Zero Emission Aircraft Market Report

Published Date: 03 February 2026 | Report Code: zero-emission-aircraft

Zero Emission Aircraft Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Zero Emission Aircraft market from 2023 to 2033, focusing on market trends, regional insights, technological advancements, and future forecasts.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

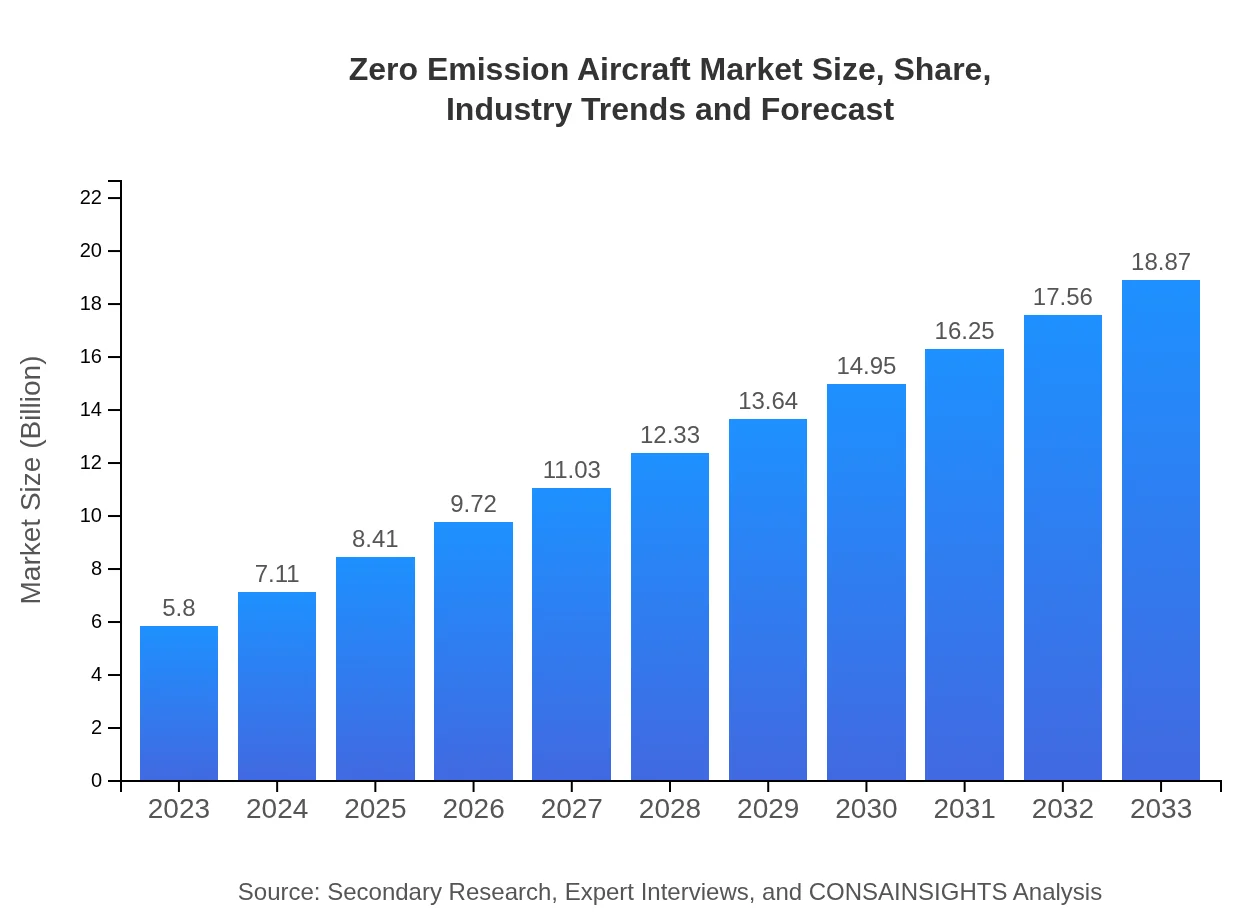

| 2023 Market Size | $5.80 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $18.87 Billion |

| Top Companies | Airbus, Boeing , Rolls-Royce, Zunum Aero, Bye Aerospace |

| Last Modified Date | 03 February 2026 |

Zero Emission Aircraft Market Overview

Customize Zero Emission Aircraft Market Report market research report

- ✔ Get in-depth analysis of Zero Emission Aircraft market size, growth, and forecasts.

- ✔ Understand Zero Emission Aircraft's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Zero Emission Aircraft

What is the Market Size & CAGR of Zero Emission Aircraft market in 2023?

Zero Emission Aircraft Industry Analysis

Zero Emission Aircraft Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Zero Emission Aircraft Market Analysis Report by Region

Europe Zero Emission Aircraft Market Report:

Europe leads with a forecast market size of $1.98 billion in 2023, anticipated to surge to $6.45 billion by 2033, driven by stringent emission regulations and strong commitments to Net Zero targets across the aviation sector.Asia Pacific Zero Emission Aircraft Market Report:

In 2023, the Asia Pacific region holds a market value of approximately $1.10 billion, projected to grow to $3.58 billion by 2033. The region benefits from a growing appetite for sustainable transport solutions alongside governmental policies fostering innovation.North America Zero Emission Aircraft Market Report:

North America is robust in this market, with a value of $1.86 billion in 2023, expected to grow to $6.05 billion by 2033. The region is a hub for aerospace technology and innovation, supported by significant funding and governmental push towards cleaner aviation technologies.South America Zero Emission Aircraft Market Report:

South America’s Zero Emission Aircraft market is valued at around $0.31 billion in 2023, with expectations to reach $1.00 billion by 2033. Factors such as urbanization and sustainable tourism are key drivers for potential growth in this segment.Middle East & Africa Zero Emission Aircraft Market Report:

The Middle East and Africa region is estimated at $0.55 billion in 2023 and is projected to grow to $1.79 billion by 2033. Increased investments in sustainable aviation infrastructure and a rising number of flights warrant a significant shift toward zero-emission technologies.Tell us your focus area and get a customized research report.

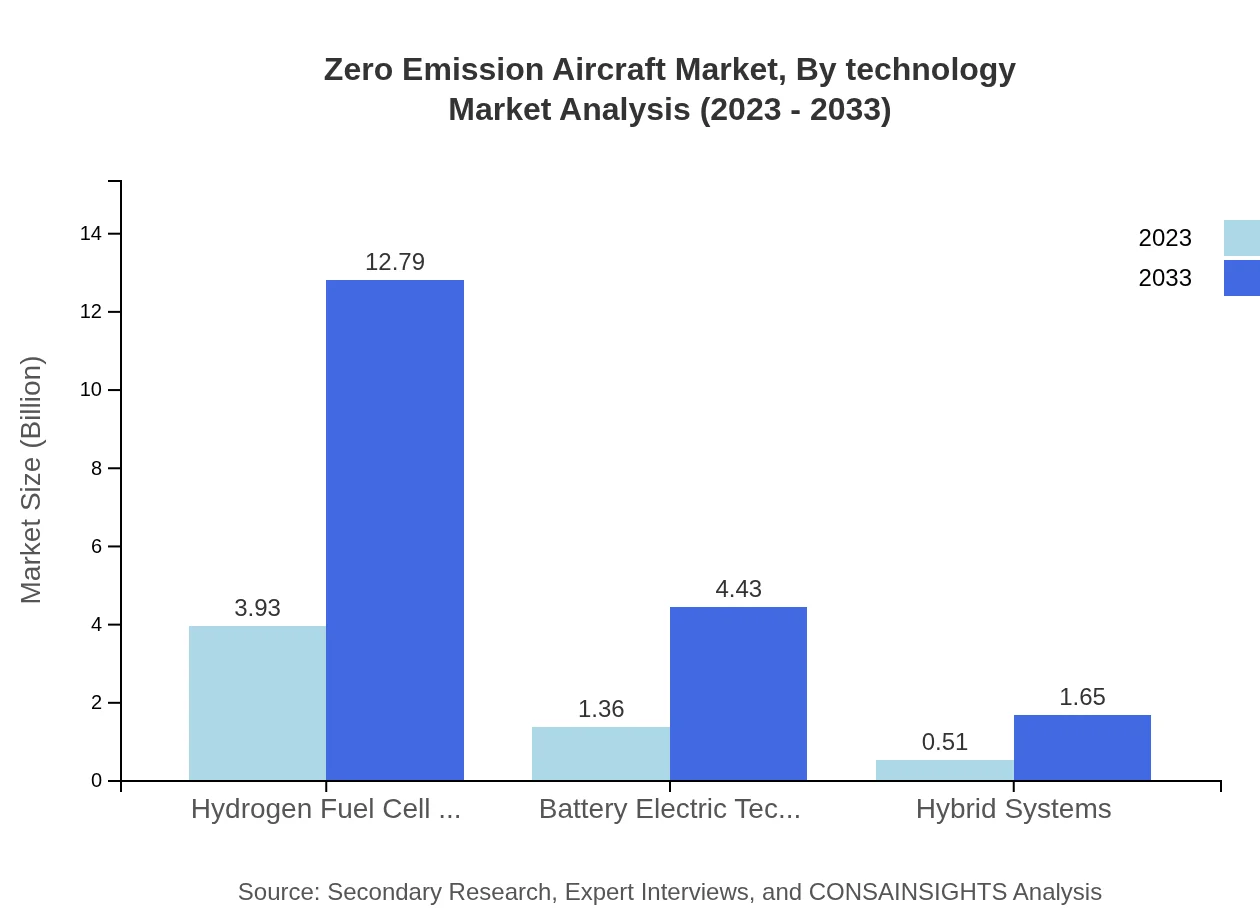

Zero Emission Aircraft Market Analysis By Technology

The Zero Emission Aircraft Market by technology indicates a rapid growth trajectory from $3.93 billion in 2023 to $12.79 billion by 2033, primarily driven by design innovations and energy efficiency enhancements. Hydrogen fuel cell technology holds a large share of this segment, with projections indicating it will remain a critical frontier for advancements.

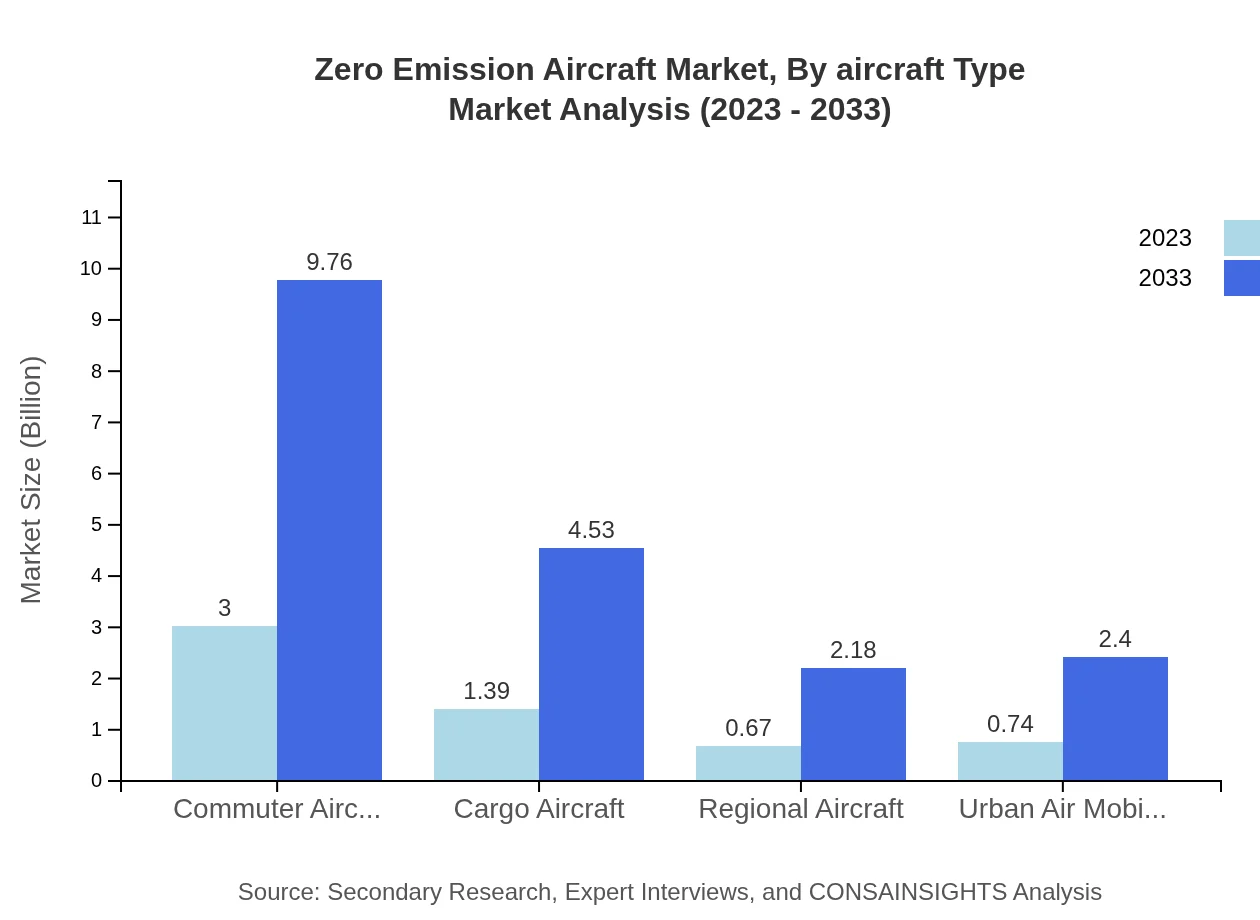

Zero Emission Aircraft Market Analysis By Aircraft Type

In terms of aircraft type, the passenger transport segment dominates the market, growing from $3.00 billion in 2023 to $9.76 billion by 2033. Cargo aircraft also show promising growth from $1.39 billion to $4.53 billion during the same period, spurred by the escalating demand for sustainable freight solutions.

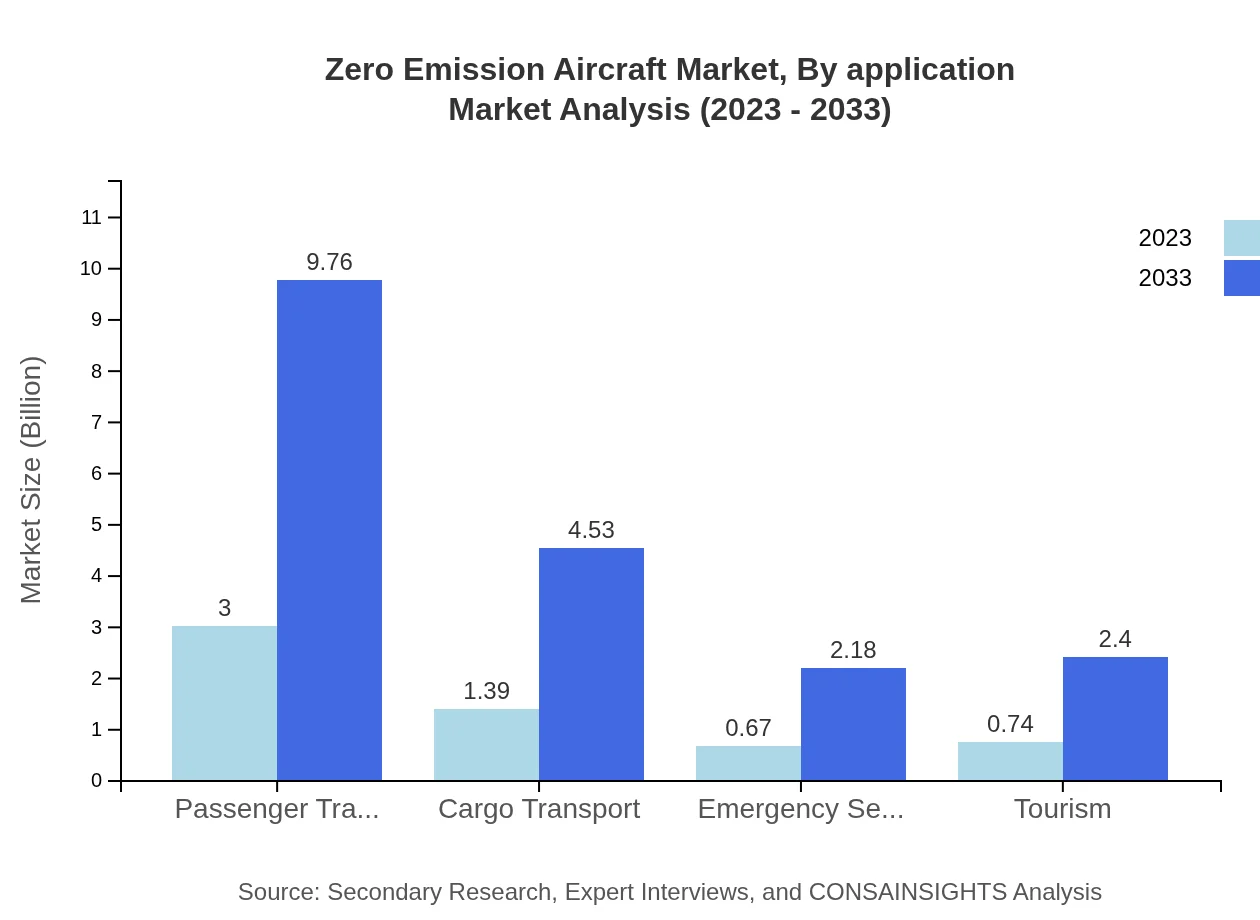

Zero Emission Aircraft Market Analysis By Application

The application segment reflects a diverse range of uses, with passenger transport maintaining a significant market share of 51.73% in 2023. Emergency services and urban air mobility applications are also gaining traction, highlighting their increasing relevance in sustainable aviation.

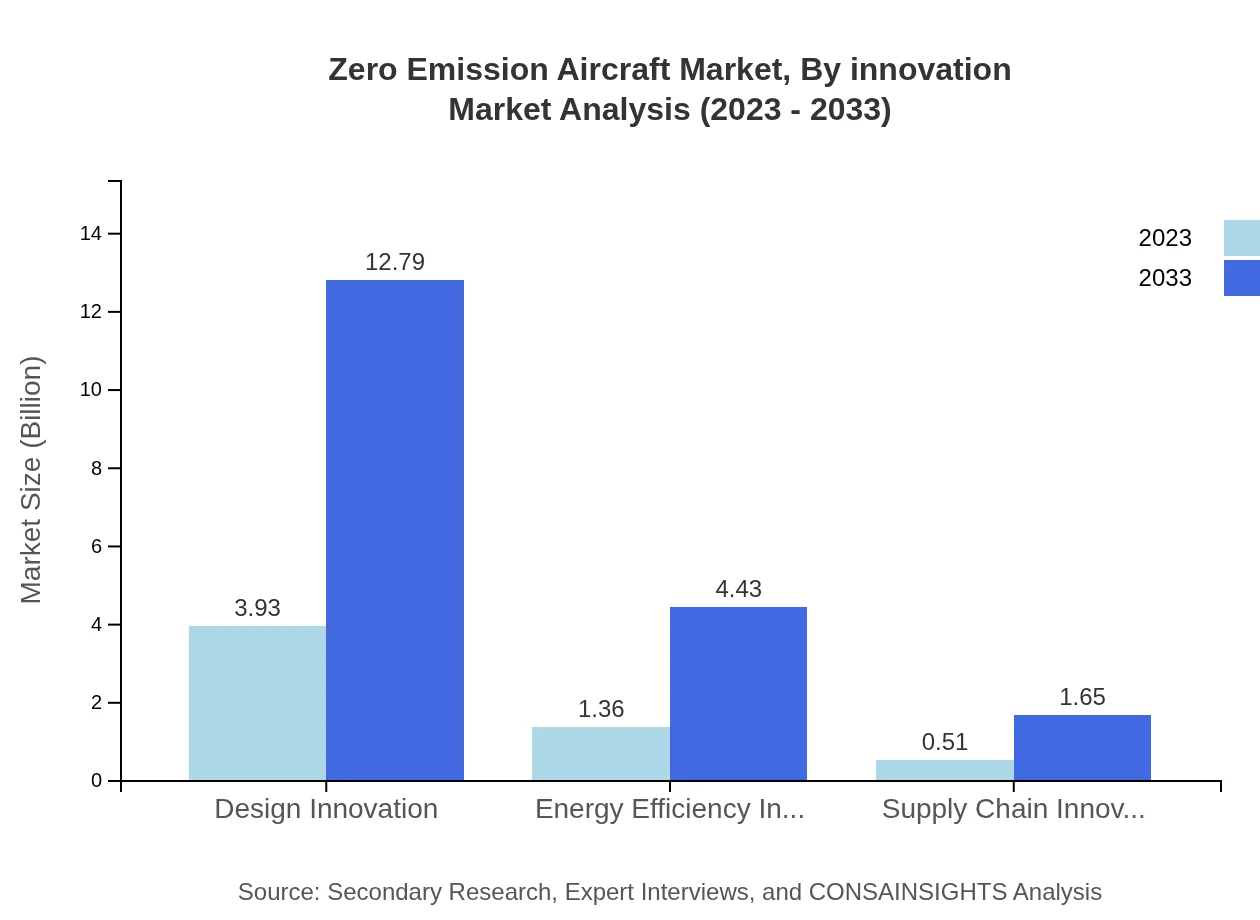

Zero Emission Aircraft Market Analysis By Innovation

The market for Zero Emission Aircraft by innovation is witnessing robust growth, with design innovations leading the sector. Continuous advancements in energy efficiency innovations and supply chain improvements also play essential roles as companies push toward more sustainable operations.

Zero Emission Aircraft Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Zero Emission Aircraft Industry

Airbus:

Airbus is leading the charge in developing hydrogen-powered aircraft with its ZEROe initiative, aiming for entry into service by the early 2030s, marking a significant advancement in sustainable aviation.Boeing :

Boeing is actively investing in sustainable aviation technologies and has launched several initiatives to explore hydrogen fuel cells and electric propulsion systems.Rolls-Royce:

Rolls-Royce is focused on developing propulsion systems that support zero-emission aircraft, partnering with various stakeholders to push technological boundaries.Zunum Aero:

Zunum Aero is innovating in hybrid-electric technology and aims to revolutionize regional air travel by providing sustainable and cost-effective options.Bye Aerospace:

Bye Aerospace is making strides with its electric aircraft technology and aims to address the demand for sustainable pilot training solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of Zero Emission Aircraft?

The market size for zero-emission aircraft was valued at approximately $5.8 billion in 2023, with an anticipated compound annual growth rate (CAGR) of 12% through 2033, highlighting significant growth potential in this emerging industry.

What are the key market players or companies in the Zero Emission Aircraft industry?

Key players include major aerospace manufacturers like Boeing, Airbus, and emerging startups focused on innovative electric and hydrogen technologies. These companies are pivotal in advancing zero-emission aircraft designs, which will shape the future of sustainable aviation.

What are the primary factors driving the growth in the Zero Emission Aircraft industry?

Key drivers include increasing regulatory pressures for sustainable aviation, advancements in technology such as battery efficiency, and rising environmental awareness among consumers and corporations alike, all pushing the aerospace industry towards zero-emission solutions.

Which region is the fastest Growing in the Zero Emission Aircraft market?

Europe is currently the fastest-growing region in the zero-emission aircraft market, projected to expand from $1.98 billion in 2023 to $6.45 billion by 2033, driven by strong governmental support and extensive investment in green technologies.

Does ConsaInsights provide customized market report data for the Zero Emission Aircraft industry?

Yes, ConsaInsights offers customized market report data for the zero-emission aircraft industry, tailored to your specific needs including insights on market growth, competitive analysis, and sector development to enhance strategic decision-making.

What deliverables can I expect from this Zero Emission Aircraft market research project?

You can expect comprehensive deliverables including detailed market analysis, forecasts, segment insights, competitive landscape reports, and actionable recommendations crafted to support your strategic initiatives in the zero-emission aircraft market.

What are the market trends of Zero Emission Aircraft?

Current market trends include a surge in design innovations and energy efficiency technologies, with significant focus on battery electric and hydrogen fuel cell systems, alongside a growing interest in new mobility solutions like urban air mobility.