Drug Discovery Services Market Report

Published Date: 31 January 2026 | Report Code: drug-discovery-services

Drug Discovery Services Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Drug Discovery Services market, analyzing trends, market dynamics, segmentation, and forecasts for the period of 2023 to 2033. It offers valuable insights for stakeholders seeking to navigate this complex landscape.

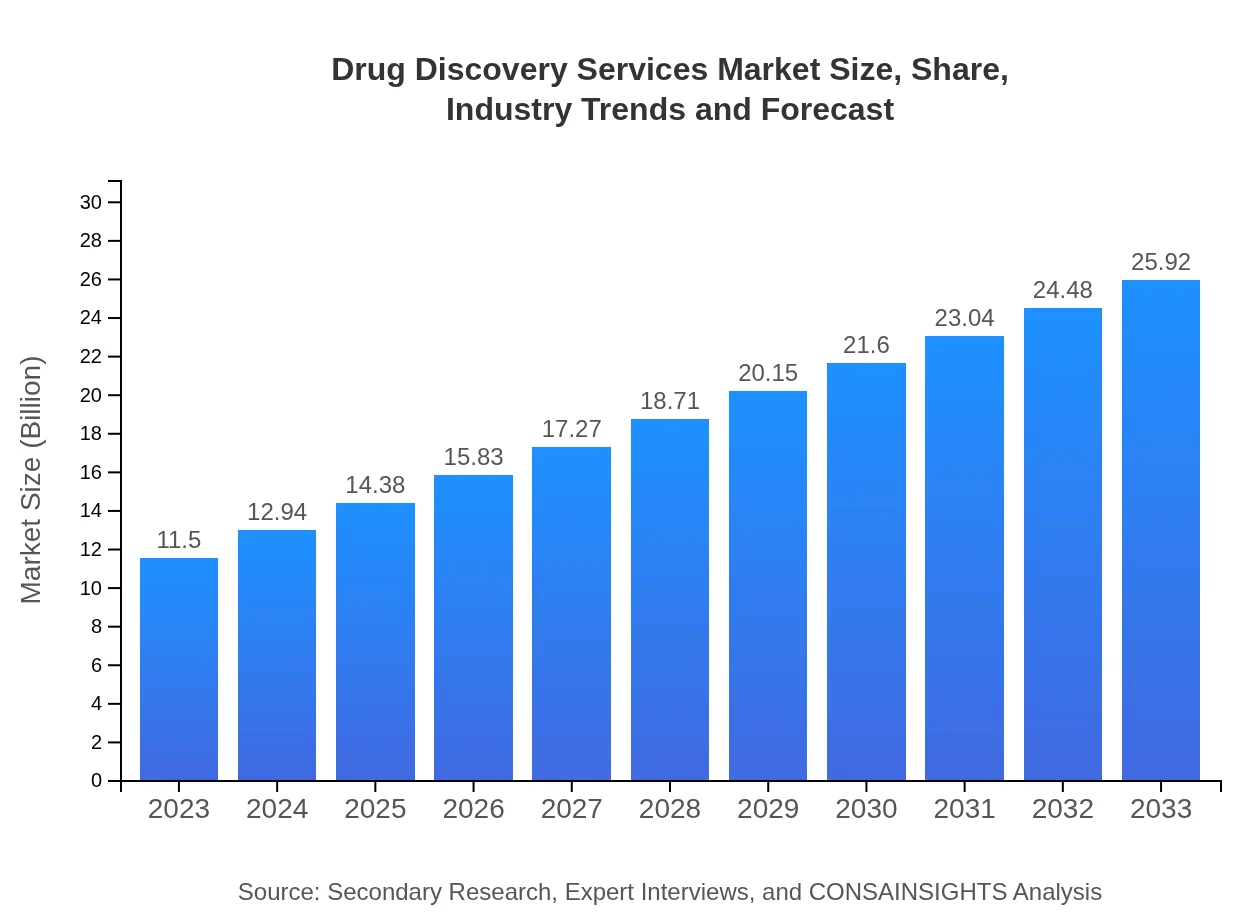

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $11.50 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $25.92 Billion |

| Top Companies | Covance, Charles River Laboratories, Syneos Health, Medpace, PRA Health Sciences |

| Last Modified Date | 31 January 2026 |

Drug Discovery Services Market Overview

Customize Drug Discovery Services Market Report market research report

- ✔ Get in-depth analysis of Drug Discovery Services market size, growth, and forecasts.

- ✔ Understand Drug Discovery Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Drug Discovery Services

What is the Market Size & CAGR of Drug Discovery Services market in 2023 and 2033?

Drug Discovery Services Industry Analysis

Drug Discovery Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Drug Discovery Services Market Analysis Report by Region

Europe Drug Discovery Services Market Report:

In Europe, the market is anticipated to expand from $2.95 billion in 2023 to $6.65 billion in 2033. The growth is supported by government initiatives promoting R&D investment and an increased focus on personalized medicine across the continent.Asia Pacific Drug Discovery Services Market Report:

The Asia Pacific region is projected to witness significant growth, from a market value of $2.25 billion in 2023 to $5.08 billion in 2033. This growth is fueled by increased investment in biopharmaceuticals and a rise in clinical trials in countries like China and India, coupled with favorable regulations that support drug development.North America Drug Discovery Services Market Report:

North America remains the largest market for Drug Discovery Services, growing from $4.46 billion in 2023 to $10.06 billion by 2033. The region is characterized by a strong presence of biotech and pharmaceutical companies, robust R&D funding, and advancements in technology, making it a central hub for drug discovery.South America Drug Discovery Services Market Report:

South America exhibits a burgeoning market for drug discovery services, growing from $0.24 billion in 2023 to $0.54 billion in 2033. Factors such as increasing collaborations between local firms and global pharmaceutical companies and a rising focus on drug innovation contribute to this growth.Middle East & Africa Drug Discovery Services Market Report:

The Middle East and Africa market is forecasted to grow from $1.59 billion in 2023 to $3.59 billion in 2033. Enhanced government spending on healthcare and a burgeoning pharmaceutical sector signal positive growth potential for the region.Tell us your focus area and get a customized research report.

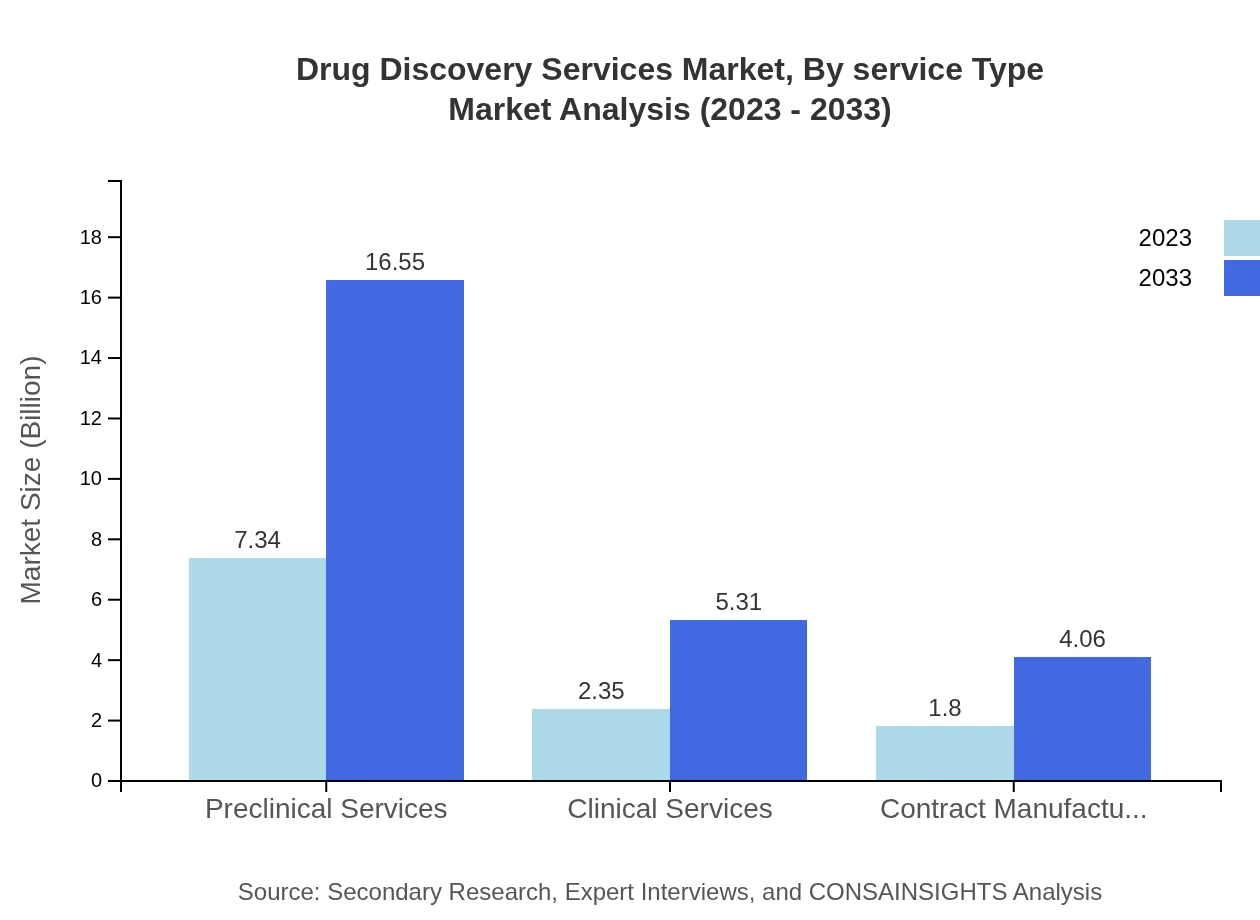

Drug Discovery Services Market Analysis By Service Type

By service type, preclinical services dominate the market, growing from $7.34 billion in 2023 to $16.55 billion in 2033, accounting for approximately 63.86% market share in 2023. Clinical services and contract manufacturing services also show robust growth, indicative of the increasing demand for comprehensive drug development services.

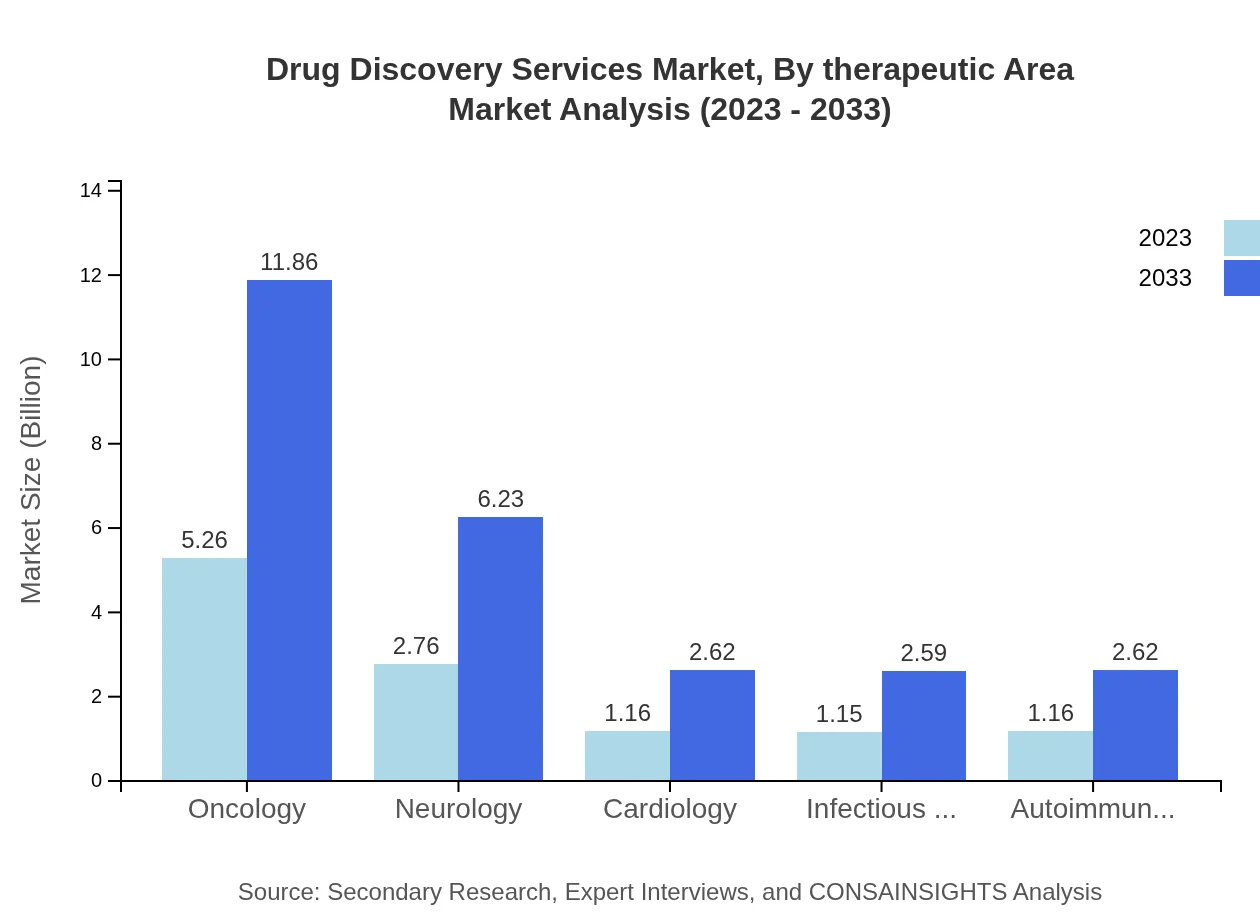

Drug Discovery Services Market Analysis By Therapeutic Area

Oncology leads the therapeutic area segment with a market size of $5.26 billion in 2023, projected to increase to $11.86 billion in 2033. Neurology and cardiology also present significant market shares, reflecting their critical importance in addressing prevalent health issues.

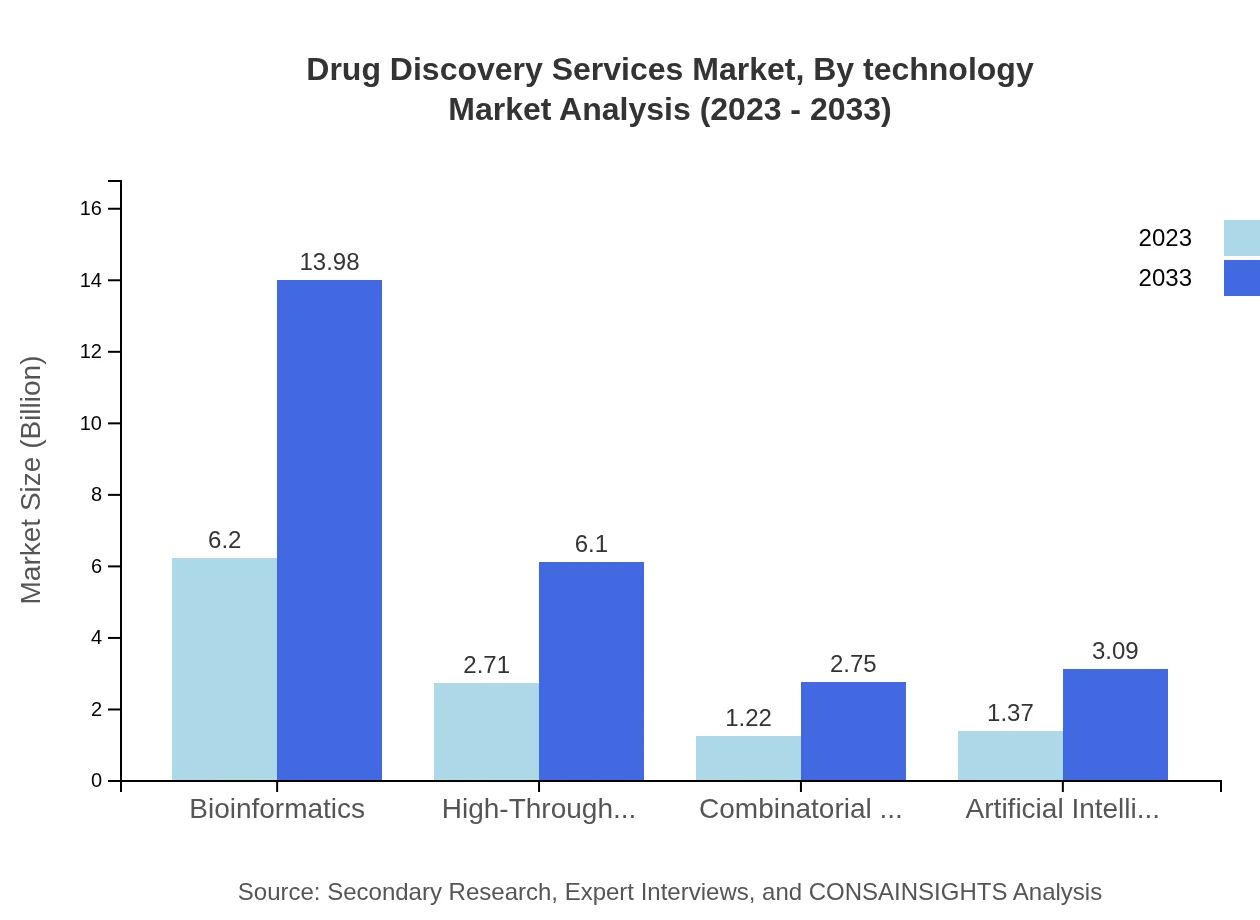

Drug Discovery Services Market Analysis By Technology

The application of AI and machine learning in drug discovery is transforming the landscape. AI technologies alone are expected to grow from $1.37 billion in 2023 to $3.09 billion in 2033, illustrating the potential of technology to expedite drug development processes.

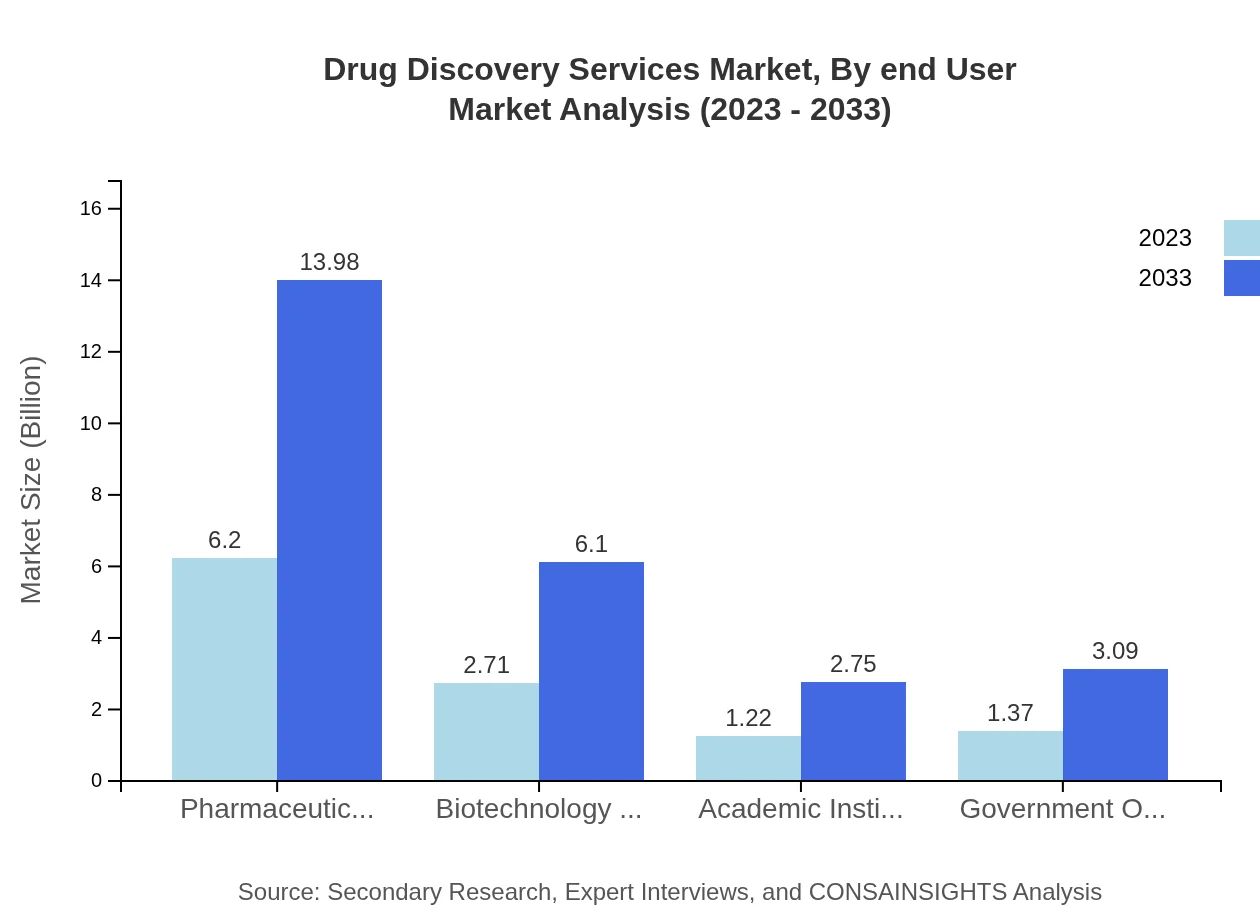

Drug Discovery Services Market Analysis By End User

Pharmaceutical companies hold the largest share in the market, valued at $6.20 billion in 2023 and projected at $13.98 billion by 2033. Biotechnology companies follow with a growing share, emphasizing the strong collaboration between the two sectors.

Drug Discovery Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Drug Discovery Services Industry

Covance:

A leading provider of drug development and animal testing services, Covance offers comprehensive capabilities across all phases of drug development, helping clients streamline their processes.Charles River Laboratories:

Specializing in preclinical and clinical laboratory services, Charles River Laboratories supports the drug discovery process through high-quality testing services, enhancing research outcomes.Syneos Health:

Syneos Health provides integrated biopharmaceutical solutions, offering insights and innovative technologies that expedite drug development and optimize deployment.Medpace:

Medpace is a full-service contract research organization providing drug development solutions to the pharmaceutical and biotechnology industries, known for its scientific expertise.PRA Health Sciences:

A global contract research organization offering comprehensive and integrated drug development services, PRA Health Sciences leverages vast experience to support clients worldwide.We're grateful to work with incredible clients.

FAQs

What is the market size of drug Discovery Services?

The Drug Discovery Services market is projected to reach approximately $11.5 billion in 2023, with a robust CAGR of 8.2%, highlighting the sector's growth potential through 2033.

What are the key market players or companies in this drug Discovery Services industry?

Key players in the Drug Discovery Services market include major pharmaceutical companies, biotechnology firms, and specialized service providers. Their innovations drive competitive dynamics and shape market strategies.

What are the primary factors driving the growth in the drug Discovery Services industry?

Factors such as advancements in technology, increasing investments in R&D, and the growing need for efficient drug development processes are prominent in driving the Drug Discovery Services market growth.

Which region is the fastest Growing in the drug Discovery Services?

North America leads with a market size of $4.46 billion in 2023, expected to grow to $10.06 billion by 2033. Other notable regions include Europe and Asia Pacific, growing significantly during this period.

Does ConsaInsights provide customized market report data for the drug Discovery Services industry?

Yes, ConsaInsights specializes in providing tailored market reports that align with the specific needs and requirements of clients in the Drug Discovery Services industry.

What deliverables can I expect from this drug Discovery Services market research project?

Deliverables include comprehensive market analysis reports, segmented data, growth forecasts, and insights into emerging trends and competitive landscapes within the Drug Discovery Services market.

What are the market trends of drug Discovery Services?

Significant trends include the rise of artificial intelligence in drug discovery, increasing collaborations between academia and industry, and a growing focus on personalized medicine to enhance drug development efficiency.