Yeast And Yeast Extract Market Report

Published Date: 31 January 2026 | Report Code: yeast-and-yeast-extract

Yeast And Yeast Extract Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Yeast and Yeast Extract market, covering key insights and data for the forecast period from 2023 to 2033, including market trends, segmentation, regional insights, and industry leaders.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

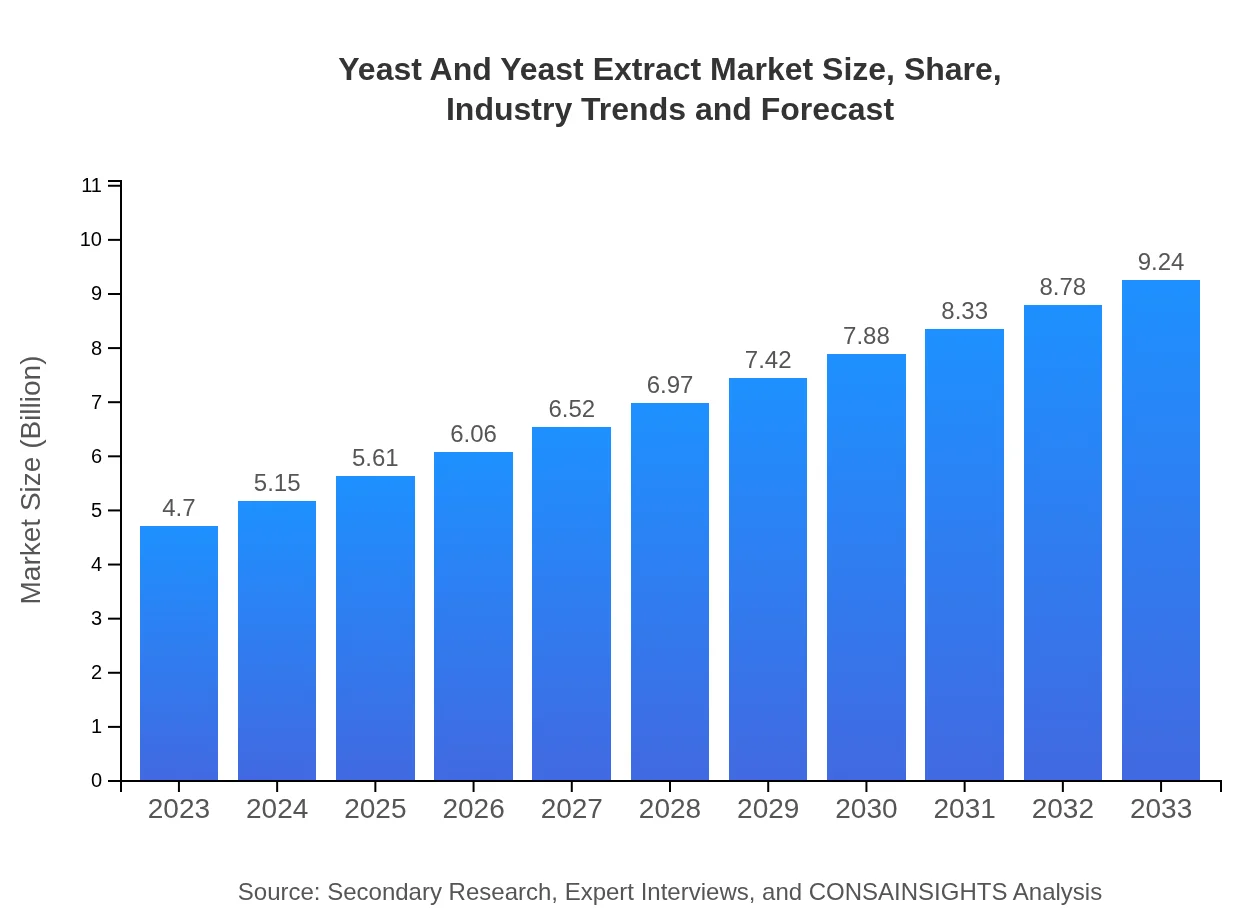

| 2023 Market Size | $4.70 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $9.24 Billion |

| Top Companies | Lesaffre, AB Mauri, Yeast and Yeast Extract Producer, Oriental Yeast Co., Ltd. |

| Last Modified Date | 31 January 2026 |

Yeast And Yeast Extract Market Overview

Customize Yeast And Yeast Extract Market Report market research report

- ✔ Get in-depth analysis of Yeast And Yeast Extract market size, growth, and forecasts.

- ✔ Understand Yeast And Yeast Extract's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Yeast And Yeast Extract

What is the Market Size & CAGR of Yeast And Yeast Extract market in 2023?

Yeast And Yeast Extract Industry Analysis

Yeast And Yeast Extract Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Yeast And Yeast Extract Market Analysis Report by Region

Europe Yeast And Yeast Extract Market Report:

The European market, valued at $1.45 billion in 2023, is expected to reach $2.86 billion by 2033 with a CAGR of 7.1%. High demand for natural and organic products is propelling the yeast market in this region.Asia Pacific Yeast And Yeast Extract Market Report:

In 2023, the Asia Pacific Yeast and Yeast Extract market is valued at $0.89 billion, projected to reach $1.75 billion by 2033, growing at a CAGR of 7.2%. The increasing demand for processed foods and rapid urbanization in countries like China and India are key growth drivers.North America Yeast And Yeast Extract Market Report:

North America holds a significant market share, valued at $1.66 billion in 2023 and projected to grow to $3.25 billion by 2033. Factors such as increasing health awareness and the growing bakery sector contribute to the robust growth forecast.South America Yeast And Yeast Extract Market Report:

The South American market is valued at $0.34 billion in 2023 and is expected to reach $0.66 billion by 2033, with a CAGR of 7.1%. The growing acceptance of healthy food products is driving market expansion.Middle East & Africa Yeast And Yeast Extract Market Report:

The Middle East and African market is estimated at $0.36 billion in 2023 and is anticipated to grow to $0.71 billion by 2033, representing a CAGR of 7.0%. Growth in the food processing industry and rising dietary supplement demand play a crucial role.Tell us your focus area and get a customized research report.

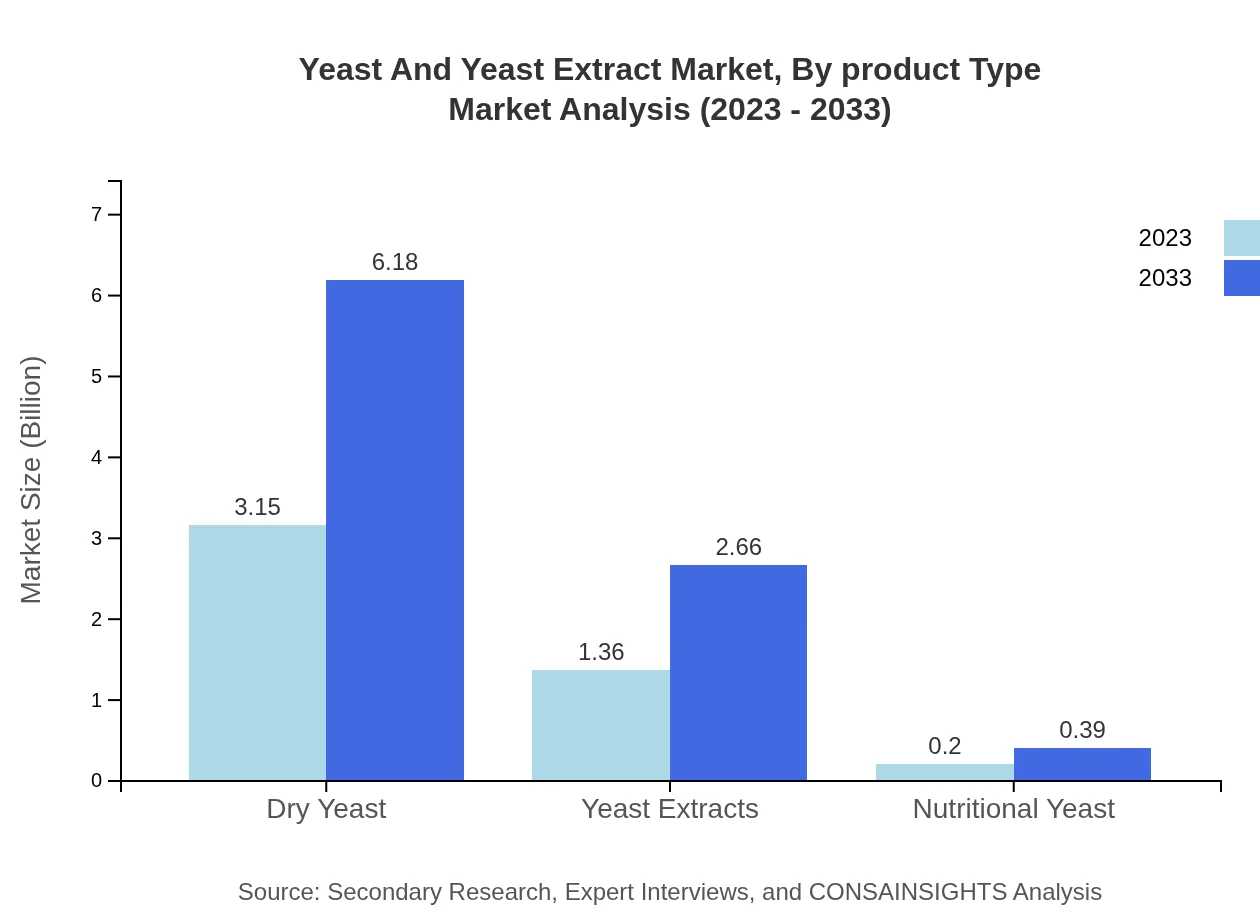

Yeast And Yeast Extract Market Analysis By Product Type

The Yeast and Yeast Extract market by product type includes segments such as Dry Yeast, Yeast Extracts, and Nutritional Yeast. Dry Yeast dominates the market, valued at $3.15 billion in 2023 with a projected growth to $6.18 billion by 2033, driven by the bakery and brewing sectors. Yeast Extracts also show significant growth from $1.36 billion to $2.66 billion in the same period, owing to their flavoring applications.

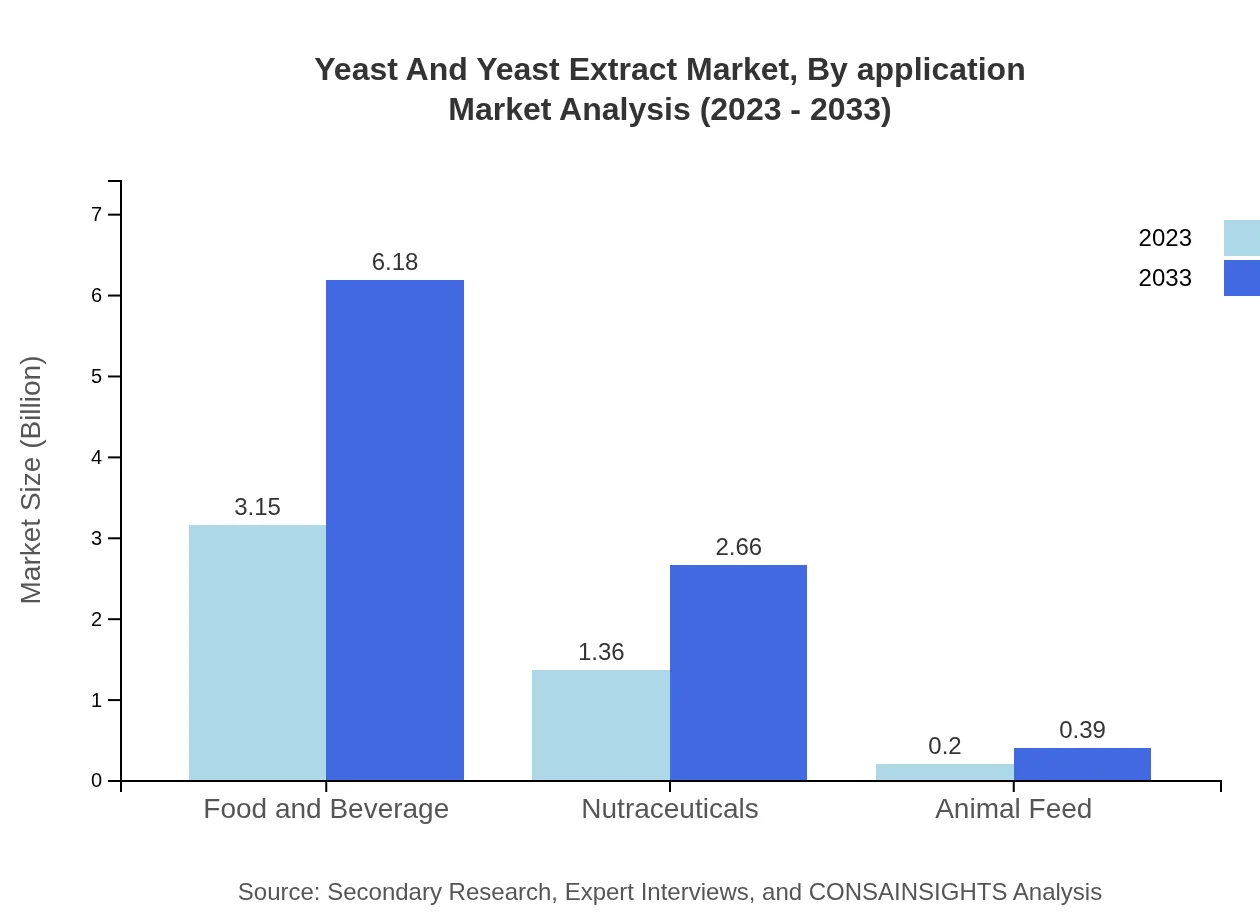

Yeast And Yeast Extract Market Analysis By Application

The applications of Yeast and Yeast Extract span various industries, predominantly the Food Industry, which accounts for a significant share of around 66.95% in both 2023 and 2033. The Beverage Industry follows as a vital segment, growing from $1.36 billion to $2.66 billion. Other applications include Pharmaceuticals and Nutraceuticals, indicating a trend towards health and wellness in consumer preferences.

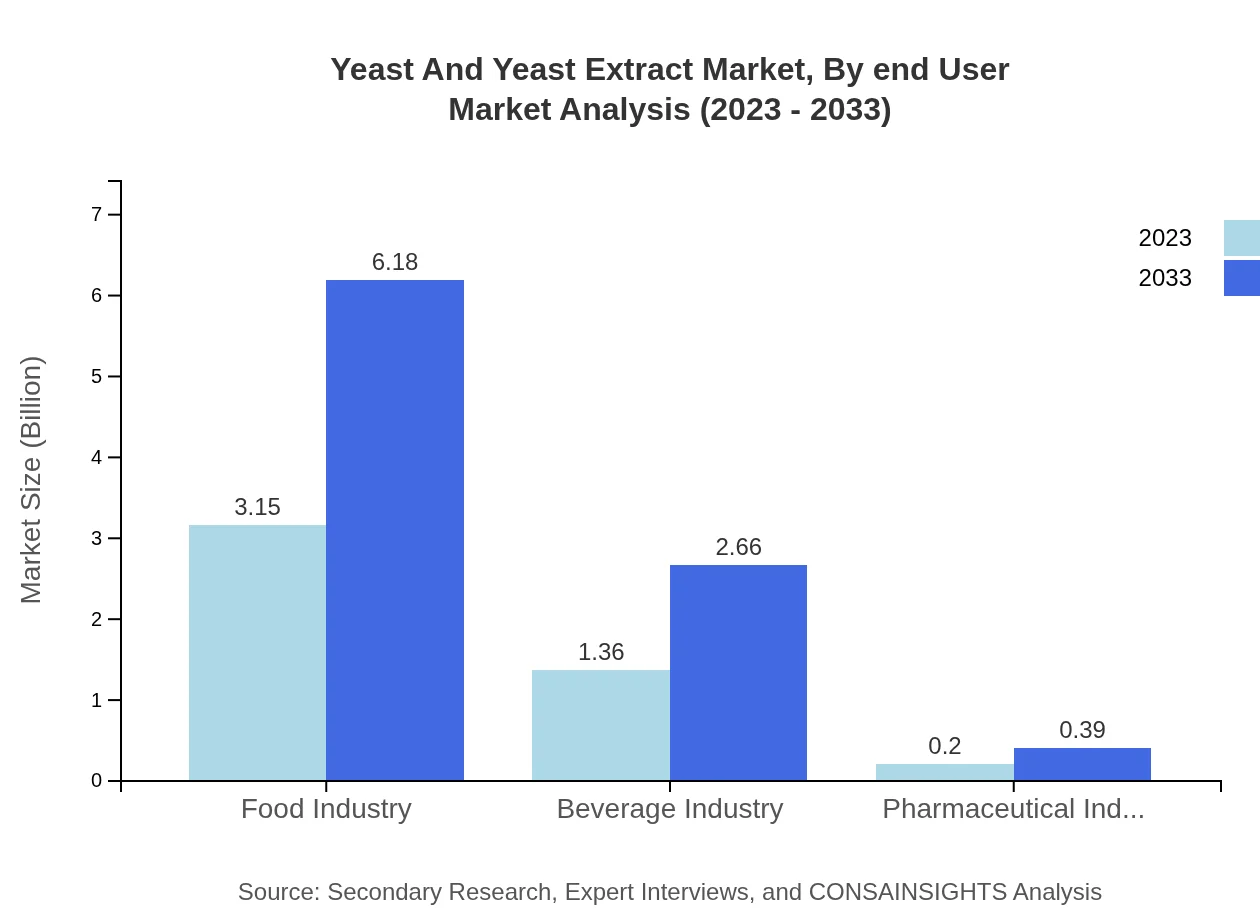

Yeast And Yeast Extract Market Analysis By End User

End-user industries include Food and Beverage, Pharmaceuticals, and Animal Feed. The Food and Beverage industry is the largest end-user segment, projected to maintain its lead with substantial growth due to rising consumer demand for processed foods. The Nutraceuticals sector is also expected to see increased investments in yeast-based dietary supplements.

Yeast And Yeast Extract Market Analysis By Region

Global Yeast and Yeast Extract Market, By Region Market Analysis (2023 - 2033)

Regional analysis highlights differing growth dynamics, with North America leading in market size and innovation, followed by Europe with strong demand for natural products. Asia Pacific shows rapid growth due to urbanization and changing dietary preferences, while Latin America and Africa present emerging opportunities amid rising health awareness.

Yeast And Yeast Extract Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Yeast And Yeast Extract Industry

Lesaffre:

A global leader in yeast and fermentation, Lesaffre operates in over 50 countries, focusing on innovation and sustainable practices in the bakery and food industry.AB Mauri:

Known for their varied yeast products and solutions, AB Mauri is a major player in the baking sector and is committed to research and development for innovative fermentation solutions.Yeast and Yeast Extract Producer:

A key producer with a strong market presence, focusing on product diversification and supply chain optimization to cater to the growing demand in various sectors.Oriental Yeast Co., Ltd.:

A prominent manufacturer based in Japan, specializing in dry yeast products and yeast extracts, catering to both domestic and international markets.We're grateful to work with incredible clients.