Feed Minerals Market Report

Published Date: 31 January 2026 | Report Code: feed-minerals

Feed Minerals Market Size, Share, Industry Trends and Forecast to 2033

This report presents a comprehensive analysis of the Feed Minerals market for the forecast period 2023-2033, highlighting key trends, regional insights, market size, and growth opportunities within the industry.

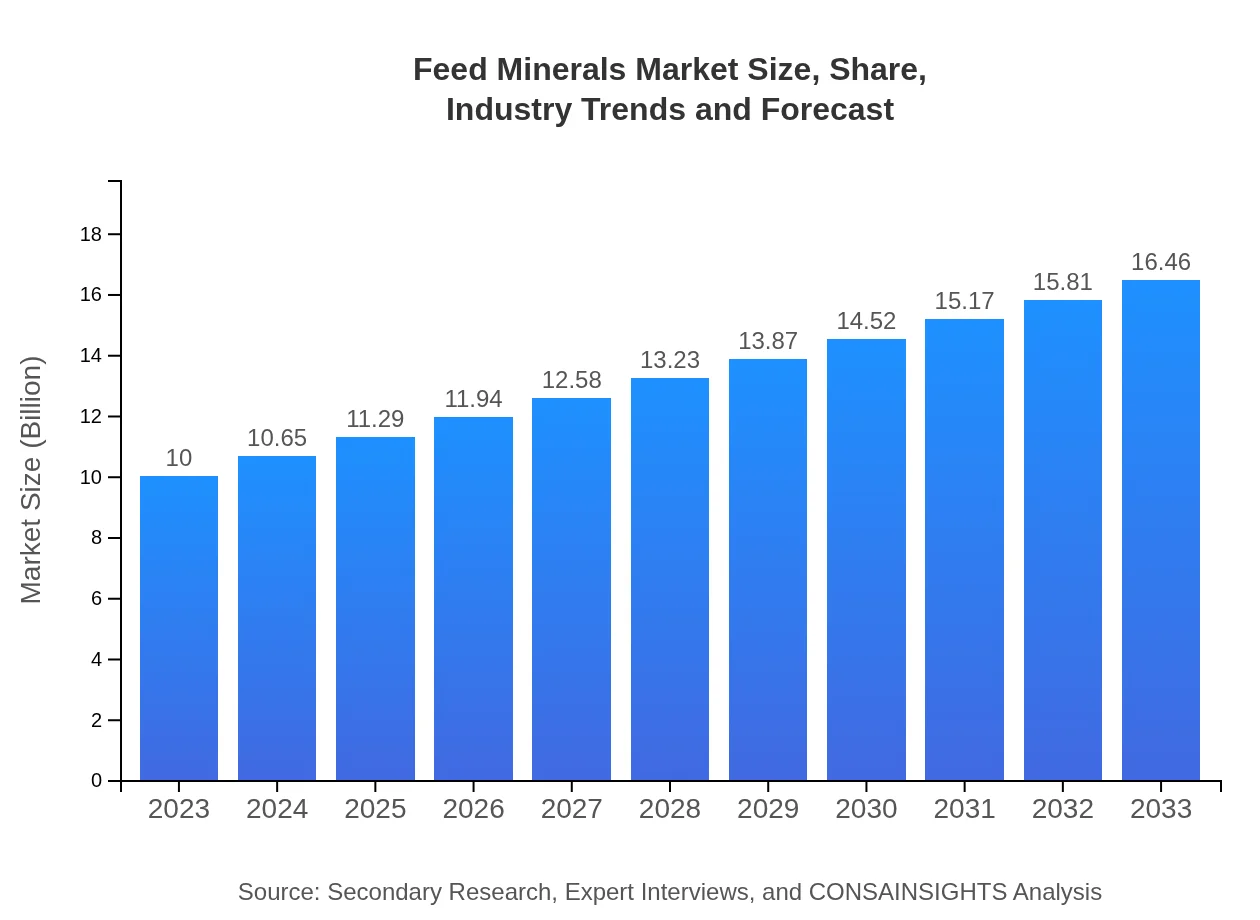

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $16.46 Billion |

| Top Companies | Cargill, Incorporated, BASF SE, ADM Animal Nutrition, DSM Nutritional Products, Nutreco N.V. |

| Last Modified Date | 31 January 2026 |

Feed Minerals Market Overview

Customize Feed Minerals Market Report market research report

- ✔ Get in-depth analysis of Feed Minerals market size, growth, and forecasts.

- ✔ Understand Feed Minerals's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Feed Minerals

What is the Market Size & CAGR of Feed Minerals market in 2023?

Feed Minerals Industry Analysis

Feed Minerals Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Feed Minerals Market Analysis Report by Region

Europe Feed Minerals Market Report:

The European Feed Minerals market is anticipated to rise from $3.07 billion in 2023 to $5.05 billion by 2033. European countries are adopting stringent regulations regarding feed quality and animal welfare, which drives the demand for high-quality feed minerals to ensure compliance and enhance livestock health.Asia Pacific Feed Minerals Market Report:

In the Asia Pacific region, the Feed Minerals market is expected to grow from $1.94 billion in 2023 to $3.19 billion by 2033. This growth trajectory is propelled by the rising livestock population, increased demand for protein, and significant investment in the livestock sector by countries such as China and India, which are focusing on improving feed quality and animal health standards.North America Feed Minerals Market Report:

North America holds a strong position in the global Feed Minerals market, with an estimated market size of $3.49 billion in 2023, projected to increase to $5.74 billion by 2033. The region is driven by advanced livestock farming practices, significant research and development investments, and increasing demand for high-quality feed products among farmers.South America Feed Minerals Market Report:

The South American market, valued at $0.21 billion in 2023, is projected to reach $0.35 billion by 2033. This growth can be attributed to the increasing awareness of animal nutrition and rising beef and poultry production in countries such as Brazil and Argentina.Middle East & Africa Feed Minerals Market Report:

The Middle East and Africa market is expected to experience growth from $1.30 billion in 2023 to $2.14 billion by 2033, driven by increasing livestock production and a shift towards modern farming techniques. There's a growing focus on improving feed efficiency and animal health, which further propels demand for specialized feed mineral supplements.Tell us your focus area and get a customized research report.

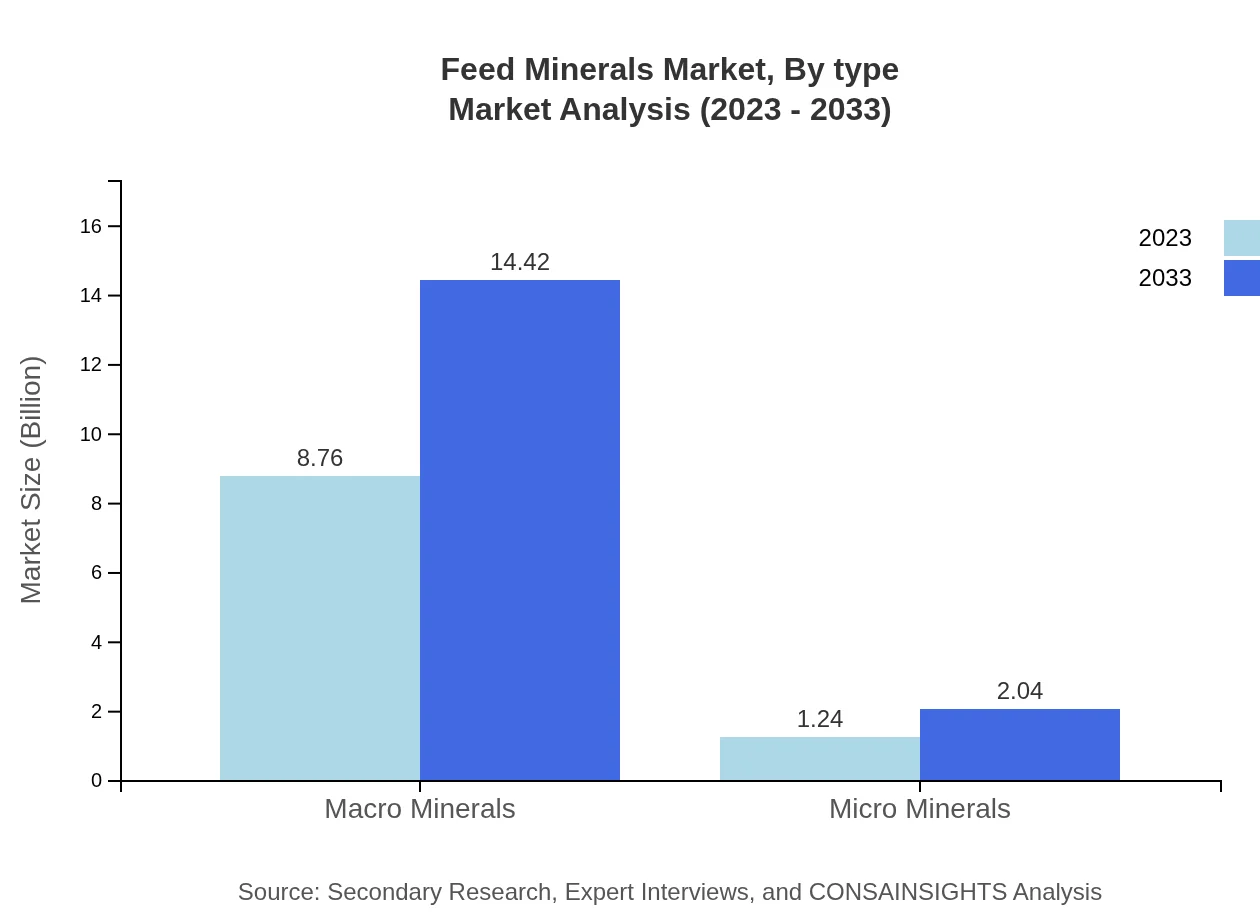

Feed Minerals Market Analysis By Type

The Feed Minerals Market by Type includes Macro Minerals and Micro Minerals. Macro Minerals dominated the market with a size of $8.76 billion in 2023, set to grow to $14.42 billion by 2033. This segment highlights the foundational role of minerals like calcium, phosphorus, and potassium in animal diets. Micro Minerals, while smaller, play a critical role in health and nutrition, expected to expand from $1.24 billion in 2023 to $2.04 billion by 2033.

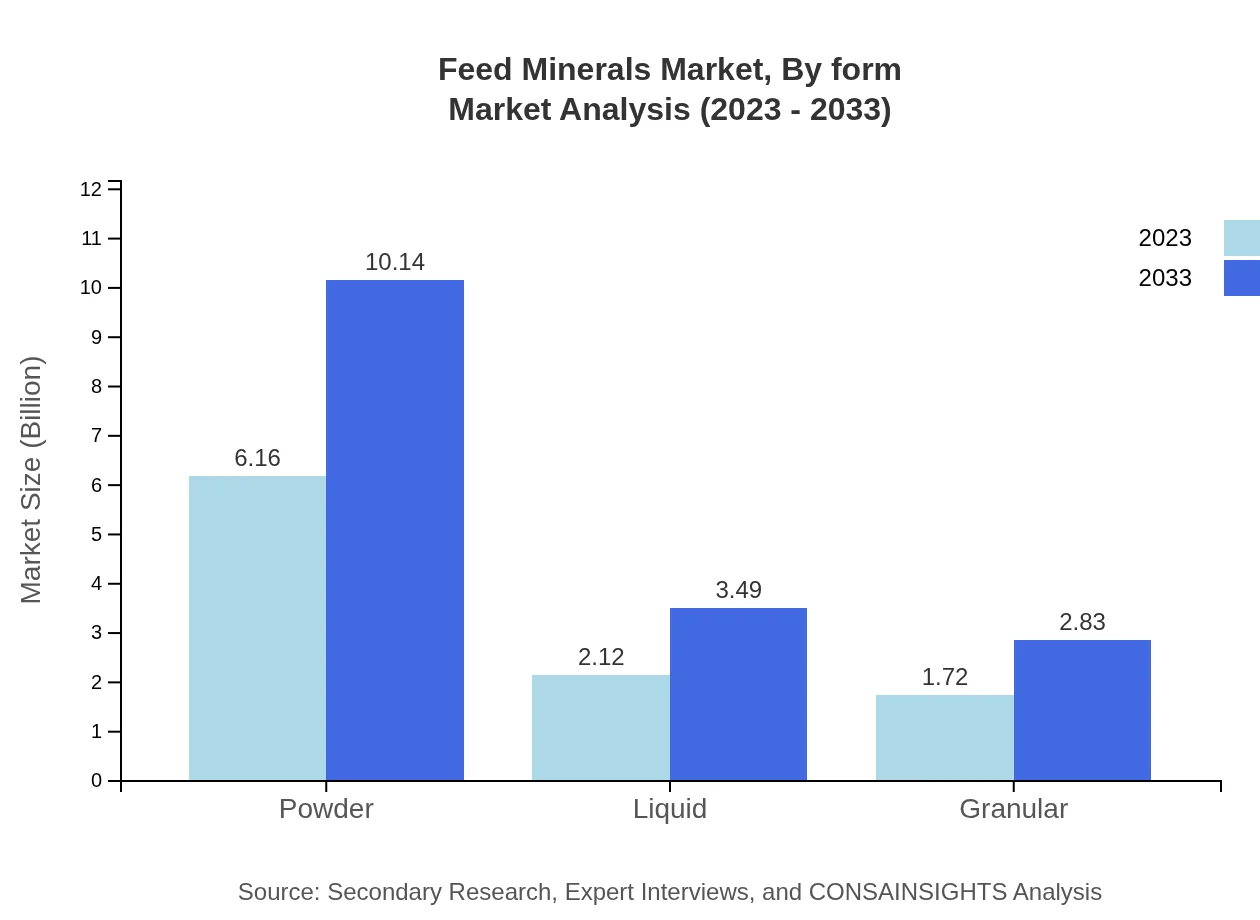

Feed Minerals Market Analysis By Form

In terms of form, the Powder segment leads with a size of $6.16 billion in 2023, projected to grow to $10.14 billion by 2033. Liquid forms, valued at $2.12 billion, are anticipated to rise to $3.49 billion, while Granular forms grow from $1.72 billion to $2.83 billion over the same period. Powders are favored for their ease of mixing and higher nutrient concentration.

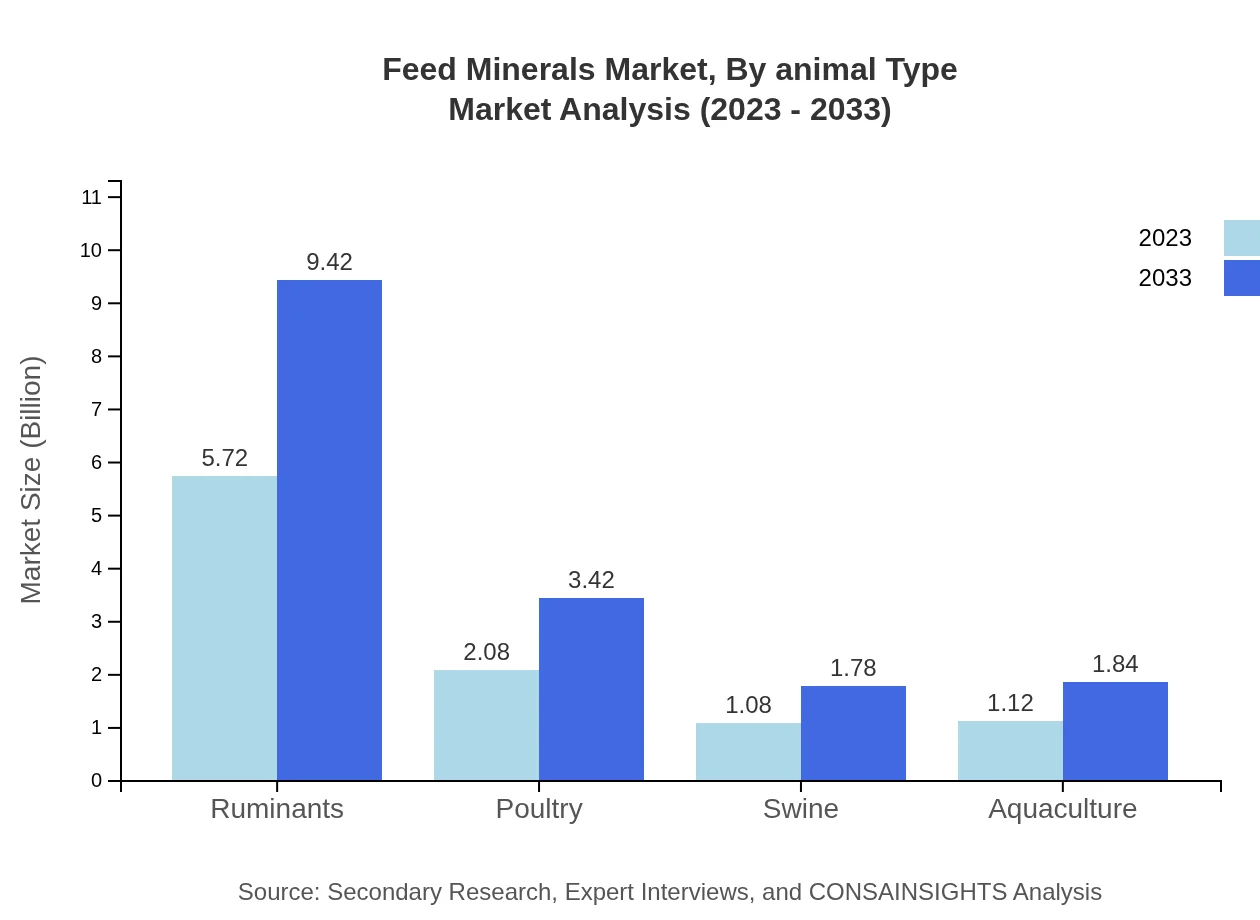

Feed Minerals Market Analysis By Animal Type

The Feed Minerals Market segmentation by animal type includes Ruminants, Poultry, Swine, and Aquaculture. Ruminants hold the largest share of $5.72 billion in 2023 and are projected to see growth up to $9.42 billion by 2033, driven by the demand for beef and dairy production. Poultry represents $2.08 billion in 2023, with continued expansion expected as global poultry meat consumption increases.

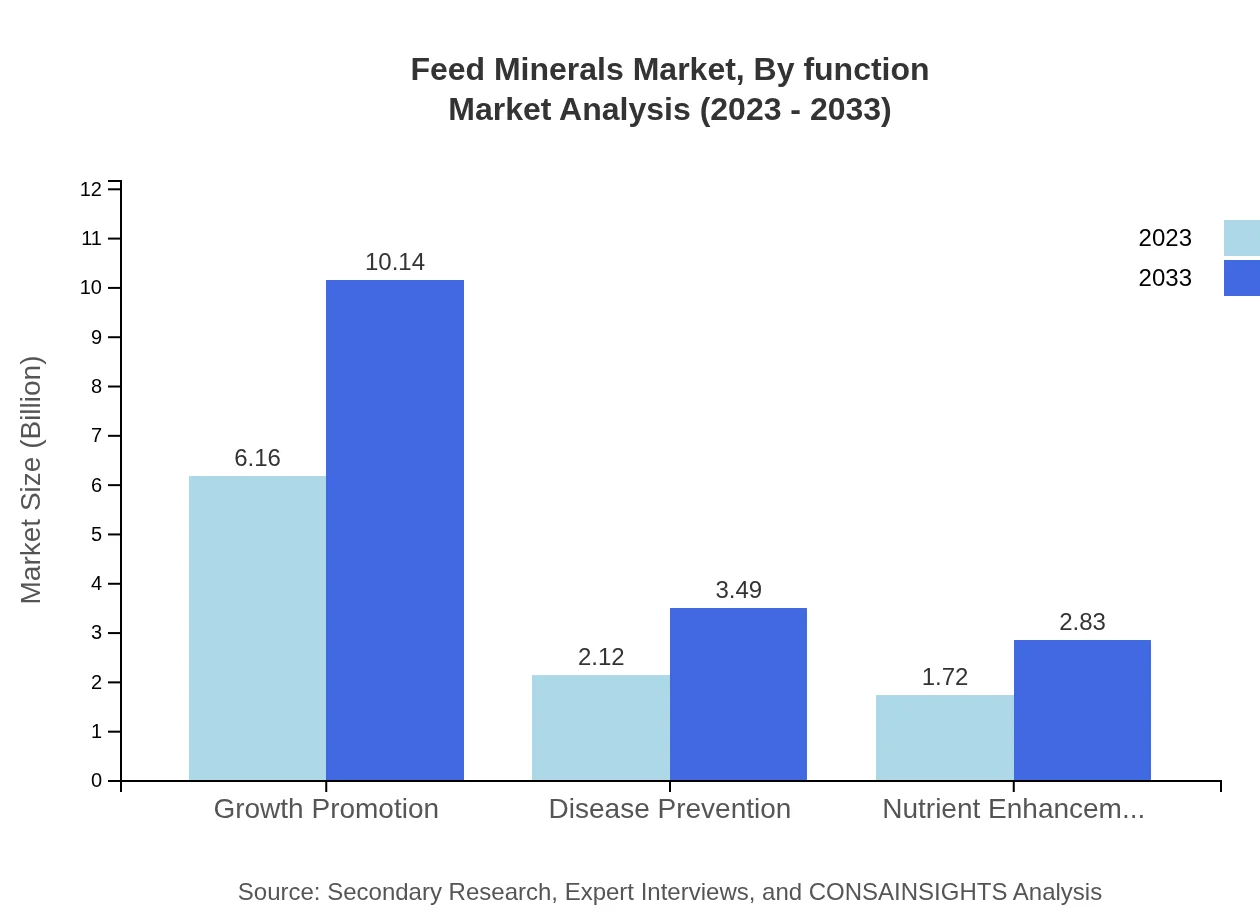

Feed Minerals Market Analysis By Function

The market is segmented by function into Growth Promotion, Disease Prevention, and Nutrient Enhancement. Growth Promotion is currently the leading segment at $6.16 billion in 2023, expected to grow to $10.14 billion by 2033, reflecting the focus on improving growth rates in livestock. Disease Prevention is significant at $2.12 billion, poised to increase to $3.49 billion, emphasizing health assurance for livestock.

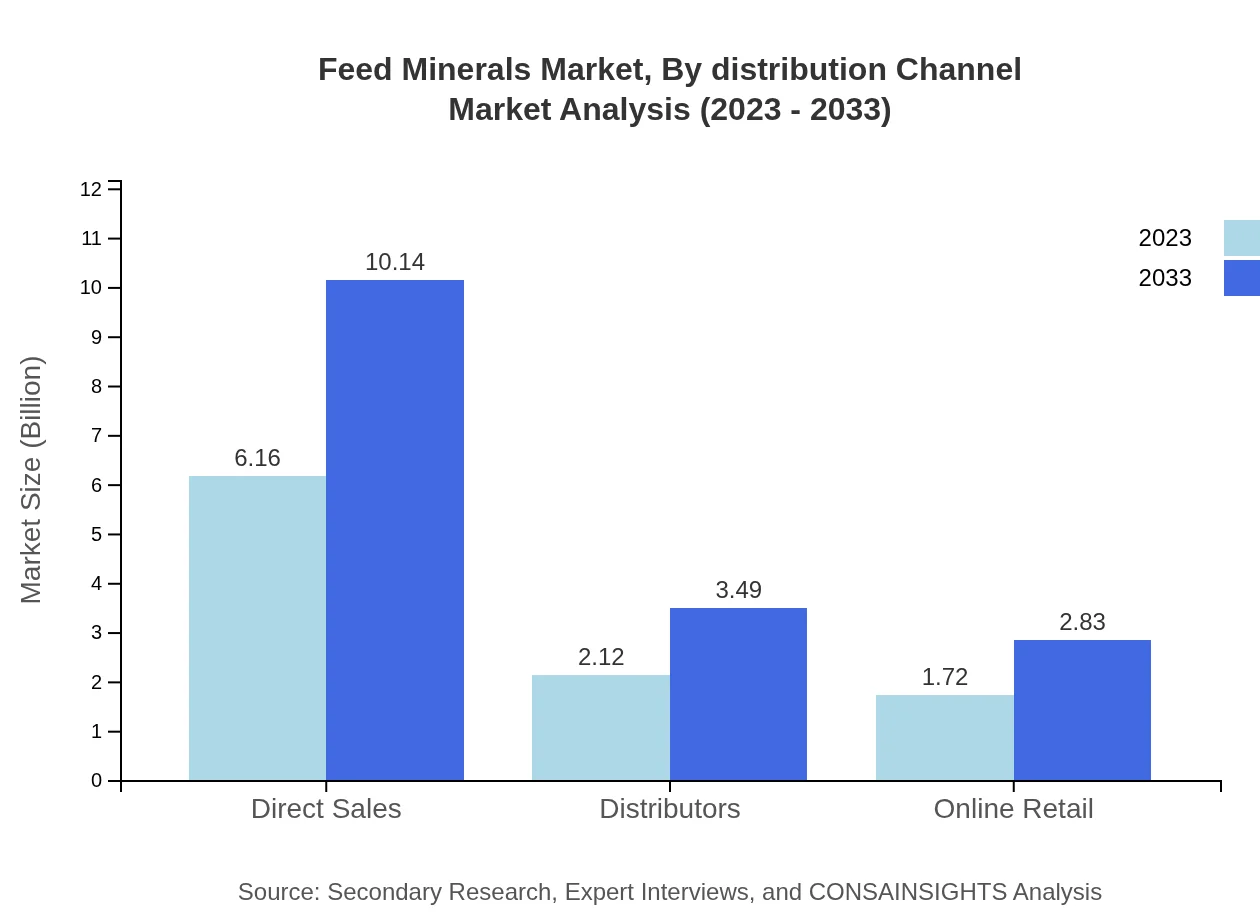

Feed Minerals Market Analysis By Distribution Channel

Distribution channels for Feed Minerals include Direct Sales, Distributors, and Online Retail. Direct Sales dominate with a market size of $6.16 billion in 2023, consistent with industry trends favoring relationship-driven business. Distributors stand at $2.12 billion, while Online Retail, a growing channel, is projected to reach $2.83 billion by 2033, catering to the increasing preference for e-commerce.

Feed Minerals Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Feed Minerals Industry

Cargill, Incorporated:

Cargill is a multinational corporation that provides food, agriculture, financial, and industrial products and services. It is a dominant leader in animal nutrition, offering a wide range of feed additives including feed minerals.BASF SE:

BASF is one of the largest chemical producers in the world and has a strong presence in the animal nutrition market, particularly for its innovative feed mineral solutions that enhance livestock productivity.ADM Animal Nutrition:

Archer Daniels Midland Company (ADM) is a global leader in animal nutrition, offering nutrient-rich mineral blends to optimize animal health and performance.DSM Nutritional Products:

DSM Nutritional Products specializes in vitamins, carotenoids, and feed minerals, leading innovations in animal health and nutrition aimed at improving livestock productivity.Nutreco N.V.:

Nutreco is a leading global player in animal nutrition and fish feed, focusing on providing sustainable feed solutions that enhance nutrition and health in livestock.We're grateful to work with incredible clients.

FAQs

What is the market size of feed Minerals?

The global feed minerals market is valued at approximately $10 billion in 2023, with a projected CAGR of 5% from 2023 to 2033, indicating robust growth opportunities in this sector.

What are the key market players or companies in the feed Minerals industry?

Key players in the feed-minerals industry include leading global companies known for their advancements in agricultural technology and livestock nutrition, enhancing product offerings and market competitiveness.

What are the primary factors driving the growth in the feed Minerals industry?

The growth in the feed-minerals industry is driven by rising global meat consumption, increased focus on animal health, and advancements in agricultural technologies that enhance livestock productivity.

Which region is the fastest Growing in the feed Minerals?

The fastest-growing region in the feed minerals market is Europe, expected to grow from $3.07 billion in 2023 to $5.05 billion by 2033, showcasing significant market potential in livestock feeding solutions.

Does ConsaInsights provide customized market report data for the feed Minerals industry?

Yes, ConsaInsights offers customized market report data for the feed-minerals industry, tailoring insights to specific client needs and market dynamics to drive informed decision-making.

What deliverables can I expect from this feed Minerals market research project?

Deliverables for the feed-minerals market research project include comprehensive reports, segmented data analysis, regional insights, forecasts, and detailed competitor breakdowns to guide strategic planning.

What are the market trends of feed Minerals?

Current trends in the feed-minerals market indicate a shift towards sustainable practices, increased demand for organic feed additives, and enhanced focus on nutrient efficiency to support livestock health.