X Ray Detector Market Report

Published Date: 31 January 2026 | Report Code: x-ray-detector

X Ray Detector Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the X Ray Detector market, including market size, growth trends, and regional insights from 2023 to 2033. Detailed segments cover product types, applications, and technological advancements in the industry.

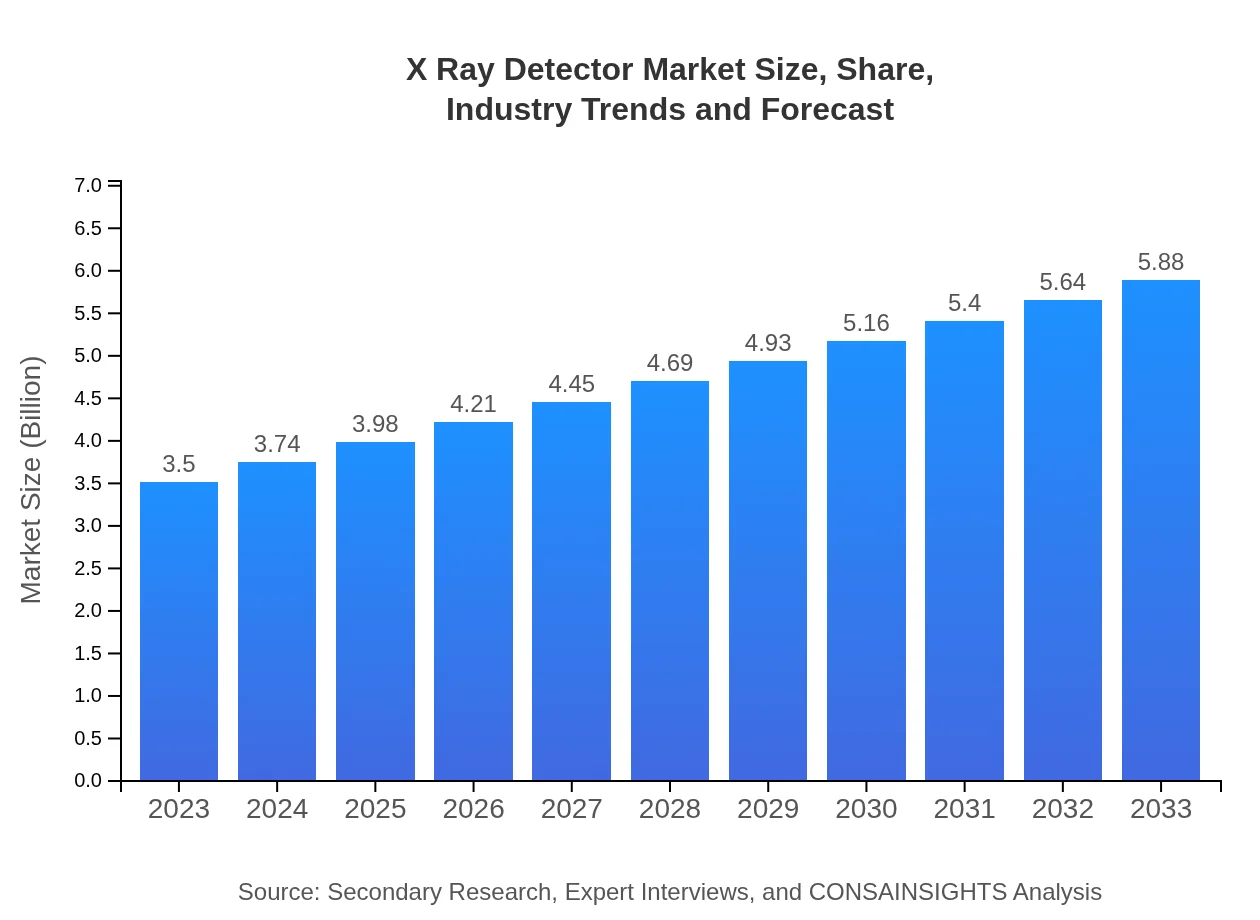

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $5.88 Billion |

| Top Companies | GE Healthcare, Philips Healthcare, Siemens Healthineers, Canon Medical Systems, Carestream Health |

| Last Modified Date | 31 January 2026 |

X Ray Detector Market Overview

Customize X Ray Detector Market Report market research report

- ✔ Get in-depth analysis of X Ray Detector market size, growth, and forecasts.

- ✔ Understand X Ray Detector's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in X Ray Detector

What is the Market Size & CAGR of X Ray Detector market in 2023?

X Ray Detector Industry Analysis

X Ray Detector Market Segmentation and Scope

Tell us your focus area and get a customized research report.

X Ray Detector Market Analysis Report by Region

Europe X Ray Detector Market Report:

Europe’s market is anticipated to increase from $1.20 billion in 2023 to $2.01 billion in 2033. The region benefits from a well-established healthcare sector and ongoing innovations in medical imaging technologies.Asia Pacific X Ray Detector Market Report:

The Asia Pacific region is projected to grow from $0.59 billion in 2023 to $0.98 billion in 2033. The growth is driven by increased investments in healthcare infrastructure, rising medical imaging needs, and technological advancements in diagnostics. Countries like China and India are expanding their healthcare capabilities significantly.North America X Ray Detector Market Report:

The North American market is the largest, with an estimated value of $1.23 billion in 2023, growing to $2.06 billion by 2033. This growth is fueled by advanced healthcare facilities, high adoption of new technologies, and significant investments in R&D.South America X Ray Detector Market Report:

In South America, the X Ray Detector market is expected to rise from $0.14 billion in 2023 to $0.24 billion by 2033. The growth can be attributed to improvements in healthcare systems and a growing population increasingly requiring diagnostic imaging.Middle East & Africa X Ray Detector Market Report:

The Middle East and Africa market is expected to grow from $0.35 billion in 2023 to $0.58 billion in 2033, driven by increasing healthcare expenditures and demands for advanced diagnostic solutions in emerging markets.Tell us your focus area and get a customized research report.

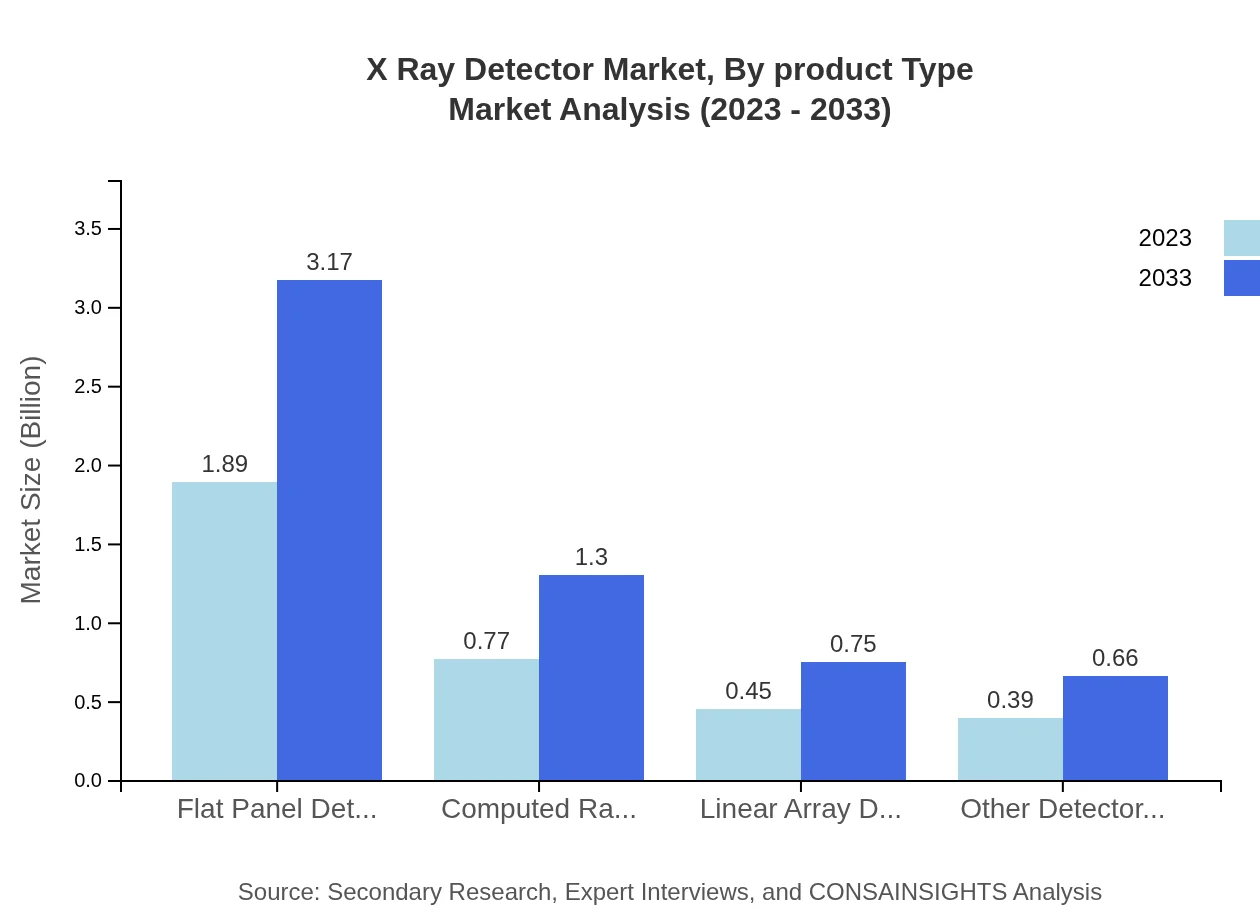

X Ray Detector Market Analysis By Product Type

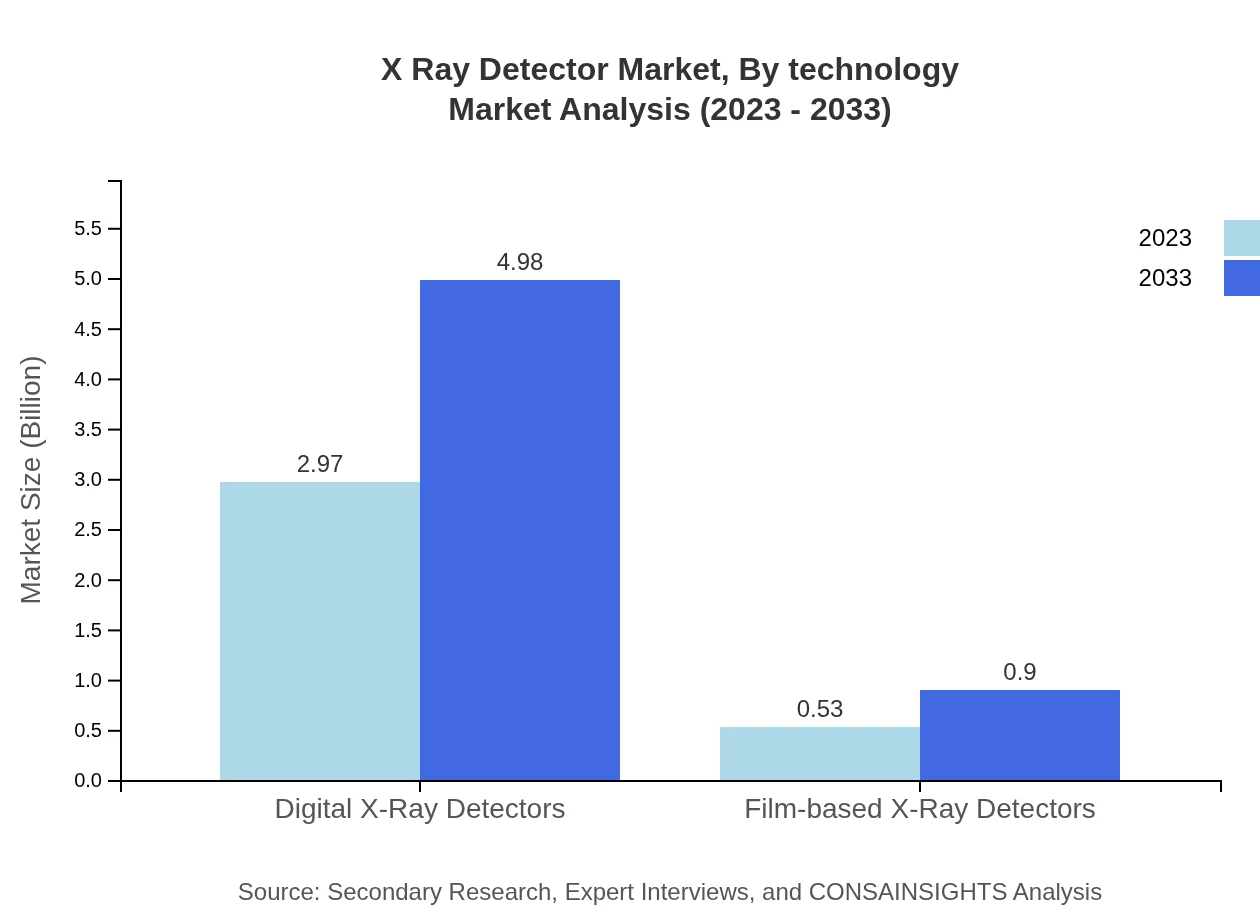

The X Ray Detector market by product type is dominated by digital X-Ray Detectors, which will see significant growth from $2.97 billion in 2023 to $4.98 billion by 2033, accounting for roughly 84.74% market share. Film-based X Ray Detectors, while declining, maintain relevance in certain sectors, projected to grow from $0.53 billion to $0.90 billion during the same period.

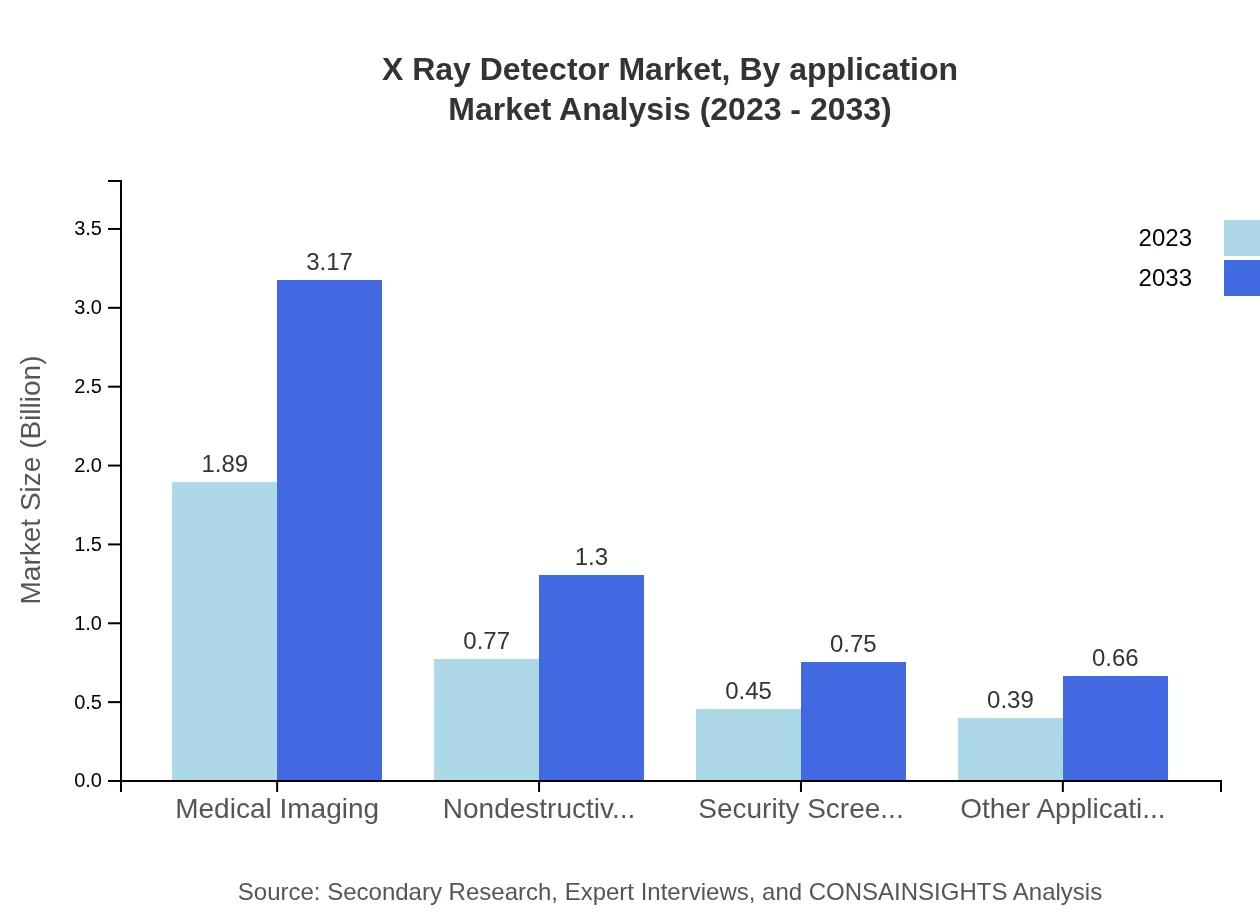

X Ray Detector Market Analysis By Application

Applications of X Ray Detectors span various fields including medical imaging, security screening, and nondestructive testing. Medical imaging holds the largest share, with market growth from $1.89 billion in 2023 to $3.17 billion in 2033, driven by demand for diagnostic procedures.

X Ray Detector Market Analysis By Technology

Technological advancements are a key driver of the X Ray Detector market. Flat panel detectors are leading the charge, showcasing growth from $1.89 billion to $3.17 billion by 2033, owing to their efficiency and image quality.

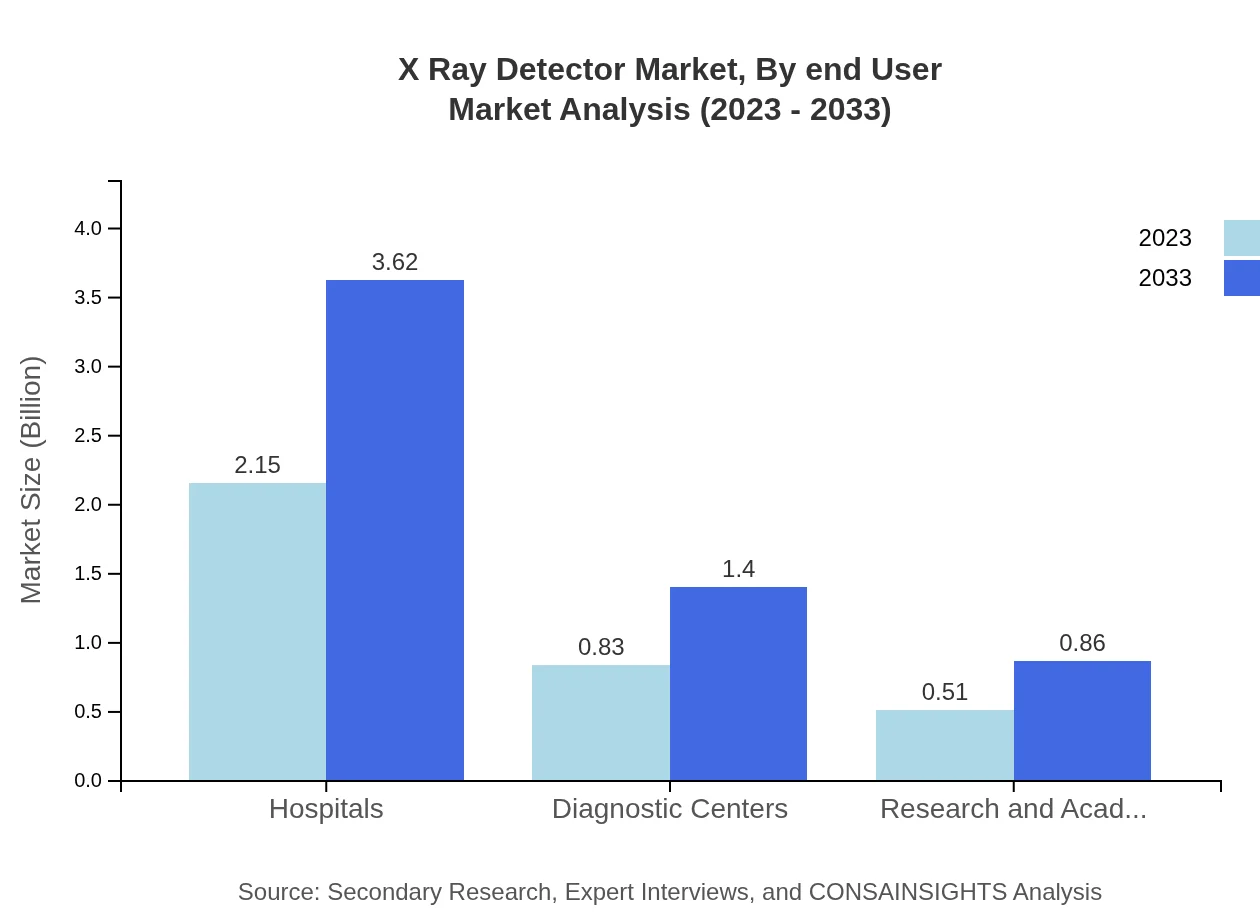

X Ray Detector Market Analysis By End User

Hospitals constitute the primary end-user segment, with a projected market increase from $2.15 billion in 2023 to $3.62 billion by 2033. Diagnostic centers and research institutions are also significant, contributing to the growing healthcare landscape.

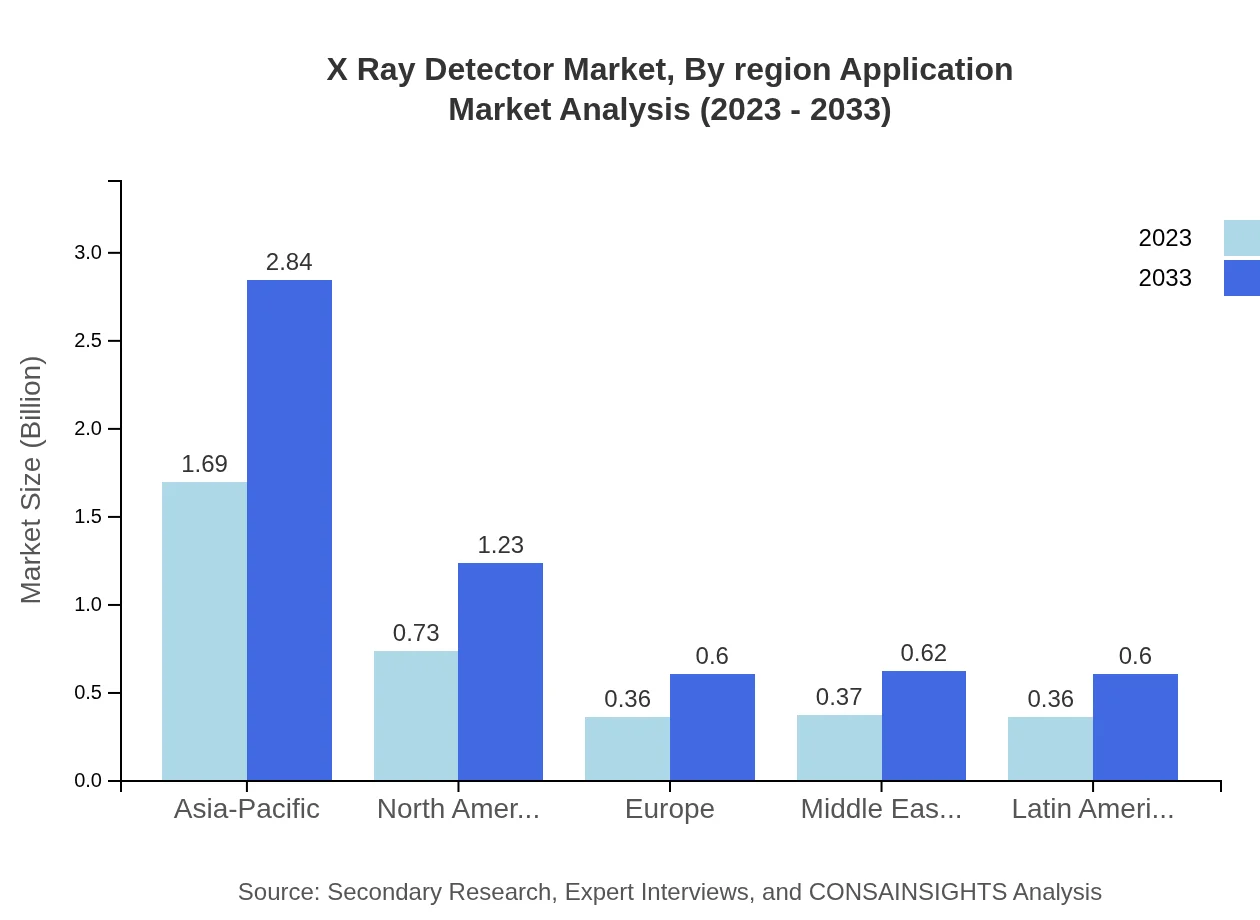

X Ray Detector Market Analysis By Region Application

Geographically, North America leads in adoption rates, followed by Europe and the Asia Pacific. Each region displays distinct regulatory environments and technological advancements, influencing market growth trajectories and investment patterns.

X Ray Detector Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in X Ray Detector Industry

GE Healthcare:

A leader in medical imaging technologies, GE Healthcare develops advanced X Ray Detectors that enhance imaging clarity and patient safety.Philips Healthcare:

Philips Healthcare is renowned for its innovative solutions in medical imaging, offering a range of X Ray Detectors with a focus on digital advancement and increased diagnostic capabilities.Siemens Healthineers:

Siemens is a pioneer in healthcare technology and offers cutting-edge X Ray Detectors aimed at improving clinical outcomes.Canon Medical Systems:

Canon emphasizes advanced imaging technologies and is dedicated to delivering high-quality X Ray detectors that are widely used in various medical applications.Carestream Health:

Carestream Health provides a broad range of imaging solutions, including high-performance X Ray Detectors tailored for both diagnostic and industrial use.We're grateful to work with incredible clients.