Infrastructure Sector Trends Industry Competitiveness Forecasts To-2024 Market Report

Published Date: 22 January 2026 | Report Code: infrastructure-sector-trends-industry-competitiveness-forecasts-to-2024

Infrastructure Sector Trends Industry Competitiveness Forecasts To-2024 Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the infrastructure sector trends, focusing on industry competitiveness and forecasts until 2033. It covers market size, growth projections, regional insights, and key players shaping the landscape.

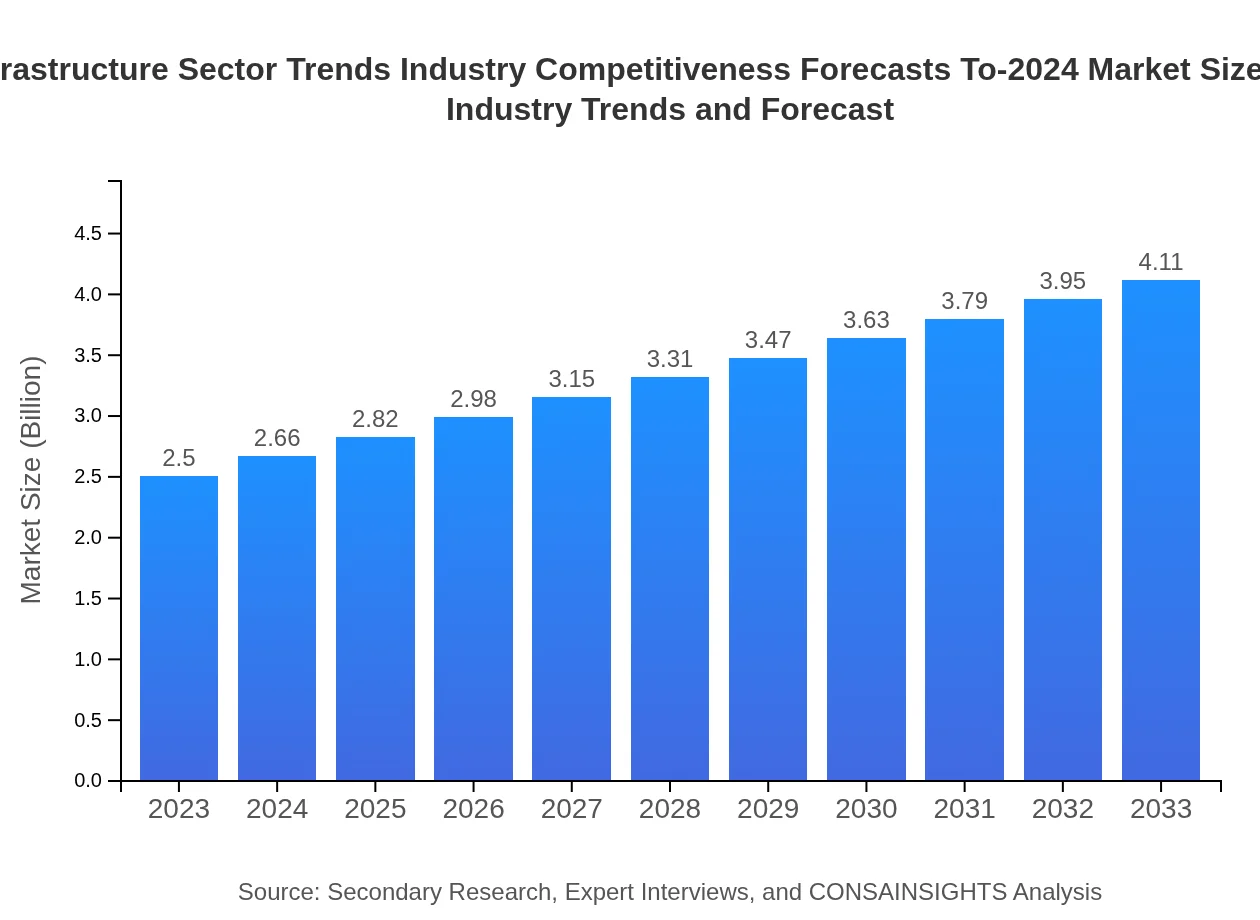

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Trillion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $4.11 Trillion |

| Top Companies | Bechtel Corporation, ACCIONA, Fluor Corporation, Skanska |

| Last Modified Date | 22 January 2026 |

Infrastructure Sector Trends Industry Competitiveness Forecasts To-2024 Market Overview

Customize Infrastructure Sector Trends Industry Competitiveness Forecasts To-2024 Market Report market research report

- ✔ Get in-depth analysis of Infrastructure Sector Trends Industry Competitiveness Forecasts To-2024 market size, growth, and forecasts.

- ✔ Understand Infrastructure Sector Trends Industry Competitiveness Forecasts To-2024's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Infrastructure Sector Trends Industry Competitiveness Forecasts To-2024

What is the Market Size & CAGR of Infrastructure Sector Trends Industry Competitiveness Forecasts To-2024 market in 2023?

Infrastructure Sector Trends Industry Competitiveness Forecasts To-2024 Industry Analysis

Infrastructure Sector Trends Industry Competitiveness Forecasts To-2024 Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Infrastructure Sector Trends Industry Competitiveness Forecasts To-2024 Market Analysis Report by Region

Europe Infrastructure Sector Trends Industry Competitiveness Forecasts To-2024 Market Report:

Europe's infrastructure market stands at approximately $0.88 trillion in 2023 and is forecasted to grow to $1.44 trillion by 2033. The EU's focus on green infrastructure and connectivity improvements forms the backbone of investments, aligning with sustainability goals across member states.Asia Pacific Infrastructure Sector Trends Industry Competitiveness Forecasts To-2024 Market Report:

In 2023, the Asia Pacific infrastructure market is valued at approximately $0.41 trillion, expected to rise to $0.68 trillion by 2033. Rapid urbanization and regional economic growth in countries like India and China drive infrastructure expansion, with increased investments in smart city initiatives and sustainable development.North America Infrastructure Sector Trends Industry Competitiveness Forecasts To-2024 Market Report:

North America's infrastructure market is robust, valued at $0.86 trillion in 2023, reaching $1.41 trillion by 2033. Strong government spending and infrastructure renewal initiatives in the U.S. fuel significant growth, alongside investments in renewable energy and aging infrastructure replacement.South America Infrastructure Sector Trends Industry Competitiveness Forecasts To-2024 Market Report:

The South American infrastructure market is relatively small, valued at $0.06 trillion in 2023 and projected to grow to $0.10 trillion by 2033. Economic instability hinders significant growth, though investments in urban transport and energy projects are set to increase with improved government policies.Middle East & Africa Infrastructure Sector Trends Industry Competitiveness Forecasts To-2024 Market Report:

The Middle East and Africa market is valued at $0.29 trillion in 2023, increasing to $0.48 trillion by 2033. Investment in mega-infrastructure projects, especially in the Gulf countries, is expected to accelerate growth despite economic challenges in sub-Saharan Africa.Tell us your focus area and get a customized research report.

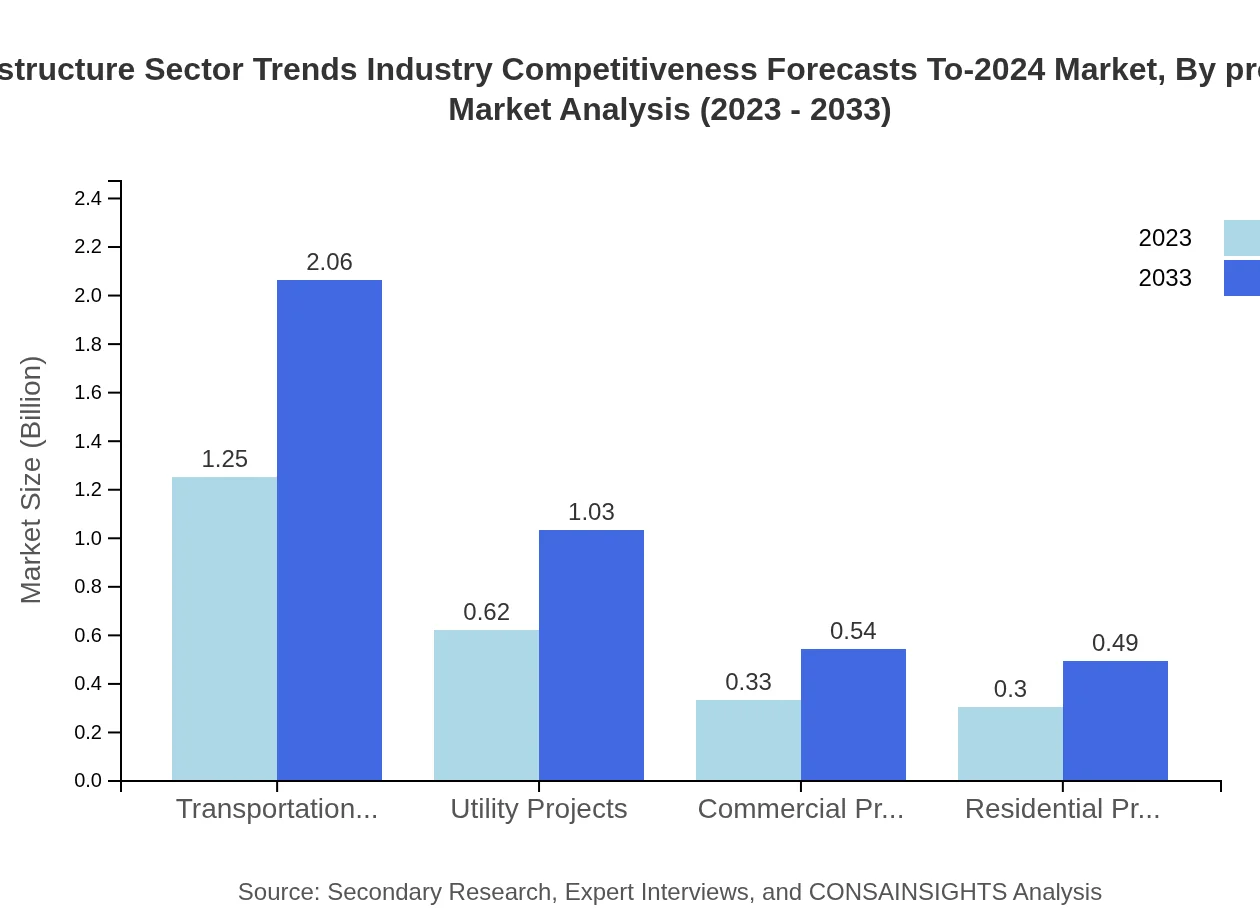

Infrastructure Sector Trends Industry Competitiveness Forecasts To-2024 Market Analysis By Project Type

Transportation Projects are at the forefront, with a market size of $1.25 trillion in 2023, expected to expand to $2.06 trillion by 2033, accounting for 50.1% of the segment. Utility Projects follow, growing from $0.62 trillion to $1.03 trillion (24.95% share). The commercial and residential sectors, while smaller, show steady growth, indicating broader infrastructure demand driven by urban expansion.

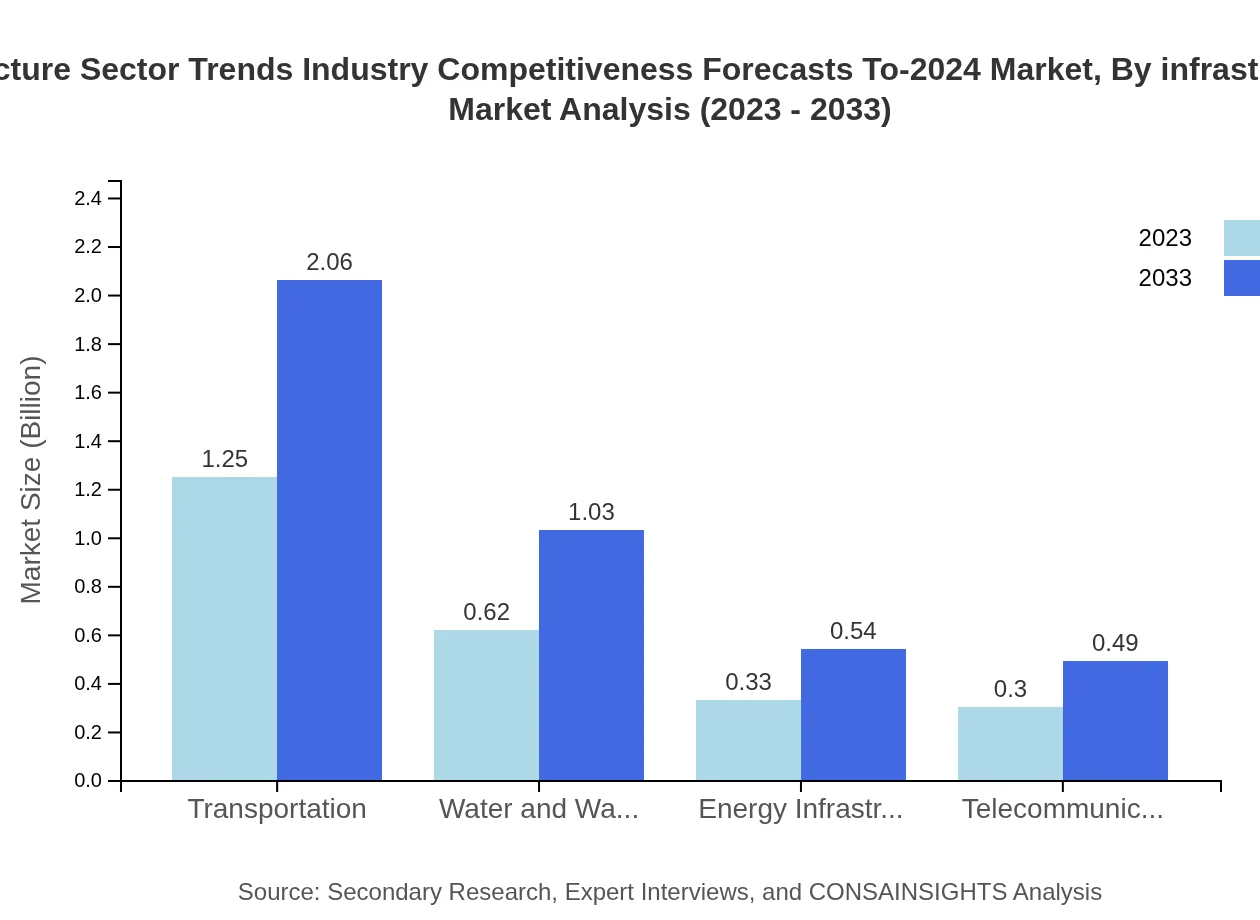

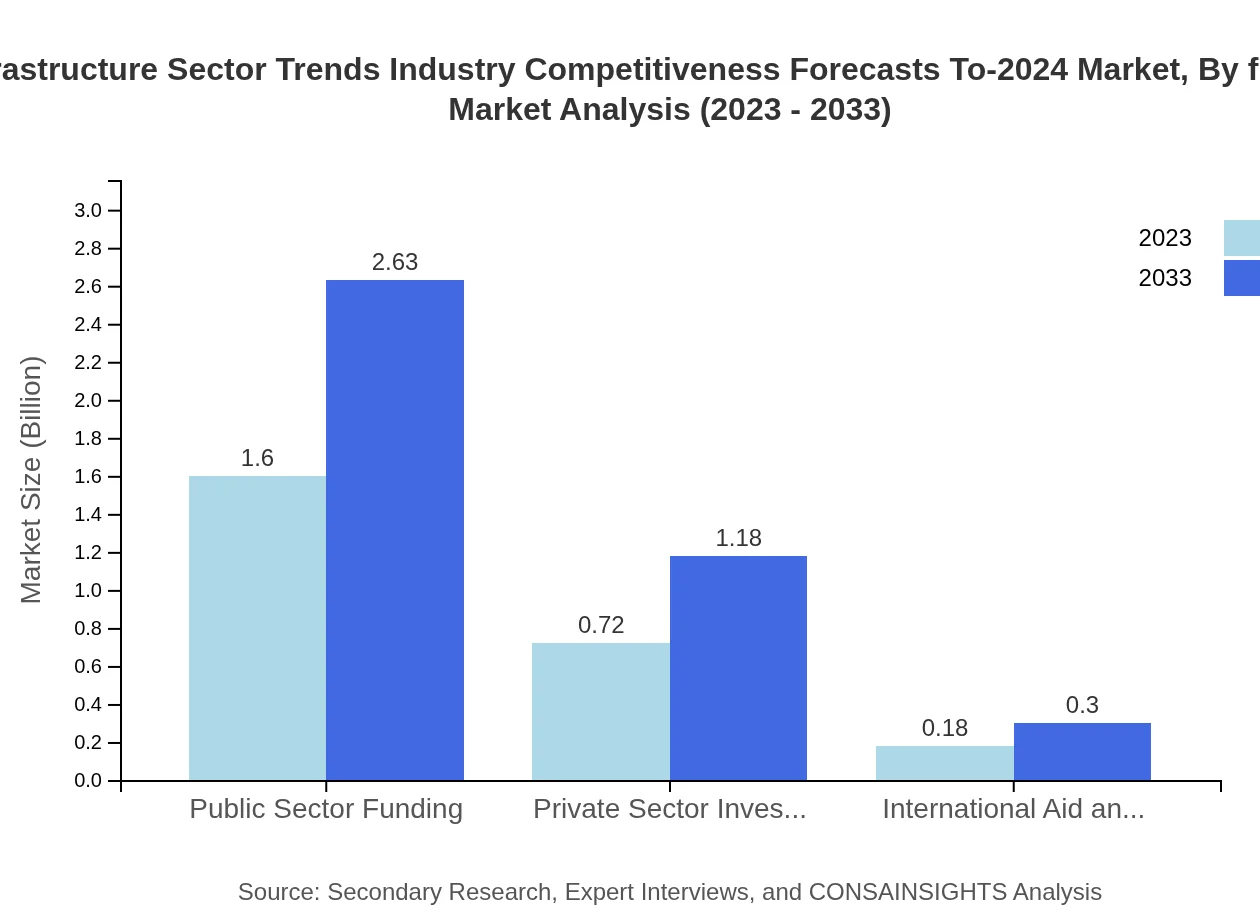

Infrastructure Sector Trends Industry Competitiveness Forecasts To-2024 Market Analysis By Infrastructure Sector

Public Sector Funding is the largest segment, with $1.60 trillion in 2023 and projected to increase to $2.63 trillion by 2033 (64.03% share). Private Sector Investments are also significant, rising from $0.72 trillion to $1.18 trillion (28.67%). The International Aid and Financing sector, while smaller, plays a critical role in less developed regions, projected to grow to $0.30 trillion (7.3% share).

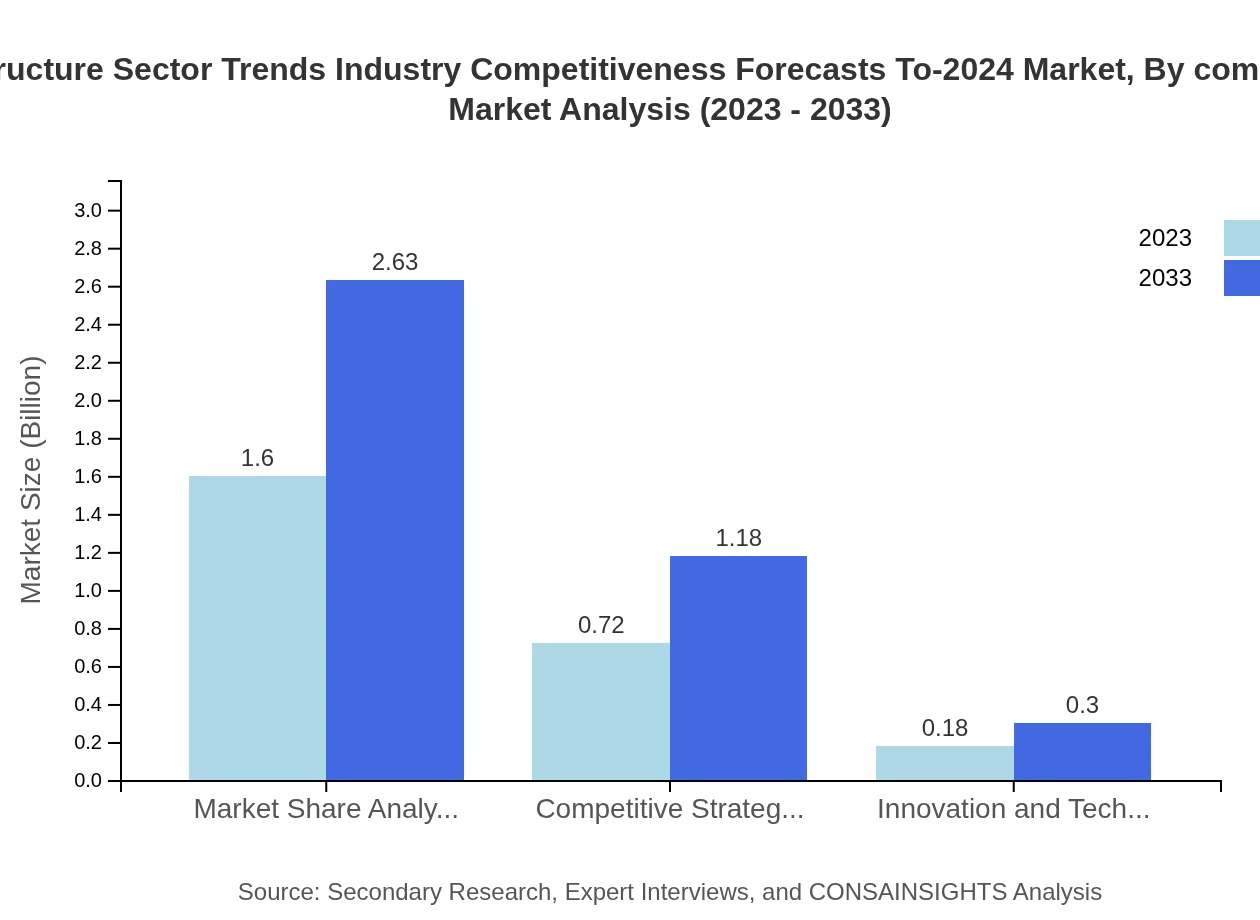

Infrastructure Sector Trends Industry Competitiveness Forecasts To-2024 Market Analysis By Competitiveness

Competitive strategies within the infrastructure market are evolving rapidly, focusing on incorporation of technology in planning and execution phases. Innovation and efficiency are paramount, with stakeholders adopting digital tools to improve project delivery timelines and performance assessment, essential for maintaining a competitive edge.

Infrastructure Sector Trends Industry Competitiveness Forecasts To-2024 Market Analysis By Financing

Funding dynamics in the infrastructure sector are characterized by a reliance on diverse sources. Government funding remains dominant, but private investments and international aid are increasingly critical for financing large-scale projects. The challenge remains in balancing public interests with the need for investment returns from private entities.

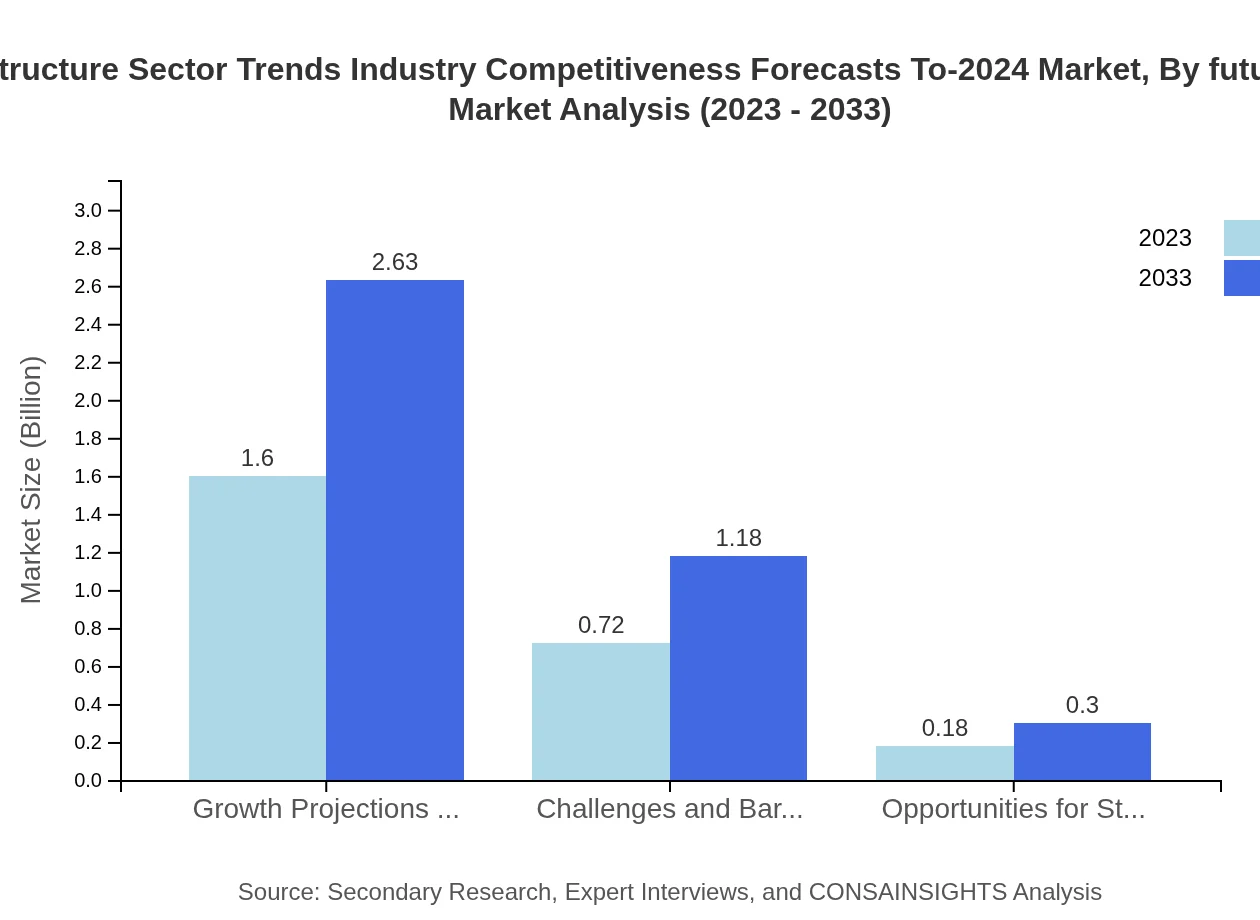

Infrastructure Sector Trends Industry Competitiveness Forecasts To-2024 Market Analysis By Future Outlook

The future outlook for the infrastructure sector remains optimistic, with substantial growth anticipated. However, challenges such as regulatory hurdles, financing gaps, and labor shortages could impede progress. Technological advancements and a focus on sustainability are vital for unlocking future opportunities and achieving resilience in infrastructure investments.

Infrastructure Sector Trends Industry Competitiveness Forecasts To-2024 Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Infrastructure Sector Trends Industry Competitiveness Forecasts To-2024 Industry

Bechtel Corporation:

A global engineering firm known for its role in major infrastructure projects across the transportation, water, and energy sectors, emphasizing sustainable practices.ACCIONA:

A multinational company specializing in renewable energy and infrastructure, recognized for its commitment to innovation and sustainability in project execution.Fluor Corporation:

Fluor provides project management and engineering services, focusing on infrastructure development across various sectors with an emphasis on safety and efficiency.Skanska:

A project development and construction group known for its sustainable construction techniques and commitment to reducing carbon footprints in its operations.We're grateful to work with incredible clients.

FAQs

What is the market size of Infrastructure Sector Trends Industry Competitiveness Forecasts To 2024?

The market size of the Infrastructure Sector is projected to reach approximately 2.5 trillion USD by 2024, growing at a compound annual growth rate (CAGR) of 5% from the current forecast period.

What are the key market players or companies in this Infrastructure Sector Trends Industry?

Key players in the Infrastructure Sector include major construction firms, engineering consultancies, and private equity firms specializing in infrastructure development. These entities drive innovation, capital flow, and project delivery across various infrastructures.

What are the primary factors driving the growth in the Infrastructure Sector?

Key growth drivers in the Infrastructure Sector include increased urbanization, government spending on infrastructure projects, rising public-private partnerships, and growing demand for sustainable development practices across various infrastructure domains.

Which region is the fastest Growing in the Infrastructure Sector?

The fastest-growing region in the Infrastructure Sector is Europe, with a market projected to grow from $0.88 trillion in 2023 to $1.44 trillion by 2033, reflecting a significant investment in infrastructure modernization and sustainability.

Does ConsaInsights provide customized market report data for the Infrastructure Sector industry?

Yes, ConsaInsights offers customized market reports for the Infrastructure Sector, tailored to client specifications. These reports encompass detailed analyses, forecasting, and insights specific to the needs of stakeholders.

What deliverables can I expect from this Infrastructure Sector market research project?

Deliverables from this research project include comprehensive market analysis reports, segmentation data, trends and forecasts, competitive landscape assessments, and strategic recommendations tailored to key industry players.

What are the market trends of Infrastructure Sector?

Current market trends in the Infrastructure Sector include digitalization of infrastructure projects, sustainable construction practices, increased investment in transportation and utility projects, and a focus on innovation and technology to enhance project efficiency.