Wrapping Machine Market Report

Published Date: 31 January 2026 | Report Code: wrapping-machine

Wrapping Machine Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive overview of the Wrapping Machine market, analyzing recent trends, market size, and forecasts from 2023 to 2033. Insights into market segmentation, regional dynamics, and key players are also included.

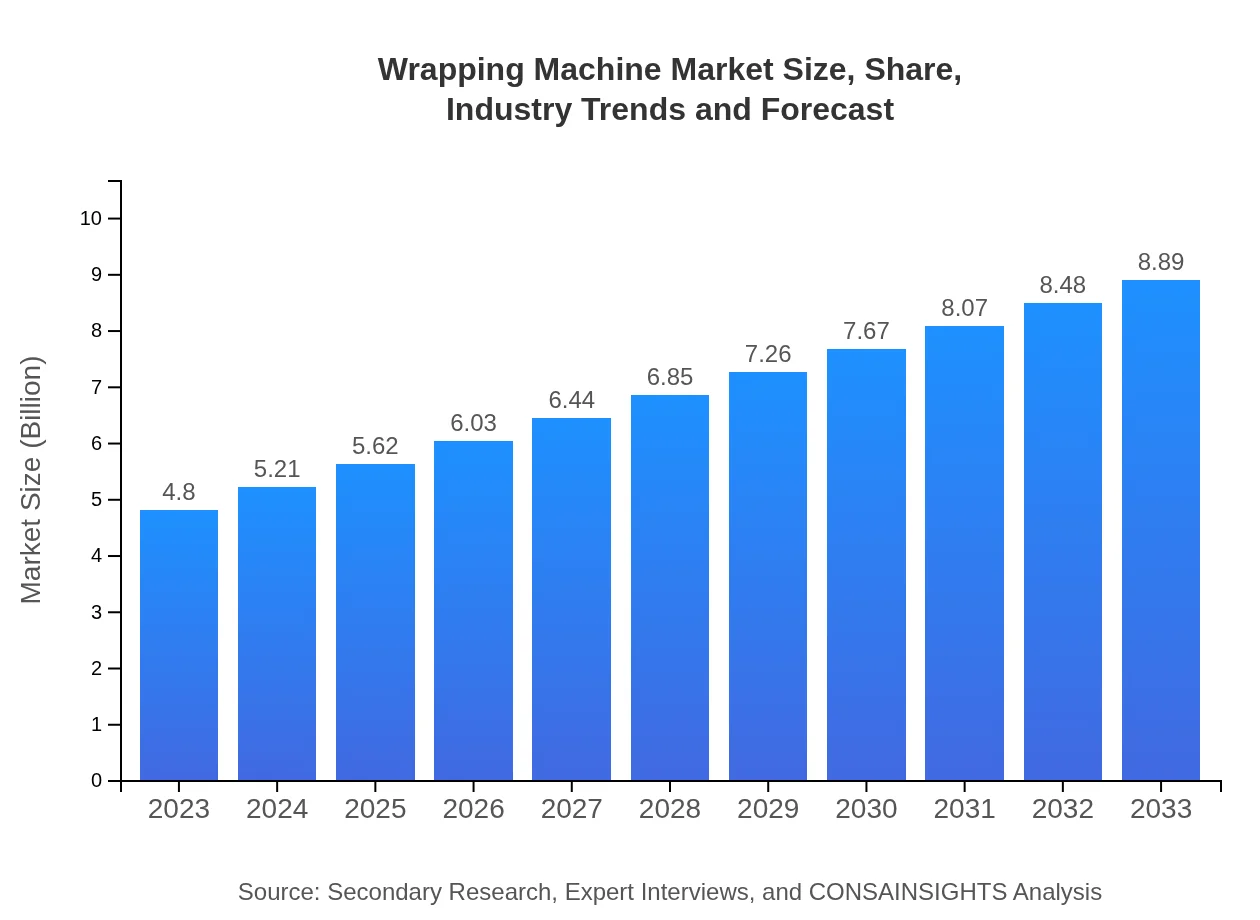

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $8.89 Billion |

| Top Companies | Aetna Group, Multivac, Bosch Packaging Technology, PMB, Herma |

| Last Modified Date | 31 January 2026 |

Wrapping Machine Market Overview

Customize Wrapping Machine Market Report market research report

- ✔ Get in-depth analysis of Wrapping Machine market size, growth, and forecasts.

- ✔ Understand Wrapping Machine's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Wrapping Machine

What is the Market Size & CAGR of Wrapping Machine market in 2023?

Wrapping Machine Industry Analysis

Wrapping Machine Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Wrapping Machine Market Analysis Report by Region

Europe Wrapping Machine Market Report:

The European Wrapping Machine market is projected to expand from $1.56 billion in 2023 to $2.89 billion by 2033. A focus on sustainability and efficiency in packaging processes, driven by stringent regulations, is supporting the demand for advanced wrapping technologies.Asia Pacific Wrapping Machine Market Report:

The Asia Pacific region is witnessing a significant growth trajectory, with the Wrapping Machine market projected to reach $1.54 billion by 2033, up from $0.83 billion in 2023. This growth is driven by rising consumer demand for packaged goods and increased investments in and implementation of advanced packaging technologies in countries like China and India.North America Wrapping Machine Market Report:

In North America, the market is anticipated to grow significantly from $1.71 billion in 2023 to $3.17 billion by 2033, fueled by advancements in technology and the increased demand for efficient packaging solutions across sectors such as food and beverage and pharmaceuticals.South America Wrapping Machine Market Report:

The South American market for Wrapping Machines is expected to grow from $0.41 billion in 2023 to $0.75 billion by 2033. The growth is attributed to increasing food and beverage production, alongside a growing inclination towards automation in various industries.Middle East & Africa Wrapping Machine Market Report:

In the Middle East and Africa, the Wrapping Machine market is expected to grow from $0.29 billion in 2023 to $0.54 billion by 2033. This growth is supported by the rising investments in the manufacturing sector and increased demand for packaging in emerging markets.Tell us your focus area and get a customized research report.

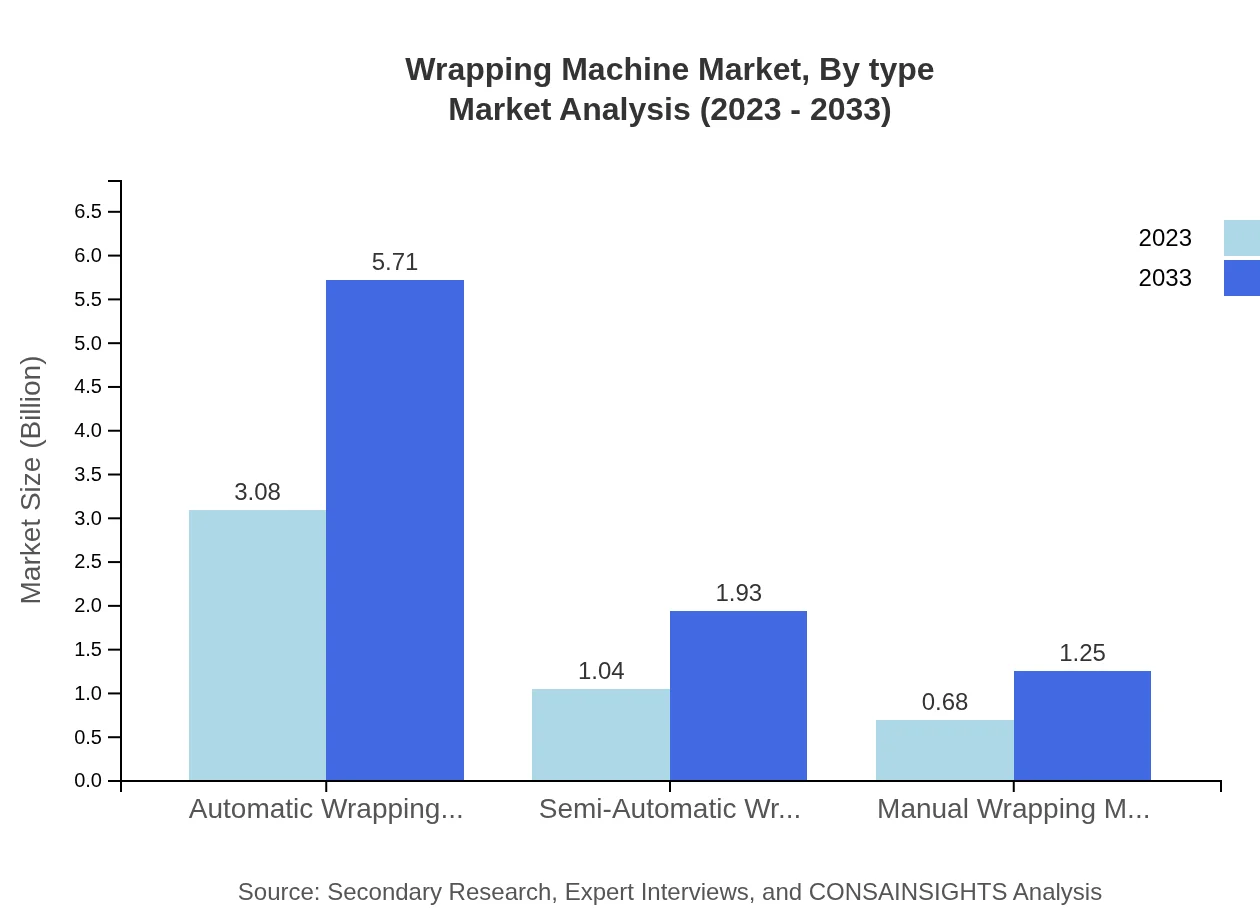

Wrapping Machine Market Analysis By Type

The Wrapping Machine market by type is dominated by Automatic Wrapping Machines, which are projected to grow from $3.08 billion in 2023 to $5.71 billion in 2033, maintaining a market share of 64.16%. Semi-Automatic Machines follow, growing from $1.04 billion to $1.93 billion, holding a 21.75% share, while Manual Wrapping Machines are expected to expand from $0.68 billion to $1.25 billion, with a 14.09% market share.

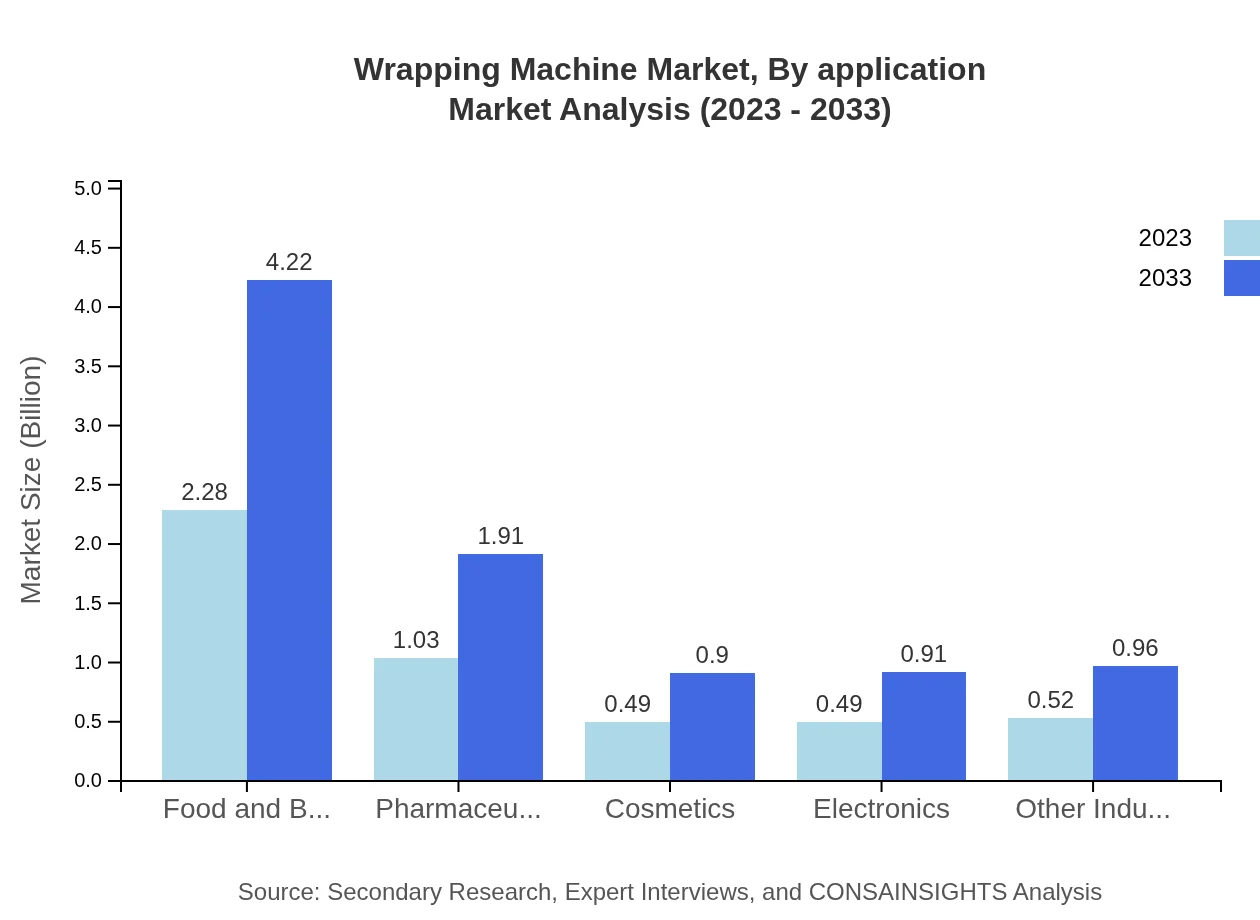

Wrapping Machine Market Analysis By Application

In terms of application, the Food and Beverage segment holds the largest share, with a market size of $2.28 billion in 2023, projected to rise to $4.22 billion by 2033 (47.48% share). Pharmaceuticals follow with a size of $1.03 billion, expected to reach $1.91 billion, comprising 21.45%. The Cosmetics, Electronics, and other industries also demonstrate significant growth, driven by increasing consumer expectations for packaged products.

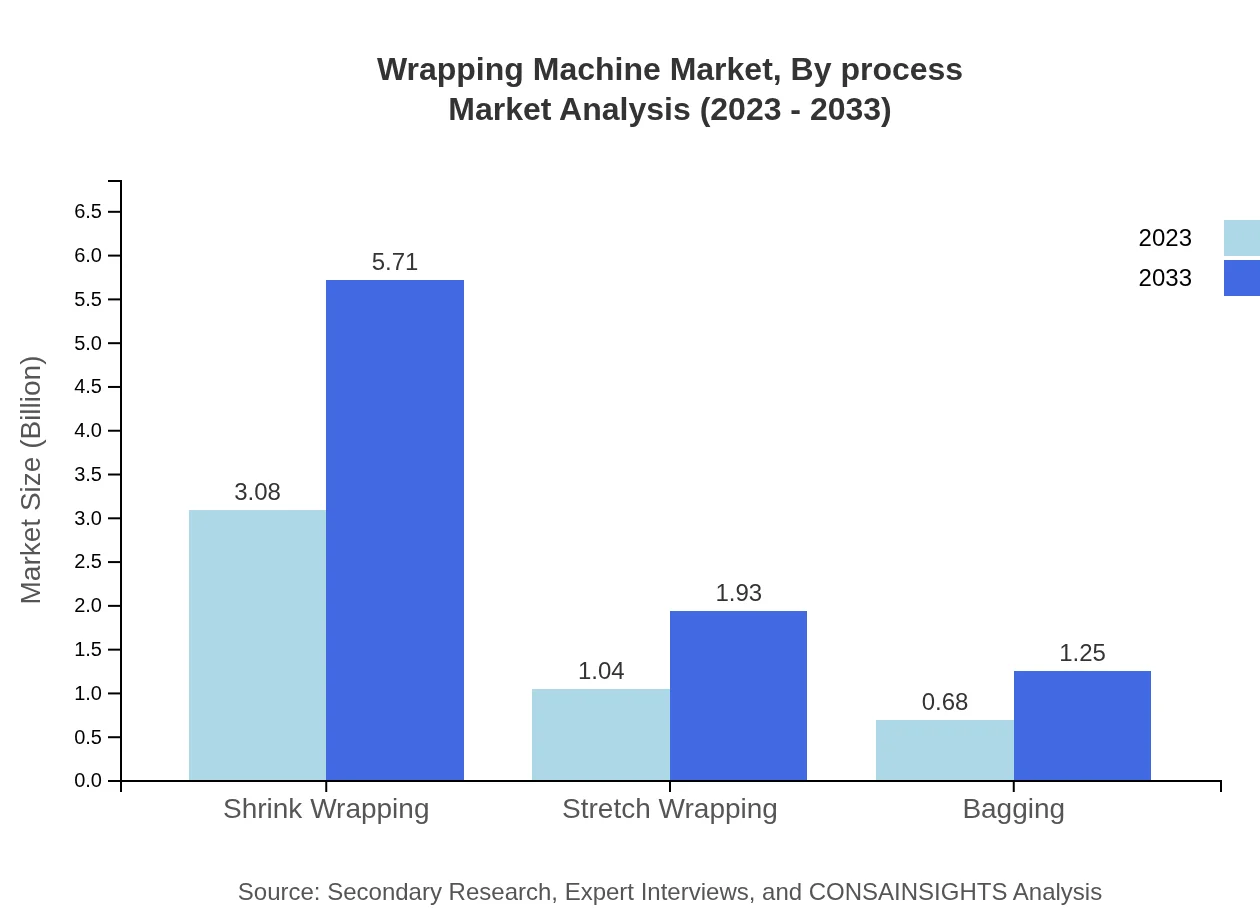

Wrapping Machine Market Analysis By Process

The market segmented by process shows the importance of shrink wrapping, expected to grow from $3.08 billion in 2023 to $5.71 billion in 2033, retaining a 64.16% share. Stretch wrapping follows at a size of $1.04 billion, projected to reach $1.93 billion (21.75% share), while bagging is estimated to rise from $0.68 billion to $1.25 billion, maintaining a share of 14.09%.

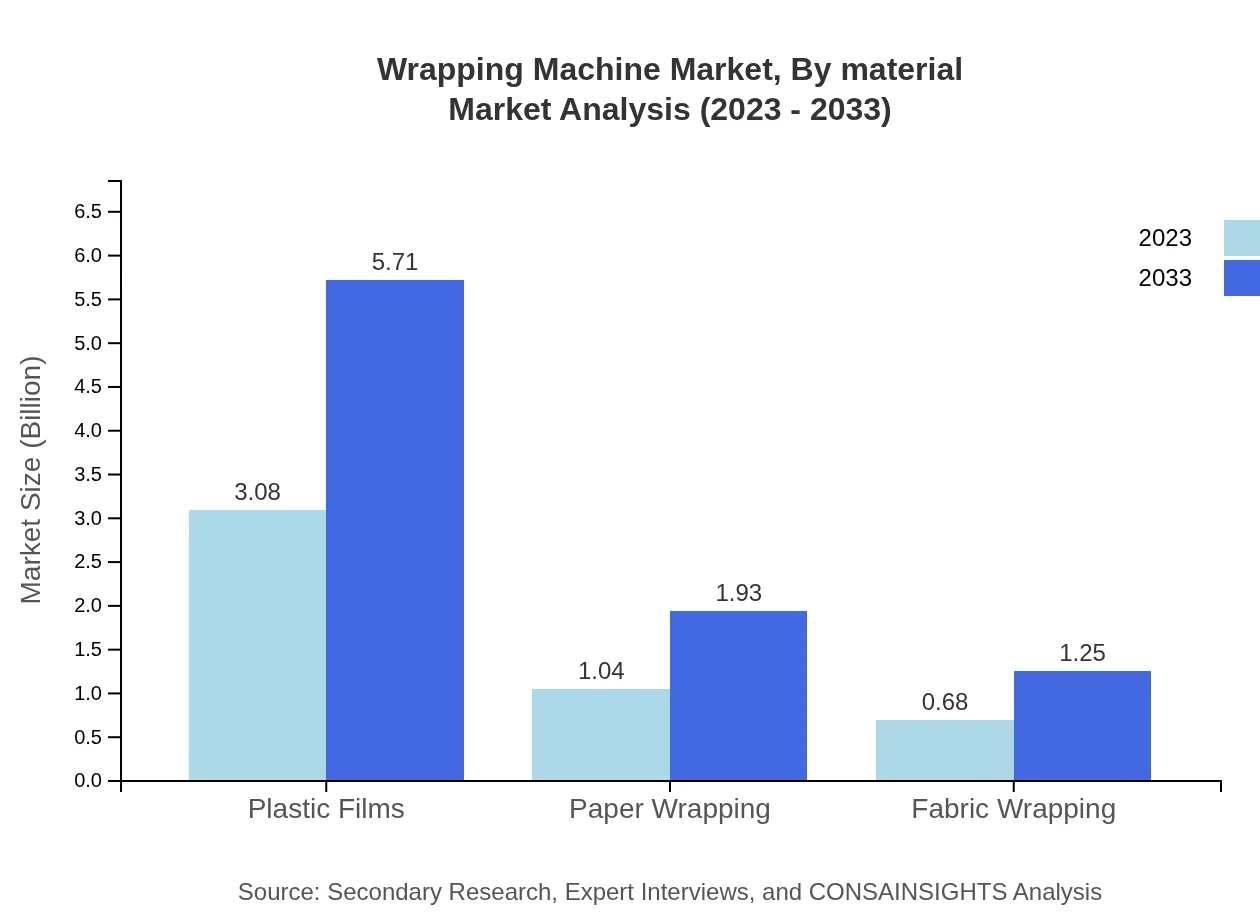

Wrapping Machine Market Analysis By Material

Plastic films dominate the Wrapping Machine market as a material, anticipated to expand from $3.08 billion to $5.71 billion by 2033, capturing a 64.16% market share. Paper wrapping is set to grow from $1.04 billion to $1.93 billion, maintaining a 21.75% share, while fabric wrapping will increase from $0.68 billion to $1.25 billion, holding 14.09% of the market.

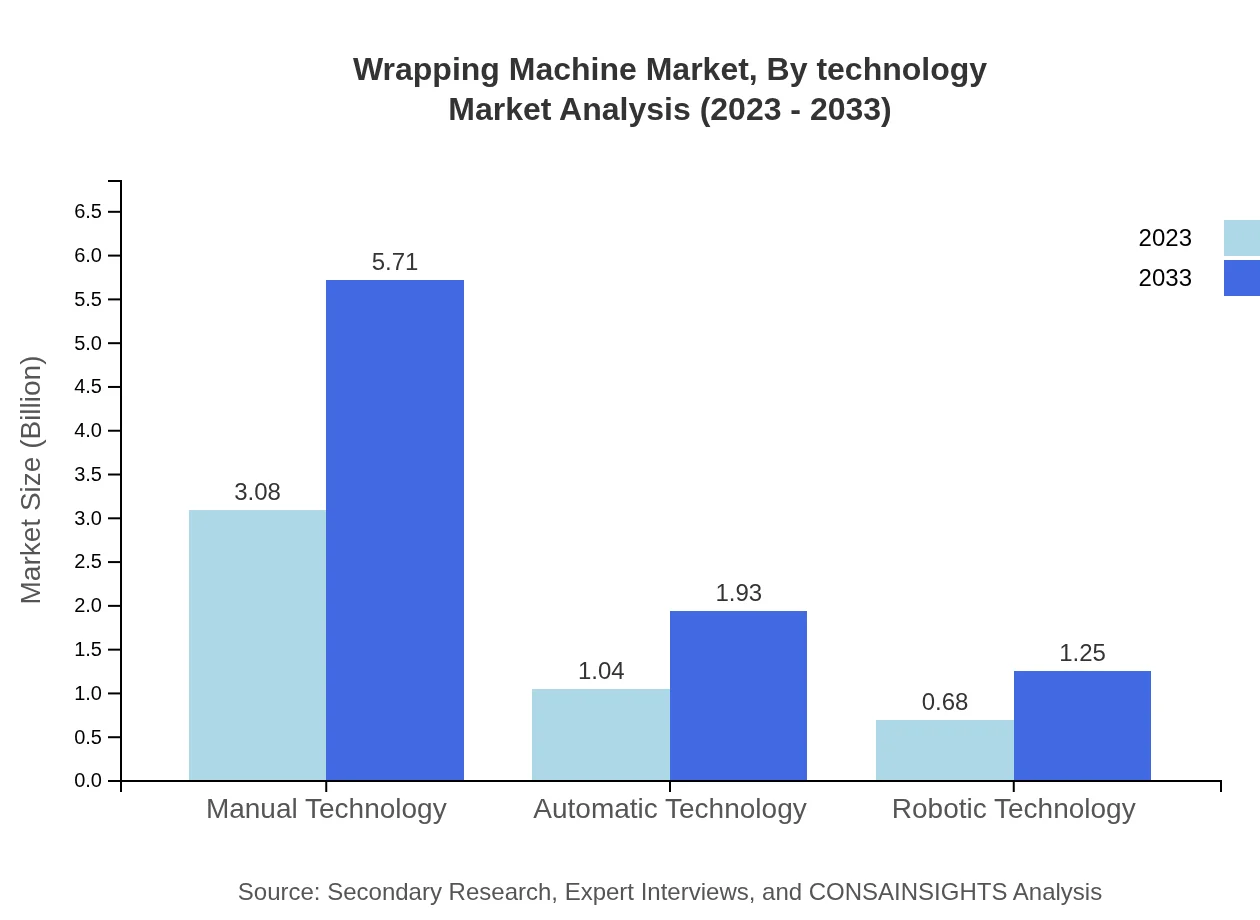

Wrapping Machine Market Analysis By Technology

The market analysis by technology reveals that manual technology leads with $3.08 billion in 2023, projected to reach $5.71 billion by 2033 (64.16% share). Automatic technology follows, growing from $1.04 billion to $1.93 billion (21.75% share), while robotic technology is expected to rise from $0.68 billion to $1.25 billion (14.09%).

Wrapping Machine Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Wrapping Machine Industry

Aetna Group:

A leading manufacturer of wrapping and packaging machines specializing in customized solutions to improve production efficiency for a range of industries.Multivac:

A global provider of packaging solutions, offering innovative wrapping machines and systems for food and pharmaceuticals, focusing on sustainability and efficiency.Bosch Packaging Technology:

Known for their advanced packaging technology, Bosch leads in providing wrapping machines that enhance automation and are tailored to meet evolving market demands.PMB:

A prominent player in packaging technology saw consistent growth by delivering efficient wrapping solutions with a focus on customer satisfaction and technological advancement.Herma:

Specializes in labeling and wrapping equipment, Herma offers innovative solutions that improve packaging lines across various sectors.We're grateful to work with incredible clients.