Wood Pulp Value Chain Analysis Market Size & CAGR

The Wood Pulp Value Chain Analysis market is projected to reach a market size of USD 15.6 billion by 2023, with a Compound Annual Growth Rate (CAGR) of 4.2% from 2023 to 2030. The forecasted growth rate signifies a steady increase in the demand for wood pulp products across various industries.

COVID-19 Impact on the Wood Pulp Value Chain Analysis Market

The COVID-19 pandemic had a significant impact on the Wood Pulp Value Chain Analysis market, causing disruptions in the global supply chain and affecting demand for wood pulp products. The lockdowns and restrictions imposed by governments led to a temporary decline in market growth. However, as the economy gradually recovers, the market is expected to rebound, driven by increased demand for sustainable and eco-friendly packaging solutions.

Wood Pulp Value Chain Analysis Market Dynamics

The Wood Pulp Value Chain Analysis market dynamics are influenced by various factors such as increasing environmental concerns, rising demand for recycled paper products, technological advancements in pulp production, and changing consumer preferences for sustainable packaging solutions. Manufacturers are focusing on adopting innovative technologies to enhance production efficiency and reduce the environmental impact of wood pulp processing.

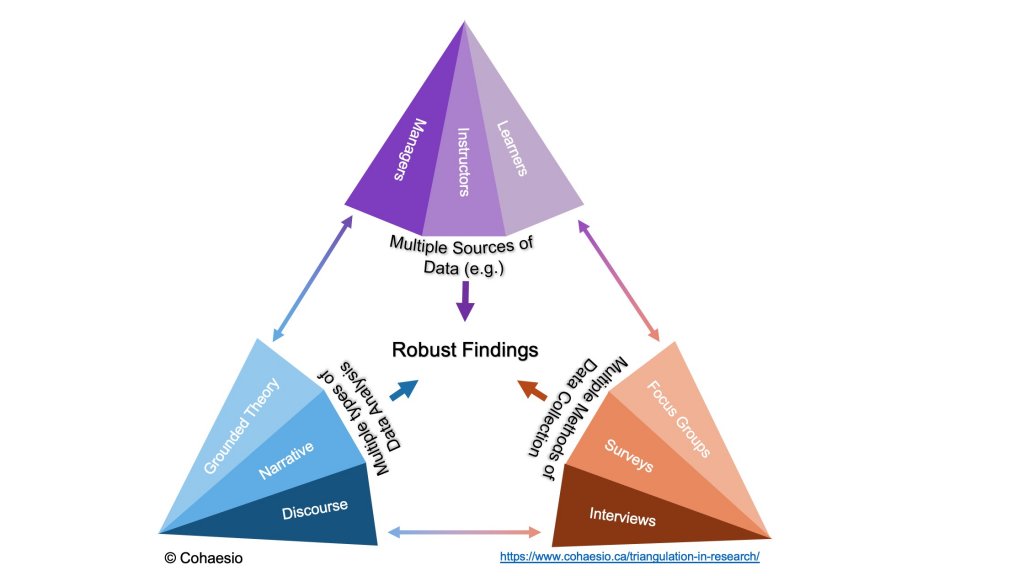

Segments and Related Analysis of the Wood Pulp Value Chain Analysis market

The Wood Pulp Value Chain Analysis market can be segmented based on product type, application, end-user industry, and technology. Different segments cater to specific market needs and offer unique value propositions to customers. Understanding these segments is essential for market players to develop targeted strategies and capitalize on growth opportunities.

Wood Pulp Value Chain Analysis market analysis report by Region

Asia Pacific Wood Pulp Value Chain Analysis Market Report

The Asia Pacific region is a key market for the Wood Pulp Value Chain Analysis industry due to the growing demand for paper and packaging materials in countries like China, India, and Japan. The region's rapid industrialization and urbanization have increased the consumption of wood pulp products, driving market growth.

South America Wood Pulp Value Chain Analysis Market Report

South America is another important region for the Wood Pulp Value Chain Analysis market, with Brazil and Chile being major producers of wood pulp. The region's abundance of natural resources and favorable climatic conditions make it a prime location for pulp and paper manufacturing.

North America Wood Pulp Value Chain Analysis Market Report

North America has a mature Wood Pulp Value Chain Analysis market, with the United States and Canada leading in pulp production and consumption. The region's focus on sustainability and recycling has driven innovations in the wood pulp industry, leading to the development of eco-friendly products.

Europe Wood Pulp Value Chain Analysis Market Report

Europe is a significant market for the Wood Pulp Value Chain Analysis sector, with countries like Sweden and Finland being major producers of wood pulp. The region's strict environmental regulations and emphasis on sustainable practices have shaped the development of the wood pulp industry in Europe.

Middle East and Africa Wood Pulp Value Chain Analysis Market Report

The Middle East and Africa region are emerging markets for the Wood Pulp Value Chain Analysis industry, with countries like South Africa and Egypt witnessing growth in pulp production. The region's expanding packaging and paper manufacturing sector presents opportunities for market players to expand their presence in the region.

Wood Pulp Value Chain Analysis market analysis report by Technology

The Wood Pulp Value Chain Analysis market is driven by technological advancements in pulp processing, including sustainable production methods, digitalization of production processes, and adoption of IoT and AI technologies. Companies are investing in innovation to improve efficiency, reduce waste, and meet the growing demand for eco-friendly pulp products.

Wood Pulp Value Chain Analysis market analysis report by Product

The Wood Pulp Value Chain Analysis market offers a range of products such as bleached and unbleached pulp, dissolving pulp, and specialty pulp for various applications. Each product category caters to specific market needs and is used in industries like paper manufacturing, textiles, packaging, and pharmaceuticals.

Wood Pulp Value Chain Analysis market analysis report by Application

The Wood Pulp Value Chain Analysis market finds applications in industries such as packaging, printing, hygiene products, textiles, and specialty chemicals. The versatile nature of wood pulp products allows for a wide range of applications across different sectors, driving market demand and growth.

Wood Pulp Value Chain Analysis market analysis report by End-User

The Wood Pulp Value Chain Analysis market serves diverse end-users, including paper mills, packaging companies, textile manufacturers, chemical industries, and pharmaceutical companies. Understanding the specific needs and requirements of each end-user segment is essential for market players to tailor their products and services accordingly.

Key Growth Drivers and Key Market Players of Wood Pulp Value Chain Analysis market

The key growth drivers for the Wood Pulp Value Chain Analysis market include increasing demand for sustainable packaging solutions, growth in the paper and pulp industry, technological advancements in pulp processing, and rising awareness about environmental conservation. The market is highly competitive, with key players such as International Paper, Stora Enso, Kimberly-Clark, Smurfit Kappa, and WestRock leading the market with their innovative products and sustainable practices.

Wood Pulp Value Chain Analysis market trends and future forecast

The Wood Pulp Value Chain Analysis market is witnessing trends such as the shift towards bio-based and recyclable packaging materials, adoption of digital technologies in pulp processing, and increasing investment in sustainable production practices. The future forecast for the market looks promising, with a focus on innovation, sustainability, and meeting evolving customer demands.

Recent happenings in the Wood Pulp Value Chain Analysis Market

The Wood Pulp Value Chain Analysis market has seen recent developments such as mergers and acquisitions among key players, investments in sustainable production practices, and the launch of eco-friendly pulp products. Companies are aligning their strategies with changing market dynamics and consumer preferences to stay competitive in the evolving wood pulp industry.