Workforce Analytics Market Report

Published Date: 31 January 2026 | Report Code: workforce-analytics

Workforce Analytics Market Size, Share, Industry Trends and Forecast to 2033

This report explores the Workforce Analytics market from 2023 to 2033, offering insights into market size, growth trends, segmentation, and regional analysis, while identifying key players and future projections.

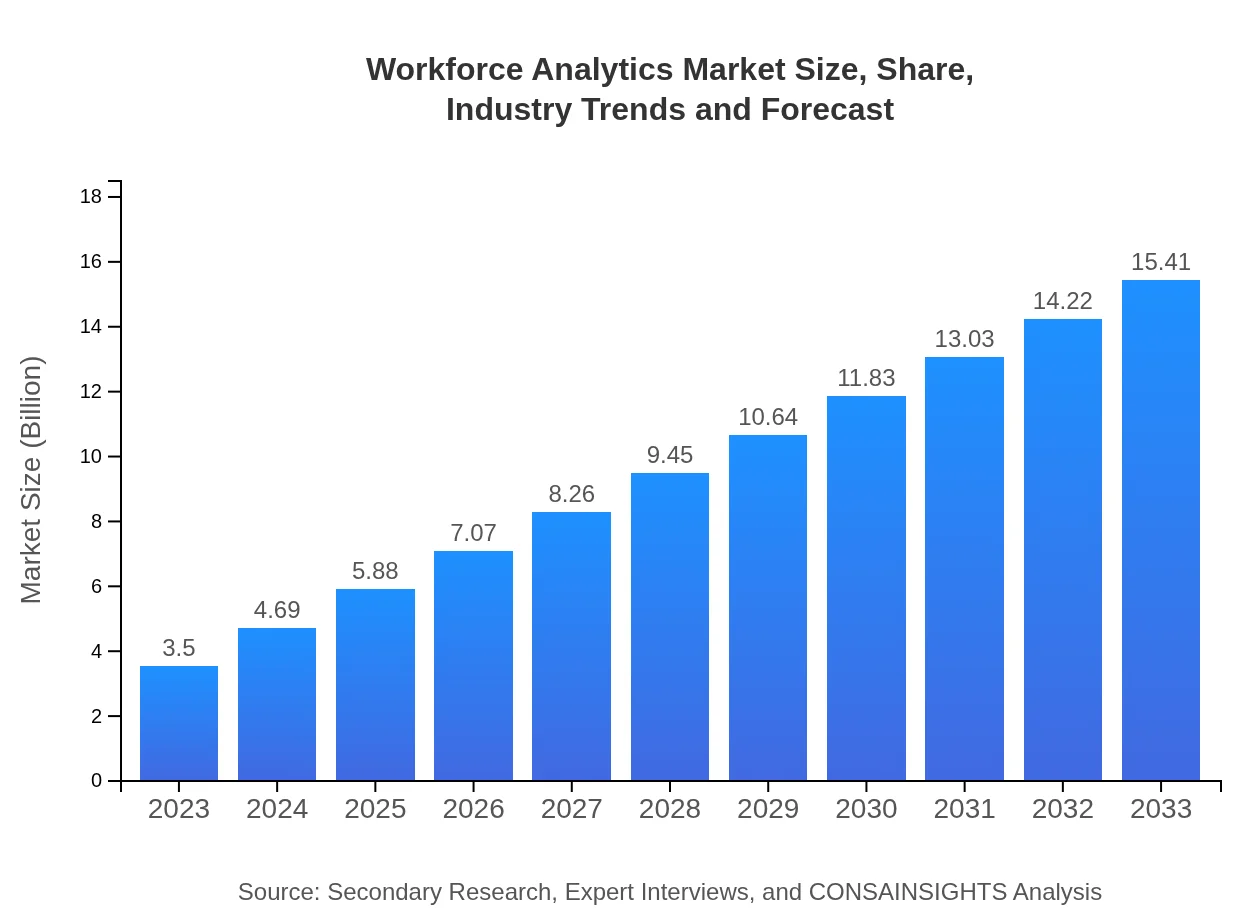

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 15.2% |

| 2033 Market Size | $15.41 Billion |

| Top Companies | Workday, Inc., SAP SE, ADP, LLC, Oracle Corporation |

| Last Modified Date | 31 January 2026 |

Workforce Analytics Market Overview

Customize Workforce Analytics Market Report market research report

- ✔ Get in-depth analysis of Workforce Analytics market size, growth, and forecasts.

- ✔ Understand Workforce Analytics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Workforce Analytics

What is the Market Size & CAGR of Workforce Analytics market in 2023?

Workforce Analytics Industry Analysis

Workforce Analytics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Workforce Analytics Market Analysis Report by Region

Europe Workforce Analytics Market Report:

Europe’s Workforce Analytics market is valued at $0.91 billion in 2023, anticipated to grow significantly to $3.99 billion by 2033. The regulatory framework surrounding data privacy, combined with the need for data-driven HR practices, contributes to this growth.Asia Pacific Workforce Analytics Market Report:

The Asia Pacific region is emerging as a significant player in the Workforce Analytics market, with a valuation of approximately $0.74 billion in 2023, expected to reach $3.24 billion by 2033. The rise of digital transformation initiatives and a growing emphasis on talent management are major growth drivers in this region.North America Workforce Analytics Market Report:

North America continues to lead the Workforce Analytics market, with a size of $1.26 billion in 2023 projected to rise to $5.56 billion by 2033. The presence of established technology firms coupled with high adoption rates of analytics solutions drive significant market growth in this region.South America Workforce Analytics Market Report:

In South America, the Workforce Analytics market is valued at $0.32 billion in 2023, predicted to grow to $1.39 billion by 2033. Increased investment in HR technology and the integration of analytics into workforce management processes are boosting market growth here.Middle East & Africa Workforce Analytics Market Report:

The Middle East and Africa Workforce Analytics market is valued at $0.28 billion in 2023, expected to increase to $1.22 billion by 2033. Growing investment in digital HR solutions and a burgeoning workforce are key to this market's expansion.Tell us your focus area and get a customized research report.

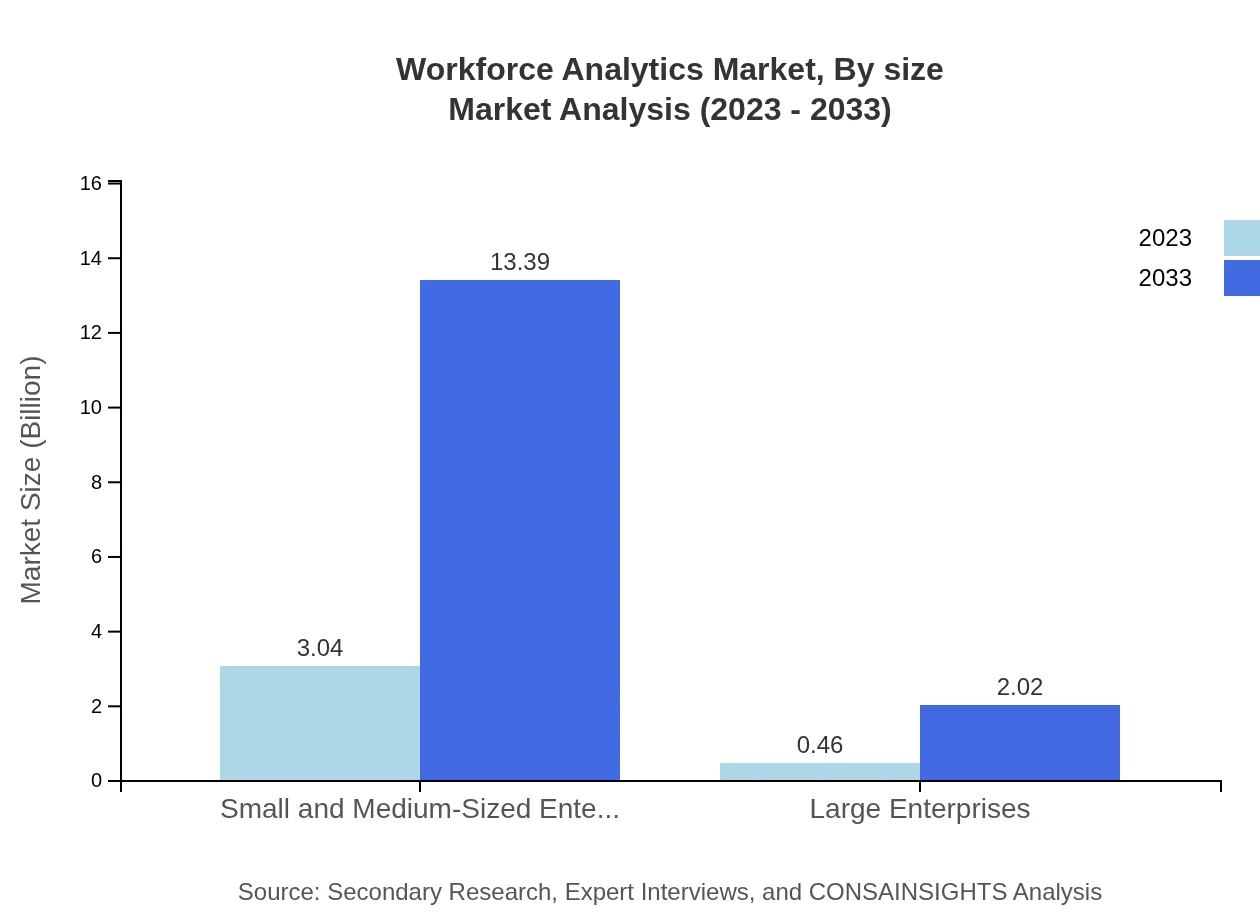

Workforce Analytics Market Analysis By Size

In 2023, Small and Medium-Sized Enterprises (SMEs) represent a dominant share (86.89%) of the Workforce Analytics market, valued at $3.04 billion, projected to grow to $13.39 billion by 2033. In contrast, Large Enterprises, holding a share of 13.11%, will see their market size increase from $0.46 billion to $2.02 billion during the same period.

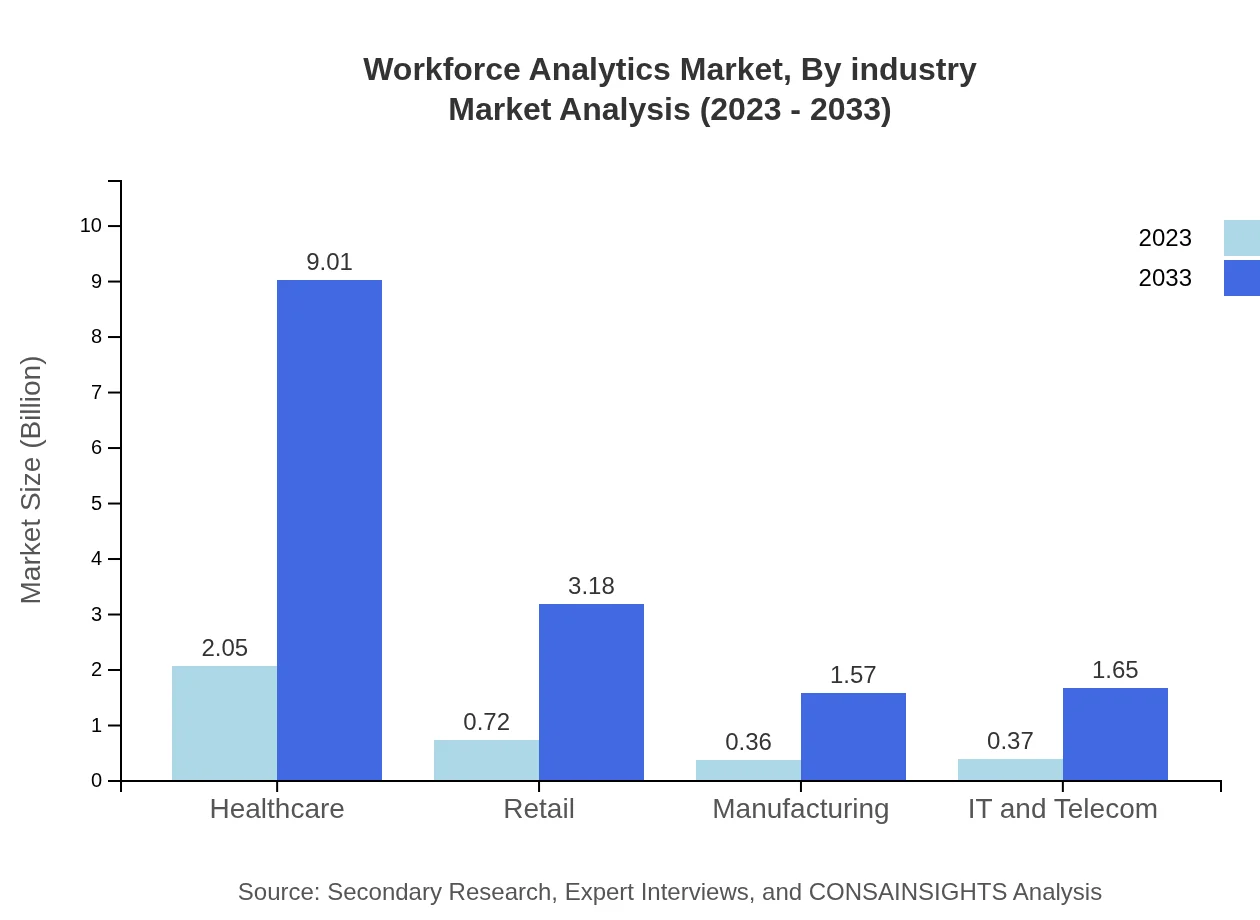

Workforce Analytics Market Analysis By Industry

The Healthcare sector leads the Workforce Analytics market with a share of 58.48%, valued at $2.05 billion in 2023, forecasted to reach $9.01 billion by 2033. Retail and Manufacturing industries will also show growth, with retail market size increasing from $0.72 billion to $3.18 billion and manufacturing from $0.36 billion to $1.57 billion during the decade.

Workforce Analytics Market Analysis By Solution

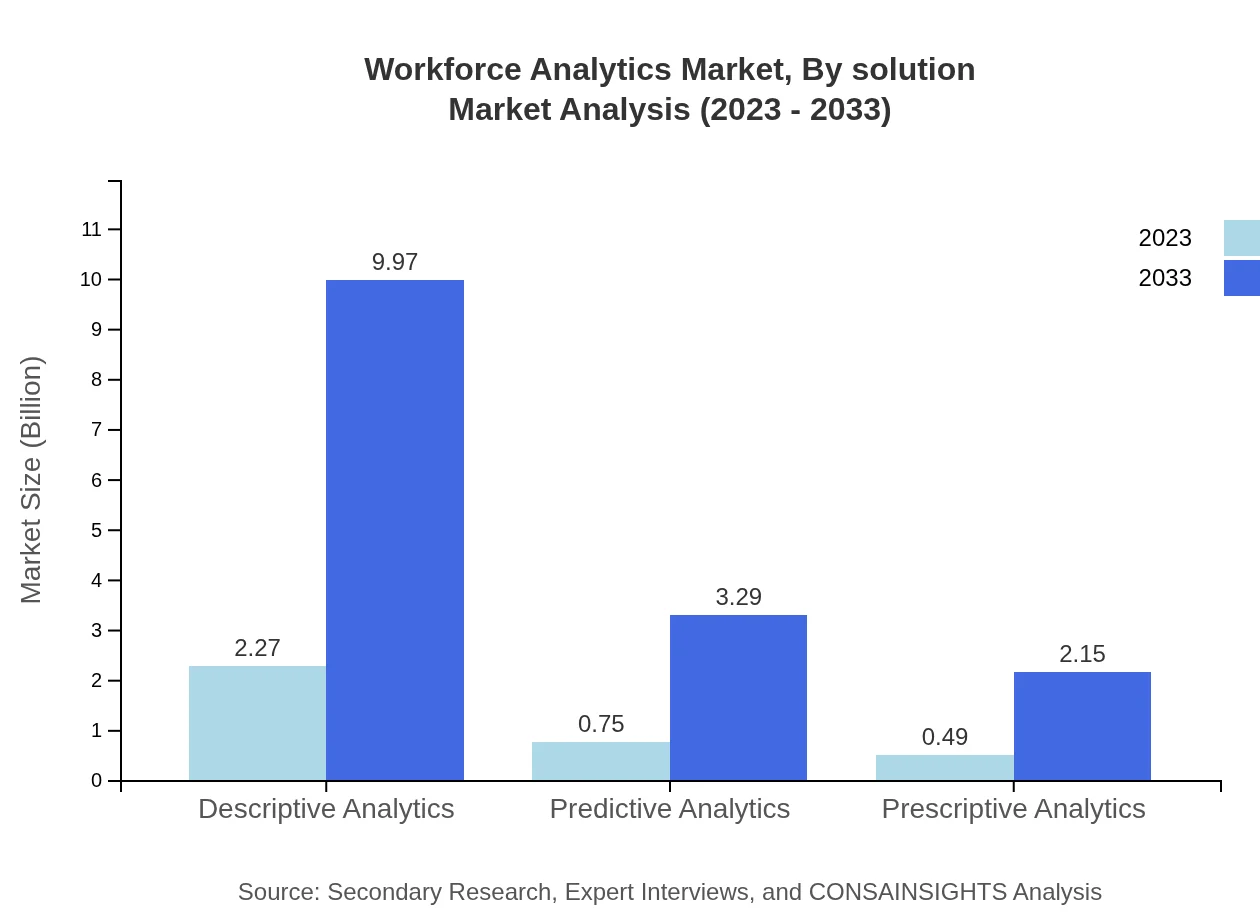

Descriptive Analytics leads the Workforce Analytics segment with a market size of $2.27 billion in 2023, expected to grow to $9.97 billion by 2033, maintaining a market share of 64.73%. Predictive Analytics follows with $0.75 billion rising to $3.29 billion and Prescriptive Analytics from $0.49 billion to $2.15 billion, revealing an increasing focus on forecasting employee behaviors and optimizing decision-making.

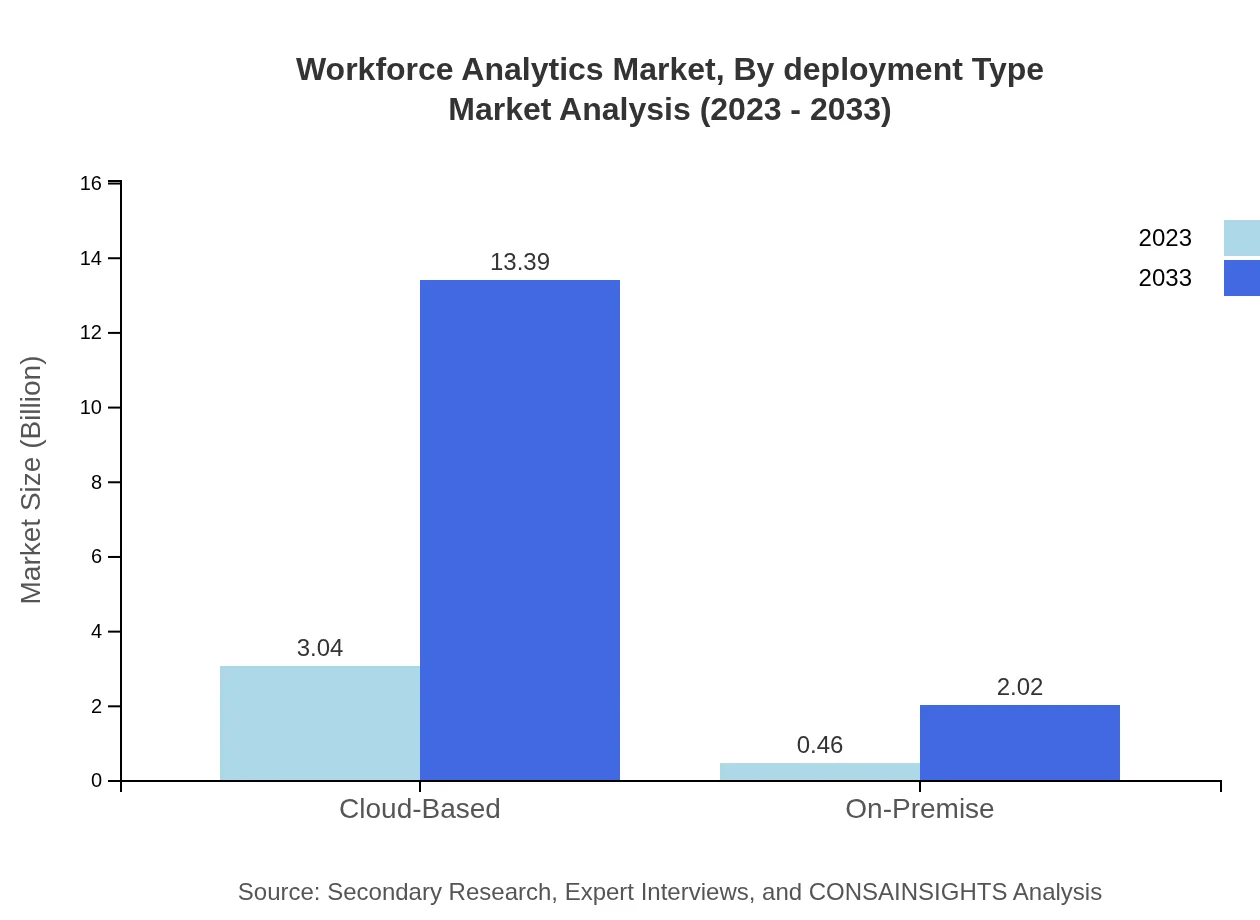

Workforce Analytics Market Analysis By Deployment Type

The cloud-based deployment type dominates the Workforce Analytics market with an 86.89% share, valued at $3.04 billion in 2023, projected to soar to $13.39 billion by 2033. Conversely, the on-premise deployment type accounts for the remaining share, increasing from $0.46 billion to $2.02 billion.

Workforce Analytics Market Analysis By Geography

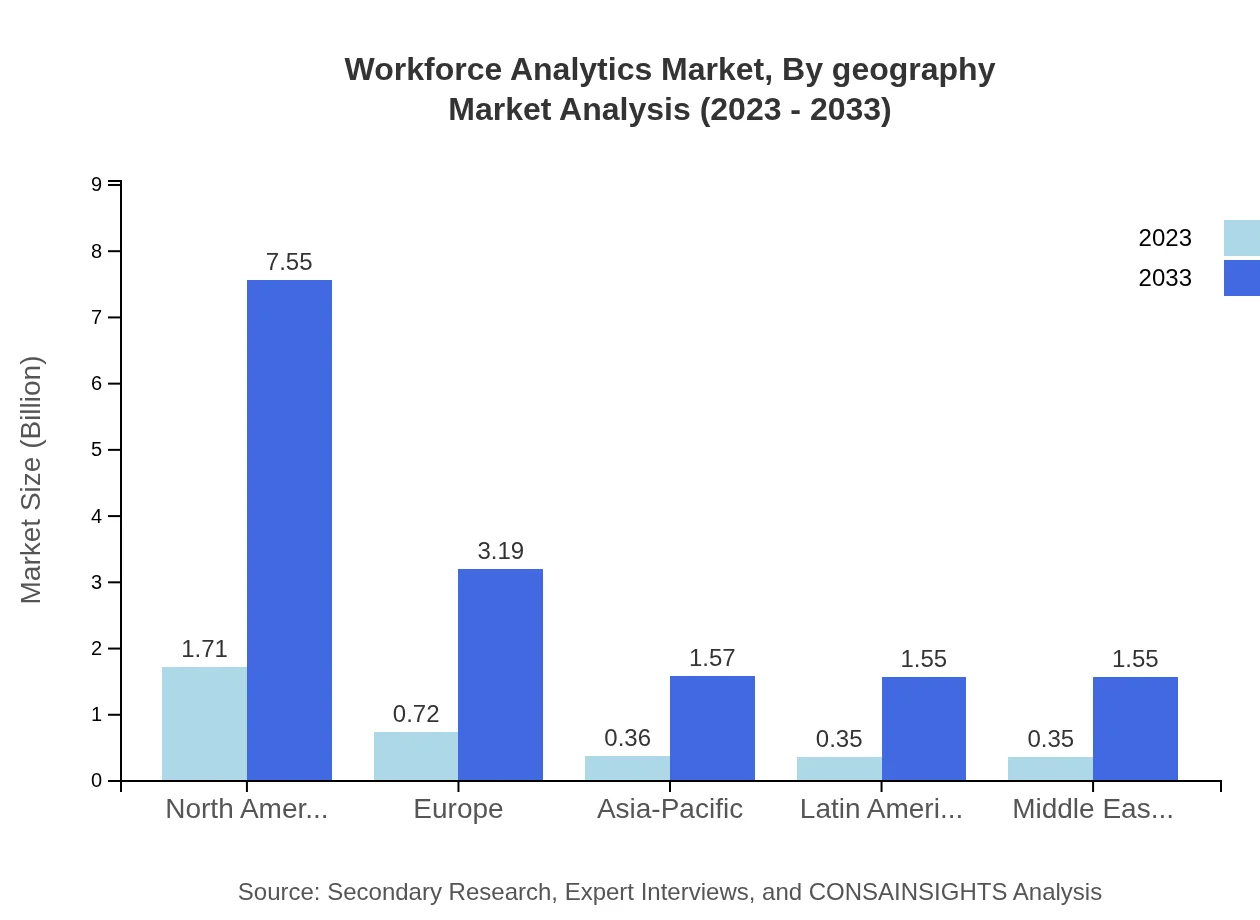

Geographically, North America holds a significant market share of 48.99%, valued at $1.71 billion in 2023, foreseen to rise to $7.55 billion by 2033. Europe and Asia Pacific also display noteworthy growth potential, showing particular strength in implementing advanced HR technologies.

Workforce Analytics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Workforce Analytics Industry

Workday, Inc.:

Workday provides enterprise cloud applications for finance and human resources, recognized for its user-friendly interface and powerful analytics functionality.SAP SE:

SAP offers SAP SuccessFactors, a leading cloud-based solution for HR analytics that enables companies to integrate and analyze workforce data seamlessly.ADP, LLC:

ADP is a comprehensive payroll services provider that extends its capabilities to Workforce Analytics, helping businesses leverage their HR data for improved decision-making.Oracle Corporation:

Oracle provides Oracle Cloud HCM, a suite of HR solutions offering advanced analytics functionalities tailored for the global workforce.We're grateful to work with incredible clients.

FAQs

What is the market size of Workforce Analytics?

The workforce analytics market is currently valued at approximately $3.5 billion in 2023, with a robust projected CAGR of 15.2% through 2033, indicating strong growth as organizations increasingly leverage data for workforce management.

What are the key market players or companies in the Workforce Analytics industry?

Key players in the workforce analytics market include companies such as SAP, IBM, Oracle, Workday, and Cornerstone OnDemand. These companies offer a diverse range of solutions tailored to meet the analytic needs of organizations across various sectors.

What are the primary factors driving the growth in the Workforce Analytics industry?

Growth in the workforce analytics industry is driven by factors such as increased demand for data-driven decision-making, a focus on enhancing employee productivity and engagement, and advancements in technology facilitating real-time analytics.

Which region is the fastest Growing in the Workforce Analytics market?

North America emerges as the fastest-growing region in workforce analytics, projected to expand from $1.26 billion in 2023 to $5.56 billion by 2033, fueled by high adoption rates among enterprises seeking to enhance workforce efficiency.

Does ConsaInsights provide customized market report data for the Workforce Analytics industry?

Yes, ConsaInsights offers customized market report data tailored to meet specific client needs within the workforce analytics industry, ensuring that insights and data points align with unique business objectives and market conditions.

What deliverables can I expect from this Workforce Analytics market research project?

Deliverables from the workforce analytics market research project typically include detailed market analysis, growth forecasts, competitive landscape assessments, regional insights, and data on key trends impacting the industry over the specified timeline.

What are the market trends of Workforce Analytics?

Current trends in workforce analytics include a surge in cloud-based solutions, increased integration of AI and machine learning capabilities, and a growing emphasis on employee experience and diversity metrics within data analysis practices.