Wound Care Biologics Market Report

Published Date: 31 January 2026 | Report Code: wound-care-biologics

Wound Care Biologics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Wound Care Biologics market, including key trends, market size, and forecast data for 2023-2033. It aims to offer insights into the evolving landscape of wound care solutions influenced by technology and consumer demand.

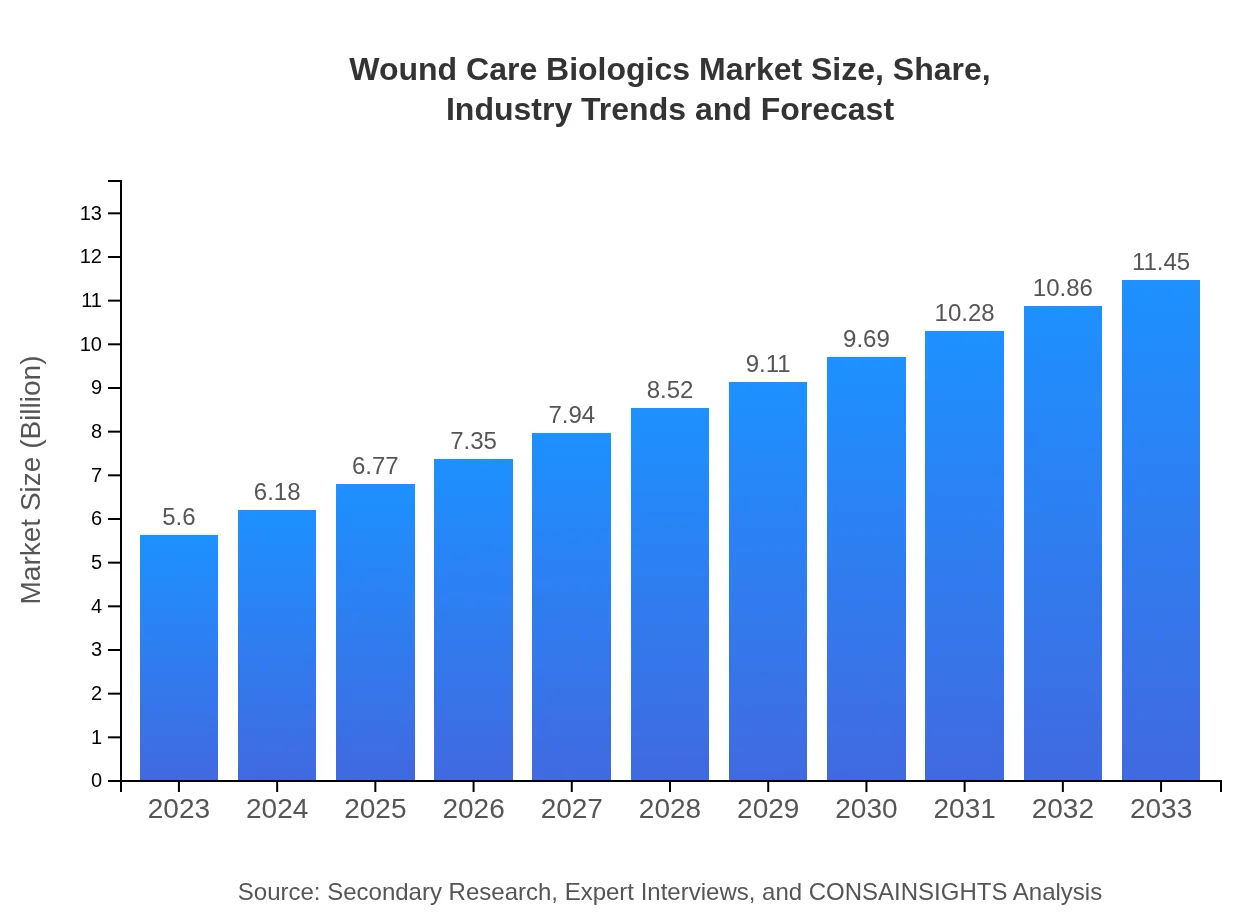

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $11.45 Billion |

| Top Companies | Smith & Nephew, MediWound, Acelity, Organogenesis |

| Last Modified Date | 31 January 2026 |

Wound Care Biologics Market Overview

Customize Wound Care Biologics Market Report market research report

- ✔ Get in-depth analysis of Wound Care Biologics market size, growth, and forecasts.

- ✔ Understand Wound Care Biologics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Wound Care Biologics

What is the Market Size & CAGR of Wound Care Biologics market in 2023?

Wound Care Biologics Industry Analysis

Wound Care Biologics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Wound Care Biologics Market Analysis Report by Region

Europe Wound Care Biologics Market Report:

The European market is forecasted to grow from USD 1.72 billion in 2023 to USD 3.51 billion by 2033. Factors influencing this growth include an aging population and increasing prevalence of chronic diseases such as diabetes, leading to a higher demand for efficient wound care solutions.Asia Pacific Wound Care Biologics Market Report:

In the Asia Pacific region, the Wound Care Biologics market is expected to grow from USD 0.97 billion in 2023 to USD 1.98 billion by 2033, propelled by increasing investments in healthcare infrastructure and rising awareness of advanced treatment options among practitioners and patients alike.North America Wound Care Biologics Market Report:

North America holds a substantial share of the market, with an expected growth from USD 2.16 billion in 2023 to USD 4.42 billion by 2033. The presence of key industry players, advanced healthcare facilities, and a well-established reimbursement framework are vital contributors to this market growth.South America Wound Care Biologics Market Report:

The South American market is projected to grow from USD 0.44 billion in 2023 to USD 0.90 billion by 2033. Economic development and improving access to healthcare services are expected to drive growth, although challenges such as regulatory hurdles remain significant.Middle East & Africa Wound Care Biologics Market Report:

In the Middle East and Africa region, the market is projected to grow from USD 0.31 billion in 2023 to USD 0.64 billion by 2033. Despite limited healthcare infrastructure in some areas, rising healthcare expenditure and increasing incidence of non-communicable diseases are key factors driving demand.Tell us your focus area and get a customized research report.

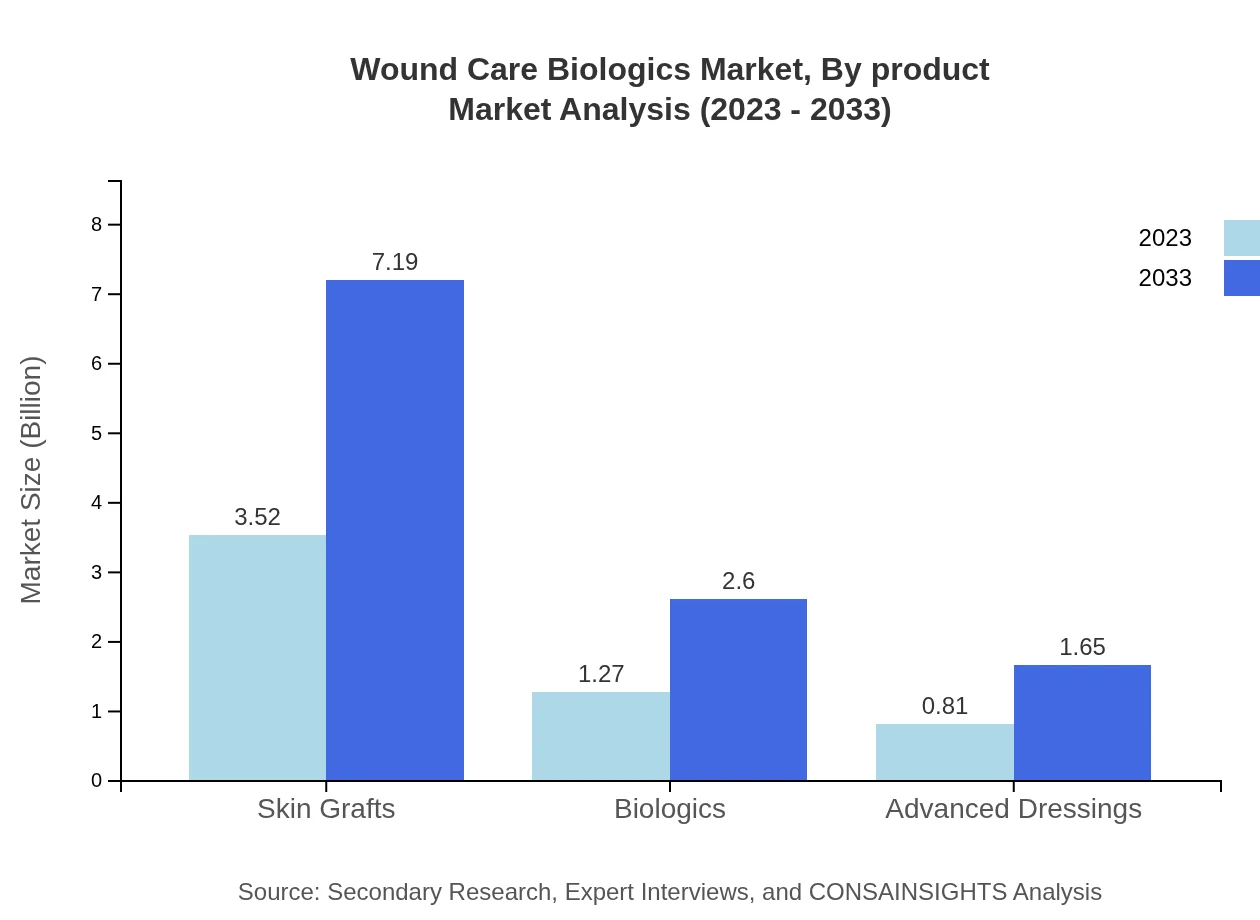

Wound Care Biologics Market Analysis By Product

The product segment is dominated by Skin Grafts, expected to grow from USD 3.52 billion in 2023 to USD 7.19 billion in 2033, holding a share of 62.83%. Advanced Dressings and Biologics are also significant contributors, with expected increases to USD 1.65 billion and USD 2.60 billion respectively by 2033.

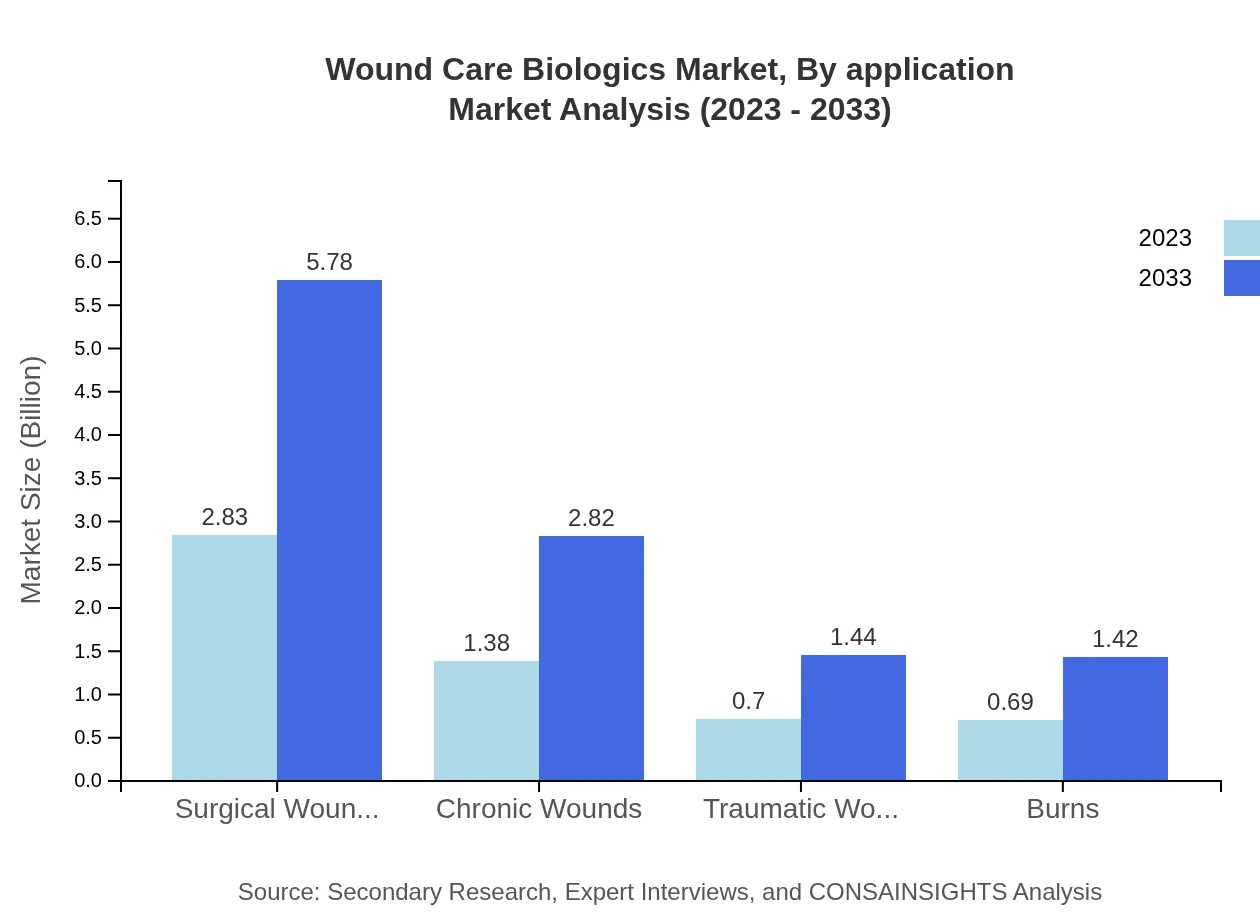

Wound Care Biologics Market Analysis By Application

Application segments differentiate between Surgical Wounds and Chronic Wounds. Surgical Wounds will grow from USD 2.83 billion in 2023 to USD 5.78 billion by 2033, while Chronic Wounds are expected to grow from USD 1.38 billion to USD 2.82 billion, indicative of rising surgical procedures and chronic illness prevalence.

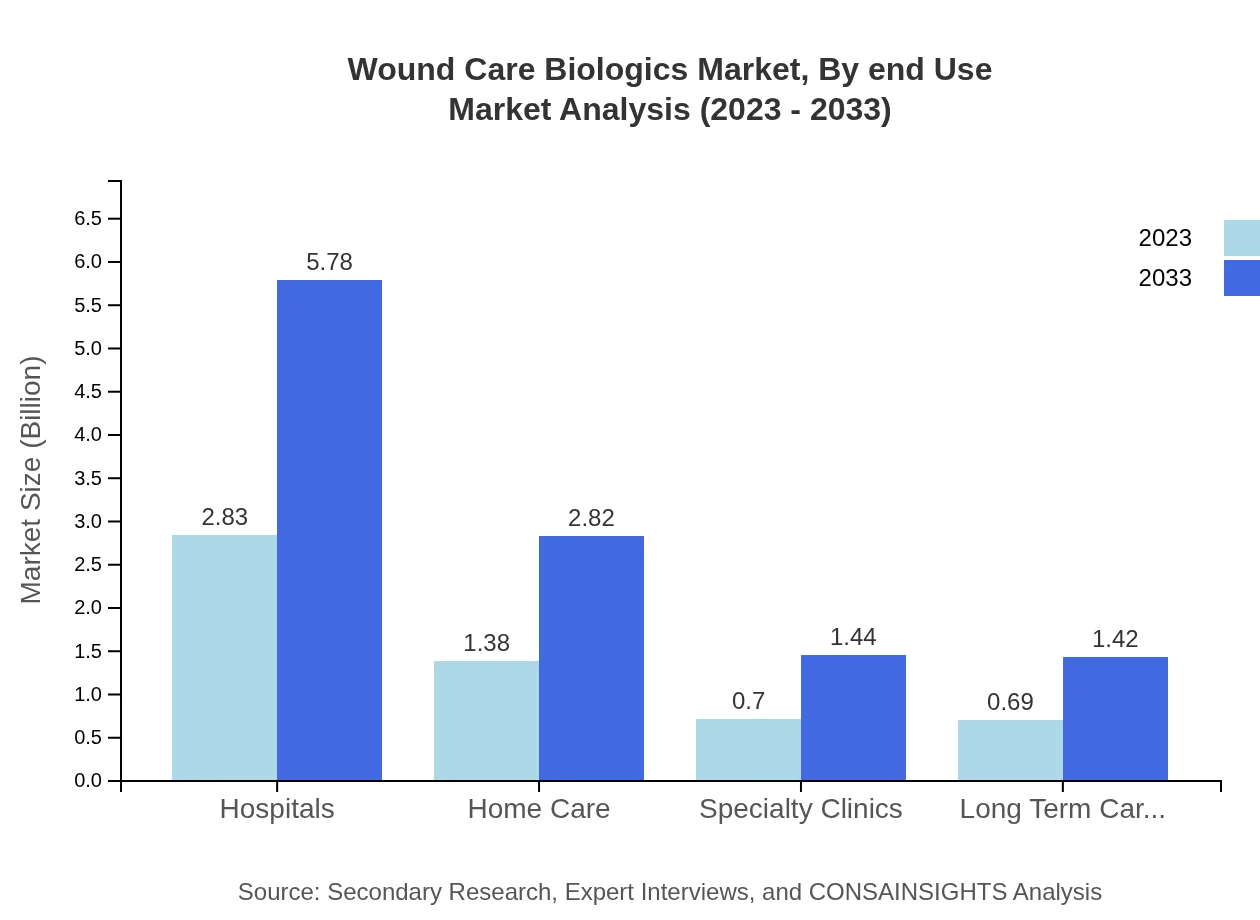

Wound Care Biologics Market Analysis By End Use

Major end-users include Hospitals, which dominate with USD 2.83 billion in 2023, and are expected to remain stable at 50.45% market share through 2033. Home Care facilities are also evolving as crucial end-users, anticipated to reach USD 2.82 billion by 2033.

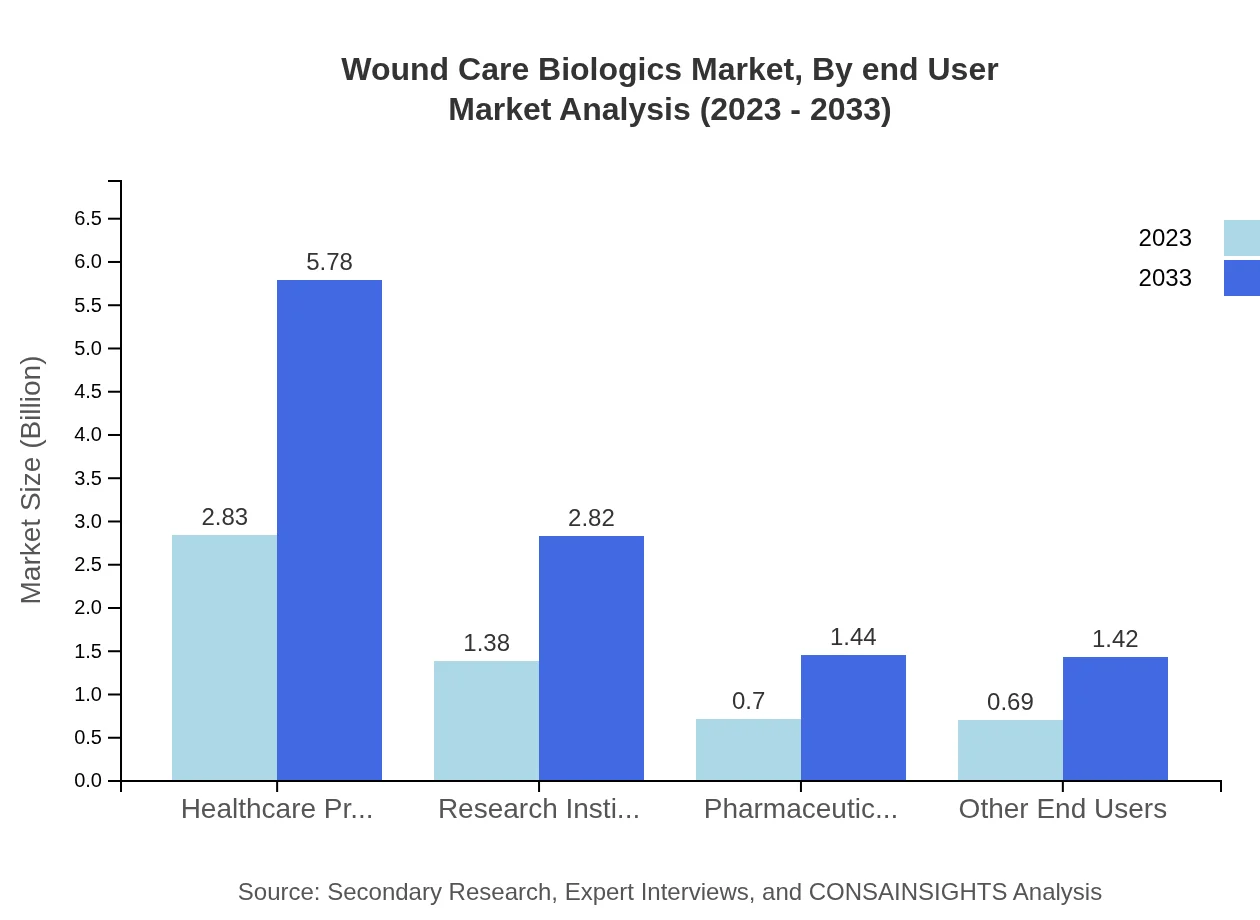

Wound Care Biologics Market Analysis By End User

End-users include Healthcare Providers, Research Institutes, and Pharmaceutical Companies. Healthcare Providers currently hold a significant market size expected to reach USD 5.78 billion by 2033, maintaining a 50.45% share throughout this period.

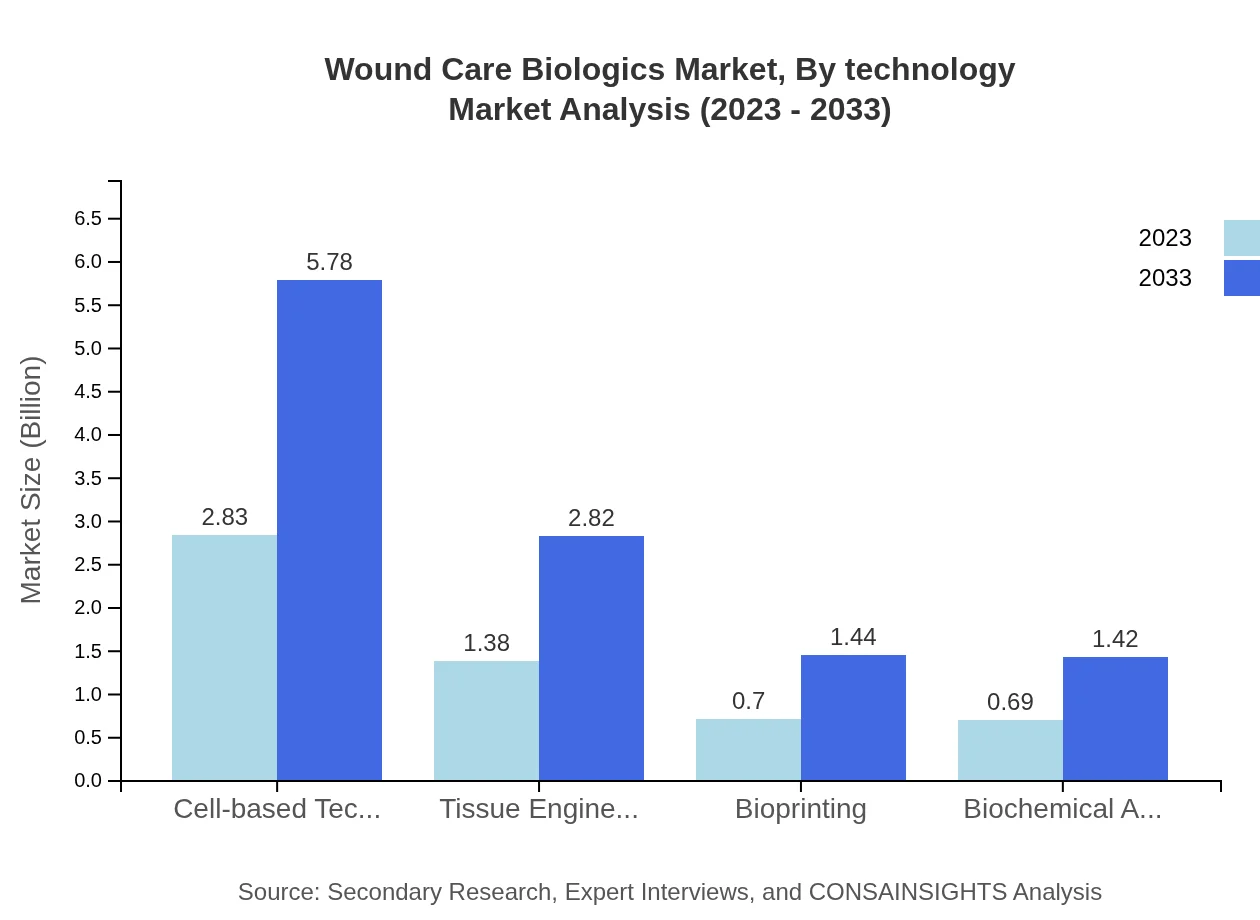

Wound Care Biologics Market Analysis By Technology

Emerging technologies like Cell-based Techniques, Tissue Engineering, and Bioprinting are leading the technological segment, with expected growth rates encouraging the delivery of advanced wound care options, thus facilitating market expansion.

Wound Care Biologics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Wound Care Biologics Industry

Smith & Nephew:

A leading medical technology company specializing in advanced wound management and tissue repair solutions.MediWound:

A biopharmaceutical company focused on innovative therapeutics for wound care, with a robust pipeline of biologic products.Acelity:

A key player in wound care that develops advanced healing solutions including negative pressure wound therapy and advanced dressings.Organogenesis:

A leader in the development of regenerative medicine products for wound healing using innovative biologics.We're grateful to work with incredible clients.

FAQs

What is the market size of Wound-Care-Biologics?

The wound-care-biologics market is currently valued at $5.6 billion and is projected to grow at a CAGR of 7.2% over the next decade, reaching $11.1 billion by 2033.

What are the key market players or companies in the Wound-Care-Biologics industry?

Key players in the wound-care-biologics market include established pharmaceutical and medical device companies that develop advanced wound care solutions, such as skin grafts, biologics, and innovative dressings.

What are the primary factors driving the growth in the Wound-Care-Biologics industry?

The growth in the wound-care-biologics market is primarily driven by the increasing incidence of chronic wounds, the rising elderly population, advancements in wound management technology, and increased healthcare expenditure.

Which region is the fastest Growing in the Wound-Care-Biologics market?

The North American region is the fastest-growing market for wound-care-biologics, with a projected increase from $2.16 billion in 2023 to $4.42 billion by 2033, capturing significant market share alongside Europe.

Does ConsaInsights provide customized market report data for the Wound-Care-Biologics industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the wound-care-biologics industry, providing insights that cater to particular market segments and regions.

What deliverables can I expect from this Wound-Care-Biologics market research project?

Expect comprehensive reports detailing market size, growth trends, competitive analysis, segment insights, and regional forecasts, delivered in an accessible format that facilitates data-driven decision-making.

What are the market trends of Wound-Care-Biologics?

Current trends in the wound-care-biologics market include the increasing adoption of advanced wound care technologies, a focus on patient-centered care, and the development of innovative biologics for effective wound healing.