billion in 2023, expected to grow to $2.94 billion by 2033. Factors such as the demand for packaging materials and the growing population contribute to market growth. Furthermore, investments in improving manufacturing technologies are also anticipated to boost production efficiency in the region.Tell us your focus area and get a customized research report.

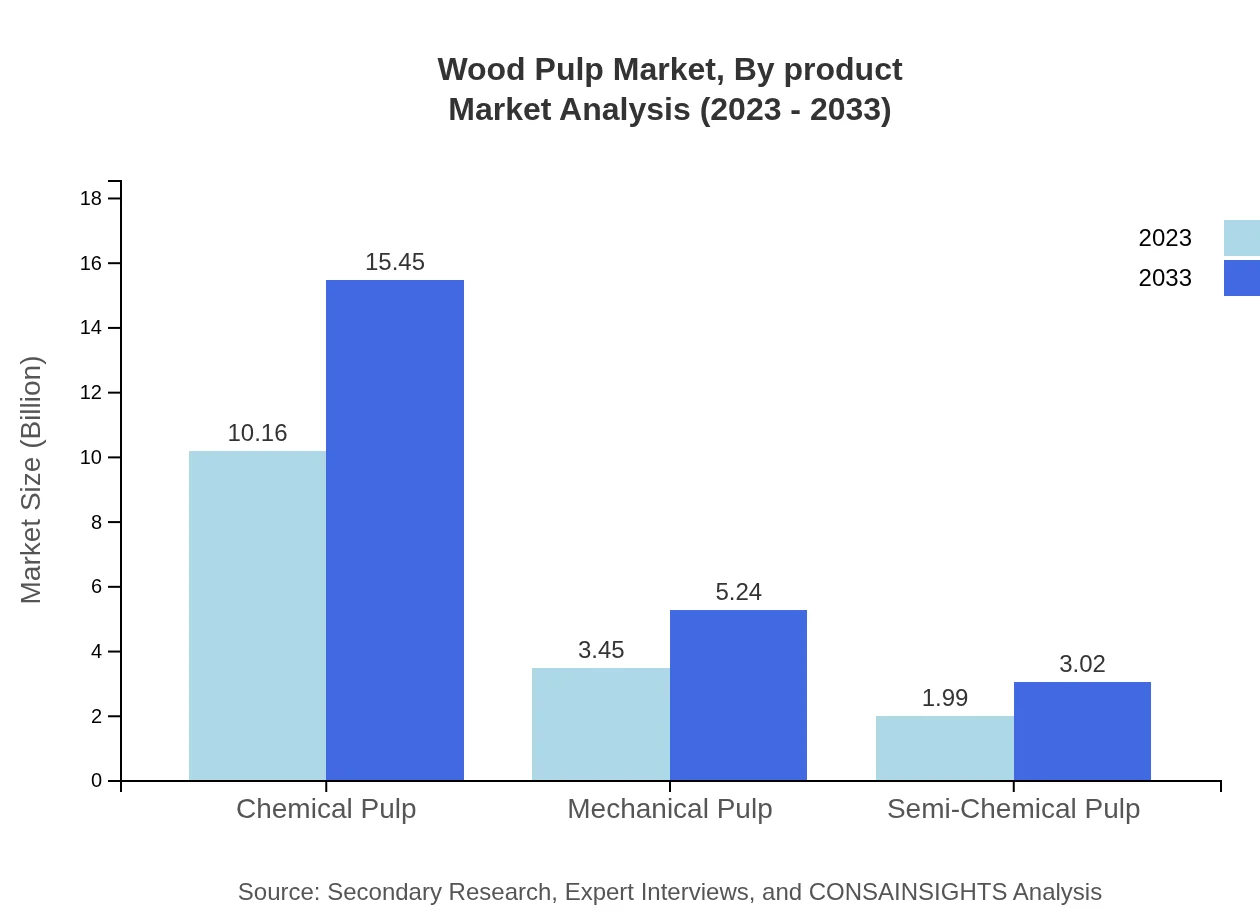

Wood Pulp Market Analysis By Product

The wood pulp market can be mainly categorized into chemical pulp, mechanical pulp, and semi-chemical pulp. Chemical pulp dominates the market with a size of $10.16 billion in 2023, forecasted to grow to $15.45 billion by 2033, capturing a significant market share of 65.15%. Mechanical pulp and semi-chemical pulp follow with sizes of $3.45 billion and $1.99 billion in 2023, projected to rise to $5.24 billion and $3.02 billion, respectively. Each segment holds unique importance depending on the application, with chemical pulp being preferred for high-quality paper products, while mechanical pulp is favored for lower-quality applications.

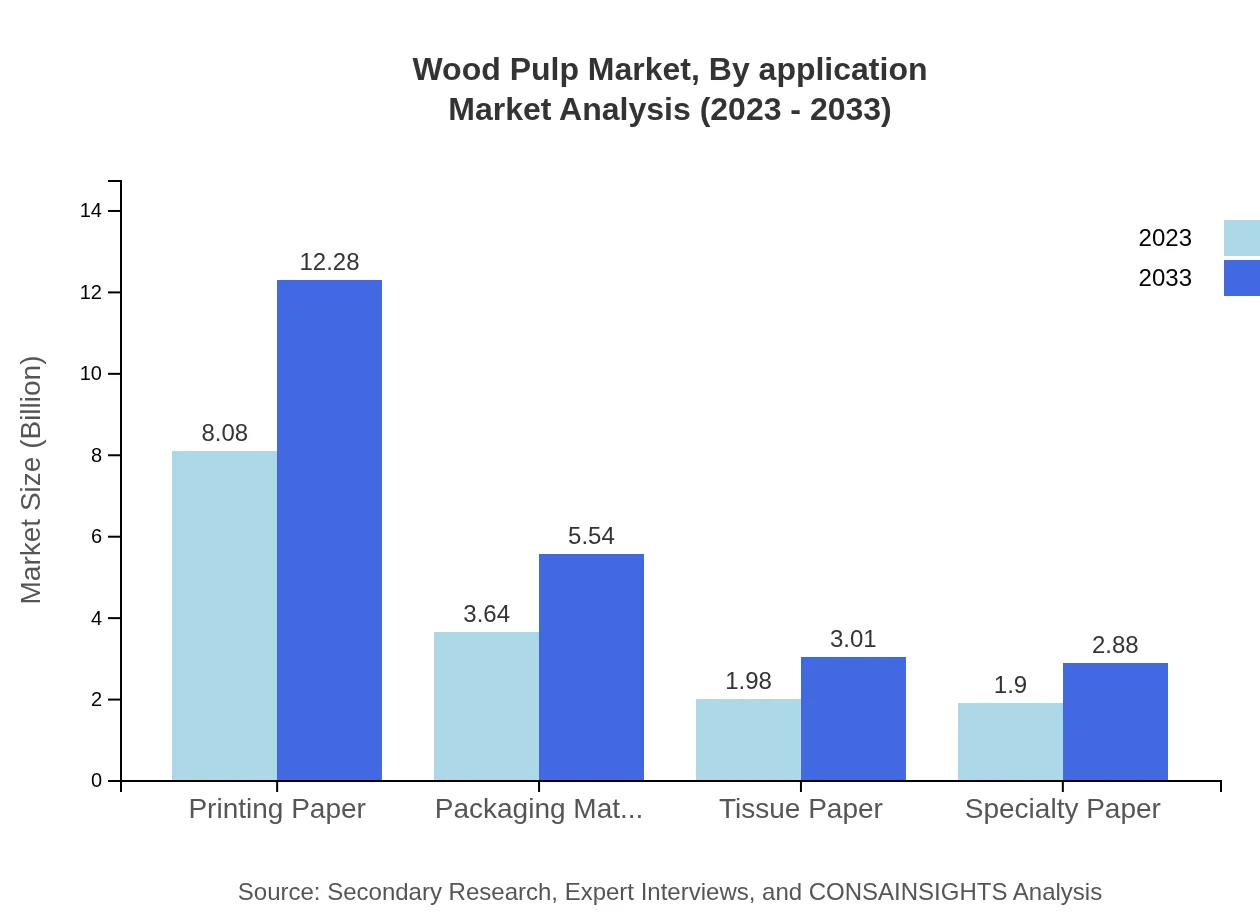

Wood Pulp Market Analysis By Application

The application segments of the wood pulp market include paper, packaging, textiles, and others. The paper industry is the largest segment, valued at $7.17 billion in 2023 and expected to reach $10.90 billion by 2033. The packaging industry, which generates $3.37 billion in 2023, is also on the rise, projected to grow alongside increasing consumer demand for sustainable packaging solutions. The textile and construction segments are smaller but show consistent growth reflecting changes in consumer behaviors and resource availability.

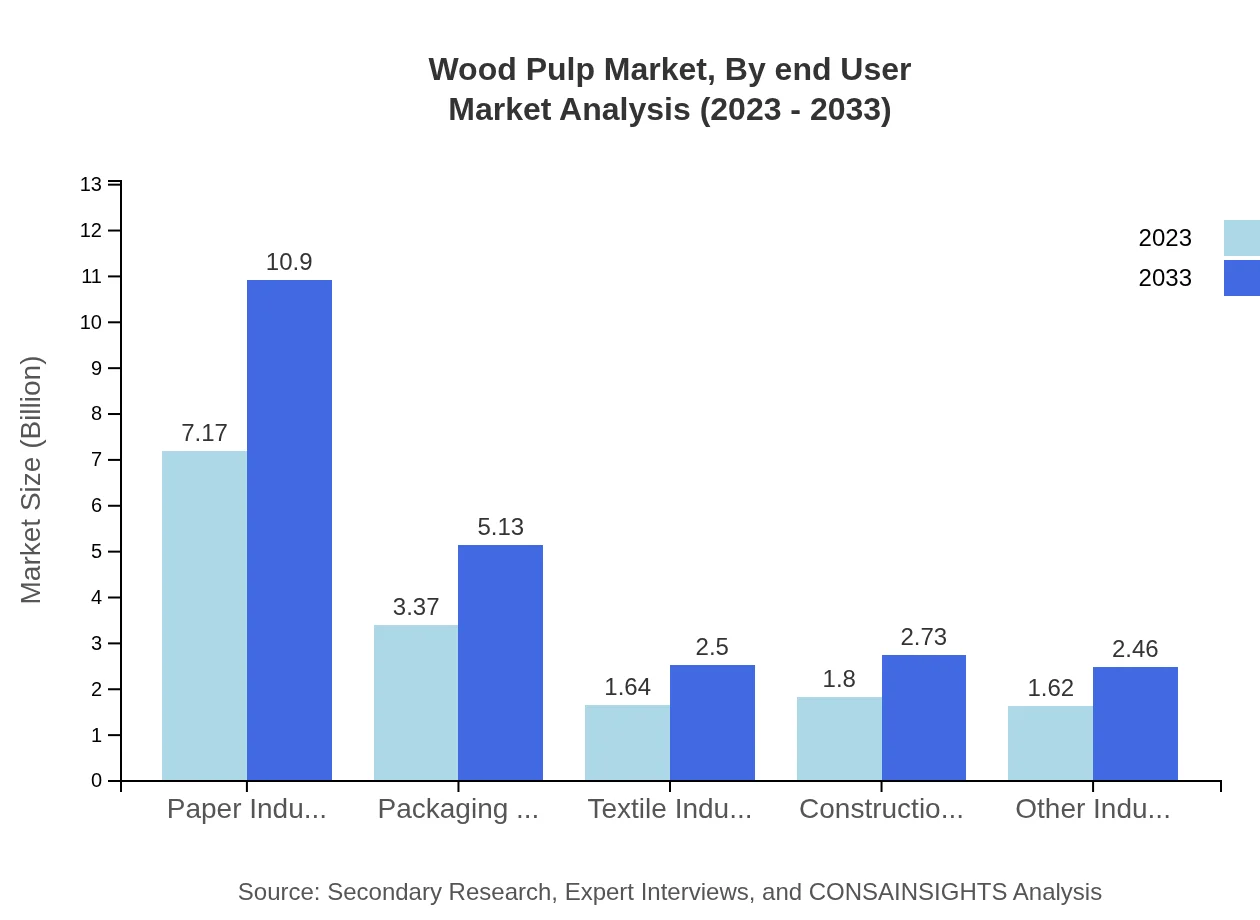

Wood Pulp Market Analysis By End User

The key end-user industries for wood pulp include paper, textiles, construction, and packaging. The paper industry remains the largest end-user, reflecting a market size of $7.17 billion in 2023. Other industries, such as textiles and packaging, are also significant, heralding sustainability-driven practices that influence growth. The construction sector is emerging with increasing material demands for sustainable building practices, driving further market expansion.

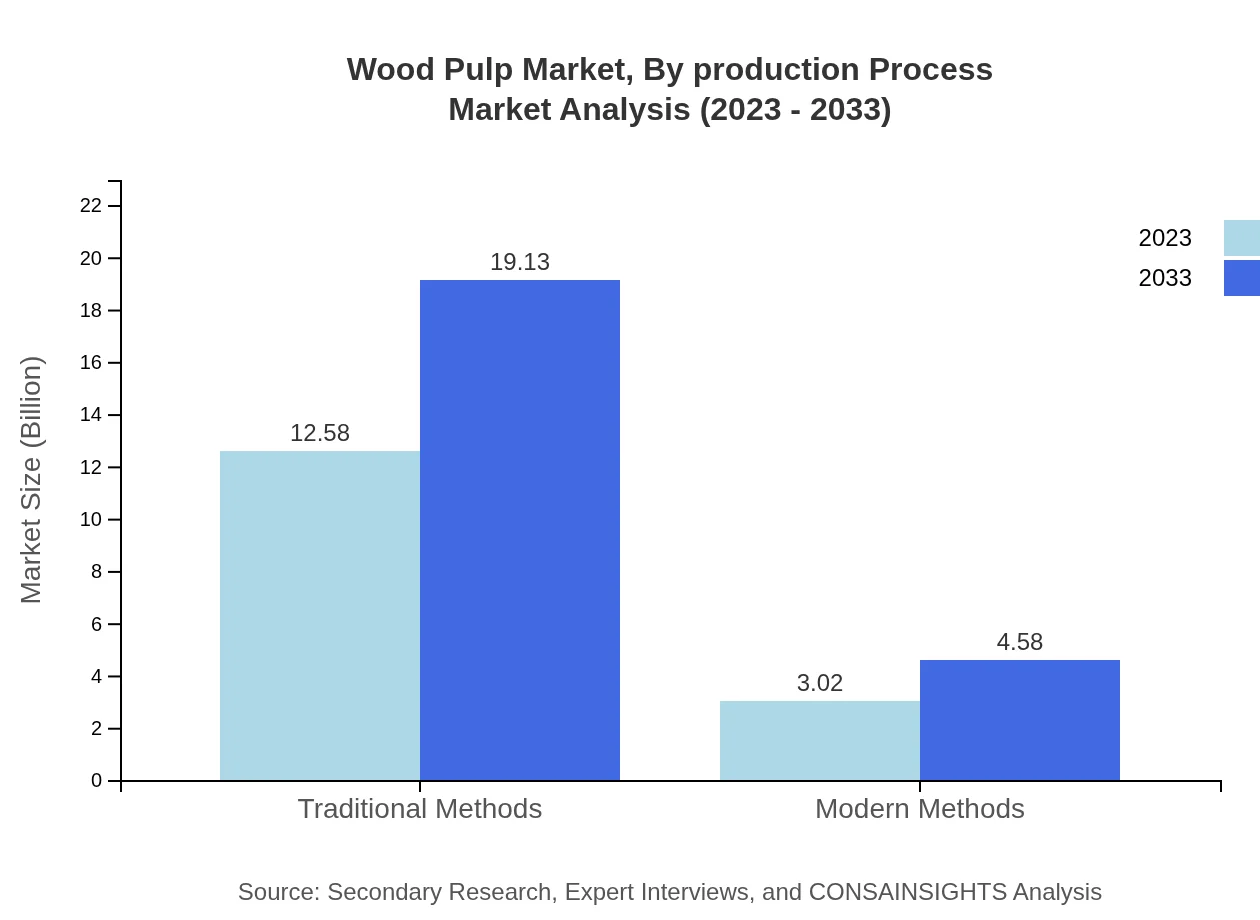

Wood Pulp Market Analysis By Production Process

The wood pulp market segments by production process into traditional methods and modern methods. Traditional methods, representing a market size of $12.58 billion in 2023, are forecasted to grow to $19.13 billion by 2033. Conversely, modern methods, while smaller at $3.02 billion, are expected to grow steadily, reflecting a shift in industry standard practices towards efficiency and reduced environmental impact.

Wood Pulp Market Analysis By Sourcing

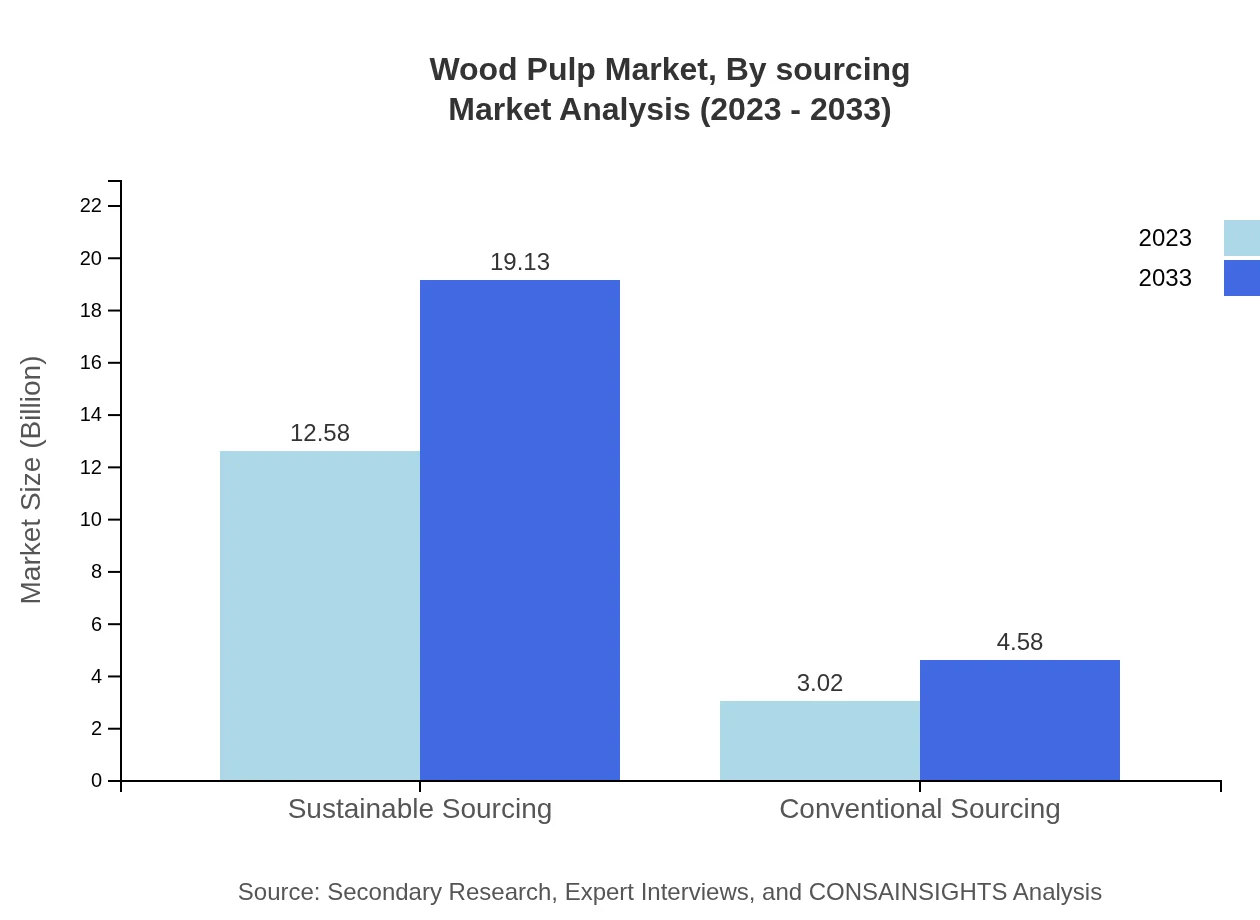

Sourcing for wood pulp can be categorized into sustainable and conventional methods. The sustainable sourcing segment, valued at $12.58 billion in 2023, is projected to remain the leading segment due to an increased focus on responsible manufacturing and forest management practices. This segment's share is expected to maintain around 80.67%, responding to global pressures for sustainability.

Wood Pulp Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Wood Pulp Industry

International Paper:

A leading global supplier of renewable fiber-based products, International Paper is one of the largest manufacturers of wood pulp, serving markets worldwide.Weyerhaeuser:

Weyerhaeuser is a prominent timberland and forest products company that produces a significant amount of wood pulp, emphasizing sustainable forest management.Stora Enso:

A global leader in renewable solutions in packaging, biomaterials, wood, and paper, Stora Enso combines sustainability with innovation in its wood pulp operations.Georgia-Pacific:

As a wholly-owned subsidiary of Koch Industries, Georgia-Pacific is a major player in the wood pulp market, manufacturing a wide range of paper and pulp products.We're grateful to work with incredible clients.

FAQs

What is the market size of wood Pulp?

The global wood pulp market was valued at approximately $15.6 billion in 2023, projected to grow at a CAGR of 4.2%, reaching about $24.2 billion by 2033.

What are the key market players or companies in this wood Pulp industry?

Key players in the wood pulp industry include companies like UPM-Kymmene Corporation, Sappi Limited, and Stora Enso Oyj, which dominate the market through extensive production capabilities and global reach.

What are the primary factors driving the growth in the wood Pulp industry?

Growth in the wood pulp industry is driven by increasing demand for paper and packaging products, a shift towards sustainable sourcing practices, and the rising popularity of eco-friendly materials.

Which region is the fastest Growing in the wood Pulp?

The Asia Pacific region is the fastest-growing market for wood pulp, expected to increase from $3.12 billion in 2023 to $4.75 billion by 2033, reflecting a robust demand for paper products.

Does ConsaInsights provide customized market report data for the wood Pulp industry?

Yes, ConsaInsights offers customized market report data for the wood-pulp industry, allowing clients to access tailored insights and analyses based on specific market needs and interests.

What deliverables can I expect from this wood Pulp market research project?

From the wood-pulp market research project, you can expect comprehensive deliverables, including market size analysis, growth forecasts, competitive landscape, segment performance, and regional market insights.

What are the market trends of wood Pulp?

Trends in the wood-pulp industry include a growing emphasis on sustainable sourcing, technological advancements in pulp production, and an increasing shift towards digitalization in the paper industry.