Rapid Oral Fluid Screening Device Market Report

Published Date: 31 January 2026 | Report Code: rapid-oral-fluid-screening-device

Rapid Oral Fluid Screening Device Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Rapid Oral Fluid Screening Device market, covering key insights, trends, and forecasts from 2023 to 2033. It highlights market dynamics and growth opportunities across different segments and regions.

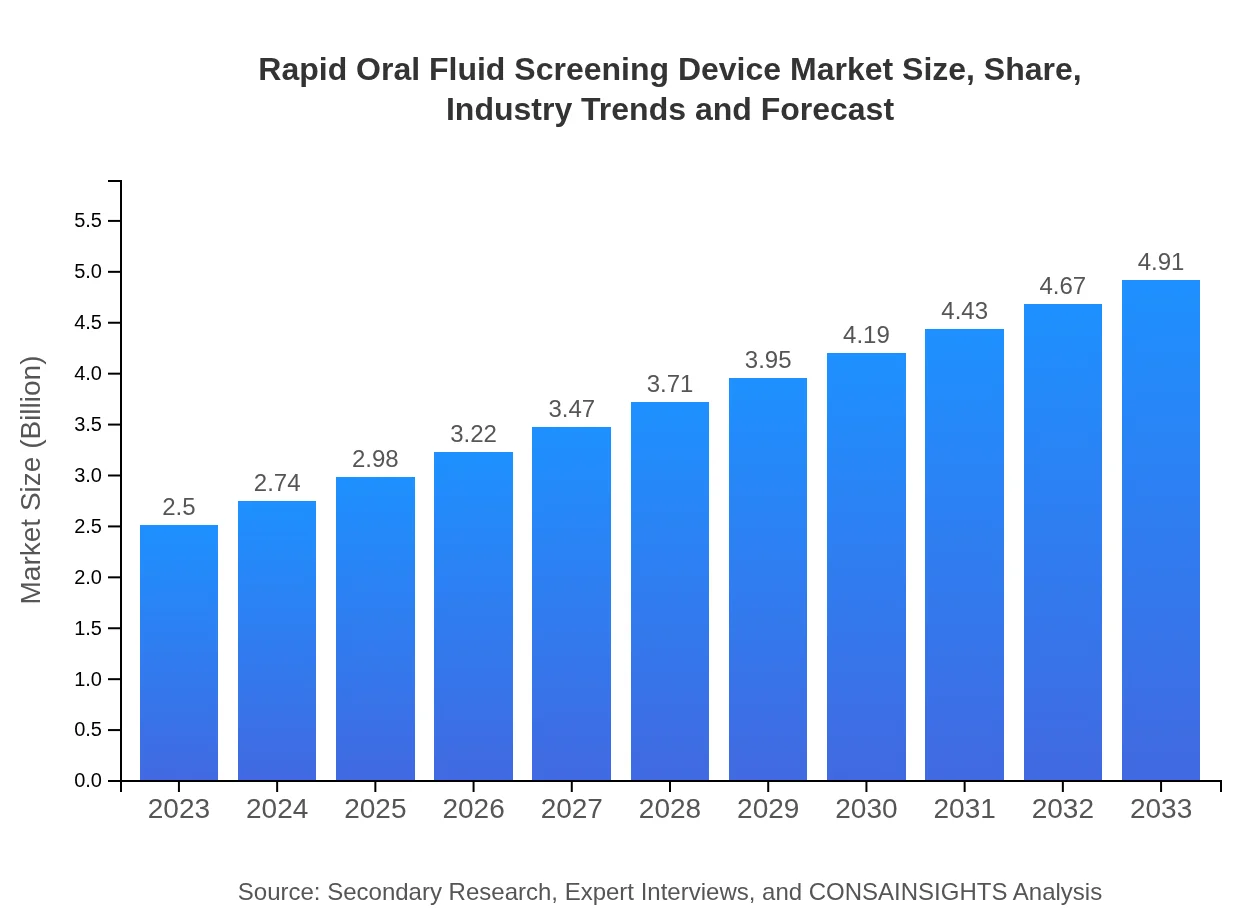

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Abbott Laboratories, OraSure Technologies, Inc., Roche Diagnostics, Alere Inc. |

| Last Modified Date | 31 January 2026 |

Rapid Oral Fluid Screening Device Market Overview

Customize Rapid Oral Fluid Screening Device Market Report market research report

- ✔ Get in-depth analysis of Rapid Oral Fluid Screening Device market size, growth, and forecasts.

- ✔ Understand Rapid Oral Fluid Screening Device's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Rapid Oral Fluid Screening Device

What is the Market Size & CAGR of Rapid Oral Fluid Screening Device market in 2023?

Rapid Oral Fluid Screening Device Industry Analysis

Rapid Oral Fluid Screening Device Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Rapid Oral Fluid Screening Device Market Analysis Report by Region

Europe Rapid Oral Fluid Screening Device Market Report:

The European market is set to expand from $0.73 billion in 2023 to $1.44 billion by 2033, driven by favorable reimbursement policies, rising prevalence of drug usage, and increased investments in new technologies. The region's focus on health promotion and prevention strategies further supports market growth.Asia Pacific Rapid Oral Fluid Screening Device Market Report:

In the Asia Pacific region, the market for Rapid Oral Fluid Screening Devices is anticipated to grow from $0.47 billion in 2023 to $0.92 billion by 2033, primarily driven by increasing healthcare expenditures, government initiatives regarding drug testing, and rising awareness of substance abuse. Countries like India and China are pivotal to this growth due to their vast population and evolving healthcare infrastructure.North America Rapid Oral Fluid Screening Device Market Report:

North America is the largest market for Rapid Oral Fluid Screening Devices, expected to rise from $0.96 billion in 2023 to $1.88 billion by 2033. This significant growth is fueled by stringent regulations regarding workplace safety, increasing substance abuse cases, and a preference for rapid testing methods among healthcare providers.South America Rapid Oral Fluid Screening Device Market Report:

In South America, the market is projected to increase from $0.02 billion in 2023 to $0.04 billion by 2033. The growth is attributed to the improving healthcare infrastructure, governmental support for drug-free initiatives, and rising public awareness about health and safety. Brazil and Argentina are leading markets in this region.Middle East & Africa Rapid Oral Fluid Screening Device Market Report:

The Middle East and Africa (MEA) market for Rapid Oral Fluid Screening Devices is anticipated to grow from $0.32 billion in 2023 to $0.63 billion by 2033. This growth is supported by improving economic conditions and healthcare investments, particularly in the UAE and South Africa, which are focusing on enhancing their public health services.Tell us your focus area and get a customized research report.

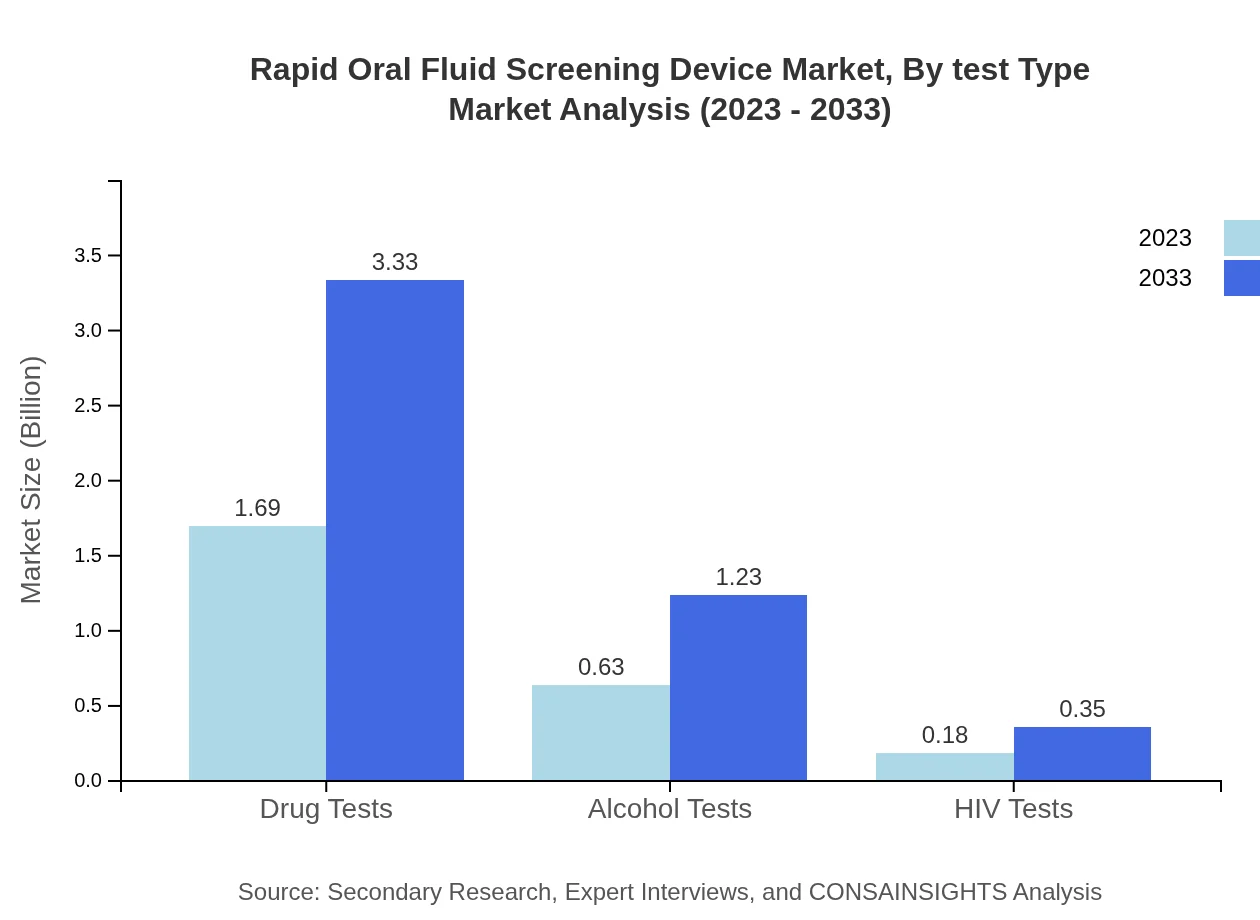

Rapid Oral Fluid Screening Device Market Analysis By Test Type

In 2023, the drug tests segment dominates the market with a share of 67.74% and a size of $1.69 billion, expected to grow to $3.33 billion by 2033. Alcohol tests follow at 25.06%, with sizes expected to reach $1.23 billion by 2033. HIV tests account for 7.2% of market share, showing steady growth reflecting increased awareness in health screenings.

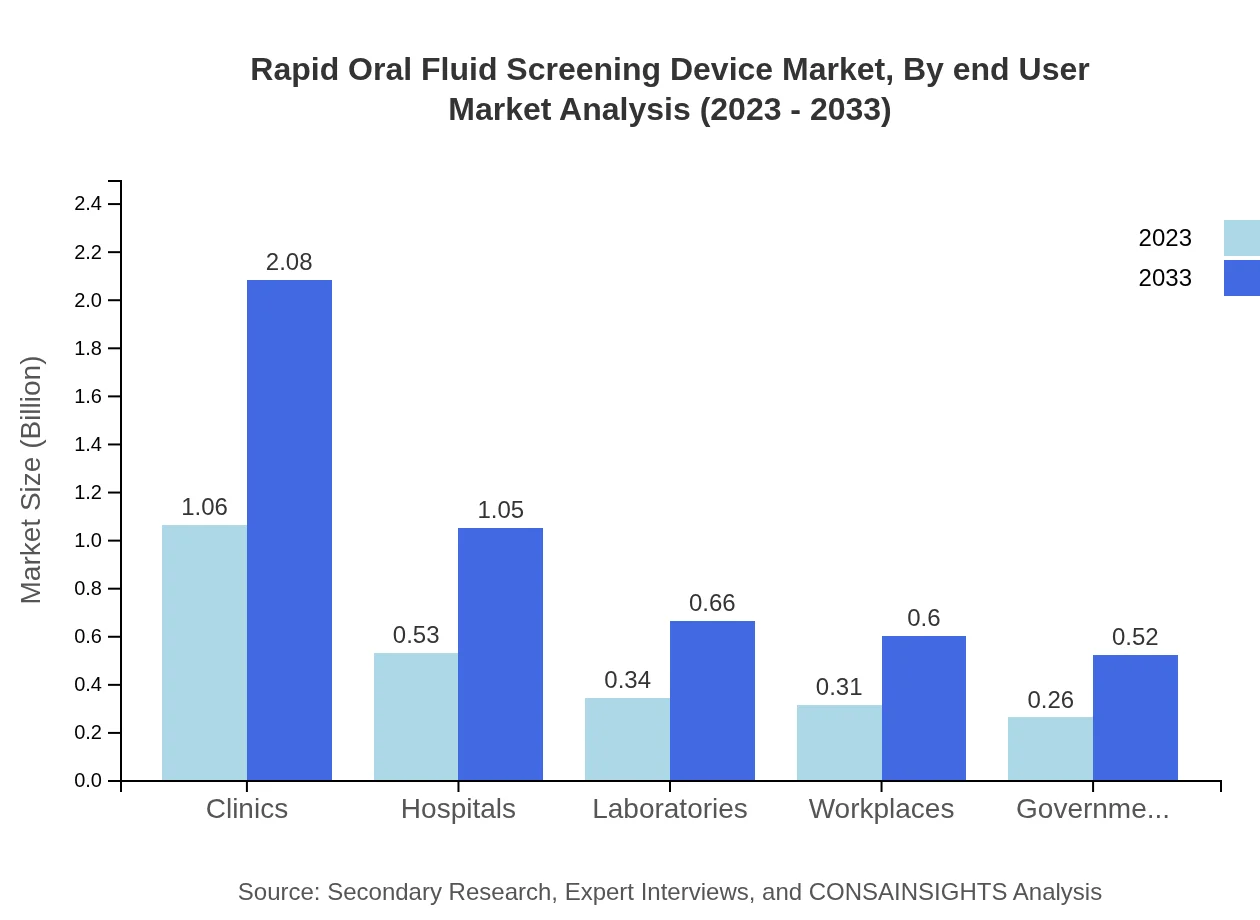

Rapid Oral Fluid Screening Device Market Analysis By End User

Clinics lead the market with a size of $1.06 billion in 2023 and growing to $2.08 billion by 2033. Hospitals have a modest size of $0.53 billion in 2023, set to reach $1.05 billion by 2033. Laboratories are predicted to increase from $0.34 billion to $0.66 billion, showing the importance of quick diagnostics in clinical settings.

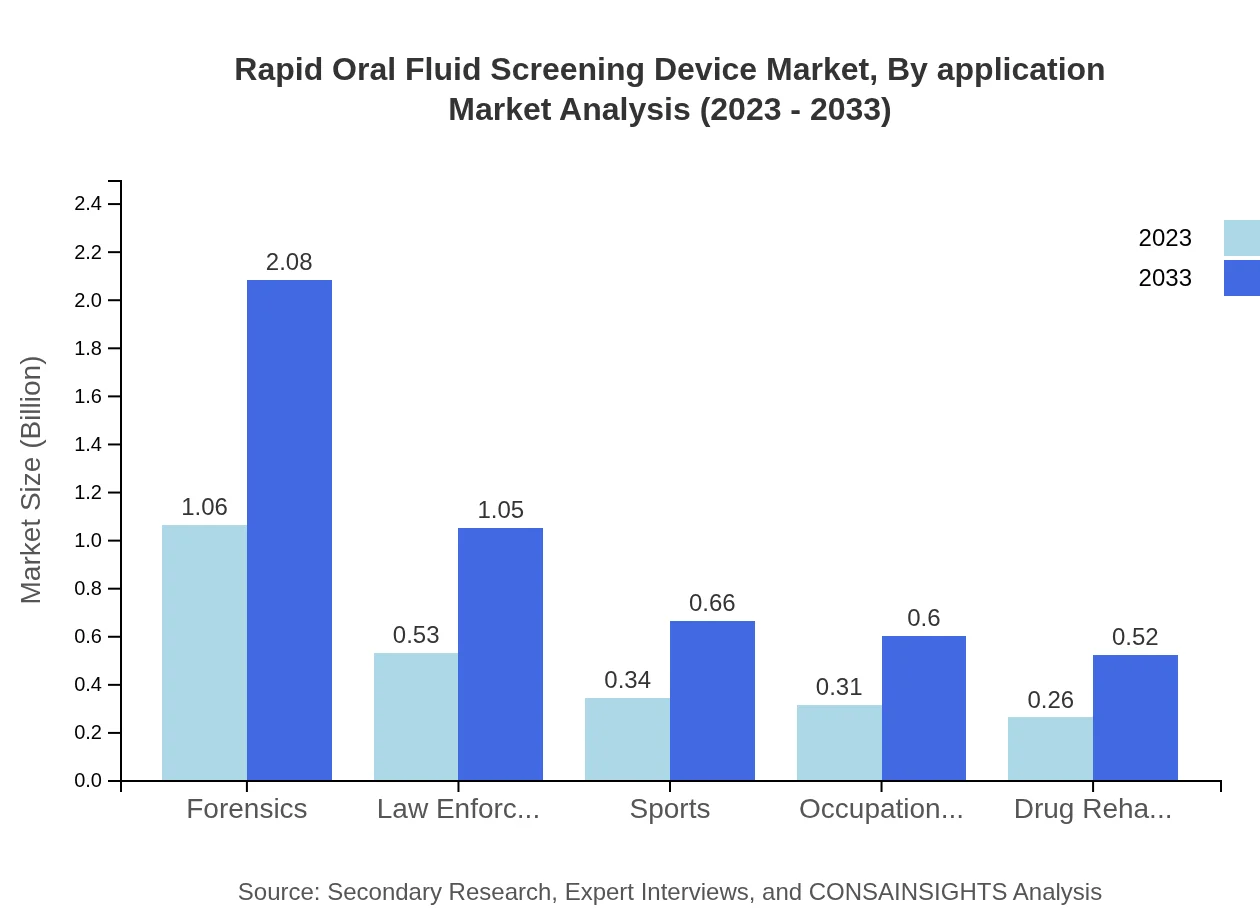

Rapid Oral Fluid Screening Device Market Analysis By Application

Forensic applications remain substantial, pegging the size at $1.06 billion in 2023 and increasing to $2.08 billion by 2033. Law enforcement and sports testing applications also display significant market shares of 21.34% and 13.52%, enhancing the relevance of these devices in regulatory compliance.

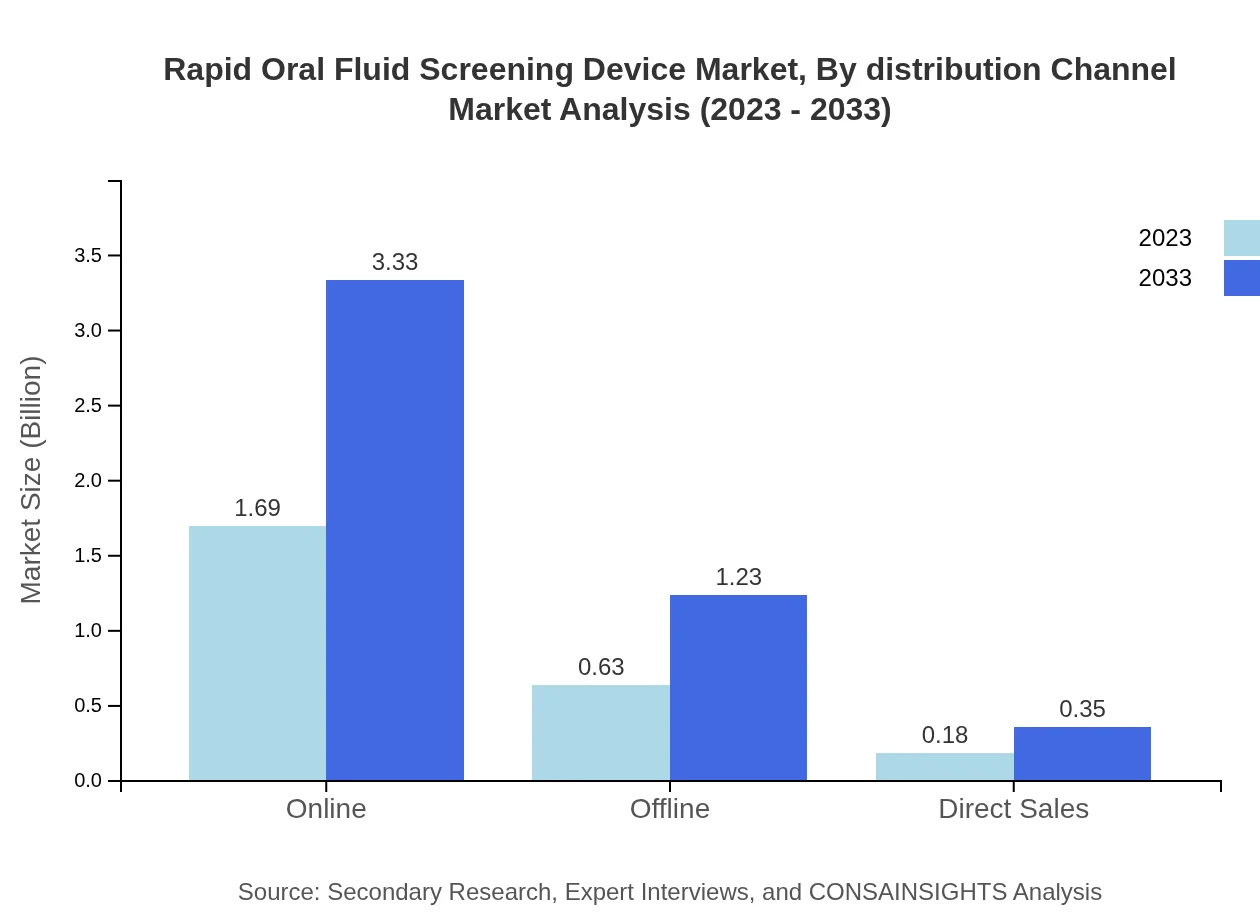

Rapid Oral Fluid Screening Device Market Analysis By Distribution Channel

The online distribution channel is expected to dominate the market, accounting for a size of $1.69 billion in 2023, anticipated to grow to $3.33 billion by 2033, while offline sales continue to represent significant market needs, increasing from $0.63 billion to $1.23 billion due to consumer preferences.

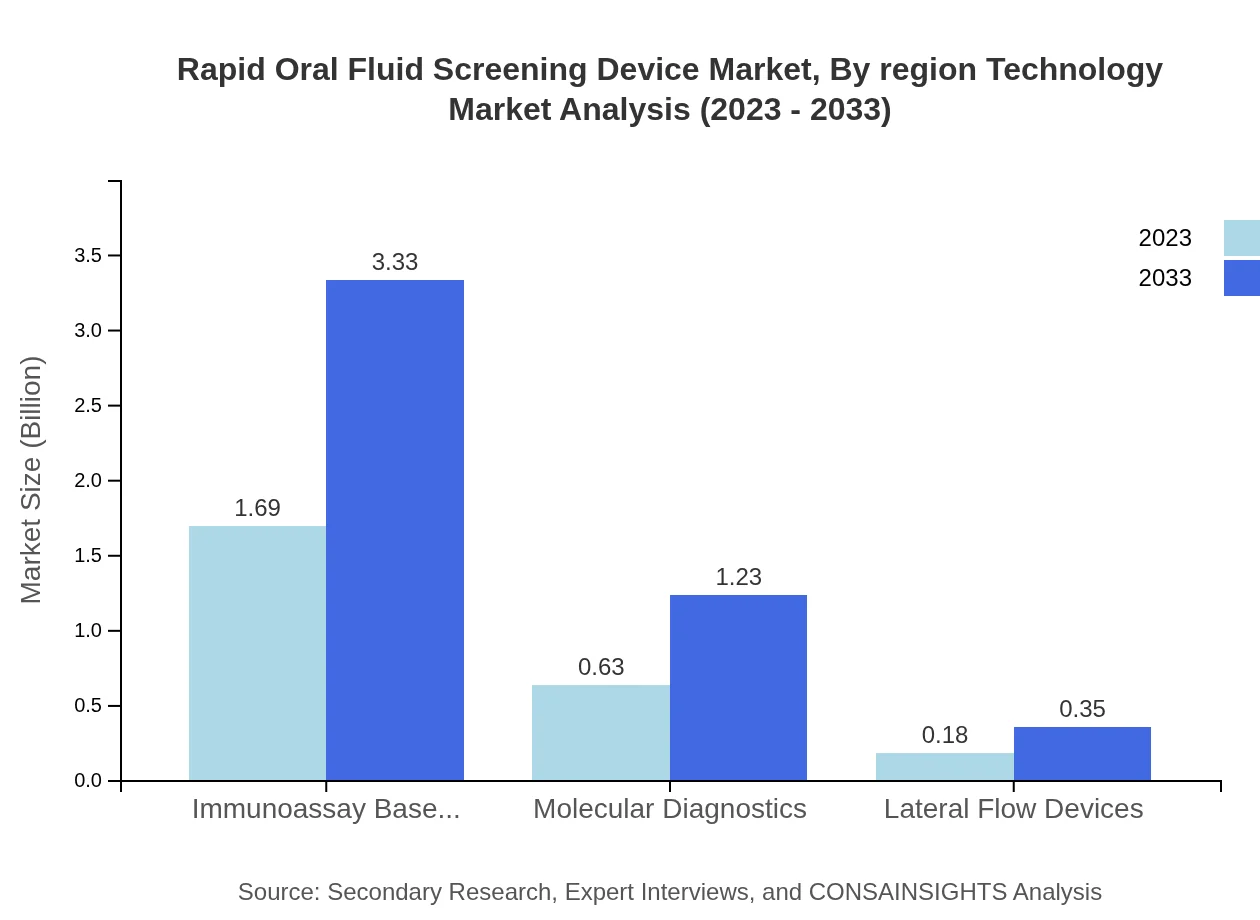

Rapid Oral Fluid Screening Device Market Analysis By Region Technology

Immunoassay-based testing holds the market share at 67.74% in 2023 and is set to grow correspondingly. Lateral flow devices represent a significant segment as well, with growing adoption due to their ease of use and diagnostic capabilities, thus enhancing their significance in the industry.

Rapid Oral Fluid Screening Device Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Rapid Oral Fluid Screening Device Industry

Abbott Laboratories:

A leading player in the rapid diagnostics field, Abbott Laboratories develops innovative oral fluid testing devices that cater to various markets, including healthcare and law enforcement.OraSure Technologies, Inc.:

Specializes in oral fluid diagnostic devices and is recognized for its commitment to research and innovation in drug and alcohol testing.Roche Diagnostics:

Offers comprehensive solutions in point-of-care testing, greatly influencing the rapid oral screening device market through advanced technologies and product offerings.Alere Inc.:

A leading player focused on delivering rapid diagnostic tests and screening devices that enhance patient care across multiple regions.We're grateful to work with incredible clients.

FAQs

What is the market size of rapid Oral Fluid Screening Device?

The global market size for rapid oral fluid screening devices is approximately $2.5 billion in 2023, with a projected CAGR of 6.8% through 2033. This growth is fueled by increased demand in various healthcare and safety sectors.

What are the key market players or companies in this rapid Oral Fluid Screening Device industry?

Key players in the rapid oral fluid screening device market include major diagnostics companies and healthcare providers that innovate technologies and maintain robust distribution networks, ensuring accessibility and reliability of testing solutions across various applications.

What are the primary factors driving the growth in the rapid Oral Fluid Screening Device industry?

Growth drivers for the rapid oral fluid screening device market include rising demand for non-invasive testing methods, increasing prevalence of substance abuse, and stringent regulations for workplace drug testing, which collectively enhance market adoption.

Which region is the fastest Growing in the rapid Oral Fluid Screening Device?

North America is the fastest-growing region for rapid oral fluid screening devices, projected to expand from $0.96 billion in 2023 to $1.88 billion by 2033, demonstrating significant growth compared to other regions.

Does ConsaInsights provide customized market report data for the rapid Oral Fluid Screening Device industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the rapid oral fluid screening device industry, providing detailed insights, regional analysis, and competitive assessments for strategic decision-making.

What deliverables can I expect from this rapid Oral Fluid Screening Device market research project?

Expect comprehensive deliverables including detailed market analysis, trend forecasts, competitive landscape overviews, regional insights, and customized recommendations intended to inform strategic planning and investment decisions.

What are the market trends of rapid Oral Fluid Screening Device?

Market trends for rapid oral fluid screening devices include increased innovation in testing technology, a shift towards point-of-care testing, and integration of digital solutions, all aimed at improving the accuracy and accessibility of screening processes.