Vacuum Packaging Market Report

Published Date: 22 January 2026 | Report Code: vacuum-packaging

Vacuum Packaging Market Size, Share, Industry Trends and Forecast to 2033

This report explores the Vacuum Packaging market, providing in-depth insights into market trends, growth forecasts, and regional analysis from 2023 to 2033, aimed at supporting strategic decision-making for stakeholders in the industry.

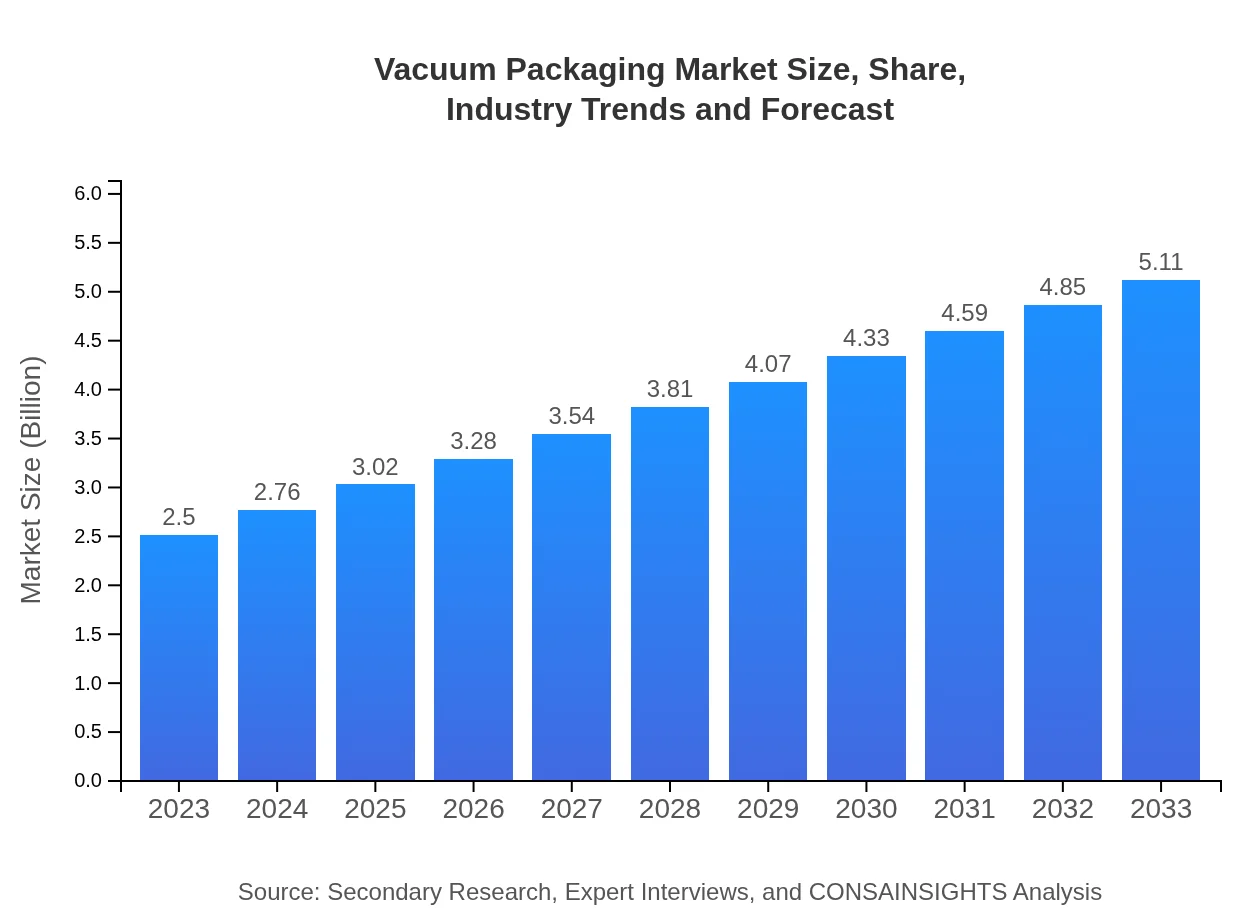

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $5.11 Billion |

| Top Companies | Sealed Air Corporation, Mitsubishi Gas Chemical Company, Inc., Amcor plc, Berry Global, Inc., Multivac Sepp Haggenmüller SE |

| Last Modified Date | 22 January 2026 |

Vacuum Packaging Market Overview

Customize Vacuum Packaging Market Report market research report

- ✔ Get in-depth analysis of Vacuum Packaging market size, growth, and forecasts.

- ✔ Understand Vacuum Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Vacuum Packaging

What is the Market Size & CAGR of Vacuum Packaging market in 2023?

Vacuum Packaging Industry Analysis

Vacuum Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Vacuum Packaging Market Analysis Report by Region

Europe Vacuum Packaging Market Report:

The European vacuum packaging market is expected to grow from $0.71 billion in 2023 to $1.46 billion by 2033, sustained by increasing awareness of sustainable practices and enhanced shelf life for food products. Germany, France, and Italy are key markets in Europe, exhibiting high demand for innovative packaging technologies. The focus on reducing food waste drives investments in advanced vacuum packaging solutions.Asia Pacific Vacuum Packaging Market Report:

The Asia Pacific vacuum packaging market is anticipated to grow significantly, reaching $0.99 billion by 2033 from $0.48 billion in 2023. Factors such as rapid urbanization, increasing disposable income, and robust foodprocessing industries contribute to this growth. Countries like China and India are showing extensive adoption of vacuum packaging technologies in their food and healthcare sectors, driven by the rising demand for packaged goods.North America Vacuum Packaging Market Report:

In North America, the market is poised to expand from $0.92 billion in 2023 to $1.89 billion by 2033. The United States is the primary market, where consumers emphasize convenience and safety in food packaging. The rising trend of e-commerce and demand for ready-to-eat products are fueling market growth, alongside strict food safety regulations encouraging manufacturers to adopt vacuum packaging.South America Vacuum Packaging Market Report:

The South American vacuum packaging market is projected to increase from $0.07 billion in 2023 to $0.14 billion by 2033. A rising middle class and growing awareness of food safety are the primary growth factors. Brazil and Argentina lead in market demand due to their significant food processing industries. The increasing export of packaged food products also propels the market in this region.Middle East & Africa Vacuum Packaging Market Report:

The Middle East and African vacuum packaging market will see growth from $0.31 billion in 2023 to $0.63 billion by 2033. The food processing industry is expanding rapidly in this region due to population growth and urbanization. Countries like South Africa and the UAE are at the forefront, leveraging vacuum packaging to meet growing consumer demands for preserved food and enhance product shelf life.Tell us your focus area and get a customized research report.

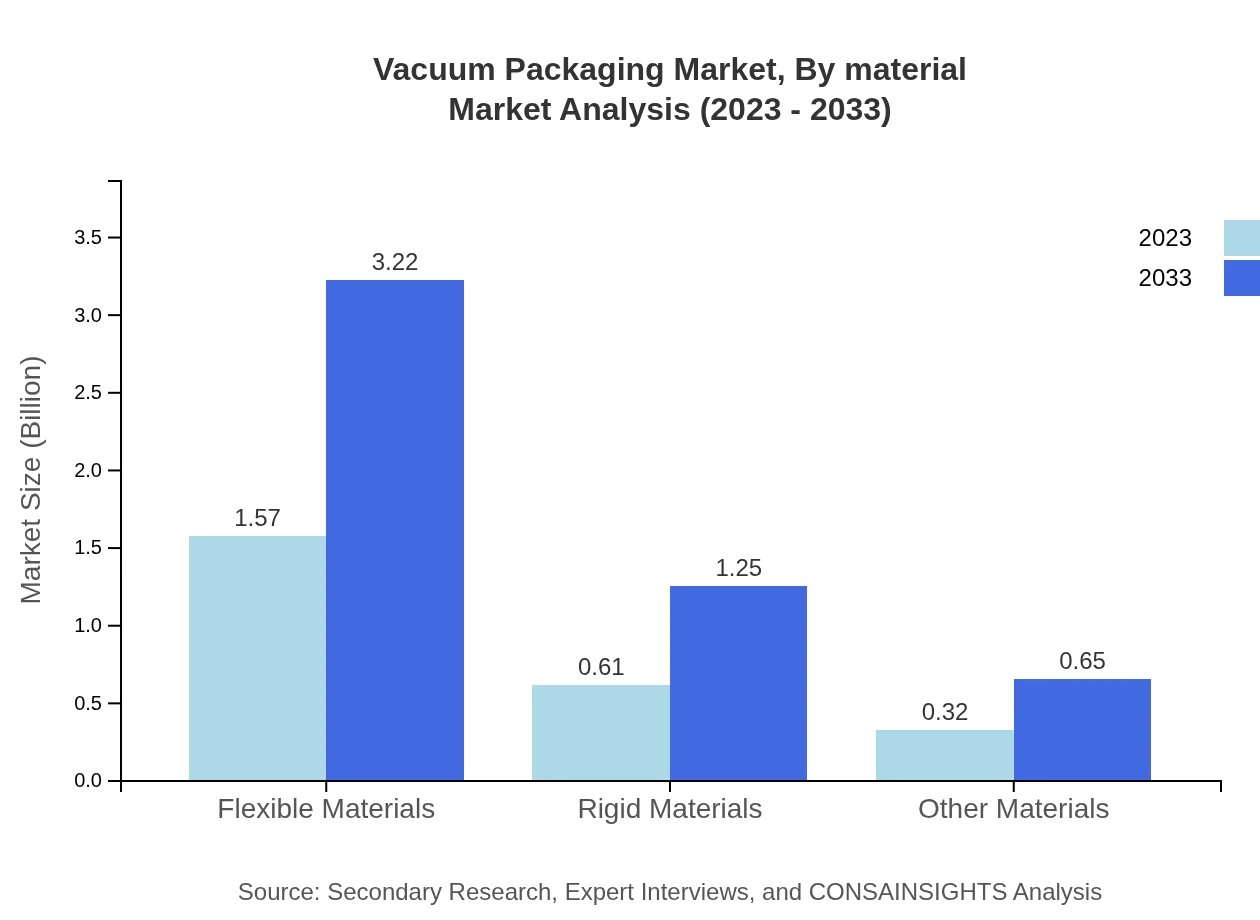

Vacuum Packaging Market Analysis By Material

Flexible materials dominate the vacuum packaging market, valued at $1.57 billion in 2023 and projected to reach $3.22 billion by 2033, capturing 63% market share. Rigid materials follow, anticipated to grow from $0.61 billion to $1.25 billion, constituting 24.37% of the market. Other materials account for the remainder, addressing niche applications in various sectors.

Vacuum Packaging Market Analysis By Technology

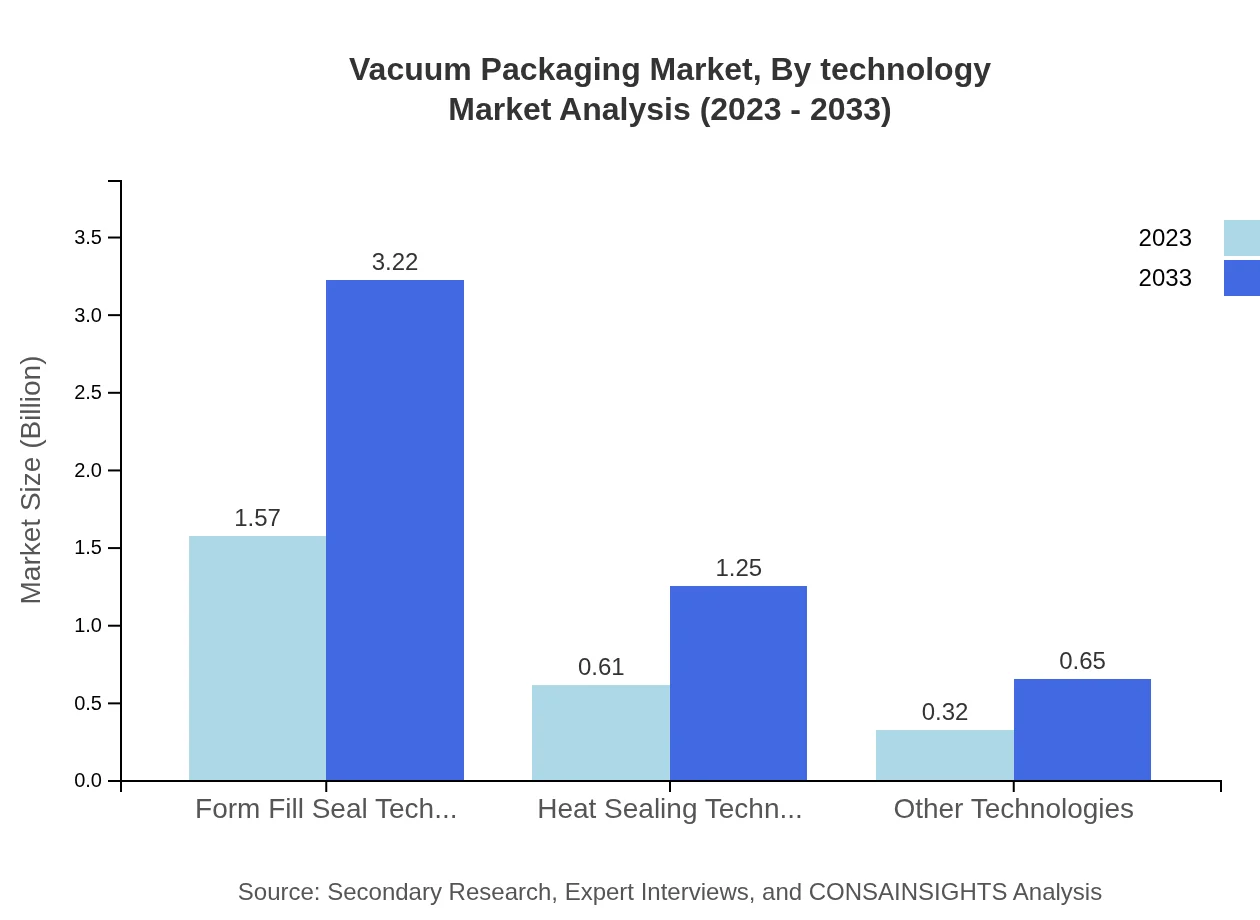

Form fill seal technology leads the vacuum packaging segment, with a market size of $1.57 billion in 2023, expected to double by 2033. Heat sealing technology holds a considerable position, rising from $0.61 billion to $1.25 billion. Other technologies contribute to the innovation in vacuum packaging, catering to diverse industry needs.

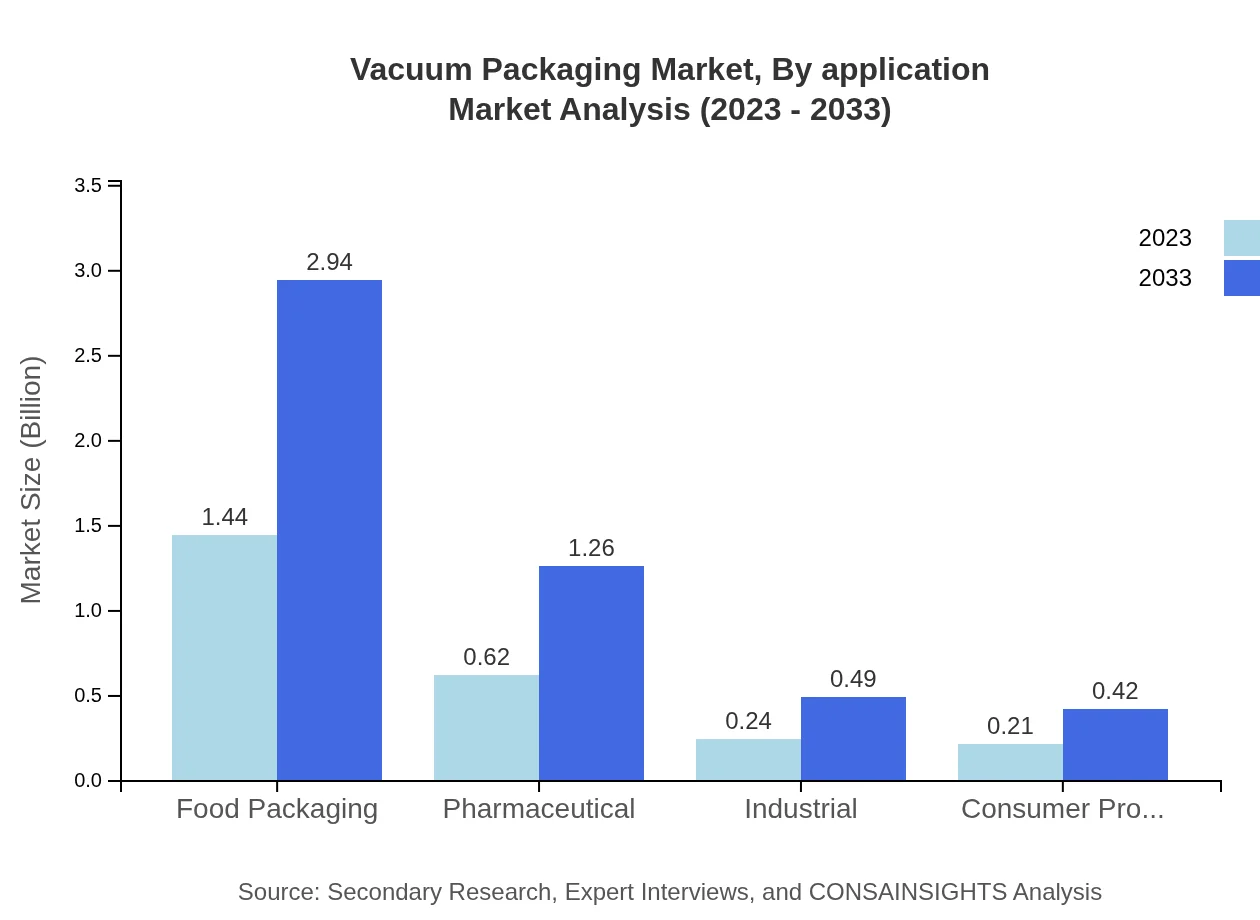

Vacuum Packaging Market Analysis By Application

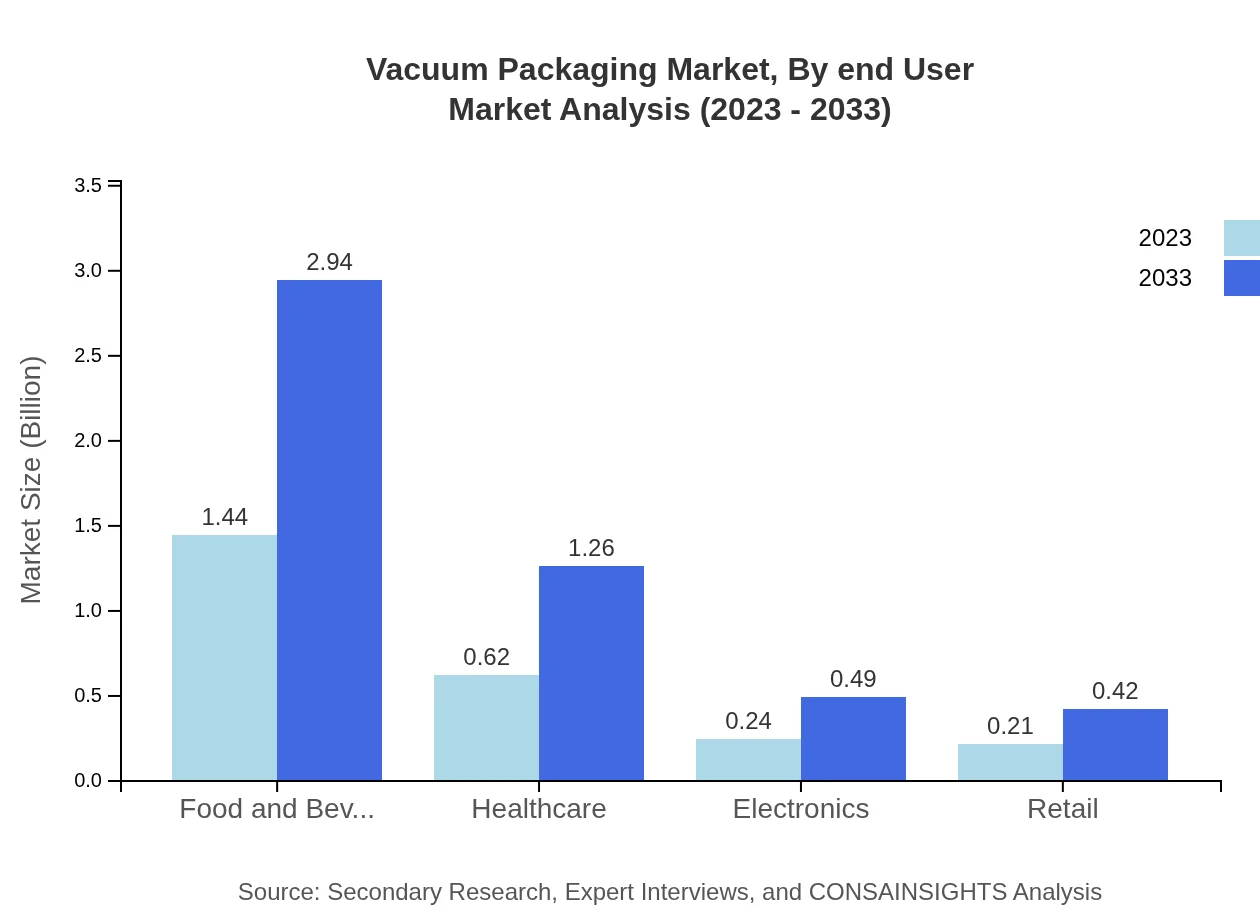

The food packaging segment is a critical component of the vacuum packaging market, valued at $1.44 billion in 2023 and estimated to grow to $2.94 billion by 2033, maintaining a 57.52% market share. The healthcare application, which includes pharmaceuticals, is also significant, with a market reach of $0.62 billion expected to double by 2033.

Vacuum Packaging Market Analysis By End User

End-user segments highlight the significant uptake of vacuum packaging in food and beverage, healthcare, industrial, and consumer products. The food and beverage sector dominates, followed by healthcare, which relies on vacuum solutions for pharmaceuticals. Industrial applications show moderate growth, driven by logistics trends.

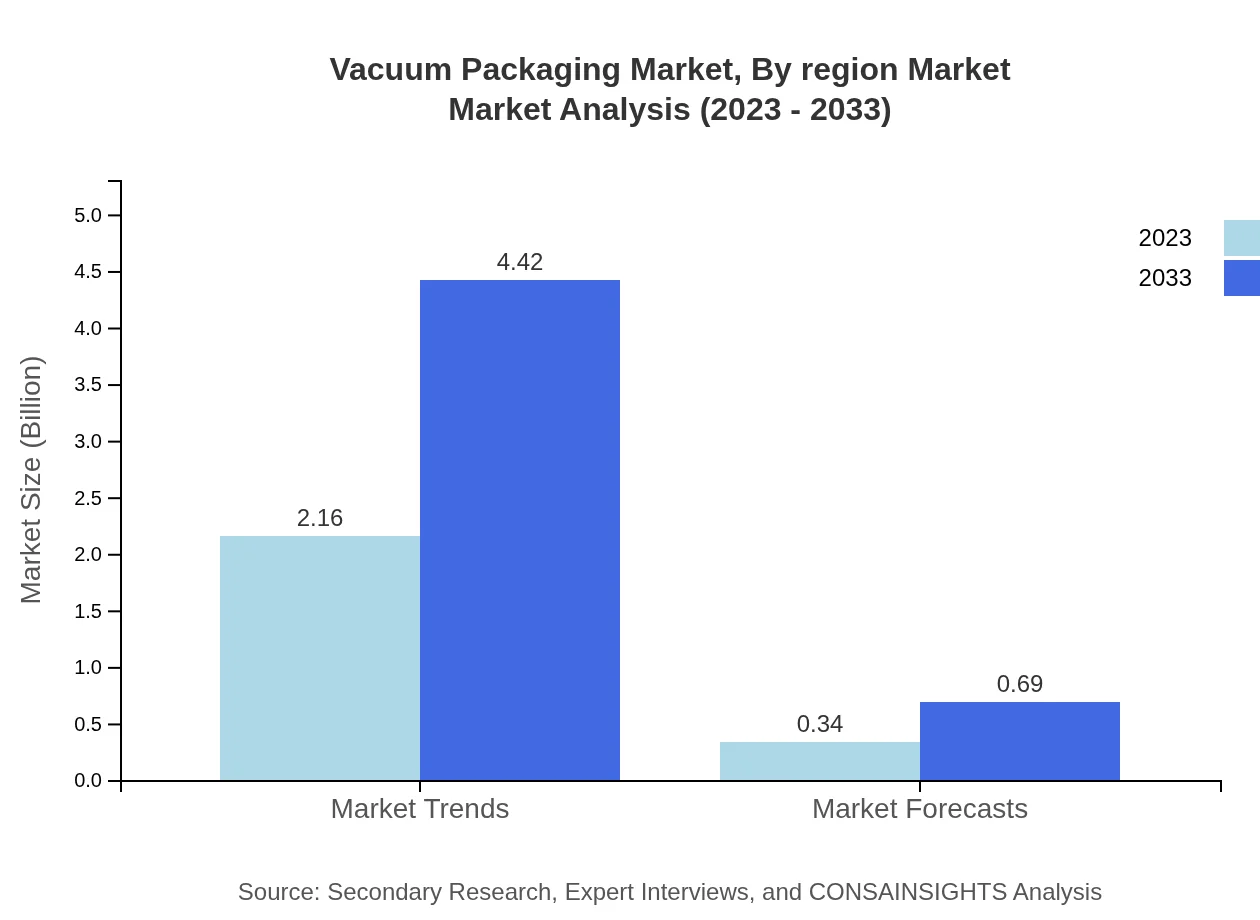

Vacuum Packaging Market Analysis By Region Market

The global vacuum packaging market showcases a robust expansion trajectory across regions. North America and Europe lead in market share and technological advancements, while the Asia Pacific demonstrates rapid growth potential due to increasing consumerism and industrial activities.

Vacuum Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Vacuum Packaging Industry

Sealed Air Corporation:

Sealed Air is a leading provider of packaging solutions that focus on innovative technologies, including vacuum packaging, to enhance product shelf life and reduce waste.Mitsubishi Gas Chemical Company, Inc.:

Mitsubishi is renowned for its advanced packaging materials and technologies, contributing significantly to the vacuum packaging segment, particularly in food preservation.Amcor plc:

Amcor is a prominent global packaging company that offers a variety of sustainable vacuum packaging solutions to meet the diverse needs of its clientele.Berry Global, Inc.:

Berry Global specializes in providing custom packaging solutions including vacuum packaging, aiming to cater to specific industry requirements across the globe.Multivac Sepp Haggenmüller SE:

Multivac is a major player in the vacuum packaging equipment sector, known for its innovative technology and comprehensive service offerings for food and medical industries.We're grateful to work with incredible clients.

FAQs

What is the market size of vacuum Packaging?

The vacuum-packaging market is valued at approximately $2.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 7.2%. This growth indicates a robust demand for vacuum packaging solutions across various industries.

What are the key market players or companies in the vacuum Packaging industry?

Key players in the vacuum-packaging industry include Sealed Air Corporation, Amcor plc, and Berry Global, among others. These companies are recognized for their innovative technologies and commitment to sustainability in vacuum packaging solutions.

What are the primary factors driving the growth in the vacuum Packaging industry?

The growth of the vacuum-packaging industry is driven by increasing consumer demand for packaged food, advancements in packaging technologies, and the rising importance of shelf life extension in food preservation, leading to a broader adoption across sectors.

Which region is the fastest Growing in the vacuum packaging?

The fastest-growing region in the vacuum-packaging market is North America, projected to grow from $0.92 billion in 2023 to $1.89 billion by 2033. This growth is fueled by high demand in the food and healthcare sectors.

Does ConsaInsights provide customized market report data for the vacuum packaging industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the vacuum packaging industry. Clients can request targeted insights and analyses to fit their unique business requirements.

What deliverables can I expect from this vacuum packaging market research project?

Deliverables from the vacuum packaging market research project typically include comprehensive reports, regional analysis, segment performance data, competitive landscape overviews, and insights tailored to your business strategy.

What are the market trends of vacuum packaging?

Current trends in vacuum packaging include increased adoption of flexible materials, growing sustainability initiatives within packaging industries, and technological advancements such as smart packaging solutions to enhance food safety and traceability.