Preclinical Cro Market Report

Published Date: 31 January 2026 | Report Code: preclinical-cro

Preclinical Cro Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Preclinical Contract Research Organization (CRO) market, focusing on trends, sizes, and forecasts from 2023 to 2033. It covers market segmentation, regional dynamics, and key players shaping the industry.

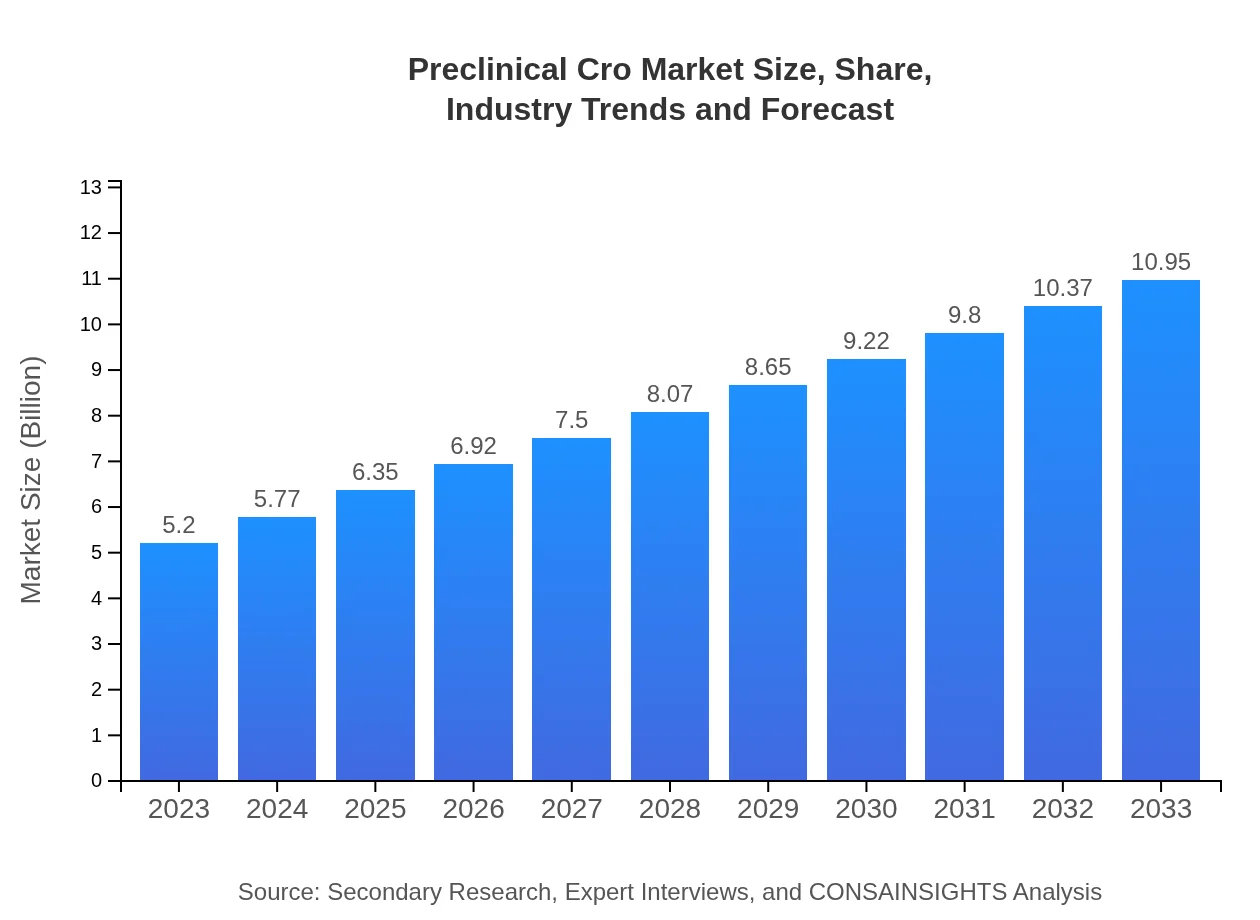

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $10.95 Billion |

| Top Companies | Charles River Laboratories, Covance, PRA Health Sciences, Wuxi AppTec |

| Last Modified Date | 31 January 2026 |

Preclinical CRO Market Overview

Customize Preclinical Cro Market Report market research report

- ✔ Get in-depth analysis of Preclinical Cro market size, growth, and forecasts.

- ✔ Understand Preclinical Cro's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Preclinical Cro

What is the Market Size & CAGR of Preclinical CRO market in 2023?

Preclinical CRO Industry Analysis

Preclinical CRO Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Preclinical CRO Market Analysis Report by Region

Europe Preclinical Cro Market Report:

The European market is also significant, anticipated to grow from $1.72 billion in 2023 to $3.61 billion by 2033, supported by stringent regulatory requirements and increased collaboration between academic institutions and CROs.Asia Pacific Preclinical Cro Market Report:

The Asia Pacific region is experiencing substantial growth in the Preclinical CRO market, expected to increase from $0.86 billion in 2023 to $1.81 billion by 2033. Key factors include lower operational costs, increasing government investments in healthcare, and the rise of biotechnology firms in the region.North America Preclinical Cro Market Report:

North America is the largest market for Preclinical CRO services, with a size of $1.89 billion in 2023 and projected growth to $3.97 billion by 2033. This is fueled by the strong presence of major pharmaceutical companies and substantial R&D investments.South America Preclinical Cro Market Report:

The South American market, though smaller, is expected to see growth from $0.13 billion in 2023 to $0.28 billion by 2033, driven by improvements in regulatory frameworks and growing pharmaceutical investments.Middle East & Africa Preclinical Cro Market Report:

In the Middle East and Africa, the market is expected to expand from $0.60 billion in 2023 to $1.27 billion by 2033, driven by rising healthcare initiatives and investments in drug development.Tell us your focus area and get a customized research report.

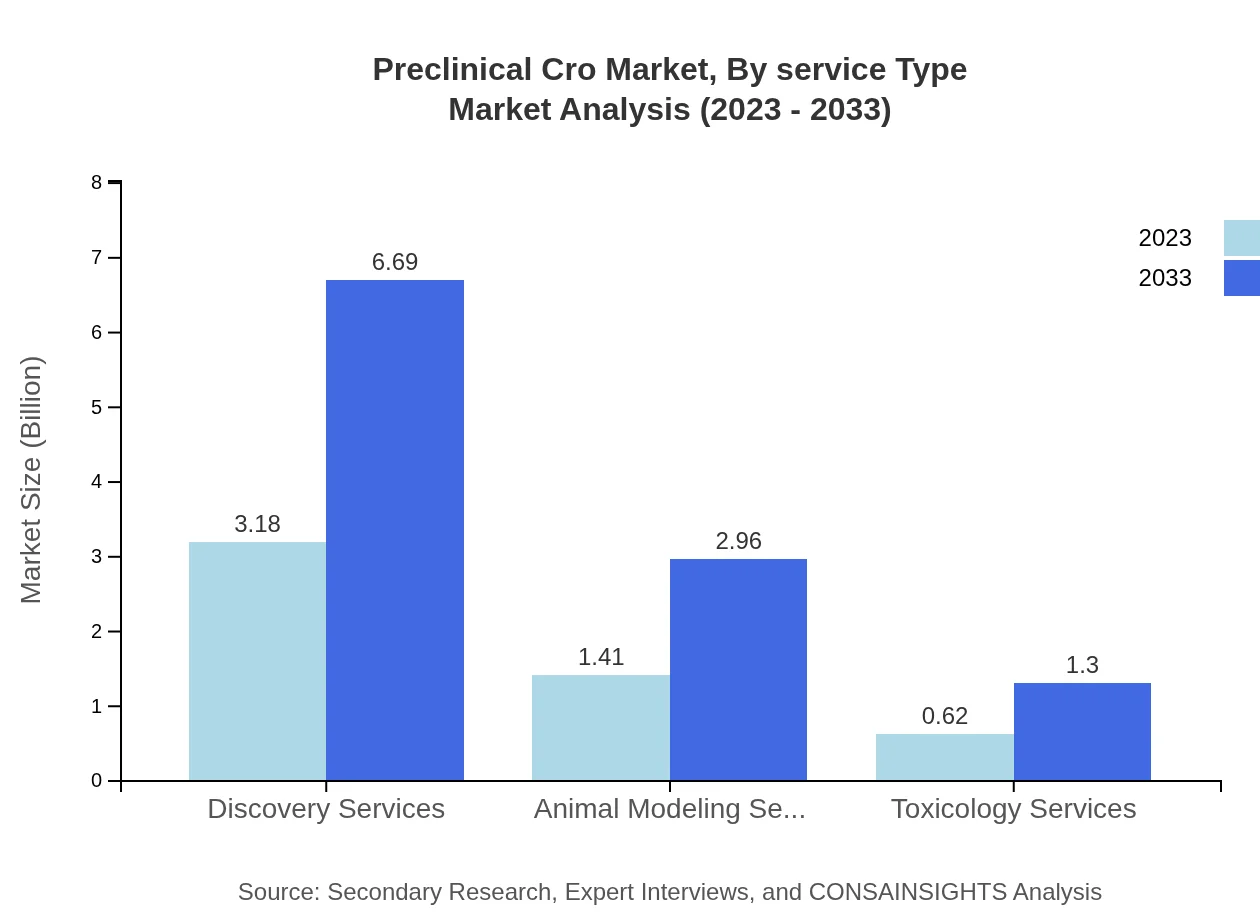

Preclinical Cro Market Analysis By Service Type

The breakdown of the Preclinical CRO market by service type shows that Discovery Services and Toxicology Services dominate the market. In 2023, Discovery Services accounted for a market size of approximately $3.18 billion, expected to rise to $6.69 billion by 2033. Toxicology Services, essential for assessing drug safety, will grow significantly, paralleling the demand for early-stage drug development.

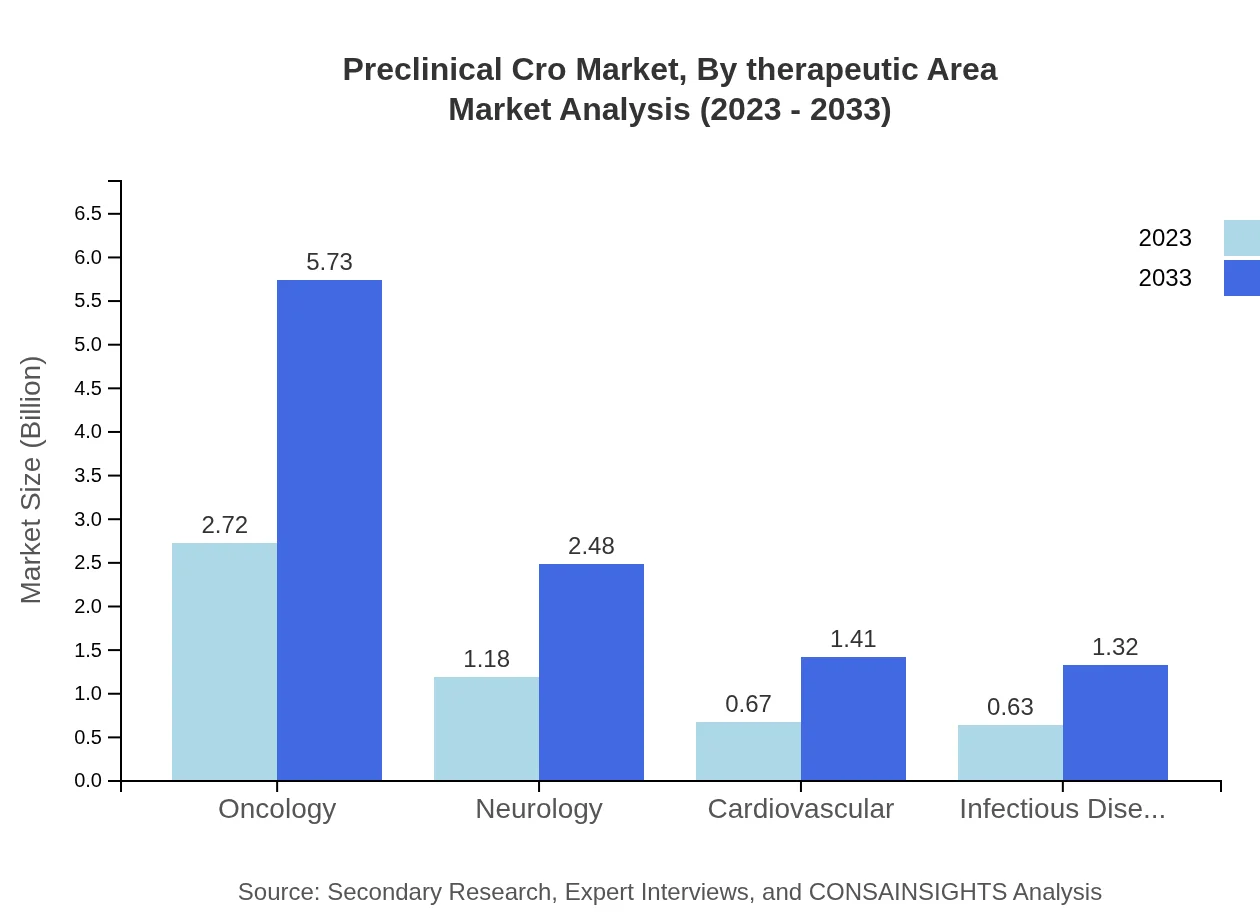

Preclinical Cro Market Analysis By Therapeutic Area

Oncology remains a leading therapeutic area within the Preclinical CRO market, valued at $2.72 billion in 2023 and projected to rise to $5.73 billion by 2033. Other areas such as Neurology and Infectious Diseases also show growth potential, reflecting shifts in healthcare needs and therapeutic research focus.

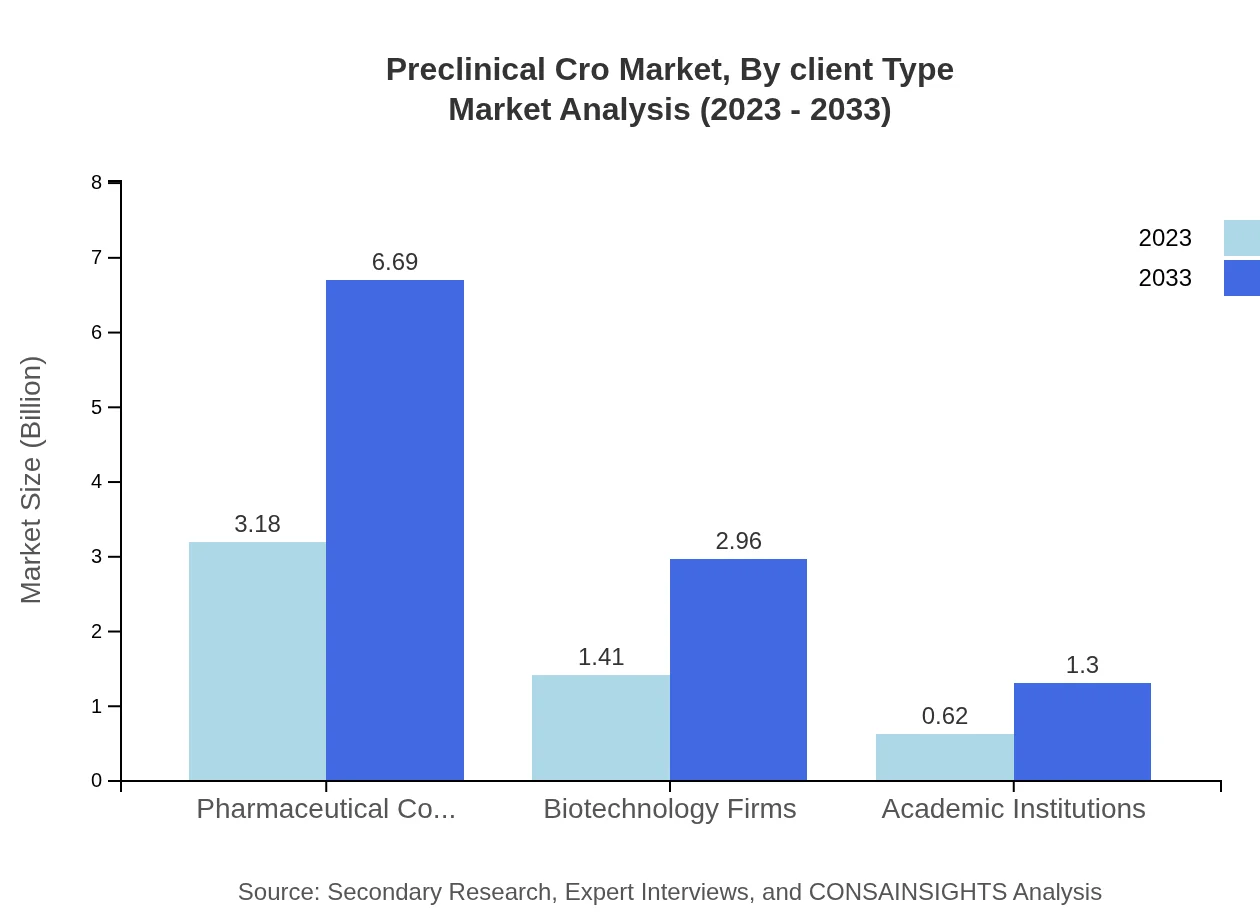

Preclinical Cro Market Analysis By Client Type

Pharmaceutical companies hold a commanding share in the Preclinical CRO market, with a market value of $3.18 billion in 2023, expected to increase to $6.69 billion by 2033. Biotechnology firms and academic institutions also play critical roles, reflecting the diverse client base that drives CRO services.

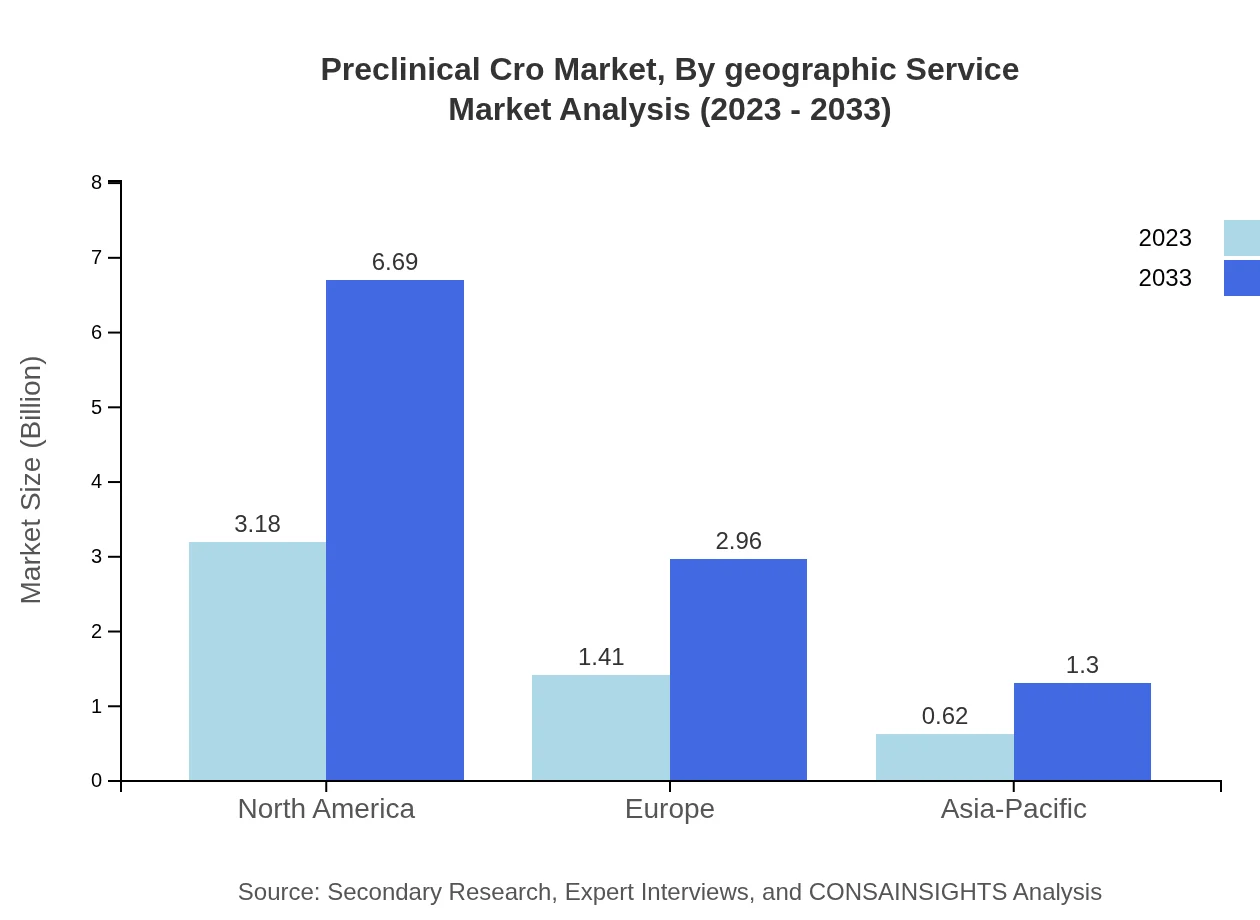

Preclinical Cro Market Analysis By Geographic Service

Geographically, North America dominates the Preclinical CRO market with a share of 61.11% in 2023, reflecting its robust R&D environment, followed by Europe with 27.02%. Emerging markets in Asia-Pacific and Latin America are on a growth trajectory, driven by increasing investments in research and development.

Preclinical CRO Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Preclinical CRO Industry

Charles River Laboratories:

A leading global provider of animal models and preclinical services, Charles River Laboratories plays a vital role in enabling the pharmaceutical and biotechnology industries to enhance drug development efficiency.Covance:

Covance is a global CRO offering comprehensive drug development services and laboratory capabilities. Its expertise in preclinical testing supports clients in the successful development of new therapies.PRA Health Sciences:

PRA Health Sciences is a prominent contract research organization that provides outsourced clinical development and data solution services to the pharmaceutical and biotechnology industries.Wuxi AppTec:

Wuxi AppTec offers a diverse range of preclinical and clinical solutions, leveraging its global resources to help clients increase the speed and productivity of drug development.We're grateful to work with incredible clients.

FAQs

What is the market size of preclinical Cro?

The global preclinical CRO market was valued at $5.2 billion in 2023, with a projected CAGR of 7.5% from 2023 to 2033, potentially reaching a significant market size by 2033.

What are the key market players or companies in this preclinical Cro industry?

Key players in the preclinical CRO market include major global biopharmaceutical firms and specialized contract research organizations that provide essential preclinical testing services essential for drug development.

What are the primary factors driving the growth in the preclinical Cro industry?

Factors driving growth include increased R&D investment in pharmaceuticals, demand for outsourcing services, advancements in biotechnologies, and the need for faster drug development timelines.

Which region is the fastest Growing in the preclinical Cro?

The fastest-growing region for preclinical CRO services is North America, expected to see growth from $1.89 billion in 2023 to $3.97 billion by 2033, supported by strong pharmaceutical industry presence.

Does Consainsights provide customized market report data for the preclinical Cro industry?

Yes, Consainsights offers customized market report data tailored to specific needs within the preclinical CRO industry, ensuring detailed insights on market trends and forecasts.

What deliverables can I expect from this preclinical Cro market research project?

Deliverables typically include comprehensive market analysis, growth forecasts, competitive landscape insights, and detailed segmentation, providing a thorough understanding of the preclinical CRO market.

What are the market trends of preclinical Cro?

Current market trends include increasing collaboration between CROs and pharmaceutical companies, focus on precision medicine, and rising investments in biomanufacturing and technological innovations within the sector.