Workspace As A Service Waas Market Report

Published Date: 31 January 2026 | Report Code: workspace-as-a-service-waas

Workspace As A Service Waas Market Size, Share, Industry Trends and Forecast to 2033

This market report provides a comprehensive analysis of the Workspace As A Service (WaaS) industry, offering insights on market trends, size, growth forecasts for 2023 to 2033, and regional performance. It also delves into technology advancements and key players shaping the market.

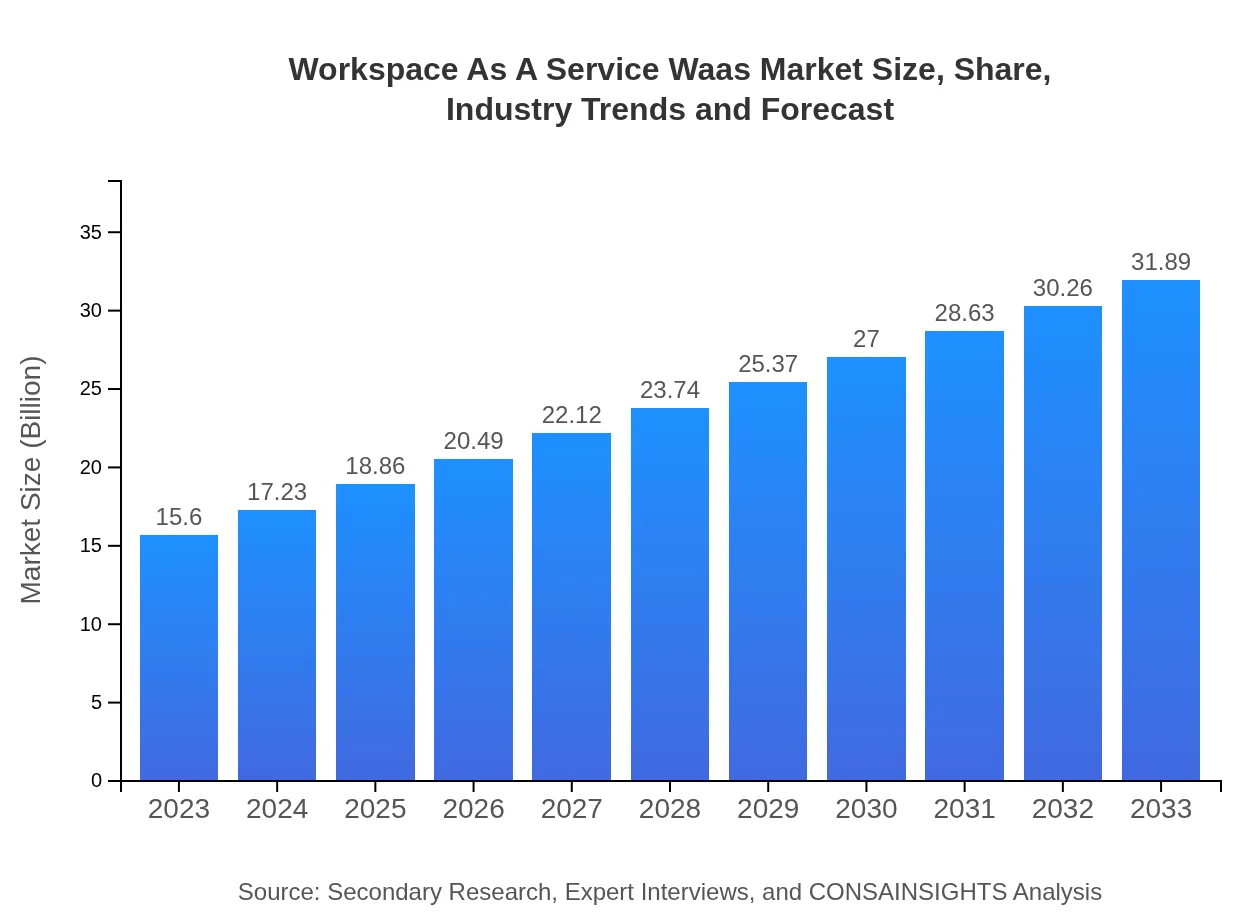

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $31.89 Billion |

| Top Companies | Microsoft, Amazon Web Services (AWS), VMware, Citrix, Google Cloud |

| Last Modified Date | 31 January 2026 |

Workspace As A Service Waas Market Overview

Customize Workspace As A Service Waas Market Report market research report

- ✔ Get in-depth analysis of Workspace As A Service Waas market size, growth, and forecasts.

- ✔ Understand Workspace As A Service Waas's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Workspace As A Service Waas

What is the Market Size & CAGR of Workspace As A Service Waas market in 2023 and 2033?

Workspace As A Service Waas Industry Analysis

Workspace As A Service Waas Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Workspace As A Service Waas Market Analysis Report by Region

Europe Workspace As A Service Waas Market Report:

The European WaaS market is estimated at $4.92 billion in 2023 and projected to reach $10.06 billion by 2033. Key countries like Germany, the UK, and France are driving the demand for WaaS, encouraged by favorable government policies and significant investments in digital infrastructure. The ongoing need for compliance with data protection regulations further drives organizations to seek flexible and secure WaaS solutions.Asia Pacific Workspace As A Service Waas Market Report:

In 2023, the Asia Pacific market size for WaaS stands at $2.96 billion, expected to grow to $6.06 billion by 2033. This region is experiencing rapid digital transformation, with an increasing number of SMEs adopting WaaS solutions to foster flexibility and innovation. The growing emphasis on the use of technology in business settings and the rise of remote work culture further bolster this trend.North America Workspace As A Service Waas Market Report:

North America leads the WaaS market, with a size of $5.38 billion in 2023, expected to expand to $10.99 billion by 2033. The region's advanced technological landscape and the presence of numerous key players contribute to higher adoption rates among enterprises. Moreover, the need for digital transformation amid competitive pressures accelerates growth in this market.South America Workspace As A Service Waas Market Report:

The South American WaaS market is valued at $1.41 billion in 2023, projected to rise to $2.89 billion by 2033. Growing urbanization and an increasing focus on adopting new technologies are key drivers in this region. Companies are increasingly turning towards WaaS for enhanced operational efficiency and access to global talent.Middle East & Africa Workspace As A Service Waas Market Report:

The WaaS market in the Middle East and Africa is at $0.93 billion in 2023, set to grow to $1.89 billion by 2033. This growth is propelled by increasing internet penetration, a growing emphasis on workforce digitalization, and rising investments by governments in smart infrastructure initiatives.Tell us your focus area and get a customized research report.

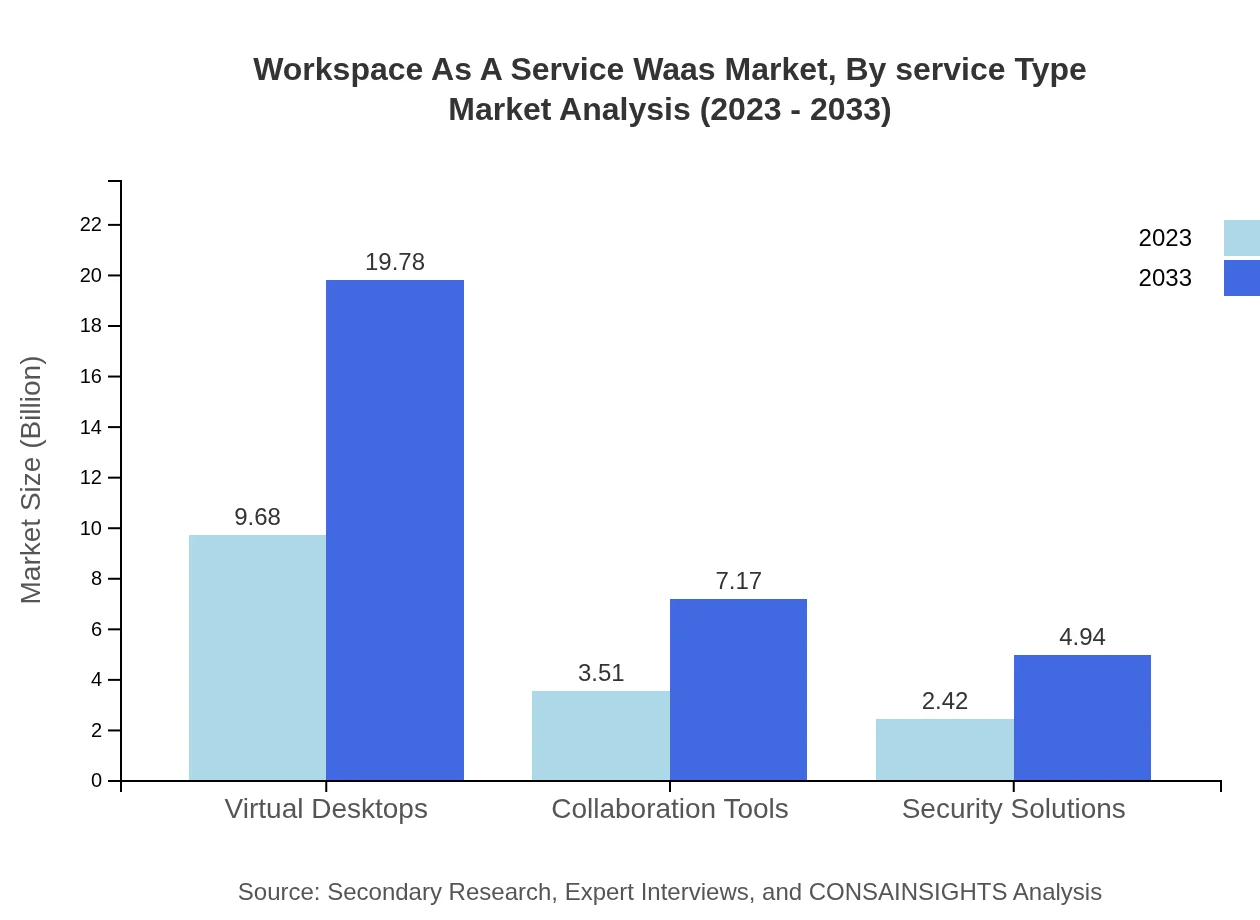

Workspace As A Service Waas Market Analysis By Service Type

The WaaS market comprises various service types, with notable segments including virtual desktops, cloud-based applications, and integrated collaboration tools. Virtualization technologies alone are projected to generate a market size of $9.68 billion in 2023, expanding to $19.78 billion by 2033, demonstrating a significant shift towards virtual infrastructures.

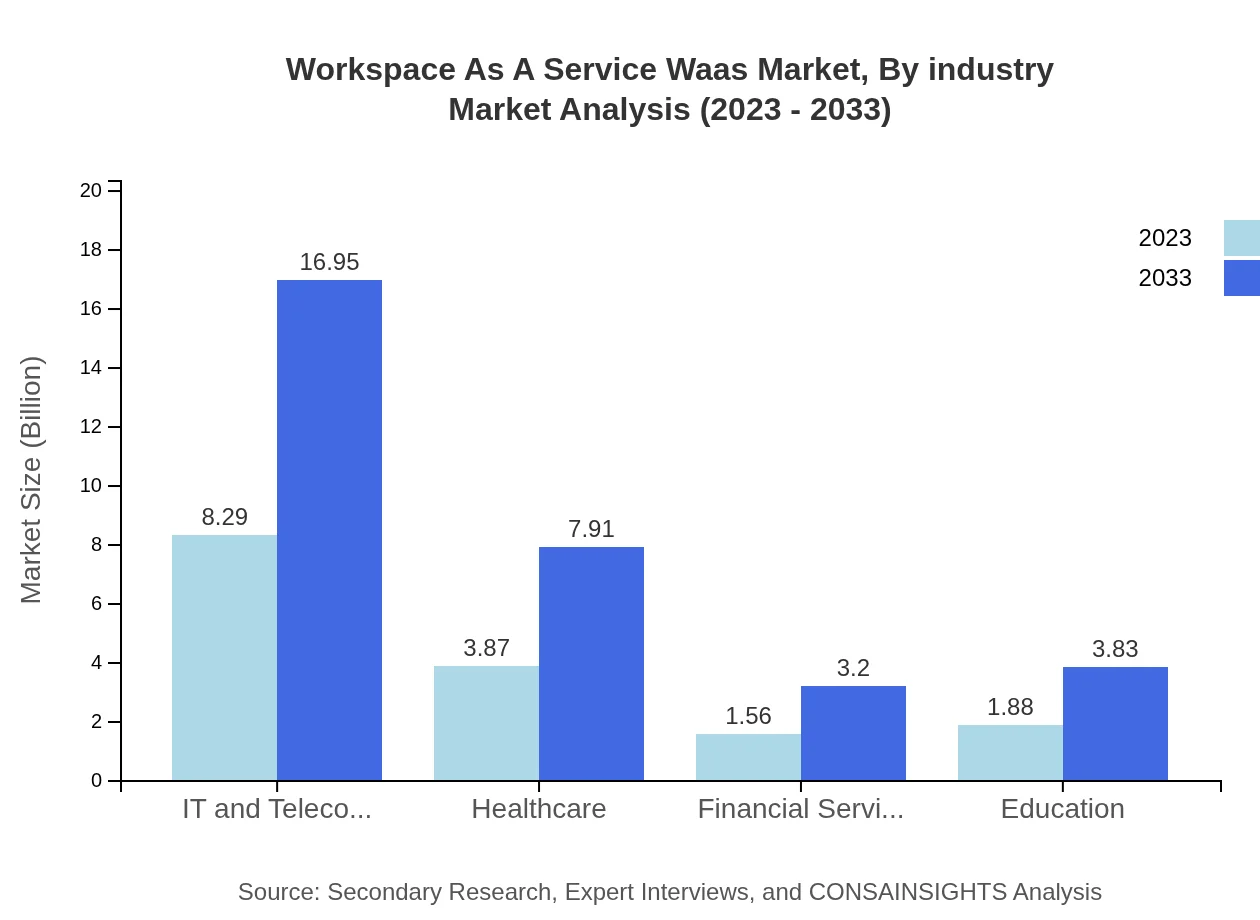

Workspace As A Service Waas Market Analysis By Industry

The industry segments utilizing WaaS predominantly include IT and telecommunications (valued at $8.29 billion in 2023), healthcare ($3.87 billion), and financial services ($1.56 billion). Each sector is leveraging WaaS to enhance operational capabilities, improve collaboration, and meet compliance requirements.

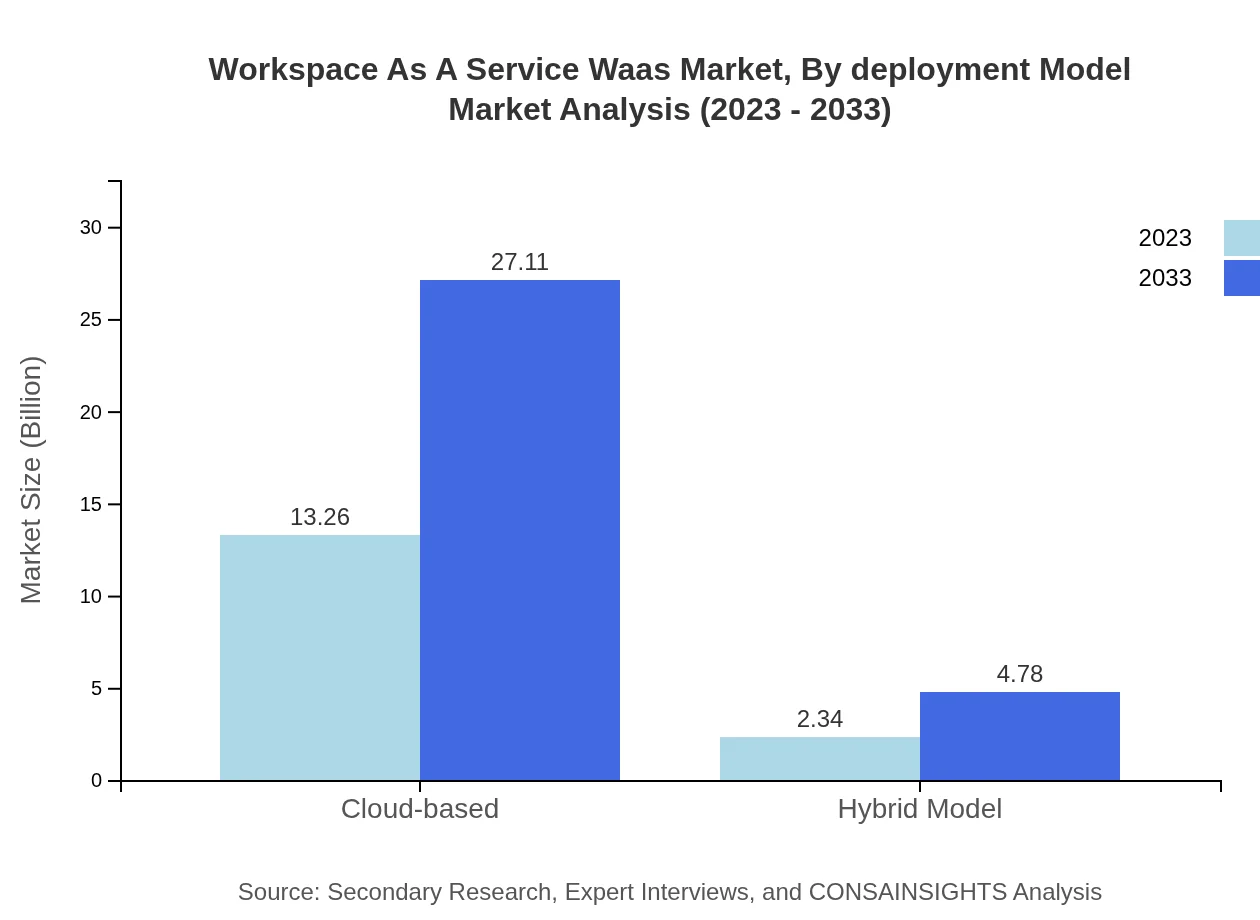

Workspace As A Service Waas Market Analysis By Deployment Model

The WaaS market segments based on deployment models include cloud-based and hybrid models. The cloud-based segment dominates, with a projected size of $13.26 billion in 2023, growing to $27.11 billion by 2033, indicating businesses' preference for fully-managed solutions that offer scalability and accessibility.

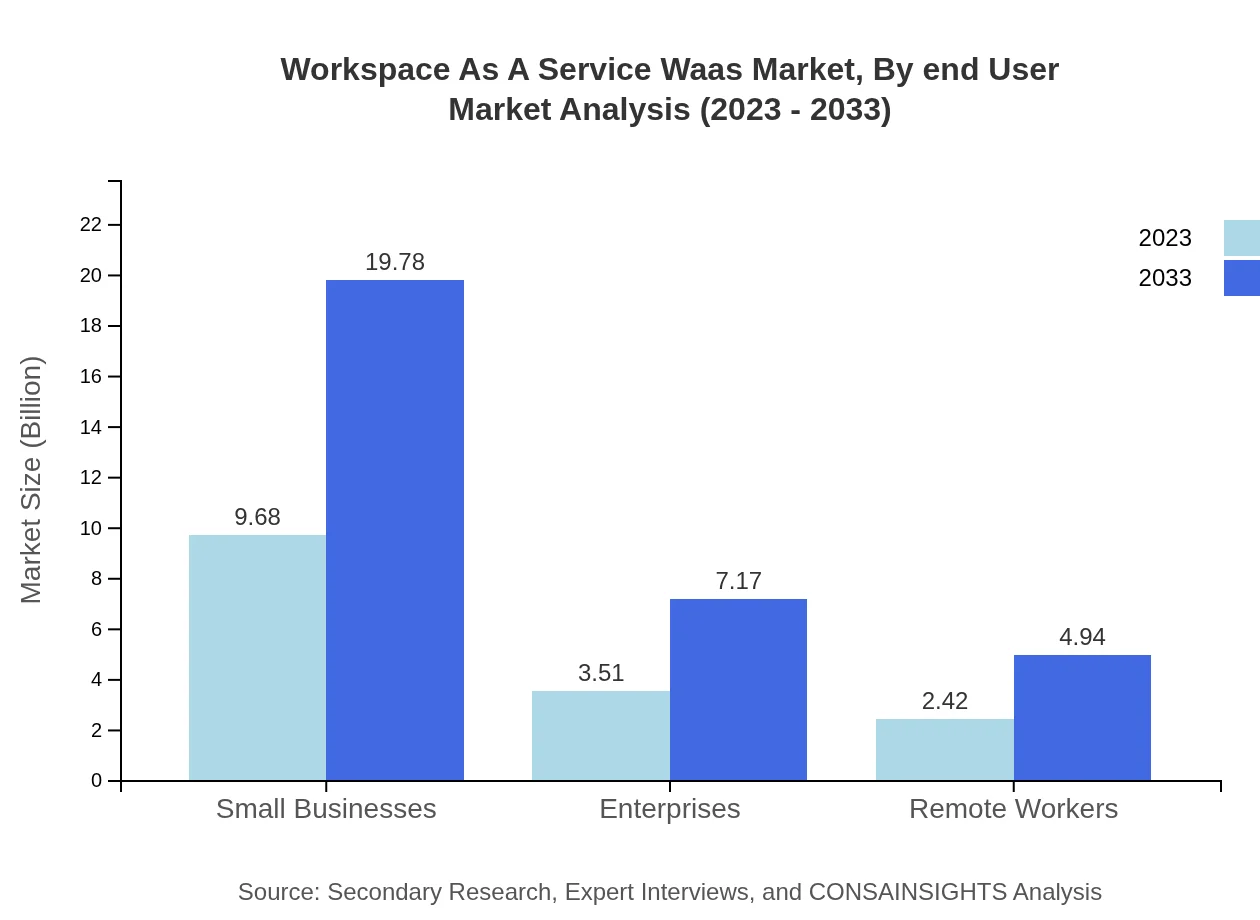

Workspace As A Service Waas Market Analysis By End User

End-users primarily comprise small businesses, enterprises, and remote workers. Small businesses showcase strong growth, with market sizes growing from $9.68 billion in 2023 to $19.78 billion by 2033, as these companies seek affordable and scalable solutions to compete effectively.

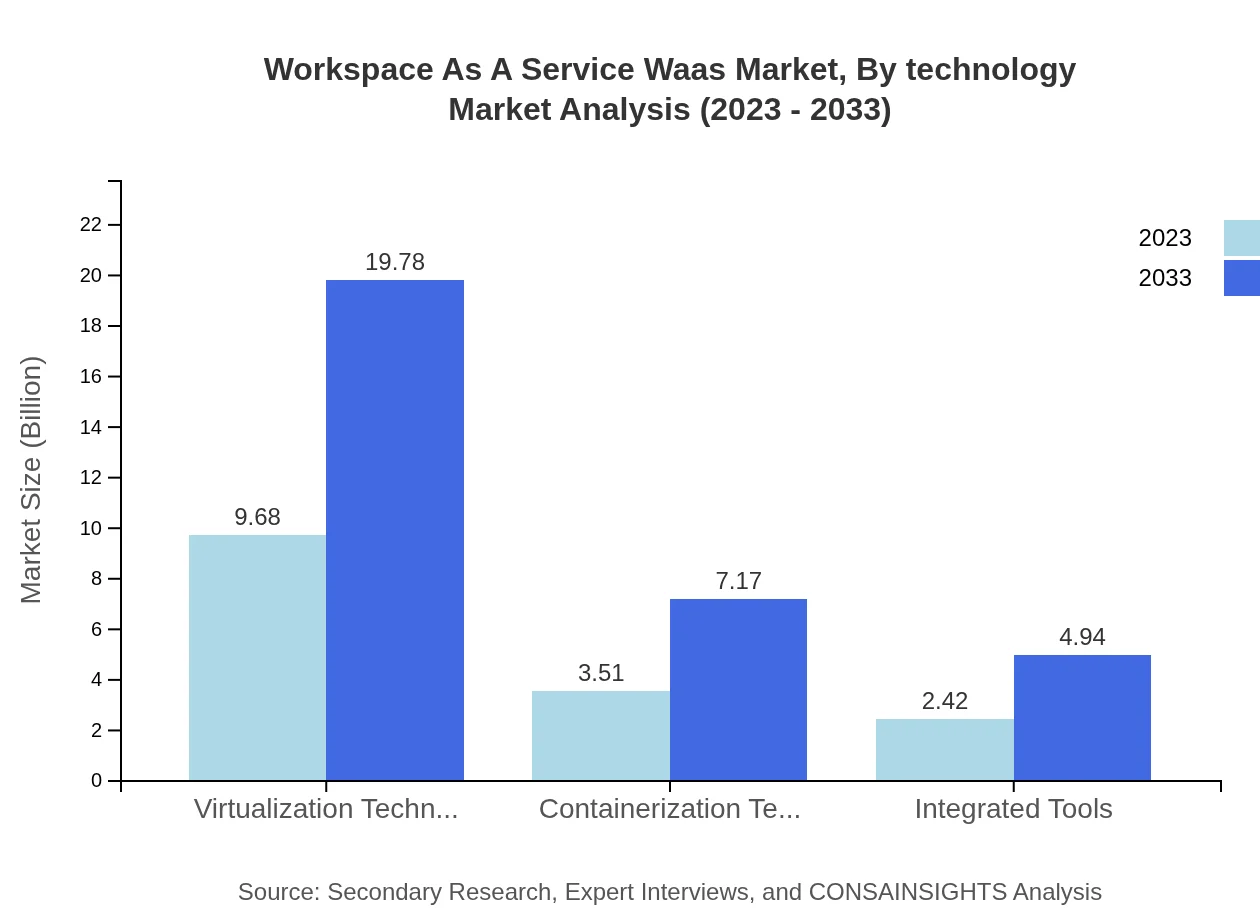

Workspace As A Service Waas Market Analysis By Technology

Technologies like virtualization and containerization substantially influence the WaaS market. Virtual desktops show significant promise, with market demand expected to rise from $9.68 billion in 2023 to $19.78 billion by 2033, highlighting the crucial role of technology in shaping the workspaces of the future.

Workspace As A Service Waas Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Workspace As A Service Waas Industry

Microsoft:

Microsoft leads the market with its Azure cloud platform, offering comprehensive WaaS solutions integrated with Office 365, enabling enhanced collaboration and productivity.Amazon Web Services (AWS):

AWS provides a robust suite of WaaS solutions through its extensive cloud offerings, catering to a diverse range of business needs from small enterprises to global corporations.VMware:

VMware specializes in virtualization technologies, providing innovative WaaS solutions that empower businesses to manage their resources efficiently.Citrix:

Citrix is known for its leading secure application delivery and virtual desktop infrastructure technologies, helping organizations transform their workspace capabilities.Google Cloud:

Google Cloud offers advanced cloud solutions that include WaaS capabilities, focusing on improving collaboration and productivity for remote teams.We're grateful to work with incredible clients.

FAQs

What is the market size of workspace As A Service (WaaS)?

The global workspace-as-a-service (WaaS) market is projected to reach approximately $15.6 billion by 2033, growing at a CAGR of 7.2% from its current size. This growth is driven by increasing demand for flexible workplace solutions across various sectors.

What are the key market players or companies in the workspace As A Service (WaaS) industry?

Key players in the WaaS market include major technology companies, cloud service providers, and software vendors. These companies are continuously innovating to enhance their service offerings and stay competitive in the evolving landscape of cloud-based work solutions.

What are the primary factors driving the growth in the workspace As A Service (WaaS) industry?

Growth drivers for the WaaS market include the rising adoption of remote work, the need for cost-effective IT solutions, and the increasing trend toward digital transformation. Furthermore, the shift from traditional office spaces to virtual solutions supports this trend.

Which region is the fastest Growing in the workspace As A Service (WaaS)?

The fastest-growing region in the WaaS market is North America, projected to grow from $5.38 billion in 2023 to $10.99 billion by 2033. Other significant regions include Europe and the Asia Pacific, which also demonstrate strong growth potential.

Does ConsaInsights provide customized market report data for the workspace As A Service (WaaS) industry?

Yes, ConsaInsights offers tailored market reports for the WaaS industry, allowing businesses to gain insights that align with their specific operational needs and market concerns. Customized reports can include detailed analysis and forecasts based on client requirements.

What deliverables can I expect from this workspace As A Service (WaaS) market research project?

Deliverables for the WaaS market research project typically include comprehensive reports, data analytics, trend analyses, competitor benchmarking, and actionable insights tailored to business needs, ensuring clients are well-informed for decision-making.

What are the market trends of workspace As A Service (WaaS)?

Current trends in the WaaS market include the rise of cloud-based solutions, increasing mobile accessibility, and the integration of advanced security measures. Companies are focusing on collaboration tools and virtual desktops, enhancing user experiences in remote setups.